TIDMBIOM

RNS Number : 0425M

Biome Technologies PLC

12 September 2019

THIS ANNOUNCEMENT (INCLUDING ANY APPIX) AND THE INFORMATION

CONTAINED HEREIN IS RESTRICTED AND IS NOT FOR RELEASE, PUBLICATION

OR DISTRIBUTION, IN WHOLE OR IN PART, DIRECTLY OR INDIRECTLY, IN,

INTO OR FROM THE UNITED STATES, RUSSIA, CANADA, AUSTRALIA, REPUBLIC

OF IRELAND, REPUBLIC OF SOUTH AFRICA OR JAPAN OR ANY OTHER

JURISDICTION IN WHICH SUCH RELEASE, PUBLICATION OR DISTRIBUTION

WOULD BE UNLAWFUL.

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES

OF ARTICLE 7 OF THE MARKET ABUSE REGULATIONS (EU) NO. 596/2014

("MAR"). IN ADDITION, MARKET SOUNDINGS WERE TAKEN IN RESPECT OF THE

MATTERS CONTAINED IN THIS ANNOUNCEMENT, WITH THE RESULT THAT

CERTAIN PERSONS BECAME AWARE OF SUCH INSIDE INFORMATION. UPON THE

PUBLICATION OF THIS ANNOUNCEMENT, THIS INSIDE INFORMATION IS NOW

CONSIDERED TO BE IN THE PUBLIC DOMAIN AND SUCH PERSONS SHALL

THEREFORE CEASE TO BE IN POSSESSION OF INSIDE INFORMATION.

12 September 2019

Biome Technologies plc

("Biome", "the Company" or "the Group")

Proposed Placing to raise GBP1.3 million

Directors' Placing participations and related party

transactions

Notice of General Meeting

Biome Technologies plc, a leading bioplastics and radio

frequency technology business, is pleased to announce that it has

conditionally raised approximately GBP1.3 million (before expenses)

by way of a placing (the "Placing") of 433,337 new ordinary shares

in the Company ("Placing Shares") at a price of 300 pence per share

(the "Issue Price").

It is intended that the net proceeds of the Placing will be used

to fund growth and development of the Group's Biome Bioplastics

division. The Placing is subject, inter alia, to shareholder

approval at a general meeting of the Company (the "General

Meeting").

Highlights

-- Biome proposes to raise gross proceeds of approximately

GBP1.3 million via the Placing to fund Biome Bioplastics' growth

and development

-- Opportunity for significant further growth of the Biome

Bioplastics business via the deployment of additional resources

-- Pipeline of approximately 15 key bioplastics development

projects underway with a customer group that ranges from mid-sized

businesses to multi-nationals

-- Net proceeds of the Placing are expected to be used for:

o Growth capital needs for several bioplastics projects that are

scaling up and will drive a significant increase in revenues over

the next 18 months as manufacturing ramps-up in UK, Germany and the

USA

o Maintaining an increased investment in sales activities and

development spending to support and further accelerate the growth

of Biome Bioplastics' business

o Investment in bioplastics Industrial Biotechnology Research

and Development that will support growth beyond the two-year

timescale

-- Placing Shares will represent approximately 15.5 per cent of

the issued share capital of the Company as enlarged by the issue of

the Placing Shares

Paul Mines, Chief Executive Officer of Biome, commented:

"Against a background of growing interest in our bioplastics

materials, these additional funds will enable the Group to proceed

with multiple projects to deliver its ambitious revenue growth

targets as well as invest in the development of the next generation

of high-performance products."

John Standen, Non-Executive Chairman, and his wife Kathleen

Standen have subscribed for 5,000 Placing Shares in aggregate,

which represents an amount of GBP15,000 at the Issue Price. Paul

Mines, Chief Executive Officer, has subscribed for 5,000 Placing

Shares, which represents an amount of GBP15,000 at the Issue Price.

The FCA notifications, made in accordance with the requirements of

the EU Market Abuse Regulation, are appended below.

Upon Admission, the Company's issued ordinary share capital will

consist of 2,798,525 Ordinary Shares with one voting right each.

The Company does not hold any Ordinary Shares in treasury.

Therefore, the total number of Ordinary Shares and voting rights in

the Company will be 2,798,525. With effect from Admission, this

figure may be used by Shareholders in the Company as the

denominator for the calculations by which they will determine if

they are required to notify their interest in, or a change to their

interest in, the share capital of the Company under the FCA's

Disclosure Guidance and Transparency Rules.

A Circular containing the Notice of General Meeting will be

posted to shareholders later today and will be made available

shortly on the Company's website at

www.biometechnologiesplc.com.

The above summary should be read in conjunction with the full

text of this announcement and the Circular, extracts from which are

set out below. All capitalised terms used throughout this

announcement shall have the meanings given to such terms in the

Definitions section of this announcement and as defined in the

Circular.

Extracts from the Circular

(References to pages or paragraphs below refer to the relevant

pages or paragraphs of the Circular. References to 'this document'

refer to the Circular.)

1. Introduction

The Company announced today that it proposes to raise

approximately GBP1.3 million (before expenses) by way of a placing

of the Placing Shares at the Issue Price of 300 pence per new

Ordinary Share. It is intended that the net proceeds of the Placing

will be used to fund growth and development of the Group's Biome

Bioplastics division. The purpose of this letter is to explain to

Shareholders the background to and reasons for the Placing and to

seek their approval of the Resolutions.

The allotment of the Placing Shares is conditional, inter alia,

upon the Company obtaining approval of shareholders of the

Resolutions to be proposed at the General Meeting to provide

sufficient authority to enable the allotment of the Placing Shares

and disapply statutory pre-emption rights which would otherwise

apply to the allotment of the Placing Shares.

Accordingly, the Company is seeking the approval of Shareholders

to the Resolutions which are to be put to the General Meeting of

the Company to be held at the offices of Osborne Clarke LLP, One

London Wall London EC2Y 5EB at 2.30 p.m. on 30 September 2019. If

the Resolutions are not passed by Shareholders at the General

Meeting, the Placing as currently envisaged will not proceed. The

Notice of General Meeting is set out at the end of the

Circular.

Whether or not you intend to attend the General Meeting you are

encouraged to complete the return the enclosed Form of Proxy in

accordance with the instructions printed thereon. The Form of Proxy

must be received by our Registrar as soon as possible and by no

later than 2.30 p.m. on 28 September 2019.

The Placing Shares to be issued pursuant to the Placing are to

be admitted to trading on AIM, which, should the Resolutions be

passed at the General Meeting, is expected to take place on 2

October 2019.

2. Background to and reasons for the Placing

The Group is a growth-orientated, commercially driven technology

group. Its strategy is founded on building market-leading positions

based on patented technology and serving international customers in

valuable market sectors. Products are developed for application

areas where value-added pricing can be justified and are not

reliant on government legislation. These products are driven by

customer requirements and are compatible with existing

manufacturing processes. The business is market rather than

technology-led.

The Group comprises two divisions, Biome Bioplastics and

Stanelco RF Technologies. Biome Bioplastics is a leading developer

of highly-functional, bio-based and biodegradable plastics. Biome

Bioplastics' mission is to produce bioplastics that challenge the

dominance of oil-based polymers. Stanelco RF Technologies designs,

builds and services advanced radio frequency (RF) systems.

Under the glare of environmental concerns, brands are changing

the plastics that they use, and revenues from Biome Bioplastics

have begun to accelerate (particularly in the US market). There is

now an opportunity for significant further growth of the Biome

Bioplastics business via the deployment of additional

resources.

The Company therefore proposes to raise gross proceeds of

approximately GBP1.3 million via the Placing to fund Biome

Bioplastics' growth and development.

The bioplastics market and opportunity

An estimated 8.3 billion tonnes of plastic waste has been

generated globally since the 1950s (Science, 2017) and

approximately 80% of this still remains in landfill or in the

environment. Oil-based plastics are produced at a rate of

approximately 350 million tonnes per annum, which is growing.

Although incredibly useful, such materials have been developed with

a focus on performance rather than recyclability and environmental

impact. The enormity of the plastics problem is now apparent and

although multi-tiered, the crux of the issue often lies with the

molecular structure of the materials. For several reasons recycling

alone is not the answer.

Bio-based and biodegradable/compostable plastics are being seen

as an important part of the solution to the "plastics problem",

with bio-based materials made from renewable biomass being

replacements for fossil-oil based materials. Studies show that

bio-based materials can play a role in reducing carbon emissions

from the manufacture and the lifecycle of plastic products.

Compostable plastics also have a role to play, particularly in food

packaging, in terms of both diverting food waste away from landfill

and in providing a suitable end-of-life for such materials via

composting (organic recycling).

The bioplastics market has been growing for several years with

the recent focus on environmental damage bringing greater focus on

the sector. Many commentators are anticipating significant further

growth in the global bioplastics market in the coming years. Whilst

the UK market has lagged behind the likes of Italy, Germany and the

US, the Directors believe that a change of direction now appears

underway. This is evidenced by the UK Plastics Pact, a coalition of

companies that account for some 80% of consumer packaging in the

UK, which have signed up to a target that requires all packaging to

be recyclable or compostable by 2025.

The Biome Bioplastics Business

Biome Bioplastics develops and manufactures bioplastic

compounds, using bio-based/biodegradable polymers, natural

materials and other additives. It works closely with customers in

two to four year development cycles to deliver highly

differentiated products. Biome's capability has been built from

over 10 years of development and is based on extensive knowledge of

the sector and the performance of its materials.

Biome Bioplastics deploys a low capital expenditure

manufacturing model, using contracted manufacturing facilities in

Europe/the US to make its finished products at scale. This allows

for a rapid scale-up in the production of new materials close to

their point of use. The business' existing portfolio of

commercialised products includes materials used in oxygen barrier

packaging for coffee, high temperature rigid materials and

non-woven filtration product used in coffee pods.

Biome Bioplastics has a strong focus on the US market where

brand interest, volumes of scale and supportive industrial

composting infrastructure are already in place. Most of the

products sold are bespoke compounds and the business has a pipeline

of approximately 15 key development projects underway with a

customer group that ranges from mid-sized businesses to

multi-nationals.

Since 2013, Biome Bioplastics' medium-term research and

development has been focused on the production of bio-based and

biodegradable aromatic polyesters using Industrial Biotechnology.

Using biomass inputs and biological conversion processes, Biome

Bioplastics has been able to create what the Directors consider to

be a new generation of bioplastics with outstanding functionality,

at laboratory scale. During this process, Biome Bioplastics

pioneered novel bio-manufacturing and polymerisation processes,

which enables access to a significant number of pathways to create

a series of monomers and co-polymers.

Biome Bioplastics' extended team is working with leading

universities, research bodies, scale-up facilities and government,

in order to accelerate its work in Industrial Biotechnology. The

Group's network comprises some of the leading expertise and

facilities available in the world. Over the last four years Biome

Bioplastics has coordinated over GBP6 million of research and

development funding in pursuit of the goal of bringing novel

bio-based polyesters to market. Four patent applications on this

Industrial Biotechnology work have been filed in major markets and

having demonstrated the technology at laboratory scale, the next 24

months will focus on the scale-up of the processes and establishing

commercial viability.

A number of high-quality projects/products with significant

revenue potential have come through Biome Bioplastics' development

cycle and are launching in FY 2019 and 2020, namely:

-- a new material for disposable cutlery for a customer in the

US market started with initial revenues in Q2 2019 and is being

ramped up in Q3 2019. This material has broader market

applicability;

-- a new material for the structure of a coffee pod used in the

US coffee market that is heat stable. Revenues are anticipated to

start in Q3 2019;

-- a new material for a single serve nutrition pod being

manufactured in Switzerland and launched in the US market. Revenues

started in Q2 2019 and are expected to step-up in FY 2020; and

-- existing materials (manufactured in Germany) are being

deployed in a number of plastic film products for a US customer.

Revenues commenced Q2 2019.

It is anticipated that these projects will support growth in

Biome Bioplastics' revenues in the coming years.

The Stanelco RF Technologies market and opportunity

Stanelco RF Technologies is a specialist Original Equipment

Manufacturer (OEM) engineering business that develops radio

frequency (RF) welding, heating and furnace technology-based

equipment, which uses the heating effect of electromagnetic waves

to heat and weld materials. The business operates in a variety of

international markets with India and China as markets of scale.

The business has an international market-leading position in the

furnace market for fibre-optic cable production. These furnaces are

an important part of the 5G mobile technology rollout and the

demand for the infrastructure underlying the global data capacity

for the internet.

Recently, the fibre-optic market has seen rapid growth, driven

by investment in significant new capacity in Asia. Stanelco RF

Technologies moved quickly to realise this growth opportunity and

scaled-up its production of furnaces to more than double that of

2017. This scale-up included expansion at the Group's Southampton

facilities and a 30% increase in production staff. To maintain its

leading position Stanelco RF Technologies continues to make

significant further investment in the next generation of furnace

technologies.

The Group has made a concerted effort to increase Stanelco RF

Technologies' geographic footprint and range of applications. In FY

2017/2018, it launched several new "standard" power supply products

into new industrial markets, with dedicated sales and technical

support staff. The business now benefits from repeat revenues from

power generation, medical and general industrial markets, primarily

in the UK.

3. Current trading and prospects

Earlier today, the Company announced its unaudited interim

financial results for the period ended 30 June 2019. Group revenues

for the first half of 2019 were GBP3.6 million (H1 2018: GBP4.4

million), which reflected a more normal level of revenue at the

Stanelco RF Technologies division after its exceptional performance

in 2018. The Group recorded a small loss before interest,

depreciation, amortisation and share option charges in the first

half of 2019 of GBP0.2 million (H1 2018: GBP0.5 million

profit).

Biome Bioplastics

Revenues in the Biome Bioplastics division for the first half of

2019 were GBP1.4 million (H1 2018: GBP0.9 million) with the

turnover reflecting increases in existing products as well as the

early phase of commercialisation of three new products with

customers in the USA. It is anticipated that revenues for these

products will increase over the coming quarters as they scale up in

line with customers' demands.

The commercial opportunities in bioplastics that the Group is

sourcing are growing in scale and improving in quality. To further

Biome Bioplastics' strong product development pipeline, a number of

new commercial and technical team members have been recruited into

the business in the last 12 months and they are all now making

significant contributions alongside their more experienced

colleagues. Biome Bioplastics has continued with its mid-term

strategy to develop a new range of bioplastics, with the aim of

generating bio-based and biodegradable plastic products with

increased performance that can be produced at a cost more

comparable to traditional plastics made from petro-chemicals.

Additionally, during the first half the year, development work

commenced on scale up of one of the new monomers in conjunction

with Nottingham University.

Stanelco RF Technologies

Revenues for the first half of 2019 in the RF Technologies

division were GBP2.2 million (H1 2018: GBP3.5 million) reflecting a

return to the more normalised levels of fibre optic furnace demand

from the previously reported exceptional demand recorded in 2018.

The division signed a GBP1.3 million contract for the supply of a

number of fibre optic furnaces in the second half of 2019 and it is

against this backdrop that the Board continues to expect full year

revenues for this division to be in line with those of 2017.

4. Reasons for the Placing and use of proceeds

Revenues from Biome Bioplastics have, in the first six months of

2019, begun to accelerate, particularly in the US market.

To maintain and build on this growth, investment is required in

both:

-- the costs associated with scaling up manufacture (in the US, Germany and UK); and

-- the acquisition of raw materials, stocks and debtors as production volumes increase.

Further, Biome Bioplastics is working on a variety of further

projects with implementations that stretch through 2020 and beyond

and the business continues to receive an elevated level of new

enquiries. Progressing these will require investment to bring them

to market.

The Directors believe that continuing the Biome Bioplastics'

research and development investment in new disruptive technology

has the potential to further differentiate the business and this

investment will be leveraged by grant funding to establish the

initial commercial viability of the associated novel polyesters and

supporting monomers.

The timing and expected use of the net proceeds of the Placing

is set out below:

Item Timing Approximate

deployment

A. Growth capital needs for several H2 2019 and FY 2020 GBP0.80 million

bioplastics projects that are

scaling up and will drive a significant

increase in revenues over the

next 18 months as manufacturing

ramps-up in UK, Germany and the

USA.

---------------------------- ----------------

B. Maintaining an increased investment Supporting increased GBP0.25 million

in sales activities and development commercial and technical

spending to support and further activity over 24

accelerate the growth of Biome months

Bioplastics' business

---------------------------- ----------------

C. Investment in bioplastics Industrial Project related expenditure GBP0.15 million

Biotechnology Research and Development via periodic spending

that will support growth beyond over 24 months

the two-year timescale

---------------------------- ----------------

Total GBP1.2 million*

---------------------------- ----------------

* Net of the estimated costs associated with the Placing.

5. Details of the Placing and Admission

The Placing will result in the issue of a total of 433,337 new

Ordinary Shares, representing, in aggregate, approximately 15.5 per

cent. of the Enlarged Share Capital. The Placing Shares, when

issued and fully paid, will rank pari passu in all respects with

the Existing Ordinary Shares of the Company and will therefore rank

equally for all dividends or other distributions declared, made or

paid following Admission.

The Issue Price of 300 pence approximately represents a 14.3 per

cent. discount to the closing middle market price of an Ordinary

Share of 350 pence on 11 September 2019, being the latest

practicable date prior to the announcement of the Placing.

An application will be made to London Stock Exchange for the

Placing Shares to be admitted to trading on AIM and such admission

is expected to occur on 2 October 2019, subject to approval of the

Resolutions.

Allenby Capital has entered into the Placing Agreement with the

Company under which Allenby Capital has, on the terms and subject

to the conditions set out therein (including Admission), undertaken

to use its reasonable endeavours to procure subscribers for the

Placing Shares at the Issue Price. The Placing Agreement contains

certain warranties and indemnities from the Company in favour of

Allenby Capital. The Placing is not being underwritten by Allenby

Capital or any other person.

The Placing is conditional, inter alia, upon the passing of the

Resolutions and Admission and the Placing Agreement not being

terminated prior to Admission (and in any event no later than 15

October 2019).

6. Significant shareholder and Director participations

Details of the subscriptions by certain of the Directors at the

Issue Price and their resultant shareholdings on Admission are as

follows:

Name Placing Shares Value of the Ordinary Shares Percentage

being subscribed subscriptions held on Admission of Enlarged

at the Issue Share Capital

Price held on Admission

Paul Mines 5,000 GBP15,000 31,525 1.13%

John Standen* 5,000 GBP15,000 58,336 2.08%

* John Standen's participation in the Placing includes 2,500

Placing Shares subscribed for by his wife, Mrs K M Standen.

The subscriptions by Paul Mines and John Standen (and his wife)

in the Placing are deemed to be related party transactions pursuant

to rule 13 of the AIM Rules for Companies. Accordingly, the

Independent Directors consider, having consulted with the Company's

nominated adviser, Allenby Capital, that the terms of subscription

to the Placing Shares by Paul Mines and John Standen (and his wife)

are fair and reasonable insofar as Shareholders are concerned.

Assuming completion of the Placing, the Company is aware of the

following persons that will be interested in three per cent. or

more of the Enlarged Share Capital:

Name Ordinary Shares Ordinary Shares Percentage of enlarged

currently held on Admission share capital held

held on Admission

Mr V Pereira* 534,022 600,689 21.46%

Mr JM Rushton-Turner 288,050 364,717 13.03%

Miss G Pereira 79,286 79,286 2.83%

Miss B Pereira 78,149 78,149 2.79%

*Mr V A Pereira's holding includes 82,416 Ordinary Shares held

by his wife, Mrs G Pereira.

Mr V Pereira and Mr JM Rushton-Turner are subscribing for 66,667

and 76,667 Placing Shares respectively, representing GBP200,001 and

GBP230,001 respectively at the Issue Price. As Mr V Pereira and Mr

JM Rushton-Turner each currently hold more than 10 per cent. of the

Ordinary Shares, both of the subscriptions of Placing Shares by

them are deemed to be related party transactions pursuant to rule

13 of the AIM Rules for Companies.

Accordingly, the Independent Directors consider, having

consulted with the Company's nominated adviser, Allenby Capital,

that the terms of subscription to the Placing Shares by Mr V

Pereira and Mr JM Rushton-Turner are fair and reasonable insofar as

Shareholders are concerned.

7. General Meeting

A notice convening a General Meeting of the Company, to be held

at the offices of Osborne Clarke LLP, One London Wall London EC2Y

5EB at 2.30 p.m. on 30 September 2019 is set out at the end of the

Circular. At the General Meeting, the following Resolutions will be

proposed:

1. Resolution numbered 1 is proposed as an ordinary resolution

to grant authority to the Directors to allot Ordinary Shares up to

an aggregate nominal amount of GBP21,666.85. This resolution will

give the Directors sufficient authority to allot the Placing Shares

pursuant to the Placing; and

2. Resolution numbered 2 is proposed as a special resolution to

dis-apply statutory pre-emption rights in respect of the allotment

of up to 433,337 new Ordinary Shares for cash. This number

represents 433,337 Placing Shares pursuant to the Placing.

Resolution 1 will be proposed as an ordinary resolution and

Resolution 2 as a special resolution.

8. Action to be taken by Shareholders

Shareholders will find enclosed with this document a Form of

Proxy for use at the General Meeting. Whether or not you intend to

be present the General Meeting, you are requested to complete, sign

and return the Form of Proxy in accordance with the instructions

printed on it to Neville Registrars Limited, Neville House,

Steelpark Road, Halesowen B62 8HD as soon as possible and, in any

event, so as to arrive no later than 2.30 p.m. on 28 September

2019. Completion and return of the Form of Proxy will not affect

your right to attend and vote in person at the General Meeting if

you so wish.

Instructions for voting by proxy through CREST are set out in

paragraphs 9 to 11 of the notes to the notice of General

Meeting.

In the case of non-registered Shareholders who receive these

materials through their broker or other intermediary, the

Shareholder should complete and send a letter of direction in

accordance with the instructions provided by their broker or other

intermediary.

In order for the Placing to proceed, Shareholders will need to

approve both of the Resolutions set out in the Notice of General

Meeting. If the Resolutions are not passed at the General Meeting,

the Placing will not proceed which will have an impact on the

ability of the Group to pursue its growth strategy. Accordingly, it

is important that Shareholders vote in favour of the

Resolutions.

9. Directors' Recommendation

The Board of Biome considers the Placing to be in the best

interests of the Company and its shareholders as a whole and

therefore the Directors unanimously recommend that shareholders

vote in favour of the Resolutions as they intend to do in respect

of their own shareholdings (and the shareholdings of their

connected parties) of, in aggregate, 87,902 Ordinary Shares

(representing approximately 3.7% per cent. of the Company's

existing issued share capital).

PLACING STATISTICS

Issue Price 300 pence

Number of Existing Ordinary Shares 2,365,188

Total number of Placing Shares 433,337

Enlarged Share Capital following the Placing 2,798,525

Percentage of the Enlarged Share Capital comprised 15.5 per cent.

by the Placing Shares

Estimated gross proceeds of the Placing GBP1.3 million

Estimated expenses of Placing GBP0.1 million

Estimated net proceeds of the Placing GBP1.2 million

ISIN GB00B9Z1M820

SEDOL B9Z1M82

DEFINITIONS

"Act" the Companies Act 2006 (as amended);

"Admission" the admission of the Placing Shares to trading on

AIM becoming effective in accordance with the AIM Rules;

"AIM Rules" the AIM Rules for Companies, as published and

amended from

time to time by the London Stock Exchange;

"Allenby Capital" Allenby Capital Limited, the Company's

nominated adviser and

broker pursuant to the AIM Rules;

"Articles" the existing articles of association of the Company

as at the

date of the Circular;

"Biome Bioplastics" Biome Bioplastics Limited, a wholly owned

subsidiary of the Company which operates in the field of bio-based

and biodegradable plastics;

"Business Day" any day (other than a Saturday or Sunday) upon

which

commercial banks are open for business in London, UK;

"Circular" the circular sent to shareholders of the Company on

or around the date of this announcement;

"Company" or "Biome" Biome Technologies plc;

"CREST" the relevant system for the paperless settlement of

trades and the holding of uncertificated securities operated by

Euroclear UK and Ireland in accordance with the CREST

Regulations;

"CREST member" a person who has been admitted by Euroclear UK

and Ireland as a system- member (as defined in the CREST

Regulations);

"Directors" or "Board" the directors of the Company;

"Enlarged Share Capital" the issued ordinary share capital of

the Company immediately following Admission;

"Euroclear UK & Ireland" Euroclear UK & Ireland Limited,

the operator of CREST;

"Existing Ordinary Shares" the existing Ordinary Shares as at

the date of the Circular;

"FCA" the Financial Conduct Authority of the United Kingdom;

"Form of Proxy" the form of proxy for use by Shareholders in

connection with the General Meeting;

"FSMA" the Financial Services and Markets Act 2000 (as

amended);

"General Meeting" or "GM" the general meeting of Shareholders to

be held at the offices of Osborne Clarke LLP, One London Wall

London EC2Y 5EB at 2.30 p.m. on 30 September 2019;

"Independent Directors" for the purposes of the Placing only,

Declan Brown and Michael Kayser;

"ISIN" International Securities Identification Number;

"Issue Price" 300 pence per Placing Share;

"London Stock Exchange" London Stock Exchange plc;

"Member Account ID" the identification code or number attached

to any member account

in CREST;

"Notice of General Meeting" the notice of General Meeting set

out at the end of the Circular;

"Ordinary Shares" the ordinary shares of 5p each in the capital

of the Company;

"Overseas Shareholder" a Shareholder who is resident in, or who

is a citizen of, or who has a registered address in a jurisdiction

outside the United Kingdom;

"Placees" the persons who have conditionally agreed to subscribe

for the Placing Shares;

"Placing" the placing of the Placing Shares at the Issue Price

as

described in the Circular;

"Placing Agreement" the conditional agreement dated 12 September

2019 between the Company and Allenby Capital relating to the

Placing;

"Placing Shares" the 433,337 new Ordinary Shares which have been

conditionally placed by Allenby Capital with institutional and

other investors pursuant to the Placing;

"Registrars" Neville Registrars Limited;

"Resolutions" the resolutions numbered 1 and 2 set out in the

Notice of

General Meeting to be proposed at the General Meeting;

"Restricted Jurisdiction" each and any of the United States of

America, Australia, Canada, Japan, New Zealand, Russia, the

Republic of Ireland and the Republic of South Africa and any other

jurisdiction where extension or availability of the Placing would

breach any applicable law or regulations;

"Shareholder(s)" holder(s) of Existing Ordinary Shares;

"Stanelco RF" Stanelco RF Technologies Limited, a wholly-owned

subsidiary of the Company which is an equipment manufacturer in the

specialised field of radio-frequency heating;

"sterling", "pounds sterling", the lawful currency of the United Kingdom;

"GBP", "pence" or "p"

"US$" or "US dollar" the lawful currency of the United States of

America;

"US Person" a US person as defined in Regulation S promulgated

under the US Securities Act; and

"US Securities Act" the United States Securities Act of 1933 (as

amended).

For further information please contact: Biome

Technologies plc

Paul Mines, Chief Executive Officer

Declan Brown, Group Finance Director

www.biometechnologiesplc.com Tel: +44 (0) 2380 867

100

Allenby Capital

David Hart/Alex Brearley (Nominated Adviser)

Kelly Gardiner (Broker)

www.allenbycapital.com Tel: +44 (0) 20 3328

5656

About Biome

Biome Technologies plc (Ticker: BIOM) is an AIM listed,

growth-orientated, commercially driven technology group. Our

strategy is founded on building market-leading positions based on

patented technology and serving international customers in valuable

market sectors. We have chosen to do this by developing products in

application areas where the value-added pricing can be justified

and that are not reliant on government legislation. These products

are driven by customer requirements and are compatible with

existing manufacturing processes. They are market rather than

technology-led.

The Group comprises two divisions, Biome Bioplastics Limited and

Stanelco RF Technologies Limited. Biome Bioplastics is a leading

developer of highly-functional, bio-based and biodegradable

plastics. The company's mission is to produce bioplastics that

challenge the dominance of oil-based polymers. Stanelco RF

Technologies designs, builds and services advanced radio frequency

(RF) systems. Dielectric and induction heating products are at the

core of a product offering that ranges from portable sealing

devices to large furnaces for the fibre optics markets.

In 2018, the Board adopted the following three high level KPIs

for the next three years to continue its ambitious momentum:

-- Compound revenue growth of 25% per annum across the Group and

40% compound revenue growth in the Bioplastics division

-- Diversify the Group's turnover by product and market to

ensure that no one product or end customer contributes more than

15% of revenues by 2020

-- Increase investment in the Group's next generation of

products by spending significantly more per annum on average than

the GBP0.3m per annum average spend over the previous strategic

objective cycle

www.biometechnologiesplc.com

www.biomebioplastics.com and www.thinkbioplastic.com

www.stanelcorftechnologies.com

#ThinkBioplastic is our digital educational platform, launched

in October 2018 in response to the emerging global plastic

conversation. It speaks to a wide audience, highlighting

bioplastics as a leading solution among several to reduce the

negative impact of plastic manufacture and disposal. Following the

much acclaimed first series of short videos the second series was

recently released.

Notification and public disclosure of transactions by persons

discharging managerial responsibilities and persons closely

associated with them

1. Details of the person discharging managerial responsibilities

/ person closely associated

a) Name John Standen

-------------------------------- --------------------------------------------

2. Reason for the Notification

------------------------------------------------------------------------------

a) Position/status Director - Non-Executive Chairman

-------------------------------- --------------------------------------------

b) Initial notification/Amendment Initial Notification

-------------------------------- --------------------------------------------

3. Details of the issuer, emission allowance market participant,

auction platform, auctioneer or auction monitor

------------------------------------------------------------------------------

a) Name Biome Technologies plc

-------------------------------- --------------------------------------------

b) LEI 213800B9QI14B12TAO51

-------------------------------- --------------------------------------------

4. Details of the transaction(s): section to be repeated

for (i) each type of instrument; (ii) each type of transaction;

(iii) each date; and (iv) each place where transactions

have been conducted

------------------------------------------------------------------------------

a) Description of the Financial Ordinary shares of 5p in Biome Technologies

instrument, type of instrument plc. Identification code (ISIN)

for Biome Technologies plc ordinary

shares: GB00B9Z1M820

Identification code

-------------------------------- --------------------------------------------

b) Nature of the transaction Participation in placing of new

ordinary shares

-------------------------------- --------------------------------------------

c) Price(s) and volume(s) Price(s) Volume(s)

300p 2,500

----------

-------------------------------- --------------------------------------------

d) Aggregated information:

--Aggregated volume N/A

--Price

-------------------------------- --------------------------------------------

e) Date of the transaction 12 September 2019

-------------------------------- --------------------------------------------

f) Place of the transaction Outside a trading venue

-------------------------------- --------------------------------------------

1. Details of the person discharging managerial responsibilities

/ person closely associated

a) Name Kathleen Standen

-------------------------------- --------------------------------------------

2. Reason for the Notification

------------------------------------------------------------------------------

a) Position/status PCA of John Standen, PDMR - Non-Executive

Chairman

-------------------------------- --------------------------------------------

b) Initial notification/Amendment Initial Notification

-------------------------------- --------------------------------------------

3. Details of the issuer, emission allowance market participant,

auction platform, auctioneer or auction monitor

------------------------------------------------------------------------------

a) Name Biome Technologies plc

-------------------------------- --------------------------------------------

b) LEI 213800B9QI14B12TAO51

-------------------------------- --------------------------------------------

4. Details of the transaction(s): section to be repeated

for (i) each type of instrument; (ii) each type of transaction;

(iii) each date; and (iv) each place where transactions

have been conducted

------------------------------------------------------------------------------

a) Description of the Financial Ordinary shares of 5p in Biome Technologies

instrument, type of instrument plc. Identification code (ISIN)

for Biome Technologies plc ordinary

shares: GB00B9Z1M820

Identification code

-------------------------------- --------------------------------------------

b) Nature of the transaction Participation in placing of new

ordinary shares

-------------------------------- --------------------------------------------

c) Price(s) and volume(s) Price(s) Volume(s)

300p 2,500

----------

-------------------------------- --------------------------------------------

d) Aggregated information:

--Aggregated volume N/A

--Price

-------------------------------- --------------------------------------------

e) Date of the transaction 12 September 2019

-------------------------------- --------------------------------------------

f) Place of the transaction Outside a trading venue

-------------------------------- --------------------------------------------

1. Details of the person discharging managerial responsibilities

/ person closely associated

------------------------------------------------------------------------------

a) Name Paul Mines

-------------------------------- --------------------------------------------

2. Reason for the Notification

------------------------------------------------------------------------------

a) Position/status Director - Chief Executive Officer

-------------------------------- --------------------------------------------

b) Initial notification/Amendment Initial Notification

-------------------------------- --------------------------------------------

3. Details of the issuer, emission allowance market participant,

auction platform, auctioneer or auction monitor

------------------------------------------------------------------------------

a) Name Biome Technologies plc

-------------------------------- --------------------------------------------

b) LEI 213800B9QI14B12TAO51

-------------------------------- --------------------------------------------

4. Details of the transaction(s): section to be repeated

for (i) each type of instrument; (ii) each type of transaction;

(iii) each date; and (iv) each place where transactions

have been conducted

------------------------------------------------------------------------------

a) Description of the Financial Ordinary shares of 5p in Biome Technologies

instrument, type of instrument plc. Identification code (ISIN)

for Biome Technologies plc ordinary

shares: GB00B9Z1M820

Identification code

-------------------------------- --------------------------------------------

b) Nature of the transaction Participation in placing of new

ordinary shares

-------------------------------- --------------------------------------------

c) Price(s) and volume(s) Price(s) Volume(s)

300p 5,000

----------

-------------------------------- --------------------------------------------

d) Aggregated information:

--Aggregated volume N/A

--Price

-------------------------------- --------------------------------------------

e) Date of the transaction 12 September 2019

-------------------------------- --------------------------------------------

f) Place of the transaction Outside a trading venue

-------------------------------- --------------------------------------------

Information to Distributors

Solely for the purposes of the product governance requirements

contained within: (a) EU Directive 2014/65/EU on markets in

financial instruments, as amended ("MiFID II"); (b) Articles 9 and

10 of Commission Delegated Directive (EU) 2017/593 supplementing

MiFID II; and (c) local implementing measures (together, the

"Product Governance Requirements"), and disclaiming all and any

liability, whether arising in tort, contract or otherwise, which

any "manufacturer" (for the purposes of the Product Governance

Requirements) may otherwise have with respect thereto, the Placing

Shares have been subject to a product approval process, which has

determined that the Placing Shares are: (i) compatible with an end

target market of retail investors and investors who meet the

criteria of professional clients and eligible counterparties, each

as defined in MiFID II; and (ii) eligible for distribution through

all distribution channels as are permitted by MiFID II (the "Target

Market Assessment"). Notwithstanding the Target Market Assessment,

investors should note that: the price of the Placing Shares may

decline and investors could lose all or part of their investment;

Placing Shares offer no guaranteed income and no capital

protection; and an investment in Placing Shares is compatible only

with investors who do not need a guaranteed income or capital

protection, who (either alone or in conjunction with an appropriate

financial or other adviser) are capable of evaluating the merits

and risks of such an investment and who have sufficient resources

to be able to bear any losses that may result therefrom. The Target

Market Assessment is without prejudice to the requirements of any

contractual, legal or regulatory selling restrictions in relation

to the Placing. Furthermore, it is noted that, notwithstanding the

Target Market Assessment, only investors who have met the criteria

of professional clients and eligible counterparties have been

procured. For the avoidance of doubt, the Target Market Assessment

does not constitute: (a) an assessment of suitability or

appropriateness for the purposes of MiFID II; or (b) a

recommendation to any investor or group of investors to invest in,

or purchase, or take any other action whatsoever with respect to

Placing Shares.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IOEBIGDCBSBBGCB

(END) Dow Jones Newswires

September 12, 2019 02:05 ET (06:05 GMT)

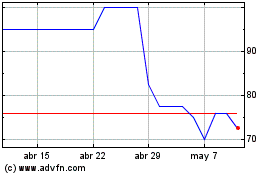

Biome Technologies (LSE:BIOM)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Biome Technologies (LSE:BIOM)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024