TIDMFIH

RNS Number : 2589L

FIH Group PLC

05 September 2019

5 September 2019

FIH group plc

AGM Statement

FIH group plc ("FIH", "the Company" or the "group"), the AIM

quoted international services group that owns essential services

businesses in the Falkland Islands and the UK, is holding its

Annual General Meeting ("AGM") at the offices of FTI Consulting at

200 Aldersgate, London EC1A 4HD, at 2.00 p.m. today.

At the meeting, Chairman, Robin Williams, will make the

following statement:

"On behalf of the board, I am delighted to welcome shareholders

to the FIH group AGM. I am pleased to say that in the year to 31

March 2019 the group made further progress producing Profit Before

Tax of GBP3.9 million, an increase of 19% over the prior year. I

would also like to note that since the year end the group's

available cash reserves have been strengthened by the draw-down of

a long-term commercial mortgage on the group's freehold property at

Leyton, which boosted cash balances by GBP3.9 million.

Proposed Final Dividend

"As announced in the group's annual report issued on 11 June

2019, subject to approval by shareholders at today's AGM, a final

dividend of 3.35 pence per FIH share will be paid on 20 September

2019 to shareholders on the register at the close of business on 16

August 2019. This will take the total dividend paid for the year to

31 March 2019 to 5.0p per share, up 11.1% on the 4.5p dividend paid

last year. The full 2018-19 dividend, if approved by shareholders,

will be covered 4.8 times by the group's reported earnings per

share of 24.1p per share.

Update on Trading and Liquidity

"Trading at the group's fine art handling and storage company,

Momart, has started slowly with activity in both the commercial art

market and public sector being noticeably more subdued than normal.

In contrast, Momart's large Exhibitions order book for the

remainder of the financial year is ahead of the comparable period

last year and despite the slow start the board is confident that

Momart's performance will improve as the year progresses.

"At the Falklands Islands Company, ("FIC"), trading has started

the year in line with our expectations and the company has built up

a record order book for houses to be built in the current year.

"At Portsmouth, trading at the group's ferry business in

Portsmouth Harbour, has been satisfactory and broadly in line with

last year.

"The group's liquidity position has strengthened since the

beginning of the financial year and at 31 August 2019 the group's

cash reserves were GBP10.5 million (31 March 2019: GBP6.2 million).

Following the aforementioned mortgage draw down for the group's

Leyton property, bank borrowings at 31 August were GBP16.4 million

comprised of a new GBP13.9 million ten year commercial mortgage

with interest rates fixed at 3% and other long term loans of GBP2.5

million. Total bank borrowings of GBP16.4 million compare to

GBP12.8 million at 31 March 2019 giving net bank debt at 31 August

of GBP5.9 million (31 March 2019: GBP6.6million).

Developments in the Falklands

"Development of oil production in the Falklands remains

uncertain and has been adversely affected by the weaker outlook for

the price of oil, which has led to delays in the investment

decision by licence holder, Premier Oil, on whether to proceed with

development of the Sea Lion field.

"On a more positive note prospective government and military

infrastructure projects in the Falklands are still moving forward,

albeit slowly and in a highly competitive environment. Despite this

the group remains well placed to take advantage of the expected

flow of contracts over the medium term. At FIC's house building

division, Falklands Building Services, a record order book

including FIC's first government housing contract means a strong

recovery in house sales is expected in the current financial

year.

Impact of Brexit

"Uncertainty over Brexit has already negatively impacted trading

in the current financial year and may cause some further slow-down

in activity at least in the immediate autumn period, if there is

any physical disruption at ports of entry or any adverse changes in

UK / EU customs and taxation arrangements.

"Of the group's companies, Momart is the most exposed but with

careful planning we are seeking to mitigate potential disruption to

the movement of art works in and out of Europe however, it will not

be possible to ensure complete insulation from the expected

short-term negative impacts of a disorderly Brexit. The precise

extent of any problems (and potential opportunities) will become

clearer over the next 12 months as will the impact of possible

tariffs on Falklands-caught squid exported to the EU, which

although not directly involving FIC, is a key driver of the

Falklands economy.

"In overall terms we expect the impact of Brexit on the group's

current year's trading to be negative although the exact extent is

difficult to judge.

Outlook

"Investment in property assets and capital projects is

continuing in the Falklands with a further strengthening of the

team in Stanley to manage expected medium-term growth.

"At Momart, management energies are focussed on recovering the

shortfall experienced in the first five months of the year and in

continuing the sale of spare capacity at the company's art storage

facilities at Leyton. A further strengthening of the executive team

is also being put in place to underpin the company's long term

future.

"The long-term outlook for all the group's businesses remains

strong. However with the costs of strengthening the operational

management teams across the group, the absence of the one-off

credits reported last year, plus the uncertainty caused by Brexit

and wider geo-political instability, the near term outlook, in line

with analysts' forecasts, is for a consolidation of earnings in the

current year at a level below that seen in 2018-19.

"Once through the choppy waters we foresee in the near term,

with its strong balance sheet and embedded market positions across

its diverse trading companies, your board remains confident that

the group remains well placed to deliver growth over the

medium-term."

- Ends -

Enquiries:

FIH group plc

John Foster, Chief Executive Tel: 01279 461 630

WH Ireland Ltd. - NOMAD and Broker

to FIH

Adrian Hadden / Jessica Cave / Lydia Tel: 020 7220 1666

Zychowska

FTI Consulting - Communications adviser

to FIH

Alex Beagley / Eleanor Purdon Tel: 020 3727 1000

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

AGMBUGDCBUGBGCS

(END) Dow Jones Newswires

September 05, 2019 02:00 ET (06:00 GMT)

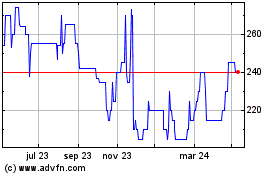

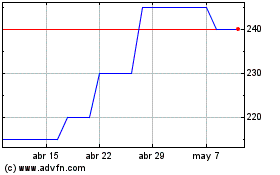

Fih (LSE:FIH)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Fih (LSE:FIH)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024