TIDMBPET

RNS Number : 9893J

BMO Private Equity Trust PLC

23 August 2019

To: Stock Exchange For immediate release:

23 August 2019

BMO Private Equity Trust PLC

LEI: 2138009FW98WZFCGRN66

Unaudited results for the half year to 30 June 2019

Financial Highlights

-- NAV of 388.05p per Ordinary Share reflecting a total return

for the six months of 2.4% for the Ordinary Shares.

-- Share price total return for the six months of 13.7% for the Ordinary Shares.

-- Total quarterly dividends of 7.54p per Ordinary Share year to date.

-- Quarterly dividend of 3.73p paid on 31 July 2019

-- Quarterly dividend of 3.81p to be paid on 31 October 2019

-- Dividend yield of 4.3% based on the period end share price (1).

Chairman's Statement

As at 30 June 2019 the Net Asset Value ("NAV") of BMO Private

Equity Trust PLC ("the Company") was GBP286.9 million giving a NAV

per share of 388.05p. Taking account of dividends paid the NAV

total return for the six-month period was 2.4%. In addition, with

the share price discount having fallen to 9.0% at 30 June 2019 and

5.7% at the time of writing, compared to 17.9% at 31 December 2018,

the share price total return for the period was an impressive

13.7%.

In accordance with the Company's stated dividend policy, the

Board declares a quarterly dividend of 3.81p per ordinary share,

payable on 31 October 2019 to shareholders on the register on 4

October 2019 with an ex-dividend date of 3 October 2019. For

illustrative purposes only, this dividend and that paid on 31 July

2019 represent an annualised yield of 4.3% based on the share price

as at 30 June 2019. I would like to remind shareholders of our

dividend re-investment plan, which can be a convenient and easy way

to build up an existing holding.

On 19 June 2019, the Company entered into a new five-year

unsecured facility agreement with The Royal Bank of Scotland

International Limited ("RBSI"). This facility is comprised of a

EUR25 million term loan and a GBP75 million multi-currency

revolving credit facility. This new facility replaced the Company's

previous arrangements with Royal Bank of Scotland plc. The previous

facility comprised a EUR30 million term loan and a GBP45 million

multi-currency revolving credit facility.

The Board is pleased to have secured this new, larger and

cheaper facility which will allow the Company to maintain a

moderately but flexibly geared structure with the ability to draw

borrowings in multiple currencies.

As at 30 June 2019, the Company had cash of GBP6.7 million. With

borrowings of GBP25.2 million under the new loan facility, net debt

was GBP18.5 million, equivalent to a gearing level of 6.0%. The

total of outstanding undrawn commitments at 30 June 2019 was

GBP111.9 million and, of this, approximately GBP16.4 million is to

funds where the investment period has expired.

There is a healthy two-way market in private equity

internationally underpinned by increasing interest in the asset

class over the longer term. In this reporting period the Company

invested GBP28.0 million in new investments and we received through

realisations and income GBP25.4 million. Most of the portfolio is

invested in niche companies where there is a long-term growth

thesis based around a specific market, product or service. These

'secular' growth characteristics can provide useful resilience when

the background economic conditions are challenging. The broadly

diversified nature of the Company's portfolio is also a source of

strength.

Mark Tennant

Chairman

(1) Calculated as dividends of 3.73p paid on 31 July 2019 and

3.81p payable on 31 October 2019 annualised divided by the

Company's share price as at 30 June 2019.

Manager's Review

New Investments

In the first half of the year five new fund commitments and

three new co-investments have been made. Most of this activity was

in the first quarter.

GBP7 million has been committed to Kester Capital, a buy-out

fund focusing on the UK lower mid-market. We have previously

co-invested with Kester in Jollyes (pet shop chain) and CETA

(caravan insurance). EUR7 million was committed to Silverfleet

European Development Fund, a new initiative from this

well-established firm focusing on lower mid-market buy-outs across

Europe which lie in the size range with enterprise value between

EUR25 and EUR75 million. SEK 40 million (GBP3.5 million) has been

committed to Summa II, a Nordic focused buy-out fund with a

sustainability angle.

In the second quarter two new fund investments were made in

Inflexion Enterprise Fund V (GBP2.7 million) and Inflexion

Supplemental Fund V (GBP6.0 million). These are the latest in a

series of investments with this leading UK based mid-market buy-out

group.

Three co-investments were made in the first half of the year,

all of them in the first quarter. GBP2.9 million was invested in

San Siro, the market leading funeral services company based in

Milan, Italy. Led by Augens the plan is to build out a small chain

of funeral parlours. EUR3.5 million has been invested in STAXS the

Netherlands based provider of cleanroom consumables principally for

the pharmaceuticals industry. The deal is led by Silverfleet.

GBP2.1 million has been invested in Unmanned Aerial Vehicle (UAV)

company, Cyberhawk. Using the UAVs to inspect critical energy

infrastructure Cyberhawk delivers the results to clients via its

own cloud-based asset management software, iHawk. This deal is led

by energy specialists Magnesium.

In the second quarter many of the funds in the portfolio have

been active with a wide range of new investments being established.

Total drawdowns in the quarter were GBP12.6 million bringing the

total for new investments for the first half to GBP28.0 million. As

is typical, the new investments cover a diverse range of industrial

sectors and geographies. Some of the more notable ones illustrate

this mix.

In the UK GBP2.4 million was drawn by deal leaders Buckthorn for

a follow-on investment in oil services company Coretrax. This was

for the acquisition of US company Mohawk, which designs,

manufactures and operates a range of downhole tools which are

complementary to Coretrax's suite of well bore cleanup and plug and

abandonment products. August Equity IV called GBP0.8 million for

veterinary imaging business Hallmarq. SEP V called GBP0.6 million

for Immedis, a cloud-based payroll and employment tax software

provider. Our co-investment in Apposite Capital led care provider

Swanton made two follow-on acquisitions and an additional GBP0.5

million was called for these. RJD III called GBP0.7 million, of

which GBP0.6 million was for new investment in Survey Solutions, a

land and buildings survey company. The balance was for a

refinancing of training company Babington. We also contributed

GBP0.4 million to the refinancing of our co-investment in

Babington.

In Continental Europe Silverfleet European Development Fund

invested GBP0.6 million in Netherlands based cleanroom consumables

company STAXS complementing our GBP3.0 million co-investment made

in the company noted above. In France Montefiore IV invested GBP0.4

million in MCS Groupe, a credit management services company.

The US component of the portfolio has seen some new deals.

Graycliff III called GBP0.9 million for Sweeteners Plus, a New York

State based manufacturer and distributor of liquid and dry

sweeteners which are sold into restaurants and the beverage,

bakery, confectionary and pharmaceutical sectors. Bluepoint Capital

IV called GBP0.3 million for W.A. Kendall, a Georgia based company

providing vegetation management services to utilities, specifically

to ensure the safety of powerlines. They also called GBP0.4 million

for TAS Environmental Services, a Texas based company involved in

specialised environmental and industrial cleaning and waste

transportation.

Realisations

Total realisations and income received in the first half

amounted to GBP25.4 million. This was slightly behind the total of

GBP29.9 million at the same point last year.

Earlier in the year the Company benefitted from a number of

excellent exits from across the portfolio. Notable realisations

included GBP4 million coming in from August Equity's sale of cyber

security company SecureData (7.2x, 35% IRR). The further sell down

by Argan Capital of Swedish healthcare company Humana returned

GBP1.8 million bringing the return on this investment so far to 5x

cost. Hutton Collins returned GBP0.9 million on the exit of

restaurant chain Wagamama through its sale to the listed Restaurant

Group (2.6x, 17% IRR). In Spain Corpfin IV sold perfume company

Arenal to listed Portuguese company Sonae Group returning GBP0.8

million (1.8x, with potential to reach 2.4x and 32% IRR, through

earn out).

The flow of realisations has continued more recently. The

largest distribution in the second quarter came from the sale of

shares in Eventbrite, which we had received as consideration for

our holding in cloud enabled ticketing software company

Ticketscript. Eventbrite was listed in New York in September 2018.

After a strong debut the shares fell back and once the lock up had

expired FPE, the deal leaders, were able to exit at $19.4, some way

below the peak of $40. The net proceeds to us were GBP3.1 million,

which meant that the final return for the total holding was 2.0x

cost and an IRR of 17%. Collingwood, the Gibraltar based niche

motor insurer, returned GBP1.9 million through repayment of loan

notes along with interest and dividends. This was a result of a

debt refinancing of the company and this repays 80% of the cost of

the investment. Healthpoint Capital distributed GBP0.8 million

following the sale of Orthospace, an Israel based company with

disruptive technology for the treatment of rotator cuff injuries.

The initial consideration may be doubled if certain performance

milestones are met and this could result in a return of 3.7x cost

and an IRR of 43%. The Italian fund NEM Impresse distributed GBP0.8

million following the sale of plastic packaging for household,

personal care and cosmetics company Taplast. This

represented 2.8x cost and an IRR of over 100% since our

acquisition in January 2018. Portobello Capital III exited

Iberconsa, the Spanish hake, shrimp and squid fishing business

through the sale to Platinum Equity. Our proceeds were GBP0.7

million representing 3.6x cost and 50% IRR. In France Ciclad 5 had

two good exits. GBP0.6 million came in from the sale of

Slat&Infodis, a secure power supplies company (2.4x cost, 24%

IRR). A further GBP0.6 million came from the sale of Val'Eco &

Nord Coffrage, specialists in rental equipment for the building

industry (2.6x, 31% IRR).

Valuation Movements

The valuation movements in the first half of the year were quite

broadly spread. The largest uplift, of GBP2.9 million was from

medical device company Accuvein, which is seeing strong revenue

growth on the back of a new product launch. Our co-investment in US

based electrical motors company Sigma was up by GBP2.7 million

reflecting growth in revenues and EBITDA of 15% for the year ended

March 2019. Dotmatics, the specialist software company was up by

GBP1.9 million. Specialist Care provider Swanton was up by GBP0.5

million reflecting good progress with the roll out and in trading.

Chequers Capital XV was up by GBP0.4 million due to the last

remaining holding Thermocoax (temperature measurement systems)

being sold after the quarter end to Spirax-Sarco plc.

There were some negative movements. Ambio was adjusted down by

GBP1.3 million due to a weakening of sales momentum. Weird Fish was

down by GBP0.7 million due to continuing trading difficulties in a

weak market. Pinebridge New Europe Fund II was down by GBP0.6

million on the back of weak trading in some of its key remaining

holdings and the lowish exit value of car battery recycler Orzel

Bialy. In the US Camden Partners IV was down by GBP0.6 million

mainly due a number of adverse portfolio movements driven by weaker

trading. Lastly our holding in Environmental Technologies Fund was

down by GBP0.5 million due to the administration of their

longstanding holding in metals refiner, Metalysis.

Financing

As noted above on 19 June the Company entered into a new

five-year unsecured facility agreement with The Royal Bank of

Scotland International Limited (RBSI) comprising a EUR25 million

term loan and a GBP75 million multi-currency revolving credit

facility. At present the term loan is fully drawn (EUR25 million)

with another GBP4 million of the revolver drawn. This leaves GBP71

million of the revolving credit facility potentially available,

subject to compliance with the various covenants. The Company is

therefore well placed to fund any gap between drawdown and

realisations as well as having good scope for the acquisition of

co-investments or secondaries.

Outlook

The economic and political background has deteriorated over the

last few months with a resolution to the Brexit impasse appearing

no nearer and the threat of 'no deal', or something close to it,

rising in probability. Both the UK and German economies appear to

be at real risk of dipping into recession and similar trends are

seen elsewhere in Europe. Notwithstanding these challenges there is

a very healthy amount of activity within the private equity market

internationally. Our portfolio has recorded a slightly lower amount

of exit activity in the first half of the year compared with last

year, which was a record year, with total proceeds to date around

15% down. There has been exit activity in every section of the

portfolio and the mature element of the portfolio is expected to

continue to yield a healthy flow of realisations in the second half

of the year. There are some companies in the portfolio facing

challenges, but the general picture is one of good progress and the

broadly-based rise in valuations underlines this. Our dealflow in

both funds and co-investments is strong and we expect to add a

number of new investments over the remainder of the year. Our

assessment is that there is excellent scope for further growth in

shareholder value between now and the year end.

Hamish Mair

Investment Manager

BMO Investment Business Limited

BMO Private Equity Trust PLC

Statement of Comprehensive Income for the

half year ended 30 June 2019

Unaudited

Revenue Capital Total

GBP'000 GBP'000 GBP'000

---------------------------------------------- --------- --------- ---------

Income

Gains on investments held at fair value - 8,692 8,692

Exchange gains - 95 95

Investment income 2,083 - 2,083

Other income 49 - 49

---------------------------------------------- --------- --------- ---------

Total income 2,132 8,787 10,919

---------------------------------------------- --------- --------- ---------

Expenditure

Investment management fee - basic fee (138) (1,244) (1,382)

Investment management fee - performance

fee - (1,624) (1,624)

Other expenses (414) - (414)

---------------------------------------------- --------- --------- ---------

Total expenditure (552) (2,868) (3,420)

---------------------------------------------- --------- --------- ---------

Profit before finance costs and taxation 1,580 5,919 7,499

Finance costs (85) (767) (852)

---------------------------------------------- --------- --------- ---------

Profit before taxation 1,495 5,152 6,647

Taxation (284) 284 -

Profit for period/total comprehensive income 1,211 5,436 6,647

Return per Ordinary Share 1.64p 7.35p 8.99p

---------------------------------------------- --------- --------- ---------

The total column is the profit and loss account of the

Company.

All revenue and capital items in the above statement derive from

continuing operations.

BMO Private Equity Trust PLC

Statement of Comprehensive Income for the

half year ended 30 June 2018

Unaudited

Revenue Capital Total

GBP'000 GBP'000 GBP'000

------------------------------------------------- --------- --------- ---------

Income

Gains on investments held at fair value - 8,387 8,387

Exchange gains - 98 98

Investment income 495 - 495

Other income 40 - 40

------------------------------------------------- --------- --------- ---------

Total income 535 8,485 9,020

------------------------------------------------- --------- --------- ---------

Expenditure

Investment management fee - basic fee (320) (961) (1,281)

Investment management fee - performance

fee - (2,032) (2,032)

Other expenses (387) - (387)

------------------------------------------------- --------- --------- ---------

Total expenditure (707) (2,993) (3,700)

------------------------------------------------- --------- --------- ---------

(Loss)/profit before finance costs and taxation (172) 5,492 5,320

Finance costs (210) (631) (841)

------------------------------------------------- --------- --------- ---------

(Loss)/profit before taxation (382) 4,861 4,479

Taxation - - -

(Loss)/profit for period/total comprehensive

income (382) 4,861 4,479

Return per Ordinary Share (0.52)p 6.58p 6.06p

------------------------------------------------- --------- --------- ---------

The total column is the profit and loss account of the

Company.

All revenue and capital items in the above statement derive from

continuing operations.

BMO Private Equity Trust PLC

Statement of Comprehensive Income for the

year ended 31 December 2018

(Audited)

Revenue Capital Total

GBP'000 GBP'000 GBP'000

-------------------------------------------- --------- --------- ---------

Income

Gains on investments held at fair value - 36,966 36,966

Exchange gains - 35 35

Investment income 2,340 - 2,340

Other income 81 - 81

-------------------------------------------- --------- --------- ---------

Total income 2,421 37,001 39,422

-------------------------------------------- --------- --------- ---------

Expenditure

Investment management fee - basic fee (660) (1,980) (2,640)

Investment management fee - performance

fee - (2,277) (2,277)

Other expenses (760) - (760)

-------------------------------------------- --------- --------- ---------

Total expenditure (1,420) (4,257) (5,677)

-------------------------------------------- --------- --------- ---------

Profit before finance costs and taxation 1,001 32,744 33,745

Finance costs (428) (1,286) (1,714)

-------------------------------------------- --------- --------- ---------

Profit before taxation 573 31,458 32,031

Taxation (109) 109 -

Profit for year/total comprehensive income 464 31,567 32,031

Return per Ordinary Share 0.63p 42.69p 43.32p

-------------------------------------------- --------- --------- ---------

The total column is the profit and loss account of the

Company.

All revenue and capital items in the above statement derive from

continuing operations.

BMO Private Equity Trust PLC

Amounts Recognised as Dividends

Six months Six months

ended 30 ended 30

June 2019 June 2018

(unaudited) (unaudited)

GBP'000 GBP'000 Year ended

31 December

2018

(audited)

GBP'000

Quarterly Ordinary Share dividend of 3.55p

per share for the quarter ended 30 September

2017 2,624 2,624

------------- ------------- --------------

Quarterly Ordinary Share dividend of 3.57p

per share for the quarter ended 31 December

2017 - 2,640 2,640

------------- ------------- --------------

Quarterly Ordinary Share dividend of 3.57p

per share for the quarter ended 31 March

2018 2,640

------------- ------------- --------------

Quarterly Ordinary Share dividend of 3.57p

per share for the quarter ended 30 June

2018 - - 2,640

------------- ------------- --------------

Quarterly Ordinary Share dividend of 3.58p 2,647 - -

per share for the quarter ended 31 September

2018

------------- ------------- --------------

Quarterly Ordinary Share dividend of 3.65p

per share for the quarter ended 31 December

2018 2,699

------------- ------------- --------------

5,346 5,264 10,544

------------- ------------- --------------

BMO Private Equity Trust PLC

Balance Sheet

As at 30 June As at 30 As at 31

2019 June 2018 December

(unaudited) 2018

(unaudited) (audited)

GBP'000 GBP'000 GBP'000

----------------------------------- -------------- ------------- -----------

Non-current assets

Investments at fair value through

profit or loss 308,737 286,352 295,242

Current assets

Other receivables 17 32 142

Cash and cash equivalents 6,693 7,017 21,335

----------------------------------- -------------- ------------- -----------

6,710 7,049 21,477

Current liabilities

Other payables (3,362) (3,726) (4,267)

Interest-bearing bank loan (4,000) - (26,821)

----------------------------------- -------------- ------------- -----------

(7,362) (3,726) (31,088)

----------------------------------- -------------- ------------- -----------

Net current (liabilities)/assets (652) 3,323 (9,611)

Non-current liabilities

Interest-bearing bank loan (21,153) (26,316) -

----------------------------------- -------------- ------------- -----------

Net assets 286,932 263,359 285,631

----------------------------------- -------------- ------------- -----------

Equity

Called-up ordinary share capital 739 739 739

Share premium account 2,527 2,527 2,527

Special distributable capital

reserve 15,040 15,040 15,040

Special distributable revenue

reserve 31,403 31,403 31,403

Capital redemption reserve 1,335 1,335 1,335

Capital reserve 235,888 212,697 234,587

Revenue reserve - (382) -

Shareholders' funds 286,932 263,359 285,631

----------------------------------- -------------- ------------- -----------

Net asset value per Ordinary

Share 388.05p 356.17p 386.29p

----------------------------------- -------------- ------------- -----------

BMO Private Equity Trust PLC

Statement of Changes in Equity

Share Share Special Special Capital Capital Revenue Total

Capital Premium Distributable Distributable Redemption Reserve Reserve

Account Capital Revenue Reserve

Reserve Reserve

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

For the six months ended 30 June 2019 (unaudited)

Net assets at 1 January

2019 739 2,527 15,040 31,403 1,335 234,587 - 285,631

Profit/(loss) for

the period/total

comprehensive income - - - - - 5,436 1,211 6,647

Dividends paid - - - - - (4,135) (1,211) (5,346)

Net assets at 30

June 2019 739 2,527 15,040 31,403 1,335 235,888 - 286,932

------------------ ---- ------ ------- ------- ------ -------- --------

For the six months ended 30 June 2018 (unaudited)

Net assets at 1 January

2018 739 2,527 15,040 31,403 1,335 213,100 - 264,144

Profit/(loss) for

the period/total

comprehensive income - - - - - 4,861 (382) 4,479

Dividends paid - - - - - (5,264) - (5,264)

Net assets at 30

June 2018 739 2,527 15,040 31,403 1,335 212,697 (382) 263,359

------------------ ---- ------ ------- ------- ------ -------- ------ --------

For the year ended 31 December 2018 (audited)

Net assets at 1 January

2018 739 2,527 15,040 31,403 1,335 213,100 - 264,144

Profit/(loss) for

the year/total comprehensive

income - - - - - 31,567 464 32,031

Dividends paid - - - - - (10,080) (464) (10,544)

Net assets at 31

December 2018 739 2,527 15,040 31,403 1,335 234,587 - 285,631

------------------ ---- ------ ------- ------- ------ -------- --------

BMO Private Equity Trust PLC

Cash Flow Statement

Six months Six months Year ended

ended ended

30 June 2019 30 June 2018 31 December

2018

(unaudited) (unaudited) (audited)

GBP000 GBP000 GBP000

------------------------------------- -------------- -------------- -------------

Operating activities

Profit before taxation 6,647 4,479 32,031

Gains on disposals of investments (10,611) (13,525) (41,549)

Decrease/ (increase) in

holding gains 1,919 5,138 4,583

Exchange differences (95) (98) (35)

Interest income (49) (40) (81)

Interest received 49 40 81

Investment income (2,083) (495) (2,340)

Dividends received 2,083 495 2,340

Finance costs 852 841 1,714

Decrease/ (increase) in

other receivables 103 (6) (2)

(Decrease)/ increase in

other payables (676) 655 999

------------------------------------- -------------- -------------- -------------

Net cash outflow from operating

activities (1,861) (2,516) (2,259)

------------------------------------- -------------- -------------- -------------

Investing activities

Purchases of investments (28,019) (40,528) (71,909)

Sales of investments 23,216 29,306 80,261

Net cash (outflow)/ inflow

from investing activities (4,803) (11,222) 8,352

------------------------------------- -------------- -------------- -------------

Financing activities

Drawdown of bank loans, 4,000 - -

net of costs

Arrangement cost from issue (1,203) - -

of loan facilities

Net movement in loan facilities (4,457) - -

Interest paid (967) (743) (1,310)

Equity dividends paid (5,346) (5,264) (10,544)

------------------------------------- -------------- -------------- -------------

Net cash outflow from financing

activities (7,973) (6,007) (11,854)

------------------------------------- -------------- -------------- -------------

Net decrease in cash and

cash equivalents (14,637) (19,745) (5,761)

Currency (losses)/gains (5) (3) 331

------------------------------------- -------------- -------------- -------------

Net decrease in cash and

cash equivalents (14,462) (19,748) (5,430)

Opening cash and cash equivalents 21,335 26,765 26,765

------------------------------------- -------------- -------------- -------------

Closing cash and cash equivalents 6,693 7,017 21,335

------------------------------------- -------------- -------------- -------------

Statement of Principal Risks and Uncertainties

The Directors believe that the principal risks and uncertainties

faced by the Company include investment, strategic, external,

regulatory, operational, financial and funding. The Company is also

exposed to risks in relation to its financial instruments. These

risks, and the way in which they are managed, are described in more

detail under the heading Principal Risks and Uncertainties and Risk

Management within the Business Model, Strategy and Policies Section

in the Annual Report for the year ended 31 December 2018. The

Company's principal risks and uncertainties have not changed

materially since the date of that report and are not expected to

change materially for the remaining six months of the Company's

financial year.

Directors' Statement of Responsibilities in Respect of the Half

Yearly Financial Report

In accordance with Chapter 4 of the Disclosure Guidance and

Transparency Rules, the Directors confirm that to the best of their

knowledge:

-- the condensed set of financial statements has been prepared

in accordance with applicable International

Financial Reporting Standards on a going concern basis, and

gives a true and fair view of the assets, liabilities, financial

position and net return of the Company;

-- the half-yearly report includes a fair review of the

development and performance of the Company and

important events that have occurred during the first six months

of the financial year and their impact on the

financial statements;

-- the Directors' Statement of Principal Risks and Uncertainties

shown above is a fair review of the principal risks and

uncertainties for the remainder of the financial year; and

-- the half-yearly report includes a fair review of the related

party transactions that have taken place in the first six months of

the financial year.

On behalf of the Board

Mark Tennant

Chairman

Notes (unaudited)

1. The condensed company financial statements have been prepared

on a going concern basis in accordance with International Financial

Reporting Standard ('IFRS') IAS 34 'Interim Financial Reporting'

and the accounting policies set out in the statutory accounts for

the year ended 31 December 2018. The condensed financial statements

do not include all of the information and disclosures required for

a complete set of IFRS financial statements and should be read in

conjunction with the financial statements for the year ended 31

December 2018, which were prepared under full IFRS

requirements.

During the year to 31 December 2018, the management fee and bank

loan interest were allocated 75 per cent to capital and 25 per cent

to revenue. In accordance with the Board's expected long-term

splits of returns in the form of capital gains and income, with

effect from 1 January 2019 the allocation basis has been revised to

90 per cent to capital and 10 per cent to revenue.

2. Earnings for the six months to 30 June 2019 should not be

taken as a guide to the results for the year to 31 December

2019.

3. Investment management fee:

Six months to 30 Six months to 30 Year ended 31 December

June 2019 June 2018 (unaudited) 2018 (audited)

(unaudited)

Revenue Capital Total Revenue Capital Total Revenue Capital Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------- --------- --------- --------- --------- --------- --------- --------- --------- ---------

Investment

management

fee - basic fee 138 1,244 1,382 320 961 1,281 660 1,980 2,640

Investment

management

fee - performance

fee - 1,624 1,624 - 2,032 2,032 - 2,277 2,277

138 2,868 3,006 320 2,993 3,313 660 4,257 4,917

------------------- --------- --------- --------- --------- --------- --------- --------- --------- ---------

4. Finance costs:

Six months to 30 Six months to 30 Year ended 31 December

June 2019 June 2018 (unaudited) 2018 (audited)

(unaudited)

Revenue Capital Total Revenue Capital Total Revenue Capital Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------ --------- --------- --------- --------- --------- --------- --------- --------- ---------

Interest payable

on bank loans 85 767 852 210 631 841 428 1,286 1,714

5. The return per Ordinary Share is based on a net profit on

ordinary activities after taxation of GBP6,647,000 (30 June 2018 -

GBP4,479,000; 31 December 2018 - GBP32,031,000) and on 73,941,429

(30 June 2018 -73,941,429; 31 December 2018 -73,941,429) shares,

being the weighted average number of Ordinary Shares in issue

during the period.

6. The net asset value per Ordinary Share is based on net assets

at the period end of GBP286,932,000 (30 June 2018 - GBP263,359,000;

31 December 2018 - GBP285,631,000) and on 73,941,429 (30 June 2018

- 73,941,429; 31 December 2018 - 73,941,429) shares, being the

number of Ordinary Shares in issue at the period end.

7. The fair value measurements for financial assets and

liabilities are categorised into different levels in the fair value

hierarchy based on inputs to valuation techniques used. The

different levels are defined as follows:

Level 1 reflects financial instruments quoted in an active

market.

Level 2 reflects financial instruments whose fair value is

evidenced by comparison with other observable current market

transactions in the same instrument or based on a valuation

technique whose variables includes only data from observable

markets.

Level 3 reflects financial instruments whose fair value is

determined in whole or in part using a valuation technique based on

assumptions that are not supported by prices from observable market

transactions in the same instrument and not based on available

observable market data.

Level Level Level Total

1 2 3

GBP'000 GBP'000 GBP'000 GBP'000

----------------------------- -------- ----------- -------- -----------

30 June 2019

Financial assets 503 - 308,234 308,737

Investments

Financial liabilities

Interest-bearing bank loan - (22,394) - (22,394)

30 June 2018

Financial assets 800 - 285,552 286,352

Investments

Financial liabilities

Interest-bearing bank loan - (26,539) - (26,539)

31 December 2018

Financial assets

Investments 629 - 294,613 295,242

Financial liabilities

Interest-bearing bank loan - (26,932) - (26,932)

There were no transfers between levels in the fair value

hierarchy in the period ended 30 June 2019. Transfers between

levels of the fair value hierarchy are deemed to have occurred at

the date of the event that caused the transfer.

Valuation techniques

Quoted fixed asset investments held are valued at bid prices

which equate to their fair values. When fair values of publicly

traded equities are based on quoted market prices in an active

market without any adjustments, the investments are included within

Level 1 of the hierarchy. The Company invests primarily in private

equity funds and co-investments via limited partnerships or similar

fund structures. Such vehicles are mostly unquoted and in turn

invest in unquoted securities. The fair value of a holding is based

on the Company's share of the total net asset value of the fund or

share of the valuation of the co-investment calculated by the lead

private equity manager on a quarterly basis. The lead private

equity manager derives the net asset value of a fund from the fair

value of underlying investments. The fair value of these underlying

investments and the Company's co-investments is calculated using

methodology which is consistent with the International Private

Equity and Venture Capital Valuation Guidelines ('IPEG'). In

accordance with IPEG these investments are generally valued using

an appropriate multiple of maintainable earnings, which has been

derived from comparable multiples of quoted companies or recent

transactions. The BMO private equity team has access to the

underlying valuations used by the lead private equity managers

including multiples and any adjustments. The BMO private equity

team generally values the Company's holdings in line with the lead

managers but may make adjustments where they do not believe the

underlying managers' valuations represent fair value. On a

quarterly basis, the BMO private equity team present the valuations

to the Board. This includes a discussion of the major assumptions

used in the valuations, which focuses on significant investments

and significant changes in the fair value of investments. If

considered appropriate, the Board will approve the valuations.

The interest-bearing bank loan is recognised in the Balance

Sheet at amortised cost in accordance with IFRS. The fair value of

the loan is based on indicative break costs. The fair values of all

of the Company's other financial assets and liabilities are not

materially different from their carrying values in the balance

sheet.

Significant unobservable inputs for Level 3 valuations

The Company's unlisted investments are all classified as Level 3

investments. The fair values of the unlisted investments have been

determined principally by reference to earnings multiples, with

adjustments made as appropriate to reflect matters such as the

sizes of the holdings and liquidity. The weighted average earnings

multiple for the portfolio as at 30 June 2019 was 8.9 times EBITDA

(Earnings Before Interest, Tax, Depreciation and Amortisation) (30

June 2018: 8.7 times EBITDA; 31 December 2018: 8.9 times

EBITDA).

The significant unobservable input used in the fair value

measurement categorised within Level 3 of the fair value hierarchy

together with a quantitative sensitivity analysis are shown

below:

Period ended Input Sensitivity Effect on

used* fair value

GBP'000

-------------- --------------------------- ------------ ------------

Weighted average earnings

30 June 2019 multiple 1x 49,796

Weighted average earnings

30 June 2018 multiple 1x 52,064

31 December Weighted average earnings

2018 multiple 1x 47,260

-------------- --------------------------- ------------ ------------

* The sensitivity analysis refers to an amount added or deducted

from the input and the effect this has on the fair value.

The fair value of the Company's unlisted investments are

sensitive to changes in the assumed earnings multiples. The

managers of the underlying funds assume an earnings multiple for

each holding. An increase in the weighted average earnings multiple

would lead to an increase in the fair value of the investment

portfolio and a decrease in the multiple would lead to a decrease

in the fair value.

The following table shows a reconciliation of all movements in

the fair value of financial instruments categorised within Level 3

between the beginning and the end of the period:

30 June 30 June 31 December

2019 2018 2018

GBP'000 GBP'000 GBP'000

-------------------------------- --------- --------- ------------

Balance at beginning of period 294,613 265,580 265,580

Purchases 28,019 40,528 71,794

Sales (23,216) (29,099) (80,054)

Gains on disposal 10,611 13,525 41,549

Increase in holding losses (1,793) (4,982) (4,256)

-------------------------------- --------- --------- ------------

Balance at end of period 308,234 285,552 294,613

-------------------------------- --------- --------- ------------

8. In assessing the going concern basis of accounting the

Directors have had regard to the guidance issued by the Financial

Reporting Council. They have considered the current cash position

of the Company, the availability of the Company's loan facility and

compliance with its covenants. They have also considered forecast

cash flows, especially those relating to capital commitments and

realisations.

As at 30 June 2019, the Company had outstanding undrawn

commitments of GBP111.9 million. Of this amount, approximately

GBP16.4 million is to funds where the investment period has

expired, and the Manager would expect very little of this to be

drawn. Of the outstanding undrawn commitments remaining within

their investment periods, the Manager would expect that a

significant amount will not be drawn before these periods

expire.

Based on this information the Directors believe the Company has

the ability to meet its financial obligations as they fall due for

a period of at least twelve months from the date of approval of the

accounts. Accordingly, the accounts have been prepared on a going

concern basis.

9. These are not statutory accounts in terms of Section 434 of

the Companies Act 2006 and have not been audited or reviewed by the

Company's auditors. The information for the year ended 31 December

2018 has been extracted from the latest published financial

statements which received an unqualified audit report and have been

filed with the Registrar of Companies. No statutory accounts in

respect of any period after 31 December 2018 have been reported on

by the Company's auditors or delivered to the Registrar of

Companies. The Half-Year Report is available at the Company's

website address, www.bmoprivateequitytrust.com.

For more information, please contact:

Hamish Mair (Fund Manager) 0131 718 1184

hamish.mair@bmogam.com

Scott McEllen (Company Secretary) 0131 718 1137

scott.mcellen@bmogam.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR BLGDIGDDBGCD

(END) Dow Jones Newswires

August 23, 2019 02:00 ET (06:00 GMT)

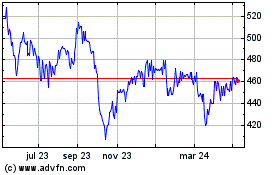

Ct Private Equity (LSE:CTPE)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

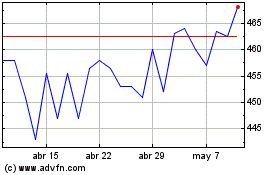

Ct Private Equity (LSE:CTPE)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024