Feedback PLC Posting of Circular and Notice of General Meeting (9022I)

13 Agosto 2019 - 8:45AM

UK Regulatory

TIDMFDBK

RNS Number : 9022I

Feedback PLC

13 August 2019

Feedback plc

Posting of Circular and Notice of General Meeting

Cambridge, 13 August 2019: Further to its announcement on 12

August 2019, Feedback plc (AIM: FDBK, "Feedback" or the "Company"),

the specialist medical imaging technology company, announces that

it will hold a general meeting of the Company at 1.00 p.m. on 29

August 2019, at the offices of Peterhouse Capital Limited at 80

Cheapside, London EC2V 6EE.

The Company has today posted to its shareholders a circular

containing a notice convening the General Meeting (the "Circular"),

the purpose of which is to explain to Shareholders the background

to and reasons for the Placing and the Subscription and to seek

their approval of the resolutions to be proposed at the General

Meeting. The Circular will be available on the Company's website,

www.fbkmed.com, shortly.

Further re. Proposed Grant of Options

As previously announced, the Board intends to grant Tom Oakley,

CEO of Feedback, options over 13,498,748 new Ordinary Shares ("CEO

Options"), representing 2.5 per cent. of the Company's issued share

capital as enlarged by the Placing and Subscription. The CEO

Options will be exercisable at the Issue Price of 1.2 pence and

will vest over three years from the date of the grant. The grant of

the CEO Options will be subject to shareholder approval at the

General Meeting and, if approved, will be granted to the extent

possible pursuant to the EMI Option Scheme and any balance will be

granted pursuant to the Non Tax-Advantaged Option Scheme.

Should the resolution regarding the grant of the CEO Options be

approved by shareholders at the General Meeting, Tom Oakley will

hold options over 22,820,829 Ordinary Shares, equivalent to 4.23

per cent. of the Company's issued share capital, as enlarged by the

Placing and the Subscription.

Clarification re. the amendment to the Company's Option

Schemes

Further to the Company's announcement on 12 August 2019, the

Board wishes to clarify information provided regarding the

Company's existing option schemes. The Company stated in

yesterday's announcement that its EMI Option Scheme contains a

limit on the number of options that can be granted under the EMI

Option Scheme, in a 10-year period of 10 per cent. of the issued

share capital at the time of grant, including options that have

since lapsed or been exercised.

It has subsequently come to the Company's attention that the 10

per cent. limit on the number of options that can be granted in a

10-year period relates to the aggregate number of options granted

under the EMI Option Scheme and the Non Tax-Advantaged Option

Scheme (the "Company's Option Schemes") in a 10-year period,

excluding options that were granted in the period and have

subsequently lapsed.

On this basis, including the proposed grant of options to Tom

Oakley mentioned above, a total of 8.91 per cent. of the Company's

enlarged issued share capital will have been granted under option

under the Company's Option Schemes, in the last 10-year period

(excluding options that were granted in such period and have

subsequently lapsed). Accordingly, subject to shareholder approval

at the General Meeting, the Board intends to amend the Company's

Option Schemes to increase the number of options that can be

granted during the 10-year period from 10 per cent. to 12.5 per

cent of the Company's issued share capital at the time of the

grant.

Capitalised terms used but not defined in this announcement

shall have the meanings given to such terms in the section headed

'Definitions' in the Company's announcement of 12 August 2019.

Enquiries:

Feedback plc

Tom Oakley, CEO +44 (0)1954 718072

Lindsay Melvin, CFO IR@fbk.com

Allenby Capital Limited (Nominated

Adviser)

David Worlidge / Asha Chotai +44 (0)20 3328 5656

Peterhouse Capital Limited (Joint Broker)

Lucy Williams / Duncan Vasey +44 (0)20 7469 0936

Stanford Capital Partners Limited (Joint

Broker)

Patrick Claridge / John Howes +44 20 3815 8880

Instinctif Partners +44 (0)20 7457 2020

Rozi Morris/ Deborah Bell/ Phillip feedbackplc@instinctif.com

Marriage

About Feedback plc

Feedback plc (AIM: FDBK) is a specialist medical imaging

technology company providing innovative software and systems,

through its fully-owned trading subsidiary, Feedback Medical

Limited. Its products advance the work of radiologists, clinicians

and medical researchers by improving workflows and giving unique

insights into diseases, particularly cancer. Feedback Medical works

with customers globally from headquarters in the internationally

renowned scientific hub of Cambridge, UK. Its proprietary

technologies are TexRAD(R) , the quantitative texture analysis tool

and Cadran, a picture archiving communication system (PACS). For

more information, see www.fbkmed.com/

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

MSCUOOORKSAWAAR

(END) Dow Jones Newswires

August 13, 2019 09:45 ET (13:45 GMT)

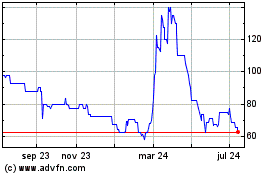

Feedback (LSE:FDBK)

Gráfica de Acción Histórica

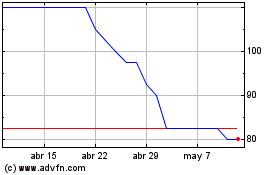

De Mar 2024 a Abr 2024

Feedback (LSE:FDBK)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024