TIDMPPH

RNS Number : 1607M

PPHE Hotel Group Limited

12 September 2019

12 September 2019

PPHE Hotel Group Limited

("PPHE Hotel Group" or the "Company")

Holding(s) in Company

The Company announces that on 12 September 2019, it was notified

of the following changes in shareholdings which result from a

transfer between members of the concert party (the Concert Party)

which, in aggregate, holds approximately 43.4% of the issued share

capital of the Company. The aggregate holding of the Concert Party

remains unchanged following the transfer.

TR-1: Standard form for notification of major holdings

NOTIFICATION OF MAJOR HOLDINGS (to be sent to the relevant issuer and

to the FCA in Microsoft Word format if possible)(i)

1a. Identity of the issuer or the PPHE Hotel Group Limited

underlying issuer of existing shares

to which voting rights are attached(ii)

:

--------------------------------------------------------------------

1b. Please indicate if the issuer is a non-UK issuer (please mark with

an "X" if appropriate)

Non-UK issuer X

-------

2. Reason for the notification (please mark the appropriate box or boxes

with an "X")

An acquisition or disposal of voting rights X

-------

An acquisition or disposal of financial instruments

-------

An event changing the breakdown of voting rights

-------

Other (please specify)(iii) :

-------

3. Details of person subject to the notification obligation(iv)

Name Euro Plaza Holdings B.V.

City and country of registered office The Netherlands

(if applicable)

4. Full name of shareholder(s) (if different from 3.)(v)

Name

--------------------------------------------------------------------

City and country of registered office

(if applicable)

--------------------------------------------------------------------

5. Date on which the threshold was 11/09/2019

crossed or reached(vi) :

--------------------------------------------------------------------

6. Date on which issuer notified (DD/MM/YYYY): 12/09/2019

--------------------------------------------------------------------

7. Total positions of person(s) subject to the notification obligation

% of voting % of voting rights Total of both Total number

rights attached through financial in % (8.A + of voting rights

to shares (total instruments 8.B) of issuer(vii)

of 8. A) (total of 8.B

1 + 8.B 2)

---------------------------- -------------------------------- ---------------------------- --------------------------

Resulting

situation

on the date

on which

threshold

was crossed

or reached 28.79% 0% 28.79% 42,398,188

---------------------------- -------------------------------- ---------------------------- --------------------------

Position of

previous

notification

(if

applicable) 27.21% 0% 27.21%

---------------------------- -------------------------------- ---------------------------- -------------------------- ------

8. Notified details of the resulting situation on the date on which the

threshold was crossed or reached(viii)

A: Voting rights attached to shares

Class/type of Number of voting rights(ix) % of voting rights

shares

ISIN code (if

possible)

Direct Indirect Direct Indirect

(Art 9 of Directive (Art 10 of Directive (Art 9 of Directive (Art 10 of Directive

2004/109/EC) 2004/109/EC) 2004/109/EC) (DTR5.1) 2004/109/EC)

(DTR5.1) (DTR5.2.1) (DTR5.2.1)

-------------------------------

GG00B1Z5FH87/PPH 12,207,843 28.79%

---------------------------- ------------------------------- ---------------------------- -------------------------

SUBTOTAL 8. A 12,207,843 28.79%

------------------------------------------------------------- -------------------------------------------------------

B 1: Financial Instruments according to Art. 13(1)(a) of Directive 2004/109/EC

(DTR5.3.1.1 (a))

Type of financial Expiration Exercise/ Number of voting % of voting

instrument date(x) Conversion Period(xi) rights that may rights

be acquired if

the instrument

is

exercised/converted.

----------- --------------------------------------- ------------------------------------- -------------------------

SUBTOTAL 8. B 1

--------------------------------------- ------------------------------------- -------------------------

B 2: Financial Instruments with similar economic effect according to

Art. 13(1)(b) of Directive 2004/109/EC (DTR5.3.1.1 (b))

Type of financial Expiration Exercise/ Physical or Number of % of voting

instrument date(x) Conversion cash voting rights rights

Period (xi) settlement(xii)

----------------- --------------------------- -------------------------- ---------------------

SUBTOTAL 8.B.2

-------------------------- ---------------------

9. Information in relation to the person subject to the notification

obligation (please mark the

applicable box with an "X")

Person subject to the notification obligation is not controlled

by any natural person or legal entity and does not control any other

undertaking(s) holding directly or indirectly an interest in the

(underlying) issuer(xiii)

Full chain of controlled undertakings through which the voting rights X

and/or the

financial instruments are effectively held starting with the ultimate

controlling natural person or legal entity(xiv) (please add additional

rows as necessary)

Name(xv) % of voting rights % of voting rights Total of both

if it equals or through financial if it equals

is higher than instruments if it or is higher

the notifiable equals or is higher than the notifiable

threshold than the notifiable threshold

threshold

------------------- --------------------- -----------------------

Mr Eli Papouchado

------------------- --------------------- -----------------------

A.P.Y. Investments and

Real Estate Ltd.

------------------- --------------------- -----------------------

Red Sea Hotels Ltd.

------------------- --------------------- -----------------------

Red Sea Club Ltd.

------------------- --------------------- -----------------------

Southern- Moadon, Partnership

------------------- --------------------- -----------------------

Southern Hotels Holding

and Investment B.V.

------------------- --------------------- -----------------------

Euro Plaza Holdings

B.V.(1) 28.79% 0% 28.79%

------------------- --------------------- -----------------------

10. In case of proxy voting, please identify:

Name of the proxy holder

----------------------------------------------

The number and % of voting rights held

----------------------------------------------

The date until which the voting rights

will be held

----------------------------------------------

11. Additional information(xvi)

(1) Euro Plaza Holdings B.V. ("Euro Plaza") is an indirect wholly-owned

Dutch incorporated subsidiary of A.P.Y. Investments & Real Estate Ltd

("APY"). As at the date hereof, 98% of the shares in APY are held by

Eli Papouchado as trustee of an endowment created under Israeli law which

he formed in 1998 (the "Endowment"). The primary beneficiaries of the

Endowment are Eli Papouchado and his sons, Yoav Papouchado and Avner

Papouchado, and the secondary beneficiaries are the children of Yoav

and Avner. The remaining 2% of the shares in APY are held by Yoav and

Avner Papouchado respectively (1% each). APY and its subsidiaries are

part of an international construction, hotel and real estate group (the

"Red Sea Group") that was founded by Eli Papouchado. Alongside Euro Plaza,

Eli Papouchado is also deemed to be interested in: (a) 22,417 Ordinary

Shares held by Red Sea Club Limited, an intermediate subsidiary of APY

and holding company of Euro Plaza; and (b) 1,530,000 Ordinary Shares

held by A.A. Papo Trust Company Limited, a company which is wholly-owned

by Eli Papouchado, acting in its capacity as the sole trustee of an endowment

whose main beneficiary is Eli Papouchado's daughter, Eliana Papouchado.

Place of completion Herzliya 4672835, Israel

Date of completion 12/09/2019

--------------------------

TR-1: Standard form for notification of major holdings

NOTIFICATION OF MAJOR HOLDINGS (to be sent to the relevant issuer and

to the FCA in Microsoft Word format if possible)(i)

1a. Identity of the issuer or the PPHE Hotel Group Limited

underlying issuer of existing shares

to which voting rights are attached(ii)

:

-------------------------------------------------

1b. Please indicate if the issuer is a non-UK issuer (please mark with

an "X" if appropriate)

Non-UK issuer X

----

2. Reason for the notification (please mark the appropriate box or boxes

with an "X")

An acquisition or disposal of voting rights X

----

An acquisition or disposal of financial instruments

----

An event changing the breakdown of voting rights

----

Other (please specify)(iii) :

----

3. Details of person subject to the notification obligation(iv)

Name A.A. Papo Trust Company Limited

(acting in its capacity as sole trustee

of an endowment whose main beneficiary

is Eliana Papouchado)

City and country of registered office Israel

(if applicable)

4. Full name of shareholder(s) (if different from 3.)(v)

Name

-------------------------------------------------

City and country of registered office

(if applicable)

-------------------------------------------------

5. Date on which the threshold was 11/09/2019

crossed or reached(vi) :

-------------------------------------------------

6. Date on which issuer notified 12/09/2019

(DD/MM/YYYY):

-------------------------------------------------

7. Total positions of person(s) subject to the notification obligation

% of voting % of voting rights Total of both Total number

rights attached through financial in % (8.A + of voting rights

to shares (total instruments 8.B) of issuer(vii)

of 8. A) (total of 8.B

1 + 8.B 2)

------------------ ---------------------- ---------------- --------------------

Resulting situation

on the date

on which threshold

was crossed

or reached 3.61% 0% 3.61% 42,398,188

------------------ ---------------------- ---------------- --------------------

Position of

previous notification

(if

applicable) 5.19% 0% 5.19%

------------------ ---------------------- ---------------- --------------------

8. Notified details of the resulting situation on the date on which the

threshold was crossed or reached(viii)

A: Voting rights attached to shares

Class/type of Number of voting rights(ix) % of voting rights

shares

ISIN code (if

possible)

Direct Indirect Direct Indirect

(Art 9 of Directive (Art 10 of Directive (Art 9 of Directive (Art 10 of Directive

2004/109/EC) 2004/109/EC) 2004/109/EC) (DTR5.1) 2004/109/EC)

(DTR5.1) (DTR5.2.1) (DTR5.2.1)

-----------------------------

GG00B1Z5FH87/PPH 1,530,000 3.61%

------------------------ ----------------------------- ------------------------- ---------------------

SUBTOTAL 8. A 1,530,000 3.61%

------------------------------------------------------- ------------------------------------------------

B 1: Financial Instruments according to Art. 13(1)(a) of Directive 2004/109/EC

(DTR5.3.1.1 (a))

Type of financial Expiration Exercise/ Number of voting % of voting

instrument date(x) Conversion Period(xi) rights that may rights

be acquired if

the instrument

is

exercised/converted.

----------- ----------------------------------- -------------------------------- ---------------------

SUBTOTAL 8. B 1

----------------------------------- -------------------------------- ---------------------

B 2: Financial Instruments with similar economic effect according to

Art. 13(1)(b) of Directive 2004/109/EC (DTR5.3.1.1 (b))

Type of Expiration Exercise/ Physical or Number of % of voting

financial date(x) Conversion cash voting rights rights

instrument Period (xi) settlement(xii)

------------------ ---------------------- ----------------------- --------------------

SUBTOTAL 8.B.2

----------------------- --------------------

9. Information in relation to the person subject to the notification

obligation (please mark the

applicable box with an "X")

Person subject to the notification obligation is not controlled

by any natural person or legal entity and does not control any other

undertaking(s) holding directly or indirectly an interest in the

(underlying) issuer(xiii)

Full chain of controlled undertakings through which the voting rights X

and/or the

financial instruments are effectively held starting with the ultimate

controlling natural person or legal entity(xiv) (please add additional

rows as necessary)

Name(xv) % of voting rights % of voting rights Total of both

if it equals through financial if it equals

or is higher instruments if it or is higher

than the notifiable equals or is higher than the notifiable

threshold than the notifiable threshold

threshold

--------------------- --------------------- -----------------------

Mr Eli Papouchado

--------------------- --------------------- -----------------------

A.A. Papo Trust Company

Limited(1) 3.61% 0% 3.61%

--------------------- --------------------- -----------------------

10. In case of proxy voting, please identify:

Name of the proxy holder

----------------------------------------------

The number and % of voting rights held

----------------------------------------------

The date until which the voting rights

will be held

----------------------------------------------

11. Additional information(xvi)

(1) A.A. Papo Trust Company Limited ("AA") is a company which is wholly-owned

by Eli Papouchado, acting in its capacity as the sole trustee of an endowment

whose main beneficiary is Eli Papouchado's daughter, Eliana Papouchado.

Alongside AA, Eli Papouchado is also deemed to be interested in: (a)

12,207,843 Ordinary Shares held by Euro Plaza Holdings B.V., and (b)

22,417 Ordinary Shares held by Red Sea Club Limited.

Place of completion Herzliya 4672835, Israel

Date of completion 12/09/2019

-------------------------

Enquiries

PPHE Hotel Group Limited +31 20 717 8600

Daniel Kos, Chief Financial Officer & Executive

Director

Robert Henke, Executive Vice President of

Commercial & Corporate Affairs

Tulchan +44 207 353 4200

Jessica Reid / David Allchurch

Notes to editors

PPHE Hotel Group Limited, is an international hospitality real

estate company, with a GBP1.7 billion portfolio (valued as at

summer of 2019) of primarily prime freehold and long leasehold

assets in Europe.

PPHE Hotel Group's guiding principle is to generate attractive

returns from operations and long-term capital appreciation.

Through its subsidiaries, jointly controlled entities and

associates it owns, co-owns, develops, leases, operates and

franchises hospitality real estate. Its primary focus is

full-service upscale, upper upscale and lifestyle hotels in major

gateway cities and regional centres, as well as hotel, resort and

campsite properties in select resort destinations.

PPHE Hotel Group benefits from having an exclusive and perpetual

licence from the Radisson Hotel Group, one of the world's largest

hotel groups, to develop and operate Park Plaza(R) branded hotels

and resorts in Europe, the Middle East and Africa. In addition,

PPHE Hotel Group wholly owns, and operates under, the art'otel(R)

brand and its Croatian subsidiary owns, and operates under, the

Arena Hotels & Apartments(R) and Arena Campsites(R) brands.

This multi-brand approach enables PPHE Hotel Group to develop and

operate properties across several segments of the hospitality

market.

PPHE Hotel Group is one of the largest owner/operators of hotels

in central London and its property portfolio comprises of 38 hotels

and resorts in operation, offering a total of approximately 8,800

rooms and 8 campsites, offering approximately 6,000 units. PPHE

Hotel Group's development pipeline includes two new hotels in

London and one in New York City which are expected to add an

additional 600 rooms by the end of 2022/2023.

PPHE Hotel Group is a Guernsey registered company with shares

listed on the London Stock Exchange and a constituent of the FTSE

250. PPHE Hotel Group also holds a controlling ownership interest

in Arena Hospitality Group, whose shares are listed on the Prime

market of the Zagreb Stock Exchange.

Company websites:

www.pphe.com

www.arenahospitalitygroup.com

For reservations:

www.parkplaza.com

www.artotels.com

www.arenahotels.com

www.arenacampsites.com

For images and logos visit www.vfmii.com/parkplaza

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

HOLEAANAFFNNEFF

(END) Dow Jones Newswires

September 12, 2019 08:21 ET (12:21 GMT)

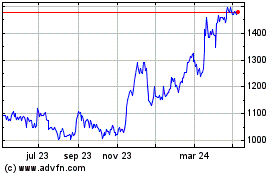

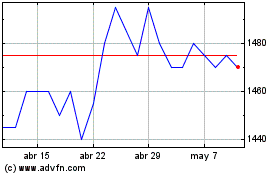

Pphe Hotel (LSE:PPH)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Pphe Hotel (LSE:PPH)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024