TIDMBCPT

To: RNS

Date: 17 September 2019

From: BMO Commercial Property Trust Limited (formerly F&C

Commercial Property Trust Limited)

LEI: 213800A2B1H4ULF3K397

(Classified Regulated Information, under DTR 6 Annex 1 Section 1.2)

Interim Report for the Period ended 30 June 2019

Highlights

* Share price total return of -8.0 per cent for the six months*

* -0.4 per cent net asset value total return*

* Maintained annualised dividend at 6.0 pence per share giving a yield of 5.4

per cent on the period end share price*

* See Alternative Performance Measures

Chairman's Statement

Performance for the period

The first six months of 2019 has seen continued uncertainty surrounding

commercial property markets in the UK, with the trading environment for

retailers and the potential impact of Brexit causing particular concern. This

has been challenging for the listed real estate sector with many of the large

cap companies trading at significant discounts to their Net Asset Values

('NAV's). Against this backdrop, the Company's share price total return to

shareholders over the six-months to 30 June 2019 was -8.0 per cent. The share

price at the period-end was 111.8p, representing a discount of 18.0 per cent to

the NAV per share of 136.3p.

The NAV total return over the six months was -0.4 per cent. The following table

provides an analysis of the movement in the NAV per share for the period:

Pence

NAV per share as at 31 December 2018 139.8

Unrealised decrease in valuation of direct property (2.9)

portfolio

Other net revenue 2.4

Dividends paid (3.0)

NAV per share as at 30 June 2019 136.3

The total return from the underlying portfolio was 0.5 per cent, compared with

a total return of 0.9 per cent from the MSCI Quarterly Property Universe. The

Income return from the portfolio over the period was 2.1 per cent, offset by

negative capital returns of -1.7 per cent. Unsurprisingly the weakest sector in

the MSCI Quarterly Universe was retail with the strongest returns again coming

from industrials, driven by rental growth and further modest yield compression.

One of our priorities has been the selective disposal of assets which were felt

to have limited future growth prospects and we were delighted to complete the

sales of Thames Valley Park 1, Thames Valley Park 2 and Building A, Watchmoor

Park, Camberley during the period. We will look to recycle some of this capital

into a number of the advanced asset management opportunities the Manager is

currently working on and where we expect the outcomes will deliver sustainable,

long-term income and support future fund performance.

Another current priority is to replace the income lost or at risk at both

Newbury Retail Park in Newbury and Sears Retail Park in Solihull. We have

already completed a large letting to Lidl at Newbury for a 25-year lease with a

break option at year 20. Beyond this, there are significant ongoing

negotiations at both Parks and we hope to report on these at a later date.

St. Christopher's Place continues to enjoy strong occupier demand although this

popular West End estate has not been immune to the current challenges facing

the retail sector and we expect rental growth may be muted here in the

short-term.

Borrowings

The Group's available borrowings comprise a GBP260 million term loan with Legal &

General Pensions Limited, maturing on 31 December 2024 and a GBP50 million term

loan facility and an undrawn GBP50 million revolving credit facility, both with

Barclays and available until June 2021. The Group's net gearing was 20.4 per

cent at the end of the period and the weighted average interest rate on total

current borrowings is 3.3 per cent.

Dividends and Dividend Cover

Monthly interim dividends of 0.5p per share continued during the period,

maintaining the annual dividend of 6.0p per share paid since 2006 and providing

a dividend yield of 5.4 per cent based on the period-end share price. Barring

unforeseen circumstances, your Board intends that dividends will continue to be

paid monthly at the same rate.

The Company's level of dividend cover for the period was 81.7 per cent,

slightly higher than the equivalent period last year (79.2 per cent). There has

been a small fall in rental income compared with the same period last year due

to the sale of the property at Thames Valley Park 2 and to the loss of income

at Solihull and Newbury. This was more than compensated for by a fall in the

level of taxation payable and a reduction in expenses, where a one-off

surrender premium was paid in 2018.

REIT Conversion

Shareholders voted in favour of the REIT proposals at an extraordinary general

meeting held on 30 May 2019 and the Group entered the UK REIT regime on 3 June

2019. The adoption of REIT status by the Group will alter the shareholders' tax

positions in respect of the receipt of distributions under the REIT regime, as

the majority of the distributions from the Company will be property income

distributions. The first distribution that the Company will make under the REIT

regime will relate to profits earned from June 2019. The amount and payment

date of such property income distribution will be announced in October 2019.

Board Composition

Having served nine years on the Board, Chris Russell stepped down as Chairman

of the Company and retired from the Board at the annual general meeting on 30

May 2019. I became Chairman from that date and Paul Marcuse took on the role of

Senior Independent Director. Chris joined the Board in 2009 and became Chairman

in 2011. He excelled in this role and I would like to thank him for his

significant contribution and leadership over the years.

Following the approval of the REIT conversion proposals, Peter Cornell and

David Preston, both Guernsey directors, also stood down from the Board with

effect from 30 May 2019. I'd like to thank them too, at the same time welcoming

Linda Wilding. Linda is UK based and joined the Board on 3 June 2019.

Following these changes, the Board now consists of five Directors, three male

and two female, four of whom are based in the UK and one in Guernsey.

Outlook

The property market continues to deliver positive total return, but the pace

has slowed and investment activity has weakened. The market is likely to

encounter continued headwinds related to Brexit and its political and economic

ramifications. Slower economic growth and political uncertainties

internationally are also affecting sentiment. However, post Brexit, if there is

some easing in fiscal policy and interest rates are kept low, as the market

expects, then this should provide some support for property, particularly from

investors seeking a higher-yielding alternative to gilts.

Total returns are expected to be low single-digit and will be driven by income,

with well-specified and well-let assets in established locations likely to

out-perform.

Notwithstanding the short-term pressures in the retail sector, the Company has

a well-positioned and resilient portfolio with exciting opportunities across

many sectors to add value and deliver sustainable long-term rental income. Our

efforts continue to be focused on delivering these over the months ahead.

Martin Moore

Chairman

Performance Summary

Half year

ended 30 June

2019

Total Returns for the period *

Net asset value per share (0.4)%

Ordinary Share price (8.0)%

Portfolio 0.5%

MSCI UK Quarterly Property Universe 0.9%

FTSE All-Share Index 13.0%

Half year Year ended 31

ended 30 June December 2018 % change

2019

Capital Values

Total assets less current liabilities (GBP'000) 1,400,346 1,427,310 (1.9)

Net asset value per share 136.3p 139.8p (2.5)

Ordinary Share price 111.8p 124.6p (10.3)

FTSE All-Share Index 4,056.88 3,675.06 10.4

Discount to net asset value per share* (18.0)% (10.9)%

Net Gearing * 20.4% 21.2%

Half year Half year

ended 30 June ended 30 June

2019 2018

Earnings and Dividends

Earnings per Ordinary Share (0.4)p 5.0p

Dividends per Ordinary Share 3.0p 3.0p

Annualised dividend yield * 5.4% 4.0%

Sources: BMO Investment Business, MSCI Inc and Refinitiv Eikon

* See Alternative Performance Measures

Managers' Review

Property highlights over the period

* Six-month total return of 0.5 per cent versus the MSCI UK Quarterly

Property Universe ('MSCI') return of 0.9 per cent.

* Completed the sales of Thames Valley Park 1 & 2 and Watchmoor Park Building

A, as part of the strategic office sales programme.

* Signed new lease agreements to Lidl and Hobbycraft at Newbury Retail Park

and made good progress in attracting new retailers to both Newbury and

Solihull retail parks.

* Completed the lease to Shore Capital who took the 4th and 5th floors at

Cassini House, London SW1.

Property Market Review

The market total return for the six months to 30 June 2019, as measured by the

MSCI UK Quarterly Property Universe ('MSCI') was 0.9 per cent. Returns,

although positive, are moderating, with capital values falling by 1.3 per cent

and income returns of 2.2 per cent. Rental growth was -0.2 per cent at the

all-property level, although the fall was largely attributable to problems in

the retail market, where rents fell by 1.9 per cent.

Performance was led by a 3.4 per cent total return for industrials.

Alternatives (such as hotels and student accommodation) delivered 2.6 per cent,

with offices returning 2.1 per cent and retail the weakest sector at -2.4 per

cent.

Key Benchmark Metrics - All Property

Jan-June Jan-June

2019 2018

% %

Total Returns 0.9 3.7

Income Return 2.2 2.2

Capital Return (1.3) 1.5

Open Market Rental Value Growth (0.2) 0.5

Initial Yield 4.6 4.5

Equivalent Yield 5.5 5.5

Source: MSCI Inc

The UK economy saw modest growth over the period. Monetary policy and interest

rates were unchanged although gilt yields continued to fall, finishing the

period below 1.0 per cent. Investor sentiment was affected by growing political

uncertainty involving the lack of agreement in Brexit negotiations, which looks

set to continue as we enter the autumn. The weakening in global growth

prospects and the advance of protectionism globally are also areas of concern.

This uncertainty has caused a sharp drop in investment activity across all

sectors. Net investment from overseas buyers was still positive, demonstrating

the continued attraction of UK commercial real estate. Local authorities were

also net purchasers of property, whilst institutions were marginal net sellers

during the period, as were listed and unlisted property companies.

CBRE market data showed yields moving higher across most parts of the retail

market, with office and industrial yields broadly stable. There was some yield

compression in the alternatives space, notably for student accommodation, and

for properties secured on long leases with inflation linked uplifts, where

investor appetite remains strong. The all-property initial yield moved higher

during the period, leading to some widening in the yield gap between property

and ten-year gilts. Property, measured on this basis, looks fairly priced in

relation to the average margin over the longer-term.

The occupational market has been less affected, but not immune, to the

political and economic climate. Offices saw 0.5 per cent rental growth and

industrials 1.4 per cent in the six-month period. Occupier most affected appear

to be large multi-national corporates with pan-European presence who are

generally waiting until after Brexit before making any long-term strategic

decisions.

The structural problems and challenges in the retail sector have continued.

Although central London shops delivered a positive total return, performance

has slipped compared with the same period a year ago. Most other parts of the

retail market recorded a negative total return, with shopping centres and

retail warehousing being particularly weak. The central London office market

has remained resilient despite Brexit uncertainty, with higher than average

occupancy rates and continued rental growth. Overall, property performance was

driven by the strength in the industrials market with both distribution

warehousing and standard industrials outperforming the all-property average.

Valuation and Portfolio

Total Portfolio Performance

Year ended

30 June 31 December

2019 2018

No of properties 36 38

Valuation (GBP'000) 1,383,125 1,430,190

Average Lot Size (GBP'm) 38.4 37.6

Portfolio MSCI

Six months to 30 June 2019 (%) (%)

Portfolio Capital Return* (1.7) (1.3)

Portfolio Income Return* 2.1 2.2

Portfolio Total Return* 0.5 0.9

Source: BMO REP Asset Management plc, MSCI Inc

* See Alternative Performance Measures

The total return from the portfolio over the period was 0.5 per cent compared

with the MSCI return of 0.9 per cent. The Company's underperformance at

portfolio level over the period has been driven by valuation movements of the

two large retail warehouse parks, with the valuation of Newbury falling by 10.2

per cent and Solihull falling by 2.2 per cent. Despite the challenges faced in

the sector the portfolio's retail total return outperformed MSCI which was

helped by the fact that the Company doesn't hold any shopping centres which was

the weakest performing retail sub-sector.

The office portfolio also outperformed MSCI with a 2.3 per cent total return

versus 2.1 per cent, although industrials were lower at 1.3 per cent versus 3.4

per cent, predominantly owing to a relatively quiet period of asset management.

Geographical Analysis (% of total property portfolio)

30 June 2019

(%)

South East 21.6

London - West End 36.0

Eastern 2.2

Midlands 11.9

Scotland 12.6

North West 11.8

Rest of London 1.5

South West 2.4

Source: BMO REP Asset Management plc

Sector Analysis (% of total property portfolio)

30 June 2019

(%)

Offices 39.5

Retail 22.4

Retail Warehouses 10.6

Industrial 18.2

Alternative 9.3

Source: BMO REP Asset Management plc

Income Analysis

The portfolio continues to benefit from a resilient and secure income stream.

We have reduced the void rate to 5.0 per cent (31 December 2018: 8.5 per cent)

through a combination of asset management initiatives, such as the letting of

two floors at Cassini House, London and the sale of non-core assets which were

largely vacant. Other opportunities are in hand to reduce the void level

further.

Lease Expiry Profile

At 30 June 2019 the weighted average lease length for the portfolio, assuming

all break options are exercised, was 6.8 years

% of leases expiring (weighted by rental 30 June 2019 31 December 2018

value) (%) (%)

0 - 5 years 45.8 44.4

5 - 10 years 33.5 30.2

10 - 15 years 14.9 17.1

15 - 25 years 5.8 8.3

Source: BMO REP Asset Management plc

Covenant Strength (% of income by risk bands)

30 June 2019

(%)

Unscored and ineligible 6.0

Maximum 9.9

High 1.7

Medium to High 3.1

Low to Medium 2.0

Low 18.2

Negligible and Government 59.1

Source: IRIS Report, MSCI Inc

Retail

It has been a busy period for the Company with a number of significant retail

leases either completed or in negotiation. The challenges faced by UK retailers

have been well documented and the Company experienced a concentrated period of

defaults or Company Voluntary Arrangements (CVAs) on its two large retail parks

(Newbury and Solihull) during the middle part of 2018.

Newbury

We have recently completed an important letting on the retail park to Lidl, who

signed an agreement for a 25-year lease with CPI linked reviews (break at year

20) at a rent equating to GBP23.00 per square foot to occupy the majority of the

former Homebase unit. Landlord works have commenced, and Lidl are expected to

open for trade in early 2020. This follows the letting to Hobbycraft at Unit 8A

(GBP215,578 per annum for 10 years) replacing Poundworld, who went into

administration last year. We are also close to exchanging an agreement with

another large retailer to occupy part of the former Mothercare store. These

lettings demonstrate the resilience of the park and its attractiveness to

retailers and shoppers alike. There remain two small units to let at the park

and we hope to put these under offer shortly.

Solihull

We are now under offer to a major UK retailer to occupy the former Homebase

store and hope to exchange a conditional agreement for lease shortly. The store

was vacated in February 2019 and will require significant capital-investment in

return for a long lease commitment. The new store will be transformational for

the park and, like Newbury, demonstrates that quality assets can still attract

desirable retailers for whom physical real estate remains a key part of their

long-term sales strategy.

St Christopher's Place

We believe that the long-term future of physical retail lies in experience led

"destination" retailing, be that food and beverage (F&B) or traditional

retailing. This is core to the strategy for St Christopher's Place, which is

the principal F&B destination for the area around the Bond Street/Oxford Street

interchange.

Our asset management strategy for the mixed-use estate continues to deliver

income growth through refurbishment, selective re-lettings, and the enhancement

of the F&B offer on James Street. The residential element of the estate remains

well occupied and progress has been made in letting recently refurbished office

space, most notably to Leica Camera Ltd at 6-8 James Street on a 10-year lease.

We have recently exchanged a lease to steak restaurant Flat Iron at 42-44 James

Street, starting at GBP240,000 per annum on a 15-year lease. This follows the

lettings to Harry's Bar, Patty & Bun and Bone Daddies which have proved popular

since opening.

The estate remains a continuing source of asset management opportunity to

protect and enhance income.

There are five initiatives in progress or recently completed, with a further

six that could be pursued over the next 12-24 months; a number of these

requiring planning permission and redevelopment. We are carefully managing the

timing of projects to ensure they are delivered to market at the optimum time

to capture the most attractive lease terms possible. We are supportive of the

ongoing works being considered by the New West End Company to enhance the

pedestrian experience on and surrounding Oxford Street and are optimistic about

the benefits following the opening of the Bond Street Elizabeth Line station

(Crossrail), currently scheduled for late 2020 / early 2021.

Office

There has been progress and success with the strategic sales program to dispose

of non-income producing assets with challenging re-letting prospects. The

largest of these, Thames Valley Park One and Thames Valley Park Two, exchanged

in December 2018 and completed in January 2019 at a combined sale price of GBP

24.5 million. This sale alone removed 103,900 sq. ft. of vacant office space

from the portfolio, which would have required around GBP8 million of reinvestment

to undertake refurbishment. We prefer to focus capital expenditure on

opportunities that provide greater prospects of success for the Company. In

April, Building A, Watchmoor Park, Camberley, sold for a net price of GBP3.94

million following the sale of Building B last year.

In March, two more floors at the recently refurbished Cassini House, London SW1

were let. Shore Capital took the 4th and 5th floors at a headline rent of GBP105

per sq. ft. for 10 years (with a tenant break option at the end of year 5). The

letting was in line with the valuers estimated rental value (ERV) and has had

an accretive impact on valuation. There is a strong level of occupier interest

in the remaining un-let floor and this will complete the leasing program for

the asset.

We have signed two new tenants at Building C, Watchmoor Park in Camberley in

advance of Novartis vacating the building in 2020. The new rents achieved are

at a headline of GBP22.50 per sq. ft., reflecting a significant uplift from the

current passing rent of GBP14.00 per sq. ft. At Edinburgh Park, Diageo have now

taken possession of their new Scottish headquarters at Ness & Nevis House

following a significant GBP6.5m refurbishment by the Company. Diageo are

currently fitting out their offices and aim to start operating from the

building in November 2019 on a 16-year lease (break at year 10) at a rent of GBP

21.00 per square foot. Over the summer, we have also let two further floors at

7 Birchin Lane, EC3, where all office accommodation is now fully occupied at

the time of writing. The 5-yearly rent reviews of all properties at Prime Four

in Aberdeen have completed at 3 per cent per annum compounded.

Industrial & logistics

The Company's industrial portfolio is characterised by secure single-let

logistics assets. Owing to the stable nature of the income, no major lease

events occurred over the period.

Last year we acquired Hurricane 47, Estuary Business Park, Liverpool (a 47,500

sq. ft. logistics unit) for GBP3.995 million and are in advance discussions with

a number of potential occupiers at rents that exceed the original underwrite.

The purchase also included an adjoining 3.6-acre site for GBP1.080 million with

the Company entering into an agreement to fund a second warehouse for an

additional sum of GBP3.382 million. Works are likely to start on this in the

second half of 2019 with completion in 2020.

The industrial market continues to see solid rental growth for existing quality

assets and this was demonstrated by the recent rent review to Syncreon at 6A

Hams Hall, which we settled at GBP6.25 per sq. ft. reflecting a notable uplift

from the previous passing rent of GBP5.57 per sq. ft.

In July 2019, we successfully completed the sale of phase 1 of the former

Ozalid Works site in Colchester to Persimmon Homes which had been conditional

upon them securing a revised planning consent and agreeing the 'Section 106'

obligations. The sale of phase 2 will now complete in July 2020, exactly 12

months after the sale of phase 1, which is an excellent result for the Company,

allowing us to dispose of an obsolete light-industrial park for above

valuation. We can now focus our resources on the neighbouring Cowdray Centre

Trade Park, where we have recently submitted a planning application to

construct a new terrace of trade units.

Alternative property sector

Following the re-classification of sector weightings at the end of 2018 (as

highlighted in the 2018 Annual Report) the Company's weighting to alternatives

is c. 9 per cent. The Company's exposure relates to the purpose-built student

accommodation block in Winchester, the residential properties within St

Christopher's Place, and the leisure units at Wimbledon Broadway, which

comprise an Odeon Cinema and Nuffield Health gym. The student accommodation

block continues to perform well, driven by the annual RPI-linked rent reviews.

Outlook

Investment volumes have fallen by almost 50 per cent in the first half of 2019

compared to the same period last year, following the uncertainty that crept in

at the end of 2018. The second half of 2019 looks set to be dominated by the

potential economic and political ramifications surrounding Brexit as well as

the nervousness around retail assets. Retail values have fallen steadily over

the past three quarters, and we expect this to continue throughout 2019 and

2020 as rents are rebased, yields find their new longer-term discounts and

occupier woes continue for many. The rise of the CVA has had a lasting effect

on the risk adjusted returns required from retail assets and unless the

Insolvency Act revises how CVA's can be applied this is unlikely to change.

Therefore, the importance of quality core assets cannot be underestimated.

Despite the drop off in activity, values in all sectors except for retail have

held up relatively well, particularly at the prime end of the market. Yields

for secondary and tertiary assets have moved out marginally after the highly

bullish market of early 2018.

There may be a 'bounce' in investment and letting activity following Brexit,

but values are likely to remain high compared to long-term levels and we

consider it unlikely for pricing to increase significantly. Lending remains

constrained the expected pressure on commercial property yields from future

increases in interest rates is likely to curtail any medium-term capital

growth.

UK commercial real estate is expected to produce positive returns, but the

performance will remain muted in the short to medium term compared to long-term

values and retail will be a notable drag. Despite this, UK commercial property

will likely continue to offer an attractive level of income and the

opportunities offered by demographic and technological change will increase in

significance as the economy adapts to the post-Brexit world.

The Company continues to look at quality assets in the industrial, alternative

and regional office sectors and remains focused on long-term value creation but

will remain highly selective until we see better value in the market. The

current uncertain economic and political climate serves to reinforce the

Manager's strategy of investing resource and capital into the existing assets;

to protect, enhance and sustain income for the longer term. We have enjoyed

recent successes with many more opportunities to pursue over the coming months.

Richard Kirby and Matthew Howard

Fund Managers

BMO REP Asset Management plc

Responsible Property Investment

Highlights for the period to 30 June 2019

The Company has continued to advance the implementation of its Responsible

Property Investment ('RPI') Strategy over the period with material progress

being made in a number of key areas.

* Achieved an overall score of 68 in the 2019 GRESB (Global Real Estate

Sustainability Benchmark) survey, the 21-point improvement representing a

44.7% increase over the previous year's count and enabling the Company to

obtain two green star status.

* Compared with the six-month period to 30 June 2018, the Company has

realised:

+ a 0.4% reduction in like-for-like energy consumption

+ a 14.7% reduction in absolute energy consumption

+ a 5.7% like-for-like reduction in carbon emissions

+ a 20% absolute reduction in carbon emissions

+ a 6kWhe/m2 reduction in energy intensity

+ a 1% reduction in like-for-like water consumption

+ an 11% reduction in absolute water consumption

+ a 0.04m3/m2 reduction in water intensity

* Launched a major exercise to assess the exposure of the portfolio to

physical climate risks through scenario-based analysis.

* The Company attained an A rating in the GRESB Public Disclosure assessment

representing the highest level of transparency for disclosure of ESG

related information.

* Following submission to the minimum tier of the CDP climate change module

in 2018, the Company submitted to the full tier in 2019 and expects to

receive a rating by the end of this calendar year.

A considerable degree of reduction in absolute energy consumption and

associated carbon emissions has been realised through the disposal of several

property assets. In contrast, the reduction in like-for-like energy consumption

has been tempered by increased demand driven by key property refurbishments

undertaken by the Company, as well as increased demands on landlord central

services from occupiers scaling up operations following occupation. Against a

2016 baseline the reduction in like-for-like energy intensity currently equates

to 14%. The Company's Property Manager continues its efforts to identify and

implement further energy efficiency opportunities across its directly managed

properties. Water consumption reduction and the collection and finessing of

waste data remain on target.

The distribution of Energy Performance Certificate (EPC) ratings remains

broadly unchanged across the portfolio taking certificate expiry and renewal

into account. The number of 'C' rated demises has fallen due to property sales.

Using the desktop flood risk assessments undertaken in 2018, the overall flood

risk profile of the portfolio has marginally improved on account of property

disposals.

The Company continues to monitor its tenant mix as part of its commitment to

minimising leasing exposure to organisations connected to the production,

storage, distribution or use of Controversial Weapons*. At the period ending 30

June 2019 zero per cent of rental income was attributable to organisations that

appear on the exclusion lists managed by BMO Global Asset Management.

* Including cluster munitions, anti-personnel mines and biochemical weapons as

covered by the 1972 Biological and Toxic Weapons Convention, the 1997 Chemical

Weapons Convention, the 1999 Anti-Personnel Mine Ban Convention, and the 2008

Convention on Cluster Munitions

BMO Commercial Property Trust Limited

Condensed Consolidated Statement of Comprehensive Income (unaudited)

for the six months to 30 June 2019

Notes Six months Six months Year to

to 30 June to 30 June 31 December

2019 2018 2018*

GBP'000 GBP'000 GBP'000

Revenue

Rental income 31,938 32,638 64,903

Other income - - 1,483

Total revenue 31,938 32,638 66,386

Gains / (losses) on investments properties

Unrealised (losses)/gains on revaluation of 5 (22,593) 20,971 (6,171)

investment properties

(Loss)/gain on sale of investment properties 5 (316) - 2,613

realised

Total income 9,029 53,609 62,828

Expenditure

Investment management fee (3,716) (3,876) (7,823)

Other expenses 3 (3,214) (3,461) (6,191)

Total expenditure (6,930) (7,337) (14,014)

Operating profit before finance costs and taxation 2,099 46,272 48,814

Net finance costs

Interest receivable 1 6 6

Finance costs (5,445) (5,450) (10,912)

(5,444) (5,444) (10,906)

(Loss) / profit before taxation (3,345) 40,828 37,908

Taxation 17 (871) (1,510)

(Loss) / profit for the period (3,328) 39,957 36,398

Other comprehensive income

Items that are or may be reclassified subsequently

to profit

or loss

Movement in fair value of effective interest rate (350) 315 362

swap

Total comprehensive income for the period (3,678) 40,272 36,760

Basic and diluted earnings per share 4 (0.4)p 5.0p 4.6p

All of the profit and total comprehensive income for the period is attributable

to the owners of the Group.

All items in the above statement derive from continuing operations.

* These figures are audited.

BMO Commercial Property Trust Limited

Condensed Consolidated Balance Sheet (unaudited)

as at 30 June 2019

Notes 30 June 30 June 31 Dec

2019 2018 2018*

GBP'000 GBP'000 GBP'000

Non-current assets

Investment properties 5 1,361,685 1,429,277 1,384,856

Trade and other receivables 20,204 19,394 19,344

Interest rate swap - 55 102

1,381,889 1,448,726 1,404,302

Current assets

Investment properties held for sale - - 23,562

Trade and other receivables 5,979 5,067 6,630

Cash and cash equivalents 29,954 19,933 10,127

35,933 25,000 40,319

Total assets 1,417,822 1,473,726 1,444,621

Current liabilities

Trade and other payables (17,389) (17,608) (16,282)

Taxation payable (87) (1,384) (1,029)

(17,476) (18,992) (17,311)

Non-current liabilities

Trade and other payables (2,118) (1,947) (1,847)

Interest-bearing loans (308,191) (307,846) (308,015)

Interest rate swap (248) - -

(310,557) (309,793) (309,862)

Total liabilities (328,033) (328,785) (327,173)

Net assets 1,089,789 1,144,941 1,117,448

Represented by:

Share capital 6 7,994 7,994 7,994

Special reserves 589,593 589,593 589,593

Capital reserves 389,036 436,474 411,945

Hedging reserve (248) 55 102

Revenue reserve 103,414 110,825 107,814

Equity shareholders' funds 1,089,789 1,144,941 1,117,448

Net asset value per share 7 136.3p 143.2p 139.8p

* These figures are audited.

BMO Commercial Property Trust Limited

Condensed Consolidated Statement of Changes in Equity (unaudited)

for the six months to 30 June 2019

Share Special Capital Hedging Revenue

Capital Reserves Reserves Reserve Reserve Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Notes

At 1 January 7,994 589,593 411,945 102 107,814 1,117,448

2019

Total

comprehensive

income for the

period

Loss for the - - - - (3,328) (3,328)

period

Movement in fair

value of

interest rate - - - (350) - (350)

swap

Transfer in

respect of

unrealised

losses on 5 - - (22,593) - 22,593 -

investment

properties

Loss on sale of

investment

properties 5 - - (316) - 316 -

realised

Total

comprehensive

income for the

period - - (22,909) (350) 19,581 (3,678)

Transactions

with owners of

the Company

recognised

directly in

equity

Dividends paid 2 - - - - (23,981) (23,981)

At 30 June 2019 7,994 589,593 389,036 (248) 103,414 1,089,789

BMO Commercial Property Trust Limited

Condensed Consolidated Statement of Changes in Equity (unaudited)

for the six months to 30 June 2018

Share Special Capital Hedging Revenue

Capital Reserves Reserves Reserve Reserve Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Notes

At 1 January 7,994 589,593 415,503 (260) 115,820 1,128,650

2018

Total

comprehensive

income for the

period

Profit for the - - - - 39,957 39,957

period

Movement in fair

value of

interest rate - - - 315 - 315

swap

Transfer in

respect of

unrealised gains

on investment 5 - - 20,971 - (20,971) -

properties

Total

comprehensive

income for the

period - - 20,971 315 18,986 40,272

Transactions

with owners of

the Company

recognised

directly in

equity

Dividends paid 2 - - - - (23,981) (23,981)

At 30 June 2018 7,994 589,593 436,474 55 110,825 1,144,941

BMO Commercial Property Trust Limited

Condensed Consolidated Statement of Changes in Equity

for the year to 31 December 2018*

Share Special Capital Hedging Revenue

Capital Reserves Reserves Reserve Reserve Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Notes

At 1 January 2018 7,994 589,593 415,503 (260) 115,820 1,128,650

Total

comprehensive

income for the

year

Profit for the - - - - 36,398 36,398

year

Movement in fair

value of interest - - - 362 - 362

rate swaps

Transfer in

respect of

unrealised losses 5 - - (6,171) - 6,171 -

on investment

properties

Gains on sale of

investment

properties 5 - - 2,613 - (2,613) -

realised

Total

comprehensive - - (3,558) 362 39,956 36,760

income for the

year

Transactions with

owners of the

Company recognised

directly in equity

Dividends paid 2 - - - - (47,962) (47,962)

At 31 December 7,994 589,593 411,945 102 107,814 1,117,448

2018

* These figures are audited.

BMO Commercial Property Trust Limited

Condensed Consolidated Statement of Cash Flows (unaudited)

for the six months to 30 June 2019

Six months Six months Year to

to 30 June to 30 June 31 December

Notes 2019 2018 2018*

GBP'000 GBP'000 GBP'000

Cash flows from operating activities

(Loss)/profit for the period before taxation (3,345) 40,828 37,908

Adjustments for:

Finance costs 5,445 5,450 10,912

Interest receivable (1) (6) (6)

Unrealised losses/(gains) on revaluation of 5 22,593 (20,971) 6,171

investment properties

Losses/(gains) on sale of investment properties 316 - (2,613)

realised

Increase in operating trade and other receivables (260) (490) (2,054)

Decrease/(increase) in operating trade and other 1,393 (872) (2,317)

payables

Cash generated from operations 26,141 23,939 48,001

Interest received 1 6 6

Interest and bank fees paid (5,320) (5,303) (10,551)

Taxation paid (918) (227) (1,220)

(6,237) (5,524) (11,765)

Net cash inflow from operating activities 19,904 18,415 36,236

Cash flows from investing activities

Sale of investment properties 5 28,440 - 5,100

Purchase of investment properties 5 - (5,777) (5,754)

Capital expenditure of investment properties 5 (4,536) (3,880) (12,649)

Net cash inflow/(outflow) from investing 23,904 (9,657) (13,303)

activities

Cash flows from financing activities

Dividends paid 2 (23,981) (23,981) (47,962)

Net cash outflow from financing activities (23,981) (23,981) (47,962)

Net increase/(decrease) in cash and cash 19,827 (15,223) (25,029)

equivalents

Opening cash and cash equivalents 10,127 35,156 35,156

Closing cash and cash equivalents 29,954 19,933 10,127

* These figures are audited

BMO Commercial Property Trust Limited

Notes to the Consolidated Financial Statements

for the six months to 30 June 2019

1. General information and basis of preparation

The condensed consolidated financial statements have been prepared in

accordance with the Disclosure Guidance and Transparency Rules of the United

Kingdom Financial Conduct Authority and IAS 34 'Interim Financial Reporting'.

The condensed consolidated financial statements do not include all of the

information required for a complete set of IFRS financial statements and should

be read in conjunction with the consolidated financial statements of the Group

for the year ended 31 December 2018, which were prepared under full IFRS as

adopted by the European Union requirements. The accounting policies used in the

preparation of the condensed consolidated financial statements are consistent

with those of the consolidated financial statements of the Group for the year

ended 31 December 2018. The Group's entry to UK REIT Regime was effective from

3 June 2019. The Group's rental profits arising from both income and capital

gains are exempt from UK corporation tax from that date, subject to the Group's

continuing compliance with the UK REIT rules. These condensed interim financial

statements have been reviewed, not audited.

After making enquiries, and bearing in mind the nature

of the Company's business and assets, the Directors consider that the Company

has adequate resources to continue in operational existence for the next twelve

months. In assessing the going concern basis of accounting the Directors have

had regard to the guidance issued by the Financial Reporting Council. They have

considered the current cash position of the Group, forecast rental income and

other forecast cash flows. The Group has agreements relating to its borrowing

facilities with which it has complied during the period. Based on the

information the Directors believe that the Group has the ability to meet its

financial obligations as they fall due for the foreseeable future, which is

considered to be for a period of at least twelve months from the date of

approval of the accounts. For this reason they continue to adopt the going

concern basis in preparing the accounts.

These condensed interim financial statements were

approved for issue on 16 September 2019.

2. Dividends

Six months to Six months to Year to 31

30 June 2019 30 June 2018 December 2018

GBP'000 GBP'000 GBP'000

In respect of the previous

period:

Ninth interim (0.5p per share) 3,997 3,997 3,997

Tenth interim (0.5p per share) 3,997 3,997 3,997

Eleventh interim (0.5p per share) 3,996 3,996 3,996

Twelfth interim (0.5p per share) 3,997 3,997 3,997

In respect of the period

under review:

First interim (0.5p per share) 3,997 3,997 3,997

Second interim (0.5p per share) 3,997 3,997 3,997

Third interim (0.5p per share) - - 3,996

Fourth interim (0.5p per share) - - 3,997

Fifth interim (0.5p per share) - - 3,997

Sixth interim (0.5p per share) - - 3,997

Seventh interim (0.5p per share) - - 3,997

Eighth interim (0.5p per share) - - 3,997

23,981 23,981 47,962

A third interim dividend for the year to 31 December 2019, of 0.5 pence per

share totalling GBP3,997,000 was paid on 31 July 2019. A fourth interim dividend

of 0.5 pence per share was paid on 30 August 2019 to shareholders on the

register on 9 August 2019. A fifth interim dividend of 0.5 pence per share will

be paid on 30 September 2019 to shareholders on the register on 13 September

2019. Although these payments relate to the period ended 30 June 2019, under

IFRS they will be accounted for in the period during which they are declared.

Barring unforeseen circumstances, it is the Directors' intention that the

Company will continue to pay dividends monthly.

3. Other expenses

Six months Six months Year to 31

to 30 June to 30 June December

2019 2018 2018

GBP'000 GBP'000 GBP'000

Direct operating expenses of rental 2,114 2,069 4,017

property

Surrender premium - 613 613

Valuation and other professional fees 243 207 399

Professional fees for REIT conversion 314 - -

Directors' fees 166 145 302

Administration fee 76 74 151

Depositary fee 80 86 172

Other 221 267 537

3,214 3,461 6,191

The basis of payment for the Directors' and investment management fees are

detailed within the consolidated financial statements of the Group for the year

ended 31 December 2018.

4. Earnings per share

The Group's basic and diluted earnings per Ordinary Share are based on the loss

for the period of GBP3,328,000 (period to 30 June 2018: profit GBP39,957,000; 31

December 2018: profit GBP36,398,000) and on 799,366,108 (period to 30 June 2018:

799,366,108; 31 December 2018: 799,366,108) Ordinary Shares, being the weighted

average number of shares in issue during the period. Earnings for the six

months to 30 June 2019 should not be taken as guide to the results for the year

to 31 December 2019.

5. Investment properties

Six months Six months Year to 31

to 30 June to 30 June December

2019 2018 2018

Non-current assets - Investment properties GBP'000 GBP'000 GBP'000

Freehold and leasehold properties

Opening fair value 1,384,856 1,398,894 1,398,894

Sales - proceeds (3,940) - (5,100)

- loss on sale (4,705) - (5,355)

Capital expenditure 4,616 3,880 12,649

Purchase of investment properties - 5,532 5,533

Unrealised losses realised during the period 3,451 - 7,968

Unrealised gains on investment properties 7,254 31,353 37,468

Unrealised losses on investment properties (29,847) (10,382) (43,639)

Transfer to asset classified as held for sale - - (23,562)

Closing fair value 1,361,685 1,429,277 1,384,856

Historic cost at the end of the period 947,145 999,866 951,155

Current assets - Investment properties held

for sale

Freehold properties

Opening fair value 23,562 - -

Sales - proceeds (24,500) - -

- loss on sale (22,507) - -

Unrealised losses realised during the period 23,445 - -

Closing fair value - - 23,562

Historic cost at the end of the period - - 47,026

Six months Six months Year to 31

to 30 June to 30 June December

2019 2018 2018

GBP'000 GBP'000 GBP'000

Losses on sale (27,212) - (5,355)

Unrealised losses realised during the period 26,896 - 7,968

(Losses) / gains on sales of investment (316) - 2,613

properties realised

The fair value of investment properties reconciled to the appraised value as

follows:

Six months Six months Year to 31

to 30 June to 30 June December

2019 2018 2018

GBP'000 GBP'000 GBP'000

Appraised value prepared by CBRE excluding

asset classified as held for sale 1,383,125 1,450,035 1,405,790

Lease incentives held as debtors (21,440) (20,758) (20,934)

Closing fair value 1,361,685 1,429,277 1,384,856

The assets classified as held for sale reconciled to the appraised value as

follows:

Six months Six months Year to 31

to 30 June to 30 June December

2019 2018 2018

GBP'000 GBP'000 GBP'000

Appraised value prepared by CBRE of asset

classified as held for sale - - 24,400

Lease incentives held as debtors - - (538)

Selling costs of assets held for sale - - (300)

Closing fair value - - 23,562

There were no properties held for sale at 30 June 2019 (2018: 2 properties).

All the Group's investment properties were valued as at 30 June 2019 by RICS

Registered Valuers working for CBRE Limited ('CBRE'), commercial real estate

advisors, acting in the capacity of a valuation adviser to the AIFM. All such

valuers are Chartered Surveyors, being members of the Royal Institution of

Chartered Surveyors ('RICS').

CBRE completed the valuation of the Group's investment properties at 30 June

2019 on a fair value basis and in accordance with The RICS Valuation - Global

Standards 2017.

There were no significant changes to the valuation process, assumptions and

techniques used during the period, further details on which were included in

note 9 of the consolidated financial statements of the Group for the year ended

31 December 2018.

As at 30 June 2019, all of the Group's properties are Level 3 in the fair value

hierarchy as it involves the use of significant unobservable inputs and there

were no transfers between levels during the period. Level 3 inputs used in

valuing the properties are those which are unobservable, as opposed to Level 1

(inputs from quoted prices) and Level 2 (observable inputs either directly i.e.

as priced, or indirectly, i.e. derived from prices).

6. Share capital

GBP'000

Allocated, called-up and fully paid

799,366,108 Ordinary Shares of 1p each in issue at 7,994

30 June 2019

Under the Company's Articles of Incorporation, the Company may issue an

unlimited number of Ordinary Shares. The Company issued nil Ordinary Shares

during the period (2018: nil) raising net proceeds of GBPnil (2018: GBPnil).

The Company did not repurchase any Ordinary Shares during the period.

7. Net asset value per share

The Group's net asset value per Ordinary Share of 136.3p (30 June 2018: 143.2p;

31 December 2018: 139.8p) is based on equity shareholders' funds of GBP

1,089,789,000 (30 June 2018: GBP1,144,941,000; 31 December 2018: GBP1,117,448,000)

and on 799,366,108 (30 June 2018: 799,366,108; 31 December 2018: 799,366,108)

Ordinary Shares, being the number of shares in issue at the period

end.

8. Related party transactions

The Directors of the Company received fees for their services and dividends

from their shareholdings in the Company. No fees remained payable at the period

end.

9. Capital commitments

The Group had capital commitments totalling GBP2,400,000 as at 30 June 2019 (30

June 2018: GBP10,300,000; 31 December 2018: GBP3,600,000). These commitments

related mainly to contracted development works at the Group's properties at

Cassini House, London SW1 and Nevis/Ness Houses, Edinburgh.

10. List of Subsidiaries

The Group results consolidate the results of the following

companies:

- FCPT Holdings Limited (the parent company of F&C Commercial

Property Holdings Limited and Winchester Burma Limited)

- F&C Commercial Property Holdings Limited (a company which invests

in properties)

- SCP Estate Holdings Limited (the parent company of SCP Estate

Limited and Prime Four Limited)

- SCP Estate Limited (a company which invests in properties)

- Prime Four Limited (a company which invests in properties)

- Winchester Burma Limited (a company which invests in properties)

- Leonardo Crawley Limited (a company which invests in properties)

All of the above named companies are registered in Guernsey.

The Group's ultimate parent company is BMO Commercial Property Trust Limited.

11. Subsequent events

On 30 July 2019, the Group completed the sale of phase 1 of the former Ozalid

Works site in Colchester to Persimmon Homes for a price of GBP6.2 million.

12. Forward looking statements

Certain statements in this report are forward looking statements. By their

nature, forward looking statements involve a number of risks, uncertainties or

assumptions that could cause actual results or events to differ materially from

those expressed or implied by those statements. Forward looking statements

regarding past trends or activities should not be taken as representation that

such trends or activities will continue in the future. Accordingly, undue

reliance should not be placed on forward looking statements.

Statement of Principal Risks and Uncertainties

The Company's assets comprise mainly of direct investments in UK commercial

property. Its principal risks are therefore related to the commercial property

market in general. Other risks faced by the Company include market,

geopolitical, investment and strategic, regulatory, environmental, taxation,

management and control, operational, and financial risks. The Company is also

exposed to risks in relation to its financial instruments. These risks, and the

way in which they are managed, are described in more detail under the heading

'Principal Risks and Risk Management' within the Business Model and Strategy in

the Company's Annual Report for the year ended 31 December 2018. The Company's

principal risks and uncertainties have not changed materially since the date of

that report and are not expected to change materially for the remainder of the

Company's financial year.

Statement of Directors' Responsibilities in Respect of the Interim Report

We confirm that to the best of our knowledge:

* the condensed set of consolidated financial statements has been

prepared in accordance with IAS 34 'Interim Financial Reporting' as adopted by

the European Union;

* the Chairman's Statement and Managers' Review (together

constituting the Interim Management Report) together with the Statement of

Principal Risks and Uncertainties above include a fair review of the

information required by the Disclosure and Transparency Rules ('DTR') 4.2.7R,

being an indication of important events that have occurred during the first six

months of the financial year and their impact on the condensed set of

consolidated financial statements; and

* the Chairman's Statement together with the condensed set of

consolidated financial statements include a fair review of the information

required by DTR 4.2.8R, being related party transactions that have taken place

in the first six months of the current financial year and that have materially

affected the financial position or performance of the Company during that

period, and any changes in the related party transactions described in the last

Annual Report that could do so.

On behalf of the Board

Martin Moore

Director

BMO Commercial Property Trust Limited

Independent Review Report to BMO Commercial Property Trust Limited

Our conclusion

We have reviewed the accompanying condensed consolidated interim financial

information of BMO Commercial Property Trust Limited (the "Company") and its

subsidiaries (together the "Group") as of 30 June 2019. Based on our review,

nothing has come to our attention that causes us to believe that the

accompanying condensed consolidated interim financial information is not

prepared, in all material respects, in accordance with International Accounting

Standard 34, 'Interim Financial Reporting', as adopted by the European Union

and the Disclosure Guidance and Transparency Rules sourcebook of the United

Kingdom's Financial Conduct Authority.

What we have reviewed

The accompanying condensed consolidated interim financial information comprise:

* the condensed consolidated balance sheet as of 30 June 2019;

* the condensed consolidated statement of comprehensive income for

the six-month period then ended;

* the condensed consolidated statement of changes in equity for the

six-month period then ended;

* the condensed consolidated statement of cash flows for the

six-month period then ended; and

* the notes, comprising a summary of significant accounting policies

and other explanatory information.

The condensed consolidated interim financial information has been prepared in

accordance with International Accounting Standard 34, 'Interim Financial

Reporting', as adopted by the European Union and the Disclosure Guidance and

Transparency Rules sourcebook of the United Kingdom's Financial Conduct

Authority.

Our responsibilities and those of the Directors

The Directors are responsible for the preparation and presentation of this

condensed consolidated interim financial information in accordance with the

Disclosure Guidance and Transparency Rules sourcebook of the United Kingdom's

Financial Conduct Authority.

Our responsibility is to express a conclusion on this condensed consolidated

interim financial information based on our review. This report, including the

conclusion, has been prepared for and only for the Company for the purpose of

complying with the Disclosure Guidance and Transparency Rules sourcebook of the

United Kingdom's Financial Conduct Authority and for no other purpose. We do

not, in giving this conclusion, accept or assume responsibility for any other

purpose or to any other person to whom this report is shown or into whose hands

it may come save where expressly agreed by our prior consent in writing.

Scope of review

We conducted our review in accordance with International Standard on Review

Engagements 2410, 'Review of interim financial information performed by the

independent auditor of the entity' issued by the International Auditing and

Assurance Standards Board. A review of interim financial information consists

of making inquiries, primarily of persons responsible for financial and

accounting matters, and applying analytical and other review procedures.

A review is substantially less in scope than an audit conducted in accordance

with International Standards on Auditing and consequently does not enable us to

obtain assurance that we would become aware of all significant matters that

might be identified in an audit. Accordingly, we do not express an audit

opinion.

We have read the other information contained in the Interim Report and

considered whether it contains any apparent misstatements or material

inconsistencies with the information in the interim financial statements.

PricewaterhouseCoopers CI LLP

Chartered Accountants

Guernsey, Channel Islands

Alternative Performance Measures

The Company uses the following Alternative Performance Measures ('APMs'). APMs

do not have a standard meaning prescribed by GAAP and therefore may not be

comparable to similar measures presented by other entities. Further details of

the APMs methodology are available in the Company's Annual Report for the year

ended 31 December 2018.

Discount or Premium - the share price of an Investment Company is derived from

buyers and sellers trading their shares on the stock market. If the share price

is lower than the NAV per share, the shares are trading at a discount. This

usually indicates that there are more sellers than buyers. Shares trading at a

price above the NAV per share, are said to be at a premium.

Dividend Cover - The percentage by which Profits for the year (less gains/

losses on investment properties) cover the dividend paid.

A reconciliation of dividend cover is shown below:

30 June 30 June

2019 2018

GBP'000 GBP'000

(Loss)/profit for the period (3,328) 39,957

Add back: Unrealised losses / (gains) on revaluation (20,971)

of investment properties 22,593 (20,971)

Losses on sales of investment properties 316 - -

realised

Profit before investment gains and losses (a) 19,581 18,986 18,986

Dividends (b) 23,981 23,981

Dividend Cover percentage (c = a/b) (c) 81.7 79.2 79.2

Dividend Yield - The annualised dividend divided by the share price at the

period-end. An analysis of dividends is contained in note 2 to the accounts.

Net Gearing - Borrowings less cash dividend by total assets (less current

liabilities and cash).

Portfolio (Property) Capital Return - The change in property value during the

period after taking account of property purchase and sales and capital

expenditure, calculated on a quarterly time-weighted basis.

Portfolio (Property) Income Return - The income derived from a property during

the period as a percentage of the property value, taking account of direct

property expenditure, calculated on a quarterly time-weighted basis.

Portfolio (Property) Total Return - Combining the Portfolio Capital Return and

Portfolio Income Return over the period, calculated on a quarterly

time-weighted basis.

Total Return - The theoretical return to shareholders calculated on a per share

basis by adding dividends paid in the period to the increase or decrease in the

Share Price or NAV. The dividends are assumed to have been reinvested in the

form of Ordinary Shares or Net Assets, respectively, on the date on which they

were quoted ex-dividend.

All enquiries to:

The Company Secretary

Northern Trust International Fund Administration Services (Guernsey)

Limited

Trafalgar Court

Les Banques

St. Peter Port

Guernsey GY1 3QL

Tel: 01481 745324

Fax: 01481 745051

Richard Kirby

BMO REP Asset Management plc

Tel: 0207 499 2244

Graeme Caton

Winterflood Securities Limited

Tel: 0203 100 0268

The full interim report for the period to 30 June 2019 will be sent to

shareholders and will be available for inspection at Trafalgar Court, Les

Banques, St Peter Port, Guernsey GY1 3QL, the registered office of the Company,

and from the Company's website: www.bmocommercialproperty.com

END

(END) Dow Jones Newswires

September 17, 2019 02:00 ET (06:00 GMT)

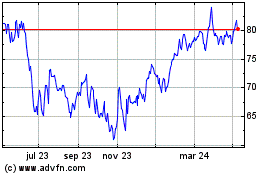

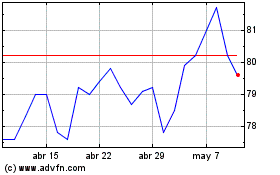

Balanced Commercial Prop... (LSE:BCPT)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Balanced Commercial Prop... (LSE:BCPT)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024