TIDM88E

RNS Number : 2443M

88 Energy Limited

13 September 2019

88 Energy Limited

Interim Report

88 Energy Limited (ASX: 88E; AIM: 88E) ("88 Energy" or "the

Company") is pleased to announce its interim results for the half

year ended 30 June 2019.

A copy of the Company's Interim Report, extracts from which are

set out below, has been lodged on the ASX and is also available on

the Company's website at www.88energy.com.

Media and Investor relations:

88 Energy Ltd Email: admin@88energy.com

Dave Wall, Managing Director Tel: +61 8 9485 0990

Finlay Thomson, Investor Relations Tel: +44 7976 248471

Hartleys Ltd

Dale Bryan Tel: +61 8 9268 2829

Cenkos Securities plc

Neil McDonald Tel: +44 131 220 9771

Derrick Lee Tel: +44 131 220 9100

OPERATING AND FINANCIAL REVIEW

During the period, the Group has continued its principal

activities in Alaska. A summary of significant activities is

below:

Highlights for the first half of 2019:

Project Icewine

-- Project Icewine Conventional;

o The Conventional farm-out campaign continued in the half-year,

with the deadline for bids extended to end January 2019 due to

demand from multiple parties;

o After consideration, a preferred bidder was selected by the

Company in March 2019 with the third-party due diligence process

and negotiation of terms and conditions completed in Q2 2019;

o Farminee internal approvals were complete prior to the end of

June 2019 for the proposed conventional portfolio farm-out deal;

and

o Subsequent to period end an Exclusivity Agreement was executed

with the preferred bidder to facilitate near term operational

activity whilst final terms were agreed on the proposed farmout

agreement, with execution of the Farm-out completed and announced

on 23 August 2019.

-- Project Icewine Unconventional;

o Advanced FIB-SEM and HAWK analysis was undertaken in the

half-year which significantly advanced the understanding of the HRZ

shale play, with the following noted;

o The majority of acreage remains within revised prospectivity

fairway;

o Additional application of FIB-SEM underway to validate fairway

revision; and

o Franklin Bluffs (Icewine#2 location) considered to be

marginally outside revised fairway.

Yukon Acreage

-- Processing of the Yukon 3D interpretation and resource

evaluation on the inversion product was completed in the half-year;

and

-- Discussions were underway with nearby resource owners to

optimise monetisation strategy to the acreage.

Western Blocks

-- Winx-1 Exploration well;

o The Permit to Drill for the Winx-1 exploration well was

approved by the Alaska Oil and Gas Conservation Commission (AOGCC)

in January, with the Winx-1 exploration well spudded on schedule on

15th February;

o Total Depth of 6,800' was reached on the 3rd March 2019,

having intersected all targets, including the primary Nanushuk

Formation Topset objective;

o Petrophysical analysis of the wireline logging program

indicated low oil saturations in both the primary Nanushuk Topset

objectives and the Torok objective, with testing and fluid sampling

indicating that reservoir quality and fluid mobility at this

location are considered insufficient to warrant production testing;

and

o The Winx-1 well was successfully plugged and abandoned on the

18th March, 2019, with the Nordic#3 rig and associated services

were fully demobilised prior to the end of Q1 2019. Drilling

operations were completed on time and without incident, and under

budget.

PROJECT ICEWINE

Project Icewine Conventional

A fast track farm-out campaign commenced in August 2018, whilst

processing of newly acquired 3D seismic (March 2018) was still

underway. Processing was finalised in October 2018, including

inversion, marking the first time that potential farminees could

comprehensively assess the mapped conventional resource potential

on the Western Play Fairway at Project Icewine. Consequently,

requests were made by potential farminees for more time to evaluate

the opportunity, which the Company granted.

The farm-out process progressed to the next stage at the end of

Q1 2019 with a preferred bidder selected and negotiations and

indicative terms agreed and due diligence completed in Q2 2019. The

Company was advised by the preferred bidder in June 2019 that Board

approval and other required internal approvals had been secured.

The Company advised at half-year that the parties will quickly move

to agree to document and finalise terms and close the transaction

in July 2019. Subsequent to half-year 2019, the Company advised

that it had executed an Exclusivity Agreement executed with the

preferred bidder to facilitate near term operational activity

whilst final terms are agreed on the proposed farmout agreement,

with the Company announcing execution of the Farm-out Agreement

with Premier Oil Plc of the United Kingdom on 22 August 2019, with

the farm-in to occur over multiple stages beginning with Premier

acquiring a 60% interest in return for the drilling of 1

exploration well in Area A of Project Icewine in the first quarter

of 2020.

Project Icewine Unconventional

Baker Hughes and the United States Geological Society (USGS)

continue to apply advanced evaluation techniques to the HRZ shale

play, including additional tests on both core and cuttings obtained

from the drilling of the Icewine-1 and Icewine-2 wells.

Finalisation of advanced analysis using state-of-the-art

technology has significantly advanced the Joint Venture

understanding of the nature of the HRZ play. This analysis has

confirmed that the HRZ is an excellent source rock with good

potential as an economic shale play.

The nature of the dominant kerogen in the HRZ has been

demonstrated to be prone to more rapid transformation into

hydrocarbons than other shales initially used for comparison. This

means that the thermal maturity window for volatile oil in the HRZ

is at lower temperature than that typically seen in other plays. As

a result, the Franklin Bluffs location (where both Icewine wells

were drilled) is considered to be just outside the fairway. The

kerogen in the HRZ at Franklin Bluffs has been converted largely to

solid bitumen, with sub optimal intraparticle porosity and

connectivity. The total porosity of the formation remains excellent

- the effective kerogen porosity (pathways between the particles

that contain the hydrocarbon); however, is lower than ideal. At

slightly lower thermal maturity, it is prognosed that

porosity/connectivity will be significantly improved.

The expansive leasing strategy employed by the Joint Venture

means that the majority of the revised fairway for the play remains

captured within the Project Icewine leasehold, with greater than

50% of the acres under lease considered prospective.

The forward program consists of accessing material from regional

wells in order to conduct additional FIB-SEM analysis to confirm

improved effective porosity and connectivity. Consequently, the

formal farm-out process will be deferred until 2H 2019 to allow for

this work to be completed. The Joint Venture continues to field

unsolicited third party interest in the HRZ shale play and an

informal farm-out process is underway.

The Company continues to receive third party interest in the HRZ

shale project and anticipates being able to integrate the data from

the current evaluation into a dataroom by mid-2019 in order to

commence a formal farm-out process.

Purchase of Outstanding Tax Credits and an Additional Tax Credit

Certificate Granted

On the 9th of January 2019 the Alaskan Department of Revenue

("DoR") informed the Company of the purchase of US$1.57m (A$2.2m)

in tax credits, with the funds received directly applied against

the Brevet debt facility. Debt outstanding at half-year ended 30

June 2019 totalled US$15.5 m (A$22.3m). Further, on the 26 March

2019, the Company was informed by the Alaska DoR that it had issued

a Credit Certificate to Accumulate Energy Alaska Inc., (100% owned

subsidiary of 88 Energy Ltd), for US$2.35m (A$3.4m) related to

CY2016 2D seismic expenditure. The total expected cashable credits

owed by the State to 88E at quarter end was US$19.1 m (A$27.3m),

which is far in excess of debt outstanding of US$15.5m

(A$22.3m).

YUKON LEASES

The Yukon 3D interpretation and resource evaluation was

completed in the half-year on the inversion product.

Discussions have been initiated by the Company with nearby lease

owners to optimise the monetisation strategy for existing

discovered resources located in the vicinity of the Yukon Leases.

The Yukon Leases contain the 86 million barrel Cascade Prospect#,

which was intersected peripherally by Yukon Gold 1, drilled in

1994, and classified as an historic oil discovery. 88 Energy

recently acquired 3D seismic (2018) over Cascade and, on final

processing and interpretation, high-graded it from a lead to a

drillable prospect. The Yukon Leases are located adjacent to ANWR

and in close proximity to recently commissioned infrastructure.

# Refer announcement 7th November 2018

Cautionary Statement: The estimated quantities of petroleum that

may be potentially recovered by the application of a future

development project relate to undiscovered accumulations. These

estimates have both an associated risk of discovery and a risk of

development. Further exploration, appraisal and evaluation are

required to determine the existence of a significant quantity of

potentially movable hydrocarbons..

WESTERN BLOCKS

Winx-1 Exploration Well

The Permit to Drill for the Winx-1 exploration well was approved

by the Alaska Oil and Gas Conservation Commission (AOGCC) on the

16th January 2019, and with the completion of the construction of

the 11 mile ice road in late January the Nordic#3 rig was mobilised

and arrived at the drill site location as planned on the 7th

February. Spud of the Winx-1 exploration well occurred on schedule

on 15th February 2019, with the well intersecting all the of the

pre-drill targets safely and efficiently. Total Depth of 6,800' was

reached on the 3rd March 2019, with multiple potential pay zones

identified in the Nanushuk Formation Topset Play (primary targets)

and Torok Formation (secondary targets).

The Winx-1 well was plugged and abandoned on the 18th March

2019, with the rig and associated services fully demobilised prior

to the end of the quarter. Drilling operations were completed on

time and without incident, and under budget

Petrophysical interpretation of the LWD data at Winx-1 indicated

elevated resistivities associated with increased mud gas ratios (C1

- C5) in the distinctive Nanushuk Topset sequence, comparable with

other successful neighbouring wells in the Nanushuk play fairway.

Early indications were encouraging and, on this basis, a

comprehensive wireline program was undertaken to further evaluate

the interval of interest.

The wireline program was designed to fully evaluate and quantify

the reservoir potential and associated shows in the Nanushuk

Topsets. The suite comprised specialist logging tools capable of

quantifying laminated pay zones, including nuclear magnetic

resonance; a triaxial induction tool that measures both horizontal

and vertical resistivity, and an MDT program to determine pressure

gradients and sample fluids from the zones of interest.

Wireline results indicate low oil saturations in the Nanushuk

Topsets not conducive to successfully flowing the formation, as

borne out by the MDT sampling results, which did not retrieve

hydrocarbon samples. Reservoir properties appear to be compromised

by dispersed clay in the matrix at Winx-1. This clay is often

present in other successful Nanushuk wells but in discrete

laminations with decent quality, high resistivity, oil saturated

sandstones in between. The dispersed clay in the Nanushuk at Winx

impacts both fluid mobility and oil saturations. The clay serves to

bind much of the fluid present in place so that it cannot flow. It

also occupies pore space within the formation, resulting in a lower

relative hydrocarbon saturation. This means that, whilst oil is

present in the reservoir, there is less of it and it is not mobile.

Further evaluation will be undertaken post drill to fully

understand the implications of the petrophysical results

The reservoir performance in the Torok Channel Sequence was

better than the Nanushuk in the Winx-1 well, as evidenced by

relatively faster influx of fluid during MDT sampling. On

completion of the wireline logging program it is apparent that the

oil saturations in the Torok zone of interest are also low and not

conducive to hydrocarbon flow. The oil saturations are evidence of

an active petroleum system / charge and further work is required to

determine whether there is an effective trapping mechanism at this

location or elsewhere on the leases.

Performance Bond

In consideration for acquiring a working interest from Great

Bear Petroleum in the Western Blocks the Company, and Consortium

partners, provided a US$3.0 million (A$4.2 million) Performance

Bond to the State of Alaska in July 2018 as part of the commitment

to drilling an exploration well by 31 May 2019.

On satisfying the requirement of drilling an exploration well on

the acreage 88 Energy have earnt the rights to a 36% working

interest on the acreage. Well data was submitted to the Department

of Natural Resources, Division of Oil and Gas in March 2019 to

initiate the release of the US$3.0 million (A$4.2

million)performance bond, (US$1.2 million (A$1.7 million) net to

88E), which was refunded in full in May 2019.

Forward Plan

The forward plan is to further evaluate and integrate the

valuable data acquired at Winx-1, reprocess the Nanuq 3D seismic

(2004) in order to evaluate the remaining prospectivity on the

Western Leases including the Nanushuk Fairway potential.

FINANCIAL

For the period ended 30 June 2019 the Company recorded a loss of

$29.325 million (30 June 2018: $3.198 million loss). The loss was

largely attributable to the impairment of the Winx-1, Icewine-1 and

Icewine-2 exploration wells during the half-year, together with

general and administrative costs, finance costs and employee

benefits expense.

No dividends were paid or declared by the Company during the

period.

As at 30 June 2019, the Group had cash on hand of $6.7 million

(31 December 2018: $21.7 million) which includes A$0.4 million in

restricted cash held which is for JV operations, net assets of $65

million (31 December 2018: $94.1 million). The significant decrease

in net assets is largely due to the impairment of the exploration

wells noted above.

CONSOLIDATED STATEMENT OF PROFIT OR LOSS & OTHER COMPREHENSIVE

INCOME

Note

30 June 30 June

2019 2018

$ $

Income 3(a) 2,058,773 552,980

Administration expenses 3(b) (78,550) (832,391)

Occupancy expenses (21,430) (24,553)

Employee benefit expenses 3(c) (843,745) (987,631)

Share based payment expense 13 (53,924) -

Depreciation and amortisation expense (28,618) (23,322)

Finance cost (1,544,969) (2,110,118)

Realised/unrealised gain on foreign

exchange 15,028 340,029

Other expenses 3(d) (28,827,806) (113,189)

Loss before income tax (29,325,241) (3,198,195)

Income tax benefit/(expense) - -

------------- ------------

Net loss attributable to members of

the parent (29,325,241) (3,198,195)

============= ============

Other comprehensive income for the

period

Other comprehensive income that may

be recycled to profit or loss in subsequent

periods:

Exchange differences on translation

of foreign operations 172,919 2,987,322

------------- ------------

Total comprehensive loss for the period (29,152,322) (210,873)

============= ============

Basic and diluted loss per share (0.005) (0.001)

The consolidated statement of profit or loss and other

comprehensive income should be read in conjunction with the

accompanying notes.

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

Note

30 June 31 December

2019 2018

$ $

ASSETS

Current Assets

Cash and cash equivalents 5 6,674,076 21,722,211

Other receivables 6 326,480 2,101,501

------------- -------------

Total Current Assets 7,000,556 23,823,712

============= =============

Non-Current Assets

Plant and equipment 11,658 11,172

Exploration and evaluation expenditure 7 60,678,988 76,983,981

Other assets 8 26,231,771 22,977,103

Total Non-Current Assets 86,922,417 99,972,256

------------- -------------

TOTAL ASSETS 93,922,973 123,795,968

============= =============

LIABILITIES

Current Liabilities

Provisions 10 527,681 255,353

Trade and other payables 9 6,072,895 6,001,949

Total Current Liabilities 6,600,576 6,257,302

------------- -------------

Non-Current Liabilities

Borrowings 11 22,306,600 23,424,471

Total Non-Current Liabilities 22,306,600 23,424,471

------------- -------------

TOTAL LIABILITIES 28,907,176 29,681,773

------------- -------------

NET ASSETS 65,015,797 94,114,195

============= =============

EQUITY

Contributed Equity 12(a) 179,304,850 179,304,850

Reserves 12(b) 22,855,233 22,628,390

Accumulated losses (137,144,286) (107,819,045)

------------- -------------

TOTAL EQUITY 65,015,797 94,114,195

============= =============

The consolidated statement of financial position should be read

in conjunction with the accompanying notes

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

Contributed Accumulated Total

Equity Reserves losses equity

$ $ $ $

Balance at 1 January 2018 141,711,466 15,645,286 (101,825,452) 55,531,300

Loss for the period - - (3,198,195) (3,198,195)

Other comprehensive income - 2,987,322 - 2,987,322

---------------- ---------- ------------- ------------

Total comprehensive loss for

the period, net of tax 2,987,322 (3,198,195) (210,873)

Shares issued during the period 25,772,805 - - 25,772,805

Equity raising costs (1,477,973) - - (1,477,973)

Balance at 30 June 2018 166,006,298 18,632,608 (105,023,647) 79,615,262

================ ========== ============= ============

Balance at 1 January 2019 179,304,850 22,628,390 (107,819,045) 94,114,195

Loss for the period - - (29,325,241) (29,325,241)

Other comprehensive income - 172,919 - 172,919

---------------- ---------- ------------- ------------

Total comprehensive loss for

the period, net of tax - 172,919 (29,325,241) (29,152,322)

Share based payments - 53,924 - 53,924

Balance at 30 June 2019 179,304,850 22,855,233 (137,144,286) 65,015,797

================ ========== ============= ============

The consolidated statement of changes in equity should be read

in conjunction with the accompanying notes

CONSOLIDATED STATEMENT OF CASH FLOWS

Note

30 June 30 June

2019 2018

$ $

Cash flows from operating activities

Interest 19,532 6,000

Interest Paid (1,198,562) (1,037,869)

Payments to suppliers and employees (1,369,467) (2,201,692)

Net cash outflows used in operating activities (2,548,497) (3,233,561)

------------- ------------

Cash flows from investing activities

Payments for exploration and evaluation activities (21,147,306) (20,847,096)

Contributions from JV Partners in relation to

Exploration 8,600,245 1,592,488

Net cash outflows used in investing activities (12,547,061) (19,254,608)

------------- ------------

Cash flows from financing activities

Proceeds from issue of shares - 25,772,793

Share issue costs - (1,496,000)

Payment of borrowing costs - (1,126,456)

Net cash inflows from financing activities - 23,150,337

------------- ------------

Net increase/(decrease) in cash and cash equivalents (15,095,557) 662,168

Net foreign exchange differences 47,422 415,085

Cash and cash equivalents at beginning of period 21,722,211 14,014,422

Cash and cash equivalents at end of period 5 6,674,076 15,091,675

============= ============

The consolidated statement of cash flows should be read in

conjunction with the accompanying notes.

NOTES

1. CORPORATE INFORMATION

The consolidated financial statements of the Company for the six

months ended 30 June 2019 were authorised for issue in accordance

with a resolution of the Directors on 13 September 2019.

88 Energy Limited is a for-profit, limited company incorporated

and domiciled in Australia whose shares are publicly traded. The

principal activities of the company and its subsidiaries (the

Company) are oil and gas exploration with a portfolio of

exploration interests in Alaska.

2. BASIS OF PREPARATION AND CHANGES TO THE COMPANY'S ACCOUNTING POLICIES

(a) Basis of Preparation

The half year financial report for the six months ended 30 June

2019 is a general purpose financial report prepared in accordance

with requirements of the Corporations Act 2001 and Australian

Accounting Standard AASB 134: Interim Financial Reporting.

The half year financial report has been prepared on a historical

cost basis, except for available for sale assets, which have been

measured at fair value. Unless otherwise noted, the carrying value

of financial assets and liabilities as disclosed in the half year

financial report approximates their fair value. The company is

domiciled in Australia and all amounts are presented in Australian

dollars, unless otherwise noted.

For the purpose of preparing the half year financial report, the

half-year has been treated as a discrete reporting period.

The accounting policies adopted in the preparation of the half

year financial report are consistent with those followed in the

preparation of the Company's annual financial report for the year

ended 31 December 2018.

The half year financial report does not include all the

information and disclosures required in the annual financial

statements, and should be read in conjunction with the Company's

annual financial statements as at 31 December 2018, together with

any public announcements made during the period.

(b) Adoption of new and revised accounting standards

In the prior period, the directors adopted all the new and

revised Standards and Interpretations issued by the AASB that are

relevant to its operations and effective from 1 January 2018.

-- AASB 9 Financial Instruments.

-- AASB 15 Revenue from Contracts.

-- AASB 16 Leases.

(c) Significant Judgements and Estimates - AASB 9 Impairment of Financial Assets

In addition to significant estimates and judgements disclosed in

the 2018 annual report, we note the following;

As at 30 June 2019, the Group had a tax credit receivable of

US$19.1 million (A$27.3 million) from the State of Alaska, which

has a fair value in the Statement of Financial Position of A$25.7

million. As at the reporting date, management have considered

whether there is any objective evidence as to whether there are any

indicators of impairment in accordance with AASB 9 Financial

Instruments and believe this amount will be recoverable from the

Alaskan DOR as a cash rebate in full based on the current

legislative arrangements in Alaska. The timing and extent of

payments is expected to vary however it is anticipated that all

amounts will be received on or before 2021. The accretion of the

receivable will be recognised as finance income.

(d) Going concern

As at 30 June 2019, the Group had working capital of ($399,980)

(current assets less current liabilities) with cash on hand of

$6,674,076 and a comprehensive net loss of ($29,152,322) with cash

out flow from operating activities for the half-year of

($2,548,497).

The Directors are confident of the ability of the Group to

manage its working capital requirements, or raise funding through

various other alternatives including:

-Raising funds through issue of new shares;

-Sale of Alaskan Tax Credits to a third party which would lower

debt and interest commitments; and

-Managing the Company's working capital requirements.

These circumstances led to management assessing the entity's

ability to continue as a going concern. See Note 14 for further

information supporting this position.

The Directors are satisfied the Group is a going concern and

therefore have prepared the financial statements on the basis the

Group will continue to meet its commitments and can therefore

continue normal business activities and realise its assets and

settle liabilities in the normal course of business.

30 June 30 June

2019 2018

$ $

3. INCOME AND EXPENSES

(a) Other Income

Interest Income 16,638 5,858

Other finance income* 2,042,135 547,122

*Unwinding of the effect of present value

discounting of tax receivable 2,058,773 552,980

=============== ==============

(b) Corporate & Administrative expenses

Consultancy and professional fees 125,861 267,440

Legal fees 7,062 48,379

General and administration expenses (95,036) 499,292

Travel 40,663 17,280

78,550 832,391

=============== ==============

(c) Employee benefit expenses

Wages and salaries 718,609 932,932

Superannuation 45,417 51,222

Annual leave expense 50,873 14,751

Other employee expenses 28,846 (11,274)

843,745 987,631

=============== ==============

(d) Other expenses

Impairment expense - Icewine & Winx 28,767,174 -

Other expenses 60,632 113,189

--------------- --------------

28,827,806 113,189

=============== ==============

4. SEGMENT INFORMATION

Identification of reportable segments

For management purposes during the period ended 30 June 2019 the

Company was organised into the following strategic unit:

-- Oil and Gas exploration in Alaska, USA.

Operating segments are reported in a manner consistent with the

internal reporting provided to the chief operating decision maker.

The chief operating decision maker, who is responsible for

allocating resources and assessing performance of the operating

segments, has been identified as the Board of Directors.

The Board of Directors review internal management reports on a

periodic basis that is consistent with the information provided in

the statement of profit or loss and other comprehensive income,

statement of financial position and statement of cash flows. As a

result no reconciliation is required, because the information as

presented is used by the Board to make strategic decisions.

Management has determined, based on the reports reviewed by the

Board of Directors and used to make strategic decisions, that the

Group has one reportable segment being Oil & Gas Exploration in

Alaska, USA. Such structural organisation is determined by the

nature of risks and returns associated with each business segment

and define the management structure as well as the internal

reporting system.

30 June 31 December

2019 2018

$ $

5. RECONCILIATION OF CASH

For the purposes of the statement of cash

flows, cash and cash equivalents comprise

the following:

Cash at bank and in hand (i) 6,674,076 21,722,211

6,674,076 21,722,211

=================== =====================

(i) As per the Directors' Report $0.4m

is restricted for the JV Operations.

6. OTHER RECEIVABLES

Goods and Services Tax (GST) receivable 26,400 116,249

Other deposits and receivables 300,080 1,985,252

------------------- ---------------------

326,480 2,101,501

=================== =====================

(a) Allowance for expected credit loss

Receivables past due but not considered impaired are nil (2018:

Nil).

7. EXPLORATION & EVALUATION EXPITURE

Capitalised expenditure at the beginning

of the period 76,983,981 46,934,162

Additions 15,161,364 24,093,718

Less Impairment - Icewine & WINX (28,545,718) -

Tax credit receivable (i) (3,351,469) 899,716

Foreign currency translation 430,831 5,056,385

Closing balance 60,678,988 76,983,981

=================== =====================

(i) Movement in 2019 relates to the approval of an Alaskan tax credit

receivable (s43.55.025).

30 June 2019 31 December 2018

$ $ .

8. OTHER NON-CURRENT ASSETS

ROU Asset - Lease 5 Ord St 30,388 56,434

North Slope Bid Round Deposit 29,909 29,743

Tax credit receivable (i) 25,743,697 22,464,515

Investments 427,777 425,411

------------------- ---------------------

26,231,771 22,977,103

=================== =====================

(i) The Alaskan Government has approved tax credits of A$27.3 million

as at 30 June 2019 (US$19.1 million). This amount has been fair

valued as at 30 June 2019 to A$25.7 million and recognised as an

offset against Exploration & Evaluation capitalised and recognised

above within Other Non-Current Assets. The amount paid will be directly

applied against the outstanding loan with Brevet. Refer to Significant

Judgements & Estimates (2c) above.

9. TRADE AND OTHER PAYABLES

Trade payables 1,091,301 403,935

Other payables 4,981,594 5,598,014

------------------- ---------------------

6,072,895 6,001,949

=================== =====================

10. PROVISIONS

Annual Leave 270,458 226,584

Long Service Leave 35,768 28,769

Provision for Abandonment 221,455 -

527,681 255,353

=================== =====================

11. BORROWINGS

Non-Current

Bank Facility (i) 22,306,600 23,424,471

------------------- ---------------------

22,306,600 23,424,471

=================== =====================

(i) On 23 March 2018, 88 Energy Limited refinanced the Facility

and entered into a credit agreement with FCS Advisors, LLC (d/b/a

Brevet Capital Advisors). The Facility expires Dec 2022. The Facility

contains financial covenants which have been met. As at 30 June

2019, US$15.5 (A$22.3) million was outstanding under the Facility.

Borrowings are secured by available Production Tax Credits and Accumulate

and Burgundy acreage.

12. CONTRIBUTED EQUITY AND RESERVES

(a) Ordinary shares fully paid 30 June 2019 31 December

2018

Ordinary shares 179,304,850 179,304,850

=================== =====================

Number 30 June

of shares 2019

$

Balance at 1 January 2019 6,331,540,324 179,304,850

Issued and fully paid shares at 30 June

2019 6,331,540,324 179,304,850

=================== =====================

(b) Reserves 30 June 2019 31 December 2018

$ $

Share-based payments 17,541,313 17,487,389

Foreign currency translation reserve 5,313,920 5,141,001

---------- -----------

22,855,233 22,628,390

---------- -----------

Movement reconciliation

Share-based payments reserve

Balance at the beginning of the year 17,487,389 17,465,639

Equity settled share-based payment transactions

(Note 13) 53,924 21,750

---------- -----------

Balance at the end of the year 17,541,313 17,487,389

---------- -----------

Foreign currency translation reserve

Balance at the beginning of the year 5,141,001 (1,820,353)

Effect of translation of foreign currency operations

to group presentation 172,919 6,961,354

---------- -----------

Balance at the end of the year 5,313,920 5,141,001

---------- -----------

Share-based payment reserve

The share-based payment reserve is used to record the value of

share-based payments provided to outside parties, and share-based

remuneration provided to employees and directors. Refer to Note 13

for further details.

Foreign currency translation reserve

The translation reserve comprises all foreign exchange

differences arising from the translation of the financial

statements of foreign operations where their functional currency is

different to the presentation currency of the reporting entity.

13. SHARE BASED PAYMENTS

Share-based payment transactions recognised during the reporting

period were as follows:

30 June 30 June

2019 2018

$ $

Options issued to Directors 22,219 -

Options issued to employees 31,705 -

53,924 -

========== ========

No options were granted in the half-year ended 30 June 2019.

14. EVENTS AFTER THE PERIOD END

The following events occurred subsequent to the period end;

* On 6 August 2019 the Company announced the execution

of an Exclusivity Agreement with the preferred bidder

to facilitate near term operational activity whilst

final terms are agreed on the proposed farmout

agreement. Exclusivity was granted by the JV Parties

until 31 August 2019, with customary exclusivity

undertakings and a US$500,000 payment (the

"Exclusivity Fee") by the preferred bidder to the JV

Parties to facilitate incurring of initial agreed

costs associated with the 2020 drilling program. The

Exclusivity Fee was non-refundable unless the farmout

agreement is not finalised owing to an act or

omission of the JV Parties;

* On 22 August 2019 the Company announced execution of

the Farm-out Agreement with Premier Oil Plc of the

United Kingdom on 22 August 2019, with the farm-in to

occur over multiple stages beginning with Premier

acquiring a 60% interest in return for the drilling

of 1 exploration well in Area A of Project Icewine in

the first quarter of 2020; and

* On the 13 September 2019, the Company announced that

it had successfully completed a capital raise of

A$6.75 million (before costs), with the placement

made to domestic and international institutional and

sophisticated investors through the issue of

540,000,000 million ordinary shares at A$0.0125

(equivalent to GBP0.07) per New Ordinary Share.

There were no other subsequent events.

15. COMMITMENTS AND CONTINGENCIES

As at 30 June 2019 there have been no material changes to commitments

since 31 December 2018. There were no contingent liabilities

as at 30 June 2019.

16. RELATED PARTY TRANSACTIONS

The terms and conditions of transactions with Directors and Executives

and their related entities were no more favourable than those

available, or which might reasonably be expected to be available,

on similar transactions to Non-Director related entities on an

arm's length basis.

Related party transactions similar to those described in the 31

December 2018 Annual Report continued during the period.

17. FAIR VALUE MEASUREMENT

The management assessed that the carrying amount of financial

assets and financial liabilities recorded in the financial statements

represents their respective fair values largely due to the short-term

maturities of these instruments. The carrying amounts are determined

in accordance with accounting policies disclosed in Note 2.

AASB 13 requires disclosure of fair value measurements by level

of the following fair value measurement hierarchy:

(i) Level 1 - the instrument has quoted prices (unadjusted) in

active markets for identical assets and liabilities;

(ii) Level 2 - a valuation technique using inputs other than quoted

prices within Level 1 that are observable for the financial instrument,

either directly (i.e. prices), or indirectly (i.e. derived from

prices); or

(iii) Level 3 - a valuation technique using inputs that are not

based on observable market data (unobservable inputs).

The Group has recorded the Tax Credit Receivable (in Note 8) at

Fair Value at a Level 1 measurement using a market interest rate.

The Group does not have any level 2 or 3 assets or liabilities.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR UORVRKWAKARR

(END) Dow Jones Newswires

September 13, 2019 02:00 ET (06:00 GMT)

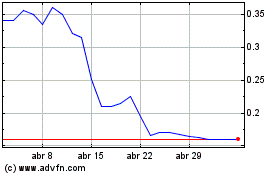

88 Energy (LSE:88E)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

88 Energy (LSE:88E)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024