TIDMPOLX

RNS Number : 3725N

Polarean Imaging PLC

24 September 2019

Polarean Imaging Plc

("Polarean" or the "Company")

Half-year Report

Polarean Imaging plc (AIM: POLX), the medical-imaging technology

company, with a proprietary drug-device combination product for the

magnetic resonance imaging (MRI) market, announces its unaudited

interim results for the six months ended 30 June 2019.

Highlights

-- Significant enrolment in Phase III FDA clinical trials (the

"Clinical Trials") as Clinical Trials near completion

-- Third trial site added at University of Cincinnati, in

addition to Duke University and the University of Virginia, to

improve enrolment rates for its Clinical Trials

-- Three new orders for Polarean's 9820 Xenon Polariser system

from the University of British Columbia, The Hospital for Sick

Children ("SickKids") in Toronto and the University of Kansas.

-- Third tranche of US$1m confirmed from US$3m Small Business

Innovation Research ("SBIR") grant

-- Second London Investor Symposium completed in June 2019

-- Appointment of Charles ("Chuck") Osborne as the Company's new Chief Financial Officer

-- Net cash of US$1.28m at 30 June 2019

Post-period end

-- Raised GBP2.1m (gross) via a placing of 11,666,667 ordinary

shares at a placing price of 18p per share in July 2019

-- Enrolment for the Clinical Trials has now passed 98% in the

lung transplant pathway and 87% in the lung lobe resection pathway,

with a total of 80 patients targeted for enrolment

-- Delivered and installed a 9820 Xenon Polariser system at SickKids

-- Number of Xenon Polariser systems installed or on order is 25

Richard Hullihen, CEO of Polarean, commented: "Our continued

global engagement with the expanding base of clinicians and

researchers, while extending our technology and discovering new

techniques, reinforces our belief that pulmonary medicine patients

and their doctors deserve the benefits of our unique

three-dimensional, non-invasive, reproducible hyperpolarised xenon

gas imaging technology. We have now entered a crucial period for

the Company as the Clinical Trials near completion, with the

top-line results of the Clinical Trials expected before the end of

2019. We remain confident and excited for the future of Polarean

and are grateful to our shareholders and stakeholders for their

continued support."

This announcement contains inside information for the purposes

of Article 7 of Regulation (EU) 596/2014.

Enquiries:

Polarean Imaging plc www.polarean.com / www.polarean-ir.com

Richard Hullihen, Chief Executive Officer Via Walbrook PR

Richard Morgan, Chairman

SP Angel Corporate Finance LLP Tel: +44 (0)20 3470 0470

David Hignell / Lindsay Mair / Jamie Spotswood

(Corporate Finance)

Vadim Alexandre / Rob Rees (Corporate Broking)

Walbrook PR Tel: +44 (0)20 7933 8780 or polarean@walbrookpr.com

Paul McManus / Anna Dunphy Mob: +44 (0)7980 541 893 / +44 (0)7879

741 001

About Polarean (www.polarean.com)

The Company and its wholly owned subsidiary, Polarean, Inc.

(together the "Group") are revenue generating, medical drug-device

combination companies operating in the high resolution functional

magnetic resonance imaging market.

The Group develops equipment that enables existing MRI systems

to achieve an improved level of pulmonary function imaging and

specialises in the use of hyperpolarised Xenon gas ((129) Xe) as an

imaging agent to visualise ventilation and gas exchange regionally

in the smallest airways of the lungs, the tissue barrier between

the lung and the bloodstream and in the pulmonary vasculature.

Xenon gas exhibits solubility and signal properties that enable it

to be imaged within other tissues and organs.

CEO Statement

Introduction

The six month period ending 30 June 2019 has seen Polarean make

substantial progress towards its goal of completing the Clinical

Trials for the Company's medical drug-device combination.

The first half of the financial year was committed to critically

analysing the performance of the Clinical Trial sites and their

protocols and processes for recruitment as the Clinical Trials

progressed and enrolment rates increased. Despite having skilled

academic site clinical trial organizations and contract research

organizations (CROs), there is always a period of discovery and

correction associated with any first of type trial, and we found

and fixed several restrictions to our recruitment rates, working

collaboratively with our CROs and academic sites.

Results overview

Our financial performance, with sales being made on a

research-use-only basis to academic institutions in the US and

Europe, remains in-line with management expectations. Revenues for

the first half decreased from US$1.0m to US$0.4m, with gross

profits US $0.32m (H1 2018: US$0.75m). This is primarily

attributable to the timing of polariser sales. We received three

high value polariser orders, during H1 2019, one of which was

installed during September 2019. The other two polarisers are

anticipated to be delivered during Q4 2019. Gross operating margins

remain at over 50%. Administrative Expenses were flat for the

period. Our overall loss before tax increased to US$3.4m from

US$2.7m in the same comparable period, due to the lower revenue

during the period. Cash controls within the business remain robust

and as at 30 June 2019 we held US US$1.28m in net cash or cash

equivalents.

The Company held its second Investor Symposium in London on 12

June 2019. Attendance was significantly higher than it was at our

first investor symposium which we held in June 2018, and the

feedback from the 2019 symposium was positive. We conducted a

review of the latest technology breakthroughs, as well as

presentations by Key Opinion Leaders from two sites: Dr. Jason

Woods from Cincinnati Chilldren's Hospital speaking on Cystic

Fibrosis, and Dr. Sudarshan Rajagopal from Duke University speaking

on pulmonary vascular disease. The video of the symposium can be

viewed here:

http://www.polarean-ir.com/content/investors/videos.asp

Post-period end events

Placing to raise GBP2.1m (gross) at 18p completed

On the 22 July 2019 Polarean announced the completion of a

placing to raise an additional GBP2.1m (gross) at a placing price

of 18 pence per share in response to strong demand from

institutional and EIS/VCT investors. We are encouraged with the

support shown by new and existing shareholders and these additional

funds will further support our Clinical Trials in the US,

preparation of our New Drug Application ("NDA") for submission to

the US Food and Drug Administration ("FDA"), preparations for

commercial launch and the improvements we continue to make to our

polarisers.

Delivery of Xenon Polarisers

Whilst we seek clinical approval for our medical drug-device

combination we continue to expand our installed base of systems

through additional sales of research units to academic

institutions.

Post-period end, we delivered and installed a new system at the

SickKids Hospital Toronto. This is an additional system for

SickKids who is a long-term collaborator and customer of the

Company.

In February and July 2019, we received orders for additional

Polarean 9820 Polariser systems. We anticipate shipping these two

systems to the customers in the second half of 2019. The number of

systems installed or on order is currently 25*.

* Inadvertently reported as 24 in the RNS dated 10 September

2019 which omitted the system ordered by KUMC as per the RNS dated

11 July 2019.

Outlook

We continue to demonstrate and reinforce our belief that

Polarean's technology can be a tremendous benefit to patients and a

powerful new tool for clinicians in discovering and demonstrating

treatable traits in pulmonary medicine. In addition, our latest new

techniques lead us into the field of cardiology and pulmonary

vascular disease which is one example of the upside potential of

our technology. There are 40 clinical trials currently ongoing into

the use of (129) Xe MRI accruing to the FDA website.

The burden of pulmonary disease in the USA is approximately

US$150bn, with pulmonary disease widespread and growing, affecting

nearly 40 million Americans. Given the limitations of existing

methods of diagnosis and lung disease monitoring, we believe that

there is a significant unmet need for non-invasive, quantitative,

and cost-effective image-based diagnosis technology. We believe

that our unique medical drug-device combination utilizing 129Xe

offers the ideal solution for improving pulmonary disease diagnosis

and we are confident that this will be borne out during the

Company's Clinical Trials.

Richard Hullihen

Chief Executive Officer

23 September 2019

Consolidated unaudited statement of comprehensive income

for the six months ended 30 June 2019

Unaudited Unaudited Audited

Note 6 months 6 months 12 months

ended 30.6.19 ended 30.6.18 ended 31.12.18

US$ US$ US$

Revenue 399,639 1,026,926 2,439,139

Cost of sales (75,185) (279,455) (633,463)

--------------- --------------- ----------------

Gross profit 324,454 747,471 1,805,676

Administrative expenses (3,068,371) (3,106,922) (6,161,916)

Depreciation (4,661) (4,489) (10,140)

Amortisation (341,937) (308,426) (616,852)

Selling and distribution expenses (147,821) (20,998) (31,766)

Share based payment expense (139,886) (87,400) (251,790)

--------------- --------------- ----------------

Loss from operations (3,378,222)) (2,780,764) (5,266,788)

(22,356)

Finance expense 356) (52,654) (188,055)

Finance income 274 27 184

--------------- --------------- ----------------

Loss on ordinary activities

before taxation 4 (3,400,304) (2,833,391) (5,454,659)

Taxation - - -

--------------- --------------- ----------------

Loss and total other comprehensive

expense (3,400,304) (2,833,391) (5,454,659)

Basic and fully diluted loss

per share (US$) 4 (0.034) (0.057) (0.078)

POLAREAN IMAGING PLC

Consolidated unaudited statement of financial position

As at 30 June 2019

Unaudited Unaudited Audited

As at 30.6.19 As at 30.6.18 As at 31.12.18

US$ US$ US$

Assets Note

Non-current assets

Property, plant and equipment 13,091 23,403 17,752

Intangible assets 3,735,973 4,352,824 4,044,398

Right-of-use asset 131,773 - -

Trade and other receivables 5,539 12,536 12,539

-------------- -------------- ---------------

3,886,376 4,388,763 4,074,689

Current assets

Inventories 1,233,039 1,069,342 651,781

Trade and other receivables 1,094,988 1,148,306 4,226,585

Cash and cash equivalents 1,277,195 1,374,866 875,601

-------------- -------------- ---------------

3,605,222 3,592,514 5,753,967

-------------- -------------- ---------------

Total assets 7,491,598 7,981,277 9,828,656

-------------- -------------- ---------------

Equity

Share capital 5 49,767 36,396 49,427

Share premium 11,200,461 6,432,812 11,063,075

Group reorganisation reserve 7,813,337 7,813,337 7,813,337

Share-based payment reserve 1,218,221 913,945 1,078,335

Accumulated losses (15,619,993) (9,591,499) (12,212,767)

-------------- -------------- ---------------

Total equity 4,661,793 5,604,991 7,791,407

Liabilities

Non-current liabilities

Deferred income 87,029 - 70,726

Borrowings 6 83,168 - -

Contingent consideration 316,000 316,000 316,000

-------------- -------------- ---------------

486,197 316,000 386,726

Current liabilities

Trade and other payables 1,604,792 1,908,079 1,590,482

Borrowings 6 82,716 149,878 5,213

Deferred income 656,100 2,329 54,828

-------------- -------------- ---------------

2,343,608 2,060,286 1,650,523

-------------- -------------- ---------------

Total equity and liabilities 7,491,598 7,981,277 9,828,656

-------------- -------------- ---------------

Consolidated unaudited statement of changes in equity

As at 30 June 2019

Share-based

Share Share Group Other payment Accumulated

capital premium re-organisation equity reserve losses Total equity

-------- ------------ ---------------- -------- ------------ -------------- -------------

Balance as at 31 December

2017 (audited) 23,291 1,448,037 7,813,337 87,305 826,545 (6,758,108) 3,440,407

Loss and total comprehensive

income for the period - - - - - (2,833,391) (2,833,391)

Transaction with owners

Issue of shares 13,105 5,124,897 - (87,305) - - 5,050,697

Share issue costs - (140,122) - - - - (140,122)

Share-based payments - - - - 87,400 - 87,400

-------- ------------ ---------------- -------- ------------ -------------- -------------

Balance as at 30 June

2018 (unaudited) 36,396 6,432,812 7,813,337 - 913,945 (9,591,499) 5,604,991

Loss and total comprehensive

income for the period - - - - - (2,621,268) (2,621,268)

Transaction with owners

Issue of shares 13,031 5,036,577 - - - - 5,049,608

Share issue costs - (406,314) - - - - (406,314)

Share-based payments - - - - 164,390 - 164,390

Balance as at 31 December

2018 (audited) 49,427 11,063,075 7,813,337 - 1,078,335 (12,212,767) 7,791,407

-------- ------------ ---------------- -------- ------------ -------------- -------------

Change in accounting policy - - - - - (6,922) (6,922)

-------- ------------ ---------------- -------- ------------ -------------- -------------

Restated total equity

at 1 January 2019 49,427 11,063,075 7,813,337 - 1,078,335 (12,219,689) 7,784,485

-------- ------------ ---------------- -------- ------------ -------------- -------------

Loss and total comprehensive

income for the period

Transaction with owners - - - - - (3,400,304) (3,400,304)

Issue of shares

Share-based payments 340 137,386 - - - - 137,726

- - - - 139,886 - 139,886

Balance as at 30 June

2019 (unaudited) 49,767 11,200,461 7,813,337 - 1,218,221 (15,619,993) 4,661,793

======== ============ ================ ======== ============ ============== =============

Consolidated unaudited cash flow statement

for the six months ended 30 June 2019

Unaudited Unaudited Audited

6 months 6 months 12 months

ended 30.6.19 ended 30.6.18 ended

US$ US$ 31.12.18

US$

Cash flows from operating activities

Loss for the period before taxation (3,400,304) (2,833,391) (5,454,659)

Adjustments for non-cash/non-operating

items:

Depreciation of plant and equipment 4,661 4,489 10,140

Amortisation of intangible assets 341,937 308,426 616,852

Share based compensation 139,886 87,400 251,790

Interest paid 22,356 52,654 188,055

Interest received (274) (27) (184)

(2,891,738) (2,380,449) (4,388,006)

Changes in working capital:

Increase in inventories (581,257) (419,482) (1,921)

Increase in trade and other receivables (301,448) (659,448) (69,517)

(Decrease)/increase/ in trade

and other payables 36,955 10,026 (315,894)

Increase/(decrease) in deferred

revenue 617,575 (24,233) 98,992

--------------- --------------- ------------

Net cash flows used from operating

activities (3,119,913) (3,473,586) (4,676,346)

Cash flows from investing activities

Purchase of plant and equipment - (6,551) (6,551)

--------------- --------------- ------------

Net cash used in investing activities - (6,551) (6,551)

Cash flows from financing activities

Repayment of loans (116,126) (307,623)

Issue of shares 3,577,509 4,063,539 5,093,775

Interest paid (22,356) (52,654) (188,055)

Interest received 274 27 184

Principal elements of lease payments (42,793) - -

Interest elements of lease payments 8,873 - -

--------------- --------------- ------------

Net cash generated from financing

activities 3,521,507 3,894,786 4,598,281

Net increase in cash and equivalents 401,594 414,649 (84,616)

Cash and equivalents at beginning

of period 875,601 960,217 960,217

Cash and equivalents at end of

period 1,277,195 1,374,866 875,601

NOTES TO THE INTERIM ACCOUNTS

1. Basis of preparation

The accounting policies adopted are consistent with those of the

previous financial year ended 31 December 2018.

This interim consolidated financial information for the six

months ended 30 June 2019 has been prepared in accordance with AIM

rule 18, 'Half yearly reports and accounts'. This interim

consolidated financial information is not the group's statutory

financial statements within the meaning of section 434 of the

Companies Act 2006 (and information as required by section 435 of

the Companies Act 2006) and should be read in conjunction with the

annual financial statements for the year ended 31 December 2018,

which have been prepared in accordance with International Financial

Reporting Standards (IFRS) and have been delivered to the Registrar

of Companies. The auditors have reported on those accounts; their

report was unqualified, did not include references to any matters

to which the auditors drew attention by way of emphasis of matter

without qualifying their report and did not contain statements

under section 498(2) or (3) of the Companies Act 2006.

The interim consolidated financial information for the six

months ended 30 June 2019 is unaudited. In the opinion of the

Directors, the interim consolidated financial information presents

fairly the financial position, and results from operations and cash

flows for the period. Comparative numbers for the six months ended

30 June 2018 are also unaudited.

This interim consolidated financial information is presented in

US Dollars ($).

2. Changes in accounting policies

The Group has initially adopted IFRS 16 Leases from 1 January

2019. IFRS 16 introduced a single, on-balance sheet accounting

model for leases. As a result, the Group, as a lessee, has

recognised right-of-use assets representing its rights to use the

underlying assets and lease liabilities representing its obligation

to make lease payments.

The Group has applied IFRS 16 using the modified retrospective

approach, under which the cumulative effect of initial application

is recognised in retained earnings at 1 January 2019. Accordingly,

the comparative information presented for 2018 has not been

restated - i.e. it is presented, as previously reported, under IAS

17 and related interpretations. The details of the changes in

accounting policies are disclosed below.

Definition of a lease

Previously, the Group determined at contract inception whether

the arrangement was or contained a lease under IFRIC 4 Determining

Whether an Arrangement contains a Lease. The Group now assesses

whether a contract is or contains a lease based on the new

definition of a lease. Under IFRS 16, a contract is, or contains, a

lease if the contract conveys a right to control the use of an

identified asset for a period of time in exchange for

consideration.

On transition to IFRS 16, the Group elected to apply the

practical expedient to grandfather the assessment of which

transactions are leases. It applied IFRS 16 only to contracts that

were previously identified as leases. Contracts that were not

identified as leases under IAS 17 and IFRIC 4 were not

reassessed.

Significant accounting policies

The Group recognises a right-of-use asset and a lease liability

at the lease commencement date. The right-of-use asset is initially

measured at cost, and subsequently at cost less any accumulated

amortisation and impairment losses, and adjusted for certain

measurements of the lease liability.

The lease liability is initially measured at the present value

of the lease payments that are not paid at the commencement date,

discounted using the interest rate implicit or, if that rate cannot

be readily determined, the Group's incremental borrowing rate.

Generally, the Group uses its incremental borrowing rate as the

discount rate.

The lease liability is subsequently increased by the interest

cost on the lease liability and decreased by lease payments made.

It is remeasured when there is a change in future lease payments

arising from a change in an index or rate, a change in estimate of

the amount expected to be payable under a residual value guarantee,

or as appropriate, changes in the assessment of whether a purchase

or extension option is reasonably certain to be exercised or a

termination option is reasonably certain not to be exercised.

The Group has applied judgement to determine the lease term for

some lease contracts in which it is a lease that include renewal

options. The assessment of whether the Group is reasonably certain

to exercise such options impacts the lease term, which

significantly affects the amount of lease liabilities ad

right-of-use assets recognised.

Transition

Previously, the Group classified property leases as operating

lease under IAS 17. At transition, for leases classified as

operating leases under IAS 17, lease liabilities were measured at

the present value of the remaining lease payments, discounted at

the Group's incremental borrowing rate as at 1 January 2019.

Right-of-use assets are measured at their carrying value as if IFRS

16 has been applied since the commencement date, discounted using

the lessee's incremental borrowing rate at the date of initial

application.

The Group used the following practical expedients when applying

IFRS 16 to leases previously classified as operating leases under

IAS 17:

-- Applied the exemption not to recognise right-of-use assets

and liabilities for leases with less than 12 months of lease

term;

-- Excluded the initial direct costs from measuring the

right-of-use asset at the date of initial application; and

-- Used hindsight when determining the lease term if the

contract contains options to extend or terminate the lease.

Impact on transition

The impact (increase/(decrease)) on the statement of financial

position as at 1 January 2019 as a result of adopting IFRS 16 is as

follows:

US$

---------

Right-of-use assets 165,284

Accumulated losses (6,922)

Borrowings 191,361

Trade and other payables (19,155)

---------

When measuring lease liabilities for leases that were classified

as operating leases, the Group discounted the lease payment using

its incremental borrowing rate at 1 January 2019. The

weighted-average rate applied is 10%.

US$

--------

Operating lease commitment at 31 December 2018 as disclosed

in the Group's consolidated financial statements 183,421

Plus additional lease payments 34,814

--------

Operating lease commitment 218,235

The discounted lease liability recognised at 1 January 2019

after using the incremental borrowing rate 191,361

--------

Impact for the period

As a of result of initially applying IFRS 16, in relation to the

leases that were previously classified as operating leases, the

Group recognised amortisation and interest costs, instead of

operating lease expense. During the six months ended 30 June 2019,

the Group recognised US$33,511 of amortisation charges and US$8,873

of interest costs from these leases.

3. Going concern

The interim consolidated financial information for the six

months ended 30 June 2019 have been prepared on the going concern

basis.

The Directors consider the going concern basis of preparation to

be appropriate in preparing the financial statements. In

considering the appropriateness of this basis of preparation, the

Directors have received the Group's working capital forecasts for a

minimum of 12 months from the date of the approval of this

financial information. Based on their consideration the Directors

have reasonable expectation that the Group has adequate resources

to continue for the foreseeable future and that carrying values of

intangible assets are supported. Thus, they continue to adopt the

going concern basis of accounting in preparing this financial

information.

4. Loss per share

The basic and diluted loss per share for the period ended 30

June 2019 was US$0.034 (2018: US$0.057) The calculation of loss per

share is based on the loss of US$3,400,304 for the period ended 30

June 2019 (2018: loss of US$2,833,391) and the weighted average

number of shares in issue during the period for calculating the

basic profit per share of 101,087,330 shares (2017:

49,432,227).

5. Called up share capital

Unaudited Unaudited Audited

30.6.19 30.6.18 31.12.18

US$ US$ US$

Allotted, issued and fully paid

Ordinary Shares 49,767 36,396 49,427

---------- ---------- ---------

The number of shares in issue was as follows: Number of

shares

Balance at 1 January 2018 1,814,003

Effect of share split 46,656,158

Issued during the period 24,939,303

------------

Balance at 30 June 2018 73,409,464

Issued during the period 22,382,126

Issue of shares upon converting loans 4,939,303

------------

Balance at 31 December 2018 100,730,893

Exercised warrants (705,040)

------------

Balance at 30 June 2019 101,435,933

------------

On 31 March 2019, the warrants were exercised that resulted in

the conversion of an addition 705,040 ordinary shares.

6. Borrowings

Unaudited Unaudited Audited

30.6.19 30.6.18 31.12.18

US$ US$ US$

Non-current

Lease liability 83,168 - -

---------- ---------- ---------

Current

Related Party Loans - 7,936 -

Bank Overdraft 8,443 141,942 5,213

Lease Liability 74,273 - -

---------- ---------- ---------

Total 82,716 149,878 5,213

---------- ---------- ---------

7. Share based payments

Share Options

The Company grants share options as its discretion to Directors,

management and employees. These are accounted for as equity settled

transactions. Should the options remain unexercised after a period

of ten years from the date of grant the options will expire unless

an extension is agreed to by the board. Options are exercisable at

a price equal to the Company's quoted market price on the date of

grant or an exercise price to be determined by the board.

Details of share options granted, exercised, forfeited and

outstanding at the year-end are as follows:

Number of Weighted average

share options exercise price(US$)

Outstanding at 1 January 2019 15,560,560 0.13

Forfeited during the period (550,941) 0.20

Granted during the period 1,200,000 0.20

Outstanding at 30 June 2019 16,209,619 0.14

-------------------------------- --------------- ---------------------

The fair value of options granted has been calculated using the

Black Scholes model which has given rise to fair values per share

of US$0.09. This is based on risk-free rates of 1.41% and

volatility of 40.84%.

The weighted average contractual life of the share options

outstanding at the reporting date is 7.41 years.

Share Warrants

The Company grants share warrants at its discretion to

Directors, management, employees, advisors and lenders. These are

accounted for as equity settled transactions. Terms of warrants

vary from agreement to agreement.

Details for the warrants exercised, lapsed and outstanding at

the period ending 30 June 2019 are as follows:

Number Weighted average

of share exercise price

warrants (US$)

Outstanding at 1 January 2019 7,023,539 0.09

Lapsed during the period (157,796) 0.20

Exercised during the period (705,040) 0.20

Outstanding at 30 June 2019 6,160,703 0.08

-------------------------------- ---------- -----------------

Exercisable at 30 June 2019 6,160,703 0.08

-------------------------------- ---------- -----------------

On 2 April 2019, the Company issued 705,040 new ordinary shares

of GBP0.00037 each in the capital of the Company at the exercise

price of 15 pence per share, following the exercise of warrants.

The total consideration received by the Company pursuant to the

warrant exercise was GBP105,756. An additional 157,796 warrants

lapsed on 31 March 2019.

The weighted average contractual life of the share warrants

outstanding at the reporting date is 4.14 years.

8. Subsequent events

On 22 July 2019, the Company announced it had raised a total of

GBP2.1million (before expenses) via the placing of total of

11,666,667 ordinary shares at a price of 18p per share with

institutional investors. The net proceeds of the placing will be

used to further support the Company's Clinical Trials, the

preparation and submission of the NDA, provide additional working

capital to build new polarisers for future orders and to further

support the preparation for market launch following submission of

the NDA and the development of relationships with strategic

partners of the Company.

On 24 July 2019, the Company issued 1,336,000 new ordinary

shares of GBP0.00037 each in the capital of the Company at the

exercise price of 15 pence per share, following the exercise of

warrants.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR BCGDCLDDBGCX

(END) Dow Jones Newswires

September 24, 2019 02:01 ET (06:01 GMT)

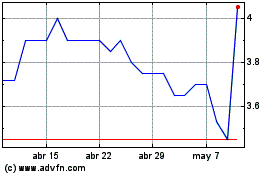

Polarean Imaging (LSE:POLX)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Polarean Imaging (LSE:POLX)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024