TIDMBIDS

RNS Number : 4688H

Bidstack Group PLC

01 August 2019

Certain information contained within this Announcement is deemed

by the Company to constitute inside information as stipulated under

the Market Abuse Regulation (EU) No. 596/2014 ("MAR"). Upon

publication of this Announcement, this information is considered to

be in the public domain.

1 August 2019

Bidstack Group PLC ("Bidstack" or "the Company")

Acquisition of Pubguard

Acquisition of advertising safety and fraud detection

platform

Bidstack Group plc (AIM: BIDS.L), the in-game advertising group,

is pleased to announce that it has, today, acquired the entire

issued share capital of Minimised Media Limited ("Minimised Media")

which trades under the name "Pubguard".

Minimised Media have built software technology that

automatically reviews advertisements served in-app and on mobile

and desktop web content to identify offensive, malicious, illegal

ad content and malware which can be blocked at a clients'

discretion.

Pubguard's platform and technology offering is both well known

and well respected in the digital advertising industry. Pubguard's

software will be used to protect all of Bidstack's gaming

inventories.

Brand safety and ad fraud have been hot topics in the

advertising industry for a number of years. According to a recent

Brand Safety report 65% of advertisers are present in non-brand

safe environments and there have been numerous calls to tackle

these challenges from industry leaders(1) .

Bidstack intends to maintain and utilise the Pubguard platform

to enhance its current technical and commercial offering as part of

its Software Development Kit. The Directors believe the acquisition

will provide a ready-made solution to enhance the Bidstack platform

and save the Company several months of development time and

resource.

The sellers of Minimised Media include Andrew Stevens, Chairman,

Justin Wenczka, Chief Executive, Chris Damski, Chief Product

Officer, Dan Hapgood, Chief Technology Officer, and two funds

operated by Mercia Asset Management Plc ("Mercia"). The

consideration for the transaction of GBP300,000 will be entirely

satisfied by the issue and allotment of 869,565 Bidstack ordinary

shares credited as fully paid at a price of 34.5 pence per share

("Consideration Shares").

Each of Justin Wenczka, Chris Damski, Dan Hapgood and Andrew

Stevens have agreed not to sell any of their Consideration Shares

for twelve months following completion save in certain limited

circumstances and for the following twelve months to sell their

shares only through a broker nominated by the Company. Mercia has

agreed not to sell any of its funds' Consideration Shares for six

months following completion save in certain limited

circumstances.

In the financial year from 1 May 2017 to 30 April 2018 Minimised

Media it made an unaudited loss of approximately GBP270k. In the

period from 1 May to 31 December 2018 it made an unaudited loss of

approximately GBP177k. As at 31 December 2018 the unaudited net

assets of Minimised Media were approximately GBP28k.

James Draper, CEO of Bidstack, commented, "As custodians of

studio director's artwork the prevention of fraudulent advertising

is a priority for us. Pubguard brings a number of technical and

commercial upsides to Bidstack. First, we are protecting gamers

against fake adverts that, for example, could redirect them to

adult content. Second, Pubguard brings the group technology and a

brand that is respected in the gaming and digital media space.

"As we have said previously, our intention is to grow Bidstack

to become a significant media owner in the video games market. We

stated Q3 would be an important period for us and I believe the

purchase of Pubguard, our first venture into growth by acquisition,

shows our commitment towards commercial innovation.

"We'd like to welcome the Pubguard team into the Bidstack family

and we look forward to growing the business further."

Justin Wenczka, CEO of Minimised Media said, "Due to high levels

of user engagement we've seen gaming brands targeted by fraudsters

so it makes sense for us to focus on an area of great need with the

fantastic team at Bidstack. Gaming is part of our company culture

so we know the huge potential of unlocking multi-platform ad spaces

and the need for increased safety measures to protect its sensitive

demographics. Bidstack has a tremendous focus and comprises of some

of the best talent in the industry and we're looking forward to

achieving great things together moving forward."

Application has been made for the admission of the 869,565

Consideration Shares to trading on AIM and it is expected that

dealings in the New Shares will commence on or around 6 August

2019. On admission the Consideration Shares will rank pari passu in

all respects with the Company's existing ordinary shares.

Total Voting Rights

Following admission of the Consideration Shares, the total

issued share capital of the Company will consist of 244,227,812

ordinary shares. As such the total number of voting rights in the

Company will be 244,227,812 ordinary shares. This number may be

used by shareholders as the denominator for the calculations by

which they will determine if they are required to notify their

interest in, or a change to their interest in, the Company under

the FCA's Disclosure and Transparency Rules.

References:

1. "Willing to risk it? A Report on Brand Safety and advertiser

preference" published by Ebiquity and Zulu 5, 26 June 2019

https://www.ebiquity.com/news-insights/research/brand-safety-in-the-uk-willing-to-risk-it-a-report-on-brand-safety-and-advertiser-preference/

Contacts

Bidstack Group PLC

James Draper, CEO +44 (0) 7850 341 885

SPARK Advisory Partners Limited (Nomad)

Mark Brady/Neil Baldwin/James Keeshan +44 (0) 203 368 3550

Peterhouse Capital Limited (Broker)

Eran Zucker/Lucy Williams/Duncan Vasey +44 (0) 20 7409 0930

ENDS

Notes to editors

Bidstack is an advertising technology company which provides

dynamic, targeted and automated native in-game advertising for the

global video games industry across multiple platforms. Its

proprietary API technology is capable of inserting adverts into

natural advertising space within video games across multiple video

games platforms (mobile, PC and console).

Bidstack's customers are games publishers and developers and

advertising agencies, brands and programmatic advertising

platforms. Bidstack contracts exclusive access to the native

in-game advertising space within video games from their developers

or publishers and sells that advertising space either direct to

specific brands and their agencies or through programmatic

advertising platforms.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

ACQCKDDDDBKBKON

(END) Dow Jones Newswires

August 01, 2019 02:02 ET (06:02 GMT)

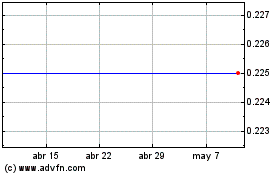

Bidstack (LSE:BIDS)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Bidstack (LSE:BIDS)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024