Royal Bank of Canada's Profit Increases

21 Agosto 2019 - 6:23AM

Noticias Dow Jones

By Allison Prang

Royal Bank of Canada's profit increased in the third quarter as

net interest income rose by almost 10%.

The bank, based in Toronto, reported net income of $3.26 billion

Canadian dollars ($2.45 billion) in net income, up from roughly

$3.1 billion the comparable quarter a year prior. Earnings were

C$2.22 a share, up from C$2.10 a share. The bank said it had

earnings of C$2.26 a share on an adjusted basis, up from C$2.14 a

share.

The bank's credit-loss provision climbed 23% to C$425

million.

Net interest income, or the money that banks make from loans

after taking out what they pay customers in interest, was C$5.05

billion, up 9.8%. Noninterest income, which comes from categories

like insurance premiums and investment management, was C$6.5

billion, up 1%.

Total revenue, or net interest income and noninterest income

combined, was C$11.54 billion. Analysts were expecting C$11.16

billion.

The Bank of Canada, the country's central bank, is expected to

keep interest rates where they are, but it has faced more pressure

to lower rates after the U.S. Federal Reserve recently cut interest

rates by 25 basis points. Lower rates can hurt bank earnings by

lowering what banks can make in interest on some loans.

Separately, the bank said Wednesday that at the end of January,

its group head of RBC Capital Markets and RBC Investor &

Treasury Services, Doug McGregor, is retiring. The bank said RBC

Capital Markets' global head of investment banking, Derek Neldner,

would take over as group head of capital markets in November.

(END) Dow Jones Newswires

August 21, 2019 07:08 ET (11:08 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

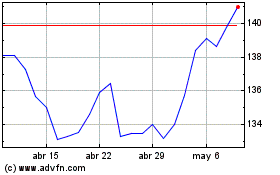

Royal Bank of Canada (TSX:RY)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

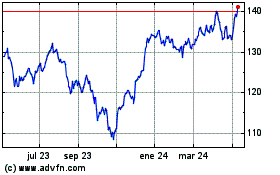

Royal Bank of Canada (TSX:RY)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024