TIDMFUM

RNS Number : 8860L

Futura Medical PLC

11 September 2019

For immediate release

11 September 2019

Futura Medical plc

("Futura" or "the Company")

Interim Results for the Six Months ended 30 June 2019

Futura Medical plc (AIM: FUM) ("Futura" or the "Company"), a

pharmaceutical company developing a portfolio of innovative

products based on its proprietary, transdermal DermaSys(R) drug

delivery technology currently focused on sexual health and pain, is

pleased to announce its interim results for the six months ended 30

June 2019.

Highlights

MED2005 - Topical glyceryl trinitrate (GTN) formulation for

erectile dysfunction

-- Patient recruitment completed in June 2019 for the MED2005 first European Phase 3 study "FM57". This study is on

track to deliver headline efficacy and safety data by the end of 2019. Patient recruitment was completed in June

2019 and at the end of August over 500 patients had completed the 12 week double-blind phase of the study with

80% of these patients having elected to continue into the open label extension to study long term safety of the

highest dose.

-- Planning for a second, confirmatory Phase 3 study for MED2005 is underway.

-- Positive data to support safety in sexual partners provided at the European Society of Sexual Medicine (ESSM)

congress in February 2019, including a review of safety data from the Phase 2a study, pharmacokinetic study and

in-vitro impedance data.

-- Second advisory panel held at ESSM in Slovenia in February 2019 with prominent European key opinion leaders

(KOLs) to review the data and discuss the on-going development and educational programme. As with US KOLs, their

reaction to the therapeutic potential for MED2005 in erectile dysfunction and its areas of differentiation as

well as the ongoing clinical programme was highly positive reflecting the limited amount of innovation in the

sector for over ten years.

TPR100 - Topical non-steroidal anti-inflammatory for the pain

and inflammation associated with sprains, strains and bruises and

soft tissue rheumatism

-- UK partner Thornton & Ross (a subsidiary of STADA AG) received feedback from UK Medicines and Healthcare products

Regulatory Agency (MHRA) in February 2019 requiring additional laboratory work to be conducted to support the UK

filing. This work is progressing, and we expect to respond in Q1 2020 within the timelines agreed with the MHRA.

-- Ongoing commercial discussions with several potential distribution partners for other territories. Any further

licensing deals are expected to be after UK regulatory approval.

CBD100 - Joint Venture Collaboration on optimised topical

delivery of Cannabidiol

-- Joint venture collaboration with CBDerma Technology Limited to explore the application of DermaSys(R) for

optimised delivery of Cannabidiol through the skin to explore a number of disease states including pain relief.

The initial joint venture development costs are expected to be in the region of $1 million. Any Intellectual

Property will be jointly owned.

Financial highlights

-- GBP4.46 million net loss in the period (30 June 2018: net loss GBP1.95 million).

-- Cash resources of GBP5.63 million at 30 June 2019 (30 June 2018: GBP6.03 million).

-- R&D tax credits of GBP1.36 million for year ending 2018 received in August (Year ending 2017: GBP0.94 million)

James Barder, Chief Executive of Futura, commented: "We continue

to make good progress in the development and commercialisation of

our pipeline of product opportunities. We are pleased to have

completed recruitment for the double-blind, clinical efficacy of

the first European Phase 3 study of MED2005. Most patients have

elected to continue into the open-label, Phase 3, safety stage in

which all patients are on the highest dose of MED2005. We look

forward to Phase 3 headline data by the end of the year. Engagement

with eminent experts in the field of erectile dysfunction continues

in both Europe and the US to increase awareness as well as with

potential commercial partners in advance of Phase 3 results which

remain our key priority to deliver on by the end of 2019."

Analyst meeting and webcast

The Executive Team will host a presentation at 10am (BST), 11

September 2019, for analysts at the office of Liberum Capital at 25

Ropemaker Street, London, EC2Y 9LY. Analysts wishing to attend the

presentation should register their interest by emailing

futuramedical@optimumcomms.com.

Following the results meeting, a webcast of the presentation

will also be made available within the Investor Centre section of

the Futura company website at www.futuramedical.com.

For further information please contact:

Futura Medical plc

James Barder, Chief Executive

Angela Hildreth, Finance Director and COO

Email: Investor.relations@futuramedical.com

Tel: +44 (0) 1483 685 670

Nominated Adviser and Sole Broker:

Liberum

Bidhi Bhoma/ Euan Brown/ Kane Collings

Tel: +44 (0) 203 100 2000

For media enquiries please contact:

Optimum Strategic Communications

Mary Clark/ Eva Haas/ Hollie Vile

Email: futuramedical@optimumcomms.com

Tel: +44 (0) 203 950 9144

Notes to editors:

About Futura Medical plc

Futura Medical plc (AIM: FUM), is a pharmaceutical company

developing a portfolio of innovative products based on its

proprietary, transdermal DermaSys(R) drug delivery technology.

These products are optimised for clinical efficacy, safety,

administration and patient convenience and are developed for the

prescription and consumer healthcare markets as appropriate.

Current therapeutic areas are sexual health, including erectile

dysfunction, and pain relief. Development and commercialisation

strategies are designed to maximise product differentiation and

value creation whilst minimising risk.

The first European Phase 3 study for MED2005, referred to as

"FM57", is a 1,000 patient, dose-ranging, multi-centre, randomised,

double blind, placebo-controlled, home use, parallel group study of

MED2005 0.2%, 0.4% and 0.6% Glyceryl Trinitrate for the treatment

of erectile dysfunction with a 450 patient open label extension.

FM57 is progressing on track, with headline data expected by the

end of 2019.

Futura is based in Guildford, Surrey, and its shares trade on

the AIM market of the London Stock Exchange.

www.futuramedical.com

Operational Review - "Building for the future"

As an innovative, specialist R&D company, Futura's strategy

is to leverage its DermaSys(R) transdermal delivery technology to

bring innovative products to market in sexual health and pain,

bringing new treatment options to patients particularly in areas of

significant unmet need.

MED2005 - Topical gel for erectile dysfunction ("ED")

Futura's lead product MED2005 is a topical glyceryl trinitrate

(GTN) gel for the treatment of erectile dysfunction (ED). MED2005

has the potential to be a highly differentiated therapy, especially

for mild to moderate ED. In a Phase 2a study, MED2005 was shown to

have a fast onset of action (5-10 minutes) and rapid clearance.

MED2005 has the potential to be the fastest-acting ED treatment

available.

Erectile dysfunction disrupts the lives of at least 1 in 5 men

globally(1) , affecting the sexual and emotional health of around

27 million men and their partners in the USA alone. There has been

little innovation in ED treatments for over ten years and many

patients continue to suffer dissatisfaction with existing

treatments especially those looking for a fast-acting treatment

that can form part of sexual foreplay or those contraindicated from

using existing therapies(2) .

Recent focus group research conducted by Futura in the UK on pre

and post-menopausal women with partners with erectile dysfunction

showed strong interest in MED2005 and its unique attributes. In

particular it highlighted the perceived benefit of MED2005

providing a shared sexual experience with the potential to take the

responsibility of treatment away from their male partner alone

towards a solution that is embraced by the couple together. KOLs

have consistently said treating the couple is more effective than

treating the individual.

With an independently assessed market potential of over $1

billion as a prescription treatment and subsequently over the

counter (OTC) treatment(3) , MED2005 is Futura's lead asset and a

key value creation opportunity.

Phase 3 clinical programme progressing well

"FM57" - First, European Phase 3

MED2005's first Phase 3 study, "FM57" completed patient

recruitment in June 2019. The 1,000 patient study includes

approximately 60 centres across Central and Eastern Europe. Futura

remains on track to deliver first Phase 3 headline data by the end

of 2019.

This Phase 3 study is a dose ranging, randomised, double blind,

placebo controlled, home use, parallel group clinical trial and

compares the efficacy of 0.2%, 0.4% and 0.6% GTN doses of MED2005

in mild, moderate and severe ED patients.

Following positive Phase 2a "FM53" data, we have confidence that

the higher doses of 0.4% and 0.6% being studied in addition to the

0.2% dose will show improved efficacy across patients with mild,

mild to moderate and moderate ED - which represent the large

majority of ED sufferers throughout the world and the largest

commercial opportunity. Severe ED patients, who often have the most

medical complications as well as being the oldest men, are a

difficult patient cohort to treat. This is further evidenced by the

limited success of the existing ED treatments in this cohort. We

therefore remain cautious over the potential benefit MED2005 will

bring to severe patients. As the first Phase 3 includes patients of

all ED severities, if reduced efficacy in severe ED patients

occurs, it is not expected to compromise the overall success of the

study.

KOLs in both US and EU have expressed strong interest in a

locally acting, fast and safe new treatment for ED that

particularly targets those younger patients with mild and mild to

moderate ED where frequency of intercourse is generally high

compared to those patients with moderate to severe ED.

As part of the Phase 3 programme, Futura is required by

regulators to run an open label extension study for safety. After

patients complete their 4-month trial period, they are invited to

enter the open label extension study ("OLE") to assess safety at

the highest dose (0.6% GTN) up to the required number of 450

patients. Of these patients 300 are to continue treatment for a

further 6 months and 150 patients for a further 12 months. At the

end of August 500 patients had completed the 12 week double-blind

phase of the study with 80% of these patients having elected to

continue into the open label extension to study long term safety of

the highest dose. This OLE is a normal requirement of regulators

for pharmaceutical products to provide additional reassurance on

safety for longer term use of MED2005.

"FM59" - Second, confirmatory Phase 3

We anticipate patient enrolment to commence for "FM59", a

second, confirmatory Phase 3 study for MED2005 in H1 2020.

This study will incorporate a US patient cohort and we will be

shortly filing protocols and an Investigational New Drug

Application (IND) in the US. The protocols for this study will be

the same as for "FM57" initially but will be informed by the

receipt and analysis of the first Phase 3 data and adapted

accordingly, if necessary, via regulatory amendments. The second

Phase 3 will be a placebo controlled, parallel group study and will

compare the efficacy of two GTN doses of MED2005, shown to be

optimal in the first Phase 3 trial, in a smaller patient cohort of

around 700 patients. The Company is currently undertaking

pre-recruitment start-up activities in order to commence patient

enrolment in H1 2020.

Completion of the second, confirmatory Phase 3 study, expected

by the end of 2020, is subject to funding and positive results from

"FM57", the first European Phase 3 trial. Any financing is expected

to depend on the strength of the results in FM57. In anticipation

of this, the Board is therefore exploring both non-dilutory and

dilutory funding options and intends to place the Company in a

position of strength to continue capitalising on product

development and for negotiating any out-licensing agreements for

MED2005.

It is usual for two Phase 3 studies to be required for

regulatory filing. However, depending on data from the first

European Phase 3 study, Futura may explore filing MED2005 with

regulatory bodies in Europe with one Phase 3 study which could

occur during H2 2020. The US FDA has been clear that two studies

are required, and US filing will await results from the second

Phase 3 study.

Futura held a R&D analyst event in London in February 2019

including a presentation from Professor David Ralph, a world

leading expert in erectile dysfunction and male infertility and

Chair of the Futura Medical European Advisory Panel. These

activities and events organised by Futura are continuing to

increase the awareness and credibility of the potential innovation

that MED2005 brings within the treatment arena of ED to both the

medical and pharmaceutical communities. A second US advisory board

meeting has been arranged for October 2019 at the Sexual Medicine

Society of North America Conference.

Discussions continue with a number of interested commercial

partners for the out-licensing of MED2005 although the Company's

main focus is to deliver Phase 3 headline data by the end of 2019

and prepare for the second smaller Phase 3 which is critical for US

regulatory approval in order to bring MED2005's novel benefits to

ED patients through the EU and US as soon as possible.

We believe MED2005 has the required efficacy, speed of onset and

favourable safety profile consistent with use as a prescription

therapy as well as the potential to be an over-the-counter

therapy.

MED2005 Intellectual Property

MED2005's current patent protection runs until August 2028 in

the USA and August 2025 in Europe. In August 2018 Futura filed a

Patent Co-operation Treaty (PCT) patent filing which is expected to

extend patent life in many geographies to 2038. The PCT filing will

be moving into the National filing phase in Q1 2020 in line with

standard processes. This phase sets out specific, nominated

countries under the Patent Co-operation Treaty which will adhere to

the 2018 priority date through to 2037.

The EU also can provide up to ten year's data exclusivity and US

up to three years from the date of regulatory approval subject to

EU and FDA guidelines.

TPR100 - Topical gel for pain relief

TPR100 is a topical non-steroidal anti-inflammatory for the

treatment of pain and inflammation associated with sprains,

strains, bruises and soft tissue rheumatism.

TPR100 is partnered for manufacturing and distribution in the UK

with Thornton & Ross, one of the UK's largest consumer

healthcare companies and a subsidiary of STADA AG. In February

2019, the UK Medicines and Healthcare products Regulatory Agency

(MHRA) responded to Thornton & Ross's marketing authorisation

application filed in July 2018, raising a number of questions

requiring additional laboratory work specifically around the

permeation characteristics of TPR100 to be conducted. This work is

progressing, and we expect Thornton & Ross to respond by the

end of February 2020 within the timelines agreed with the MHRA.

The Company has received expressions of interest from a number

of parties to enable Futura to expand the geographical reach of

TPR100. Futura is awaiting regulatory authorisation in the UK

before progressing further with these discussions.

CBD100 - Joint Venture Collaboration on optimised topical

delivery of Cannabidiol

A joint venture collaboration has been signed with CBDerma

Technology Limited to explore the application of Futura's advanced

proprietary transdermal drug delivery technology, DermaSys(R) for

delivery of Cannabidiol. All Intellectual Property will be owned

jointly by the Company and CBDerma Technology Limited.

CBDerma Technology is a company that has been established and

funded to specifically exploit the therapeutic potential of

Cannabis. The company's management, backers and advisors have

extensive knowledge, expertise and investments in plant derived

product manufacturing. Cannabidiol is a major component of the

cannabis plant and is generally regarded as non-addictive and

non-psychoactive, making it ideal for consideration as a topically

delivered molecule for local or regional (non-systemic) use.

Initial development costs are expected to be in the region of

US$ 1 million and will cover all development costs incurred by the

Company during the next 15 months in order to develop and optimise

a DermaSys(R) - cannabidiol formulation as well as establish early

ex-vivo proof of concept studies likely to include certain disease

states most suited for local or regional (non-systemic) topical

treatment such as pain relief. The Company does not expect this

project's initial development to have any material impact on

cashflow as Futura's financial share of the project will be

delivered from its expertise and existing internal resources.

DermaSys(R) provides rapid and targeted local delivery of active

pharmaceutical ingredients at therapeutic levels through the skin

to the required site of action with a high level of safety. It is a

versatile and bespoke technology that can be tailored to suit the

specific active compound being used and the therapeutic indication.

Each product is formulated to maximise its benefits for patients

and consumers and can be developed for the prescription and

consumer healthcare markets as appropriate.

Financial Review

Research and Development Costs

Research and Development costs for the six months ended 30 June

2019 were GBP4.74 million, compared to GBP1.65 million for the six

months ended 30 June 2018. The increase of GBP3 million is

attributable to the FM57 Phase 3 study which is running on time,

within budget and expected to provide headline data in December

2019.

Administrative Costs

Administrative costs were GBP0.53 million for the six months

ended 30 June 2019 compared to GBP0.86 million for the six months

ended 30 June 2018 and were reflective of the Company's strategy to

keep central costs lean and focus cash resources on delivering the

R&D programme.

Going Concern

At the period end the Group held GBP5.63 million of cash with a

further GBP1.36 million of R&D tax credit refund received after

the period end, in August 2019. As has been previously discussed,

the cash currently held by the Group will not be sufficient to

complete the second Phase 3 study (FM59) which the Group intends to

commence during 2020, assuming that the results of FM57 are

positive. The Board is therefore exploring a number of funding

options including non-dilutory and dilutory options and believe

that the results of the FM57 trial will have a major impact on

these funding options and the costs associated with them. Whilst

there can be no guarantee that any of these opportunities will be

successfully concluded, the Directors believe that it remains

appropriate to prepare the financial statements on a going concern

basis.

Taxation

The tax credit of GBP0.8 million (2018: GBP0.6m) is an accrual

for the expected R&D tax credit receivable for the six months

ended 30 June 2019.

Post Period Events

The R&D tax credit relating to 2018 claim of GBP1.36 million

was received in August 2019.

Outlook

Futura now has the potential for a significant value inflection

driven by MED2005 late stage clinical development. We look forward

to headline data from the first Phase 3 study towards the end of

2019. We are excited to be moving closer to bringing an innovative,

highly differentiated ED product to market that could help the many

ED patients whose needs are not met by current treatments. In

parallel we are managing the Company's resources prudently whilst

planning and building for the future to further leverage our

DermaSys(R) technology and products.

References

1 EMEA, Withdrawal assessment report for Viagra, 2008

2 50% of men discontinue treatment on PDE5s, reference

Carvalheira J Sex Med. 2012 Sep;9(9):2361-9. Research from Decision

Resources Group and Cello Health Consulting show that many patients

are dissatisfied with their treatment. In the research from Cello,

physicians stated that the main reason they see their patients

switch to MED2005 is the speed of onset.

3 Based on external market assessments from market research

conducted by Cello Health Consulting as a prescription product and

Ipsos Group as an over the counter product.

Consolidated Statement of Comprehensive loss

For the six months ended 30 June 2019

Unaudited Unaudited Audited

6 months 6 months ended year

ended 30 June ended

30 June 2018 31 December

2019 2018

Notes GBP GBP GBP

Revenue - - -

Research and development costs (4,739,965) (1,652,536) (6,038,941)

Administrative costs (534,545) (866,132) (1,227,547)

Operating loss (5,274,510) (2,518,668) (7,266,488)

Finance income 13,395 9,429 27,576

Loss before tax 5,261,115) (2,509,239) (7,238,912)

Taxation 9 800,000 558,557 1,358,336

------------------------------- ------- ---------------------- ---------------------- ------------------------

Total comprehensive loss for

the period attributable to

owners

of the parent company (4,461,115) (1,950,682) (5,880,576)

------------------------------- ------- ---------------------- ---------------------- ------------------------

Loss per share (pence) 5 (2.18p) (1.61p) (4.46p)

------------------------------- ------- ---------------------- ---------------------- ------------------------

Consolidated Statement of Changes in Equity

For the six months ended 30 June 2019

Share Share Merger Retained Total

Capital Premium Reserve Losses Equity

GBP GBP GBP GBP GBP

--------------- ---

At 1 January

2018 -

audited 241,392 44,671,396 1,152,165 (36,959,195) 9,105,758

--------------- --- ------------------ ------------------- ----------------- ------------------- -------------------

Total

comprehensive

loss for the

period - - - (1,950,682) (1,950,682)

Share-based

payment - - - 103,464 103,464

Shares issued

during

the period 620 92,380 - - 93,000

At 30 June 2018

- unaudited 242,012 44,763,776 1,152,165 (38,806,413) 7,351,540

--------------- --- ------------------ ------------------- ----------------- ------------------- -------------------

Total

comprehensive

loss for the

period - - - (3,929,894) (3,929,894)

Share-based

payment - - - 43,369 43,369

Shares issued

during

the period 167,155 5,220,084 - - 5,387,239

At 31 December

2018

- audited 409,167 49,983,860 1,152,165 (42,692,938) 8,852,254

--------------- --- ------------------ ------------------- ----------------- ------------------- -------------------

Total

comprehensive

loss for the

period - - - (4,461,115) (4,461,115)

Share-based

payment - - - 41,724 41,724

Shares issued during

the period 154 19,130 - - 19,284

At 30 June 2019

- unaudited 409,321 50,002,990 1,152,165 (47,112,329) 4,452,147

--------------- --- ------------------ ------------------- ----------------- ------------------- -------------------

Consolidated Statement of Financial Position

At 30 June 2019

Unaudited Unaudited Audited

30 June 30 June 31 December

2019 2018 2018

Notes GBP GBP GBP

Assets

Non-current assets

Plant and equipment 71,800 55,681 47,473

Total non-current

assets 71,800 55,681 47,473

---------------------------- ----- ------------------ ------------------ ----------------

Current assets

Inventories 7,780 70,413 7,780

Trade and other receivables 6 122,887 152,049 306,408

Current tax asset 2,158,192 1,485,803 1,358,192

Cash and cash equivalents 7 5,626,792 6,025,174 9,157,916

---------------------------- ----- ------------------ ------------------ ----------------

Total current assets 7,915,651 7,733,439 10,830,296

---------------------------- ----- ------------------ ------------------ ----------------

Liabilities

Current liabilities

Trade and other payables (3,535,304) (437,580) (2,025,515)

---------------------------- ----- ------------------ ------------------ ----------------

Total liabilities (3,535,304) (437,580) (2,025,515)

---------------------------- ----- ------------------ ------------------ ----------------

Total net assets 4,452,147 7,351,540 8,852,254

---------------------------- ----- ------------------ ------------------ ----------------

Capital and reserves

attributable to

owners of the parent

company

Share capital 409,321 242,012 409,167

Share premium 50,002,990 44,763,776 49,983,860

Merger reserve 1,152,165 1,152,165 1,152,165

Retained losses (47,112,329) (38,806,413) (42,692,938)

---------------------------- ----- ------------------ ------------------ ----------------

Total equity 4,452,147 7,351,540 8,852.254

---------------------------- ----- ------------------ ------------------ ----------------

Consolidated Statement of Cash Flows

For the six months ended 30 June 2019

Unaudited Unaudited Audited

6 months 6 months year

ended ended ended

30 June 30 June 31 December

2019 2018 2018

GBP GBP GBP

Cash flows from operating activities

Loss before tax (5,261,115) (2,509,239) (7,238,912)

Adjustments for:

Depreciation 7,860 9,935 19,850

Loss on disposal of fixed assets 703

Finance income (13,395) (9,429) (27,576)

Share-based payment charge 41,724 103,464 146,833

------------------------------------------ ---------------------- -------------------- --------------------

Cash flows from operating activities

before changes

in working capital (5,224,926) (2,405,269) (7,099,102)

------------------------------------------ ---------------------- -------------------- --------------------

Decrease in inventories - - 62,633

(Increase) / decrease in trade and

other receivables 183,522 29,027 (125,332)

(Decrease) / increase in trade and

other payables 1,509,788 (61,561) 1,526,375

------------------------------------------ ---------------------- -------------------- --------------------

Cash used in operations (3,531,617) (2,437,803) (5,635,426)

------------------------------------------ ---------------------- -------------------- --------------------

Income tax received - - 927,391

------------------------------------------ ---------------------- -------------------- --------------------

Net cash used in operating activities (3,531,617) (2,437,803) (4,708,035)

------------------------------------------ ---------------------- -------------------- --------------------

Cash flows from investing activities

Purchase of plant and equipment (32,186) (2,099) (4,510)

Interest received 13,395 9,429 27,576

Cash (absorbed ) / generated by investing

activities (18,791) 7,330 (23,066)

------------------------------------------ ---------------------- -------------------- --------------------

Cash flows from financing activities

Issue of ordinary shares 19,284 93,000 5,943.421

Expenses paid in connection with share

issues - - (463,182)

Cash generated by financing activities 19,284 93,000 5,480,239

------------------------------------------ ---------------------- -------------------- --------------------

(Decrease) / increase in cash and

cash equivalents (3,531,124) (2,337,472) 795,270

Cash and cash equivalents at beginning

of period 9,157,916 8,362,646 8,362,646

------------------------------------------ ---------------------- -------------------- --------------------

Cash and cash equivalents at end of

period 5,626,792 6,025,174 9,157,916

------------------------------------------ ---------------------- -------------------- --------------------

Notes to the Consolidated Interim Financial Statements

For the six months ended 30 June 2019

1. Corporate Information

The interim condensed consolidated financial statements of

Futura Medical plc and its subsidiaries (the "Group") for the six

months ended 30 June, 2019 were authorised for issue in accordance

with a resolution of the Directors on 10th September, 2019. Futura

Medical plc (the "Company") is a public limited company

incorporated and domiciled in the United Kingdom and whose shares

are publicly traded on the AIM Market of the London Stock Exchange.

The registered office is located at Surrey Technology Centre, 40

Occam Road, Guildford, Surrey, GU2 7YG.

The Group is principally engaged in the development of

pharmaceutical and healthcare products.

2. Accounting policies

The accounting policies applied in these interim statements are

consistent with those of the annual financial statements for the

year end 31 December 2018, as described in those financial

statements except for the new accounting policies described in

accounting developments below.

These condensed interim consolidated financial statements for

the six months ended 30 June 2019 and for the six months ended 30

June 2018 do not constitute statutory accounts within the meaning

of section 434(3) of the Companies Act 2006 and are unaudited.

The Group's financial information for the year ended 31 December

2018 has been extracted from the financial statements of the

statutory accounts ("Annual Report") of Futura Medical plc, which

were prepared in accordance with International Financial Reporting

Standards ("IFRSs") as adopted by the European Union and

International Financial Reporting Interpretations Committee

("IFRIC") interpretations that were applicable for the year ended

31 December 2018 and does not constitute the full statutory

accounts for that period. The Annual Report for 2018 has been filed

with the Registrar of Companies. The Independent Auditor's Report

on those financial statements was unqualified and did not contain a

statement under Section 498 (2) or (3) of the Companies Act 2006;

though it did include a reference to a matter to which the auditor

drew attention by way of emphasis without qualifying their report

in relation to going concern. It does not comply with IAS 34

Interim financial reporting, as is permissible under the rules of

AIM.

Accounting developments

The Directors have considered all new standards, amendments to

standards and interpretations which are mandatory for the first

time for the financial year beginning 1 January 2019. From 1

January 2019 the Company adopted IFRS 16 Leases and concluded that

the adoption of IFRS 16 does not have a material impact on the

Group's consolidated statements and requires no transitional

adjustments to be made.

3. Critical accounting judgements, assumptions and estimates

The preparation of the interim condensed consolidated financial

statements in conformity with IFRS requires management to make

certain estimates, assumptions and judgements that affect the

application of accounting policies and the reported amounts of

assets and liabilities and the reported amounts of income and

expenses in the period.

Critical accounting estimates, assumptions and judgements are

continually evaluated by the Directors based on available

information and experience. As the use of estimates is inherent in

financial reporting actual results could differ from these

estimates.

Going concern

The Group has reported a loss after tax for the six months ended

30 June 2019 of GBP4.46 million (six months ended 30 June 2018:

GBP1.95 million, year ended 31 December 2018: GBP5.88 million). The

Group holds cash balances of GBP5.63 million at 30 June 2019 (30

June 2018: GBP6.03 million, 31 December 2018: GBP9.16 million)

The Directors have prepared a detailed forecast to 31 December

2021 based on current plans. The forecast assumes both committed

costs and future planned discretionary spend and the Directors

consider that they will have sufficient cash resources to settle

all committed costs and discretionary costs for at least 12 months

from the date of approval of these financial statements. The

forecasts also assume that the group will be able to raise

additional sources of finance to fund future expenditure if the

results of the MED2005 trial are positive.

It should be noted that the forecasts do not include any cash

receipts from future MED2005 out-licensing agreements or other

forms of funding that the Directors are actively considering, and

which the Directors believe, from previous and ongoing discussions

will result in material cashflow into the business during the

detailed forecast period to 31 December 2021.

The Directors continue to monitor the levels of discretionary

spend and have the ability to delay certain costs, such as Research

and Development expenditure, in the event of unforeseen cash

constraints or delayed cash receipts.

The Directors have also considered a scenario where the Phase 3

results of the MED2005 trial are not successful, although this

scenario is considered to be highly unlikely. In this scenario the

Directors will have sufficient cash to meet and settle all the

committed expenditure and have sufficient cash to re-align their

business strategy and continue investment in other products within

their pipeline. The cash balances will be sufficient to cover at

least 12 months from the date of signing the financial

statements.

The Directors, having reviewed the Group's and Company's budgets

and plans, taking account of reasonably possible changes in trading

performance, have a reasonable expectation that the Group and the

Company have adequate resources to continue in operational

existence for the foreseeable future (being at least 12 months from

the date of approval of these financial statements) and that it is

therefore appropriate to continue to adopt the going concern basis

in preparing the financial statements.

Based on the above, the Directors believe that it remains

appropriate to prepare the financial statements on a going concern

basis. However, they acknowledge there exists a material

uncertainty over the Group's ability to access additional sources

of finance which may be dependent upon the outcome of the MED2005

trial - that may cast significant doubt on the Group's and

Company's ability to continue as a going concern and, therefore, to

continue realising its assets and discharging its liabilities in

the normal course of business. The financial statements do not

include any adjustments that would result from the basis of

preparation being inappropriate.

3.1 Estimates and assumptions

Share-based payments

The Group operates an equity-settled share-based compensation

plan for employee (and consultant) services to be received and the

corresponding increases in equity are measured by reference to the

fair value of the equity instruments as at the date of grant. The

fair value determination is based on the principles of the

Black-Scholes Model, the inputs of which require the use of

estimation.

3.2 Judgements

Deferred tax recognition

The determination of probable future profits, against which the

Group's deferred tax profits can be offset, requires judgement.

4. Segment reporting

There was no revenue reported in the six months ended 30 June

2019 or in the comparator period therefore, there is no segmental

information to report in respect of turnover.

5. Loss per share (pence)

The calculation of the loss per share is based on a loss of

GBP4,461,115 (six months ended 30 June 2018: loss of GBP1,950,682;

year ended 31 December 2018: loss of GBP5,880,576) and on a

weighted average number of shares in issue of 204,655,173 (six

months ended 30 June 2018: 120,959,395; year ended 31 December

2018: 131,936,761). The loss attributable to equity holders of the

Company for the purpose of calculating the fully diluted loss per

share is identical to that used for calculating the basic loss per

share. The exercise of share options, or the issue of shares under

the long-term incentive scheme, would have the effect of reducing

the loss per share and is therefore anti-dilutive under the terms

of IAS 33 'Earnings per Share'.

6. Trade and other receivables

Unaudited Unaudited Audited

30 June 30 June 31 December

2019 2018 2018

GBP GBP GBP

Amounts receivable within one year:

Trade receivables 627 627 627

Other receivables 63,604 23,253 247,799

Prepayments and accrued income 58,656 128,168 57,982

------------------------------------ ----------------- ----------------- ----------------

122,887 152,049 306,408

------------------------------------ ----------------- ----------------- ----------------

Trade and other receivables do not contain any impaired assets.

The Group does not hold any collateral as security and the maximum

exposure to credit risk at the Consolidated Statement of Financial

Position date is the fair value of each class of receivable.

7. Cash and cash equivalents

Unaudited Unaudited Audited

30 June 30 June 31 December

2019 2018 2018

GBP GBP GBP

Cash at bank and in hand 2,162,364 186,097 5,706,519

Sterling fixed rate short-term

deposits 3,464,428 5,839,077 3,451,397

5,626,792 6,025,174 9,157,916

------------------------------- ------------------- ----------------- ----------------

8. Related party transactions

Related parties, as defined by IAS 24 'Related Party

Disclosures', are the wholly owned subsidiary companies: Futura

Medical Developments Limited and Futura Consumer Healthcare Limited

and the Board. Transactions between the Company and the wholly

owned subsidiary companies have been eliminated on consolidation

and are not disclosed.

9. Taxation

The Group's tax credit in the six months ended 30 June 2019 was

GBP0.8 million (six months ended 30 June 2018: GBP0.55m, year ended

31 December: GBP1.36 million). The current period tax credit

relates to anticipated R&D tax credits in respect of claims not

yet submitted for the 2019 financial year.

10. Subsequent events

In August 2019, the Group received the 2018 R&D tax credit

of GBP1.36m.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR FMGMLVGLGLZM

(END) Dow Jones Newswires

September 11, 2019 02:00 ET (06:00 GMT)

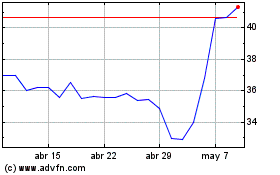

Futura Medical (LSE:FUM)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Futura Medical (LSE:FUM)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024