By Sebastian Herrera and Allison Pran

EBay Inc. Chief Executive Devin Wenig has left the online

marketplace citing conflicts with the company's new board, which is

overseeing a strategic review of the business.

The San Jose, Calif., company has been evaluating its business

since March after activist investors Elliott Management Corp. and

Starboard Value LP had criticized the company's performance and

called for breaking it up. The company, which has been searching

for growth in light of steep online retail competition, has said it

plans to share the results from that review this fall.

Mr. Wenig, who is also stepping down as a board director, served

as CEO for more than four years. He joined the firm in 2011 as

president over its marketplace, which generates the bulk of eBay's

revenue.

"In the past few weeks it became clear that I was not on the

same page as my new Board," Mr. Wenig tweeted from his personal

account Wednesday. "Whenever that happens, its [sic] best for

everyone to turn that page over."

EBay declined to comment about Mr. Wenig's statements.

"Notwithstanding this progress, given a number of

considerations, both Devin and the board believe that a new CEO is

best for the company at this time," Chairman Thomas Tierney said in

a statement.

EBay said Chief Financial Officer Scott Schenkel will serve as

CEO on an interim basis while it conducts a search for a successor,

adding that it will consider internal and external candidates. Andy

Cring, currently vice president of global financial planning and

analysis, will serve as interim finance chief.

Shares in eBay fell 1.7% in Wednesday trading. The stock has

gained about 39% this year.

Earlier this year, eBay agreed to add three new board members

after reaching agreements with big hedge funds Starboard and

Elliott. So far eBay has added two new directors, including Jesse

Cohn, who runs Elliott's U.S. equity activism.

Elliott and Starboard had pressured the online marketplace

company to rid itself of StubHub. Elliott had also said eBay should

unload its classified advertising business.

Mr. Wenig became eBay's CEO after the company spun off PayPal in

2015, which it had purchased in 2002 for roughly $1.5 billion --

one of the biggest tech deals at the time. The rationale for the

split was that it would allow both companies greater flexibility in

their respective industries, eBay in online retail and PayPal in a

rapidly evolving payments industry. Currently, PayPay Holdings Inc.

carries a stock market value of more than $120 billion, while

eBay's is more than $32 billion, the latter being little changed

since the spinoff.

Pierre Omidyar led eBay from its founding in 1995 through 1997.

Meg Whitman, who steered the company through its 1998 initial

public offering, left the company in 2008. Its next CEO, John

Donahoe, ran eBay from then until 2015.

Mr. Wenig has faced difficulties in growing the company from its

roots as an online auction into more of a true marketplace. EBay

has tried to attract younger customers and worked to get brands to

sell more of their products through the company's e-commerce

platform.

EBay's annual revenue has grown in each year after the PayPal

sale, totaling $10.75 billion last year.

Mr. Wenig's departure also follows a string of other high-level

exits from eBay over the past year or so, including chief

technology officer Steve Fisher, who left in May, and chief product

officer RJ Pittman, who left in 2018.

Beginning in late 2018, eBay began making drastic changes to its

managed-payment systems, allowing sellers to manage their selling,

payments and other services within one account and accepting

different forms of payment. It has been altering its advertisement

business. And it recently shut down its third-party ad network that

let merchants advertise on other sites to focus on promoted

listings on its own site

While eBay has said its new initiatives could bolster the

business, it hasn't seen enough growth to offset problems

elsewhere. EBay's revenue growth has been slowing, rising just 2%

in its most recent quarter from the prior year, as the value of

goods sold on its site has declined, falling another 4% in the

quarter to $22.6 billion.

Once an online juggernaut, eBay hasn't been able to compete with

its much larger rival Amazon.com Inc., which commands about 38% of

U.S. online retail sales, according to eMarketer, while eBay has

just a 6% share.

Unlike Amazon, which has built warehouses throughout the

country, a third-party seller network and built up its own brands,

eBay's revenue relies heavily on transaction fees, and it hasn't

grown its own distribution network. In July, eBay launched a

fulfillment service, but only for its biggest sellers.

"They did not have people who had a lot of experience in

e-commerce or who knew e-commerce in the early years," a former

eBay board member said. "Devin has been more of an operations guy

than an innovator."

Write to Sebastian Herrera at Sebastian.Herrera@wsj.com

(END) Dow Jones Newswires

September 25, 2019 12:17 ET (16:17 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

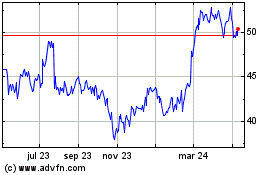

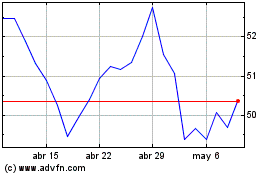

eBay (NASDAQ:EBAY)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

eBay (NASDAQ:EBAY)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024