TIDMUKOG

RNS Number : 1643I

UK Oil & Gas PLC

07 August 2019

UK Oil & Gas PLC

("UKOG" or the "Company")

UKOG net share of Horse Hill oil field increases to 86% via

purchase of Tellurian's 35% interest

UK Oil & Gas PLC (London AIM: UKOG) is pleased to announce

that it has signed a binding heads of terms with Tellurian

Investments LLC ("Tellurian") to acquire the entire share capital

of its subsidiary Magellan Petroleum (UK) Investment Holdings

Limited ("Magellan") for a total consideration of GBP12 million in

cash and shares. Magellan holds a 35% direct interest in the Horse

Hill oil field and surrounding highly prospective PEDL137 and

PEDL246 licences, UKOG's flagship asset.

Upon completion of a share purchase agreement ("SPA"), this key

acquisition will see UKOG's Horse Hill net oil sales revenues, net

reserves and recoverable resources increase by over 69% from our

current 50.635% interest to a material 85.635% net share.

Crucially, the acquisition will also give the Company full control

over the forward Horse Hill drilling programme and production

schedule, together with sole ownership of the Horse Hill oil field

site lease.

As a consequence of this transaction, drilling of the

much-anticipated HH-2/2z Portland horizontal well will follow very

shortly after completion of the SPA.

This acquisition is in accordance with UKOG's stated business

plan to further consolidate its position in key assets with near

term cash generation potential. The acquisition is fully funded

primarily by current cash reserves and partly by a convertible

loan, which the company has entered into today, but has not yet

drawn down.

It should be noted that the cash consideration will not impact

UKOG's ability to fund the forthcoming Horse Hill 2/2z drilling and

extended testing campaign, as cash funds for its full 85.635% share

were set aside and ringfenced internally in Spring of this year.

The convertible loan detailed below also ensures full funding for

UKOG's increased share of future production facilities costs and

other near-term surface, subsurface and regulatory costs necessary

to bring the field into long-term production.

Transaction details:

The GBP12 million total consideration payable to Tellurian

comprises:

-- An GBP8 million initial payment on SPA Completion (GBP5

million in cash and GBP3 million in UKOG shares).

-- A GBP3 million deferred payment, on or before 31 December 2019, in UKOG shares.

-- A GBP1 million second deferred payment, on or before 31 March 2020, in UKOG shares.

-- The number of consideration shares issued will be calculated

by the payment amount divided by the 10-day volume weighted average

price ("VWAP") prior to the respective payment due date. At its

sole discretion, UKOG can also elect to pay all or part of the

deferred and second deferred payments in cash.

-- Tellurian's dealing in UKOG consideration shares is to be

subject to a 6-month orderly market provision.

Whilst this corporate transaction does not strictly require

formal Oil and Gas Authority ("OGA") consent, OGA has informed the

Company that they have no objections to the acquisition and that

they will provide the customary "comfort letter" to this effect

regarding the change in control of a licensee.

Stephen Sanderson, UKOG's Chief Executive, commented:

"This transformational acquisition, the largest in UKOG's 6 year

history as an oil and gas company, boosts UKOG's net share of its

flagship Horse Hill asset by a significant 69% from a 50.635% to an

85.635% net interest, providing the Company with the lion's share

of future production revenues and reserves, together with absolute

control over the field's future development and progress.

Importantly, the acquisition forms a key part of UKOG's stated

near term strategy to grow the company via organic appraisal

drilling and by targeted acquisitions in key assets with near term

cash flow potential.

The funding of UKOG's increased 85.635% share of the new HH-2/2z

horizontal drilling and testing campaign, scheduled to commence

later this year following transaction completion, will not be

impacted by this acquisition, as existing cash funds were set aside

and ringfenced for this purpose in Spring 2019. The Loan ensures we

also remain fully funded for further capital expenditures necessary

to get the field into long-term production once necessary

regulatory permits are in place this Autumn.

We now look forward to the transaction's completion and the

start of what promises to be an exciting new drilling and testing

campaign at Horse Hill, designed to bring the field into long term

oil production by year-end.

We thank Tellurian and its subsidiary Magellan for their

significant contribution over many years to the success of Horse

Hill and wish them good fortune in developing their global LNG

business."

Acquisition Financing

To fund this acquisition, UKOG will primarily use cash from the

GBP3.5 million placing raised in March 2019, together with funds

from an initial GBP5.5 million loan agreement ("Loan") with

Riverfort Global Opportunities PCC Limited and YA II PN Ltd

("Investors") that UKOG has entered into. The Company will receive

the full GBP5.5 million Loan in cash from the Investors upon draw

down, which is expected to be triggered towards the completion date

of the acquisition.

The portion of the Loan not utilised in the acquisition will be

utilised for the construction of production facilities, and other

surface, subsurface and regulatory activities necessary to bring

Horse Hill into long-term production following the expected grant

of production-related regulatory permissions.

The Loan attracts 0% interest and may, at the sole discretion of

the Investors, be converted into new ordinary shares in the

Company. The conversion price is the lower of either a share price

of 130% of the Company's average VWAP prior to the Loan drawdown

('Fixed Conversion Price'), or 90% of the Company's lowest VWAP

during the five days prior to the conversion date. The Loan is

convertible by the Investors in tranches of not less than

GBP150,000, with a limit of GBP3 million per quarter, unless

otherwise agreed by the Company.

The Loan is subject to customary conditions precedent and events

of default and is repayable 24 months after drawdown. The Company

retains the right to prepay any outstanding amount so long as the 5

day VWAP prior to prepayment is less than the Fixed Conversion

Price and subject to a 10 percent prepayment premium

The Loan includes a provision that, for as long as any portion

of the Loan is outstanding, neither the Investors nor any of their

affiliates shall hold any net short position with respect to the

equity of UKOG.

This Loan agreement also provides for further funding on the

same terms of between GBP3.6 million and GBP4.5 million dependent

on the operational performance of the Horse Hill asset.

Qualified Person's Statement

Matt Cartwright, UKOG's Commercial Director, who has over 35

years of relevant experience in the global oil industry, has

approved the information contained in this announcement. Mr

Cartwright is a Chartered Engineer and member of the Society of

Petroleum Engineers.

For further information, please contact:

UK Oil & Gas PLC

Stephen Sanderson / Kiran Morzaria Tel: 01483 900582

WH Ireland Ltd (Nominated Adviser and Broker)

James Joyce / James Sinclair-Ford Tel: 020 7220 1666

Cenkos Securities PLC (Joint Broker)

Joe Nally / Neil McDonald Tel: 0207 397 8919

Novum Securities (Joint Broker)

John Bellis Tel: 020 7399 9400

Public Relations

Brian Alexander Tel: 01483 900582

Glossary

extended well a well test, as per the permission granted by the

test or production Oil and Gas Authority, with an aggregate flow period

test duration over each zone of greater than 96 hours;

the objective being to establish whether a discovery

is commercially viable and the optimal methods

of future production and recovery

flow test a flow test or well test involves testing a well

by flowing hydrocarbons to surface, typically through

a test separator; key measured parameters are oil

and gas flow rates, downhole pressure and surface

pressure. The overall objective is to identify

the well's capacity to produce hydrocarbons at

a commercial flow rate

-------------------------------------------------------

horizontal a well that during drilling is steered so as to

well follow and remain within a particular geological

stratum or reservoir unit having a trajectory that

runs approximately parallel to the top and or base

of the target horizon

-------------------------------------------------------

oil field an accumulation, pool or group of pools of oil

in the subsurface that produces oil to surface

-------------------------------------------------------

UKOG Licence Interests

The Company has interests in the following UK licences:

Asset Licence UKOG Licence Operator Area Status

Interest Holder (km(2)

)

Field currently

Avington UKOG (GB) IGas Energy temporarily

(1) PEDL070 5% Limited Plc 18.3 shut in

--------------------- ---------- ------------------- ------------------- -------- --------------------

BB-1/1z oil

Broadford discovery, Loxley-1

Bridge/Loxley/Godley gas appraisal

Bridge well planning

(2, 3, UKOG (234) UKOG (234) application

8) PEDL234 100% Ltd (4) Ltd (4) 300.0 submitted

--------------------- ---------- ------------------- ------------------- -------- --------------------

Finalising new

site selection

to drill Portland

and Kimmeridge

A24 (3) PEDL143 67.5% UKOG UKOG (7) 91.8 prospects

--------------------- ---------- ------------------- ------------------- -------- --------------------

Horndean UKOG (GB) IGas Energy Field in stable

(1) PL211 10% Limited Plc 27.3 production

--------------------- ---------- ------------------- ------------------- -------- --------------------

Production tests

ongoing, two

Horse Horse further appraisal

Horse Hill Hill Developments Hill Developments wells scheduled

(5) PEDL137 85.635% Ltd Ltd 99.3 for 2019

--------------------- ---------- ------------------- ------------------- -------- --------------------

Horse Horse

Horse Hill Hill Developments Hill Developments

(5) PEDL246 85.635% Ltd Ltd 43.6 As above

--------------------- ---------- ------------------- ------------------- -------- --------------------

Preparing planning

submission for

Arreton-3 oil

appraisal well

Isle of and Arreton

Wight (Onshore) South exploration

(2, 3) PEDL331 95% UKOG UKOG 200.0 well

--------------------- ---------- ------------------- ------------------- -------- --------------------

Markwells UKOG (GB) UKOG (GB)

Wood PEDL126 100% Limited Limited 11.2 MW-1 P&A

--------------------- ---------- ------------------- ------------------- -------- --------------------

Notes:

1. Oil field currently in stable production.

2. Oil discovery pending development and/or appraisal

drilling.

3. Exploration asset with drillable prospects and leads.

4. Contains the Broadford Bridge-1/1z Kimmeridge oil discovery,

the eastern extension of the Godley Bridge Portland gas discovery

plus further undrilled Kimmeridge exploration prospects.

5. Oil field with three productive and commercially viable

zones, EWT ongoing, further drilling campaign scheduled,

development underway subject to grant of planning consent expected

in Q3 2019.

6. UKOG has a direct 77.9% interest in HHDL, which has a 65%

interest in PEDL137 and PEDL246.

7. OGA consent received for the transfer of operatorship from

Europa to UKOG

8. Gas discovery pending appraisal drilling and development with

underlying Kimmeridge potential

The information contained within this announcement is deemed by

the Company to constitute inside information under the Market Abuse

Regulation (EU) No. 596/2014

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

ACQCKADBDBKBNFK

(END) Dow Jones Newswires

August 07, 2019 02:01 ET (06:01 GMT)

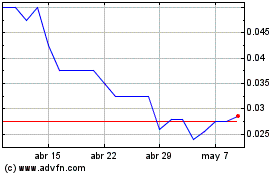

Uk Oil & Gas (LSE:UKOG)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Uk Oil & Gas (LSE:UKOG)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024