European Economics Preview: BoE Rate Decision Due

18 Septiembre 2019 - 7:24PM

RTTF2

Interest rate announcements from the Bank of England and the

Swiss National Bank are due on Thursday, headlining a busy day for

the European economic news.

At 3.30 am ET, the Swiss National Bank is set to announce its

quarterly monetary policy assessment. The bank is expected to hold

its new policy rate at -0.75 percent.

At 4.00 am ET, the Eurozone current account data is due for

July. The surplus totaled EUR 18.4 billion in June.

In the meantime, Norges bank announces its rate decision. The

bank is expected to hold its key rate at 1.25 percent. Also,

industrial production and producer prices are due from Poland.

At 4.30 am ET, the Office for National Statistics is scheduled

to issue UK retail sales data. Economists forecast sales to remain

flat on month in August, following a 0.2 percent rise in July. At

7.00 am ET, the Bank of England is set to leave its key interest

rate unchanged at the final policy session ahead of the Brexit

scheduled on October 31. Policymakers are likely to retain the

interest rate at 0.75 percent and quantitative easing at GBP 435

billion.

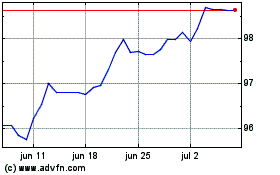

NZD vs Yen (FX:NZDJPY)

Gráfica de Divisa

De Mar 2024 a Abr 2024

NZD vs Yen (FX:NZDJPY)

Gráfica de Divisa

De Abr 2023 a Abr 2024