TIDMPTY

RNS Number : 0245N

Parity Group PLC

20 September 2019

PARITY GROUP PLC

INTERIM RESULTS FOR THE SIX MONTHS TO 30 JUNE 2019

20 September 2019

Parity Group plc ("Parity" or the "Group" or the "Company"), the

data and technology focussed professional services business,

announces its half year results for the six months ended 30 June

2019.

Headlines:

-- Phase 1 of a comprehensive transformation programme,

commenced in March under new CEO, completed

-- Annualised gross operating costs reduced by GBP2.08m, a

higher than anticipated gross cost saving, including a net

headcount reduction of 35%

-- After GBP0.93m investment in the transformation programme,

net annualised cost savings of GBP1.15m achieved

-- Investment in the transformation program:

o Following the appointment of the new Head of Consultancy

division, Antonio Acuña MBE, a new Commercial Director, Christopher

Jones, and Head of Learning and Development, Dianne Martin, have

been appointed

o The new Parity brand and associated marketing campaigns have

been launched since the half year end

o Commenced an evaluation of Artificial Intelligence and

technological advancement opportunities in the recruitment

market

-- Board anticipates making a modest level of adjusted pre-tax profit for the full year 2019

-- Continuing difficult market conditions in the traditional UK

recruitment market including loss of major Scottish Government

contract announced in March 2019 only partially offset by recent

wins in Consultancy business

o New initial consultancy retainer contract just signed with

Compass Group plc

o Two new contract wins with the Department of Education

o New contract with BAT

-- Continued positive cash flow from operating activities(3) of

GBP0.08m despite GBP0.41m outflow in relation to restructuring

costs

-- Period on period reduction in net debt(3) to GBP1.2m (30 June

2018: GBP1.9m, 31 December 2018: GBP1.1m)

-- GBP10m credit facility with current provider extended on

improved terms for a further two years until May 2021.

Six months ended 30 June 2019

Six months Six months

to to

30.06.19 30.06.18 Incr./

(Unaudited) (Unaudited) (Decr.)

GBP'000 GBP'000 %

-------------------------------------------- ------------- ------------- ----------

Revenue 44,514 43,220 3%

Adjusted profit before tax(1) 203 847 (76%)

(Loss)/profit before tax(2) (541) 847 -

Net cash flow from operating activities(3) 77 (238) -

Net debt(3) 1,174 1,891 (38%)

1. On a Continuing basis, before non-recurring items

2. On a Continuing basis

3. Pre the adoption of IFRS 16

John Conoley, Non-Executive Chairman of Parity Group plc,

said:

"The period we are reporting on includes the first four months

under our new Chief Executive, Matthew Bayfield, who was appointed

in February 2019. He and the senior management team have moved

quickly to restructure the business, executing the plan set out

earlier in the year.

"The Board is confident in reaching a modest level of adjusted

profitability for the year, which will be a significant achievement

by the management team given the extent of the transformation being

undertaken and following the loss of the very large legacy contract

with the Scottish Govt in Q1. The precise year end achievement will

depend on the timing and mix of contracts closed in the remainder

of the year."

Matthew Bayfield, Chief Executive, said:

"Due to changing client demand we are moving Parity's focus from

a single line of business dependent upon relatively low margin

recruitment revenues into a multi-line business built around

consultancy, learning and development and strategic recruitment in

the data world.

"The restructuring programme that we embarked upon earlier in

the year has gone deeper into the organisation and has had to be

more comprehensive than we originally anticipated. This more

comprehensive transformation programme has had an expected impact

on our short term gross revenue, however we are seeing the first

signs that the plan will deliver higher margins and robust

profitability in the medium term.

"A new senior team has been recruited which is focussed on

higher margin opportunities and new service lines. The second phase

of our transformation plan is about taking the new Parity business

model to market with a renewed marketing and communications

focus.

"Whilst we still have a long way to go, we have a clear vision,

a good plan and the support of our clients in what we are setting

out to achieve, which is helping us develop a growing pipeline of

new revenue opportunities. In the last few months we have signed

new contracts with, amongst others, the Department of Education,

BAT and The Crown Commercial Service and are delighted to report

today a new retainer consultancy relationship with Compass

Group."

For further information, contact:

Matthew Bayfield

CEO 020 8543

Roger Antony GFD Parity Group plc 5353

David Beck Donhead Consultants 07836 293383

Mike Coe

Chris Savidge WH Ireland 01179 453470

This announcement contains certain statements that are or may be

forward-looking with respect to the financial condition, results or

operations and business of Parity Group plc. By their nature

forward-looking statements involve risk and uncertainty because

they relate to events and depend on circumstances that will occur

in the future. There are a number of factors that could cause

actual results and developments to differ materially from those

expressed or implied by such forward-looking statements. These

factors include, but are not limited to (i) adverse changes to the

current outlook for the UK IT recruitment and solutions market,

(ii) adverse changes in tax laws and regulations, (iii) the risks

associated with the introduction of new products and services, (iv)

pricing and product initiatives of competitors, (v) changes in

technology or consumer demand, (vi) the termination or delay of key

contracts and (vii) volatility in financial markets.

Overview:

Due to changing client demand we are moving Parity's focus from

a single line of business dependent upon relatively low margin

recruitment revenues into a multi-line business built around

consultancy, learning and development and strategic recruitment in

the data world.

The restructuring programme that we embarked upon earlier in the

year has gone deeper into the organisation and has had to be more

comprehensive than we originally anticipated. This more

comprehensive transformation programme has had an impact on our

short term profitability however we can see the first signs that

the plan will deliver in the medium term.

A new senior team has been recruited who are focussed on higher

margin opportunities and new service lines. The second phase of our

transformation plan is about taking the new Parity business model

to market with a renewed marketing and communications focus.

Whilst we still have a long way to go, we have a clear vision, a

good plan and the support of our clients in what we are setting out

to achieve, which is helping us develop a growing pipeline of new

revenue opportunities. In the last few months we have signed new

contracts with amongst others the Department of Education, BAT and

The Crown Commercial Service and are delighted to report today a

new retainer consultancy relationship with Compass Group.

About us:

45 years of trusted relationships with our clients

Parity provides expertise that delivers positive growth

for our clients through realising the true value of their

data. We are passionate about empowering business and

government to make better commercial decisions based

on reliable data.

Specifically, we advise on data and we provide access

to skills either as a managed service, through resourcing

in the contract and permanent market, or as part of a

learning and development programme.

Our work comes from a mix of long-term contracts with

public and private sector organisations as well as expanded

projects with existing clients as a result of strong

relationships and a track record of high client satisfaction.

Around 60 staff work in our offices in Belfast, Edinburgh,

London and Manchester and we had, during H1 2019, over

1,000 associates supporting clients around the UK and

Ireland.

OUR STRATEGIC GOAL OUR FINANCIAL GOAL OUR OPERATING MODEL

To equip clients with To grow margin and Applying an account

the talent, skills net profitability. management approach

and advice necessary to ensure clients can

to make bold data-led choose the right mix

business decisions of our support in consulting,

confidently. resourcing, and learning

and development.

OUR PURPOSE OUR MISSION OUR VISION

We are the trusted We provide expertise To build the world's

partner of data driven that delivers positive most dynamic community

transformation. growth for clients of data experts, enabling

through realising the our clients to realise

true value of their their vision.

data.

Transformation to deliver growth

New Operating Model

Since the appointment of Matthew Bayfield as Chief Executive in

February this year the Group has adopted a new and more client

focused operating model. Clients are now offered a suite of

integrated services through a single account management structure.

Working with our clients we identify their needs and design a

solution that can encompass consultancy, learning and development

or strategic recruitment, or any combination of the three. We have

put this client centric account management at the heart of our

business to improve the quality of our client relationships and to

ensure our clients are able to access the full range of services

that Parity can offer them.

The success of this new model will be judged on the depth of our

client relationships and our ability to help our clients realise

the value of their data and make better commercial decisions based

on reliable data. When successfully in place the new model will

also transform the profitability of Parity as we will have moved

from low margin and increasingly commoditised recruitment into,

data focused consultancy, learning and development and strategic

recruitment for data people; service lines that attract

significantly higher margins.

Investment in New Strategic Hires

Critical to the success of our new model is the quality of our

people and especially the leaders of each of our service lines. We

have invested in new team members who will work together as part of

a new executive operating board to oversee the implementation of

our new model and complete the transformation of the business. We

have recently completed this process with the appointment of a new

Head of Learning and Development and a Commercial Director.

Senior hires made in the last six months as part of the

transformation programme have been as follows:

-- Antonio Acuña MBE appointed as Head of Consulting in April

-- Dianne Martin appointed as Head of Learning and Development in August

-- Chris Jones appointed as Commercial Director in September

-- Shaun O'Hara engaged as People Officer, focussed on Transformation

Investment in Branding and New Website

As we move to a new way of working and the transformation of our

business it has been important to refresh and update the Parity

brand which had not seen any significant investment for over ten

years.

In July we launched our new identity which reflects the new

integrated offering. Our new website went live at the same time

with a fresh look and modern feel, we have unified Parity's web

presence to reflect the integrated offering and increase both

client and candidate interaction.

The new brand is central to the second phase of our

transformation as we initiate a new marketing strategy to support

growth and generate leads via the website.

Aligning our Cost Base

A further critical element of our transformation plan has been

to align our cost base to our new operating model, both reducing

overall costs and moving costs into account management and the

three service lines that support the model. We have achieved a

gross annualised saving of GBP2.08m (GBP1.15m net of investments)

and a net reduction of 35% in our headcount.

As part of the review of our cost base we have been able to move

resources away from low margin commoditised recruitment to higher

margin work, and redeployed resource to improve the consistency of

our client relationships. Whilst the net 35% reduction in headcount

relates predominately to a reduction in recruitment sales staff,

the annualised savings figure also includes reductions in general

and administration, IT and property costs. There were one off costs

of the restructuring of GBP0.74m in the first half.

Financial Review

Revenue

Group revenues were up by 3% or GBP1.3m year on year. Lower

margin recruitment revenues were up by 7% or GBP2.8m reflecting

higher contractor volumes which averaged 1,021 in H1 2019 (H1 2018:

953 contractors). Whilst there was an increase in the year on year

average, we saw a downward trajectory over H1 with the number of

contractors on billing decreasing from 995 to 913 over the six

months. The reduction was due in part to the expected run off of

contractors under the Scottish Government framework which we

announced in March 2019, and also as a result of challenging

trading conditions in the UK recruitment market.

Consultancy revenues were down by GBP1.55m or 30% due to the

inclusion of revenues from the significant MoD contract in the

comparative period. The MoD contract ran until August 2018 but was

not renewed. Consultancy revenues in H1 2019 included GBP0.2m from

new higher margin data consultancy work.

Selling Contribution

External contribution margin for recruitment was GBP3.9m at a

margin of 9.6% (H1 2018: GBP3.8m at 10.1%) and for consultancy was

GBP0.8m at a margin of 21% (H1 2018: GBP1.4m at 27%). Group selling

contribution to overheads was GBP2.4m (H1 2018: GBP2.8m) down by

14% or GBP0.4m due to the sales mix between recruitment and

consultancy.

Result Before Tax

The Group reported a loss before tax for the six months of

GBP0.5m (H1 2018: profit of GBP0.8m) and an adjusted profit before

tax (excluding non-recurring items) of GBP0.2m (H1 2018: GBP0.8m).

Non-recurring items were GBP0.7m (H1 2018: GBPnil) and reflect the

charge for specific restructuring costs. The restructuring costs

primarily related to the headcount reduction, but also included

onerous property lease costs in respect of office relocations.

Cash and Net Debt

Free cash flow from operating activities, pre the adoption of

IFRS 16, was an inflow of GBP0.1m (H1 2018: outflow of GBP0.2m) and

was after an outflow of GBP0.4m in respect of restructuring costs.

We achieved a further improvement in debtor days to 16 days (H1

2018: 20 days).

Net debt, pre the adoption of IFRS 16, at the end of June was

GBP1.2m (30 June 2018: GBP1.9m; 31 December 2018: GBP1.1m). During

the period we finalised renewal of our credit facility with PNC who

have acted as the Company's lenders since 2010. The GBP10m facility

is subject to a minimum period of two years, expiring May 2021,

with an improved discount rate of 2.00% + base (previously 2.35% +

base).

Defined Benefit Pension

The final salary pension scheme deficit was GBP1.1m at 30 June

2019 (30 June 2018: GBP0.9m; 31 December 2018 GBP1.9m). The deficit

has reduced by GBP0.8m since the 2018 year end despite a fall in

discount rates. The improvement was partly due to an increase in

the value of scheme investments and partly as a result of actions

taken by the Board and the Trustees to reduce scheme risk.

The results of the triennial review as at 5 April 2018 were

agreed during the period. As part of the agreement, minimum

contributions to the scheme will remain at similar levels to

contributions made in 2018 at GBP0.3m per year.

Outlook

Trading conditions in the UK recruitment market continue to be

extremely challenging, which supports the Board's view of the need

to change the Parity business model. To that end we have

implemented the first phase of a transformation programme that we

believe will improve the medium-term profitability of the

business.

We are encouraged by the recently announced contract wins and

renewals, and our growing pipeline in higher margin service lines,

but recognise that it will take time for the benefits of our change

programme to translate into improved financial returns. The Board

anticipate making a modest level of adjusted pre-tax profit in the

full year 2019. The precise year end achievement will depend on the

timing and mix of contracts closed in the remainder of the

year.

We remain excited by the scale of opportunity in the data

market. The second half will see further progress with the

transformation plan as we take the new Parity offer to our clients

with enhanced marketing and client communications. We look forward

with increasing confidence to 2020 now that we have the right

people and the right plan in place. The next phase of the

investment programme will include an evaluation of technology

opportunities for competitive advantage and operational

efficiency.

Consolidated condensed income statement

For the six months ended 30 June 2019

Six months Year

to 30.06.19 to 31.12.18

Six months

to 30.06.18

(Unaudited) (Unaudited) (Audited)

Non-recurring Non-recurring

Before items After Before items After

non-recurring (note non-recurring non-recurring (note non-recurring

items 4) items items 4) items

Notes GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

-------------------------- ------- -------------- -------------- -------------- ------------ -------------- -------------- --------------

Continuing operations 2,

Revenue 3 44,514 - 44,514 43,220 86,112 - 86,112

Employee benefit

costs (2,906) (500) (3,406) (3,098) (5,976) (299) (6,275)

Depreciation,

amortisation and

impairment (410) (174) (584) (112) (194) - (194)

All other operating

expenses (40,784) (70) (40,854) (38,984) (78,724) (196) (78,920)

-------------------------- ------- -------------- -------------- -------------- ------------ -------------- -------------- --------------

Total operating

expenses (44,100) (744) (44,844) (42,194) (84,894) (495) (85,389)

-------------------------- ------- -------------- -------------- -------------- ------------ -------------- -------------- --------------

Operating profit/(loss) 414 (744) (330) 1,026 1,218 (495) 723

Finance costs 5 (211) - (211) (179) (365) - (365)

-------------------------- ------- -------------- -------------- -------------- ------------ -------------- -------------- --------------

Profit/(loss)

before tax 203 (744) (541) 847 853 (495) 358

Tax (charge)/credit 7 (71) 135 64 (88) (16) 79 63

-------------------------- ------- -------------- -------------- -------------- ------------ -------------- -------------- --------------

Profit/(loss)

for the period

from continuing

operations 132 (609) (477) 759 837 (416) 421

-------------------------- ------- -------------- -------------- -------------- ------------ -------------- -------------- --------------

Discontinued operations

Loss from discontinued

operations after

tax 6 - - - (388) (381) - (381)

-------------------------- ------- -------------- -------------- -------------- ------------ -------------- -------------- --------------

Profit/(loss)

for the period

attributable to

owners of the

parent 132 (609) (477) 371 456 (416) 40

-------------------------- ------- -------------- -------------- -------------- ------------ -------------- -------------- --------------

(Loss)/earnings per share - Continuing

operations

Basic (loss)/earnings 8 (0.47p) 0.74p 0.41p

per share

Diluted (loss)/earnings 8 (0.47p) 0.73p 0.41p

per share

(Loss)/earnings per share - Continuing

and discontinued operations

Basic (loss)/earnings 8 (0.47p) 0.36p 0.04p

per share

Diluted (loss)/earnings 8 (0.47p) 0.36p 0.04p

per share

-------------------------- ------- -------------- -------------- -------------- ------------ -------------- -------------- --------------

Consolidated condensed statement of comprehensive income

For the six months ended 30 June 2019

Six months Six months Year

to 30.06.19 to 30.06.18 to 31.12.18

(Unaudited) (Unaudited) (Audited)

GBP'000 GBP'000 GBP'000

------------------------------------------- -------------- ------------- -------------

(Loss)/profit for the period (477) 371 40

Other comprehensive income

Items that may be reclassified to profit

or loss

Exchange differences on translation

of foreign operations - - (3)

Items that will never be reclassified

to profit or loss

Remeasurement of defined benefit pension

scheme 857 124 (1,005)

Deferred taxation on remeasurement of

defined benefit pension scheme (146) (21) 171

------------------------------------------- -------------- ------------- -------------

Other comprehensive income/(expense)

for the period after tax 711 103 (837)

------------------------------------------- -------------- ------------- -------------

Total comprehensive income/(expense)

for the period attributable to owners

of the parent 234 474 (797)

------------------------------------------- -------------- ------------- -------------

Consolidated condensed statement of changes in equity

For the six months ended 30 June 2019

Six months to 30 June 2019 (Unaudited)

Share Capital

Share premium redemption Other Retained

capital reserve reserve reserves earnings Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

-------------------------- --------- --------- ------------ ---------- ---------- ---------

At 31 December 2018 2,053 33,244 14,319 34,560 (77,612) 6,564

Adoption of IFRS 16

(note 1) - - - - 6 6

-------------------------- --------- --------- ------------ ---------- ---------- ---------

Revised at 1 January

2019 2,053 33,244 14,319 34,560 (77,606) 6,570

Share options - value

of employee services - - - - 116 116

-------------------------- --------- --------- ------------ ---------- ---------- ---------

Transactions with owners - - - - 116 116

-------------------------- --------- --------- ------------ ---------- ---------- ---------

Loss for the period - - - - (477) (477)

Other comprehensive

income for the period

after tax - - - - 711 711

At 30 June 2019 2,053 33,244 14,319 34,560 (77,256) 6,920

-------------------------- --------- --------- ------------ ---------- ---------- ---------

Six months to 30 June 2018 (Unaudited)

Share Capital

Share premium redemption Other Retained

capital reserve reserve reserves earnings Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

-------------------------- --------- --------- ------------ ---------- ---------- ---------

At 1 January 2018 2,043 33,211 14,319 44,160 (86,544) 7,189

Issue of new ordinary

shares 10 33 - - - 43

Share options - value

of employee services - - - - 27 27

-------------------------- --------- --------- ------------ ---------- ---------- ---------

Transactions with owners 10 33 - - 27 70

-------------------------- --------- --------- ------------ ---------- ---------- ---------

Profit for the period - - - - 371 371

Other comprehensive

income for the period

after tax - - - - 103 103

At 30 June 2018 2,053 33,244 14,319 44,160 (86,043) 7,733

-------------------------- --------- --------- ------------ ---------- ---------- ---------

Year to 31 December 2018 (Audited)

Share Capital

Share premium redemption Other Retained

capital reserve reserve reserves earnings Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

---------------------------- --------- --------- ------------ ---------- ---------- ---------

At 1 January 2018 2,043 33,211 14,319 44,160 (86,544) 7,189

Issue of new ordinary

shares 10 33 - - - 43

Share options - value

of employee services - - - - 129 129

---------------------------- --------- --------- ------------ ---------- ---------- ---------

Transactions with owners 10 33 - - 129 172

---------------------------- --------- --------- ------------ ---------- ---------- ---------

Profit for the year - - - - 40 40

Other comprehensive

expense for the year

after tax - - - - (837) (837)

Reallocation of impairment

charge - - - (9,600) 9,600 -

---------------------------- --------- --------- ------------ ---------- ---------- ---------

At 31 December 2018 2,053 33,244 14,319 34,560 (77,612) 6,564

---------------------------- --------- --------- ------------ ---------- ---------- ---------

Consolidated condensed statement of financial position

As at 30 June 2019

As at As at As at

30.06.19 30.06.18 31.12.18

(Unaudited) (Unaudited) (Audited)

Notes GBP'000 GBP'000 GBP'000

------------------------------- ------ ------------- ------------- -----------

Assets

Non-current assets

Goodwill 4,594 4,594 4,594

Other intangible assets 93 139 86

Property, plant and equipment 92 61 69

Right-of-use assets 1 710 - -

Deferred tax assets 1,071 810 1,153

------------------------------- ------ ------------- ------------- -----------

Total non-current assets 6,560 5,604 5,902

------------------------------- ------ ------------- ------------- -----------

Current assets

Trade and other receivables 11,063 13,279 12,018

Cash and cash equivalents 5,152 5,461 5,829

Total current assets 16,215 18,740 17,847

------------------------------- ------ ------------- ------------- -----------

Total assets 22,775 24,344 23,749

------------------------------- ------ ------------- ------------- -----------

Liabilities

Current liabilities

Loans and borrowings (6,326) (7,364) (6,919)

Lease liabilities 1 (625) - -

Trade and other payables (7,365) (8,324) (8,261)

Provisions (168) - (43)

Total current liabilities (14,484) (15,688) (15,223)

------------------------------- ------ ------------- ------------- -----------

Non-current liabilities

Loans and borrowings - (2) -

Lease liabilities 1 (256) - -

Provisions (20) (19) (20)

Retirement benefit liability 9 (1,095) (902) (1,942)

Total non-current liabilities (1,371) (923) (1,962)

------------------------------- ------ ------------- ------------- -----------

Total liabilities (15,855) (16,611) (17,185)

------------------------------- ------ ------------- ------------- -----------

Net assets 6,920 7,733 6,564

------------------------------- ------ ------------- ------------- -----------

Shareholders' equity

Called up share capital 2,053 2,053 2,053

Share premium account 33,244 33,244 33,244

Capital redemption reserve 14,319 14,319 14,319

Other reserves 34,560 44,160 34,560

Retained earnings (77,256) (86,043) (77,612)

------------------------------- ------ ------------- ------------- -----------

Total shareholders' equity 6,920 7,733 6,564

------------------------------- ------ ------------- ------------- -----------

Consolidated condensed statement of cash flows

For the six months ended 30 June 2019

Six months Six months Year

to 30.06.19 to 30.06.18 to 31.12.18

(Unaudited) (Unaudited) (Audited)

Notes GBP'000 GBP'000 GBP'000

-------------------------------------- ------- -------------- ------------- -------------

Cash flows from operating activities

(Loss)/profit for the period (477) 371 40

Adjustments for:

Net finance expense 5 211 179 365

Share-based payment expense 116 27 129

Income tax credit 7 (64) (85) (236)

Amortisation of intangible assets 35 99 165

Depreciation of property, plant

and equipment 20 37 53

Depreciation and impairment 529 - -

of right-to-use assets

Loss on disposal of discontinued

operation 6 - 312 306

-------------------------------------- ------- -------------- ------------- -------------

370 940 822

Working capital movements

Decrease/(increase) in trade

and other receivables 955 (958) 204

Decrease in trade and other

payables (896) (96) (141)

Increase in provisions 125 1 45

Payments to retirement benefit

plan 9 (103) (125) (326)

-------------------------------------- ------- -------------- ------------- -------------

Net cash flow from/(used in)

operating activities 451 (238) 604

-------------------------------------- ------- -------------- ------------- -------------

Investing activities

Purchase of intangible assets (42) - (14)

Purchase of property, plant

and equipment (43) (11) (35)

Net proceeds from disposal of

subsidiary 6 - 14 114

-------------------------------------- ------- -------------- ------------- -------------

Net cash flow (used in)/from

investing activities (85) 3 65

-------------------------------------- ------- -------------- ------------- -------------

Financing activities

Issue of ordinary shares - 43 43

(Repayment)/drawdown of finance

facility (585) 771 330

Principal repayment of lease

liabilities 1 (374) - -

Interest paid 5 (84) (86) (181)

-------------------------------------- ------- -------------- ------------- -------------

Net cash (used in)/from financing

activities (1,043) 728 192

-------------------------------------- ------- -------------- ------------- -------------

Net (decrease)/increase in cash

and cash equivalents (677) 493 861

-------------------------------------- ------- -------------- ------------- -------------

Cash and cash equivalents at the beginning

of the period 5,829 4,968 4,968

----------------------------------------------- -------------- ------------- -------------

Cash and cash equivalents at the end

of the period 5,152 5,461 5,829

----------------------------------------------- -------------- ------------- -------------

Notes to the interim results

1 Accounting policies

Basis of preparation

The condensed interim financial statements comprise the

unaudited results for the six months to 30 June 2019 and 30 June

2018 and the audited results for the year ended 31 December 2018.

The financial information for the year ended 31 December 2018

herein does not constitute the full statutory accounts for that

period. The Annual Report and Financial Statements for 2018 have

been filed with the Registrar of Companies. The Independent

Auditor's Report on the Annual Report and Financial Statements for

2018 was unqualified and did not contain a statement under 498(2)

or 498(3) of the Companies Act 2006.

The condensed financial statements for the period ended 30 June

2019 have been prepared in accordance with the Disclosure and

Transparency Rules of the Financial Services Authority and with IAS

34 'Interim Financial Reporting' as adopted by the European Union.

The information in these condensed financial statements does not

include all the information and disclosures made in the annual

financial statements.

The condensed financial statements have been prepared in

accordance with International Financial Reporting Standards (IFRS)

as adopted by the EU in a manner consistent with the accounting

policies set out in the Group financial statements for the year

ended 31 December 2018, with the exception of new standards,

amendments and interpretations effective as of 1 January 2019 as

detailed below. IFRS are subject to amendment and interpretation by

the International Accounting Standards Board (IASB) and there is an

ongoing process of review and endorsement by the European

Commission. Any standards, amendments or interpretations that have

been issued but not yet effective have not been adopted early by

the Group.

Going concern

The directors are satisfied that the Group has sufficient

resources to continue in operational existence for the foreseeable

future. Accordingly, they continue to adopt the going concern basis

in preparing these financial statements.

Financial instruments

Unless otherwise indicated, the carrying amounts of the Group's

financial assets and liabilities are a reasonable approximation of

their fair values.

Accounting policies: new standards, amendments and

interpretations

IFRS 16 'Leases'

The Group adopted IFRS 16 from 1 January 2019, replacing IAS 17

'Leases' and related interpretations. This represents a change in

accounting for lease arrangements in which the Group acts as lessee

whereby operating leases previously treated solely through profit

and loss are to be recorded in the statement of financial position

in the form of a right-of-use asset and a lease liability, subject

to exemptions for low value and short-term leases. The nature of

the costs changes from operating expenses to predominantly

depreciation with an interest expense on the lease liability. The

Group has been impacted by IFRS 16 on its leases for property.

In accordance with the transition provisions of IFRS 16,

comparative information has not been restated, with the cumulative

effect of initially applying the standard recognised as an

adjustment to retained earnings at 1 January 2019. Lease

liabilities previously assessed as operating leases have been

measured on 1 January 2019 at the present value of the remaining

lease payments, discounted using the Group's incremental borrowing

rate at that date of 3.10%. Associated right-of-use assets have

been measured at amounts equal to the lease liabilities, adjusted

for any prepaid or accrued lease payments.

The Group has applied practical expedients permitted by IFRS 16,

including relying on previous assessments on whether leases are

onerous as an alternative to performing an impairment review and

excluding initial direct costs for the measurement of right-of-use

assets at 1 January 2019.

1 Accounting policies (continued)

Application resulted in the recognition of total lease

liabilities of GBP1,060,000 and right-of-use assets of

GBP1,066,000, with an adjustment to retained earnings of GBP6,000.

At 30 June 2019 the difference between the lease liabilities and

right-of-use assets mainly relates to an impairment to the

right-of-use assets. Depreciation on right-of-use assets for the

six months to 30 June 2019 was GBP355,000.

The amounts recognised in relation to right-of-use assets and

lease liabilities at the interim balance sheet date are as

follows:

(Unaudited)

GBP'000

-------------------------------------------------------- ------------

Lease liabilities

Operating lease commitments disclosed at 31 December

2018 1,132

Not recognised within the scope of IFRS 16 (39)

Effect of discounting using incremental borrowing rate (33)

-------------------------------------------------------- ------------

Recognised on application of IFRS 16 on 1 January 2019 1,060

Other finance leases at 1 January 2019 8

Additions 173

Interest expense 14

Principal repayment (374)

-------------------------------------------------------- ------------

At 30 June 2019 881

-------------------------------------------------------- ------------

Right-of-use assets

Recognised on application of IFRS 16 on 1 January 2019 1,066

Additions 173

Depreciation (355)

Impairment (note 4) (174)

At 30 June 2019 710

-------------------------------------------------------- ------------

2 Segmental information

During the period, the Group initiated a strategic

reorganisation such that reporting of financial information to the

Chief Operating Decision Maker (the Group Board) by operating

segments changed. The Group currently has three operating segments,

being Recruitment (previously Parity Professionals), Consultancy

(previously Parity Consultancy Services) and, since 2019, Learning

& Development. The three service lines are supported by a

single sales, marketing and back office function. Accordingly,

internal overheads are not allocated to service lines. In

accordance with IFRS 8 'Operating Segments', segmental information

from prior periods has been restated.

Six months to 30 June 2019

(Unaudited) Learning

Recruitment Consultancy & Development Total

Continuing operations GBP'000 GBP'000 GBP'000 GBP'000

Gross revenue from external

customers 40,920 3,594 - 44,514

Contractor costs (36,973) - - (36,973)

--------------------------------------- -------------- -------------- ---------------- ---------

Net revenue 3,947 3,594 - 7,541

Sub-contracted direct costs - (2,843) - (2,843)

--------------------------------------- -------------- -------------- ---------------- ---------

External contribution 3,947 751 - 4,698

Internal sales and delivery

costs (2,266)

--------------------------------------- -------------- -------------- ---------------- ---------

Contribution 2,432

Group and shared service

costs (1,492)

Depreciation and amortisation (410)

Share-based payment (116)

Operating profit before non-recurring

items 414

Finance costs (211)

--------------------------------------- -------------- -------------- ---------------- ---------

Adjusted profit before tax 203

Non-recurring items (744)

--------------------------------------- -------------- -------------- ---------------- ---------

Loss before tax (541)

--------------------------------------- -------------- -------------- ---------------- ---------

2 Segmental information (continued)

Six months to 30 June 2018 (Unaudited,

Restated) Recruitment Consultancy Total

Continuing operations GBP'000 GBP'000 GBP'000

Gross revenue from external customers 38,078 5,142 43,220

Contractor costs (34,230) - (34,230)

---------------------------------------- -------------- -------------- ---------

Net revenue 3,848 5,142 8,990

Sub-contracted direct costs - (3,756) (3,756)

---------------------------------------- -------------- -------------- ---------

External contribution 3,848 1,386 5,234

Internal sales and delivery costs (2,448)

---------------------------------------- -------------- -------------- ---------

Contribution 2,786

Group and shared service costs (1,621)

Depreciation and amortisation (112)

Share-based payment (27)

Operating profit before non-recurring

items 1,026

Finance costs (179)

---------------------------------------- -------------- -------------- ---------

Adjusted profit before tax 847

Non-recurring items -

---------------------------------------- -------------- -------------- ---------

Profit before tax 847

---------------------------------------- -------------- -------------- ---------

Year to 31 December 2018 (Audited,

Restated) Recruitment Consultancy Total

Continuing operations GBP'000 GBP'000 GBP'000

Gross revenue from external customers 77,616 8,496 86,112

Contractor costs (69,935) - (69,935)

---------------------------------------- -------------- -------------- ---------

Net revenue 7,681 8,496 16,177

Sub-contracted direct costs - (6,500) (6,500)

---------------------------------------- -------------- -------------- ---------

External contribution 7,681 1,996 9,677

Internal sales and delivery costs (5,034)

---------------------------------------- -------------- -------------- ---------

Contribution 4,643

Group and shared service costs (3,102)

Depreciation and amortisation (194)

Share-based payment (129)

Operating profit before non-recurring

items 1,218

Finance costs (365)

---------------------------------------- -------------- -------------- ---------

Adjusted profit before tax 853

Non-recurring items (495)

---------------------------------------- -------------- -------------- ---------

Profit before tax 358

---------------------------------------- -------------- -------------- ---------

All segment assets and liabilities are based in the UK.

3 Revenue

The Group's revenue from external customers disaggregated by

pattern of revenue recognition is as follows:

Six months to Six months to Year to 31.12.18

30.06.19 (Unaudited) 30.06.18 (Unaudited) (Audited)

Recruitment Consultancy Recruitment Consultancy Recruitment Consultancy

Continuing operations GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------------- ------------ ------------ ------------ ------------ ------------ ------------

Services transferred

over time 40,602 3,594 37,712 5,142 76,978 8,496

Services transferred

at a point in time 318 - 366 - 638 -

Revenue from external

customers 40,920 3,594 38,078 5,142 77,616 8,496

------------------------- ------------ ------------ ------------ ------------ ------------ ------------

3 Revenue (continued)

The Group's revenue from external customers disaggregated by

primary geographical market is as follows:

Six months to Six months to Year to 31.12.18

30.06.19 (Unaudited) 30.06.18 (Unaudited) (Audited)

Recruitment Consultancy Recruitment Consultancy Recruitment Consultancy

Continuing operations GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------------- ------------ ------------ ------------ ------------ ------------ ------------

UK 39,590 3,594 37,889 5,142 76,033 8,496

Rest of EU 1,330 - 189 - 1,583 -

Revenue from external

customers 40,920 3,594 38,078 5,142 77,616 8,496

------------------------- ------------ ------------ ------------ ------------ ------------ ------------

4 Non-recurring items

Six months Six months Year to

to to 31.12.18

30.06.19 30.06.18 (Audited)

(Unaudited) (Unaudited) GBP'000

Continuing operations GBP'000 GBP'000

--------------------------------------- ------------- ------------- -----------

Restructuring

- Employee benefit costs 500 - 279

- Impairment of right-of-use assets 174 - -

- Other operating costs 70 - 122

Legal costs - - 74

Past service cost for defined benefit

pension scheme - - 20

--------------------------------------- ------------- ------------- -----------

744 - 495

--------------------------------------- ------------- ------------- -----------

Non-recurring items during 2019 included:

-- Costs related to the restructuring of the Group, aligning the

organisation to its refocused strategy. Costs include employee

termination payments, impairments to right-of-use assets and

provisions for costs from vacated property, and fees for related

professional services

The impairment of right-of-use assets of GBP174,000 relates to

the Group's vacated office premises and is equal to the difference

between the carrying value of the assets and the expected

recoverable amount from subletting from the premises. Further

onerous costs in respect of the premises are included within

provisions.

Non-recurring items during 2018 included:

-- Costs related to restructuring of the Parity Consultancy

Services division. Costs include employee termination payments,

fees for professional services and costs of changes in management

structure

-- Legal costs for professional services fees in respect of one-off cases

-- Past service cost for the Group's defined benefit pension

scheme in respect of GMP equalisation

5 Finance costs

Six months Six months Year to

to to 31.12.18

30.06.19 30.06.18 (Audited)

(Unaudited) (Unaudited) GBP'000

GBP'000 GBP'000

--------------------------------------- ------------- ------------- -----------

Interest expense on lease liabilities 14 - -

Interest expense on other financial

liabilities 84 86 181

Net finance costs in respect of

post-retirement benefits 113 93 184

Total finance costs 211 179 365

--------------------------------------- ------------- ------------- -----------

The interest expense on other financial liabilities represents

interest paid on the Group's asset-based financing facilities.

6 Discontinued operations

In April 2018 the Group sold Inition Limited. As such, Inition

Limited's operating result for the comparative periods, as well as

the loss on disposal of Inition Limited is presented as

discontinued.

7 Taxation

Six months Six months Year to

to to 31.12.18

30.06.19 30.06.18 (Audited)

(Unaudited) (Unaudited) GBP'000

Continuing operations GBP'000 GBP'000

------------------------------------ ------------- ------------- -----------

Recognised in the income statement

Current tax charge - - -

Deferred tax (credit)/charge (64) 88 (63)

------------------------------------ ------------- ------------- -----------

Total tax (credit)/charge (64) 88 (63)

------------------------------------ ------------- ------------- -----------

Recognised in other comprehensive

income

Deferred tax charge/(credit) 146 21 (171)

------------------------------------ ------------- ------------- -----------

8 Earnings per ordinary share

Basic earnings per share is calculated by dividing the basic

earnings for the period by the weighted average number of fully

paid ordinary shares in issue during the period. Diluted earnings

per share is calculated on the same basis as the basic earnings per

share with a further adjustment to the weighted average number of

fully paid ordinary shares to reflect the effect of all dilutive

potential ordinary shares.

Six months to 30.06.2019 Six months to 30.06.2018 Year to 31.12.2018

(Unaudited) (Unaudited, restated) (Audited)

----------------- ------------------------------ ------------------------------------ ------------------------------------

Weighted Weighted Weighted

average average Earnings/ average Earnings/

number Loss Earnings/ number (loss) Earnings/ number (loss)

Loss of per (loss) of per (loss) of per

GBP'000 shares share GBP'000 shares share GBP'000 shares share

000's Pence 000's Pence 000's Pence

----------------- --------- --------- -------- ----------- --------- ------------ ----------- --------- ------------

Continuing operations

Basic

(loss)/earnings

per share (477) 102,624 (0.47) 759 102,302 0.74 421 102,464 0.41

Effect of

dilutive

options - - - - 1,412 - - 1,126 -

Diluted

(loss)/earnings

per share (477) 102,624 (0.47) 759 103,714 0.73 421 103,590 0.41

Discontinued operations

Basic loss per

share - - - (388) 102,302 (0.38) (381) 102,464 (0.37)

Effect of - - - - - - - - -

dilutive

options

Diluted earnings

per share - - - (388) 102,302 (0.38) (381) 102,464 (0.37)

Continuing and discontinued operations

Basic

(loss)/earnings

per share (477) 102,624 (0.47) 371 102,302 0.36 40 102,464 0.04

Effect of

dilutive

options - - - - 1,412 - - 1,126 -

Diluted

(loss)/earnings

per share (477) 102,624 (0.47) 371 103,714 0.36 40 103,590 0.04

----------------- --------- --------- -------- ----------- --------- ------------ ----------- --------- ------------

As at 30 June 2019 the number of ordinary shares in issue was

102,624,020 (30 June 2018 and 31 December 2018: 102,624,020).

9 Pension commitments

The Group provides employee benefits under various arrangements,

through defined benefit and defined contribution pension plans, the

details of which are disclosed in the 2018 Annual Report and

Accounts. At the interim balance sheet date, the major assumptions

used in assessing the defined benefit pension scheme liability have

been reviewed and updated based on a roll-forward of the last

formal actuarial valuation, which was carried out as at 5 April

2018.

The following changes in estimate have been applied to the IAS

19 valuation as at 30 June 2019:

30.06.19 30.06.18 31.12.18

----------------------------------------- --------- --------- ---------

Rate of increase in pensions in payment 3.7-3.9% 3.7-3.9% 3.7-4.0%

Discount rate 2.3% 2.7% 2.8%

Retail price inflation 3.3% 3.2% 3.4%

Consumer price inflation 2.3% 2.2% 2.4%

----------------------------------------- --------- --------- ---------

The deficit has reduced by GBP0.8m since the 2018 year end

despite a fall in discount rates. The improvement was partly due to

an increase in the value of scheme investments and partly as a

result of actions taken by the board and the Trustees to reduce

scheme risk.

10 Related party transactions

Transactions between the Company and its subsidiaries, which are

related parties, have been eliminated on consolidation and are

therefore not disclosed in this note.

There were no other related party transactions during the period

(2018: none).

11 Events after the reporting period

There are no events after the reporting period not reflected in

the interim financial statements.

Statement of Directors' responsibilities

The Directors confirm, to the best of their knowledge:

-- The condensed set of financial statements has been prepared

in accordance with IAS 34 'Interim Financial Reporting', as adopted

by the European Union;

-- The interim management report includes a fair review of the

information required by DTR 4.2.7R of the Disclosure and

Transparency Rules of the United Kingdom's Financial Services

Authority, being an indication of important events that have

occurred during the first six months of the financial year and

their impact on the condensed set of financial statements, and a

description of the principal risks and uncertainties for the

remaining six months of the year, and gives a true and fair view of

the assets, liabilities, financial position and profit for the

period of the Group; and

-- The interim management report includes a fair review of the

information required by DTR 4.2.8R of the Disclosure and

Transparency Rules of the United Kingdom's Financial Services

Authority, being a disclosure of related party transactions and

changes therein since the previous annual report.

By order of the Board

John Conoley

Non-Executive Chairman

20 September 2019

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR CKCDPPBKDBCD

(END) Dow Jones Newswires

September 20, 2019 02:00 ET (06:00 GMT)

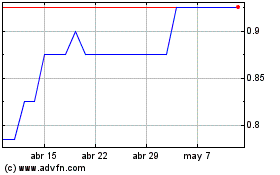

Partway (LSE:PTY)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Partway (LSE:PTY)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024