TIDMBGLF

RNS Number : 1778N

Blackstone / GSO Loan Financing Ltd

20 September 2019

20 SEPTEMBER 2019

FOR IMMEDIATE RELEASE

RELEASED BY BNP PARIBAS SECURITIES SERVICES S.C.A., JERSEY

BRANCH

HALF-YEARLY RESULTS ANNOUNCEMENT

THE BOARD OF DIRECTORS OF BLACKSTONE / GSO LOAN FINANCING

LIMITED ANNOUNCE HALF- YEARLY RESULTS FOR THE SIX MONTHSED 30 JUNE

2019

Strategic report

Reconciliation of IFRS NAV to Published NAV

At 30 June 2019, there was a difference between the NAV per

Ordinary Share and NAV per C Share as disclosed in the Condensed

Statement of Financial Position, of EUR0.8798 per Ordinary Share

and EUR0.5591, ("IFRS NAVs") compared to the published NAVs, of

EUR0.9169 per Ordinary Share and EUR0.5738 per C Share, which was

released to the LSE on 19 July 2019 ("Published NAVs"). A

reconciliation is provided in Note 14. The entire difference

between the two numbers is due to the different valuation bases

used to determine the value of the investments.

Valuation Policy for the Published NAV

The Company publishes a NAV per Ordinary Share and C Share on a

monthly basis in accordance with its Prospectus. The Published NAVs

are based on a monthly valuation process for each class that

incorporates the valuation of its CSWs and PPNs, which in turn are

based on the valuation of the BGCF portfolio using a CLO intrinsic

calculation methodology per the Company's Prospectus, which we

refer to as a "mark to model" approach. As documented in the

Prospectus, certain "Market Colour" (market clearing levels, market

fundamentals, bids wanted in competition ("BWIC"), broker quotes or

other indications) is not incorporated into this methodology. The

Directors believe that valuations on this basis are the appropriate

way of tracking the long-term performance of the Company as the

underlying portfolio of CLOs held by BGCF are comparable to held to

maturity instruments and the Company expects to receive the benefit

of the underlying cash-flows over the CLOs' entire life cycle.

Valuation Policy for the IFRS NAV

For financial reporting purposes annually and semi-annually, to

comply with IFRS as adopted by the EU, the valuation of BGCF's

portfolio of assets is at fair value using models that incorporate

Market Colour at the period end date, which we refer to as a "mark

to market" approach. IFRS fair value is the price that would be

received to sell an asset or paid to transfer a liability in an

orderly transaction between market participants as at the

measurement date, and is an "exit price" e.g. the price to sell an

asset. An exit price embodies expectations about the future cash

inflows and cash outflows associated with an asset or liability

from the perspective of a market participant. IFRS fair value is a

market-based measurement, rather than an entity-specific

measurement, and is measured using assumptions that market

participants would use in pricing the asset or liability, including

assumptions about risk. Both the mark to model Published NAV and

mark to market IFRS NAV valuation bases use modelling techniques

and input from third-party valuation specialists.

In respect of the C Share class, the CLOs held directly are

valued using a mark to market approach for both the Published NAV

and the IFRS NAV. The underlying CLO investments held by BGCF are

valued using modelling methodologies, described in the Company's

Prospectus, that are based upon many assumptions.

The Directors, as set out in the Prospectus, will continue to

assess the performance of the Company using the Published NAV. As

noted in the Annual Report and Audited Financial Statements for the

year ended 31 December 2018, going forward, the Directors, in

conjunction with the Portfolio Adviser, are also considering

presenting additional information and commentary on Market Colour,

credit risk exposure and any material divergence from the different

valuation bases referred to above.

Key Performance Indicators (1)

Ordinary Share C Share

NAV per the Published NAV per the Published

financial NAV financial NAV

statements statements

("IFRS NAV") ("IFRS NAV")

NAV (1) EUR0.8798 EUR0.9169 EUR0.5591 EUR0.5738

(31 Dec 2018: (31 Dec 2018: (31 Dec 2018: (31 Dec 2018:

EUR0.8065) EUR0.8963) N/A) N/A)

NAV total 15.30% 8.13% 2.66% 5.37%

return (1)

(31 Dec 2018: (31 Dec 2018: (31 Dec 2018: (31 Dec 2018:

(3.99)%) 6.70%) N/A) N/A)

Discount (5.66)% (9.48)% (14.15)% (16.35)%

(1)

(31 Dec 2018: (31 Dec 2018: (31 Dec 2018: (31 Dec 2018:

(5.77)%) (15.21)%) N/A) N/A)

Dividend- EUR0.050 EUR0.050 EUR0.05642 EUR0.05642

(30 Jun 2018: (30 Jun 2018: (31 Jun 2018: (31 Jun 2018:

EUR0.050) EUR0.050) N/A) N/A)

Further information on the reconciliation between the IFRS NAVs

and the Published NAVs can be found above.

Performance

Ticker IFRS Published Share Price(2) Discount Discount Dividend

NAV NAV IFRS NAV Published Yield

per Share per Share NAV

-------- ----------- ----------- --------------- ---------- ----------- ---------

BGLF

30 Jun

2019 EUR0.8798 EUR0.9169 EUR0.8300 (5.66)% (9.48)% 12.05%

31 Dec

2018 EUR0.8065 EUR0.8963 EUR0.7600 (5.77)% (15.21)% 13.16%

-------- ----------- ----------- --------------- ---------- ----------- ---------

BGLP

30 Jun

2019 GBP0.7881 GBP0.8213 GBP0.7300 (7.37)% (11.12)% 12.27%

31 Dec

2018 GBP0.7251 GBP0.8058 GBP0.7175 (1.05)% (10.95)% 12.53%

-------- ----------- ----------- --------------- ---------- ----------- ---------

BGLC

30 Jun

2019 EUR0.5591 EUR0.5738 EUR 0.4800 (14.15)% (16.35)% 15.67%

31 Dec N/A N/A N/A N/A N/A N/A

2018

-------- ----------- ----------- --------------- ---------- ----------- ---------

LTM 3-Year Annualised Cumulative

Return(1) Annualised Since Inception Since Inception

--------------------- ----------- ------------ ----------------- -----------------

BGLF IFRS NAV 9.56% 5.67% 6.50% 36.47%

BGLF Published NAV 14.18% 7.14% 7.39% 42.22%

BGLF Ordinary Share

Price 5.11% 6.78% 5.55% 30.59%

BGLC IFRS NAV N/A N/A N/A 2.66%

BGLC Published NAV N/A N/A N/A 5.37%

BGLF C Share Price N/A N/A N/A 1.90%

European Loans 2.75% 3.70% 3.31% 17.47%

US Loans 4.15% 5.43% 3.91% 20.86%

--------------------- ----------- ------------ ----------------- -----------------

(1) Refer to Glossary for an explanation of the terms used above

and elsewhere within this report

(2) Bloomberg closing price at period end

Dividend History

Whilst not forming part of the investment objective or policy of

the Company, dividends will be payable in respect of each calendar

quarter, two months after the end of such quarter. The Company

declared dividends of EUR0.050 per Ordinary Share and dividends of

EUR0.05642 per C Share for the first half of 2019.

Ordinary Share Dividends for the Period Ended 30 June 2019

Period in respect of Date Declared Ex-dividend Date Payment Date Amount per Ordinary Share

-------------------------- -------------- ----------------- ------------- -------------------------

EUR

-------------------------- -------------- ----------------- ------------- -------------------------

1 Jan 2019 to 31 Mar 2019 18 Apr 2019 2 May 2019 31 May 2019 0.0250

1 Apr 2019 to 30 Jun 2019 18 Jul 2019 25 Jul 2019 23 Aug 2019 0.0250

-------------------------- -------------- ----------------- ------------- -------------------------

Dividends paid on Ordinary Shares during the period ended 30

June 2019 amounted to EUR20,235,022.

C Share Dividends for the Period Ended 30 June 2019

Period in respect of Date Declared Ex-dividend Date Payment Date Amount per

C Share

-------------------------- -------------- ----------------- ------------- ----------

EUR

-------------------------- -------------- ----------------- ------------- ----------

1 Oct 2018 to 31 Dec 2018 22 Jan 2019 31 Jan 2019 1 Mar 2019 0.01452

1 Jan 2019 to 31 Mar 2019 18 Apr 2019 2 May 2019 31 May 2019 0.0205

1 Apr 2019 to 30 Jun 2019 18 Jul 2019 25 Jul 2019 23 Aug 2019 0.0214

-------------------------- -------------- ----------------- ------------- ----------

Dividends paid on C Shares during the period ended 30 June 2019

amounted to EUR4,673,458.

Ordinary Share Dividends for the Year Ended 31 December 2018

Period in respect of Date Declared Ex-dividend Date Payment Date Amount per Ordinary Share

--------------------------- -------------- ----------------- ------------- -------------------------

EUR

--------------------------- -------------- ----------------- ------------- -------------------------

1 Jan 2018 to 31 Mar 2018 20 Apr 2018 3 May 2018 1 Jun 2018 0.0250

1 Apr 2018 to 30 Jun 2018 19 Jul 2018 26 Jul 2018 24 Aug 2018 0.0250

1 Jul 2018 to 30 Sept 2018 18 Oct 2018 25 Oct 2018 23 Nov 2018 0.0250

1 Oct 2018 to 31 Dec 2018 22 Jan 2019 31 Jan 2019 1 Mar 2019 0.0250

--------------------------- -------------- ----------------- ------------- -------------------------

Dividends paid on Ordinary Shares during the year ended 31

December 2018 amounted to EUR40,470,044.

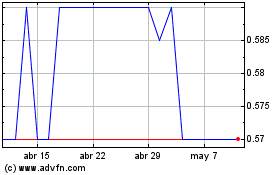

Period Highs and Lows

2019 2019 2018 2018

High Low High Low

Published NAV per Ordinary Share EUR0.9215 EUR0.8824 EUR0.9183 EUR0.8837

Ordinary Share Price (last price) EUR0.8500 EUR0.7500 EUR0.9875 EUR0.7600

GBP Ordinary Share Price (last price) GBP0.7300 GBP0.7000 GBP0.8750 GBP0.7150

Published NAV per C Share EUR0.5944 EUR0.5474 N/A N/A

C Share Price (last price) EUR0.5050 EUR0.4610 N/A N/A

-------------------------------------- --------- --------- --------- ---------

Schedule of Investments

As at 30 June 2019 - Ordinary Share

Nominal Market % of Net Asset

Holdings Value Value

EUR

-------------------------------------------- ----------- ----------- --------------

Investment held in the Lux Subsidiary:

CSWs 274,400,106 340,335,933 96.15

Shares (2,000,000 Class A and 1 Class B) 2,000,001 5,202,903 1.47

Other Net Assets - 8,406,402 2.38

-------------------------------------------- ----------- ----------- --------------

Net Assets Attributable to Ordinary Class Shareholders 353,945,238 100.00

--------------------------------------------------------- ----------- --------------

As at 30 June 2019 - C Share

Nominal Market % of Net Asset

Holdings Value Value

EUR

--------------------------------------- ---------- ---------- --------------

Investment held in the Lux Subsidiary:

CSWs 45,285,816 44,894,539 60.17

Investments held directly (CLOs):

2 Mezzanine Notes 6,141,000 4,706,395 6.31

12 Income Notes 35,267,000 14,078,223 18.87

Other Net Assets 10,933,890 14.65

--------------------------------------- ---------- ---------- --------------

Net Assets Attributable to C Class Shareholders 74,613,047 100.00

--------------------------------------------------- ---------- --------------

Schedule of Significant Transactions

Date of Transaction Transaction Type Amount Reason

EUR

------------------- ---------------- ---------- --------------------------------

CSWs held by the Ordinary Class

14 Feb 2019 Redemption 10,396,087 To fund dividend

14 May 2019 Redemption 10,533,046 To fund dividend

CSWs held by the C Class

1 February 2019 Subscription 8,000,000 Investments in PPNs

1 March 2019 Subscription 4,300,000 Investments in PPNs

1 April 2019 Subscription 8,500,000 Investments in PPNs

1 May 2019 Subscription 8,200,000 Investments in PPNs

14 May 2019 Redemption 220,490 To fund dividend

4 June 2019 Subscription 16,500,000 Investments in PPNs

CLOs directly held by the C Class

January 2019 Disposal 5,651,234 Liquidation to re-invest in CSWs

February 2019 Disposal 2,046,492 Liquidation to re-invest in CSWs

March 2019 Disposal 8,845,776 Liquidation to re-invest in CSWs

April 2019 Disposal 7,943,124 Liquidation to re-invest in CSWs

May 2019 Disposal 19,847,233 Liquidation to re-invest in CSWs

June 2019 Disposal 2,457,288 Liquidation to re-invest in CSWs

Chair's Statement

Dear Shareholders,

Company Returns and Net Asset Value(3)

The Company delivered an IFRS NAV total return per Ordinary

Share of 15.30% over the first six months of 2019 (1.04% in 2018),

ending the period with a NAV of EUR0.8798 (EUR0.8970 at 30 June

2018). LTM dividend yield was 12.05% for the Ordinary Shares. The

return was comprised 5.58% of dividend income and 9.72% of net

portfolio movement.

On a Published NAV basis, the Company delivered a total return

per Ordinary Share of 8.13% over the first six months of 2019

(1.04% in 2018), ending the period with a NAV of EUR0.9169

(EUR0.8970 at 30 June 2018). The return was composed of dividend

income 5.58% and of net portfolio movement of 2.55%.

The Company delivered an IFRS NAV total return per C Share of

2.66% over the first six months of 2019 (N/A in 2018), ending the

period at EUR0.5591 (N/A at 30 June 2018). The return was comprised

6.04% of dividend income and (3.38)% of net portfolio movement.

On a Published NAV basis, the Company delivered a total return

per C Share of 5.37% over the first six months of 2019 (N/A in

2018), ending the period at EUR0.5738 (N/A at 30 June 2018). The

return was composed of dividend income 6.04% and of net portfolio

movement of (0.67)%.

During the first half of 2019, the Company took advantage of the

continued market strength in order to further diversify and de-risk

the BGCF portfolio. Returns were positively impacted by spread

widening driving higher distributions from underlying CLOs and

improvements in the mark-to-model valuations. The directly held

loan component of the portfolio also benefitted from a recovery in

loan prices.

The Company paid two dividends to Ordinary Shareholders in

respect of the six month period ended 30 June 2019, totalling

EUR0.50 per share. The Company paid two dividends to C Shareholders

in respect of the six month period ended 30 June 2019, totalling

EUR0.035 per share. Details of all dividend payments can be found

within the Dividend History section at the front of this Half

Yearly Financial Report.

Market Conditions

As markets cross the midpoint for the year, it is hard to argue

that the first half of the year has been anything but positive for

global assets. The subsequent rebound in early 2019 after a

disappointing 4th quarter of 2018 resulted in strong returns across

the fixed income space. Global equity markets shrugged off

weakening economic data as well as increasing trade tensions

between the US and China to produce strong performance: the S&P

500 returned 17.4% for the first six months of 2019, while the

Euronext 100 returned 16.8%. Returns were fuelled mainly by an

increasingly dovish tilt in Federal Reserve commentary as well as

the European Central Bank hinting at further monetary policy

easing, the prospects of which propelled risk assets to new highs

by the end of June.

US credit outperformed European credit over the first half of

2019, with high yield the general outperformer. Loans in the US and

Europe returned 5.42% and 3.11%, respectively, compared to high

yield bonds, which returned 9.95% in the US and 7.65% in Europe

over the same period.

Clouds on the global economy have been forming in 2019, however.

Subdued economic growth was recorded in the Eurozone, with gross

domestic product ("GDP") quarter-on-quarter growth falling from

0.4% in Q1 to 0.2% in Q2. Eurozone Manufacturing PMI, a leading

indicator of growth in the economy, contracted over the first six

months of 2019 to below 50 (the demarcation line between growth and

contraction), where it has remained to date. Business confidence

was slightly more optimistic in the US, with GDP annualised

quarter-on-quarter growth of 3.1% and 2.0% in Q1 and Q2,

respectively. Employment data remained broadly encouraging in both

markets. Volatility has been elevated in recent weeks in both the

US and European markets, and we expect that may continue throughout

the rest of 2019.

Discount Management

The share price discount to IFRS NAV narrowed from 5.77% at 31

December 2018 to 5.66% at 30 June 2019 and the share price discount

to Published NAV narrowed from 15.21% at 31 December 2018 to 9.48%

at 30 June 2019. The discount is 11.88% based on the Published NAV

(31 July 2019) and the closing share price as at 18 September 2019.

As a Board, we regularly weigh the balance between maintaining

liquidity of the Euro shares, the stability of any discount or

premium, and the desire of Shareholders to see the Euro shares

trade as closely as possible to their intrinsic value.

On 23 January 2019, the Board announced that, under the general

authority conferred by the Company's Shareholders at its Annual

General Meeting on 22 June 2018; it would buy back shares in the

market using available cash with the goal of reducing the discount.

This was undertaken in the first half of 2019, and the purchased

shares were held in treasury. Further details on the share

repurchase programme can be found below.

Blackstone / GSO Loan Financing C Share Update

In January 2019, in connection with the Rollover Opportunity

whereby shareholders in Carador Income Fund plc were provided the

opportunity to rollover their existing investment into an

investment in newly issued C Shares of BGLF ("BGLC"), BGLF issued

133.5 million of such C shares. The intention was that, over time,

the assets attributed to the rollover pool would be sold. We

actively traded the BGLC portfolio of Rollover Assets liquidating

98.4 million of par (approximately 75% of the initial par rolled

over) given the recovery in loan and CLO prices. We plan to

continue the liquidation of the remaining portfolio as quickly as

possible, albeit selectively considering the softer tone of the

current CLO equity market.

Brexit Update

Geopolitical volatility has been a key driver of uncertainty,

and will remain one over the next few years. The board continues to

monitor the ongoing negotiations regarding the UK's exit from the

European Union ("Brexit") and the working group within Blackstone

and the Portfolio Adviser continue to consider the potential

implications, risks and preparations required. The potential

implications to BGLF continue to be evaluated across its service

providers as the Brexit situation evolves, including areas such as

counterparty relationships, supply chains, macroeconomic, and

regulatory policy, as well as with regards to its marketing

registrations. At this point in time, the implications are

considered to have a limited impact on the long-term sustainability

of the Company. Further information can be found on in the Risk

Overview section of this report. The longer-term impact of Brexit

will continue to be monitored as the situation evolves.

The Board

Good governance remains at the heart of our work as a Board and

is taken very seriously. We believe that the Company maintains high

standards of corporate governance. The Board was very active during

the period, convening a total of 6 Board meetings and 12 Committee

meetings, as well as undertaking an onsite due diligence review in

July 2019 of Blackstone / Debt Funds Management Europe Limited and

GSO / Blackstone Debt Funds Management LLC (together, the

"Adviser"). The Board used this visit to discuss various aspects of

operational risk and controls, the loan and CLO markets, and the

current market conditions.

In addition, as evident from the corporate activity during the

period, the Board and its advisers have worked hard to ensure the

continued success and growth of the Company to put it in the best

position to take advantage of all appropriate opportunities.

The work of the Board is assisted by the Audit Committee,

Management Engagement Committee, the Remuneration and Nomination

Committee and the Risk Committee.

The Company is a member of the Association of Investment

Companies (the "AIC") and adheres to the AIC Code of Corporate

Governance (the "AIC Code") which is endorsed by the Financial

Reporting Council (the "FRC"), and meets the Company's obligations

in relation to the UK Corporate Governance Code 2018 (the "UK

Code").

Effective 8 January 2019, the Board appointed Mark Moffat as a

non-executive director. Mark has been involved in the structuring,

managing and investing in CLOs for over 20 years. As Mark was

employed by GSO Capital Partners LP ("GSO") until early 2015, the

Board does not consider him to be an independent director; however,

we believe that his knowledge and experience will be a valuable

addition to the Board.

Shareholder Communications

During 1H19, using our Adviser and Brokers, we continued our

programme of engagement with current and prospective Shareholders.

We sincerely hope that you found the monthly factsheets and other

information valuable. We are always pleased to have contact with

Shareholders and we welcome any opportunity to meet with you and

obtain your feedback.

Prospects and Opportunities in 2019

Looking ahead to the remainder of 2019, there continues to be a

myriad of factors including weakening global macro data, escalating

trade war tensions and the impact of Brexit that may affect

investor sentiment within the global credit markets. Central banks

in the US, Europe, Japan, China and elsewhere are preparing to

flood the markets with liquidity again. With a potential new round

of quantitative easing (QE) on the horizon, investors can again

expect asset buy-backs to create liquidity allowing portfolios in

receipt of new cash to rebalance. This should ultimately lead to an

increase in demand over a broad range of assets, supporting prices

in the near term and compressing yields. From a relative value

basis, given recent price increases and potential impact of QE we

currently favour loans over high yield.

The Board remains constructive on credit in 2019 and continue to

believe that floating rate senior loans offer a compelling

risk--reward opportunity. This is further supported by our view

that the seniority of loans in the corporate structure offers

defensive positioning unique to the asset class and that loans

remain a well suited component of portfolios in a late cycle

environment.

As we move into the second half of 2019, the Board continues to

believe that the Company is well positioned to access favourable

investment opportunities in loans and CLOs through its investment

in BGCF.

The Board wishes to express its thanks for the support of the

Company's Shareholders.

Charlotte Valeur

Chair

20 September 2019

(3) Past performance is not necessarily indicative of future

results, and there can be no assurance that the Company will

achieve comparable results, will meet its target returns, achieve

its investment objectives, or be able to implement its investment

strategy.

Portfolio Adviser's Review

We are pleased to present our review of the first six months of

2019 and outlook for the remainder of the year.

Bank Loan Market Overview(4)(5)

During the first half of 2019, monetary policy transitioned

globally from coordinated tightening to coordinated easing, and

central banks in the US, Europe, Japan, China and elsewhere are

preparing to flood the markets with liquidity again. In Europe,

after nearly a year of trying to convince markets that it would end

quantitative easing, the European Central Bank ("ECB") has now

acknowledged the extent of Europe's economic problems and will

likely begin to pursue rate cuts and balance sheet expansion in the

second half of 2019 in order to stave off recession. In the US,

hawkish monetary policy was also reversed as the Federal Reserve

("Fed") bowed to pressure from investors who saw slowing growth in

Europe and China and weak inflation in the US as threats to the

global economy. The prospect of coordinated easing propelled risk

assets to new highs in the first half of 2019, turning the

relationship between markets and central banks on its head. Risk

assets are meant to rally after the Fed cuts, not before, but over

the first six months of 2019 the S&P 500, for example, was up

over 20%.

European Loans, as represented by the Credit Suisse Western

European Leveraged Loan Index, returned 3.11% for the first half of

2019 with gains largely driven by the strong rebound of prices in

January and February following weakness in the final quarter of

2018. Low levels of new loan issuance year-to-date, coupled with

strong CLO formation, resulted in increased demand for secondary

loans, which further supported prices. The average price of

European Loans increased from EUR96.54 in December 2018 to EUR98.01

in June 2019. US Loans also exhibited a meaningful performance

comeback in the first half of 2019 following a volatile 4Q18

returning 5.42% in the six months ending 30 June. This represents

the best first half-year performance in 10 years as lower levels of

new issue loan supply offset the headwind of continued outflows

from mutual funds and ETFs. Higher quality loans outperformed lower

quality loans over the first six months of the year with gains of

319bp and 246bp, respectively, for BB and B-rated loans as compared

to their CCC-rated counterparts. BB and B-rated loans have now more

than recuperated any losses suffered during the 4Q18 sell-off.

CCC-rated loans, however, have returned -1.2% for the same period

(01/10/18 through 30/6/19).(5)

Gross total loan issuance was EUR39.3 billion in Europe and

$243.4 billion in the US for the first half of 2019, representing a

decline of 36% and 37%, respectively, over last year. The largest

use of this capital in both markets was related to M&A activity

(59.2% in Europe and 47.6% in the US). Dovish rhetoric from both

the Fed and the ECB in 2Q19 fuelled investor demand for fixed rate,

longer duration assets. As a result, the shift in issuance away

from loans and towards high yield bonds has continued to

proliferate in the credit markets and resulted in lower loan

issuance year-to-date than previously expected globally. Despite

the lower volumes of issuance, both the European loan market and

the US loan market experienced growth in the first half of 2019.

The Credit Suisse Western European Leveraged Loan Index par

outstanding rose from EUR283 billion in December 2018 to EUR294

billion in June 2019 (+4%), while the Credit Suisse Leveraged Loan

Index par outstanding rose from $1,232 billion to $1,250 billion

(+1%). We expect global gross new issue loan supply to decline

year-over-year for 2019, due in part to the slow start to issuance

in 2019 year-to-date ($287 billion compared to $455 billion for the

same period in 2018).

Default rates for loans remained below historical averages

throughout the first half of 2019 with the trailing 12-month par

default rate registering 0.9% in the US and 0.0% in Europe.(5) We

expect that loan default rates will remain below 1.5% throughout

the remainder of 2019 as loan issuer fundamentals remain strong but

remain cognisant of the impact that Brexit and heightened trade

tensions could have on the global economy.

1Q19 financial results for the European issuers in GSO's Liquid

Credit Strategies portfolios show that, on average, quarterly

revenue growth slowed year-over-year while quarterly EBITDA growth

accelerated. 1Q19 year-over-year revenue grew by 3.7%, down from

4.9% in 4Q18 and despite the slowing of top line revenue growth,

year-over-year EBITDA growth increased in 1Q19 to 6.4% from 5.8% in

4Q18. Quarterly year-over-year net total leverage increased to 5.2x

from 5.0x through 1Q19 and interest coverage decreased from 5.3x to

4.9x over the same time period.(6) For the US issuers in GSO's

Liquid Credit Strategies portfolios, quarterly revenue growth

slowed year-over-year and continuing pricing pressure decelerated

quarterly EBITDA growth, however, both metrics remain positive.

1Q19 year-over-year revenue grew by 3.3%, down from 4.4% in 4Q18,

and quarterly EBITDA grew at a rate of 2.8% year-over-year as of

1Q19, down from 4.8% in 4Q18. Net Leverage remained stable

quarter-over-quarter at 5.1x (Gross Total Leverage 5.5x), the

lowest level since 4Q17. Interest coverage, however, has decreased

this quarter from 5.3x to 5.1x but remains higher than the market

average of 4.7x.(6)

CLO Market Overview

European CLO new issuance in the first six months of 2019

totalled EUR14.3 billion, the highest issuance of the first six

months of any year in the post-crisis era. In fact, this represents

the largest volume for any half-year period since 2007, surpassing

the EUR13.3 billion of issuance in 1H18 despite the current

challenging conditions for CLO arbitrage. Meanwhile, US CLO new

issuance totalled $65.1 billion in 1H19, roughly in-line with last

year's record pace of $69.1 billion, despite experiencing some

recent regulatory headwinds from Japan. Global refinancing and

resetting activities year-to-date globally total $26.7 billion

composed of $23.1 billion US CLOs and EUR2.6 billion ($3.6 billion)

of European CLOs.(4)

In the first half of 2019, the Japanese FSA increased their

regulatory scrutiny of both US and European CLO assets due to the

increased scale of these holdings among a concentrated group of

large Japanese banks. As a result, Japanese AAA CLO buyers have

slowed their pace of purchase in 2019, even after a favourable

ruling on CLOs from the Japanese FSA. Existing and new AAA buyers

have emerged to fill the void and have pushed the market toward a

more syndicated AAA distribution which has also resulted in

increased levels of risk tiering based on a manager's track record,

portfolio, and strength of document. AAA-rated US CLO tranches with

five year reinvestment periods issued by top-tier managers

contracted to as low as L+128bp in May and June, compared to the

broad market average of L+137 at the end of March. Amidst record

levels of CLO issuance, primary AAA spreads of European CLOs

averaged E+111bp in the second quarter of 2019 compared to E+99bp

recorded in the final quarter of 2018.

Collateral quality tests in global CLO portfolios remain stable,

per data from Wells Fargo. As of June 2019, Weighted Average Spread

("WAS") test results in both European and US CLOs were 367bp and

345bp, respectively, compared to 363bp and 339bp in December 2018.

Average exposure to CCC-rated assets within CLO portfolios remains

low at 1.2% for European CLOs and 3.3% for US CLOs. Exposure to

distressed assets also remained subdued, as evidenced by average

global Weighted Average Rating Factor ("WARF") test results of 2856

in European CLOs and 2818 in US CLOs, which are in-line with 2018's

results of 2858 and 2807, respectively.

Portfolio Update

BGCF

As at 30 June 2019, the Ordinary Share class and the C Share

class held 35.4% and 4.7% in BGCF respectively through their

holding in CSWs in the Lux Subsidiary which in turns holds PPNs in

BGCF. BGLF, through its investment in BGCF, increased its exposure

to US assets during the first half of 2019. As at 30 June, based on

NAV, 47% of BGCF's portfolio was composed of US CLO Income Notes

and CLO warehouses, compared to 46% in December 2018 (42% June

2018). Exposure to directly held loans, net of leverage, increased

from 18% to 21% from December 2018 to June 2019 (27% June 2018),

and European CLO Income Notes dipped slightly to 35% in June 2019

from 37% at the end of 2018 (33% June 2018).

BGCF continues to generate positive cash flows from its CLO

Income Note investments ("CLO Income Notes") and from its portfolio

of directly held and warehoused loans, generally in-line with the

BGCF's target cash on cash returns.

Directly Held Loan European CLOs US CLOs US CLO Warehouse First

Portfolio Loss

----------------------- ------------------------ -------------------- -------------------- -----------------------

Target Cash on Cash Gross: 9-10% Approximately 15-20% Approximately 15-20% Approximately 15-20%

Return(7)

Actual Cash on Cash

Return(8() Gross: 8.5% / Net: 6.6% 15.8% 17.7% 14.0%

----------------------- ------------------------ -------------------- -------------------- -----------------------

As of 30th of June, CLO Income Notes produced a weighted average

annualised distribution rate of 15.6%, representing distributions

from 28 of BGCF's CLO Income Notes.(9) This compares to a

distribution rate of 15.7% at the end of 2018. Four CLOs in the

portfolio have recently priced and, as of the end of June 2019,

have not yet paid their first distribution.

CLO European CLO Income Notes(1(0) () US CLO Income Notes(10) Global CLO Income

Vintage Notes(10)

---------- ------------------------------------------- ----------------------------------------- --------------------------

Par # of 2Q 2019 Average Par # of 2Q 2019 Average 2Q 2019 1Q 2019

(EURmm) CLOs Annualised Annualised ($mm) CLOs Annualised Annualised Annualised Annualised

Distribution Distribution Distribution Distribution Distribution Distribution

---------- --------- ---- ------------ ------------ ------- ---- ------------ ------------ ------------ ------------

2014 89.8 3 14.2% 16.7% - - - - 14.2% 13.4%

2015 69.7 3 17.1% 15.8% 48.5 1 13.9% 16.6% 15.9% 15.4%

2016 84.0 3 11.4% 11.3% - - - - 11.4% 10.9%

2017 80.4 3 18.3% 15.8% 261.0 6 15.1% 17.4% 15.9% 15.5%

2018 119.9 4 18.5% 18.1% 351.1 6 15.4% 18.1% 16.4% 18.2%

2019 34.0 1 n/a n/a 55.5 2 n/a n/a n/a n/a

Total/Wtd

Avg EUR 477.7 17 16.0% 15.8% $ 716.1 15 15.2% 17.7% 15.6% 15.9%

---------- --------- ---- ------------ ------------ ------- ---- ------------ ------------ ------------ ------------

Throughout the first half of 2019, BGCF originated EUR1.2

billion of loans, and invested EUR27.7 million (EUR34.0 million

par) in one European CLO and $49.1 million ($55.5 million par) in

two US CLOs. BGCF also invested a total of EUR42.2 million ($47.5

million) in two US CLO warehouses.

BGCF's loan portfolios, held both directly on its balance sheet

and indirectly through CLO warehouses, continue to ramp at a more

measured pace due to our current view on the CLO creation equity

arbitrage. Within each warehouse, we remain focused on balancing a

favourable return to BGCF as the warehouse first loss provider

together with any potential credit risk introduced as the

warehoused assets become more seasoned.

Portfolio vintage diversification remains an important part of

the Fund's strategy which provides for greater investment

flexibility to participate in the primary loan market and the

ability to take advantage of secondary loan market dislocations.

BGCF's concentration in newer vintage CLOs with longer reinvestment

periods has increased, albeit at a more measured pace, due to a

less consistently favourable arbitrage between CLO liability cost

and the underlying CLO portfolio asset spreads in 2019 versus 2018.

In addition to new investment activity, BGCF refinanced the

liabilities of Clarinda Park CLO, which resulted in the reduction

of the weighted average liability cost by 22 basis points and an

extension of the reinvestment period by an additional one year.

While achieving a lower cost of liabilities is not the sole reason

to refinance a CLO, the other benefits are outweighed by a higher

cost of refinanced liabilities and therefore we continue to

evaluate the cost/benefit trade-offs of refinancing or resetting

opportunities on a case by case basis.

With the pace of loan refinancings and loan spread compression

finally subsided, we are now beginning to see a turnaround and an

improvement in the net interest margins across much of the CLO

portfolio. As of 30 June 2019, the weighted average asset coupon of

the portfolio was 4.73%, compared to 4.67% as at 31 December 2018.

The average cost of liabilities across BGCF's CLO positions have

widened to a lesser degree from 2.66% to 2.70%, resulting in a

marginal improvement to the net interest margin on the overall

portfolio.

CLO Income Closing EUR Deal Position % % of RP Current Current Net NIM Distributions

Note / / Size Owned of BGCF Remain- Asset Liability Interest 3M Through Last Payment

Investments [Expected USD (mm) (mm) Tranche NAV ing Coupon Cost Margin Prior Date

Close]

Date

------------ ---------- ---- ------- -------- ------- ---- ------- ------- --------- -------- ----- --------------------

Ann. Cum.

------------ ---------- ---- ------- -------- ------- ---- ------- ------- --------- -------- ----- ----- -------------

Phoenix EUR

Park Jul-14 EUR 418 EUR 23.3 51.4% 1.6% 3.83 3.72% 1.77% 1.94% 1.81% 15.4% 73.5%

Sorrento EUR

Park Oct-14 EUR 507 EUR 29.5 51.8% 1.6% 0.00 3.65% 1.46% 2.19% 2.21% 17.1% 78.5%

Castle EUR

Park Dec-14 EUR 415 EUR 37.0 80.4% 2.4% 0.00 3.64% 1.53% 2.11% 2.13% 17.2% 74.2%

Dorchester

Park Feb-15 USD $ 533 $ 48.5 73.0% 2.3% 0.81 5.86% 4.01% 1.85% 1.79% 16.6% 68.7%

Dartry EUR

Park Mar-15 EUR 411 EUR 22.8 51.1% 1.3% 0.00 3.69% 1.63% 2.06% 2.00% 15.2% 62.6%

Orwell EUR

Park Jun-15 EUR 415 EUR 24.2 51.0% 1.7% 0.05 3.78% 1.44% 2.35% 2.29% 16.5% 63.9%

Tymon EUR

Park Dec-15 EUR 414 EUR 22.7 51.0% 1.8% 0.56 3.71% 1.31% 2.40% 2.38% 15.7% 52.4%

EUR

Elm Park May-16 EUR 558 EUR 31.9 56.1% 2.9% 0.79 3.74% 1.37% 2.37% 2.29% 12.8% 37.0%

Griffith EUR

Park Sep-16 EUR 458 EUR 29.0 59.5% 2.1% 3.89 3.74% 1.82% 1.92% 1.86% 10.4% 28.1%

Clarinda EUR

Park Nov-16 EUR 415 EUR 23.1 51.2% 1.5% 1.38 3.77% 1.81% 1.96% 1.69% 10.5% 26.2%

Grippen

Park Mar-17 USD $ 611 $ 35.6 60.0% 2.1% 2.81 5.88% 4.32% 1.56% 1.46% 13.4% 28.1%

Palmerston EUR

Park Apr-17 EUR 415 EUR 28.0 62.2% 1.9% 1.80 3.78% 1.74% 2.03% 1.91% 14.5% 29.3%

Thayer

Park May-17 USD $ 515 $ 29.8 54.6% 1.7% 2.81 5.91% 4.35% 1.55% 1.46% 17.5% 33.8%

Catskill

Park May-17 USD $ 1,029 $ 65.1 60.0% 3.6% 2.81 5.88% 4.32% 1.57% 1.48% 16.5% 31.8%

Clontarf EUR

Park Jul-17 EUR 414 EUR 29.0 66.9% 2.1% 2.10 3.68% 1.58% 2.10% 2.03% 15.1% 27.4%

Dewolf

Park Aug-17 USD $ 614 $ 36.9 60.0% 2.3% 3.29 5.96% 4.32% 1.64% 1.52% 16.7% 27.2%

Gilbert

Park Oct-17 USD $ 1022 $ 60.2 59.0% 3.8% 3.30 5.95% 4.28% 1.67% 1.55% 17.0% 25.2%

Willow EUR

Park Nov-17 EUR 412 EUR 23.4 60.9% 1.9% 3.04 3.69% 1.58% 2.11% 2.03% 18.2% 25.1%

Long Point

Park Dec-17 USD $ 611 $ 33.4 56.9% 2.2% 3.55 5.95% 4.01% 1.94% 1.87% 24.4% 31.7%

Stewart

Park Jan-18 USD $ 878 $ 126.9 69.0% 3.2% 3.51 5.89% 4.06% 1.83% 1.74% 16.6% 20.6%

Marlay EUR

Park Mar-18 EUR 413 EUR 24.6 60.0% 2.0% 2.79 3.69% 1.40% 2.29% 2.22% 19.4% 20.3%

Greenwood

Park Mar-18 USD $ 1,075 $ 63.6 59.1% 4.2% 3.80 5.94% 3.97% 1.97% 1.85% 20.8% 23.1%

Cook Park Apr-18 USD $ 1,025 $ 60.0 56.1% 4.1% 3.80 5.87% 3.93% 1.94% 1.86% 20.9% 21.2%

Milltown EUR

Park Jun-18 EUR 410 EUR 24.1 65.0% 2.2% 3.04 3.73% 1.49% 2.24% 2.16% 18.8% 15.8%

Fillmore

Park Jul-18 USD $ 561 $ 30.2 54.3% 2.4% 4.04 5.89% 4.11% 1.77% 1.68% 14.5% 10.3%

Richmond EUR

Park Jul-18 EUR 549 EUR 46.2 68.3% 2.6% 2.04 3.72% 1.53% 2.19% 2.10% 17.6% 13.1%

Myers

Park Sep-18 USD $ 510 $ 26.8 51.0% 2.1% 4.31 5.93% 4.16% 1.76% 1.87% 17.1% 9.9%

Sutton EUR

Park Oct-18 EUR 409 EUR 25.0 69.4% 2.2% 3.87 3.69% 1.72% 1.97% 1.86% 17.1% 9.8%

Harbor

Park Dec-18 USD $ 716 $ 43.6 55.0% 3.6% 4.56 5.92% 4.34% 1.59% 1.64% n/a n/a

Crosthwaite EUR

Park Feb-19 EUR 513 EUR 34.0 66.7% 2.8% 4.21 3.69% 2.00% 1.69% 1.74% n/a n/a

Buckhorn

Park Mar-19 USD $ 502 $ 29.0 60.0% 2.3% 4.80 5.99% 4.51% 1.48% 1.44% n/a n/a

Niagara

Park Jun-19 USD $ 453 $ 26.5 60.0% 2.1% 5.05 n/a 3.91% n/a n/a n/a n/a

------------ ---------- ---- ------- -------- ------- ---- ------- ------- --------- -------- ----- ----- -------------

Note - Table above excludes CLOs directly held by the C Share

class.

As at 30 June 2019, the portfolio was invested in accordance

with BGCF's investment policy and was diversified across 697

issuers (683 issuers in June 2018) through the directly held loans

and CLO portfolio, and across 18 countries (19 countries in June

2018) and 31 different industries (30 in 2018). No individual

borrower represented more than 2% of the overall portfolio at the

end of June 2019.

Key Portfolio Statistics (11)

Current WA Asset Coupon Current WA Liability Cost WA Leverage WA Remaining CLO Reinvestment

Periods

-------------------- ----------------------- ------------------------- ----------- -------------------------------

Euro CLOs 3.71% 1.60% 8.5x 2.0 Yrs

US CLOs 5.91% 4.16% 8.9x 3.4 Yrs

US CLO Warehouses 5.93% 3.47% 4.0x n/a

Directly Held Loans 3.78% 1.45% 2.5x n/a

Total Portfolio 4.73% 2.70% 7.2x 2.8 Yrs

-------------------- ----------------------- ------------------------- ----------- -------------------------------

Top 10 Holdings

Asset Country Industry % of Portfolio

Euro Garages UK Retail 1.1

Banking, Finance, Insurance and

Paysafe UK Real Estate 1.1

Refinitiv USA Services Business 1.1

Amaya Gaming Group, Inc. USA Hotels, Gaming and Leisure 0.9

Ziggo Netherlands Media Broadcasting and Subscription 0.9

BMC Software USA High Tech Industries 0.9

Numericable France Media Broadcasting and Subscription 0.8

McAfee, LLC USA High Tech Industries 0.8

AkzoNobel Specialty Chem Netherlands Chemicals, Plastics and Rubber 0.8

Banking, Finance, Insurance and

Ion Trading Ireland Real Estate 0.7

------------------------- ------------ ------------------------------------ --------------

Top 5 Industries

Industries % of Portfolio

As at 30 June 2019 As at 31 December 2018

-------------------------------------------- ------------------ ----------------------

Healthcare and Pharma 15.2 16.0

High Tech Industries 9.8 10.3

Banking, Finance, Insurance and Real Estate 9.7 9.5

Services Business 9.3 9.2

Hotel, Gaming and Leisure 7.7 7.0

-------------------------------------------- ------------------ ----------------------

Top 5 Countries

Countries % of Portfolio

As at 30 June 2019 As at 31 December 2018

--------------- ------------------ ----------------------

United States 57.7 57.2

France 8.2 8.4

Luxembourg 7.9 7.5

Netherlands 5.1 5.6

United Kingdom 5.1 5.2

--------------- ------------------ ----------------------

Directly Held CLOs

BGLC's portfolio composition has rotated from 100% Rollover

Assets and cash at the issuance date of BGLC shares to 25% of

Rollover Assets and 61% BGCF PPNs (invested via the Lux Subsidiary)

as at 30 June 2019 (14% net cash and expenses). Sales of Rollover

Assets were more concentrated within the first quarter, following a

broader recovery in loan and CLO prices. Since then, a softer tone

in the CLO equity market has resulted in a slower pace of sales of

the remaining Rollover Assets. While the vast majority of the

remaining Rollover Assets are managed by top tier, more liquid CLO

managers, we continue to monitor and consider the risks within each

of the remaining positions as it relates to a sale decision. We

expect that these remaining positions will be sold as and when

greater liquidity returns to the market.

Risk Management

Heading into the second half of 2019, slowing corporate profits

and trade tensions are likely to be a source of volatility that may

cause credit spreads to widen. However, we do not see evidence of

an immediate economic downturn and we recognize that the Fed's

activities are geared toward extending a credit cycle that is

already in its tenth year. Thus, we have been taking advantage of

the market liquidity to selectively prune risk and position the

portfolio more defensively, ensuring ample cushions within each CLO

relative to their respective tests.

In addition to our general analysis and fundamental credit

review, we have developed a proprietary system to weight and score

key document attributes. We acknowledge that loan documents have

recently become more flexible to the borrower, partially due to

strong investor demand for the asset class, creating a

borrower-friendly market. In response to the increased flexibility,

we have standardised our document review process, tracking key

attributes, and incorporating them into our portfolio and risk

management approach with the goal of tracking individual document

quality on an ongoing basis as an input to our investment and

portfolio management decisions. In cases where we believe the

document creates uncertainty regarding recovery, our seniority in

the capital structure, or collateral protection, we may choose to

pass on the deal or actively reduce positions at the first sign of

underperformance.

BGCF's non-Euro denominated assets comprise roughly 35% of the

gross portfolio and while these assets are hedged back to the Euro,

should there be an increase in volatility in currency exchange

rates as a result of the trade war turned currency war, BGCF may

experience greater volatility in both the value of and income from

these assets.

We remain constructive on credit and continue to believe that

floating rate senior loans offer a compelling risk--reward

opportunity. This is further supported by our view that the

seniority of loans in the corporate structure offers defensive

positioning unique to the asset class and that loans remain a well

suited component of portfolios in a late cycle environment.

Based on our outlook, we currently view pullbacks in the loan

market to be potential opportunities for which the Fund is well

positioned to access through its investment in BGCF.

Blackstone / GSO Debt Funds Management Europe Limited

20 September 2019

(4) Source: S&P LCD, data as of 30 June 2019

(5) Source: Credit Suisse, as of 30 June 2019

(6) Source: Axiom (GSO). Q1 figures sourced from 126 out of 222

European issuers and 599 out of 798 US issuers. Data may be

restated for prior quarters as additional companies report

quarterly financials.

(7) As of 30 June 2019. Expected cashflows are provided as

indicators of how GSO intends to manage the portfolio and are not

intended to be viewed as indicators of likely performance returns.

Expected cashflows are not guarantees, projections or predictions

of future performance and are presented solely to provide you with

insight into the portfolio's anticipated risk and reward

characteristics. There can be no assurance that the expected

cashflows will be achieved or that GSO will be able to implement

its investment strategy, achieve its objectives or avoid

substantial losses. Actual realized net IRR will depend on numerous

factors, all of which may differ from the assumptions on which the

expected cashflows are based.

(8) As of 30 June 2019. Represented by: the average monthly

annualised distribution, gross and net of leverage costs, from 31

December 2017 for Directly Held Loan Portfolio; annualised

distributions of each CLO's respective inception date through its

last payment date for European and US CLOs; average annualised

distributions of each US CLO Warehouse position for US CLO

Warehouse First Loss.

(9) Source: Intex - Annualised quarterly cash distribution based

on cost for those CLOs that have paid a distribution.

(10) As of 30 June 2019. Distributions are based off local

currency.

(11) Source: GSO Internal data, as at 30 June 2019

Strategic Overview

Purpose

As an investment company, our purpose is to provide permanent

capital to BGCF, a company established by DFME as part of its loan

financing programme, with a view to generating stable and growing

total returns for Shareholders through dividends and value

growth.

We deliver our purpose through working in line with our values,

which form the backbone of what the Company does and are an

important part of our culture.

Values

Integrity and Trust - The Company seeks to act with integrity in

everything it does and to be trustworthy. We seek to uphold the

highest standards of professionalism driven by our corporate

governance processes.

Transparency - The Company aims to ensure all of its activities

are undertaken with the utmost transparency and openness to sustain

trust.

Opportunity - The ability to see and seize opportunity in the

best interests of shareholders.

Sustainability - As an investment company we aim to maintain and

deliver attractive and sustainable returns for our

shareholders.

Principal Activities

The Company was incorporated on 30 April 2014 as a closed-ended

investment company limited by shares under the laws of Jersey and

is authorised as a listed fund under the Collective Investment

Funds (Jersey) Law 1988. The Company continues to be registered and

domiciled in Jersey. The Company's Ordinary Shares are quoted on

the Premium Segment of the Main Market of the LSE. The Company's C

Shares are quoted on the SFS of the Main Market of the LSE.

The Company's share capital consists of an unlimited number of

shares of any class. As at 30 June 2019, the Company's issued share

capital was 402,319,490 Ordinary Shares and 133,451,107 C

Shares.

The Company has a wholly-owned Luxemburg subsidiary, Blackstone

/ GSO Loan Financing (Luxembourg) S.à r.l. , which has an issued

share capital of 2,000,000 Class A shares and 1 Class B share. All

of the Class A and Class B shares were held by the Company as at 30

June 2019 together with 319,685,922 Class B CSWs issued by the Lux

Subsidiary. The Lux Subsidiary invests in PPNs issued by BGCF, an

Underlying Company.

The Company is a self-managed company. DFME acts as Portfolio

Adviser to the Company and, pursuant to the Advisory Agreement,

provides advice and assistance to the Company in connection with

its investment in the CSWs. DFM acts as Portfolio Manager in

relation to the Rollover Assets (as defined in the Company's

Prospectus published on 23 November 2018).

BNP Paribas Securities Services S.C.A., Jersey Branch acts as

Administrator, Company Secretary, Custodian and Depositary to the

Company.

Investment Objective

As outlined in the Company's Prospectus, the Company's

investment objective is to provide Shareholders with stable and

growing income returns, and to grow the capital value of the

investment portfolio by exposure to floating rate senior secured

loans and bonds directly and indirectly through CLO Securities and

investments in Loan Warehouses. The Company seeks to achieve its

investment objective through exposure (directly or indirectly) to

one or more companies or entities established from time to time

("Underlying Companies").

Investment Policy

Overview

As outlined in the Company's Prospectus, the Company's

investment policy is to invest (directly, or indirectly through one

or more Underlying Companies) in a diverse portfolio of senior

secured loans (including broadly syndicated, middle market or other

loans) (such investments being made by the Underlying Companies

directly or through investments in Loan Warehouses), bonds and CLO

Securities, and generate attractive risk-adjusted returns from such

portfolios. The Company intends to pursue its investment policy by

investing (through one or more subsidiaries) in profit

participating instruments (or similar securities) issued by one or

more Underlying Companies.

Each Underlying Company will use the proceeds from the issue of

the profit participating instruments (or similar securities),

together with the proceeds from other funding or financing

arrangements it has in place currently or may have in the future,

to invest in: (i) senior secured loans, bonds, CLO Securities and

Loan Warehouses; or (ii) other Underlying Companies which,

themselves, invest in senior secured loans, bonds, CLO Securities

and Loan Warehouses. The Underlying Companies may invest in

European or US senior secured loans, bonds, CLO Securities, Loan

Warehouses and other assets in accordance with the investment

policy of the Underlying Companies. Investments in Loan Warehouses,

which are generally expected to be subordinated to senior finance

provided by third-party banks, will typically be in the form of an

obligation to purchase preference shares or a subordinated loan.

There is no limit on the maximum US or European exposure. The

Underlying Companies do not invest substantially directly in senior

secured loans or bonds domiciled outside North America or Western

Europe.

Investment Limits and Risk Diversification

The Company's investment strategy is to implement its investment

policy by investing directly or indirectly through the Underlying

Companies, in a portfolio of senior secured loans and bonds or in

Loan Warehouses containing senior secured loans and bonds and, in

connection with such strategy, to own debt and equity tranches of

CLOs and, in the case of European CLOs and certain US CLOs, to be

the risk retention provider in each.

The Underlying Companies may periodically securitise a portion

of the loans, or a Loan Warehouse in which they invest, into CLOs

which may be managed either by such Underlying Company itself, by

DFME or DFM (or one of their affiliates), in their capacity as the

CLO Manager.

Where compliance with the European Risk Retention Requirements

is sought (which, with certain exceptions, will not be the case for

the US CLOs) the Underlying Companies will retain exposures of each

CLO, which may be held as:

-- CLO Income Notes equal to: (i) between 51% and 100% of the

CLO Income Notes issued by each such CLO in the case of European

CLOs; or (ii) CLO Income Notes representing at least 5% of the

credit risk relating to the assets collateralising the CLO in the

case of US CLOs (each of (i) and (ii), (the "horizontal strip");

or

-- Not less than 5% of the principal amount of each of the

tranches of CLO Securities in each such CLO (the "vertical

strip").

In the case of deals structured to be compliant with the

European Risk Retention Requirements, the applicable Underlying

Company may determine that, due to its role as an "originator" with

respect to such transaction, such Underlying Company should also

comply with the US Risk Retention Regulations. In addition, an

Underlying Company may invest in CLOs, such as middle market CLOs,

which are not exempt from the US Risk Retention Regulations and, as

a result, may be required to retain exposure to such CLOs in

accordance with such rules. In such a scenario, the Underlying

Company will retain exposures to such transactions for the purpose

of complying with the US Risk Retention Regulations, which may be

held as:

-- CLO Income Notes representing at least 5% of the fair market

value of the CLO Securities (including CLO Income Notes) issued by

such CLO (the "US horizontal strip");

-- A vertical strip; or

-- A combination of a vertical strip and US horizontal strip.

To the extent attributable to the Company, the value of the CLO

Income Notes retained by Underlying Companies in any CLO will not

exceed 25% of the NAV of the Company at the time of investment.

Investments in CLO Income Notes and loan warehouses are highly

leveraged. Gains and losses relating to underlying senior secured

loans will generally be magnified. Further, to the extent

attributable to the Company, the aggregate value of investments

made by Underlying Companies in vertical strips of CLOs (net of any

directly attributable financing) will not exceed 15% of the NAV of

the Company at the time of investment. This limitation shall apply

to Underlying Companies in aggregate and not to Underlying

Companies individually.

Loan Warehouses may eventually be securitised into CLOs managed

either by an Underlying Company itself or by DFME or DFM (or one of

their affiliates), in their capacity as the CLO Manager. To the

extent attributable to the Company, the aggregate value of

investments made by Underlying Companies in any single externally

financed warehouse (net of any directly attributable financing)

shall not exceed 20% of the NAV of the Company at the time of

investment, and in all externally financed warehouses taken

together (net of any directly attributable financing) shall not

exceed 30% of the NAV of the Company at the time of investment.

These limitations shall apply to Underlying Companies in aggregate

and not to Underlying Companies individually.

The following limits (the "Eligibility Criteria") apply to

senior secured loans and bonds (and, to the extent applicable,

other corporate debt instruments) directly held by any Underlying

Company (and not through CLO Securities or Loan Warehouses):

% of a Underlying Company's

Maximum Exposure Gross Asset Value

Per obligor 5

Per industry sector 15

(With the exception of one industry, which may be up to

20%)

To obligors with a rating lower than B-/B3/B- 7.5

To second lien loans, unsecured loans, mezzanine loans and

high yield bonds 10

---------------------------------------------------------- ----------------------------------------------------------

For the purposes of these Eligibility Criteria, "gross asset

value" shall mean gross assets, including any investments in CLO

Securities and any undrawn commitment amount of any gearing under

any debt facility. Further, for the avoidance of doubt, the

"maximum exposures" set out in the Eligibility Criteria shall apply

on a trade date basis.

Each of these Eligibility Criteria will be measured at the close

of each Business Day on which a new investment is made, and there

will be no requirement to sell down in the event the limits are

breached at any subsequent point (for instance, as a result of

movement in the gross asset value, or the sale or downgrading of

any assets held by an Underlying Company).

In addition, each CLO in which an Underlying Company holds CLO

Securities and each Loan Warehouse in which an Underlying Company

invests will have its own eligibility criteria and portfolio

limits. These limits are designed to ensure that: (i) the portfolio

of assets within the CLO meets a prescribed level of diversity and

quality as set by the relevant rating agencies rating securities

issued by such CLO, or (ii) in the case of a Loan Warehouse, that

the warehoused assets will eventually be eligible for a rated CLO.

The CLO Manager will seek to identify and actively manage assets

which meet those criteria and limits within each CLO or Loan

Warehouse. The eligibility criteria and portfolio limits within a

CLO or Loan Warehouse may include the following:

-- A limit on the weighted average life of the portfolio;

-- A limit on the weighted average rating of the portfolio;

-- A limit on the maximum amount of portfolio assets with a rating lower than B-/B3/B-; and

-- A limit on the minimum diversity of the portfolio.

CLOs in which an Underlying Company may hold CLO Securities or

Loan Warehouses in which an Underlying Company may invest also have

certain other criteria and limits, which may include:

-- A limit on the minimum weighted average of the prescribed rating agency recovery rate;

-- A limit on the minimum amount of senior secured assets;

-- A limit on the maximum aggregate exposure to second lien

loans, high yield bonds, mezzanine loans and unsecured loans;

-- A limit on the maximum portfolio exposure to covenant-lite loans;

-- An exclusion of project finance loans;

-- An exclusion of structured finance securities;

-- An exclusion on investing in the debt of companies domiciled

in countries with a local currency sub-investment grade rating;

and

-- An exclusion of leases.

This is not an exhaustive list of the eligibility criteria and

portfolio limits within a typical CLO or Loan Warehouse and the

inclusion or exclusion of such limits and their absolute levels are

subject to change depending on market conditions. Any such limits

applied shall be measured at the time of investment in each CLO or

Loan Warehouse.

Changes to Investment Policy

Any material change to the investment policy of the Company

would be made only with the approval of Ordinary Shareholders.

It is intended that the investment policy of each substantial

Underlying Company will mirror the Company's investment policy,

subject to such additional restrictions as may be adopted by a

substantial Underlying Company from time to time. The Company will

receive periodic reports from each substantial Underlying Company

in relation to the implementation of such substantial Underlying

Company's investment policy to enable the Company to have oversight

of its activities.

If a substantial Underlying Company proposes to make any changes

(material or otherwise) to its investment policy, the Directors

will seek Ordinary Shareholder approval of any changes which are

either material in their own right or, when viewed as a whole

together with previous non-material changes, constitute a material

change from the published investment policy of the Company. If

Ordinary Shareholders do not approve the change in investment

policy of the Company such that it is once again materially

consistent with that of such substantial Underlying Company, the

Directors will redeem the Company's investment in such substantial

Underlying Company (either directly or, if the Company's investment

in a subsidiary is invested by such subsidiary in such substantial

Underlying Company (either directly or through one or more other

Underlying Companies), by redeeming the securities held by the

Company in such subsidiary and procuring that the subsidiary

redeems its investment in such substantial Underlying Companies

(either directly or through one or more other Underlying

Companies)), as soon as reasonably practicable but at all times

subject to the relevant legal, regulatory and contractual

obligations.

The Board considers BGCF to be a substantial Underlying

Company.

Company Borrowing Limit

The Company will not utilise borrowings for investment purposes.

However, the Directors are permitted to borrow up to 10% of the

Company's NAV for day-to-day administration and cash management

purposes. For the avoidance of doubt, this limit only applies to

the Company and not the Underlying Companies.

In accordance with the Company's Prospectus, the Company may use

hedging or derivatives (both long and short) for the purposes of

efficient portfolio management. It is intended that up to 100% (as

appropriate) of the Company's exposure to any non-Euro assets will

be hedged, subject to suitable hedging contracts being available at

appropriate times and on acceptable terms.

Investment Strategy

Whether the senior secured loans, bonds or other assets are held

directly by an Underlying Company or via CLO Securities or Loan

Warehouses, it is intended that, in all cases, the portfolios will

be actively managed (by the Underlying Companies or the CLO

Manager, as the case may be) to minimise default risk and potential

loss through comprehensive credit analysis performed by the

Underlying Companies or the CLO Manager (as applicable).

Vertical strips in CLOs in which Underlying Companies may invest

are expected to be financed partly through term finance for

investment-grade CLO Securities, with the balance being provided by

the relevant Underlying Company investing in such CLO. This term

financing may be full-recourse, non-mark to market, long-term

financing which may, among other things, match the maturity of the

relevant CLO or match the reinvestment period or non-call period of

the relevant CLO. In particular, and although not forming part of

the Company's investment policy, the following levels of, or

limitations on, leverage are expected in relation to investments

made by Underlying Companies:

-- Senior secured loans and bonds may be levered up to 2.5x with term finance;

-- Investments in "first loss" positions or the "warehouse

equity" in Loan Warehouses will not be levered;

-- CLO Income Notes will not be levered;

-- Investments in CLO Securities rated B- and above at the time

of issue may be funded entirely with term finance; and

-- Investments in a vertical strip may be levered 6.0-7.0x, with

term finance as described above.

To the extent that they are financed, vertical strips are

anticipated to require less capital than horizontal strips, which

is expected to result in more efficient use of the Underlying

Companies' capital. In addition, since the return profile on

financed vertical strips is different to retained CLO Income Notes,

GSO believes that vertical strips may be more robust through a

market downturn, although projected IRRs may be slightly lower.

However, an investment in vertical strips is not expected to impact

the Company's stated target return.

From time to time, as part of its ongoing portfolio management,

the Underlying Companies may sell positions as and when suitable

opportunities arise. Where not bound by risk retention

requirements, it is the intention that the Underlying Companies

would seek to maintain control of the call option of any CLOs

securitised.

With respect to investments in CLO Securities, while the

Underlying Companies maintain a focus on investing in newly issued

CLOs, it will also evaluate the secondary market for sourcing

potential investment opportunities in CLO Securities.

Whilst the intention is to pursue an active, non-benchmark total

return strategy, the Company is cognisant of the positioning of the

loan portfolios against relevant indices. Accordingly, the

Underlying Companies will track the returns and volatility of such

indices, while seeking to outperform them on a consistent basis.

In-depth, fundamental credit research dictates name selection and

sector over-weights/under-weights relative to the benchmark,

backstopped by constant portfolio monitoring and risk oversight.

The Underlying Companies will typically look to diversify their

portfolios to avoid the risk that any one obligor or industry will

adversely impact overall returns. The Underlying Companies also

place an emphasis on loan portfolio liquidity to ensure that if

their credit outlook changes, they are free to respond quickly and

effectively to reduce or mitigate risk in their portfolio. The

Company believes this investment strategy will be successful in the

future as a result of its emphasis on risk management, capital

preservation and fundamental credit research. The Directors believe

the best way to control and mitigate risk is by remaining

disciplined in market cycles, by making careful credit decisions

and maintaining adequate diversification.

The portfolio of the Underlying Companies in which the Company

invests (through its wholly-owned subsidiary) remains broadly

divided between European CLOs and US CLOs.

The Company operates with Euro as its functional currency. The

Rollover Assets and a significant proportion of the portfolio of

assets held by Underlying Companies to which the Company has

exposure may, from time to time, be denominated in currencies other

than Euro. In accordance with the Company's investment policy, up

to 100 per cent. (as appropriate) of the Company's exposure to such

non-Euro assets is hedged, subject to suitable hedging contracts

being available at appropriate times and on acceptable terms.

Corporate Activity

Rollover Offer Proposal

On 3 January 2019, the Company announced that the 133,451,107 C

Shares arising from the Rollover transaction would be allotted and

admitted to trading on the SFS of the Main Market of the LSE with

effect from Monday 7 January 2019.

Allotment and admission to trading on the SFS of the LSE was

completed on the 7 January 2019.

Voting Rights

Holders of C Shares have the right to receive income and capital

from the C Share assets attributable to such class. C Shareholders

do not have the right to receive notice of or to attend or vote at

any general meeting of the Company.

Dividends

The Company may by a C Share ordinary resolution declare

dividends in accordance with the rights of the C Shareholders, but

no such dividend shall exceed the amount recommended by the

Directors. The Directors may pay fixed rate and interim dividends

on C Shares.

The Company has delegated portfolio management of the Rollover

Assets to DFM (the "Rollover Portfolio Manager") by way of a

Rollover Portfolio Management Agreement but has retained risk

management and overall supervision and control of the Rollover

Assets' CLO Managers.

Directorate Change

On 8 January 2019, the Company announced that Mark Moffat had

been appointed as a non-executive director effective the same

day.

Share Repurchase Programme

On 23 January 2019, the Company announced that, under the

general authority to buy back shares conferred by the Company's

Ordinary Shareholders at its AGM on 22 June 2018, it intended to

buy back shares in the market using available cash.

On 5 June 2019 and 7 June 2019, the Company announced that it

had purchased 2,056,202 and 324,754 of its Ordinary Shares of no

par value respectively at a weighted average price per share of

EUR0.81. The purchased Ordinary Shares are held in treasury.

Following completion of these two buy backs, the Company has

402,319,490 Ordinary Shares in issue.

Broker Update

On 24 June 2019, Fidante Partners Europe Limited gave the

Company notice of the termination of the agreements for asset

management services between the Company and themselves due to a

winding down of the Fidante Capital business. This termination

became effective as from 30 June 2019.

Risk Overview

Principal Risks and Uncertainties

Each Director is aware of the risks inherent in the Company's

business and understands the importance of identifying, evaluating

and monitoring these risks. The Board has adopted procedures and

controls to enable it to manage these risks within acceptable

limits and to meet all of its legal and regulatory obligations.

The Board considers the process for identifying, evaluating and

managing any significant risks faced by the Company on an ongoing

basis and these risks are reported and discussed at Board meetings.

It ensures that effective controls are in place to mitigate these

risks and that a satisfactory compliance regime exists to ensure

all applicable local and international laws and regulations are

upheld.

The Directors have carried out a robust assessment of the

principal risks facing the Company, an overview of which, along

with the applicable mitigants put in place, is set out below:

Principal risk Mitigant

Investment performance

A key risk to the Company is unsatisfactory investment Market conditions, events and political uncertainty pose

performance due to an economic downturn a risk to capital for any asset class

along with continued political uncertainty which could which by their nature (and outside efficient portfolio

negatively impact global credit markets management by the Portfolio Adviser)

and the risk reward characteristics for CLO structuring. may not have any mitigating factors.

This could directly impact the performance

of the underlying CLOs that the Company invests in and it The Board receives regular updates from the Portfolio

could also result in a reduced number Adviser on the developments and overall

of suitable investment opportunities and/or lower health of the loan and CLO market. The Board takes

shareholder demand. comfort in the Portfolio Adviser's track

record and that a sufficient number of CLOs have been

established by BGCF, the income from

which should enable the Company (through its investment

in the Lux Subsidiary) to cover its

running costs and dividend policy for the foreseeable

future.

--------------------------------------------------------- ---------------------------------------------------------

Share price discount

The price of the Company's shares may trade at a discount The Board continually monitors the Company's share price

relative to the underlying net asset discount or premium to the Published

value of the shares. NAVs and regularly consults with the Company's brokers

regarding share trading volumes, significant

buyers and sellers, and comparative data from the

Company's peer group.

In order to manage the discount existing at the time, on

23 January 2019 the Board announced

that under its general authority to buy back shares in

the market, it intended to do so using

available cash. In June 2019, the Company bought back

2,380,956 Ordinary Shares at a weighted

average price of EUR0.81.

--------------------------------------------------------- ---------------------------------------------------------

Investment valuation

The investment in the Lux Subsidiary is accounted for at The Directors use their judgement, with the assistance

fair value through profit or loss of the Portfolio Adviser, in selecting

and the investment in PPNs issued by BGCF held by the Lux an appropriate valuation technique and refer to

Subsidiary are at fair value. Investments techniques commonly used by market practitioners.

in BGCF (the PPNs) are illiquid investments, not traded The board of directors of BGCF likewise use their

on an active market and are valued judgement in determining the valuation of

using valuation techniques determined by the Directors. investments and underlying CLOs and equity tranches

The underlying CLO investments held retained by BGCF.

by BGCF are valued using modelling methodologies,

described in the Company's Prospectus, that As detailed further in Note 12 of the Annual Report and

are based upon many assumptions. Audited Financial Statements as at

31 December 2018, independent valuation service