Two River

Bancorp

(Exact name of registrant as specified in its charter)

|

New Jersey

(State or other jurisdiction

of incorporation)

|

000

-

51889

(Commission

File Number)

|

20-

3700861

(IRS Employer

Ident. No.)

|

|

|

|

766 Shrewsbury Avenue, Tinton Falls, New Jersey

(Address of principal executive offices)

|

07724

(Zip Code)

|

|

|

|

(732)

389

-

8722

Registrant’s telephone number, including area code

N/A

(Former name or former address, if changed since last report.)

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☒ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

Common Stock, no par value

|

Trading Symbol(s)

TRCB

|

Name of each exchange on which registered

The NASDAQ Stock Market LLC

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter)

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

1.01

Entry Into a Material Definitive A

greement.

On August 9, 2019, Two River Bancorp (“

Two River

”), the parent company of Two River Community Bank (“

Two River Community Bank

”), entered into an Agreement and Plan of Merger (the “

Merger Agreement

”) with OceanFirst Financial Corp. (“

OceanFirst

”), the parent company of OceanFirst Bank, N. A. (“

Ocean

First Bank

”), and Hammerhead Merger Sub Corp. (“

Merger Sub

”), a wholly-owned subsidiary of OceanFirst. Pursuant to the terms and subject to the conditions set forth in the Merger Agreement, Merger Sub will merge (the “

First-

Step Merger

”) with and into Two River, with Two River as the surviving entity, and immediately following the effective time of the First-Step Merger, Two River will merge with and into OceanFirst, with OceanFirst as the surviving entity (together with the First-Step Merger, the “

Integrated Mergers

”). In addition, immediately following the consummation of the Integrated Mergers, Two River Community Bank will merge with and into OceanFirst Bank, with OceanFirst Bank as the surviving bank (together with the Integrated Mergers, the “

Transaction

”).

Upon completion of the First-Step Merger, each share of common stock of Two River, no par value (“

Two River Common Stock

”), that is issued and outstanding immediately prior to the effective time of the First-Step Merger, other than Exception Shares (as defined in the Merger Agreement), will be converted into the right to receive a combination of 0.6663 (the “

Exchange Ratio

”) shares of OceanFirst common stock, par value $0.01 per share (the “

OceanFirst Common Stock

”), and cash in the amount of $5.375 (the “

C

ash Consideration

”). No fractional shares of OceanFirst Common Stock will be issued in connection with the Transaction. In addition, at the effective time of the First-Step Merger, each outstanding and unexercised option to purchase shares of Two River Common Stock, whether vested or unvested, will be cancelled and extinguished and exchanged into the right to receive an amount in cash (without interest) equal to the in-the-money value of such Two River stock option, determined as the excess, if any, of (a) the sum of (i) the product of the Exchange Ratio and the volume-weighted average trading price of OceanFirst Common Stock on the NASDAQ Global Select Market (the “

Nasdaq

”) for the five full trading days ending on the last trading day preceding the closing of the Transaction (the “Closing”) and (ii) the Cash Consideration over (b) the per share exercise price of such Two River stock option.

The Merger Agreement contains customary representations and warranties from both Two River and OceanFirst, and each party has agreed to customary covenants between the execution of the Merger Agreement and the effective time of the First-Step Merger, including a covenant by Two River to convene a special meeting of its shareholders to consider the Merger Agreement and, subject to certain exceptions, to recommend that its shareholders approve the Merger Agreement. In addition, the Merger Agreement contains a covenant by Two River, subject to certain exceptions, not to solicit alternative acquisition proposals, provide information to third parties or engage in discussions with third parties relating to an alternative acquisition proposal.

Each party’s obligation to complete the Integrated Mergers is subject to the satisfaction or waiver (where legally permissible) of a number of customary closing conditions, including, among others, (i) the approval of the Merger Agreement by the requisite vote of the shareholders of Two River, (ii) the effectiveness of the registration statement to be filed by OceanFirst with the Securities and Exchange Commission (“

SEC

”) relating to the OceanFirst Common Stock to be issued in the First-Step Merger, (iii) approval of the listing on the Nasdaq of the shares of OceanFirst Common Stock to be issued in the First-Step Merger, (iv) the absence of any order or other legal restriction prohibiting the consummation of the Integrated Mergers, and (v) receipt of the Requisite Regulatory Approvals (as defined in the Merger Agreement). Each party’s obligations to complete the Integrated Mergers is subject to the satisfaction or waiver of certain additional customary conditions, including: (a) subject to certain exceptions, the accuracy of the representations and warranties of the other party, including the representation that no Material Adverse Effect (as defined in the Merger Agreement) with respect such other party has occurred, (b) performance in all material respects by the other party of its obligations under the Merger Agreement, and (c) the receipt by each party of an opinion from its counsel to the effect that the Integrated Mergers will together be treated as an integrated transaction that qualifies as a “reorganization” within the meaning of Section 368(a) of the Internal Revenue Code of 1986, as amended. In addition, OceanFirst’s obligation to consummate the Integrated Mergers is subject to the condition that no Requisite Regulatory Approval include or contain, and that no governmental entity will have imposed or indicated that it will impose, any Materially Burdensome Regulatory Condition (as defined in the Merger Agreement).

The Merger Agreement provides certain termination rights for both OceanFirst and Two River, including, among others, if the closing of the Integrated Mergers has not been completed by May 31, 2020. If the Merger Agreement is terminated under certain circumstances, Two River may be obligated to pay OceanFirst a termination fee of approximately $7.3 million.

The Merger Agreement provides that OceanFirst will appoint a current member of Two River’s board of directors to the board of directors of OceanFirst and OceanFirst Bank effective upon the Closing.

Concurrently with the execution of the Merger Agreement, each of the directors and executive officers of Two River have entered into separate voting and support agreements with OceanFirst pursuant to which such individuals have agreed, subject to the terms set forth therein, to vote their shares of Two River common stock that they are entitled to vote for the Merger and related matters and to become subject to certain transfer restrictions with respect to their holdings of Two River common stock. Such voting agreements represent 1,034,049 shares of Two River common stock, or approximately 11.5% of the issued and outstanding shares of Two River common stock.

Subject to receiving the requisite approval of the Merger Agreement by Two River’s shareholders, the receipt of all required regulatory approvals, and the fulfillment of other customary closing conditions, the parties anticipate that the Transaction will close sometime in the first quarter of 2020 and that integration of the Two Rivers and OceanFirst operating systems will not until occur mid-2020. OceanFirst intends to operate the former branches of Two River Community Bank under the Two River brand until systems integration is complete.

The foregoing summary of the Merger Agreement and voting and support agreements is not complete and is qualified in its entirety by reference to the complete text of such documents, which are attached hereto as Exhibits 2.1 and 99.3 and incorporated herein by reference. The representations, warranties, and covenants of each party set forth in the Merger Agreement have been made only for purposes of, were and are solely for the benefit of the parties to, the Merger Agreement, may be subject to limitations agreed upon by the contracting parties, including being qualified by confidential disclosures made for the purposes of allocating contractual risk between the parties to the Merger Agreement instead of establishing these matters as facts, and may be subject to standards of materiality applicable to the contracting parties that differ from those applicable to investors. Accordingly, the representations and warranties may not describe the actual state of affairs at the date they were made or at any other time, and investors should not rely on them as statements of fact. In addition, such representations and warranties will not survive completion of the Transaction, and were made only as of the date of the Merger Agreement or such other date as is specified in the Merger Agreement. Moreover, information concerning the subject matter of the representations and warranties may change after the date of the Merger Agreement, which subsequent information may or may not be fully reflected in the parties’ public disclosures. Accordingly, the Merger Agreement is included with this filing only to provide investors with information regarding the terms of the Merger Agreement, and not to provide investors with any other factual information regarding OceanFirst or Two River, their respective affiliates or their respective businesses. The Merger Agreement should not be read alone, but should instead be read in conjunction with the other information regarding OceanFirst, Two River, and their respective affiliates or their respective businesses, and the Merger Agreement and the Transaction that will be contained in, or incorporated by reference into, the Registration Statement on Form S-4 that will include a proxy statement of Two River and a prospectus of OceanFirst, as well as in the Forms 10-K, Forms 10-Q and other filings that each of OceanFirst and Two River make with the SEC.

A copy of the joint press release announcing execution of the Merger Agreement is attached hereto as Exhibit 99.1

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On August 9, 2019, Two River entered into an amendment to the employment agreement between Two River and Two River Community Bank and William D. Moss, President and CEO of Two River and Two River Community Bank, and amendments to the change in control agreements between Two River and Two River Community Bank and each of A. Richard Abrahamian, Alan B. Turner, and Anthony Mero. Such amendments will become effective immediately prior to the effective time of the First Step Merger and will expire and be of no further force or effect if the First Step Merger is not completed. Copies of the amendments to such agreements are attached hereto as Exhibits 10.1 through 10.4 and incorporated herein by reference. In addition, amendments to the supplemental executive retirement agreements between Two River Community Bank and Messrs. Moss, Abrahamian, Turner, and Mero were also entered into on August 8, 2019, together with an amendment to the deferred compensation agreement for Mr. Moss and amendments to certain supplemental life insurance plans established by Two River Community Bank. Copies of such amendments are attached hereto as Exhibits 10.5 through 10.11 and incorporated herein by reference

Forward-Looking Statements

This Current Report on Form 8-K contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These statements include, but are not limited to, expectations or predictions of future financial or business performance, conditions relating to OceanFirst and Two River, or other effects of the proposed Transaction. Forward-looking statements are typically identified by words such as “believe,” “expect,” “anticipate,” “intend,” “target,” “estimate,” “continue,” “positions,” “prospects” or “potential,” or by future conditional verbs such as “will,” “would,” “should,” “could” or “may,” or by variations of such words or by similar expressions. These forward-looking statements are subject to numerous assumptions, risks and uncertainties, which change over time. Forward-looking statements are made only as of the date of this filing, and neither OceanFirst nor Two River undertakes any obligation to update any forward-looking statements contained in this presentation to reflect events or conditions after the date hereof. Actual results may differ materially from those described in any such forward-looking statements.

In addition to factors previously disclosed in the reports filed by OceanFirst and Two River with the SEC and those identified elsewhere in this document, the following factors, among others, could cause actual results to differ materially from forward looking statements or historical performance: the ability to obtain regulatory approvals and satisfy other closing conditions to the Transaction, including approval by shareholders of Two River; the timing of closing the Transaction; difficulties and delays in integrating the business or fully realizing cost savings and other benefits; changes in asset quality and credit risk; the inability to sustain revenue and earnings growth; changes in interest rates and capital markets; inflation; the effects of tariffs and currency wars on economic conditions globally and in the United States; customer acceptance of products and services; customer borrowing, repayment, investment and deposit practices; competitive conditions; economic conditions, including downturns in the local, regional or national economies; the impact, extent and timing of technological changes; changes in accounting policies or practices; changes in laws and regulations; and other actions of the Federal Reserve Board and other legislative and regulatory actions and reforms.

Important Additional Information and Where to Find It

OceanFirst intends to file with the SEC a Registration Statement on Form S-4 relating to the proposed Transaction, which will include a prospectus for the offer of OceanFirst common stock as well as the proxy statement of Two River for the solicitation of proxies from its shareholders to vote at the meeting at which the Merger Agreement will be considered. This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. SHAREHOLDERS OF TWO RIVER ARE URGED TO READ THE REGISTRATION STATEMENT AND THE PROXY STATEMENT/PROSPECTUS REGARDING THE TRANSACTION WHEN IT BECOMES AVAILABLE, AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION.

Two River, and certain of its directors and executive officers may, under the rules of the SEC, be deemed to be “participants” in the solicitation of proxies from shareholders of Two River in connection with the proposed Transaction. Information concerning the interests of the persons who may be considered “participants” in the solicitation will be set forth in the proxy statement/prospectus relating to the Transaction. Information concerning OceanFirst’s directors and executive officers, including their ownership of OceanFirst common stock, is set forth in its proxy statement previously filed with the SEC on March 18, 2019. Information concerning Two River’s directors and executive officers, including their ownership of Two River common stock, is set forth in its annual report on Form 10-K previously filed with the SEC on March 15, 2019. Shareholders may obtain additional information regarding interests of such participants by reading the registration statement and the proxy statement/prospectus when they become available.

Item

9.01.

Financial Statements and Exhibits.

(d) Exhibits.

|

2.1

|

Agreement and Plan of Merger, dated as of August 9, 2019, by and among Two River Bancorp, OceanFirst Financial Corp. and Hammerhead Merger Sub Corp.*

|

|

|

|

|

10.1

|

Amendment to Employment Agreement between William D. Moss and Two River Bancorp and Two River Community Bank, dated August 9, 2019.

|

|

|

|

|

10.2

|

Amendment to Change in Control Agreement between A. Richard Abrahamian and Two River Bancorp and Two River Community Bank, dated August 9, 2019.

|

|

|

|

|

10.3

|

Amendment to Change in Control Agreement between Alan B. Turner and Two River Bancorp and Two River Community Bank, dated August 9, 2019.

|

|

|

|

|

10.4

|

Amendment to Change in Control Agreement between Anthony Mero and Two River Bancorp and Two River Community Bank, dated August 9, 2019.

|

|

|

|

|

10.5

|

First Amendment to the Amended and Restated Two River Community Bank Supplemental Executive Retirement Agreement dated as of August 8, 2019, between Two River Community Bank and William D. Moss.

|

|

|

|

|

10.6

|

Third Amendment to the Amended and Restated Two River Community Bank Supplemental Executive Retirement Agreement dated as of August 8, 2019, between Two River Community Bank and A. Richard Abrahamian.

|

|

|

|

|

10.7

|

Sixth Amendment to the Amended and Restated Two River Community Bank Supplemental Executive Retirement Agreement dated as of August 8, 2019, between Two River Bancorp, Two River Community Bank and Alan B. Turner.

|

|

|

|

|

10.8

|

First Amendment to the Amended and Restated Two River Community Bank Supplemental Executive Retirement Agreement dated as of August 8, 2019, between Two River Bancorp, Two River Community Bank and Anthony A. Mero.

|

|

|

|

|

10.9

|

First Amendment to Deferred Compensation Agreement dated as of August 8, 2019, between Two River Community Bank and William D. Moss.

|

|

|

|

|

10,10

|

Second Amendment to the Officer Supplemental Life Insurance Plan made as of August 8, 2019 by Two River Community Bank

|

|

|

|

|

10.11

|

Second Amendment to the Officer Supplemental Life Insurance Plan # 2 made as of August 8, 2019 by Two River Community Bank

|

|

|

|

|

99.1

|

Press Release dated August 9, 2019.

|

|

|

|

|

99.2

|

Form of Voting and Support Agreement.

|

*Schedules and exhibits have been omitted pursuant to Item 601(b)(2) of Regulation S-K.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

TWO RIVER BANCORP

|

|

|

|

|

|

|

|

Dated: August 13, 2019

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/

A. Richard Abrahamian

|

|

|

|

|

A. Richard Abrahamian

|

|

|

|

|

Executive Vice President and Chief Financial Officer

|

|

6

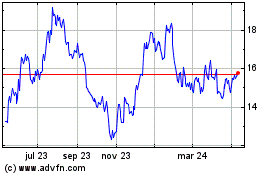

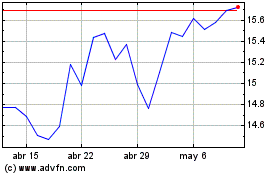

OceanFirst Financial (NASDAQ:OCFC)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

OceanFirst Financial (NASDAQ:OCFC)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024