TIDMIII

RNS Number : 2735H

3i Group PLC

31 July 2019

31 July 2019

3i Group plc

FY2020 Q1 performance update

A good start to the year

* Increase in NAV per share to 864 pence (31 March

2019: 815 pence) and total return of 6.2% for the

three months to 30 June 2019

* Completed GBP139 million Private Equity investment in

Magnitude Software Inc and signed the US

Infrastructure investment in Regional Rail, LLC,

which completed in early July

* Strong share price performance from 3i Infrastructure

plc ("3iN"), which completed its investment in Joulz

and announced a bolt-on investment for Valorem

Simon Borrows, Chief Executive, commented:

"This was another good quarter for 3i. Our Private Equity

portfolio performed well with Action again generating good growth,

as well as 3iN delivering another strong share price performance.

Both our Private Equity and Infrastructure teams had a busy quarter

on origination and investment. Our balance sheet is well-funded but

we remain cautious about the pricing of private investments in the

current environment and have continued to focus on platform and

bolt-on acquisitions."

Private Equity

Portfolio performance

The Private Equity portfolio generated good returns for the

quarter. Action has performed strongly since the end of 2018,

trading ahead of its budget for the first six months of 2019, with

good cash generation and a further improvement in year to date

like-for-like sales growth, which is now at 5%. The two new

distribution centres which opened in early 2019 are operating well,

with much improved stock availability as a result. Action opened 86

new stores in the six months to 30 June 2019, resulting in a total

store count of 1,409.

We continue to see challenging macro-economic headwinds in

Europe and in China specifically in the automotive sector, which is

affecting some of our European headquartered industrial companies.

However, there is little overall change to the momentum of our

Private Equity portfolio.

Private Equity investments

In May 2019, we completed our GBP139 million investment in

Magnitude Software Inc, a leading provider

of unified application data management solutions. We have

continued to grow portfolio value through our buy-and-build

strategy, with Havea Group (formerly Ponroy Santé) completing its

acquisition of Pasquali Healthcare and Christ acquiring Valmano, an

online retailer of jewellery and watches in Germany. These

acquisitions were funded directly by the portfolio companies and

did not require any further investment from 3i. In July, Formel D

agreed to acquire CPS, a provider of quality assurance services to

the automotive industry headquartered in France, and Lampenwelt

agreed to acquire QLF Group, one of the leading online lighting

players in the Benelux. There is a good pipeline of further

acquisition opportunities for a number of companies in the

portfolio.

During the period, we took the opportunity to purchase three

additional LP stakes in EFV, with 3i's investment totalling GBP61

million. These purchases increased 3i's holding in Action to 45.3%

(31 March 2019: 44.3%).

Since the quarter end, we have announced our investment in

Evernex, a leading international provider of third-party

maintenance services for data centre infrastructure. The investment

is expected to complete by the end of 2019.

Infrastructure

The Infrastructure business had another busy quarter. 3iN

completed its investment in Joulz in April 2019 and in July agreed

to invest c.EUR220 million in Ionisos, a leading owner and operator

of cold sterilisation facilities headquartered in France. In

addition, 3iN's portfolio company Valorem agreed to acquire a 51%

stake in Force Hydraulique Antillaise SAS. 3iN's share price

performed strongly, generating unrealised value growth of GBP58

million for 3i, in addition to dividend income of GBP12

million.

In April 2019 we announced that the 3i European Operational

Projects Fund had agreed to invest over EUR100 million in four

projects across Europe, taking total investment to c.40% of the

fund. We also announced the US Infrastructure team's agreement to

invest in Regional Rail, LLC and this investment completed in early

July. The infrastructure market remains very active and our

Infrastructure team is working on a pipeline of interesting

investment opportunities in Europe and North America.

Top 10 investments by value at 30 June 2019

Valuation Valuation

Valuation Valuation Mar-19 Jun-19

basis currency GBPm GBPm Activity in the quarter

=========== =========== ========== ========== ==============================================

Action Earnings EUR 2,731 3,076

=========== =========== ========== ========== ==============================================

3iN Quoted GBP 744 799 Accrued a GBP12 million FY2019 final dividend

=========== =========== ========== ========== ==============================================

Scandlines DCF EUR 529 555 Received a GBP6 million dividend

=========== =========== ========== ========== ==============================================

Hans Anders Earnings EUR 246 306

=========== =========== ========== ========== ==============================================

Basic-Fit Quoted EUR 254 271

=========== =========== ========== ========== ==============================================

Audley Travel Earnings GBP 270 270

=========== =========== ========== ========== ==============================================

WP Earnings EUR 241 253

=========== =========== ========== ========== ==============================================

Cirtec Medical Earnings USD 248 253

=========== =========== ========== ========== ==============================================

Q Holding Earnings USD 241 247

=========== =========== ========== ========== ==============================================

Havea Earnings EUR 174 190

=========== =========== ========== ========== ==============================================

The 10 investments in this table comprise 75% (31 March 2019:

75%) of the total Proprietary Capital portfolio value of GBP8,295

million (31 March 2019: GBP7,553 million).

Total return and NAV position

We recognised a net GBP212 million gain on foreign exchange in

the quarter, as both the US dollar and euro strengthened against

sterling. Based on the balance sheet at 30 June 2019, a 1% movement

in the euro and US dollar would result in a total return movement

of GBP48 million and GBP12 million respectively, net of any

hedging. The diluted NAV per share increased to 864 pence (31 March

2019: 815 pence) or 844 pence after deducting the 20 pence per

share second FY2019 dividend, which was paid on 19 July 2019.

Balance sheet

At 30 June 2019 net cash was GBP307 million. The 20 pence second

FY2019 dividend of GBP194 million was paid on 19 July 2019.

- ENDS -

Notes

1. Balance sheet values are stated net of foreign exchange translation. Where applicable, the

GBP equivalents at 30 June 2019 in this update have been calculated at a currency exchange

rate of EUR1.1173:GBP1 and $1.2718:GBP1 respectively. At 30 June 2019, 63% of the Group's

net assets were in euro and 16% were in US dollar.

2. At 30 June 2019 3i had 973 million diluted shares.

3. Action was valued using a post discount run-rate EBITDA multiple of 18.0x based on its run-rate

earnings to 30 June 2019.

For further information, please contact:

Silvia Santoro

Investor Relations Director

Tel: 020 7975 3258

Kathryn van der Kroft

Communications Director

Tel: 020 7975 3021

About 3i Group

3i is a leading international investment manager focused on

mid-market Private Equity and Infrastructure. Our core investment

markets are northern Europe and North America. For further

information, please visit: www.3i.com.

All statements in this performance update relate to the three

month period ended 30 June 2019 unless otherwise stated. The

financial information is unaudited and is presented on 3i's

non-GAAP Investment basis in order to provide users with the most

appropriate description of the drivers of 3i's performance. Net

asset value ("NAV") and total return are the same on the Investment

basis and on an IFRS basis. Details of the differences between 3i's

consolidated financial statements prepared on an IFRS basis and

under the Investment basis are provided in the 2019 Annual report

and accounts. There have been no material changes to the financial

position of 3i from the end of this quarter to the date of this

announcement.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

TSTSDSFWSFUSEFW

(END) Dow Jones Newswires

July 31, 2019 02:00 ET (06:00 GMT)

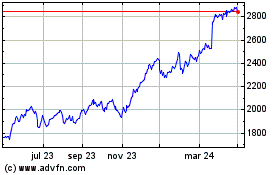

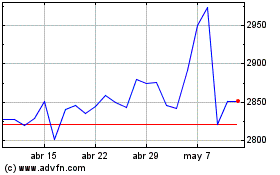

3i (LSE:III)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

3i (LSE:III)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024