TIDMFDBK

RNS Number : 6399I

Feedback PLC

12 August 2019

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulations (EU) No. 596/2014. Upon the

publication of this announcement via Regulatory Information

Service, this inside information is now considered to be in the

public domain

Feedback plc

Proposed placing and subscription to raise GBP2 million,

proposed grant of options, proposed amendment to Share Option

Scheme and notice of General Meeting

Cambridge, 12 August 2019: Feedback plc (AIM: FDBK, "Feedback"

or the "Company"), the specialist medical imaging technology

company, announces that it has conditionally raised a total of GBP2

million (before expenses) via a proposed placing by Peterhouse

Capital Limited and Stanford Capital Partners Limited, and a

subscription of a total of 166,666,667 new ordinary shares in the

Company ("New Ordinary Shares"), at an issue price of 1.2 pence per

New Ordinary Share (the "Issue Price"), (the "Fundraise"). The

Fundraise is subject to, inter alia, the approval of shareholders

at a general meeting of the Company.

Fundraise Highlights:

-- The Company has conditionally raised GBP2 million (before

expenses) through the issue of the 166,666,667 New Ordinary

Shares.

-- The Placing and the Subscription are subject to, inter alia,

shareholder approval at a general meeting of the Company on 29

August 2019. If approved, the New Ordinary Shares are expected to

be admitted to on AIM on 30 August 2019.

-- The Placing Price represents a discount of approximately

14.3% to the closing mid-market price of 1.4 pence per Ordinary

Share on 9 August 2019.

-- The net proceeds of the Placing and the Subscription will be used:

o To complete the development of the Bleepa(TM) , the Company's

clinical messaging product;

o To build a Sales/support team to market and onboard users onto

the Bleepa(TM) product; and

o For general working capital.

-- The New Ordinary Shares will represent 30.78% of the issued

share capital of the Company as enlarged by the Fundraise.

Dr Alastair Riddell, Non-Executive Chairman of Feedback

said:

"I am delighted with the support shown by new and existing

shareholders for our new product Bleepa(TM) . This is an evolution

from Cadran devised and driven by the creativity of our CEO, Tom

Oakley, and developed with the assistance of our partners Future

Processing. We believe Bleepa(TM) is set to transform the outlook

for the Company and could change the way medical images are

communicated in everyday clinical practice on mobile devices and

laptops."

Proposed Grant of Options and amendment to EMI Option Scheme

The Board believes that it is very important to incentivise key

members of the management team. In conjunction with the Fundraise,

the Board therefore intends to grant Tom Oakley, CEO of Feedback,

options over new ordinary shares in the Company, representing

approximately 2.5 per cent. of the Company's issued share capital

as enlarged by the Fundraise. The grant of options will be subject

to shareholder approval at the General Meeting and, if approved,

will be granted pursuant to the Company's EMI Option Scheme.

The EMI Option Scheme currently contains a limit on the number

of options that can be granted in a 10-year period of 10 per cent.

of the issued share capital at the time of grant. Including the

proposed grant of options to Tom Oakley mentioned above, a total of

9.97 per cent. of the Enlarged Share Capital will have been granted

under option in the last 10-year period, of which 2.26 per cent.

was issued in the period but subsequently lapsed or were exercised.

Accordingly, subject to shareholder approval at the General

Meeting, the Board intends to amend its EMI Option Scheme to

increase the number of options that can be granted during the

10-year period from 10 per cent. to 12.5 per cent of the Company's

issued share capital at the time of the grant.

Notice of General Meeting and Shareholder Circular

The Fundraise is conditional, inter alia, on the approval of

shareholders of resolutions to be proposed at a general meeting of

the Company to provide authority to the Directors to allot further

new ordinary shares otherwise than on a pre-emptive basis.

A General Meeting of the Company will be held at the offices of

Peterhouse Capital Limited, 80 Cheapside, London EC2V 6EE 1:00 p.m.

on 29 August 2019, to seek this shareholder approval. A Circular

containing a Notice of General Meeting will be posted to

shareholders on or around 13 August 2019 and will be available on

the Company's website, www.fbkmed.com, shortly thereafter.

The above summary should be read in conjunction with the full

text of this announcement.

1. Introduction

The Company is pleased to announce that it has conditionally

raised GBP2 million (before expenses), by way of the proposed

placing and the proposed subscription, a total of 166,666,667 New

Ordinary Shares at the issue price of 1.2 pence per New Ordinary

Share. The net proceeds of the Placing and the Subscription will be

used predominantly to initiate the roll out of Bleepa(TM) , the

Company's clinical messaging product. As previously announced,

Feedback plans to establish a leading role in the medical

communication market. Bleepa(TM) , is currently in beta development

and will be formally launched at NHS Expo on 4-5 September 2019 in

Manchester.

The Placing and the Subscription are subject to, inter alia, the

approval of Shareholders at the General Meeting. Peterhouse and

Stanford Capital are acting as joint brokers in relation to the

Placing.

Admission of the New Ordinary Shares is expected to take place

at 8:00 a.m. on 30 August 2019, should the Resolutions, further

details of which can be found below, be passed at the General

Meeting.

2. Background to and reasons for the Placing and the Subscription

Recent strategic review and trading update

On 10 July 2019, Feedback announced an update on its trading for

the year ended 31 May 2019. Amongst other things, this update

reported that Feedback had generated unaudited revenue of GBP563k

which represented an increase of approximately 23 per cent. on the

previous financial year (year to 31 May 2018: GBP458k).

The Company also announced the result of its strategic review of

the Cadran portfolio.

Cadran is Feedback's established Picture Archiving and

Communications System (PACS) which facilitates the review of

medical imaging studies by clinicians. It is a progressive and

rigorously tested Class 1 medical device with a longstanding legacy

of service at NHS institutions, such as the Royal Papworth

Hospital. However, it is currently positioned in a competitive

market that shows little opportunity for future growth.

According to BMJ Innovations, 97% of hospital doctors routinely

use WhatsApp to communicate about patients. There is an increasing

trend for clinicians to use personal devices to discuss patient

care and make clinical decisions, as it is more convenient and

efficient than traditional methods of clinical communication.

Medical images are often shared as part of these chats as photos of

computer screens, and do not meet diagnostic clinical standards.

This raises a number of concerns with regard to safety of patient

data, breaches of GDPR and the ability to make safe clinical

decisions without using clinical grade medical images.

By incorporating a dedicated, encrypted messaging function to

Feedback's existing Cadran technology, the Directors believe it can

become a medical communication device capable of sharing clinical

grade medical imaging directly from a hospital PACS to mobile

devices, ensuring the safe handling of patient data and

facilitating a secure means of communication for clinicians. It is

estimated that there are between 10 million and 15 million doctors

globally. In the UK, across NHS hospital, community and primary

care settings, there are approximately 150,000 doctors in total and

over 320,000 nurses and midwives.

Any hospital that uses Bleepa(TM) will own the chat data and the

entire chat is intended to be exportable into the electronic

patient record upon the patient being discharged. The Directors

believe Bleepa(TM) will be one of a limited number of communication

devices capable of displaying medical images and CE marked as a

medical device.

Having undertaken a period of market research alongside NHS

clinicians, the Company has decided to invest in the product

enhancement of Cadran and launch the new product, Bleepa(TM) , at

NHS Expo on 4-5 September 2019 in Manchester. It is proposed to

market Bleepa(TM) using a SaaS model and charging in the order of

GBP10 per month per user, with a 12-month minimum contract and a 3

month cancellation period.

The Company believes that there may be further opportunities for

the use of Bleepa(TM) outside the UK, both within the EU and in

non-GDPR markets such as India and China.

As previously announced, the Board will continue its review of

the TexRAD product portfolio. The Company intends to issue regular

updates to the market on the progress of both the TexRAD review and

new product opportunities.

3. Reasons for the Placing and use of proceeds

Pursuant to the Placing and the Subscription, the Company will

receive net proceeds of approximately GBP1.9 million. The net

Placing and Subscription funds will be used for the following

purposes:

-- To complete the development of the Bleepa(TM) product;

-- To build a Sales/support team to market and onboard users onto the Bleepa(TM) product; and

-- For general working capital.

4. Details of the Placing, the Subscription and Admission

The Company has conditionally raised GBP2 million (before

expenses), representing the issue of 166,666,667 New Ordinary

Shares at the Issue Price, by way of the Placing and the

Subscription. The Issue Price of 1.2 pence represents a discount of

14.3 per cent. to the closing middle market price of an Ordinary

Share on 9 August 2019, being the latest practicable date prior to

the announcement of the Placing and the Subscription.

The Placing and the Subscription are conditional, inter alia,

upon:

-- the passing of the Resolutions without amendment at the General Meeting;

-- admission of the New Ordinary Shares to trading on AIM

becoming effective by not later than 8.00 a.m. on 30 August 2019

(or such later time and/or date (not being later than 31 October

2019) as Peterhouse, Stanford Capital and the Company may

agree).

In addition to the above, the Placing and the Subscription are

inter-conditional, and the Placing is conditional upon the Placing

Agreement (as described in more detail below) becoming

unconditional in all respects and not having been terminated in

accordance with its terms.

The Placing and the Subscription will result in the issue of a

total of 166,666,667 New Ordinary Shares, representing, in

aggregate, approximately 30.87 per cent. of the Enlarged Share

Capital. Such New Ordinary Shares, when issued and fully paid, will

rank pari passu in all respects with the Existing Ordinary Shares

and therefore will rank equally for all dividends or other

distributions declared, made or paid after the relevant date of

Admission.

Application will be made to the London Stock Exchange for the

New Ordinary Shares to be admitted to trading on AIM and,

conditional, inter alia, on the approval of Shareholders at the

General Meeting, admission of the New Ordinary Shares is expected

to occur on 30 August 2019.

It is expected that CREST accounts will be credited on the day

of Admission as regards the New Ordinary Shares in uncertificated

form and that certificates for those shares to be issued in

certificated form will be dispatched by first class post by 13

September 2019.

5. The Placing

Pursuant to the terms of the Placing Agreement, Peterhouse and

Stanford Capital, as agents for the Company, have agreed

conditionally to use their reasonable endeavours to procure

subscribers for the Placing Shares at the Issue Price. The Placing

is not being underwritten.

The obligations of Peterhouse and Stanford Capital under the

Placing Agreement are conditional, among other things, upon: (i)

the passing of the Resolutions without amendment at the General

Meeting; and (ii) Admission becoming effective by not later than

8.00 a.m. on 30 August 2019 (or such later time and/or date (not

being later than 31 October 2019) as Peterhouse, Stanford Capital

and the Company may agree).

The Placing Agreement contains certain warranties and

indemnities given by the Company in favour of Peterhouse and

Stanford Capital as to certain matters relating to the Company's

group and its business. The obligations of Peterhouse and Stanford

Capital under the Placing Agreement may be terminated in certain

circumstances if there occurs either a breach of any of the

warranties or if a materially adverse event occurs at any time

prior to Admission. If the conditions in the Placing Agreement are

not fulfilled on or before the relevant date in the Placing

Agreement or, if applicable, waived, then the relevant placing

monies will be returned to subscribers for New Ordinary Shares

without interest at their own risk.

The Placing Agreement also provides for the Company to pay

Peterhouse and Stanford Capital commissions and certain other costs

and expenses incidental to the Placing and Admission.

6. The Subscription

The Company has received letters of subscription for, in

aggregate, 57,700,000 Subscription Shares. The Subscription is

conditional, among other things, upon: (i) the passing of the

Resolutions without amendment at the General Meeting; and (ii)

Admission becoming effective by not later than 8.00 a.m. on 30

August 2019 (or such later time and/or date (not being later than

31 October 2019) as the Company and Brokers may agree).

7. Significant shareholder and Director subscriptions

Details of the subscriptions by Directors and persons

discharging managerial responsibilities in the Subscription at the

Issue Price and their resultant shareholdings on Admission are as

follows:

Name New Ordinary Ordinary Shares Percentage held

Shares being on Admission of Enlarged

subscribed Share Capital

on Admission

Lindsay Melvin (Director) 416,667 1,016,667 0.19

Prof Rory Shaw (PDMR) 4,166,667 4,166,667 0.77

The subscriptions by Lindsay Melvin and Prof Rory Shaw in the

Subscription are, in aggregate, deemed to be related party

transactions pursuant to rule 13 of the AIM Rules for Companies.

Accordingly, the Independent Directors consider, having consulted

with the Company's nominated adviser, Allenby Capital, that the

terms of subscription by Lindsay Melvin and Prof Rory Shaw are fair

and reasonable insofar as Shareholders are concerned.

Thomas Charlton, a substantial shareholder of the Company,

having an interest in approximately 23.25 per cent. of the Existing

Ordinary Shares, is subscribing for 33,200,000 New Ordinary Shares,

which represents an aggregate amount of GBP398,400 at the Issue

Price, pursuant to the Subscription. Tom Charlton's participation

in the Subscription constitutes a related party transaction under

rule 13 of the AIM Rules. Accordingly, the Independent Directors

consider, having consulted with the Company's nominated adviser,

Allenby Capital, that the terms of subscription for the New

Ordinary Shares by Tom Charlton are fair and reasonable insofar as

Shareholders are concerned.

8. Proposed Grant of Options and amendment to EMI Option Scheme

The Board believes that it is very important to incentivise key

members of the management team. In conjunction with the Fundraise,

the Board therefore intends to grant Tom Oakley, CEO of Feedback,

options over new ordinary shares in the Company ("Options"),

representing approximately 2.5 per cent. of the Company's issued

share capital as enlarged by the Fundraise. The grant of options

will be subject to shareholder approval at the general meeting and,

if approved, will be granted pursuant to the Company's Employee

Share EMI Option Scheme.

The EMI Option Scheme currently contains a limit on the number

of options that can be granted in a 10-year period of 10 per cent.

of the issued share capital at the time of grant. Including the

proposed grant of options to Tom Oakley mentioned above, a total of

9.97 per cent. of the Enlarged Share Capital will have been granted

under option in the last 10-year period, of which 2.26 per cent.

was issued in the period but subsequently lapsed or were exercised.

Accordingly, subject to shareholder approval at the General

Meeting, the Board intends to amend its EMI Option Scheme to

increase the number of options that can be granted during the

10-year period from 10 per cent. to 12.5 per cent of the Company's

issued share capital at the time of the grant.

9. General Meeting

A notice convening a General Meeting of the Company, to be held

at offices of Peterhouse Capital Limited at 80 Cheapside, London

EC2V 6EE at 1:00 p.m. on 29 August 2019 will be set out in the

Circular. At the General Meeting, the following Resolutions will be

proposed:

1. Resolution numbered 1 will be proposed as an ordinary

resolution to grant authority to the Directors to allot the

166,666,667 New Ordinary Shares and up to an aggregate nominal

value of GBP450,000 being equivalent to the nominal value of

approximately one-third of the Enlarged Share Capital (there being

no current intention to use this further authority); and

2. Resolution numbered 2 will be proposed as a special

resolution to dis-apply statutory pre-emption rights in respect of

the allotment of up to 166,666,667 New Ordinary Shares and up to a

further aggregate nominal value of GBP202,500, which is equivalent

to the nominal value approximately 15 per cent. of the Enlarged

Share Capital (there being no current intention to use this further

authority).

3. Resolution numbered 3 will be proposed as an ordinary

resolution to grant authority to the Directors to grant options

over ordinary shares equivalent to 2.5 per cent. of the Enlarged

Share Capital;

4. Resolution numbered 4 will be proposed as an ordinary

resolution to increase the number of options that can be granted

under the EMI Option Scheme in any 10-year period from 10 per cent.

to 12.5 per cent. of the issued share capital of the Company.

Resolutions 1, 3 and 4 will be proposed as an ordinary

resolutions and Resolution 2 as a special resolution.

10. Directors' Recommendation

The Board of Feedback considers the Placing and the Subscription

to be in the best interests of the Company and its shareholders as

a whole and therefore the Directors unanimously recommend that

shareholders vote in favour of the Resolutions as they intend to do

in respect of their own shareholdings of, in aggregate, 20,433,333

Ordinary Shares (representing approximately 5.47 per cent. of the

Company's existing issued share capital).

11. Total Voting Rights

On Admission, the issued share capital of the Company will

consist of 539,949,917 Ordinary Shares with one voting right each.

The Company does not hold any ordinary shares in treasury.

Therefore, the total number of ordinary shares and voting rights in

the Company will be 539,949,917. With effect from Admission, this

figure may be used by Shareholders in the Company as the

denominator for the calculations by which they will determine if

they are required to notify their interest in, or a change to their

interest in, the share capital of the Company under the FCA's

Disclosure Guidance and Transparency Rules.

EXPECTED TIMETABLE OF PRINCIPAL EVENTS

Circular posted to Shareholders On or around 13

August 2019

Latest time and date for receipt of Form 1:00 p.m. on 27

of Proxy August 2019

General Meeting 1:00 p.m. on 29

August 2019

Admission and commencement of dealings 8:00 a.m. on 30

in the New Ordinary Shares to trading on August 2019

AIM

CREST member accounts expected to be credited 30 August 2019

for the New Ordinary Shares in uncertificated

form (where applicable)

Dispatch of definitive share certificates by 13 September

for the New Ordinary Shares in certificated 2019

form (where applicable)

PLACING AND SUBSCRIPTION STATISTICS

Issue Price 1.2 pence

Number of Existing Ordinary Shares 373,283,250

Total number of New Ordinary Shares 166,666,667

Total number of Ordinary Shares in issue

on Admission 539,949,917

Percentage of the Enlarged Share Capital 30.87 per cent.

represented by the New Ordinary Shares

Estimated net proceeds of the Placing and Approximately GBP1.9

Subscription million

ISIN GB0003340550

SEDOL 0334055

DEFINITIONS

Admission the admission of the New Ordinary Shares

to trading on AIM becoming effective

in accordance with the AIM Rules.

AIM AIM, a market operated by the London

Stock Exchange.

AIM Rules the AIM Rules for Companies, as published

and amended from time to time by the

London Stock Exchange.

Allenby Capital Allenby Capital Limited, the Company's

nominated adviser pursuant to the AIM

Rules.

Articles the existing articles of association

of the Company as at the date of this

announcement.

Brokers Peterhouse and Stanford Capital.

Circular the circular to be sent to shareholders

on or around 13 August 2019.

Company or Feedback Feedback plc.

CREST the computerised settlement system (as

defined in the CREST Regulations) which

facilitates the transfer of title to

shares in uncertificated form.

CREST Manual the manual, as amended from time to

time, produced by Euroclear UK & Ireland

which facilitates the transfer of shares

in uncertificated form.

CREST member a person who has been admitted by Euroclear

UK and Ireland as a system-member (as

defined in the CREST Regulations).

CREST Regulations the Uncertificated Securities Regulations

2001 (SI 2001/3755) (as amended).

Directors or Board the directors of the Company.

EMI Option Scheme the Company's Enterprise Management

Incentive Option Scheme.

Enlarged Share Capital the 539,949,917 Ordinary Shares in issue

immediately following Admission.

Euroclear UK & Ireland Euroclear UK & Ireland Limited, the

operator of CREST.

Existing Ordinary Shares the 373,283,250 existing Ordinary Shares

in issue in the capital of the Company

as at the date of this announcement.

Form of Proxy the form of proxy for use in connection

with the General Meeting which will

accompany the Circular.

General Meeting or GM the general meeting of Shareholders

to be held at the offices of Peterhouse

Capital Limited at 80 Cheapside, London

EC2V 6EE at 1:00 p.m. on 29 August 2019.

HMRC HM Revenue & Customs.

Independent Directors Dr Alastair Riddell, Dr Tom Oakley,

Simon Sturge and Prof Timothy Irish,

being the Directors who are not participating

in the Placing or the Subscription.

ISIN International Securities Identification

Number.

Issue Price 1.2 pence per New Ordinary Share.

London Stock Exchange London Stock Exchange plc.

New Ordinary Shares together the Placing Shares and the

Subscription Shares.

Notice of General Meeting the notice of General Meeting to be

set out in the Circular.

Optionholders the holders of options to acquire Ordinary

Shares, offered or granted in accordance

with the share option scheme operated

by the Company.

Ordinary Shares the ordinary shares of 0.25 pence per

share in the capital of the Company.

Peterhouse Peterhouse Capital Limited, the Company's

joint broker, pursuant to the AIM Rules.

Placing the placing of the Placing Shares at

the Issue Price, as described in this

announcement.

Placing Agreement the conditional agreement dated 9 August

2019 between (1) the Company; (2) Peterhouse;

(3) Stanford Capital and (4) the Directors

relating to the Placing.

Placing Shares the 108,966,667 new Ordinary Shares,

which have been placed by Peterhouse

and Stanford Capital with institutional

and other investors.

Resolutions the resolutions numbered 1 and 2 to

be proposed at the General Meeting as

set out in the Notice of General Meeting.

Shareholder(s) holder(s) of Ordinary Shares.

Stanford Capital Stanford Capital Partners Limited, the

Company's joint broker, pursuant to

the AIM Rules.

Subscription the conditional subscription for the

Subscription Shares by certain investors.

Subscription Shares the 57,700,000 new Ordinary Shares which

have been subscribed pursuant to the

Subscription

UK the United Kingdom.

uncertificated or in recorded on the relevant register of

uncertificated form the share or security concerned as being

held in uncertificated form in CREST

and title to which may be transferred

by means of CREST.

Warrantholders the holders of warrants to acquire Ordinary

Shares.

GBP or pence the lawful currency of the UK.

Notification and public disclosure of transactions by persons

discharging managerial responsibilities and persons closely

associated with them

1 Details of the person discharging managerial responsibilities

/ person closely associated

a) Name Lindsay Melvin

-------------------------- ------------------------------------------

2 Reason for the notification

----------------------------------------------------------------------

a) Position/status Chief Financial Officer

-------------------------- ------------------------------------------

b) Initial notification Initial notification

/Amendment

-------------------------- ------------------------------------------

3 Details of the issuer, emission allowance market participant,

auction platform, auctioneer or auction monitor

----------------------------------------------------------------------

a) Name Feedback plc

-------------------------- ------------------------------------------

b) LEI 213800UGOF2GT2U2RV90

-------------------------- ------------------------------------------

4 Details of the transaction(s): section to be repeated for

(i) each type of instrument; (ii) each type of transaction;

(iii) each date; and (iv) each place where transactions

have been conducted

----------------------------------------------------------------------

a) Description of the Ordinary shares of 0.25p each in Feedback

financial instrument, plc

type of instrument

Identification code Identification code (ISIN) for Feedback

plc ordinary shares:

GB0003340550

-------------------------- ------------------------------------------

b) Nature of the transaction Subscription for shares

-------------------------- ------------------------------------------

c) Price(s) and volume(s) Price(s) Volume(s)

1.2p 416,667

----------

-------------------------- ------------------------------------------

d) Aggregated information N/A

- Aggregated volume

- Price

-------------------------- ------------------------------------------

e) Date of the transaction 9 August 2019

-------------------------- ------------------------------------------

f) Place of the transaction Outside a trading venue

-------------------------- ------------------------------------------

1 Details of the person discharging managerial responsibilities

/ person closely associated

a) Name Prof Rory Shaw

-------------------------- ------------------------------------------

2 Reason for the notification

----------------------------------------------------------------------

a) Position/status PDMR

-------------------------- ------------------------------------------

b) Initial notification Initial notification

/Amendment

-------------------------- ------------------------------------------

3 Details of the issuer, emission allowance market participant,

auction platform, auctioneer or auction monitor

----------------------------------------------------------------------

a) Name Feedback plc

-------------------------- ------------------------------------------

b) LEI 213800UGOF2GT2U2RV90

-------------------------- ------------------------------------------

4 Details of the transaction(s): section to be repeated for

(i) each type of instrument; (ii) each type of transaction;

(iii) each date; and (iv) each place where transactions

have been conducted

----------------------------------------------------------------------

a) Description of the Ordinary shares of 0.25p each in Feedback

financial instrument, plc

type of instrument

Identification code Identification code (ISIN) for Feedback

plc ordinary shares:

GB0003340550

-------------------------- ------------------------------------------

b) Nature of the transaction Subscription for shares

-------------------------- ------------------------------------------

c) Price(s) and volume(s) Price(s) Volume(s)

1.2p 4,166,667

----------

-------------------------- ------------------------------------------

d) Aggregated information N/A

- Aggregated volume

- Price

-------------------------- ------------------------------------------

e) Date of the transaction 9 August 2019

-------------------------- ------------------------------------------

f) Place of the transaction Outside a trading venue

-------------------------- ------------------------------------------

Enquiries:

Feedback plc

Tom Oakley, CEO +44 (0)1954 718072

Lindsay Melvin, CFO IR@fbk.com

Allenby Capital Limited (Nominated Adviser)

David Worlidge / Asha Chotai +44 (0)20 3328 5656

Peterhouse Capital Limited (Joint Broker)

Lucy Williams / Duncan Vasey +44 (0)20 7469 0936

Stanford Capital Partners Limited (Joint

Broker)

Patrick Claridge / John Howes +44 20 3815 8880

Instinctif Partners +44 (0)20 7457 2020

Rozi Morris/ Deborah Bell/ Phillip Marriage feedbackplc@instinctif.com

About Feedback plc

Feedback plc (AIM: FDBK) is a specialist medical imaging

technology company providing innovative software and systems,

through its fully-owned trading subsidiary, Feedback Medical

Limited. Its products advance the work of radiologists, clinicians

and medical researchers by improving workflows and giving unique

insights into diseases, particularly cancer. Feedback Medical works

with customers globally from headquarters in the internationally

renowned scientific hub of Cambridge, UK. Its proprietary

technologies are TexRAD(R) , the quantitative texture analysis tool

and Cadran, a picture archiving communication system (PACS). For

more information, see www.fbkmed.com/

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IOEGGUAWRUPBPGG

(END) Dow Jones Newswires

August 12, 2019 02:00 ET (06:00 GMT)

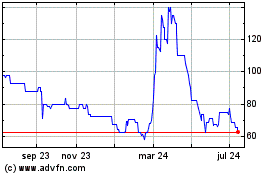

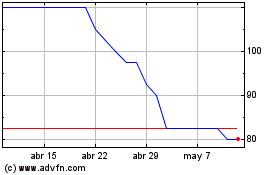

Feedback (LSE:FDBK)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Feedback (LSE:FDBK)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024