TIDMVOD

RNS Number : 2809K

Vodafone Group Plc

27 August 2019

August 27, 2019

NOT FOR DISTRIBUTION TO ANY PERSON LOCATED OR RESIDENT IN ANY

JURISDICTION IN WHICH SUCH DISTRIBUTION IS UNLAWFUL.

THIS ANNOUNCEMENT RELATES TO THE DISCLOSURE OF INFORMATION THAT

QUALIFIED AS INSIDE INFORMATION WITHIN THE MEANING OF ARTICLE 7(1)

OF THE MARKET ABUSE REGULATION (EU) 596/2014.

VODAFONE GROUP PLC ANNOUNCES COMMENCEMENT OF ANY AND ALL CASH

TER OFFERS AND CONSENT SOLICITATIONS FOR NOTES ISSUED BY UNITYMEDIA

ENTITIES, AND A CONCURRENT CHANGE OF CONTROL OFFER

Vodafone Group Plc ("Vodafone" or the "Company") (NYSE: VOD),

the ultimate parent company of: (i) Unitymedia Hessen GmbH &

Co. KG ("Hessen"); (ii) Unitymedia NRW GmbH ("NRW"); and (iii)

Unitymedia GmbH ("Unitymedia"), formerly known as Unitymedia

KabelBW GmbH, announced today that it has commenced cash tender

offers (collectively, the "Offers") to purchase any and all of the

outstanding 4.625% Senior Secured Notes due 2026 (the "2026 Senior

Secured Notes"), 3.50% Senior Secured Notes due 2027 (the "2027

Senior Secured Notes") and 6.25% Senior Secured Notes due 2029 (the

"2029 Senior Secured Notes") issued by NRW and Hessen, as

co-issuers (the "Co-Issuers"), and any and all of the outstanding

3.75% Senior Notes due 2027 (the "2027 Senior Notes" and together

with the 2026 Senior Secured Notes, the 2027 Senior Secured Notes

and the 2029 Senior Secured Notes, the "Notes") issued by

Unitymedia (together with the Co-Issuers, the "Issuers" and each an

"Issuer"). In conjunction with the Offers, the Issuers are

soliciting the consents of holders of the Notes to certain proposed

amendments to the indentures governing the Notes (the "Consent

Solicitations"). The terms and conditions of the Offers and Consent

Solicitations are set forth in the offer to purchase and consent

solicitation statement dated August 27, 2019 (the "Offer to

Purchase and Consent Solicitation Statement").

Concurrently with and as an alternative to the Offers and

Consent Solicitations, Vodafone also commenced an offer to purchase

all outstanding Notes of each series, at a purchase price equal to

101% of the principal amount of such Notes repurchased (the "Change

of Control Offer Price"), plus accrued and unpaid interest, if any,

on the Notes repurchased to the date of repurchase (such offer, the

"Change of Control Offer"). Vodafone is making the Change of

Control Offer in connection with its acquisition of certain

operations of Liberty Global plc, which was consummated on July 31,

2019 (the "Acquisition") and constituted a Change of Control under

the indentures governing the Notes.

The Company expects to fund the Offers and Consent Solicitations

and the Change of Control Offer using cash on hand. Terms used but

not defined herein have meanings ascribed to them in the Offer to

Purchase and Consent Solicitation Statement.

Offers and Consent Solicitations

The following table sets forth certain terms of the Offers:

Title of Notes Outstanding Rule 144A Regulation S Early Early Tender Expected Expected

Principal ISIN / ISIN / Tender Payment(2)(3) Tender Offer Total

Amount Common Code Common Code Yield Consideration Consideration

(1) (1)(2)(4) (1)(2)(4)

4.625% Senior

Secured Notes XS1334248579 XS1334248223

due 2026 EUR378,000,000 / 133424857 / 133424822 -0.05% EUR30.00 EUR1,059.80 EUR1,089.80

--------------- ------------- ------------- ------- -------------- -------------- --------------

3.50% Senior

Secured Notes XS1197206052 XS1197205591

due 2027 EUR500,000,000 / 119720605 / 119720559 -0.05% EUR30.00 EUR1,035.16 EUR1,065.16

--------------- ------------- ------------- ------- -------------- -------------- --------------

6.25% Senior

Secured Notes XS0982713090 XS0982713330

due 2029 EUR427,500,000 / 098271309 / 098271333 -0.05% EUR30.00 EUR1,085.84 EUR1,115.84

--------------- ------------- ------------- ------- -------------- -------------- --------------

3.75% Senior

Notes due XS1199439149 XS1199438174

2027 EUR700,000,000 / 119943914 / 119943817 -0.05% EUR30.00 EUR1,039.77 EUR1,069.77

--------------- ------------- ------------- ------- -------------- -------------- --------------

________________

(1) The Early Tender Yield is expressed on a semi-annual basis.

The Total Consideration will be calculated in accordance with

market convention with reference to the relevant Early Tender Yield

as of the Early Settlement Date, as described in further detail in

the Offer to Purchase and Consent Solicitation Statement. The

Tender Offer Consideration will be equal to the Total Consideration

minus the Early Tender Payment.

(2) Per EUR1,000 principal amount of Notes tendered and accepted

for purchase. The Expected Tender Offer Consideration and Expected

Total Consideration are calculated based upon an expected Early

Settlement Date of September 12, 2019. Should the Early Settlement

Dates in respect of any Notes differ from September 12, 2019, the

relevant Total Consideration and Tender Offer Consideration will be

recalculated as further described in the Offer to Purchase and

Consent Solicitation Statement and promptly announced.

(3) Included in the Total Consideration for Notes tendered and

accepted for purchase at or prior to the Early Tender Deadline.

(4) Does not include accrued and unpaid interest that will also

be paid on the Notes accepted for purchase.

The Offers and Consent Solicitations will expire at 11:59 p.m.,

New York City time, on September 24, 2019, unless extended or

earlier terminated (such date and time, as may be extended, the

"Expiration Time"). Under the terms of the Offers and Consent

Solicitations, holders of the Notes who validly tender their Notes

and do not validly withdraw their Notes and consents at or prior to

5:00 p.m., New York City time, on September 10, 2019 (such date and

time, as may be extended, the "Early Tender Deadline") will receive

an amount in cash equal to the applicable Total Consideration for

each EUR1,000 principal amount of Notes tendered and not validly

withdrawn and accepted for payment pursuant to the Offers, which

includes the Early Tender Payment, which is equal to EUR30.00 with

respect to each EUR1,000 principal amount of the Notes of such

series, plus accrued interest, with respect to such Notes.

Holders who validly tender their Notes after the Early Tender

Deadline, but at or prior to the Expiration Time, will receive an

amount in cash equal to the applicable Tender Offer Consideration

for each EUR1,000 principal amount of Notes tendered and accepted

for payment, plus accrued interest. The applicable Tender Offer

Consideration for each EUR1,000 principal amount of Notes validly

tendered and not validly withdrawn after the Early Tender Deadline,

but at or prior to the Expiration Time shall be equal to the

applicable Total Consideration minus the Early Tender Payment.

In conjunction with the Offers, the Issuers of the Notes are

soliciting consents from Holders of the Notes to the Proposed

Amendments to the Indentures pursuant to which the Notes were

issued, providing for amendments of the applicable Indentures as

described in the Offer to Purchase and Consent Solicitation to,

among other things, eliminate substantially all of the restrictive

covenants and certain events of default under the Indentures and

terminate certain reporting requirements. Holders who validly

tender their Notes pursuant to the Offers will be deemed to have

delivered their Consents by such tender. In order for the Proposed

Amendments to be adopted with respect to any given series of Notes,

Consents must be received in respect of at least a majority of the

aggregate principal amount of the Notes of such series then

outstanding. The Offers are not conditional upon the receipt of the

Requisite Consents and each Offer and Consent Solicitation is not

conditional upon any of the other Offers and Consent

Solicitations.

Purpose of the Offers and Consent Solicitations

The Offers are being made as part of Vodafone's liability

management and to provide liquidity to Holders by offering the

relevant Total Consideration following the completion of the

Acquisition. The Offers also provide investors with an opportunity

to sell their Notes for the relevant Total Consideration, which is

in excess of the 101% purchase price that is required by the Change

of Control provisions of the Indentures.

In conjunction with the Offers, the Issuers are also soliciting

consents to the Proposed Amendments to, among other things,

eliminate substantially all of the restrictive covenants and

certain events of default under the Indentures and terminate

certain reporting requirements under the Notes.

Immediately following completion of the Offers and the Change of

Control Offer, whether or not the Requisite Consents have been

obtained, the Co-Issuers intend to utilize their option to redeem

10% of the original aggregate principal amount of the 2026 Senior

Secured Notes, the 2027 Senior Secured Notes and the 2029 Senior

Secured Notes (or if lesser amounts are then outstanding, all Notes

of such series that remain outstanding) at a redemption price equal

to 103% of the principal amount thereof plus accrued and unpaid

interest and Additional Amounts (as defined in the Indentures), if

any, which would be a price that is below the relevant Total

Consideration available in the Offers. Only the 2026 Senior Secured

Notes, the 2027 Senior Secured Notes and the 2029 Senior Secured

Notes that are not tendered pursuant to the Offers or the Change of

Control Offer will be subject to this redemption, and as a result

the Offers provide Holders with an opportunity to sell their Notes

of such series and avoid a partial redemption at 103% of the

principal amount thereof plus accrued and unpaid interest and

Additional Amounts, if any. Since such redemption option relates to

10% of the original aggregate principal amount of Notes of such

series, the proportion of a Holder's Notes subject to such

redemption (should such Notes not be tendered pursuant to the

Offers or the Change of Control Offer) will depend upon the final

participation level in the relevant Offers and the Change of

Control Offer. The proportion of the applicable series of Notes to

be redeemed in such a manner will be based on a pro-ration factor

calculated by dividing (x) 10% of the original aggregate principal

amount of Notes of such series by (y) the aggregate principal

amount of Notes of such series that were not validly tendered and

accepted for purchase in the Offers and the Change of Control

Offer. If (x) is greater than (y), all remaining Notes of such

series will be subject to this redemption. Holders should note that

it is the Co-Issuers' intention to utilize such redemption option

even if the Offers are terminated before completion.

The Notes are each rated by Moody's and S&P. The Issuers of

the Notes have requested each of Moody's and S&P to withdraw

their ratings on each series of Notes and on the Issuers themselves

on or shortly after the date of the Offer to Purchase and Consent

Solicitation Statement. We believe that the Offers provide

liquidity to Holders in the context of such request for

withdrawal.

Change of Control Offer

In May 2018, Vodafone agreed to acquire certain operations of

Liberty Global, and the Acquisition was consummated on July 31,

2019. As a result, and pursuant to the relevant provisions of the

Indentures, a Change of Control occurred on July 31, 2019 and the

Issuers are required to offer to purchase all of the Notes at a

purchase price in cash in an amount equal to 101% of the principal

amount of such Notes plus accrued and unpaid interest, if any, on

the Notes repurchased to the date of repurchase, which is expected

to be September 26, 2019 (the "Change of Control Purchase Date").

The Indentures permit a third party to make such an offer in lieu

of the Issuers. In order to comply with the Issuer's obligations

under the Indentures, Vodafone has commenced the Change of Control

Offer at the Change of Control Offer Price, plus accrued and unpaid

interest, if any, on the Notes repurchased to the Change of Control

Purchase Date. The Change of Control Offer will expire at 11:59

p.m., New York City time, on September 24, 2019 (unless extended by

the Company). Tenders of Notes pursuant to the Change of Control

Offer will not result in the giving of a Consent pursuant to the

Consent Solicitations, and Holders of a series of Notes tendered in

the relevant Change of Control Offer will not, under any

circumstances be entitled to the Total Consideration or the Tender

Offer Consideration with respect to Notes of such series. HOLDERS

SHOULD NOTE THAT EACH OF THE TOTAL CONSIDERATION AND THE TER OFFER

CONSIDERATION WILL BE HIGHER THAN THE CHANGE OF CONTROL OFFER PRICE

UNDER THE CHANGE OF CONTROL OFFER. HOLDERS SHOULD ALSO NOTE THAT

THE CHANGE OF CONTROL OFFER PRICE REPRESENTS A SIGNIFICANT DISCOUNT

TO THE CURRENT TRADING PRICE OF THE NOTES. The procedures for

tendering Notes in the Offers and in the Change of Control Offer

are separate. Notes of a series tendered in the Offers may not be

tendered in the Change of Control Offer with respect to Notes of

such series, and Notes of a series tendered in the Change of

Control Offer may not be tendered in the Offers with respect to

Notes of such series.

Important Dates

Date Calendar Date and Time

----------------------------------------- ----------------------------------

Commencement of the Offers and August 27, 2019

Consent Solicitations

Commencement of the Change of

Control Offer

----------------------------------

Early Tender Deadline in respect 5:00 p.m., New York City time,

of the Offers and Consent Solicitations on September 10, 2019, unless

extended or earlier terminated.

----------------------------------

Withdrawal Deadline in respect 5:00 p.m., New York City time,

of the Offers and Consent Solicitations on September 10, 2019, unless

extended or earlier terminated

by us with respect to the Offer.

----------------------------------

Early Results Announcement September 11, 2019, unless

extended or earlier terminated.

----------------------------------

Early Settlement Date (at our September 12, 2019, unless

option) extended or earlier terminated.

----------------------------------

Expiration Time in respect of 11:59 p.m., New York City time,

the Offers and Consent Solicitations on September 24, 2019, unless

Expiration of the Change of extended or earlier terminated.

Control Offer

----------------------------------

Final Results Announcement September 25, 2019, unless

extended or earlier terminated.

----------------------------------

Final Settlement Date September 26, 2019, unless

extended or earlier terminated

(the "Final Settlement Date").

----------------------------------

You are advised to check with any custodian or nominee, or other

intermediary through which you hold the Notes, whether such entity

would require the receipt of instructions to participate in, or

notice of a withdrawal of your instruction to participate in, the

Offers before the deadlines specified in the Offer to Purchase and

Consent Solicitation Statement. The deadlines set by your custodian

or nominee, or by Clearstream and Euroclear, for the submission and

withdrawal of Tender and Consent Instructions may be earlier than

the relevant deadlines specified in the Offer to Purchase and

Consent Solicitation Statement.

Redemption of Other Series of Unitymedia Notes

On the date hereof, the respective Issuers have also announced

their intention to redeem in full the EUR1,000,000,000 4% Senior

Secured Notes due 2025 and $550,000,000 5% Senior Secured Notes due

2025 issued by Unitymedia Hessen and Unitymedia NRW and the

$900,000,000 6 1/8% Senior Notes due 2025 issued by Unitymedia

GmbH. It is not Vodafone's or the Issuers' intention to redeem in

full the Notes subject to the Offers and Consent Solicitations

described in the Offer to Purchase and Consent Solicitation

Statement pursuant to the corresponding option under the terms of

the Notes.

Additional Information

Holders are advised to read carefully the Offer to Purchase and

Consent Solicitation Statement for full details of, and information

on the procedures for participating in, the Offers and Consent

Solicitations. Copies of the Offer to Purchase and Consent

Solicitation Statement are available at the following website:

https://sites.dfkingltd.com/vodafone. Requests for documents

relating to the Offers and Consent Solicitations may be directed to

D.F. King, the Information and Tender Agent in connection with the

Offers and Consent Solicitations, at +1 (800) 714-3306 or +1 (212)

269-5550 (Banks and Brokers) or +44 20 7920 9700 (UK) or by e-mail

at vodafone@dfkingltd.com. Deutsche Bank AG, London Branch and

Merrill Lynch International will act as Dealer Managers for the

Offers and Consent Solicitations. Questions regarding the Offers

and Consent Solicitations may be directed to Deutsche Bank AG,

London Branch at +44 20 7545 8011 or Merrill Lynch International at

+44 20 7996 5420 and DG.LM_EMEA@baml.com.

Questions regarding the procedures for tendering Notes pursuant

to the Change of Control Offer may be directed to D.F. King, which

is acting as the Information and Tender Agent in connection with

the Change of Control Offer, at +1 (800) 714-3306 or +1 (212)

269-5550 (Banks and Brokers) or +44 20 7920 9700 (UK) or by e-mail

at vodafone@dfkingltd.com.

This announcement is released by Vodafone Group Plc and contains

information that qualified or may have qualified as inside

information for the purposes of Article 7 of the Market Abuse

Regulation (EU) 596/2014 (MAR), encompassing information relating

to the transaction described above. For the purposes of MAR and

Article 2 of Commission Implementing Regulation (EU) 2016/1055,

this announcement is made by Rosemary Martin, Group General Counsel

and Company Secretary.

Offer Restrictions

General Notice to Investors

The Offers and Consent Solicitations do not constitute an offer

to buy or the solicitation of an offer to sell Notes in any

circumstances in which such offer or solicitation is unlawful. We

are not aware of any jurisdiction where the making of the Offers

and Consent Solicitations is not in compliance with the laws of

such jurisdiction. If we become aware of any jurisdiction where the

making of the Offers and Consent Solicitations would not be in

compliance with such laws, we will make a good faith effort to

comply with any such laws or may seek to have such laws declared

inapplicable to the Offers and Consent Solicitations. If, after

such good faith effort, we cannot comply with any such applicable

laws, the Offers and Consent Solicitations will not be made to

Holders of Notes residing in each such jurisdiction.

In any jurisdictions where the securities or other laws require

the Offers and Consent Solicitations to be made by a licensed

broker or dealer and the Dealer Managers or, where the context so

requires, their respective affiliates are licensed brokers or

dealers in that jurisdiction, the Offers and Consent Solicitations

shall be deemed to be made on behalf of the Company and the

Issuers, respectively, by the Dealer Managers or affiliates (as the

case may be) in such jurisdiction.

By tendering your securities, or instructing your custodian to

tender your securities, you are representing and warranting that

you are not a person to whom it is unlawful to make an invitation

to tender pursuant to the Offers and Consent Solicitations under

applicable law, and you have observed (and will observe) all laws

of relevant jurisdictions in connection with your tender, and are

deemed to give certain representations in respect of the

jurisdictions referred to above and generally as set out in

"Procedures for Tendering Notes and Delivering Consents." If you

are unable to make these representations, your tender of Notes for

purchase may be rejected. Each of the Company, the Issuers, the

Trustee, the Information and Tender Agent or the Dealer Managers

reserves the right, in their absolute discretion, to investigate,

in relation to any tender of Notes for purchase, and delivery of

Consents, pursuant to the Offers and Consent Solicitations, whether

any such representation given by a Holder is correct and, if such

investigation is undertaken and as a result, we determine (for any

reason) that such representation is not correct, such tender may be

rejected.

Italy

None of the Offers and Consent Solicitations, this announcement,

the Offer to Purchase and Consent Solicitation Statement or any

other document or materials relating to the Offers and Consent

Solicitations have been or will be submitted to the clearance

procedures of the Commissione Nazionale per le Società e la Borsa

("CONSOB") pursuant to Italian laws and regulations. Each Offer and

Consent Solicitation is being carried out in Italy as an exempted

offer pursuant to article 101-bis, paragraph 3-bis of the

Legislative Decree No. 58 of 24 February 1998, as amended (the

"Financial Services Act") and article 35-bis, paragraph 4 of CONSOB

Regulation No. 11971 of 14 May 1999, as amended. Holders or

beneficial owners of the Notes that are located in Italy can tender

Notes for purchase in the Offers and Consent Solicitations through

authorized persons (such as investment firms, banks or financial

intermediaries permitted to conduct such activities in the Republic

of Italy in accordance with the Financial Services Act, CONSOB

Regulation No. 16190 of 29 October 2007, as amended from time to

time, and Legislative Decree No. 385 of 1 September 1993, as

amended) and in compliance with applicable laws and regulations or

with requirements imposed by CONSOB or any other Italian

authority.

Each intermediary must comply with the applicable laws and

regulations concerning information duties vis-à-vis its clients in

connection with the Notes and/or the Offers and Consent

Solicitations.

United Kingdom

The communication of this announcement, the Offer to Purchase

and Consent Solicitation Statement and any other documents or

materials relating to the Offers and Consent Solicitations is not

being made and such documents and/or materials have not been

approved by an authorized person for the purposes of section 21 of

the Financial Services and Markets Act 2000. Accordingly, such

documents and/or materials are not being distributed to, and must

not be passed on to, the general public in the United Kingdom. The

communication of such documents and/or materials as a financial

promotion is only being made to those persons in the United Kingdom

falling within the definition of investment professionals (as

defined in Article 19(5) of the Financial Services and Markets Act

2000 (Financial Promotion) Order 2005 (the "Financial Promotion

Order")) or persons who are within Article 43(2) of the Financial

Promotion Order or any other persons to whom it may otherwise

lawfully be made under the Financial Promotion Order.

France

Each Offer and Consent Solicitation is not being made, directly

or indirectly, to the public in the Republic of France ("France").

None of this announcement, the Offer to Purchase and Consent

Solicitation Statement or any other document or material relating

to the Offers and Consent Solicitations has been or shall be

distributed to the public in France and only (i) providers of

investment services relating to portfolio management for the

account of third parties (personnes fournissant le service

d'investissement de gestion de portefeuille pour compte de tiers)

and/or (ii) qualified investors (investisseurs qualifiés), acting

for their own account, with the exception of individuals, within

the meaning ascribed to them in, and in accordance with, Articles

L.411-1, L.411-2 and D.411-1 of the French Code monétaire et

financier, and applicable regulations thereunder, are eligible to

participate in the Offers and Consent Solicitations. The Offer to

Purchase and Consent Solicitation Statement has not been and will

not be submitted for clearance to nor approved by the Autorité des

Marchés Financiers.

Belgium

None of this announcement, the Offer to Purchase and Consent

Solicitation Statement or any other documents or materials relating

to the Offers and Consent Solicitations have been submitted to or

will be submitted for approval or recognition to the Belgian

Financial Services and Markets Authority (Autoriteit voor

financiële diensten en markten / Autorité des services et marchés

financiers) and, accordingly, the Offers and Consent Solicitations

may not be made in Belgium by way of a public offering, as defined

in Articles 3 and 6 of the Belgian Law of 1 April 2007 on public

takeover bids as amended or replaced from time to time.

Accordingly, the Offers and Consent Solicitations may not be

advertised and the Offers and Consent Solicitations will not be

extended, and none of this announcement, the Offer to Purchase and

Consent Solicitation Statement or any other documents or materials

relating to the Offers and Consent Solicitations (including any

memorandum, information circular, brochure or any similar

documents) has been or shall be distributed or made available,

directly or indirectly, to any person in Belgium other than

"qualified investors" in the sense of Article 10 of the Belgian Law

of 16 June 2006 on the public offer of placement instruments and

the admission to trading of placement instruments on regulated

markets, acting on their own account. Insofar as Belgium is

concerned, the Offer to Purchase and Consent Solicitation Statement

has been issued only for the personal use of the above qualified

investors and exclusively for the purpose of the Offers and Consent

Solicitations. Accordingly, the information contained in the Offer

to Purchase and Consent Solicitation Statement may not be used for

any other purpose or disclosed to any other person in Belgium.

Forward-Looking Statements

The above announcement contains "forward-looking" which involve

risks and uncertainties. All statements, other than statements of

historical facts, that are included in or incorporated by reference

into this announcement, or made in presentations, in response to

questions or otherwise, that address activities, events or

developments that the Company expects or anticipates to occur in

the future, including such matters as projections, capital

allocation, future capital expenditures, business strategy,

competitive strengths, goals, future acquisitions or dispositions,

development or operation of power generation assets, market and

industry developments and the growth of its business and operations

(often, but not always, through the use of words or phrases such as

"believes," "plans," "intends," "will likely result," "are expected

to," "will continue," "is anticipated," "estimated," "projection,"

"target," "goal," "objective," "outlook" and similar expressions),

are forward-looking statements. These statements are based on the

Company's current expectations, estimates and assumptions and are

subject to many risks, uncertainties and unknown future events that

could cause actual results to differ materially. Actual results may

differ materially from those set forth in this press release due to

the risks and uncertainties inherent to transactions of this

nature. Any forward-looking statement speaks only as of the date on

which it is made, and except as may be required by applicable law,

the Company undertakes no obligation to publicly update or revise

any forward-looking statement, whether as a

result of new information, future events or otherwise.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

TENBDLFLKVFEBBV

(END) Dow Jones Newswires

August 27, 2019 07:11 ET (11:11 GMT)

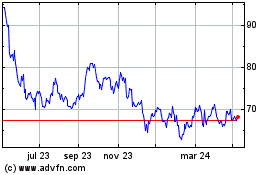

Vodafone (LSE:VOD)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

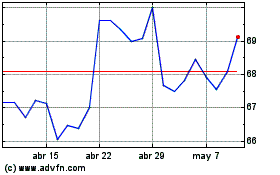

Vodafone (LSE:VOD)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024