TD Bank Group's Profit Lifted by U.S. Retail Operations -- 2nd Update

29 Agosto 2019 - 11:47AM

Noticias Dow Jones

By Vipal Monga and Kimberly Chin

Toronto-Dominion Bank Group joined its largest Canadian rival in

slowing spending during its fiscal third quarter amid macroeconomic

uncertainty and falling interest margins.

TD, Canada's second-largest bank by market capitalization,

reported quarterly profit growth of more than 4% from a year

earlier, driven largely by higher loan and deposit volumes in its

U.S. retail operations.

Meanwhile, noninterest expenses increased 4.7%, a slower pace

than the 8.5% increase reported during its second quarter.

Overall, the bank reported a net income of 3.25 billion Canadian

dollars ($2.44 billion), or C$1.74 a share, up from C$3.11 billion,

or C$1.65 a share a year earlier. Analysts polled by FactSet were

expecting C$1.77 a share.

"As we head into the final quarter of the year, the

macroeconomic environment has become less supportive," said TD's

Chief Executive Bharat Masrani.

The reduction in expense growth mirrored a similar trend at

Royal Bank of Canada, the country's largest bank, which emphasized

in its earnings report last week that it would be looking for ways

to cut expenses.

"I think we'll see expenses become much more of a focus for

Canadian banks," said James Shanahan, a banking analyst at Edward

Jones. He noted that the banks' margins have been squeezed as

interest rates have fallen, which is forcing them to focus on

spending.

TD's net interest income was C$6.02 billion, up from C$5.66

billion in the comparable quarter a year ago. Meanwhile, net

interest margin -- or the interest that banks take in from loans

versus what they pay out in deposits -- fell 0.03 percentage point

in Canada, compared with the second quarter, and fell 0.11

percentage point in the U.S.

Noninterest income was C$4.48 billion, a 5.4% increase from last

year.

Profit at the bank's U.S. retail segment rose 13% from a year

ago to C$1.29 billion.

The U.S. division includes bank and lender TD Bank and its stake

in TD Ameritrade Holding Corp. TD Ameritrade contributed C$294

million to earnings in the fiscal third quarter, the Canadian bank

said Thursday.

The bank reported that its capital ratio remained steady at 12%.

Though the regulatory capital ratio is the highest among the large

Canadian banks, TD won't rush to use any capital cushion to do

deals, said the company's finance chief, Riaz Ahmed.

"It's important to remain patient," Mr. Ahmed said. "We'll

continue to look for attractive opportunities."

TD's Canadian retail segment reported a 2% increase in profit in

the quarter ended July 31, compared with a year earlier.

Earnings on an adjusted basis were C$1.79 a share, below

analysts' estimates by 1 cent.

Total revenue at the bank rose 6.1% to C$10.5 billion. Analysts

were looking for C$10.05 billion.

Write to Vipal Monga at vipal.monga@wsj.com and Kimberly Chin at

kimberly.chin@wsj.com

(END) Dow Jones Newswires

August 29, 2019 12:32 ET (16:32 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

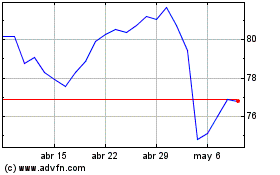

Toronto Dominion Bank (TSX:TD)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Toronto Dominion Bank (TSX:TD)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024