Paul Singer's Elliott Scores Big Win in PG&E Clash -- Update

11 Julio 2019 - 3:09PM

Noticias Dow Jones

By Matt Wirz

The California legislature delivered a preliminary victory to

hedge-fund billionaire Paul Singer and other PG&E Corp.

bondholders in their monthslong battle with the utility's

shareholders.

Mr. Singer's firm, Elliott Management Corp., is one of the

biggest owners of bonds issued by the power company, which filed

for bankruptcy protection in January while estimating that it could

owe tens of billions of dollars to victims of the state's deadly

2017 and 2018 wildfires. The investors have been lobbying in

Sacramento for months to sway the wildfire-liability bill the

legislature passed Thursday, people familiar with the process

said.

The legislation requires utilities to contribute as much as

$10.5 billion into a wildfire insurance fund and billions of

dollars for wildfire prevention, while capping future liabilities.

Bondholders and shareholders alike support the broad strokes of the

measure, but have clashed over an obscure point that may decide

which group ultimately controls the company, the people familiar

with the process said.

The skirmish over the reform bill shows how the funds involved

are reaching deep into California politics to gain an advantage.

Their lobbying has forced the state's politicians into a delicate

balancing act, forming policies that keep investors willing to

inject more cash into PG&E but don't come at the expense of

wildfire victims and electricity customers.

For PG&E to emerge from bankruptcy, it must have funding to

pay out claims from insurers and victims hurt by past wildfires it

caused, estimates of which range from $14 billion to $54

billion.

Holders of the company's stock, such as Abrams Capital

Management LP, Knighthead Capital Management LLC and Redwood

Capital Management LLC, petitioned lawmakers to include language in

the bill that would have allowed the company to pay for those

liabilities by issuing a new bond backed by income that would

otherwise be paid to shareholders.

The bondholders, who proposed to invest as much as $18 billion

to meet liabilities in exchange for control of the company, argued

that doing so would weaken PG&E's finances, according to people

familiar with the matter. Firms beside Elliott in the group include

Apollo Global Management LLC, Capital Group Cos., Citadel Advisors

LLC, Davidson Kempner Capital Management LLC, Pacific Investment

Management Co. and Värde Partners.

California lawmakers and Gov. Gavin Newsom's staff spent months

working on the reform bill and met multiple times with both

investor groups, the people familiar with the process said.

Legislators ultimately sided with bondholders on the issue,

writing a bill that allows PG&E to issue the securitization

bonds to pay victims from future wildfires, but not to pay off

claims from fires it already caused.

"Under this bill, PG&E can't borrow against the future

earnings to solve for the problems that got it into bankruptcy,"

said Michael Wara, head of the climate and energy policy program at

Stanford University's Woods Institute. "That's a good thing for the

state, but maybe not so much for shareholders."

Investors appear optimistic that both groups can come out ahead.

PG&E shares closed at $21.40 Wednesday, well above prices that

members of the shareholder group paid for their stakes. The

company's frequently traded bond due 2034 traded at 112 cents on

the dollar Wednesday, up from a low of 78 cents in January,

according to MarketAxess.

The shareholder group supports the new bill and could press for

passage of new legislation allowing issuance of bonds to fund

existing wildfire-claim settlements, a person familiar with the

group's thinking said. Equity holders also have a key advantage

over bondholders because they appointed PG&E's new management

and, for now, only the company can propose legally binding

bankruptcy plans to restructure it.

The next clash stands to be in a court hearing this month, when

bondholders will argue to remove PG&E's exclusive right to file

a restructuring plan. If they succeed, Elliott and others in the

bondholder group will be able to galvanize more support for their

own proposal to revamp the company.

Elliott's involvement could make PG&E's restructuring even

more contentious, because the fund has a reputation for employing

hardball tactics to pressure opponents ranging from the government

of Argentina to corporate executives, said a person involved in

California politics. "The governor does not want to be seen

standing next to Elliott at a press conference about this," the

person said.

Mr. Newsom's office couldn't be reached for comment.

Write to Matt Wirz at matthieu.wirz@wsj.com

(END) Dow Jones Newswires

July 11, 2019 15:54 ET (19:54 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

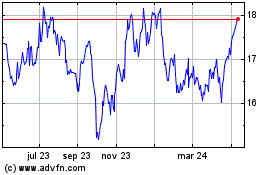

PG&E (NYSE:PCG)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

PG&E (NYSE:PCG)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024