ADRs End Lower; AngloGold, ArcelorMittal, Credit Suisse and Lloyds Trade Actively

31 Julio 2019 - 4:57PM

Noticias Dow Jones

International stocks trading in New York closed lower on

Wednesday.

The S&P/BNY Mellon index of American depositary receipts

fell 0.9% to 139.31. The European index decreased 1% to 129.48. The

Asian index fell 0.5% to 161.71. The Latin American index decreased

1.5% to 241.36. And the emerging-markets index fell 1% to

299.54.

AngloGold Ashanti Ltd. (AU), ArcelorMittal SA (MT), Credit

Suisse Group AG (CS) and Lloyds Banking Group PLC (LYG) were among

those with ADRs that traded actively.

AngloGold Ashanti said Wednesdayit expects to report a rise in

both headline and basic earnings for the first half of the year.

The South Africa-based gold miner attributed its performance to

costs against its restructured South African operations that were

booked last year and won't be repeated. For the half year AngloGold

expects to report headline earnings between $111 million and $129

million, compared with $99 million for the first half of 2018. This

equates to earnings per share of 27 cents to 31 cents, compared

with 24 cents. ADRs of AngloGold fell 9% to $17.06.

ArcelorMittal, SSAB, Hyundai Steel Co. and Tata Steel Ltd. are

best prepared to reduce their emissions in line with the levels

required to prevent global warming and are taking steps to

decarbonize, according to a report by nonprofit investment-research

provider CDP. According to the report, which analyses the world's

20 largest steel companies, Chinese, Russian and U.S. companies are

lagging behind their European and East Asian peers on environmental

performance and transparency. The report says the sector--which the

International Energy Agency says is responsible for up to 9% of

global emissions--is not reducing greenhouse gases at the rate

required to hold global warming below 2 degrees Celsius. ADRs of

ArcelorMittal fell 5% to $15.72.

Credit Suisse's profit growth accelerated in the second quarter,

bolstered by its global markets businesses and domestic operations

despite a challenging environment for Europe's lenders. The Swiss

bank's performance is a further endorsement of the sweeping

restructuring efforts that it started in 2015 to streamline its

investment-banking operations and sharpen its focus on wealth

management.The bank said Wednesday that its second-quarter net

profit rose 45% to 937 million Swiss francs ($946.3 million) from

647 million francs a year earlier, after a smaller rise in the

prior quarter. Revenue was flat from a year earlier at 5.58 billion

francs. Analysts had expected the bank to post a second-quarter net

profit of 806 million francs on revenue of 5.32 billion francs,

according to a consensus forecast provided by the bank. ADRs of

Credit Suisse rose 1.2% to $12.07.

Lloyds Banking Group missed expectations for the first half and

lowered returns guidance. Lloyds kicked off the lenders' earnings

season with a set of downbeat results, hit by impairment charges

and Brexit uncertainty. Lloyds's lackluster income growth in the

second quarter hints at weaker underlying trends in the U.K.

economy, Hargreaves Lansdown analyst Nicholas Hyett says. A tougher

economic environment and increasing competition have been

compounded by an increase in impairment charges, which have hit the

British bank's profit, Hyett says. "For now consumers still look

relatively upbeat, but increased exposure to things like unsecured

retail lending, car finance and credit cards mean that should

conditions turn sour for U.K. consumers Lloyds will suffer," Hyett

says. ADRs of Lloyds Banking Group fell 3% to $2.57.

(END) Dow Jones Newswires

July 31, 2019 17:42 ET (21:42 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

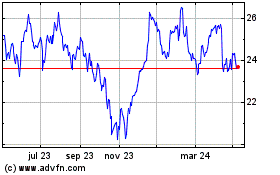

ArcelorMittal (EU:MT)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

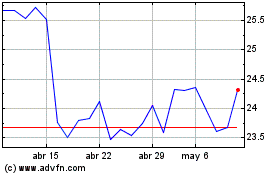

ArcelorMittal (EU:MT)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024