TIDMTMT

RNS Number : 5180M

TMT Investments PLC

17 September 2019

17 September 2019

TMT INVESTMENTS PLC

("TMT" or the "Company")

Half year report for the six months to 30 June 2019

TMT Investments PLC, the venture capital company investing in

high-growth, technology companies across a number of core

specialist sectors, is pleased to announce its unaudited interim

results for the half-year ended 30 June 2019.

The interim report will shortly be available on the Company's

website, www.tmtinvestments.com.

Highlights

-- NAV per share of US$3.66 (uplift of 18.45% from US$3.09 as of 31 December 2018)

-- US$29.5 million in positive revaluations from Backblaze,

Taxify, PandaDoc, Workiz and eAgronom

-- Many portfolio companies continue to experience rapid growth,

with three new investments made during the period

Post period end

-- Following profitable cash exit from Wrike, Inc. at the end of

2018, the Company declared and paid a special dividend of US$5.8

million (US$0.20 per ordinary share) during July 2019

-- Completed a further four new investments and remain well

funded to continue to expand and support the Company's investment

portfolio

Alexander Selegenev, Executive Director of TMT, commented: "We

are delighted with our portfolio company performance in the first

half of 2019. The Company is increasingly recognised as one of very

few AIM-quoted vehicles providing UK investors with exposure to

earlier stage, primarily US-based, tech companies. Having exceeded

US$100 million in net asset value, TMT continues to actively invest

in promising tech companies across our chosen sectors, with the

continuing objective of growing shareholder value. We look forward

to updating our shareholders on the Company's progress in the near

future."

TMT Investments PLC +44 (0)1534 281 800

Alexander Selegenev (Computershare - Company Secretary)

Executive Director

www.tmtinvestments.com alexander.selegenev@tmtinvestments.com

Strand Hanson Limited (Nominated

Adviser)

Richard Tulloch / James Dance

/ Eric Allan +44 (0)20 7409 3494

Hybridan LLP (Broker)

Claire Louise Noyce +44 (0)20 3764 2341

Kinlan Communications +44 (0)20 7638 3435

David Hothersall davidh@kinlan.net

About TMT Investments PLC

TMT Investments PLC invests in high-growth technology companies

across a number of core specialist sectors and has a significant

number of Silicon Valley investments in its portfolio. Founded in

2010, TMT has invested in over 45 companies to date and net assets

of US$107 million as at 30 June 2019. The Company's objective is to

generate an attractive rate of return for shareholders,

predominantly through capital appreciation. The Company is traded

on the AIM market of the London Stock Exchange.

www.tmtinvestments.com

EXECUTIVE DIRECTOR'S STATEMENT

We are delighted with our portfolio company performance since

the beginning of the year, which has continued the trend of

positive revaluations and cash realisations. A number of portfolio

companies received further validation for their business models by

raising fresh equity capital at higher valuations during the

period. In tandem, most of our other portfolio companies have

continued growing their businesses quietly in the background.

As a result, TMT's net asset value ("NAV") per share as of 30

June 2019 increased 18.45% to US$3.66 (US$3.09 as of 31 December

2018).

Following the disposal of our investment in Wrike, Inc.

("Wrike") at the end of 2018 for US$24.7 million (net), we have

been busy directing these proceeds towards investing in additional

exciting companies that meet our investment criteria of having

outstanding management teams, high growth potential based on

globally scalable business models, viable exit opportunities and

are typically already generating revenue. As noted below we have

invested, in aggregate, US$6.5 million in seven new investments in

the year to date, which include our first two investments in UK

companies MEL Science Ltd, an EdTech company using Virtual Reality

(VR) to focus on early science education, and HealthyHealth-UK Ltd,

an InsurTech and HealthTech company.

We were also pleased to pay a special dividend of US$5.8 million

(US$0.20 per ordinary share) to shareholders following the

Company's profitable cash exit from Wrike. The dividend was paid on

31 July 2019 and is the second special dividend paid to

shareholders, the first being US$2.9 million (US$0.10 per ordinary

share) in November 2016 following our partial cash exit from

DepositPhotos.

The following developments had an impact on and are reflected in

the Company's NAV and/or financial statements as of 30 June 2019 in

accordance with applicable accounting standards:

Full and partial profitable cash exits, and positive non-cash

revaluations:

-- In June 2019, PandaDoc, a document automation SaaS provider

(www.pandadoc.com), completed a new equity funding round. The

transaction represented a revaluation uplift of US$0.98 million (or

79.5%) in the fair value of TMT's investment in PandaDoc, compared

to the previous reported amount as of 31 December 2018.

-- As announced on 28 June 2019, Bolt, a leading international

ride-hailing company (www.bolt.eu) formerly known as Taxify,

completed a new funding round. The transaction represented a

revaluation uplift of US$5.04 million (or 29.5%) in the fair value

of TMT's investment in Bolt, compared to the previous reported

amount as of 31 December 2018.

-- In July 2019, Workiz, a field service management SaaS

provider (www.workiz.com), completed a new equity funding round.

The transaction represented a revaluation uplift of US$0.18 million

(or 67.6%) in the fair value of TMT's investment in Workiz,

compared to the previous reported amount as of 31 December

2018.

-- In August 2019, eAgronom, a farm management SaaS provider

(www.eagronom.com), completed a new equity funding round. The

transaction represented a revaluation uplift of US$54,024 (or

23.1%) in the fair value of TMT's investment in eAgronom, compared

to the previous reported amount as of 31 December 2018.

-- In August 2019, TMT entered into an agreement with a

third-party private investor to dispose of approximately 9% of its

interest in Backblaze Inc. ("Backblaze"), a leading data backup and

cloud storage company (www.backblaze.com), for a cash consideration

of US$2.0 million. The partial disposal to a third party private

investor, implied a substantial increase in the value of TMT's

interest in Backblaze to US$23.2 million, being the value of its

remaining interest and the consideration received, representing an

increase of approximately US$12.7 million (or approximately 120%)

on the value of the Company's investment in Backblaze of US$10.5

million as of 31 December 2018.

Negative revaluations:

-- In July 2019, the Company entered into a definitive agreement

to sell its entire holding in Unicell for a total net cash

consideration of US$965,729. The transaction represented a

reduction of US$14,271 in the fair value of TMT's investment in

Unicell, compared to the previous reported amount as of 31 December

2018.

Key developments for the five largest portfolio holdings in the

first half of 2019 (source: TMT's portfolio companies):

Bolt (ride-hailing and food delivery platform):

-- Active in over 90 cities over the world (from "over 70" cities as of 31 December 2018)

-- Continuing triple-digit growth in revenue and number of users

-- New equity round raised in the first half of 2019 at an increased valuation

Depositphotos (stock photo and video marketplace):

-- Continuing double-digit growth in revenue and number of files in the photobank

-- New graphic design software product Crello continues growing

fast in both users and revenue

Backblaze (online data backup and cloud storage provider):

-- Continuing double-digit revenue growth, exceeding 575,000 paying customers

-- "B2" cloud storage revenue grew at 128% year-on-year

Pipedrive (sales CRM software):

-- Continuing double-digit growth in revenue

-- Over 88,500 paying customers (from "over 85,000" as of 31 December 2018)

Scentbird (perfume and other beauty product subscription

service):

-- Continuing double-digit growth in revenue and number of customers

-- New skincare and wellness ranges launched

New investments

In the first half of 2019, the Company made the following

investments:

-- US$200,000 in Hugo Technologies Ltd. (www.hugoapp.com), a

Central American on-demand delivery service;

-- US$2 million in MEL Science Limited (www.melscience.com), a

UK EdTech company using Virtual Reality (VR) to focus on early

science education. The company's main products are subscription

kits and VR software for learning chemistry and other disciplines;

and

-- GBP200,000 (US$253,615) in HealthyHealth-UK Ltd, a UK InsurTech and HealthTech company (www.healthyhealth.uk).

Operating Expenses

In the first half of 2019, the Company's administrative expenses

of US$603,554 were in line with the 2018 levels (US$606,143).

Bonus Plan

Under the Company's Bonus Plan, subject to achieving minimum

hurdle rate and high watermark conditions in respect of the

Company's NAV, the team receives an annual cash bonus equal to 7.5%

of the net increases in the Company's NAV, adjusted for any changes

in the Company's equity capital resulting from issuance of new

shares, dividends, share buy-backs or similar corporate

transactions in each relevant year. The Company's bonus year runs

from 1 July to 30 June. For the bonus year ended 30 June 2019, the

total amount of bonus accrued was US$2,007,693. The exact

allocation of the accrued bonus is expected to be approved and paid

to the participants of the Company's Bonus Plan shortly after the

publication of this interim report.

Financial position

As of 30 June 2019, the Company had no financial debt and cash

reserves of approximately US$22.4 million. Following the special

dividend paid on 31 July 2019, a number of new investments made

since 30 June 2019 and US$2.0 million received in respect of

Backblaze in September 2019, as of 16 September 2019, the Company

had cash reserves of approximately US$15.3 million.

NAV per share

The Company's net asset value ("NAV") per share in the first

half of 2019 increased 18.45% to US$3.66 (31 December 2018:

US$3.09). The NAV per share does not reflect the dividend payment

detailed below.

Events after the reporting period

As announced on 9 July 2019, following the Company's profitable

cash exit from Wrike, Inc., the Company's Board of Directors

declared a special dividend to the holders of the Company's

ordinary shares for a total amount of US$5,837,166, or US$0.20 per

ordinary share. The dividend was paid on 31 July 2019.

As announced in August 2019, the Company has made the following

new investments in July and August 2019:

-- US$350,000 in Cheetah X, Inc., the developer of the electric scooter sharing platform Go-X (www.goxapp.com). Go-X is already operating in San Francisco, San Diego, Houston and Yuma, Arizona;

-- US$1.5 million in Scalarr, Inc., a machine learning-based

fraud detection solution focused on the advertising market

(www.scalarr.io); and

-- US$1.0 million in Accern Corporation, an AI-based data design

company that helps automate research and data analysis processes

within organisations (www.accern.com). Accern's clients include

IBM, MetLIfe, Credit Suisse and Moody's, as well as other Fortune

500 companies.

In addition, in September 2019, the Company invested

US$1,200,000 in Rocket Games Entertainment LLC, the owner of

Legionfarm, an online game coaching service that helps gamers

master complex games by hiring professional players

(www.legionfarm.com).

The proceeds from the Unicell disposal were received by the

Company in August 2019.

The proceeds from the partial Backblaze disposal were received

by the Company in September 2019.

These events after the reporting period are not reflected in the

NAV and/or the interim statements as at 30 June 2019.

Outlook

TMT has now invested in over 50 companies since its admission to

trading on AIM in December 2010 and has a diversified portfolio of

over 25 investments, focused primarily on big data/cloud,

e-commerce, SaaS (software-as-a-service) and marketplaces. We

continue to see exciting investment and exit opportunities in our

chosen sectors, and expect to complete a number of new investments

in the second half of 2019. We look forward to updating our

shareholders on the Company's progress in the near future.

FINANCIAL STATEMENTS

Statement of Comprehensive Income (unaudited)

For the For the

six months six months

ended 30/06/2019 ended 30/06/2018

Notes USD USD

2 (Restated)

------------------------------------------ ------ ------------------ ------------------

Gains on investments 3 18,919,501 11,752,157

------------------------------------------ ------ ------------------ ------------------

18,919,501 11,752,157

Expenses

Bonus scheme payment charge 6 (2,007,693) (1,512,251)

Administrative expenses 5 (603,554) (606,143)

Other operating expenses (13,078)

------------------------------------------ ------ ------------------ ------------------

Operating gain 16,295,176 9,633,763

Net finance income 7 122,959 3,063

------------------------------------------ ------ ------------------ ------------------

Gain before taxation 16,418,135 9,636,826

Taxation 8 - -

------------------------------------------ ------ ------------------ ------------------

Gain attributable to equity shareholders 16,418,135 9,636,826

Total comprehensive income for the

year 16,418,135 9,636,826

------------------------------------------ ------ ------------------ ------------------

Gain per share

Basic and diluted gain per share

(cents per share) 9 56.25 33.82

------------------------------------------ ------ ------------------ ------------------

Statement of Financial Position

At 30 June At 31 December

2019 2018

USD USD

Unaudited Audited

Notes

Non-current assets

Financial assets at FVPL 10 85,698,157 64,890,144

Total non-current assets 85,698,157 64,890,144

Current assets

Trade and other receivables 11 699,472 23,804,395

Cash and cash equivalents 12 22,389,897 3,270,088

Total current assets 23,089,369 27,074,483

Total assets 108,787,526 91,964,627

Current liabilities

Trade and other payables 13 2,107,706 1,702,942

Total current liabilities 2,107,706 1,702,942

Total liabilities 2,107,706 1,702,942

Net assets 106,679,820 90,261,685

----------------------------- ------ -------------------- ----------- ------------------------

Equity

Share capital 14 34,790,174 34,790,174

Retained profit 71,889,646 55,471,511

Total equity 106,679,820 90,261,685

----------------------------- ------ -------------------- ----------- ------------------------

Statement of Cash Flows (unaudited)

For the six For the six

months ended months ended

30/06/2019 30/06/2018

Notes USD USD

(Restated)

Operating activities

Operating gain 16,295,176 9,633,763

-------------------------------------------- ----- ------------- -------------

Adjustments for non-cash items:

Changes in fair value of financial

assets at FVPL 3 (18,922,586) (11,731,576)

Bonus scheme payment charge 2,007,693 1,512,251

Amortised costs of convertible notes

receivable 3 - 651

(619,717) (584,911)

-------------------------------------------- ----- ------------- -------------

Changes in working capital:

Decrease/(increase) in trade and

other receivables 11 23,104,922 (328,364)

Decrease in trade and other payables 13 (1,602,928) (27,673)

Net cash generated from/(used by) operating

activities 20,882,277 (940,948)

-------------------------------------------- ----- ------------- -------------

Investing activities

Interest received 7 96,757 3,063

Purchase of financial assets at FVPL 10 (2,453,607) (300,000)

Proceeds from sale of financial assets

at FVPL 10 568,180 2,063,194

Other financial income 7 26,202 -

-------------------------------------------- ----- ------------- -------------

Net cash (used in)/generated from investing

activities (1,762,468) 1,766,257

-------------------------------------------- ----- ------------- -------------

Financing activities

Proceeds from issue of shares - 3,336,664

-------------------------------------------- ----- ------------- -------------

Net cash from financing activities - 3,336,664

-------------------------------------------- ----- ------------- -------------

Increase/(decrease) in cash and cash

equivalents 19,119,809 4,161,973

-------------------------------------------- ----- ------------- -------------

Cash and cash equivalents at the beginning

of the period 12 3,270,088 985,692

-------------------------------------------- ----- ------------- -------------

Cash and cash equivalents at the end

of the period 12 22,389,897 5,147,665

-------------------------------------------- ----- ------------- -------------

Statement of Changes in Equity (unaudited)

Share capital Retained profit Total

USD USD USD

Balance at 31 December 2017 31,453,510 35,979,019 67,432,529

-------------------------------------------------------- -------------- ---------------- ------------

Gain for the year - 19,492,492 19,492,492

Total comprehensive income for the year 19,492,492 19,492,492

Transactions with owners in their capacity as owners:

Issue of shares 3,336,664 - 3,336,664

Balance at 31 December 2018 34,790,174 55,471,511 90,261,685

-------------------------------------------------------- -------------- ---------------- ------------

Gain for the period - 16,418,135 16,418,135

Total comprehensive income for the period - 16,418,135 16,418,135

-------------------------------------------------------- -------------- ---------------- ------------

Balance at 30 June 2019 34,790,174 71,889,646 106,679,820

-------------------------------------------------------- -------------- ---------------- ------------

NOTES TO THE FINANCIAL STATEMENTS FOR THE SIX MONTHSED 30 JUNE

2019

1. Company information

TMT Investments Plc ("TMT" or the "Company") is a company

incorporated in Jersey with its registered office at Queensway

House, Hilgrove Street, St Helier, JE1 1ES, Channel Islands.

The Company was incorporated and registered on 30 September 2010

in Jersey under the Companies (Jersey) Law 1991 (as amended) with

registration number 106628 under the name TMT Investments Limited.

The Company obtained consent from the Jersey Financial Services

Commission pursuant to the Control of Borrowing (Jersey) Order 1985

on 30 September 2010. On 1 December 2010 the Company re-registered

as a public company and changed its name to TMT Investments Plc.

The Company's ordinary shares were admitted to trading on the AIM

market of the London Stock Exchange on 1 December 2010.

The memorandum and articles of association of the Company do not

restrict its activities and therefore it has unlimited legal

capacity. The Company's ability to implement its Investment Policy

and achieve its desired returns will be limited by its ability to

identify and acquire suitable investments. Suitable investment

opportunities may not always be readily available.

The Company will seek to make investments in any region of the

world.

Financial statements of the Company are prepared by and approved

by the Directors in accordance with International Financial

Reporting Standards, International Accounting Standards and their

interpretations issued or adopted by the International Accounting

Standards Board as adopted by the European Union ("IFRSs"). The

Company's accounting reference date is 31 December.

2. Summary of significant accounting policies

2.1 Basis of presentation

The condensed consolidated financial statements for the six

months ended 30 June 2019 and 2018 are unaudited and were approved

by the Directors on 16 September 2019. They do not constitute

statutory accounts as defined in section 434 of the Companies Act

2006. The financial statements for the year ended 31 December 2018

were prepared in accordance with International Financial Reporting

Standards as adopted by the EU. The report of the auditor on those

financial statements was unqualified and did not draw attention to

any matters by way of emphasis of matter.

The principal accounting policies applied by the Company in the

preparation of these unaudited financial statements are set out

below and have been applied consistently.

The financial statements have been prepared on a going concern

basis, under the historical cost basis as modified by the fair

value of financial assets at FVTPL, as explained in the accounting

policies below, and in accordance with IFRS. Historical cost is

generally based on the fair value of the consideration given in

exchange for assets.

2.2 Foreign currency translation

(a) Functional and presentation currency

Items included in the financial statements of the Company are

measured in United States Dollars ('US dollars', 'USD' or 'US$'),

which is the Company's functional and presentation currency.

(b) Transactions and balances

Foreign currency transactions are translated into US$ using the

exchange rates prevailing at the dates of the transactions.

Exchange differences arising from the translation at the year-end

exchange rates of monetary assets and liabilities denominated in

foreign currencies are recognised in the statement of comprehensive

income.

Conversation rates, USD

-----------------------------------------------------------

Currency Average rate,

for six months

At 30/06/2019 ended 30/06/2019

----------------- -------------- ------------------

British pounds,

GBP 1.2677 1.2937

Euro, EUR 1.1373 1.1264

--------------------- -------------- ------------------

2.3 New IFRSs and interpretations

The IASB has issued the following standards and interpretations

which have been endorsed by the European Union to be applied to

financial statements with periods commencing on or after the

following dates:

Effective for period beginning on or after

------------------------------ ------------------------------------------

IFRS 9 Financial Instruments 1 January 2018

------- --------------------- ------------------------------------------

IFRS 16 Leases 1 January 2019

------- --------------------- ------------------------------------------

IFRS 16 sets out requirements for recognising and measuring,

presentation and disclosure of leases. The standard provides a

single lessee accounting model, requiring lessees to recognise

assets and liabilities for all leases unless the lease term is 12

months or less or the underlying asset has a low value.

As the lease held by the Company is less than 12 months, the

Company has not processed any transaction adjustments on adopting

IFRS 16. The company recognises the lease payments associated with

these leases as expenses on a straight-line basis over the lease

term.

The comparative information for the period ended 30 June 2018

has been restated to reflect the adoption of IFRS 9 using

retrospective approach.

The following table explains the changes in the treatment of

movements in fair value for the period ended 30 June 2018 in the

Statement of Comprehensive Income.

Original results Restated results

for the year for the year

ended 30/06/2018 ended 30/06/2018

USD USD

Gain attributable to equity shareholders 817,594 11,752,157

Other comprehensive income for

the period:

Change in fair value of available-for-sale 10,934,563 -

financial assets

-------------------------------------------- ------------------ ------------------

Total comprehensive income for

the period 11,752,157 11,752,157

-------------------------------------------- ------------------ ------------------

In addition to the above changes the fair value reserve of

US$57,782,682 was reclassified to Retained Earnings as at 30 June

2018.

3 Gain on investments

For six months ended 30/06/2019 Restated for six months

ended 30/06/2018

USD USD

Gross interest income from convertible notes receivable 12,516 21,232

Amortised costs of convertible notes receivable - (651)

Net interest income from convertible notes receivable 12,516 20,581

Gains on changes in fair value of financial assets at

FVPL 18,922,586 11,731,576

Success fee attributable to consultants (15,601) -

Total gain on investments 18,919,501 11,752,157

-------------------------------------------------------- -------------------------------- ------------------------

4 Segmental analysis

Geographic information

The Company has investments in six principal geographical areas

- USA, Israel, BVI, Estonia, and the United Kingdom.

Non-current financial assets

As at 31/12/2018

United

USA Israel BVI Estonia Kingdom Total

USD USD USD USD USD USD

-------------------- ----------- ---------- ---- ----------- --------- -----------

Equity investments 39,980,857 1,870,183 - 17,094,470 - 58,945,510

Convertible

notes & SAFE's 5,710,434 - - 234,200 - 5,944,634

-------------------- ----------- ---------- ---- ----------- --------- -----------

Total 45,691,291 1,870,183 - 17,328,670 - 64,890,144

-------------------- ----------- ---------- ---- ----------- --------- -----------

As at 30/06/2019

United

USA Israel BVI Estonia Kingdom Total

USD USD USD USD USD USD

-------------------- ----------- ---------- -------- ----------- ---------- -----------

Equity investments 53,260,692 1,852,652 200,000 22,132,548 2,253,607 79,699,499

Convertible

notes & SAFE's 5,710,434 - - 288,224 - 5,998,658

-------------------- ----------- ---------- -------- ----------- ---------- -----------

Total 58,971,126 1,852,652 200,000 22,420,772 2,253,607 85,698,157

-------------------- ----------- ---------- -------- ----------- ---------- -----------

5 Administrative expenses

Administrative expenses include the following amounts:

For six months ended 30/06/2019 For six months ended

30/06/2018

USD USD

--------------------------- -------------------------------- ---------------------

Staff expenses (note 6) 321,842 312,601

Professional fees 144,640 139,875

Legal fees 26,674 22,069

Bank and LSE charges 7,445 15,995

Audit and accounting fees 10,396 11,218

Rent 47,298 47,298

Other expenses 44,002 46,713

Currency exchange loss 1,257 10,374

--------------------------- -------------------------------- ---------------------

603,554 606,143

--------------------------- -------------------------------- ---------------------

6 Staff expenses and Bonuses

For six months ended 30/06/2019 For six months ended 30/06/2018

USD USD

-------------------- -------------------------------- --------------------------------

Directors' fees 93,002 106,361

Wages and salaries 228,840 206,240

321,842 312,601

-------------------- -------------------------------- --------------------------------

Wages and salaries shown above include fees and salaries

relating to the six months ended 30 June. These costs are included

in administrative expenses.

The average number of staff employed (excluding Directors) by

the Company during the six months ended 30 June was 6 (for the year

ended 31 December 2018: 5).

The Directors' fees for the six months ended 30 June 2019 and

2018 were as follows:

For six months ended 30/06/2019 For six months ended

30/06/2018

USD USD

---------------------- -------------------------------- ---------------------

Alexander Selegenev 50,052 62,685

Yuri Mostovoy 24,998 25,000

James Joseph Mullins 12,952 13,676

Petr Lanin 5,000 5,000

---------------------- -------------------------------- ---------------------

93,002 106,361

---------------------- -------------------------------- ---------------------

The Directors' fees shown above are all classified as 'short

term employment benefits' under International Accounting Standard

24. The Directors do not receive any pension contributions or other

benefits.

Key management personnel of the Company are defined as those

persons having authority and responsibility for the planning,

directing and controlling the activities of the Company, directly

or indirectly. Key management of the Company are therefore

considered to be the Directors of the Company. There were no

transactions with the key management, other than their Directors

fees, bonuses and reimbursement of business expenses.

Under the Company's Bonus Plan, subject to achieving minimum

hurdle rate and high watermark conditions in respect of the

Company's NAV, the team receives an annual cash bonus equal to 7.5%

of the net increases in the Company's NAV, adjusted for any changes

in the Company's equity capital resulting from issuance of new

shares, dividends, share buy-backs or similar corporate

transactions in each relevant year. The Company's bonus year runs

from 1 July to 30 June. For the bonus year ended 30 June 2019, the

total amount of bonus accrued was US$2,007,693. The exact

allocation of the accrued bonus is expected to be approved and paid

to the participants of the Company's Bonus Plan shortly after the

publication of this interim report.

7 Net finance income

For six months ended 30/06/2019 For six months ended 30/06/2018

USD USD

Interest income 96,757 3,063

Other financial income 26,202

122,959 3,063

------------------------ -------------------------------- --------------------------------

8 Income tax expense

For six months ended For six months ended 30/06/2018

30/06/2019

USD USD

---------------------- --------------------- --------------------------------

Current taxes

Current year - -

---------------------- --------------------- --------------------------------

Deferred taxes

Deferred income taxes - -

---------------------- --------------------- --------------------------------

- -

---------------------- --------------------- --------------------------------

The Company is incorporated in Jersey. No tax reconciliation

note has been presented as the income tax rate for Jersey companies

is 0%.

9 Gain per share

The calculation of basic gain per share is based upon the net

gain for the six months ended 30 June 2019 attributable to the

ordinary shareholders of US$16,418,135 (for the six months ended 30

June 2018: net gain of US$9,636,826) and the weighted average

number of ordinary shares outstanding calculated as follows:

Gain per share For the six months ended 30/06/2019 Restated for the six months

ended 30/06/2018

------------------------------------------------ ------------------------------------ ----------------------------

Basic gain per share (cents per share) 56.25 33.82

Gain attributable to equity holders of the

entity (USD) 16,418,135 9,636,826

------------------------------------------------ ------------------------------------ ----------------------------

The weighted average number of ordinary shares outstanding

before and after adjustment for the effects of all dilutive

potential ordinary shares calculated as follows:

(in number of shares weighted during For the six months ended 30/06/2019 For the six months ended 30/06/2018

the year outstanding)

---------------------------------------- ------------------------------------ ------------------------------------

Weighted average number of shares in

issue

Ordinary shares 29,185,831 28,493,259

29,185,831 28,493,259

---------------------------------------- ------------------------------------ ------------------------------------

10 Non-current financial assets

At 30 June 2019 At 31 December 2018

USD USD

Financial assets at FVPL:

Investments in equity shares (i)

- unlisted shares 83,039,903 62,285,914

Convertible notes receivable (ii)

- promissory notes 1,458,254 1,404,230

- SAFEs 1,200,000 1,200,000

----------------------------------- ---------------- --------------------

85,698,157 64,890,144

----------------------------------- ---------------- --------------------

Reconciliation of fair value measurements of non-current

financial assets:

Financial assets at FVPL Total

----------------------------------------------- ------------------------------- -------------

Unlisted Convertible

shares notes & SAFE's

USD USD USD

----------------------------------------------- ------------- ---------------- -------------

Balance as at 31 December 2017 57,120,436 9,452,503 66,572,939

------------------------------------------------ ------------- ---------------- -------------

Total gains or losses in 2018:

- changes in fair value 22,974,039 (69,985) 22,904,054

Purchases (including consulting & legal fees) 74,053 934,200 1,008,253

Disposal of investment (carrying value) (25,464,451) (130,651) (25,595,102)

Conversion and other movements 7,581,837 (7,581,837) -

------------------------------------------------ ------------- ---------------- -------------

Balance as at 1 January 2018 62,285,914 2,604,230 64,890,144

------------------------------------------------ ------------- ---------------- -------------

Total gains or losses in 2019:

- changes in fair value 18,868,562 54,024 18,922,586

Purchases (including consulting & legal fees) 2,453,607 - 2,453,607

Disposal of investment (carrying value) (568,180) - (568,180)

Balance as at 30 June 2019 83,039,903 2,658,254 85,698,157

------------------------------------------------ ------------- ---------------- -------------

Financial assets at fair value through profit or loss are

measured at fair value, and changes therein are recognised in

profit or loss.

When measuring the fair value of a financial instrument, the

Company uses market observable data as far as possible, including

relevant transactions during the year or shortly after the year

end, which gives an indication of fair value. The "price of recent

investment" methodology is used mainly for venture capital

investments, and the fair value is derived by reference to the most

recent equity financing round. Fair value change is only recognised

if that round involved a new external investor.

(i) Equity investments as at 30 June 2019:

Investee Date Value Additions Conversions Gain/loss Disposals, Value Equity

company of initial at to equity from from USD at 30 stake

investment 1 Jan investments loan changes Jun 2019, owned

2019, during notes, in fair USD

USD the period, USD value of

USD financial

assets,

USD

--------------- ------------ ----------- ------------ ------------ ----------- ----------- ----------- -------

Unicell 15.09.2011 980,000 - - (14,271) - 965,729 2.36%

DepositPhotos 26.07.2011 10,836,105 - - - - 10,836,105 16.41%

Wanelo 21.11.2011 1,825,596 - - - - 1,825,596 4.69%

Backblaze 24.07.2012 10,533,334 - - 12,668,178 - 23,201,512 11.78%

E2C 15.02.2014 136,781 - - - - 136,781 5.51%

Drippler 01.05.2014 3,260 - - - (3,260) - -

Remot3.it 13.06.2014 791,510 - - - - 791,510 1.68%

Le Tote 21.07.2014 1,997,073 - - - - 1,997,073 1.32%

Anews 25.08.2014 1,000,000 - - - - 1,000,000 9.41%

Klear 01.09.2014 155,000 - - - - 155,000 3.04%

Drupe 02.09.2014 595,142 - - - - 595,142 7.46%

Bolt 15.09.2014 17,094,470 - - 5,038,078 - 22,132,548 1.63%

Pipedrive 30.07.2012 10,257,098 - - - - 10,257,098 2.41%

PandaDoc 11.07.2014 1,233,770 - - 981,348 - 2,215,118 1.76%

The IRApp 16.08.2016 547,972 - 16,948 (564,920) - -

Full Contact 11.01.2018 244,506 - - - - 244,506 0.21%

ScentBird 13.04.2015 3,340,404 - - - - 3,340,404 4.01%

Workiz 16.05.2016 263,878 - - 178,281 - 442,159 2.13%

Vinebox 06.05.2016 450,015 - - - - 450,015 2.41%

19.01.

Hugo 2019 - 200,000 - - - 200,000 2.00%

MEL Science 25.02.2019 - 1,999,992 - - - 1,999,992 4.60%

Healthy

Health 06.06.2019 - 253,615 - - - 253,615 2.55%

Total 62,285,914 2,453,607 - 18,868,562 (568,180) 83,039,903

----------------------------- ----------- ------------ ------------ ----------- ----------- ----------- -------

(ii) Convertible loan notes as at 30 June 2019:

Investee Date of Value at Additions Amortized Conversions Gain/loss Disposals, Value at Term, Interest

company initial 1 Jan to costs, from loan from USD 30 Jun years rate, %

investment 2019, convertible USD notes, USD changes 2019, USD

USD note in fair

investments value of

during the financial

period, USD assets,

USD

------------- ------------ ---------- ------------ ---------- ------------ ---------- ----------- ---------- ------ ---------

Sharethis 26.03.2013 570,030 - - - - - 570,030 5.0 1.09%

KitApps

(Attendify) 10.07.2013 600,000 - - - - - 600,000 1.0 2.00%

eAgronom 31.08.2018 234,200 - - - 54,024 - 288,224 - -

Total 1,404,230 - - - 54,024 - 1,458,254

--------------------------- ---------- ------------ ---------- ------------ ---------- ----------- ---------- ------ ---------

(iii) SAFEs as at 30 June 2019:

Investee Date of initial Value at 1 Jan Additions to Gain/loss from Disposals, USD Value at 30

company investment 2019, convertible changes in Jun 2019, USD

USD note fair value of

investments SAFE

during the investments,

period, USD USD

---------------- ---------------- --------------- -------------- --------------- --------------- ---------------

Spinbackup 17.12.2018 300,000 - - - 300,000

Sixa 28.07.2016 900,000 - - - 900,000

Total 1,200,000 - - - 1,200,000

---------------------------------- --------------- -------------- --------------- --------------- ---------------

11 Trade and other receivables

At 30 June 2019 At 31 December 2018

USD USD

----------------------------------------- ---------------- --------------------

Prepayments 314,977 311,839

Other receivables 264,361 23,401,258

Interest receivable on promissory notes 102,199 89,683

Interest receivable on deposits 17,935 1,615

699,472 23,804,395

----------------------------------------- ---------------- --------------------

12 Cash and cash equivalents

The cash and cash equivalents as at 30 June 2019 include cash on

hand and in banks, deposits, net of outstanding bank overdrafts.

The effective interest rate at 30 June 2019 was 2.60%.

Cash and cash equivalents comprise the following:

At 30 June 2019 At 31 December 2018

USD USD

--------------- ---------------- --------------------

Deposits 8,565,964 1,500,000

Bank balances 13,823,933 1,770,088

--------------- ---------------- --------------------

22,389,897 3,270,088

--------------- ---------------- --------------------

The following table represents an analysis of cash and

equivalents by rating agency designation based on Fitch rating or

their equivalent:

At 30 June 2019 At 31 December 2018

USD USD

--------------- ---------------- --------------------

Bank balances

BBB+ rating 13,823,933 1,770,088

--------------- ---------------- --------------------

13,823,933 1,770,088

--------------- ---------------- --------------------

Deposits

BBB+ rating 8,565,964 1,500,000

--------------- ---------------- --------------------

8,565,964 1,500,000

--------------- ---------------- --------------------

22,389,897 3,270,088

-------------------------------- --------------------

13 Trade and other payables

At 30 June 2019 At 31 December 2018

USD USD

--------------------------- ---------------- --------------------

Salaries payable 10,933 162,500

Directors' fees payable 28,005 9,183

Bonus payable 19,016 720,632

Trade payables 30,088 789,265

Other current liabilities 59 100

Accrued expenses 11,912 21,262

Accrued bonus pool 2,007,693 -

2,107,706 1,702,942

--------------------------- ---------------- --------------------

14 Share capital

On 30 June 2019 the Company had an authorised share capital of

unlimited shares of no par value and had issued share capital

of:

At 30 June 2019 At 31 December 2018

USD USD

----------------------------- ----------------- --------------------

Share capital 34,790,174 34,790,174

Issued capital comprises: Number Number

Fully paid ordinary shares 29,185,831 29,185,831

----------------------------- ----------------- --------------------

Number of shares Share capital,

USD

----------------------------- ----------------- ----------------------

Balance at 31 December 2018 29,185,831 27,744,962

Issue of shares - 1,440,869

----------------------------- ----------------- ----------------------

Balance at 30 June 2019 29,185,831 29,185,831

----------------------------- ----------------- ----------------------

15 Related party transactions

Since May 2012, TMT's Moscow-based staff have been located in an

office that belongs to a company ("Orgtekhnika") controlled by Mr.

Alexander Morgulchik and Mr. German Kaplun, the Company's senior

managers. German Kaplun also owns 18.33% of the issued share

capital of TMT. Thus, Orgtekhnika is considered a related party.

Together with other related expenses (support personnel, company

car, security services, etc.), the total office rent costs to TMT

from 1 April 2017 has been US$7,883 per month.

The Company's Directors receive fees and bonuses from the

Company, details of which can be found in Note 6.

16 Subsequent events

As announced on 9 July 2019, following the Company's

significantly profitable cash exit from Wrike, Inc., the Company's

Board of Directors declared a special dividend to the holders of

the Company's ordinary shares for a total amount of US$5,837,166,

or US$0.20 per ordinary share. The dividend was paid on 31 July

2019.

As announced on 22 August 2019, the Company has made the

following new investments in July and August 2019:

-- US$350,000 in Cheetah X, Inc., the developer of the electric scooter sharing platform Go-X (www.goxapp.com). Go-X is already operating in San Francisco, San Diego, Houston and Yuma, Arizona;

-- US$1.5 million in Scalarr, Inc., a machine learning-based

fraud detection solution focused on the advertising market

(www.scalarr.io); and

-- US$1.0 million in Accern Corporation, an AI-based data design

company that helps automate research and data analysis processes

within organisations (www.accern.com). Accern's clients include

IBM, MetLIfe, Credit Suisse and Moody's, as well as other Fortune

500 companies.

In addition, in September 2019 the Company invested US$1,200,000

in Rocket Games Entertainment LLC, the owner of Legionfarm, an

online game coaching service that helps gamers master complex games

by hiring professional players (www.legionfarm.com).

The proceeds from the Unicell disposal were received by the

Company in August 2019.

The proceeds from the partial Backblaze disposal were received

by the Company in September 2019.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR UNSNRKBAKAAR

(END) Dow Jones Newswires

September 17, 2019 02:00 ET (06:00 GMT)

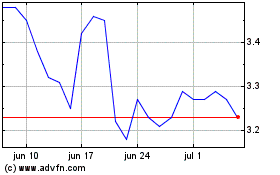

Tmt Investments (LSE:TMT)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Tmt Investments (LSE:TMT)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024