GE Chief Says Assets Sales Will Reap $38 Billion

12 Septiembre 2019 - 2:35PM

Noticias Dow Jones

By Thomas Gryta

General Electric Co. Chief Executive Larry Culp said he expects

asset sales to bring in about $38 billion in cash for the company

as it begins paring down its large debt load, and there are signs

the long-struggling power division is gaining strength.

Speaking at a Morgan Stanley investor conference Thursday, Mr.

Culp also said falling interest rates will increase GE's pension

benefits obligation by about $7 billion net of investment returns

and its insurance reserve funding by less than $1.5 billion.

Neither of the adjustments will require a cash contribution.

Mr. Culp, who took over as CEO almost a year ago, said 2019 is

progressing as planned, with no major surprises. He said the

company's power division is seeing some signs of

stronger-than-expected demand this year that may continue into

early 2020. But he warned that GE won't be running the business

with that assumption in mind.

"We want to be optimistic, we want to be positive, but we want

to be grounded," he said. GE in July raised its financial

projections for the first time in years, citing positive signs in

the power business and saying it wouldn't burn through as much cash

as feared.

Mr. Culp said there is "plenty of wood to chop" in power,

renewable energy and in the corporate organization, where he is

cutting head count and costs, as well as improving day-to-day

operations. "We know we have a lot more to do both with respect to

the balance sheet and the way we run the business," he said.

Earlier Thursday, GE disclosed that it would pay down up to $5

billion in debt through a tender offer as it puts incoming cash to

work. The company said it is also looking at other actions like

pension funding and paying down loans from GE to its financial

services division GE Capital.

GE has harvested cash from a number of moves aimed at paying

down its more than $100 billion of debt. It sold its transportation

business and airplane-finance operation and is in the process of

selling its biotech business to Danaher Corp. for $21 billion. This

week, GE began selling down its controlling stake in Baker Hughes,

giving up its majority holding and getting net proceeds of about

$2.7 billion. The sale will trigger a write-down of more than $7

billion because of the higher carrying value for the company.

The company's insurance operation is closely watched by

investors as regulators required a commitment to boost reserves by

$15 billion last year. GE is currently conducting an annual

examination of its reserves.

Mr. Culp said GE is watching the effects of the U.S.'s trade

battle with China, especially for its health-care division, along

with the continued grounding of Boeing Co.'s 737 MAX jet that uses

engines made by a GE joint venture. The company has previously said

the grounding could drain as much as $1.4 billion from cash flow

this year.

Write to Thomas Gryta at thomas.gryta@wsj.com

(END) Dow Jones Newswires

September 12, 2019 15:20 ET (19:20 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

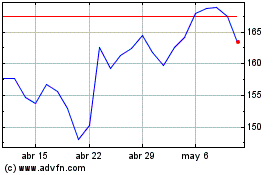

GE Aerospace (NYSE:GE)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

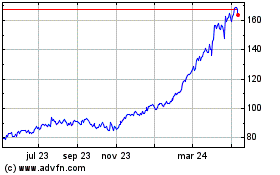

GE Aerospace (NYSE:GE)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024