TIDMPEN

RNS Number : 3756N

Pennant International Group PLC

24 September 2019

FOR IMMEDIATE RELEASE 24 September 2019

PENNANT INTERNATIONAL GROUP PLC

Interim Results for the six months ended 30 June 2019

First Half results in line with market guidance;

GBP36m Order Book and Pipeline remains strong;

Continued focus on building recurring revenues whilst delivering

major contracts

Pennant International Group plc ("Pennant", the "Group", or the

"Company"), the AIM quoted supplier of integrated training and

support solutions, products and services which train and assist

operators and maintainers in the defence and regulated civilian

sectors, announces Interim Results for the six months ended 30 June

2019 (the "First Half", the "Period", or "H1 2019").

Commenting on the results and the Company's prospects, Chairman

Simon Moore said:

"Trading in the First Half was in line with management

expectations and previous guidance issued by the Company. The First

Half saw the Group focused on building a suite of generic training

aids and, with this work being recognised as work-in-progress at

the end of the Period, a pre-tax loss of GBP1.8 million has been

recorded, in line with guidance issued by the Company.

Notwithstanding a number of customer-driven timing challenges on

specific projects which were highlighted in last month's Trading

Update, the Company's strategy is progressing to plan with two

acquisitions already completed so far this year, and with the prior

investment in products, people and facilities positioning the Group

well to exploit its considerable pipeline which includes over GBP30

million of single-source opportunities."

Key points: Financial

-- Group revenues for the Period of GBP7.2 million (H1 2018: GBP13.2 million);

-- loss before tax of GBP1.8 million (H1 2018: profit before tax of GBP2.0 million);

-- loss before interest, taxation and amortisation of GBP1.5

million (H1 2018: earnings of GBP2.1 million);

-- gross margin of 25% (H1 2018: 34%);

-- cash used in operations of GBP2.7million (H1 2018: cash generated of GBP3 million);

-- trade and other receivables of GBP5.2 million (H1 2018:

GBP5.1 million), including GBP2.8 million due from contracts (H1

2018: GBP0.8 million);

-- net debt at Period end excluding finance leases of GBP0.4

million overdrawn (H1 2018: GBP3.0 million);

-- basic (loss)/earnings per share of (5.07)p per share (H1 2018: 6.17p per share);

-- no interim dividend declared (H1 2018: nil);

-- three-year order book (to 30 June 2022) increased to GBP36.1

million (H1 2018: GBP31 million);

-- unrelieved tax losses of GBP5.3 million carried forward (H1 2018: GBP0.3 million).

Key points: Operational

-- On-schedule production of training aids for Qatar (enabling

recognition of revenue and profits for the second half of 2019 (the

"Second Half", "H2 2019").

-- Record revenues in the Integrated Logistics Support division

(home of OmegaPS), GBP2.42 million for the Period.

-- Official launch of two new products (GenSkills Mk 2 and

Generic Fastener Installation Trainer) during the First Half,

specifically designed to address gaps in training coverage, with

sales achieved during the Period.

-- Successful completion of the acquisition of the Aviation

Skills Partnership, a key step in achieving greater involvement in

the training delivery and courseware markets.

-- Completion of upgrades and refurbishments to a number of

production facilities in readiness for new contract awards and the

commencement of the build phase on the Ajax contract.

-- Appointment of Philip Cotton (ex-KPMG) as a non-executive

director and Chair of the Audit Committee following the retirement

of Christopher Powell.

-- Commencement in post of new Chief Operating Officers for

Technical Training business and Integrated Logistics Support

division.

Commenting on the Group's prospects for the year as a whole,

Simon Moore added:

"The Board anticipates a profitable outcome for the year as a

whole. With a contracted order book of GBP36 million scheduled for

delivery over the next three years, together with a sizeable

pipeline of single-source opportunities, the Board remains

confident of future prospects and of building and delivering

long-term shareholder value."

Certain information contained in this announcement would have

constituted inside information (as defined by Article 7 of

Regulation (EU) No 596/2014) ("MAR") prior to its release as part

of this announcement and is disclosed in accordance with the

Company's obligations under Article 17 of MAR.

Enquiries:

Pennant International Group plc www.pennantplc.co.uk

Philip Walker, CEO

David Clements, Commercial &

Risk Director +44 (0) 1452 714 914

WH Ireland Limited (Nomad and www.whirelandcb.com

Broker)

Mike Coe

Chris Savidge +44 (0) 117 945 3470

Walbrook PR (Financial PR) paul.vann@walbrookpr.com

Paul Vann +44 (0)20 7933 8780

Tom Cooper Mob: +44 (0)7768 807631

Pennant International Group plc

Interim Report for the six months ended 30 June 2019

Chairman's Statement

On behalf of the Board of Directors, I can report that the Group

recorded a pre-tax loss for the six months ended 30 June 2019 of

GBP1.8 million (H1 2018: pre-tax profit of GBP2.0 million).

This result was in line with management expectations and

previous guidance issued by the Company. The Group expects to trade

profitably for the full year.

Results and dividend

Revenues for the Period were lower than the equivalent period in

2018 at GBP7.2 million (H1 2018: GBP13.2 million).

This was largely attributable to the fact that, under the IFRS

15 accounting standard, the Group is required to recognise the

costs incurred in building its generic training aids as

work-in-progress when they are incurred, whereas sales revenue and

profit is only recognisable on acceptance or delivery of the

finished products. Specifically, production costs for the training

aids for the Qatar contract were incurred during the First Half and

were work-in-progress at Period end, whilst the revenues and

profits will flow on acceptance of the products in the Second

Half.

The gross profit margin for the Period was 25% (H1 2018: 34%)

due to sales mix (particularly a larger-than-typical proportion of

consultancy revenues) and prudent margin recognition on the Ajax

programme, with the higher-margin generic product sales due to be

recognised in the Second Half.

Administrative costs for the Period were GBP3.5 million (H1

2018: GBP2.5 million). The increase is predominantly due to:

Pennant 'gearing up' for the 'Major Programme' for which it was

down-selected in August 2018; depreciation relating to new

facilities; and increased overheads in Aviation Skills Partnership.

An update on the Major Programme is provided below.

The basic loss per share for the Half Year was (5.07)p compared

to earnings of 6.17p for the same period last year.

Minimal effective tax rate is expected for the full year due to

unrelieved tax losses of GBP5.3 million carried forward at the Half

Year and with R&D tax credit claims in progress.

The Group has a robust Order Book, with contracted revenues

currently scheduled for delivery over the next three years

amounting to GBP36.1 million at the Period end (H1 2018: GBP31

million).

The Group ended the Period with net debt excluding finance

leases of GBP0.4 million. With significant undrawn overdraft

facilities (and forecast cash receipts on invoices due in the

Second Half), the Group has sufficient resources to meet its

foreseeable working capital requirements.

The Directors have concluded that it is in the best interests of

the Company and its shareholders to retain cash at this time for

expected working capital requirements. The Board will therefore not

be declaring an interim dividend but will continue to review the

Group's dividend policy based on performance, cash generation and

working capital and investment requirements.

Operational Commentary

Delivering Key Contracts

Ajax Contract

The contract for electro-mechanical trainers for the Ajax

armoured fighting vehicle was awarded to the Group in 2015 and was

re-scoped in 2018 to baseline the trainers against particular

variants of the Ajax vehicle.

During the First Half, the Group successfully passed a design

review for the frame of the hull trainer and subcontracted out

proto-type builds.

Post-Period end, the Company received a request to re-base its

training solution to align with recent additional vehicle updates

and this is currently in negotiation with the customer. Further

changes may be required to the training solution as the vehicle

platform develops which is not uncommon on such programmes.

As announced on 9 August 2019, it has become apparent that the

programme schedule may need to be extended, and it is now

anticipated that progress on delivering the contract will be slower

than budgeted for the Second Half, with material uplift in revenues

not envisaged until 2020 after the contract is re-based.

Qatar

The production of training aids for Qatar is on schedule and on

budget to enable recognition of revenue and profits for the second

half of 2019.

All contractual milestones to date have been achieved in

accordance with the agreed schedule with the associated invoices

issued to and paid by the customer.

Integrated Logistics Support ("ILS") (home of Omega PS)

The Group's ILS division continued to provide long-term

recurring consultancy, support and maintenance services on the

Omega PS software product to the Canadian and Australian defence

departments and their respective supply bases, contributing

revenues for the Period of GBP2.42 million, a record for the

division.

Virtual Parachute Training Systems

Customer acceptance was achieved on the upgrade to the RAF's

virtual parachute training system at Brize Norton. Other

opportunities to sell Pennant's parachute systems are in progress

with interest from a number of overseas militaries.

Contract Wins and Pipeline

The key focus during the First Half was on progressing certain

larger opportunities with prime contractors for training aids in

support of UK defence requirements with a view to securing the

conversion of these opportunities (included in the Group's

single-source pipeline in excess of GBP30 million) in H2 2019 and

2020.

Orders were also received for multiple GenSkills devices (marks

1 and 2) together with orders for the new GFIT device, as the

Group's investment in new products started to pay off. A new

support contract with a Middle East customer was also secured,

building on the Group's critical mass in the region and generating

additional recurring revenues.

Acquisition of ASP

The Company acquired the Aviation Skills Partnership in February

2019 for the key purpose of achieving greater involvement in the

training delivery and courseware markets.

Work has been ongoing since the acquisition to progress the

opening of new aviation academies in addition to the flagship

International Aviation Academy - Norwich which is already managed

by ASP.

As detailed in the Group's trading update of 9 August 2019, this

expansion of the ASP business is taking longer than initially

expected, with public funding of projects being delayed due to the

current focus on Brexit.

Post-Period end, ASP launched a Charter for Aviation Skills with

the support and direct involvement of several major OEMs and

airlines, including Airbus, British Airways and Leonardo

Helicopters. Building on the Charter launch and securing academy

funding will be key priorities for ASP during the Second Half.

Board Changes

During the Period, Christopher Powell retired as a director and

Phil Cotton was appointed as a non-executive director and Chair of

the Audit Committee. Mr Cotton is a chartered accountant and former

partner at KPMG.

Post-Period End

Major Programme

Further to the announcement of Pennant's 'down-selection' in

August 2018 for a Major Programme, the Group continues to work with

the prospective customer to progress contract award. The solution

to meet the training requirement is currently being refined between

Pennant and the prospective customer (informed by the underlying UK

defence requirement) and this is expected to be confirmed during

the Second Half. Pennant therefore expects to have greater clarity

on the scope of the order, likely final aggregate value and

expected delivery schedule by the end of the Second Half, with

contract award still anticipated for the second half of 2020.

Costs Reduction Exercise

As announced on 2 May 2019, the Group had been incurring

significant additional costs in anticipation of work commencing on

the Major Programme (circa GBP90,000 per month) during the First

Half which was impacting operating margin.

To mitigate the delay in contract award, a costs reduction

exercise was initiated prior to that announcement and this was

intensified when it became apparent that progress was also slowing

on the Ajax contract due to data challenges and the likely contract

re-basing (mentioned above). While it is not desirable (or indeed

possible) to remove all the additional costs, to date annualised

cost savings in the region of GBP430,000 have been achieved, with

work ongoing to identify further savings. At the same time, the

Group has been very careful to avoid degrading its ability to

deliver on new contracts once awarded.

ASP

Post-Period end, the Company agreed an amendment to the share

purchase agreement under which Aviation Skills Partnership was

acquired, accelerating the earn-out period to end on 31 December

2020. The maximum amount payable under the earn-out is now GBP2.1

million and the Group expects to actually pay in the region of

GBP200,000 over the remaining term of the earn-out.

Track Access Services

Post-Period end, the Group acquired the business and assets of

Track Access Services ("TAS"). TAS provides safety-critical

services to train operating companies and rail infrastructure

providers. TAS's current capabilities include rail driver training,

rail survey services, laser and video scanning, 3D track models,

signal siting and a subscription-based route video and mapping

service. Customers include Network Rail and DB Cargo.

Strategy

The Board recognises that the Company's core 'Technical Training

Solutions' business is susceptible to lengthy and uncertain

gestation periods for contract awards and to revisions on its

engineered-to-order programmes.

This recognition drives the Board's ongoing strategy to increase

the proportion of the Group's revenues which derive from the sale

of software and services, particularly those of a recurring nature.

Steps taken so far this year include:

-- the acquisition of the Aviation Skills Partnership;

-- the acquisition of Track Access Services at the start of the Second Half;

-- the ongoing development of a new variant of Omega PS

(deployable on a 'software-as-a-service' basis);

-- promoting unique VR software products in North America; and

-- focus on securing additional, long-term product support contracts.

The Group is also progressing other strategic opportunities to

partner with or acquire complementary businesses.

Of course, the Technical Training Solutions business remains

critically important to the Group, and converting the single-source

pipeline (in excess of GBP30 million) is a top priority, with these

opportunities expected to crystallise into contracts over the next

12 months.

Outlook

With revenues and profits expected to flow in the Second Half,

the Board anticipates that the Group will trade profitably for the

year as a whole.

Prospects for next year and beyond remain positive with further

organic growth expected through conversion of the Group's active

sales pipeline and with opportunities for corporate development

under continual consideration. An ongoing key management focus will

be on further increasing visibility of long-term earnings by

seeking and converting recurring revenue streams, including the

further development of maintenance and support services across the

Group's activities.

On behalf of the Board, I wish to thank all staff across the

Group for their hard work and dedication during the Period and I

look forward to providing a further update on the Group's progress

in due course.

S A Moore

Chairman

PENNANT INTERNATIONAL GROUP plc

CONSOLIDATED INCOME STATEMENT for the six months ended 30 June

2019

Notes

Six months Six months Year ended

ended ended 31 December

30 June 2019 30 June 2018 2018

Unaudited Unaudited Audited

------------------------- -------------- -------------- -----------------------

GBP GBP GBP

------------------------- -------------- -------------- -----------------------

Revenue 7,251,631 13,232,433 21,069,223

------------------------- -------------- -------------- -----------------------

Cost of sales (5,443,075) (8,710,501) (12,806,223)

------------------------- -------------- -------------- -----------------------

Gross profit 1,808,556 4,521,932 8,263,000

------------------------- -------------- -------------- -----------------------

Administration expenses (3,568,007) (2,493,959) (5,093,520)

------------------------- -------------- -------------- -----------------------

Operating (loss)

/ profit (1,759,451) 2,027,973 3,169,480

------------------------- -------------- -------------- -----------------------

Finance costs (48,299) (2,779) (1,700)

------------------------- -------------- -------------- -----------------------

Finance income - 6,157 10,857

------------------------- -------------- -------------- -----------------------

(Loss) / profit

before taxation (1,807,750) 2,031,351 3,178,637

------------------------- -------------- -------------- -----------------------

Taxation 2 - - (32,712)

------------------------- -------------- -------------- -----------------------

(Loss) / profit

for the period (1,807,750) 2,031,351 3,145,925

------------------------- -------------- -------------- -----------------------

Earnings per share 3

------------------------- -------------- -------------- -----------------------

Basic (5.07p) 6.17p 9.49p

------------------------- -------------- -------------- -----------------------

Diluted (4.75p) 5.62p 8.67p

------------------------- -------------- -------------- -----------------------

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

for the six months ended 30 June 2019

Six months Six months Year ended

ended 30 ended 30 31 December

June 2019 June 2018 2018

Unaudited Unaudited Audited

------------ ----------- -------------

GBP GBP GBP

------------ ----------- -------------

(Loss) / profit attributable

to equity

holders of the parent (1,807,750) 2,031,351 3,145,925

Other comprehensive

income

Exchange differences

on

translation of foreign

operations 72,997 (35,283) (34,086)

------------------------------ ------------ ----------- -------------

(Loss) / profit attributable

to equity

holders of the parent (1,734,753) 1,996,068 3,111,839

------------ ----------- -------------

PENNANT INTERNATIONAL GROUP plc

CONSOLIDATED STATEMENT OF FINANCIAL POSITION as at 30 June

2019

Six months Six months Year ended

ended 30 June ended 30 June 31 December

2019 2018 2018

Unaudited Unaudited Audited

GBP GBP GBP

--------------- --------------- -------------

Non-current assets

--------------- --------------- -------------

Goodwill 2,253,845 955,200 951,939

--------------- --------------- -------------

Other intangible assets 2,029,054 381,236 1,660,292

--------------- --------------- -------------

Property plant and equipment 6,979,443 4,847,326 6,889,346

--------------- --------------- -------------

Right Of Use Asset 1,053,046 - -

--------------- --------------- -------------

Deferred tax asset 198,484 309,578 198,432

--------------- --------------- -------------

Total non-current assets 12,513,872 6,493,340 9,700,009

--------------- --------------- -------------

Current assets

--------------- --------------- -------------

Inventories / work-in-progress 2,722,707 793,417 1,923,639

--------------- --------------- -------------

Trade and other receivables 5,190,869 5,067,968 5,184,533

--------------- --------------- -------------

Cash and cash equivalents - 2,952,575 1,848,954

--------------- --------------- -------------

Current tax asset 3,637 - -

--------------- --------------- -------------

Total current assets 7,917,213 8,813,960 8,957,126

--------------- --------------- -------------

Total assets 20,431,085 15,307,300 18,657,135

--------------- --------------- -------------

Current liabilities

--------------- --------------- -------------

Trade and other payables 4,286,032 2,498,306 4,478,039

--------------- --------------- -------------

Current tax liabilities - 31,207 42,247

--------------- --------------- -------------

Obligations under finance

and operating leases 190,593 4,862 5,350

--------------- --------------- -------------

Bank loans/overdraft 413,977 - -

--------------- --------------- -------------

Other loans 7,149 - -

--------------- --------------- -------------

Earn out provision ASP 200,000

--------------- --------------- -------------

Total current liabilities 5,097,751 2,534,375 4,525,636

--------------- --------------- -------------

Net current assets 2,819,462 6,279,585 4,431,490

--------------- --------------- -------------

Non-current liabilities

--------------- --------------- -------------

Obligations under finance

and operating leases 903,140 23,748 20,383

--------------- --------------- -------------

Trade and other payables - - 23,105

--------------- --------------- -------------

Deferred tax liabilities - 307,916 -

--------------- --------------- -------------

Warranty provisions 25,000 240,000 50,000

--------------- --------------- -------------

Total non-current liabilities 928,140 571,664 93,488

--------------- --------------- -------------

Total liabilities 6,025,891 3,106,039 4,619,124

--------------- --------------- -------------

Net assets 14,405,194 12,201,261 14,038,011

--------------- --------------- -------------

Equity

--------------- --------------- -------------

Share capital 1,805,730 1,647,177 1,685,177

--------------- --------------- -------------

Share premium 5,100,253 2,677,571 3,168,870

--------------- --------------- -------------

Capital redemption reserve 200,000 200,000 200,000

--------------- --------------- -------------

Retained earnings 6,481,716 6,904,922 8,225,321

--------------- --------------- -------------

Translation reserve 370,923 296,729 297,926

--------------- --------------- -------------

Revaluation reserve 446,572 474,862 460,717

--------------- --------------- -------------

Total equity 14,405,194 12,201,261 14,038,011

--------------- --------------- -------------

PENNANT INTERNATIONAL GROUP plc

CONSOLIDATED STATEMENT OF CASH FLOWS for the six months ended 30

June 2019

Year ended

Six months ended Six months ended 31 December

30 June 2019 30 June 2018 2018

Unaudited Unaudited Audited

GBP GBP GBP

----------------- ----------------- -------------

Net cash (used in)

/ generated from operating

activities (2,712,559) 2,979,619 5,012,123

Investing activities

----------------- ----------------- -------------

Interest received - 6,157 10,857

----------------- ----------------- -------------

Proceeds from disposal

property, plant and

equipment - - 1,600

----------------- ----------------- -------------

Acquisition of ASP (359,001) - -

----------------- ----------------- -------------

Purchase of intangible

assets (634,383) (199,053) (1,583,760)

----------------- ----------------- -------------

Purchase of property

plant and equipment (336,901) (1,308,181) (3,561,439)

----------------- ----------------- -------------

Net cash used in investing

activities (1,330,285) (1,501,077) (5,132,742)

----------------- ----------------- -------------

Financing activities

----------------- ----------------- -------------

Proceeds from sale

of ordinary shares 2,051,936 - 529,299

----------------- ----------------- -------------

Net (repayment of) (103,957) - -

obligations under

operating lease

----------------- ----------------- -------------

Net (repayment of)

obligations under

finance leases (2,649) (3,230) (4,647)

----------------- ----------------- -------------

Net (repayment of) (162,601) - -

loans

----------------- ----------------- -------------

Net cash used in financing

activities 1,782,729 (3,230) 524,652

----------------- ----------------- -------------

Net (decrease) / increase

in cash and cash equivalents (2,260,115) 1,475,312 404,033

----------------- ----------------- -------------

Cash and cash equivalents

at beginning of period 1,848,954 1,502,655 1,502,655

----------------- ----------------- -------------

Effect of foreign

exchange rates 71,892 (25,392) (57,734)

----------------- ----------------- -------------

Cash and cash equivalents

at end of period (339,269) 2,952,575 1,848,954

----------------- ----------------- -------------

PENNANT INTERNATIONAL GROUP plc

STATEMENT OF CHANGES IN EQUITY for the six months ended 30 June

2019

Share Share Capital Retained Translation Revaluation Total equity

capital premium redemption earnings reserve reserve

reserve

------------- ------------

GBP GBP GBP GBP GBP GBP GBP

------------- ------------- ------------ ------------ ------------ ------------ -------------

At 31 December

2017 1,647,177 2,677,571 200,000 7,982,360 332,012 489,007 13,328,127

------------- ------------- ------------ ------------ ------------ ------------ -------------

Total

comprehensive

income - - - 3,145,925 - -- 3,145,925

------------- ------------- ------------ ------------ ------------ ------------ -------------

Adjustment on

initial

application

of IFRS 15 - - - (3,151,644) - - (3,151,644)

------------- ------------- ------------ ------------ ------------ ------------ -------------

Other

comprehensive

income - - - - (34,086) - (34,086)

------------- ------------- ------------ ------------ ------------ ------------ -------------

Total

comprehensive

income 1,647,177 2,677,571 200,000 7,976,641 297,926 489,007 13,288,322

------------- ------------- ------------ ------------ ------------ ------------ -------------

Issue of New

Ordinary

Shares 38,000 491,299 - - - - 529,299

------------- ------------- ------------ ------------ ------------ ------------ -------------

Recognition of

share based

payment - - - 103,983 - - 103,983

------------- ------------- ------------ ------------ ------------ ------------ -------------

Deferred tax

on share

options - - - 116,407 - - 116,407

------------- ------------- ------------ ------------ ------------ ------------ -------------

Transfer from

revaluation

reserve - - - 28,290 - (28,290) -

------------- ------------- ------------ ------------ ------------ ------------ -------------

At 31 December

2018 1,685,177 3,168,870 200,000 8,225,321 297,926 460,717 14,038,011

------------- ------------- ------------ ------------ ------------ ------------ -------------

Total

comprehensive

income - - - (1,807,750) - - (1,807,750)

------------- ------------- ------------ ------------ ------------ ------------ -------------

Other

comprehensive

income - - - - 72,997 - 72,997

------------- ------------- ------------ ------------ ------------ ------------ -------------

Total

comprehensive

income 1,685,177 3,168,870 200,000 6,417,571 370,923 460,717 12,303,258

------------- ------------- ------------ ------------ ------------ ------------ -------------

Issue of New

Ordinary

Shares 120,553 1,931,383 - - - - 2,051,936

------------- ------------- ------------ ------------ ------------ ------------ -------------

Recognition of

share based

payment - - - 50,000 - - 50,000

------------- ------------- ------------ ------------ ------------ ------------ -------------

Transfer from

revaluation

reserve - - - 14,145 - (14,145) -

------------- ------------- ------------ ------------ ------------ ------------ -------------

At 30 June

2019 1,805,730 5,100,253 200,000 6,481,716 370,923 446,572 14,405,194

------------- ------------- ------------ ------------ ------------ ------------ -------------

PENNANT INTERNATIONAL GROUP plc

NOTES TO THE FINANCIAL INFORMATION for the six months ended 30

June 2019

1. Basis of preparation

This condensed set of financial statements has been prepared

using accounting policies expected to be adopted for the year

ending 31 December 2019. These policies are different to those used

for the last set of audited accounts due to the Company's adoption,

with effect from 1 January 2019, of updated Lease asset and

liability recognition as required under International Financial

Reporting Standard 16 ("IFRS16"). The implementation of IFRS 16 on

1 January 2019 created an asset of GBP0.6 million and an equal

liability. The amortisation profile and the liability do not

precisely match and, including the additional operating leases

entered into during 2019, this is expected to have a positive

effect of circa GBP60,000 on EBITA and a negative effect on profit

before tax for the period of around GBP3,000.

These accounting policies are drawn up in accordance with

International Accounting Standards and International Financial

Reporting Standards as issued by the International Accounting

Standards Board and adopted by the EU.

The comparative figures for the year ended 31 December 2018 set

out in this Interim Report are not statutory accounts. A copy of

the statutory accounts for that year has been delivered to the

Registrar of Companies. The auditors reported on those accounts;

their report was unqualified, did not draw attention to any matters

by way of emphasis and did not contain a statement under s498 (2)

or s498(3) of the Companies Act 2006.

AIM-listed companies are not required to comply with IAS34

'Interim Financial Reporting' and the Company has taken advantage

of this exemption.

2. Taxation

The taxation charge for the Period is based on the estimated

rate of tax that is likely to be effective for the full year to 31

December 2019.

3. Earnings per share

Basic earnings per share are calculated by dividing the profit

for the Period attributable to the shareholders by the weighted

average number of shares in issue. The calculation of diluted

earnings per share takes into account the potentially diluting

effect of share options.

Six months Six months Year ended

ended 30 June ended 30 June 31 December

2019 2018 2018

Unaudited Unaudited Audited

GBP GBP GBP

------------------------ ------------------------ -------------

Earnings

------------------------ ------------------------ -------------

Net (loss) / profit

attributable to equity

shareholders (1,807,750) 2,031,151 3,145,925

------------------------ ------------------------ -------------

Number of shares Number Number Number

------------------------ ------------------------ -------------

Weighted average number

of ordinary shares 35,688,118 32,943,533 33,133,533

------------------------ ------------------------ -------------

Diluting effect of SIP 28,544 - -

------------------------ ------------------------ -------------

Diluting effect of share

options 2,354,043 3,171,316 3,168,134

------------------------ ------------------------ -------------

Weighted average number

of ordinary shares for

the purpose of dilutive

earnings per share 38,070,705 36,114,849 36,301,667

------------------------ ------------------------ -------------

4. Cash generated from operations

Six months Six months Year ended

ended ended 30 June 31 December

30 June 2019 2018 2018

Unaudited Unaudited Audited

GBP GBP GBP

-------------- --------------- -------------

(Loss) / profit

for the period (1,807,750) 2,031,351 3,145,925

-------------- --------------- -------------

Finance income - (6,157) (10,857)

-------------- --------------- -------------

Finance costs 48,299 2,779 1700

-------------- --------------- -------------

Income tax expense - - 32,712

-------------- --------------- -------------

Depreciation

of property,

plant and equipment 376,501 161,954 369,812

-------------- --------------- -------------

Amortisation

of other intangible

assets 265,665 48,846 154,489

-------------- --------------- -------------

Profit on disposal

of property,

plant and equipment - - 1,117

-------------- --------------- -------------

Share-based payment 50,000 28,710 103,983

-------------- --------------- -------------

Operating cash

flows before

movement in working

capital (1,067,285) 2,267,483 3,798,881

-------------- --------------- -------------

Decrease / (increase)

in receivables 1,388,288 (1,937,913) 718,640

-------------- --------------- -------------

(Increase) /

decrease in work-in-progress (799,068) 3,153,163 2,022,941

-------------- --------------- -------------

(Decrease) in

payables (2,154,075) (450,876) (1,411,156)

-------------- --------------- -------------

Cash (used in)

/ generated from

operations (2,632,140) 3,031,857 5,129,306

-------------- --------------- -------------

Tax paid (32,120) (49,459) (115,483)

-------------- --------------- -------------

Interest paid (48,299) (2,779) (1,700)

-------------- --------------- -------------

Net cash (used

in) / generated

from operations (2,712,559) 2,979,619 5,012,123

-------------- --------------- -------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR PGUUCBUPBPGW

(END) Dow Jones Newswires

September 24, 2019 02:01 ET (06:01 GMT)

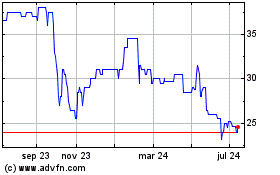

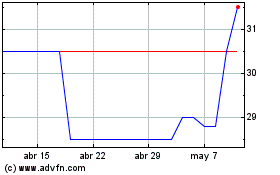

Pennant (LSE:PEN)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Pennant (LSE:PEN)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024