TIDMCPC

RNS Number : 8669M

City Pub Group PLC (The)

19 September 2019

The City Pub Group PLC

(the "City Pub Group", the "Company" or the "Group")

INTERIM RESULTS FOR THE 26 WEEK PERIODING 30 JUNE 2019

Strategic expansion drives sales and EBITDA growth

The City Pub Group is pleased to announce its unaudited results

for the 26 weeks ended 30 June 2019. The Group operates a

predominately freehold estate of 47 wet-led pubs in London,

Southern England and Wales.

Highlights:

-- Revenue up 36% to GBP27.1 million (2018: GBP20.0 million)

-- Like for like sales increased by 2.6% year on year

-- Adjusted EBITDA* up 20% to GBP3.6 million (2018: GBP3.0 million)

-- Adjusted profit before tax** up 19% to GBP1.9 million (2018: GBP1.6 million)

* Adjusted earnings before exceptional items, share option

charge, interest, taxation, depreciation and amortisation.

** Adjusted profit before tax is the profit before tax, share

option charge and exceptional items.

-- Strategic expansion continued with four pubs opened in 2019.

The expanded estate and our wet-led focus resulted in substantial

EBITDA and sales growth. Progress has continued into the second

half with sales up by 35% over the last eleven weeks.

-- With a further four projects in development and a continued

focus on the existing estate, the Board expects the Group to

continue to deliver significant growth for the foreseeable

future.

-- The Group is beginning to see the benefits of the new

regional management structure and the new Weekly Employee Bonus

Scheme, both of which will drive growth and further incentivise the

Group's employees.

-- Due to political and economic uncertainty the Group will take

a much more prudent and even more selective approach to

acquisitions and focus instead on completing the development sites

for trading, reducing debt and improving the dividend for

shareholders as cash generated increases, until a time where there

is more certainty.

Clive Watson, Executive Chairman of The City Pub Group,

said:

"Our targeted expansion of high-quality larger pubs with letting

rooms has delivered strong progress for the Group in the first

half. In the face of robust comparatives, we have delivered good

like for like growth too. As our development sites begin trading

during 2020, they will drive our performance onward. Our momentum

has continued into the second half with strong sales growth.

"We cannot ignore the uncertainty in the market due primarily to

Brexit and the potential impact of a No Deal. We are a management

team that is focused on the long-term and as such we believe it is

prudent for us to rein in our expansion programme until there is

more certainty. Instead we will focus on getting our development

sites trading, developing our existing estate, reducing our debt

and improving our dividends for shareholders. This will further

strengthen our position and minimise the impact of any headwinds

whilst continuing to deliver significant growth into the

future."

19 September 2019

This announcement contains inside information for the purposes

of EU Regulation 596/2014.

Enquiries:

City Pub Group

Clive Watson, Chairman

Tarquin Williams, CFO

Instinctif Partners

Matthew Smallwood

Andy Low +44 (0) 20 7457 2020

Liberum (Nomad & Joint Broker)

Chris Clarke

Edward Thomas

Clayton Bush +44 (0) 20 3100 2000

Berenberg (Joint Broker)

Chris Bowman

Toby Flaux

Marie Stolberg +44 (0) 20 3207 7800

For further information on City Pub Group pubs visit

www.citypubcompany.com

CHAIRMAN'S STATEMENT

The Group has continued its expansion in the first half of the

2019. We now have 47 pubs trading, a further 3 sites in the

development stage and a project to add additional bedrooms to an

existing site. The Board's ambition of having an estate of around

65 pubs is well within our reach. As the Group expands, we are

continuing to build our expertise and local knowledge in the areas

we already trade in, thereby driving further growth and improving

our overall performance.

Financial Highlights

The Board is pleased with the financial performance of the Group

over the period. Highlights include:

- Revenue growth of 36% to GBP27.1 million (2018: GBP20.0 million)

- Adjusted EBITDA* increased by 20% to GBP3.6 million (2018: GBP3.0 million)

- Adjusted Profit before tax** up 19% to GBP1.9 million (2018: GBP1.6 million)

These results have been achieved through our strategy of

increasing the number of pubs we operate as well as delivering

organic growth from the existing estate.

Like-for-like sales increased by 2.6% in the first six months.

We are pleased with this result as it is against strong

comparatives and a period which benefitted from the FIFA World Cup

and hot weather.

Operating margins were lower in the period primarily due to

one-off investments to build infrastructure for future growth,

including establishing a new regional management structure and the

overlapping of the new Weekly Employee Bonus Scheme which replaced

the Annual Employee Profit share. These projects will ensure that

we have an optimal structure and rewards programme in place to

provide a platform for us to grow. The Board is confident that

operating margin will return to its growth trajectory. A target of

20% has been set by the end of 2021.

Trading Estate

The Group operates 47 high-quality predominantly drink-led pubs.

It also acquired a freehold pub in London in July 2019, which is

leased to another operator.

Since the start of the year the Group has opened the following

pubs:

February: Pride of Paddington, a landmark pub opposite

Paddington Station which benefits from letting accommodation.

April: The Hoste, an iconic site located in Burnham Market,

North Norfolk, benefitting from 53 bedrooms as well as a lovely pub

and dining area.

June: Aragon House, a landmark site located in London's Parsons

Green with three trading floors, a large garden and 15

bedrooms.

July: Market House, a former Lloyd's Bank building located in

Market Square, Reading, now operating as a large pub with 24

letting rooms and a rooftop garden.

The Board is satisfied with the performance of these new

openings.

In addition, there are 4 projects in the development

pipeline:

Norwich - Land and building adjacent to our city centre site,

the Georgian Town House. Works are ongoing and should be completed

by end of the year, delivering a further 12 letting rooms, which

will enhance the existing operation.

Exeter - Former Turks Head Pub. As part of our refurbishment

programme we will be adding 6 letting rooms and a roof garden. It

is expected to open in the second quarter of 2020.

Cambridge - Former Tivoli Pub. Planning permission has been

received to redevelop the site with a roof garden. It is expected

to open in the third quarter of 2020 and adds to our growing

presence in Cambridge.

Bath - Former Nest Pub. This site is currently going through the

planning process. We are targeting an opening date in the third

quarter of 2020.

In addition to the sites acquired, we have a further site which

we are in the process of completing the legal documentation for and

we continue to appraise other opportunities.

During the period we sold The Grapes in Oxford for

GBP120,000.

The Group's acquisition strategy is focused on developing large,

prominent sites in our target cities which ideally have existing

letting rooms or at least space for us to develop some. These types

of pubs are attractive to us as, whilst obtaining the necessary

consents can take time, they perform well and deliver strong

returns.

Market / Brexit

We have been pleased with our trading performance to date. We

operate in a market that is benefitting from full employment and

low interest rates. Our focus continues to be building local custom

in our pubs to ensure a sustainable pattern of trade. To assist

this, we continue to evolve our retailing offer through innovation,

better customer service and driving trade through the City Club

App.

For us it is important to take into account both the long-term

view of the future of the business and short term macro-economic

factors. The uncertainty caused by Brexit hangs over the pub

industry and the UK economy as a whole. The Board believes that

given this, it is prudent at this time to be more discerning on our

acquisition strategy. The reason behind our decision is primarily

opportunism - prices of pubs should fall in a No Deal Brexit

scenario.

The Group has grown rapidly in recent years and we have a number

of development sites with significant potential to concentrate on

in the short term, which together with additional management

attention on the entire existing and development estate, there are

considerable gains to be made providing substantial growth for some

time to come.

The Group will continue to look at acquisitions of sites on a

selective basis and take advantage of our ability to move quickly

and decisively.

Regional Structure / Weekly Employee Bonus Scheme

The introduction of the Regional structure and the Weekly

Employment Bonus Scheme have had an upfront cost, but have created

a structure for further growth and provided additional motivation

for our employees. The Board believes decentralisation of our head

office functions will maintain our cutting edge as we go forward by

empowering our management team further and enabling them to focus

on the opportunity in their local markets. As part of this

activity, we have appointed our first Regional Director, Jim

Charlton, in our Western region and will make more appointments in

our other divisions later this year.

The Weekly Employee Bonus Scheme has encouraged the overall

entrepreneurial culture of the business with very tangible benefits

of staff retention and improved productivity now coming

through.

Banking Facilities / Borrowings

The Group entered into a new 5 year, GBP50 million banking

facility (GBP35m facility with GBP15m accordion option) with

Barclays Bank plc in July on more favourable terms than our

previous facility. This renewed facility ensures that we are fully

funded to make acquisitions at the appropriate time.

Current net debt is c. GBP30 million and it is the Board's

intention to maintain this level, or even reduce it, until there is

more clarity.

Dividend

It is currently Group policy not to declare interim dividends.

The Board is committed to increasing dividends in line with

earnings and will finalise the intended dividend payment when we

announce our full year results in April 2020.

Current Trading

Sales in the 11 weeks since the period end have increased 35%

driven by our strategy of opening larger sites and capitalising on

local trading opportunities. The quality of our trading estate is

continually improving and has been enhanced by the recent openings.

The increased number of letting bedrooms across the estate will

drive future operational efficiencies.

The Group's focus is now on raising the quality of the estate,

completing our development programme, acquiring new sites on an

opportunistic basis, reducing our debt and growing dividend

payments for shareholders as cash generation increases.

Clive Watson

Chairman

19 September 2019

* Adjusted Earnings before exceptional items, share option

charge, interest, taxation, depreciation and amortisation.

** Adjusted profit before tax is the profit before tax, share

option charge and exceptional items

Consolidated Statement of Comprehensive Income

For the 26 weeks ended 30 June 2019

Unaudited Unaudited Audited

26 weeks 26 weeks

ended ended 52 weeks ended

30 June 30 December

2019 1 July 2018 2018

Notes GBP'000 GBP'000 GBP'000

Revenue 27,107 19,965 45,674

Costs of sales (6,824) (5,017) (11,621)

---------- ------------ ---------------

Gross profit 20,283 14,948 34,053

Administrative expenses (19,251) (13,842) (31,244)

---------- ------------ ---------------

Operating profit 1,032 1,106 2,809

Reconciliation to adjusted

EBITDA*

Operating profit 1,032 1,106 2,809

Depreciation 6 1,594 1,207 2,552

Share option charge 180 181 377

Exceptional items 2 803 514 2,121

*Adjusted earnings before

exceptional items, share

option charge, interest,

taxation and depreciation 3,609 3,008 7,859

------------------------------

Finance costs (86) (174) (189)

---------- ------------ ---------------

Profit before tax 946 932 2,620

Tax expense 3 (436) (176) (654)

Profit for the period and

total comprehensive income 510 756 1,966

========== ============ ===============

Earnings per share

Basic earnings per share

(p) 4 0.86 1.34 3.44

========== ============ ===============

Diluted earnings per share

(p) 4 0.85 1.33 3.41

========== ============ ===============

All activities comprise continuing operations. There are no

recognised gains or losses other than those passing through the

statement of comprehensive income.

The accompanying notes are an integral part of these interim

financial statements.

Consolidated Statement of Financial Position

As at 30 June 2019

Unaudited Unaudited Audited

26 weeks

26 weeks ended ended 52 weeks ended

30 December

30 June 2019 1 July 2018 2018

Assets Notes GBP'000 GBP'000 GBP'000

Non-current

Intangible assets 4,136 3,090 3,794

Property, plant and equipment 6 107,770 78,590 90,020

Total non-current assets 111,906 81,680 93,814

--------------- ------------ ---------------

Current

Inventories 880 580 960

Trade and other receivables 2,885 1,995 2,542

Cash and cash equivalents 3,114 2,842 2,853

Total current assets 6,879 5,417 6,355

--------------- ------------ ---------------

Total assets 118,785 87,097 100,169

--------------- ------------ ---------------

Liabilities

Current liabilities

Trade and other payables (9,178) (7,715) (8,494)

Total current liabilities (9,178) (7,715) (8,494)

--------------- ------------ ---------------

Non-current

Borrowings (30,000) (7,000) (11,600)

Other payables (50) (310) -

Deferred tax liabilities (1,879) (1,096) (1,537)

Total non-current liabilities (31,929) (8,406) (13,137)

--------------- ------------ ---------------

Total liabilities (41,107) (16,121) (21,631)

--------------- ------------ ---------------

Net assets 77,678 70,976 78,538

=============== ============ ===============

Equity

Share capital 30,692 29,196 30,651

Share premium 38,328 33,586 38,287

Own shares (JSOP) (3,272) (3,272) (3,272)

Other reserve 92 92 92

Share-based payment reserve 883 507 703

Retained earnings 10,955 10,867 12,077

Total equity 77,678 70,976 78,538

=============== ============ ===============

The accompanying notes are an integral part of these interim

financial statements.

Consolidated Statement of Changes in Equity

For the 26 weeks ended 30 June 2019

Share-based

Share Share Own shares Other payment Retained

capital premium (JSOP) reserve reserve earnings Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at

31 December

2017 (Audited) 28,234 31,276 - 92 326 11,382 71,310

Employee share-based

compensation - - - - 181 - 181

Dividends - - - - - (1,271) (1,271)

Purchase of

JSOP shares 962 2,310 (3,272) - - - -

Transactions

with owners 962 2,310 (3,272) - 181 (1,271) (1,089)

--------- --------- ----------- --------- ------------ ---------- ---------

Profit for

the period - - - - - 756 756

Total comprehensive

income for

the period - - - - - 756 756

--------- --------- ----------- --------- ------------ ---------- ---------

Balance at

1 July 2018

(Unaudited) 29,196 33,586 (3,272) 92 507 10,867 70,976

========= ========= =========== ========= ============ ========== =========

Employee share-based

compensation - - - - 196 - 196

Issue of new

shares 1,455 4,701 - - - - 6,156

Transactions

with owners 1,455 4,701 - - 196 - 6,352

--------- --------- ----------- --------- ------------ ---------- ---------

Profit for

the period - - - - - 1,210 1,210

Total comprehensive

income for

the period - - - - - 1,210 1,210

--------- --------- ----------- --------- ------------ ---------- ---------

Balance at

30 December

2018 (Audited) 30,651 38,287 (3,272) 92 703 12,077 78,538

========= ========= =========== ========= ============ ========== =========

Employee share-based

compensation - - - - 180 - 180

Dividends - - - - - (1,632) (1,632)

Issue of new

shares 41 41 - - - - 82

Transactions

with owners 41 41 - - 180 (1,632) (1,370)

--------- --------- ----------- --------- ------------ ---------- ---------

Profit for

the period - - - - - 510 510

Total comprehensive

income for

the period - - - - - 510 510

--------- --------- ----------- --------- ------------ ---------- ---------

Balance at

30 June 2019

(Unaudited) 30,692 38,328 (3,272) 92 883 10,955 77,678

========= ========= =========== ========= ============ ========== =========

The accompanying notes are an integral part of these interim

financial statements.

Consolidated Statement of Cashflows

For the 26 weeks ended 30 June 2019

Unaudited Unaudited Audited

26 weeks

26 weeks ended ended 52 weeks ended

30 December

30 June 2019 1 July 2018 2018

GBP'000 GBP'000 GBP'000

Cash flows from operating activities

Profit for the period 510 756 1,966

Taxation 436 176 654

Finance costs 86 174 189

--------------- ------------ ---------------

Operating profit 1,032 1,106 2,809

Adjustments for:

Depreciation 1,594 1,207 2,552

Gain on disposal of property, (1) - -

plant and equipment

Share-based payment charge 180 181 377

Impairment 160 - 480

Change in inventories 80 (26) (406)

Change in trade and other receivables (273) (343) (992)

Change in trade and other payables (2,112) 239 2,152

--------------- ------------ ---------------

Cash generated from operations 660 2,364 6,972

Tax paid (15) (104) (535)

Net cash from operating activities 645 2,260 6,437

--------------- ------------ ---------------

Cash flows from investing activities

Purchase of property, plant and

equipment (8,787) (7,083) (11,430)

Proceeds from disposal of property, 50 - -

plant and equipment

Acquisition of new property sites (9,840) (5,332) (14,361)

Net cash used in investing activities (18,577) (12,415) (25,791)

--------------- ------------ ---------------

Cash flows from financing activities

Proceeds from issue of share capital 82 - 5,973

Repayment of borrowings - - (245)

Dividends paid - - (1,087)

Proceeds from new borrowings 18,400 7,000 11,600

Interest paid (289) (418) (449)

Net cash from financing activities 18,193 6,582 15,792

--------------- ------------ ---------------

Net change in cash and cash equivalents 261 (3,573) (3,562)

Cash and cash equivalents at the

start of the period 2,853 6,415 6,415

Cash and cash equivalents at the

end of the period 3,114 2,842 2,853

=============== ============ ===============

The accompanying notes are an integral part of these interim

financial statements.

Notes to the Financial Statements

For the 26 weeks ended 30 June 2019

1 Basis of preparation

This interim report was approved by the board on 19 September

2019. The interim financial statements are unaudited and are not

the Group's statutory accounts as defined in section 434 of the

Companies Act 2006.

The consolidated interim financial statements have been prepared

under IFRS as adopted by the European Union and on the basis of the

accounting policies set out in the statutory accounts of The City

Pub Group plc, for the period ended 30 December 2018. The financial

statements have not been prepared (and are not required to be

prepared) in accordance with IAS 34: 'Interim Financial Reporting'.

They do not include any of the information required for full annual

financial statements and should be read in conjunction with the

consolidated financial statements of the Group for the period ended

30 December 2018.

Statutory accounts for the period ended 30 December 2018 have

been delivered to the Registrar of Companies. These accounts

contain an unqualified audit report under Section 495 of the

Companies Act 2006, which did not make any statements under Section

498 of the Companies Act 2006.

The interim report is presented in Great British Pounds and all

values are rounded to the nearest thousand pounds, except where

otherwise indicated.

This interim report has been prepared in accordance with the AIM

Rules issued by the London Stock Exchange.

2 Exceptional items

Unaudited Unaudited Audited

26 weeks 26 weeks 52 weeks

ended ended ended

30 June 30 December

2019 1 July 2018 2018

GBP'000 GBP'000 GBP'000

Pre opening costs 506 450 1,455

Impairment of a pub site

(note 6) 160 - 480

Other non recurring items 137 64 186

803 514 2,121

========== ============ ============

3 Tax charge on profit on ordinary activities

The taxation charge is calculated by applying the Directors'

best estimate of the annual effective tax rate to the profit for

the period. All items of taxation are reflected through the

Statement of Comprehensive Income.

Unaudited Unaudited Audited

26 weeks 26 weeks 52 weeks

ended ended ended

30 June 1 July 30 December

2019 2018 2018

GBP'000 GBP'000 GBP'000

Current income tax:

Current income tax charge 436 162 604

Adjustments in respect of previous

period - - (81)

Total current income tax 436 162 523

---------- ---------- ------------

Deferred tax:

Origination and reversal of

temporary differences - 14 131

Adjustments in respect of previous - - -

period

Total deferred tax - 14 131

---------- ---------- ------------

Total tax 436 176 654

========== ========== ============

4 Earnings per share

Unaudited Unaudited Audited

26 weeks ended 26 weeks ended 52 weeks ended

30 December

30 June 2019 1 July 2018 2018

GBP'000 GBP'000 GBP'000

Earnings for the period

attributable to Shareholders 510 756 1,966

=============== =============== ===============

Earnings per share:

Basic earnings per

share (p) 0.86 1.34 3.44

Diluted earnings per

share (p) 0.85 1.33 3.41

Weighted average number Number of Number of Number of

of shares: shares shares shares

Weighted average shares

for basic EPS 59,378,421 56,467,333 57,216,344

Effect of share options

in issue 644,168 374,862 476,688

Weighted average shares

for diluted earnings

per share 60,022,589 56,842,195 57,693,032

=============== =============== ===============

5 Dividends

The Company declared a dividend of 2.75p per ordinary share

during the year ended 30 December 2018, which was approved at the

Annual General Meeting on 20(th) May 2019. The dividend payable of

GBP1,632,820 has been accrued as at 30 June 2019 and deducted from

retained earnings.

After the period end GBP1,405,798 of the dividend was paid in

cash and GBP227,022 was distributed as a scrip dividend.

6 Property, plant and equipment

Group

Freehold Fixtures,

& leasehold fittings

property and computers Total

Cost GBP'000 GBP'000 GBP'000

At 31 December 2017 (Audited) 59,588 15,839 75,427

Additions 5,794 1,289 7,083

Acquisitions 4,473 294 4,767

------------- --------------- ---------

At 1 July 2018 (Unaudited) 69,855 17,422 87,277

Additions 1,587 3,019 4,606

Acquisitions 7,245 1,344 4,469

At 30 December 2018 (Audited) 78,687 21,785 100,472

------------- --------------- ---------

Additions 5,988 3,001 8,989

Acquisitions (Note 8) 10,344 288 10,632

Disposals (91) (64) (155)

------------- --------------- ---------

At 30 June 2019 (Unaudited) 94,928 25,010 119,938

------------- --------------- ---------

Depreciation

At 31 December 2017 (Audited) 1,432 6,048 7,480

Provided during the period 149 1,058 1,207

At 1 July 2018 (Unaudited) 1,581 7,106 8,687

Provided during the period 200 1,145 1,345

Impairment 420 - 420

At 30 December 2018 (Audited) 2,201 8,251 10,452

------------- --------------- ---------

Provided during the period 330 1,264 1,594

Impairment 48 112 160

Disposals (19) (19) (38)

At 30 June 2019 (Unaudited) 2,560 9,608 12,168

------------- --------------- ---------

Net book value

At 30 June 2019 (Unaudited) 92,368 15,402 107,770

============= =============== =========

At 30 December 2018 (Audited) 76,486 13,534 90,020

============= =============== =========

At 1 July 2018 (Unaudited) 68,274 10,316 78,590

============= =============== =========

At 31 December 2017 (Audited) 58,156 9,791 67,947

============= =============== =========

During the period ended 30 December 2018 the group made a

provision for impairment against a Pub Site in Cambridge, due to

poor performance and it has been reduced to its value in use, with

the asset being held at its recoverable amount of GBP340,000. In

addition, the group made a provision for impairment against the

Grapes in Oxford, which was written down to its recoverable amount,

with its disposal completed on 25th February 2019.

During the period ended 30 June 2019 the group made an

additional provision for impairment against the Pub site in

Cambridge, due to poor performance and it has been reduced to its

value in use, with the asset being held at its recoverable amount

of GBP150,000.

7 Business combinations

During the period ended 30 June 2019 the Group has acquired 2

new sites through business combinations, the fair values of the

assets and liabilities acquired, and the nature of the

consideration, are outlined within the table below.

All of the above acquisitions were part of the Group's

continuing strategy to expand its pub portfolio via selective

quality acquisitions. All other pub acquisitions have been

accounted for as property acquisitions.

Unaudited

26 weeks

ended

30 June

2019

Fair value: GBP'000

Property, plant and equipment

acquired 10,632

Deferred tax liability (343)

Goodwill 343

Total 10,632

==========

Satisfied by:

Cash 9,840

Deferred consideration 792

Total 10,632

==========

8 Events after the reporting period

The Group settled the final dividend, which was approved at the

AGM in May 2019, on 1 July 2019.

In July 2019 the Company agreed a new GBP35 million revolving

credit facility, with a GBP15 million accordion option, with

Barclays Bank PLC.

On 12 July 2019, the Company purchased The Island, a freehold

site in Kensal Green.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR BLGDCLGBBGCI

(END) Dow Jones Newswires

September 19, 2019 02:00 ET (06:00 GMT)

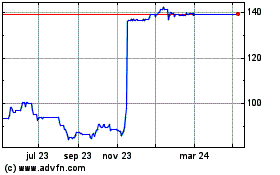

City Pub (LSE:CPC)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

City Pub (LSE:CPC)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024