Baker Steel Resources Trust Ltd Net Asset Value(s) (1078L)

04 Septiembre 2019 - 1:01AM

UK Regulatory

TIDMBSRT

RNS Number : 1078L

Baker Steel Resources Trust Ltd

04 September 2019

BAKER STEEL RESOURCES TRUST LIMITED

(Incorporated in Guernsey with registered number 51576 under the

provisions of The Companies (Guernsey) Law, 2008 as amended)

4 September 2019

30 August 2019 Unaudited NAV Statement Net Asset Value

Baker Steel Resources Trust Limited (the "Company") announces

its unaudited net asset value per share at 30 August 2019:

Net asset value per Ordinary Share: 70.7 pence

The NAV per share has increased by 3.4% against the NAV at 31

July 2019, primarily due to an increase in the carrying value of

Nussir ASA following a share placement at a 50% premium to the

previous carrying value, and an 18.8% increase in the share price

of Polymetal International Plc on the London Stock Exchange.

The Company has a total of 106,462,502 Ordinary Shares in issue

with a further 700,000 shares held in treasury as at 30 August

2019.

Portfolio Update

The Company's top 12 investments are as follows as a percentage

of NAV:

Futura Resources Ltd 16.5%

Bilboes Gold Limited 14.8%

Polymetal International Plc 14.2%

Cemos Group plc 10.6%

Polar Acquisition Ltd 9.0%

Sarmin Minerals Exploration 4.8%

Nussir ASA 4.5%

Mines & Metal Trading Peru PLC 4.4%

Anglo Saxony Mining Limited 3.8%

Black Pearl Limited Partnership 3.8%

Ivanhoe Mines Ltd 3.1%

Azarga Metals Corp 3.1%

Other Investments 5.5%

Net Cash, Equivalents and Accruals 1.9%

Investment Update

Nussir ASA ("Nussir")

During August 2019, Nussir completed an oversubscribed rights

issue of NOK 5 million at a 50% premium to its previous fundraising

and the Company's carrying value. The Company participated in the

rights issue and in accordance with its valuation policy has

increased its carrying value of Nussir shares to the rights issue

price.

The rights issue was to fund a limited amount of additional

drilling in an area of inferred resources so that those resources

could be upgraded to Indicated Resources and therefore included in

Nussir's definitive feasibility study on the Nussir/Ulveryggen

copper project in northern Norway. The area being drilled is close

to the proposed portal site to the mine and if confirmed would

provide early tonnage to the processing plant and would be expected

to have a significant positive impact on the feasibility study

cashflow. The drilling is due to be completed in September and the

definitive feasibility study completed in the fourth quarter of

2019.

Azarga Metals Corp ("Azarga")

On 15 April 2019, the Company completed an agreement to invest

US$3 million into TSXV listed Azarga via an 8% secured convertible

loan due 31 December 2022, convertible at C$0.14/share ("the

Convertible Loan") and the first US$1 million tranche of the

Convertible Loan has been drawn. 13.49 million 2-year warrants were

also issued to the Company with an exercise price of

C$0.17/share.

On 12 August 2019, Azarga drew down the remaining US$2 million

convertible loan, and assuming BSRT converted all of the US$3

million owing to it and also converted all its warrants, BSRT would

hold approximately 39.16% of the issued and outstanding shares of

Azarga.

The drawdown will be used to fund the ongoing exploration

program on the Unkur Copper-Silver Project in Eastern Russia.

Magnetic and induced polarization geophysical surveys are underway

and will continue through September. Following this work, an

approximate 6,000-meter diamond drilling program will be initiated.

The combined program represents the largest physical exploration

program undertaken on Unkur since Azarga's acquisition of the Unkur

project in 2016. The goal of the program is to expand the estimated

Inferred Mineral Resource of 62 million tonnes grading 0.53% copper

and 38.6g/t silver, containing 328,600 tonnes of copper and 76.8

million ounces of silver.

Further details of the Company and its investments are available

on the Company's website www.bakersteelresourcestrust.com

Enquiries:

Baker Steel Resources Trust Limited +44 20 7389 8237

Francis Johnstone

Trevor Steel

Numis Securities Limited +44 20 7260 1000

David Benda (corporate)

James Glass (sales)

The Net Asset Value ("NAV") figure stated is based on unaudited

estimated valuations of the underlying investments and not

necessarily based on observable inputs. Such estimates are not

subject to any independent verification or other due diligence and

may not comply with generally accepted accounting practices or

other generally accepted valuation principles. In addition, some

estimated valuations are based on the latest available information

which may relate to some time before the date set out above.

Accordingly, no reliance should be placed on such estimated

valuations and they should only be taken as an indicative guide.

Other risk factors which may be relevant to the NAV figure are set

out in the Company's Prospectus dated 26 January 2015.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

NAVMMGGLVFZGLZM

(END) Dow Jones Newswires

September 04, 2019 02:01 ET (06:01 GMT)

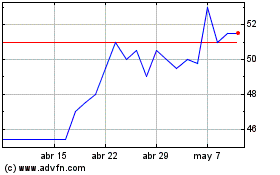

Baker Steel Resources (LSE:BSRT)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

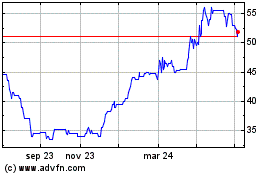

Baker Steel Resources (LSE:BSRT)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024