TIDMTPFG

RNS Number : 7344L

Property Franchise Group PLC (The)

10 September 2019

10 September 2019

THE PROPERTY FRANCHISE GROUP PLC

(the "Company" or the "Group")

Interim Results for the six months ended 30 June 2019

Profit up 6% and interim dividend up 8%

The Property Franchise Group, one of the UK's largest property

franchises, today announces its interim results for the period

ended 30 June 2019.

Financial Highlights

-- Revenue of GBP5.5m (H1 2018: GBP5.5m), in line with expectations

-- Management Service Fees ("royalties") increased by 5% to GBP4.6m (H1 2018: GBP4.4m)

-- Operating margin increased to 37% (H1 2018: 35%)

-- EBITDA increased by 5% to GBP2.4m (H1 2018: GBP2.3m)

-- Profit before tax increased 6% to GBP2.0m (H1 2018: GBP1.9m)

-- Strong balance sheet with a net cash position of GBP2.8m (H1 2018: GBP0.5m)

-- Interim dividend increased by 8% to 2.6p per share (H1 2018: 2.4p)

Operational Highlights

-- Tenanted managed properties increased 6% to 56,000 (H1 2018: 53,000)

-- 17 acquisitions by franchisees completed year to date,

generating annualised Management Services Fees of GBP0.2m

-- 369 trading offices (H1 2018: 377)

-- 8 new franchisees recruited and 9 new offices opened

-- Group remains heavily weighted towards lettings, accounting

for 70% of Management Service Fees (H1 2018: 69%)

Ian Wilson, Chief Executive Officer of The Property Franchise

Group, commented:

"We have delivered another strong set of results, with progress

in each of our six brands, which have all grown our most important

revenue stream, franchise management services fees over the same

period last year. Our profit has also grown, driven by the health

of our franchisees' businesses and prudent cost management.

"Historically, the Group experiences stronger trading in the

second half year, associated with heightened lettings activity in

the period from June to September. At this stage we believe that

this pattern will be maintained. Our strong balance sheet and our

continued confidence in the underlying strength of our business

model means that we are pleased to be increasing the interim

dividend by 8% to 2.6p in line with our progressive dividend

policy.

"Thanks to our franchise business model, diverse brand offering,

lettings weighting and high levels of cash generation, resulting in

a strong balance sheet, we are well-positioned to outperform our

competitors, increase market share and deliver value for all our

stakeholders in the immediate and longer term."

For further information, please contact:

The Property Franchise Group PLC

Ian Wilson, Chief Executive Officer

David Raggett, Chief Financial Officer 01202 292829

Cenkos Securities plc

Max Hartley, Callum Davidson (Nominated Adviser)

Julian Morse (Sales) 0207 397 8900

Alma PR

Susie Hudson

Rebecca Sanders-Hewett

Jessica Joynson 0203 405 0205

Chief Executive's Review

The Property Franchise Group has continued to outperform with

all of our six brands' franchisee networks achieving revenue growth

over the period, despite challenging market conditions.

Our franchisees added 1,175 tenanted managed properties in the

reporting period through our assisted acquisitions programme. These

additions, alongside the continued organic growth of the portfolio

leaves the Group managing 56,000 properties, as at the period

end.

Driving continued growth in our traditional brands

For our traditional brands the growth was driven largely by a

robust increase in lettings management service fees (MSF), which

outweighed the market weakness faced in sales. We were pleased to

see the Group's strategic weighting towards lettings showing its

resilience as expected during this time of uncertainty.

Our franchisees continue to invest in our centralised digital

marketing and, in the reporting period just pay-per-click delivered

29,490 new business leads compared to 30,474 leads in the whole of

2018. Our capability in this area is improving all the time which

means that our traditional high street agents can compete with the

perceived threat from online and hybrid competitors.

EweMove

As well as also increasing its lettings revenue our hybrid brand

EweMove demonstrated that its unique, highly customer centric

offering can defy the challenging sales market, as its sales

revenue increased. This was through existing franchisees achieving

higher sales conversion rates.

EweMove has 115 franchise territories trading at the end of the

reporting period which is broadly flat against the prior year.

However property listings have increased to 3,173 in H1 2019 (H1

2018: 3,062), which was pleasing against the backdrop of a falling

market. EweMove has improved its cash generation year on year, and

tight cost control has delivered a corresponding improvement in

profitability. We are on track to materially improve on the 2018

result for the full year.

Having examined the evidence, experienced estate agents

initially outperform inexperienced franchise recruits from other

sectors, but only in the first two years trading as a EweMove

franchisee. Consequently, we have resumed recruiting non-agents as

franchisees at EweMove provided that we are satisfied they have

transferable sales skills and access to sufficient working capital

during the build-up period.

The importance of the franchise business model

The period has been another example of the importance of our

business model in allowing us to support franchisees through new

regulation and wider macro-economic challenges.

The Government's tenant fee ban took effect on 1 June, with

these results reflecting one month's impact of the ban. Pleasingly,

post period we have seen July's letting results exceed our

expectations, with evidence of pent up tenant demand feeding

through. We continue to work closely with our franchisees on

mitigating the effects of the ban.

The Government has proposed the creation of a unitary regulatory

body for letting agents and the requirement for all practitioners

to submit to a test of professional competence. Our Group is

particularly well positioned to navigate hurdles such as these. Our

founding business, Martin & Co, built its reputation by

recruiting franchisees from disparate backgrounds and instilling,

through its training programme, all of the skills and knowledge

they needed to practise as agents. We have a strong heritage in

this capability and are well placed to continue supporting our

franchisees through increased regulatory challenges.

Outlook

Whilst we are cognisant of the UK market conditions and the

challenges we face, our franchisees are proving highly resilient,

taking up the opportunities to outpace their competitors afforded

through our centralised digital marketing and assisted acquisitions

programme.

As is appropriate, we are consciously risk-adverse at this point

in the cycle and continue to manage our operating margin in order

to further drive profitability. Notwithstanding this, our strong

net-cash position and available bank facility means that we are in

an excellent position to capitalise on opportunities in the

remainder of 2019 and into 2020. The Board remains confident of

delivering on market expectations for the full year.

Ian Wilson, Chief Executive Officer

Financial Review

Revenue

Revenue for the six months ended 30 June 2019 was GBP5.5m (H1

2018: GBP5.5m), in line with expectations. This is before the

amortisation of assisted acquisition support provided to

franchisees to incentivise the purchase of portfolios of managed

properties.

Underlying this was a strong performance from our network,

outperforming the market in sales and lettings. Management Service

Fees ("MSF") grew by 5% to GBP4.6m accounting for 85% of total

revenue, up from 80% this time last year.

Traditional Brands' MSF

Overall, our traditional brands' network continues to prosper.

In the traditional brands, lettings MSF grew by 6% to GBP2.85m and

sales MSF declined by 9% to GBP0.67m in the six months ended 30

June 2019 compared to the same period of 2018. Despite the falling

number of lettings instructions and the implementation of the

tenant fee ban on 1 June 2019, our network is growing revenue,

primarily due to their focus on acquiring portfolios of managed

properties with our assistance. Whilst it is disappointing to see

sales MSF decline, the weaknesses of the housing market are well

documented and 3% of the reduction is due to us reducing the number

of CJ Hole offices. We continue to pursue digital marketing

initiatives aimed at continuing to outperform the market.

EweMove's MSF

EweMove franchisees pay a monthly licence fee and a completion

fee per transaction. The total of the licence fees and completion

fees for the six months ended 30 June 2019 was GBP1.06m (H1 2018:

GBP0.92m), a 15% increase on the same period of 2018. We include

these licence fees and completion fees within MSF.

EweMove grew house sales completions in the first six months of

2019 by 16% compared to the same period last year through existing

franchisees converting more of the fewer opportunities into sales.

Lettings completions in the first six months of 2019 increased by

12% compared to the same period last year.

Franchise Sales

Franchise sales income was GBP0.1m (H1 2018: GBP0.2m). New

recruits in the first half of this year were 8 compared to 16 for

the comparative period. All have joined EweMove so far this year of

which 63% are experienced estate agents.

Other

Other income was GBP0.74m (H1 2018: GBP0.89m), down 17% on the

six months ended 30 June 2018 mainly due to reorganisations in the

network generating fewer and lower fees so far this year.

Assisted Acquisitions

In the year to end of August 19, franchisees completed on 17

Assisted Acquisitions with a total deal value of GBP3.1m (2018 YTD:

20 Assisted Acquisitions with a total deal value of GBP3.2m). The

total number of managed properties acquired was 2,000 (2018 YTD:

2,400). Based on their historic results, these acquisitions added

GBP2.4m to annualised network revenue and increased annualised

recurring MSF by GBP0.2m (2018 YTD: GBP2.3m of annualised network

revenue and additional annualised recurring MSF of GBP0.2m).

Administrative expenses

Administrative expenses have been reduced by GBP0.15m to

GBP2.85m due to targeted cost control in what we knew would be a

challenging year.

EBITDA

The Group's EBITDA was GBP2.4m (H1 2018: GBP2.3m), an increase

of 5% over the comparative period. There were no exceptional items

or share-based payment charges in the first half of 2019 nor the

comparative period.

Operating profit

Operating profit increased 5% to GBP2.0m (H1 2018 GBP1.9m) and

operating margin was 37% (H1 2018: 35%) helped by the reduction in

administrative expenses.

Earnings per share

Earnings per share for the six months ended 30 June 2019 was

6.3p (H1 2018: 5.9p). The income attributable to owners was GBP1.6m

(H1 2018: GBP1.5m).

Profit before income tax

Profit before tax was GBP2.0m (2018: GBP1.9m), an increase of

6%.

Dividends

The Board has pursued a progressive dividend policy since the

IPO. Once again, the Company has increased the interim dividend by

8% over last year reflecting the increase in profitability and

reconfirming its commitment to that policy. The Company intends to

make an interim dividend payment of 2.6p per share on 1 October

2019 to shareholders on the register on 20 September 2019, being

the record date. The ex-dividend date will be 19 September

2019.

Cash flow

At an operational level, the Group is highly cash generative and

its cash flow has annuity like characteristics. The net cash inflow

from operating activities in the first six months of 2019 increased

11% to GBP2.2m (H1 2018: GBP2.0m).

The payments of assisted acquisitions support amounted to

GBP0.1m (H1 2018: GBP0.1m) and are explained by incentives targeted

at encouraging franchisees to acquire portfolios of tenanted

managed properties.

In the first six months of 2019 the Group made bank loan

repayments of GBP0.45m (H1 2018: GBP0.45m) and paid a final

dividend of GBP1.5m for the year ended 31 December 2018 (H1 2018:

GBP1.4m for the year ended 31 December 2017).

Overall cash balances increased by GBP1.3m to GBP3.9m (H1 2018:

GBP2.6m).

Liquidity

The Group had a net cash balance of GBP2.8m at the end of the

period (H1 2018: net cash GBP0.5m).

The Group had undrawn bank loan facilities of GBP3.8m at 30 June

2019 (30 June 2018: GBP3.0m). These are due for renewal in October

2019 and arrangements are at an advanced stage. Their renewal does

not impact the repayment terms for the two existing loans.

Financial position

The Group continues to be strongly cash generative with a

significantly enhanced net cash position affording it increasing

headroom in its dividend policy as it continues to pursue an

attractive yield for investors. At the same time our strong balance

sheet enables us to continue to fulfil the acquisition element of

our strategic plan and to pursue the fulfilment of EweMove's

potential.

David Raggett, Chief Financial Officer

THE PROPERTY FRANCHISE GROUP PLC

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

FOR THE SIX MONTHSED 30 JUNE 2019

Unaudited Unaudited Audited

6 Months 6 Months 12 Months

Ended Ended Ended

30.06.19 30.06.18 31.12.18

Notes GBP GBP GBP

CONTINUING OPERATIONS

Revenue 6 5,403,446 5,478,076 11,245,613

Cost of sales (524,140) (539,503) (1,080,271)

------------ ------------ ------------

GROSS PROFIT 4,879,306 4,938,573 10,165,342

Administrative expenses (2,846,388) (3,000,645) (5,783,482)

Share-based payments charge - - (49,857)

------------ ------------ ------------

OPERATING PROFIT 2,032,918 1,937,928 4,332,003

Finance income 4,235 5,256 8,968

Finance costs (24,432) (38,945) (71,494)

------------

PROFIT BEFORE INCOME TAX 2,012,721 1,904,239 4,269,477

Tax 7 (379,607) (390,882) (847,041)

------------ ------------ ------------

PROFIT AND TOTAL COMPREHENSIVE

INCOME FOR THE PERIOD ATTRIBUTABLE

TO OWNERS 1,633,114 1,513,357 3,422,436

============ ============ ============

Earnings per share attributable

to owners 8 6.3p 5.9p 13.3p

============ ============ ============

Diluted earnings per share

attributable to owners 8 6.3p 5.9p 13.3p

============ ============ ============

THE PROPERTY FRANCHISE GROUP PLC

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

AS AT 30 JUNE 2019

Unaudited Unaudited Audited

As at As at As at

30.06.19 30.06.18 31.12.18

Notes GBP GBP GBP

ASSETS

NON-CURRENT ASSETS

Intangible assets 10 15,033,021 15,618,215 15,324,755

Property, plant and equipment 88,549 108,581 103,584

Prepaid assisted acquisitions

support 483,325 341,911 453,836

15,604,895 16,068,707 15,882,175

----------- ----------- -----------

CURRENT ASSETS

Trade and other receivables 11 1,189,127 1,095,882 1,096,274

Cash and cash equivalents 3,917,335 2,595,620 3,857,988

----------- -----------

5,106,462 3,691,502 4,954,262

----------- ----------- -----------

TOTAL ASSETS 20,711,357 19,760,209 20,836,437

=========== =========== ===========

EQUITY

SHAREHOLDERS' EQUITY

Share capital 12 258,228 258,228 258,228

Share premium 4,039,800 4,039,800 4,039,800

Other reserves 13 2,983,861 2,934,004 2,983,861

Retained earnings 8,526,709 7,153,627 8,442,960

-----------

TOTAL EQUITY 15,808,598 14,385,659 15,724,849

----------- ----------- -----------

LIABILITIES

NON-CURRENT LIABILITIES

Borrowings 14 500,000 1,150,000 700,000

Deferred tax 1,327,888 1,423,288 1,372,196

-----------

1,827,888 2,573,288 2,072,196

----------- ----------- -----------

CURRENT LIABILITIES

Borrowings 14 650,000 900,000 900,000

Trade and other payables 15 1,534,323 1,370,152 1,476,819

Tax payable 890,548 531,110 662,573

-----------

3,074,871 2,801,262 3,039,392

----------- ----------- -----------

TOTAL LIABILITIES 4,902,759 5,374,550 5,111,588

----------- ----------- -----------

TOTAL EQUITY AND LIABILITIES 20,711,357 19,760,209 20,836,437

=========== =========== ===========

THE PROPERTY FRANCHISE GROUP PLC

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR THE SIX MONTHSED 30 JUNE 2019

Called up Retained Share Other reserves Total equity

share capital earnings premium (note 13)

(note 12)

GBP GBP GBP GBP GBP

Balance at 1 January 2018

(audited) 258,228 7,034,699 4,039,800 2,934,004 14,266,731

-------------------------------------- -------- ------------ ---------- --------------- -------------

Profit and total comprehensive

income - 1,513,357 - - 1,513,357

Dividends paid (note 9) - (1,394,429) - - (1,394,429)

-------------------------------------- -------- ------------ ---------- --------------- -------------

Total transactions with owners - (1,394,429) - - (1,394,429)

-------------------------------------- -------- ------------ ---------- --------------- -------------

Balance at 30 June 2018 (unaudited) 258,228 7,153,627 4,039,800 2,934,004 14,385,659

-------------------------------------- -------- ------------ ---------- --------------- -------------

Profit and total comprehensive

income - 1,909,079 - - 1,909,079

-------------------------------------- -------- ------------ ---------- --------------- -------------

Dividends paid (note 9) - (619,746) - - (619,746)

Share-based payments charge - - - 49,857 49,857

-------------------------------------- -------- ------------ ---------- --------------- -------------

Total transactions with owners - (619,746) - 49,857 (569,889)

-------------------------------------- -------- ------------ ---------- --------------- -------------

Balance at 31 December 2018

(audited) 258,228 8,442,960 4,039,800 2,983,861 15,724,849

-------------------------------------- -------- ------------ ---------- --------------- -------------

Profit and total comprehensive

income - 1,633,114 - - 1,633,114

-------------------------------------- -------- ------------ ---------- --------------- -------------

Dividends paid (note 9) - (1,549,365) - - (1,549,365)

Total transactions with owners - (1,549,365) - - (1,549,365)

-------------------------------------- -------- ------------ ---------- --------------- -------------

Balance at 30 June 2019 (unaudited) 258,228 8,526,709 4,039,800 2,983,861 15,808,598

====================================== ======== ============ ========== =============== =============

THE PROPERTY FRANCHISE GROUP PLC

CONSOLIDATED STATEMENT OF CASH FLOWS

FOR THE SIX MONTHSED 30 JUNE 2019

Unaudited Unaudited Audited

6 Months 6 Months 12 Months

Ended Ended Ended

30.06.19 30.06.18 31.12.18

GBP GBP GBP

Cash flows from operating activities

Profit before income tax 2,012,721 1,904,239 4,269,477

Depreciation and amortisation charges 384,193 355,228 714,440

Share-based payments charge - - 49,857

Loss on disposal of intangible assets - 1,749 17,989

Finance costs 24,432 38,945 71,494

Finance income (4,235) (5,256) (8,968)

------------ ------------ ------------

Operating cash flow before changes

in working capital 2,417,111 2,294,905 5,114,289

(Increase) / decrease in trade and

other receivables (92,853) 21,455 21,062

Increase / (decrease) in trade and

other payables 59,642 70,656 178,998

------------ ------------ ------------

Cash generated from operations 2,383,900 2,387,016 5,314,349

Interest paid (26,568) (39,086) (75,346)

Tax paid (195,943) (395,991) (771,779)

Net cash generated from operations 2,161,389 1,951,939 4,467,224

------------ ------------ ------------

Cash flows from investing activities

Purchase of intangible assets - (10,000) (20,000)

Purchase of tangible assets (2,053) (15,042) (30,505)

Payment of assisted acquisitions support (104,859) (86,630) (248,050)

Interest received 4,235 5,256 8,968

Net cash used in investing activities (102,677) (106,416) (289,587)

------------ ------------ ------------

Cash flows from financing activities

Repayment of borrowings (450,000) (450,000) (900,000)

Equity dividends paid (note 9) (1,549,365) (1,394,429) (2,014,175)

Net cash used in financing activities (1,999,365) (1,844,429) (2,914,175)

------------ ------------ ------------

Increase in cash and cash equivalents 59,347 1,094 1,263,462

Cash and cash equivalents at the beginning

of the period 3,857,988 2,594,526 2,594,526

Cash and cash equivalents at end of

the period 3,917,335 2,595,620 3,857,988

============ ============ ============

THE PROPERTY FRANCHISE GROUP PLC

NOTES TO THE INTERIM RESULTS

FOR THE SIX MONTHSED 30 JUNE 2019

1. GENERAL INFORMATION

The principal activity of The Property Franchise Group plc and

its subsidiaries is that of a UK residential property franchise

business. The Group operates in the UK. The company is a public

limited company incorporated and domiciled in the UK. The address

of its head office and registered office is 2 St Stephen's Court,

St Stephen's Road, Bournemouth, Dorset, UK.

2. GOING CONCERN

The interim financial information has been prepared on the basis

that the Group is a going concern.

When assessing the foreseeable future the directors have looked

at a period of 12 months from the date of approval of the interim

financial information. The directors have a reasonable expectation

that the Group has adequate resources to continue to trade for the

foreseeable future and, therefore, consider it appropriate to

prepare the Group's interim financial information on a going

concern basis.

3. BASIS OF PREPARATION

The consolidated interim financial information for the six

months ended 30 June 2019 was approved by the Board and authorised

for issue on 10 September 2019. The results for 30 June 2019 and 30

June 2018 are unaudited. The disclosed figures are not statutory

accounts in terms of Section 435 of the Companies Act 2006.

Statutory accounts for the year ended 31 December 2018 on which the

auditors gave an audit report which was unqualified and did not

contain a statement under Section 498(2) or (3) of the Companies

Act 2006, have been filed with the Registrar of Companies. The

annual financial statements of the Group are prepared in accordance

with International Financial Reporting Standards as adopted by the

European Union.

This interim report has been prepared on a basis consistent with

the accounting policies expected to be applied for the year ending

31 December 2019, and uses the same accounting policies and methods

of computation applied for the year ended 31 December 2018. IFRS 16

Leases applies to the financial year beginning 1 January 2019 but

has not been applied in this interim report because the impact of

IFRS 16 is immaterial to the Group's interim financial

information.

IFRS 16 requires that almost all leases will be brought onto

lessees' balance sheets under a single model (except leases of less

than 12 months and leases of low-value assets), eliminating the

distinction between operating and finance leases. Currently, the

Group holds some non-cancellable operating leases but no finance

leases. The non-cancellable operating lease commitments meet the

definition of a lease under IFRS 16. Thus, the Group will recognise

a right-of-use asset and a corresponding liability in respect of

all these leases in its year-end accounts in the order of GBP0.05m.

The charge to be recognised in the consolidated statement of

comprehensive income is estimated to be GBP0.05m for 2019,

comprising depreciation and interest and will replace the operating

lease rentals which would have been charged had IFRS 16 not been

applied.

4. BASIS OF CONSOLIDATION

The Group's interim financial information includes those of the

parent company and its subsidiaries, drawn up to 30 June 2019.

Subsidiaries are all entities over which the Group has control. The

Group controls an entity when the Group is exposed to, or has

rights to, variable returns from its involvement with the entity

and has the ability to affect those returns through its power over

the entity. Subsidiaries are fully consolidated from the date on

which control is transferred to the Group. They are deconsolidated

from the date that control ceases.

The Group applies the acquisition method to account for business

combinations. The consideration transferred for the acquisition of

a subsidiary is the fair values of the assets transferred, the

liabilities incurred to the former owners of the acquiree and the

equity interests issued by the Group. Identifiable assets acquired

and liabilities and contingent liabilities assumed in a business

combination are measured initially at their fair values at the

acquisition date. Acquisition-related costs are expensed as

incurred.

Inter-company transactions, balances and unrealised gains on

transactions between Group companies are eliminated. Unrealised

losses are also eliminated. When necessary amounts reported by

subsidiaries have been adjusted to conform with the Group's

accounting policies.

5. SEGMENTAL REPORTING

The board of Directors, as the chief operating decision-making

body, review financial information for and make decisions about the

Group's overall franchising business and have identified a single

operating segment, that of property franchising.

6. REVENUE

The Directors believe there to be three material income streams

relevant to property franchising which are split as follows:

Unaudited Unaudited Audited

6 Months 6 Months 12 Months

Ended Ended Ended

30.06.19 30.06.18 31.12.18

GBP GBP GBP

Management service fee 4,641,386 4,406,284 9,464,388

Franchise sales 79,842 212,265 289,808

Other 737,469 885,630 1,552,909

----------- ----------- -----------

5,458,697 5,504,179 11,307,105

Prepaid assisted acquisitions

support release (55,251) (26,103) (61,492)

5,403,446 5,478,076 11,245,613

=========== =========== ===========

All revenue is earned in the UK and no customer represents

greater than 10 per cent of total revenue in the periods

reported.

7. TAXATION

The underlying tax charge is based on the expected effective tax

rate for the full year to December 2019. The majority of the tax

arises from applying this effective tax rate to the profit on

ordinary activities.

8. EARNINGS PER SHARE

Earnings per share is calculated by dividing the profit for the

financial period by the weighted average number of shares during

the period.

Unaudited Unaudited Audited

6 Months 6 Months 12 Months

Ended Ended Ended

30.06.19 30.06.18 31.12.18

Basic earnings per share

Weighted average number of

shares 25,822,750 25,822,750 25,822,750

----------- ------------ ---------------

Profit for the period (GBP) 1,633,114 1,513,357 3,422,436

----------- ------------ ------ -----------

Earnings per share (pence) 6.3p 5.9p 13.3p

----------- ------------ ---------------

Unaudited Unaudited Audited

6 Months 6 Months 12 Months

Ended Ended Ended

30.06.19 30.06.18 31.12.18

Diluted earnings per

share

Weighted average number

of shares 25,822,750 25,822,750 25,822,750

Dilutive effect of

share options on ordinary

shares - 349 -

25,822,750 25,823,099 25,822,750

----------- ----------- -----------

Diluted earnings per

share (pence) 6.3p 5.9p 13.3p

----------- ----------- -----------

9. DIVIDS

Unaudited Unaudited Audited

As at As at As at

30.06.19 30.06.18 31.12.18

GBP GBP GBP

Dividends (ordinary share

of GBP0.01 each) 1,549,365 1,394,429 2,014,175

Dividend per share paid 6.0p 5.4p 7.8p

10. INTANGIBLE ASSETS

Master Brands Technology Customer Goodwill Total

Franchise Lists

Agreement

GBP GBP GBP GBP GBP GBP

Cost

Balance at 1

January

2018 (Audited) 7,803,436 1,972,239 274,210 301,712 7,226,160 17,577,757

Additions - - - 10,000 - 10,000

Disposals - - - (84,205) - (84,205)

---------- ---------- ----------- --------- ---------- -----------

Balance at 30 June

2018 (Unaudited) 7,803,436 1,972,239 274,210 227,507 7,226,160 17,503,552

========== ========== =========== ========= ========== ===========

Additions - - - 10,000 - 10,000

Disposals - - - (22,567) - (22,567)

---------- ---------- ----------- --------- ---------- -----------

Balance at 31

December

2018 (Audited) 7,803,436 1,972,239 274,210 214,940 7,226,160 17,490,985

========== ========== =========== ========= ========== ===========

Additions - - - - - -

Disposals - - - - - -

========== ========== =========== ========= ========== ===========

Balance at 30 June

2019

(Unaudited) 7,803,436 1,972,239 274,210 214,940 7,226,160 17,490,985

========== ========== =========== ========= ========== ===========

Amortisation

Balance at 1

January

2018 (Audited) 1,325,528 88,968 49,118 201,846 - 1,665,460

Charge for period 206,587 33,363 39,518 22,867 - 302,335

Eliminated on

disposals - - - (82,454) - (82,454)

Balance at 30

June

2018 (Unaudited) 1,532,115 122,331 88,636 142,259 - 1,885,341

Charge for period 206,587 33,363 39,519 10,519 - 289,988

Eliminated on

disposals - - - (9,099) - (9,099)

---------- ---------- ----------- --------- ---------- -----------

Balance at 31

December

2018 (Audited) 1,738,702 155,694 128,155 143,679 - 2,166,230

Charge for period 206,587 33,363 39,518 12,266 - 291,734

Disposals - - - - - -

========== ========== =========== ========= ========== ===========

Balance at 30 June

2019 (Unaudited) 1,945,289 189,057 167,673 155,945 - 2,457,964

========== ========== =========== ========= ========== ===========

Net book value

30 June 2018 (Unaudited) 6,271,321 1,849,908 185,574 85,252 7,226,160 15,618,215

============ ========== ======== ======= ========== ===========

31 December 2018

(Audited) 6,064,734 1,816,545 146,055 71,261 7,226,160 15,324,755

============ ========== ======== ======= ========== ===========

30 June 2019 (Unaudited) 5,858,147 1,783,182 106,537 58,995 7,226,160 15,033,021

============ ========== ======== ======= ========== ===========

11. TRADE AND OTHER RECEIVABLES

Unaudited Unaudited Audited

As at As at As at

30.06.19 30.06.18 31.12.18

GBP GBP GBP

Trade receivables 237,304 157,319 113,466

Loans to franchisees 80,227 18,102 36,523

Other receivables 10,113 42,193 8,539

Prepayments and accrued

income 861,483 878,268 937,746

1,189,127 1,095,882 1,096,274

========== ========== ==========

12. CALLED UP SHARE CAPITAL

Unaudited Unaudited Audited

As at As at As at

30.06.19 30.06.18 31.12.18

GBP GBP GBP

Group

25,822,750 allotted issued

and fully paid Ordinary Shares

of 1p each 258,228 258,228 258,228

========== ========== ============

Enterprise Management Incentive ("EMI") Share Option Scheme

2017

During the year ended 31 December 2017 the Company implemented

an EMI scheme as part of the remuneration for all staff and granted

options over 2,290,000 ordinary shares at an exercise price of

GBP0.01 each which included options over 1,500,000 ordinary shares

being granted to two Executive Directors.

The options are exercisable after the approval of the financial

statements for the year ending 31 December 2019, and subject to

meeting an Earnings per Share target.

Enterprise Management Incentive ("EMI") Share Option Scheme

2018

On 1 August 2018 employees including the two Executive Directors

with options in the EMI Share Option Scheme 2017 were granted

options in a parallel scheme, over the same number of shares, and

with the same Earnings per Share target, but these are exercisable

one year later, after the approval of the financial statements for

the year ending 2020. These participants, therefore, hold two

options, one for each Scheme, and are only be able to exercise one

of their options. The total number of parallel options granted was

1,965,000.

On 1 August 2018 new employees who did not have options under

the 2017 scheme were granted options over 155,000 shares at an

exercise price of GBP0.01 each.

13. OTHER RESERVES

Merger Share Based

Reserve Payment Reserve Total

GBP GBP GBP

1 January 2018 (Audited) 2,796,984 137,020 2,934,004

30 June 2018 2,796,984 137,020 2,934,004

31 December 2018 (Audited) 2,796,984 186,877 2,983,861

30 June 2019 2,796,984 186,877 2,983,861

Merger reserve

The merger reserve relates to the acquisition of Martin & Co

(UK) Limited by The Property Franchise Group plc. This did not meet

the definition of a business combination and therefore, falls

outside of the scope of IFRS 3. This transaction was accounted for

in accordance with the principles of merger accounting as set out

in Financial Reporting Standard 6 - Acquisitions and Mergers.

Share-based payment reserve

The share-based payments reserve comprises charges made to the

income statement in respect of share-based payments and related

deferred tax impacts under the Group's equity compensation

scheme.

14. BORROWINGS

Unaudited Unaudited Audited

As at As at As at

30.06.19 30.06.18 31.12.18

GBP GBP GBP

Repayable within 1 year:

Bank loan (term loan) 650,000 900,000 900,000

Repayable in more than

1 year:

Bank loan (term loan) 500,000 1,150,000 700,000

Bank loans due after

more than 1 year are

repayable as follows:

Between 1 and 2 years 400,000 900,000 400,000

Between 2 and 5 years 100,000 250,000 300,000

The term loan of GBP1.15m (30 June 2018: GBP2.05m) is secured

with a fixed and floating charge over the Group's assets and a

cross guarantee across all companies in the Group.

The Company has a loan facility of GBP5m and has drawn down two

term loans under this facility, referred to below as 'Loan 1' and

'Loan 2'.

Loan 1 - GBP2.5m drawn down on 30 October 2014 and is repayable

over 5 years in equal instalments. Interest is charged quarterly on

the outstanding amount and the rate is fixed at 4.08%. The amount

outstanding at 30 June 2019 was GBP0.25m (30 June 2018:

GBP0.75m).

Loan 2 - GBP2m drawn down on 5 September 2016 and is repayable

over 5 years in equal instalments. Interest is charged quarterly on

the outstanding amount. The interest rate is variable during the

term at 2.5% above LIBOR and at 30 June 2019 the rate was 3.3%. The

amount outstanding at 30 June 2019 was GBP0.9m (30 June 2018:

GBP1.3m).

At 30 June 2019 the unutilised amount of the facility was

GBP3.85m (30 June 2018: GBP2.95m).

15. TRADE AND OTHER PAYABLES

Unaudited Unaudited Audited

As at As at As at

30.06.19 30.06.18 31.12.18

GBP GBP GBP

Trade payables 152,596 183,579 164,181

Other taxes and social

security 540,404 526,840 619,119

Other payables 119,545 42,924 28,113

Accruals and deferred

income 721,778 616,809 665,406

1,534,323 1,370,152 1,476,819

========== ========== ==========

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR KKLFBKKFXBBQ

(END) Dow Jones Newswires

September 10, 2019 02:01 ET (06:01 GMT)

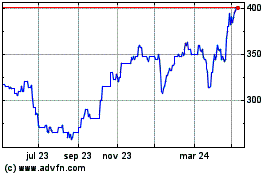

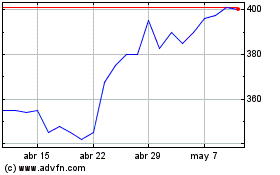

Property Franchise (LSE:TPFG)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Property Franchise (LSE:TPFG)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024