Canadian Dollar Slides Amid Risk Aversion

16 Septiembre 2019 - 1:22AM

RTTF2

The Canadian dollar drifted lower against its major counterparts

in the early European session on Monday amid risk aversion, as weak

China data stocked worries over global growth, while the attacks on

Saudi's crude facilities raised geopolitical worries.

Industrial output growth unexpectedly weakened to 4.4 percent in

August from the same period a year earlier, the slowest pace since

February 2002 and down from 4.8 percent in July.

Retail sales and investment figures also disappointed amid

rising trade pressure and softening domestic demand.

Drone attacks at Saudi Arabia's oil production facilities in

Abqaiq and Khurais heightened geopolitical tensions in the Middle

East.

The currency has been trading lower against its major

counterparts in the Asian session, excepting the euro.

The loonie dropped to 1.3261 against the greenback and 1.4692

against the euro, from its early highs of 1.3209 and 1.4635,

respectively. The next possible support for the loonie is seen

around 1.35 against the greenback and 1.49 against the euro.

The loonie edged down to 0.9120 against the aussie, off an early

high of 0.9071. If the loonie slides further, 0.945 is likely seen

as its next support level.

The loonie fell back to 81.32 against the yen, heading to pierce

an early 1-week low of 81.24. The loonie is seen finding support

around the 78.5 mark.

Looking ahead, Canada existing home sales for August and New

York Fed's empire manufacturing activity for September are due in

the New York session.

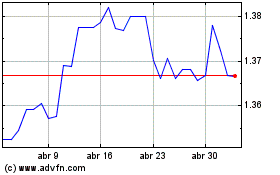

US Dollar vs CAD (FX:USDCAD)

Gráfica de Divisa

De Mar 2024 a Abr 2024

US Dollar vs CAD (FX:USDCAD)

Gráfica de Divisa

De Abr 2023 a Abr 2024