TIDMTRT

RNS Number : 6987N

Transense Technologies PLC

26 September 2019

26 September 2019

Transense Technologies Plc

("Transense", the "Company" or the "Group")

Final results for the year ended 30 June 2019

Transense Technologies Plc (AIM: TRT), the provider of sensor

systems for industrial, mining and transportation markets, is

pleased to report audited results for the year ended 30 June 2019

which are ahead of the Board's expectations. The Translogik

division revenues continue to expand, SAWSense activity remains

high and the Board is confident of increased revenues and activity

in the new financial year.

Highlights

-- Revenue up 9% to GBP2.23m (2018: GBP2.05m)

-- iTrack II subscription revenue up 58% to GBP0.98m (2018: GBP0.62m)

-- Major commercial breakthroughs achieved in each business unit:

o Licensee GE Aviation's T901-GE-900 engine incorporating a

Transense Surface Acoustic Wave (SAW) sensor selected by the U.S.

Army

o Initial iTrack II order from Bridgestone Corporation,

Japan

o Global collaboration and financial support agreements signed

with Bridgestone post year end

-- Net loss after taxation, ahead of expectations at GBP1.47m (2018: GBP1.89m)

-- Net cash used in operations reduced by 62% to GBP0.43m (2018: GBP1.11m)

-- Equity fund raise of GBP2.56m completed in April 2019

-- Net cash at end of period of GBP2.65m (2018: GBP1.59m)

Executive Chairman of Transense Technologies, David Ford,

said:

"I am pleased to report that 2019 has been a transformational

year for the Group having made a number of breakthrough successes.

These have included the selection of GE's engine by the U.S. Army,

which includes our SAW sensor, the joint collaboration agreement

with Bridgestone to develop the iTrack II system following

Bridgestone Japan's initial iTrack II order. These milestones have

been the culmination of several years of technical and commercial

development activity.

"Looking forwards, the Company is well capitalised having

completed a fundraising in April 2019 and has in place an interest

free Loan with Bridgestone. This will provide a secure platform to

support exciting future growth prospects."

For further information please visit www.transense.co.uk or

contact:

Transense Technologies plc Tel: +44 (0) 1869

Graham Storey, Chief Executive 238380

finnCap Tel: +44 (0) 20 7220

Ed Frisby, Giles Rolls, Matthew Radley 0500

(Corporate Finance)

Tim Redfern, Tim Harper (ECM)

About iTrack II

The iTrack II Mining system provides real-time data on the

condition of the tyres, combined with live tracking of vehicle

location and status. Our 24/7 Control Room monitors the pressures

and temperatures live, and this information can, for example, be

used to ensure tyres do not exceed critical heat thresholds, to

detect incorrect load distributions, predict suspension failures

and eliminate manual tyre pressure checks. The Directors believe

that these benefits maximise the hours a truck is working (Truck

Uptime) and improve productivity by minimising maintenance

requirements and using data to identify underperforming trucks.

www.trans-logik.com/itrack-2/

About Transense Technologies

Based in Oxfordshire, UK, Transense has developed

patent-protected sensor systems and supporting technology for use

in a variety of diverse high growth markets. The Directors believe

that Transense's Surface Acoustic Wave (SAW), wireless,

battery-less, sensor systems offer advantages over legacy wireless

sensor systems. Transense is targeting the transport and mining

industries, and the global torque, temperature and pressure sensing

markets, via its trading divisions, Translogik and SAWSense.

www.transense.co.uk

Transense's shares are admitted to trading on AIM (AIM:

TRT).

The information communicated in this announcement is inside

information for the purposes of Article 7 of Regulation

596/2014.

Chairman's statement

In a transformational year for the Group, financial results are

improved and major breakthrough announcements have been made

relating to commercialisation of each of our core technologies. The

balance sheet has been strengthened by an equity fundraise which,

together with the interest free Bridgestone loan received in August

2019, will provide a secure platform to support exciting future

growth prospects.

The Chairman wishes to thank the whole Transense team for its

contribution towards achieving the breakthroughs in both iTrack and

SAWSense during the year.

Strategy

The business strategy of the Group continues to be the

development of innovative sensing solutions across a range of

applications, which are commercialised either through the launch of

products and services to customers or by forming strategic

alliances with partner organisations. Value is realised through a

combination of commercial income, royalties, licensing income and

capital gains on disposals.

Commercial developments

SawSense

SAWSense is a leader in the development of Surface Acoustic Wave

("SAW") wireless, batteryless, sensor systems that offer

significant advantages over legacy systems in common use. The

business continues to be involved in several projects in

conjunction with major global industrial companies.

In July 2016, SAWSense entered into a significant licensing

agreement with General Electric Company ("GE") for the

non-exclusive use of our patented, wireless, passive SAW

technology. Initial license fees of US$0.75m were received

following the agreement, and we are entitled to receive further

significant royalty payments from GE in respect of unit sales

anticipated in the future.

The likelihood of receiving future royalty payments took a step

forward with the announcement in February 2019 that GE's engine,

incorporating our SAW sensor, had been selected by the US Army for

the Engineering and Manufacturing Development ("EMD") phase of the

Improved Turbine Engine Program ("ITEP"), the U.S. Army's endeavour

to re-engine its Boeing AH-64 Apaches and Sikorsky UH-60 Black

Hawks.

The U.S. Army intends to replace more than 6,000 engines

installed in their current fleet of these two aircraft. The wider

market for the T901 engine includes replacement engines for these

aircraft in military forces outside of the U.S., as well as other

military and commercial medium sized vertical take-off aircraft

globally. This provides the prospect of an expected growing revenue

stream as volumes of engines installed builds over time, this

selection both demonstrates the ability of our SAW sensors to

operate in extreme testing environments and that they can be

manufactured in volume. Our relationship with GE continues to

deepen, with further applications being evaluated.

Progress continues with several other applications. Our Torque

sensor is part of an innovative steering system which is due to

start vehicle trials on off road sports vehicles in 2020. Our Joint

Development Agreement with McLaren is exploring opportunities in

other race formats and our participation in a Strain &

Temperature related project with University of Southampton &

Lloyds Register, which began earlier this year is progressing on

schedule.

Translogik

Important advancements were made with the market traction of our

iTrack II mining tyre monitoring systems. The number of mine haul

trucks fitted with the system increased during the year by more

than 50% to 396, with annualised revenues at the end of the year

exceeding GBP1.2m covering installations in 4 countries across 3

continents.

In February 2019, an initial order for 50 iTrack II units was

received from Bridgestone Corporation, Japan ("Bridgestone") for

installation in mines in North America. Bridgestone are a leading

supplier of tyres to the mining off-the-road (OTR) marketplace and

their decision to offer the iTrack system is a testament to the

capabilities of Translogik and the iTrack system.

More recently in August 2019, the Company entered into a joint

collaboration agreement with Bridgestone in respect of the iTrack

II system and its future generations ("iTrack system") for an

initial 18-month period with ability to extend.

Based on this joint collaboration agreement, Bridgestone has

agreed to offer the iTrack system exclusively as a mining tyre

monitoring system for tyres 57 inches and above for its OTR

customers. In addition, the Company has agreed that it will not

contract with any other tyre manufacturer for the provision of the

iTrack system for tyres 57 inches and above for the term of the

agreement, nor will it for a period of six months have discussions

with any other party in relation to any transaction of a merger,

acquisition or joint venture nature in respect of its iTrack

business.

Since the year end, the total number of mine haul trucks fitted

or agreed to be fitted with iTrack now exceeds 500. This includes

25 units being added at South Walker Creek in Australia.

Pleasingly, Kal Tire, a corporation based in Canada and a

substantial retailer and service provider in mining and OTR, has

become a reseller for iTrack in Africa, and in August 2019 won a

contract to supply 85 iTrack II mining tyre monitoring systems for

haul trucks into a large multi-national mining company operating in

Mozambique.

The selection of the iTrack system was the outcome of a

competitive trial between iTrack and a number of other TPMS systems

with the end user concluding that iTrack was the best overall

solution, satisfying both Kal Tire, and the end user's very

specific operational and information reporting requirements. Kal

Tire has a large installed customer base throughout Africa and will

be seeking to introduce additional iTrack systems into a number of

their current and future on-site service operations.

Sales of tyre tread depth probes reduced by 46% to GBP0.45m

(2018: GBP0.84m). This followed a year of particularly strong

growth in 2017/18, when the probe was selected by Goodyear USA for

their new tyre management system called 'Tire Optix' which

incorporates the Translogik tyre probe. The take up rate has been

somewhat slower than we had anticipated.

Our probes are also specified for use in Bridgestone's

corresponding 'Toolbox' and 'Total Tyre Care' systems as well as

Continental's 'Fleetfox' system, underpinning our belief that they

represent an industry standard.

It is likely that the revenue reduction during the year was

partly a result of reduced marketing effort, especially on-line. We

have recently recommenced advertising in this way, and are

beginning to see a corresponding increase in sales orders, which is

encouraging.

Financial results and condition

Revenues for the year increased by 9% to GBP2.23m (2018:

GBP2.05m). Recurring subscription revenues generated by Translogik

from users of the iTrack II system increased by 58% to GBP0.98m

(2018: GBP0.62m). We anticipate these revenues will continue to

grow significantly over the coming year as the iTrack installed

base significantly increases.

Gross margin increased to 80.5% of revenues (2018: 62.9%)

reflecting the higher proportion of income from subscriptions, and

also ad hoc fees to support new trials. The associated costs of the

subscription income is included in depreciation charges, included

within administrative expenses, which totalled GBP0.31m in the year

(2018: GBP0.16m).

Net operating expenses were GBP3.60m (2018: GBP3.21m) and the

net loss before taxation from continuing operations reduced to

GBP1.73m (2018: GBP1.91m).

The total comprehensive loss for the period reduced to GBP1.47m

(2018: GBP1.89m), reflecting a tax credit of GBP0.27m (2018:

GBP0.03m).

Net cash used in operations reduced by 62% to GBP0.43m (2018:

GBP1.11m). Offering iTrack II to customers on a subscription basis

results in a short-term cash outlay and requires investment in the

initial months of each contract. The net investment in fixed assets

for such contracts in the period amounted to GBP0.38m (2018:

GBP0.42m) and as Translogik's iTrack II installed base increases

there will continue to be a need to invest in fixed assets.

In March and April 2019, the Company issued additional equity to

new and existing shareholders raising GBP2.56m to provide

additional working capital and fund further product development

costs for the iTrack II system.

The Group closed the year with net cash and cash equivalents of

GBP2.65m (2018: GBP1.59m). ). In August 2019 the Company received

an interest free loan of $0.75m (GBP0.62m) from Bridgestone as part

of the Joint Collaboration Agreement with them to be used to

support the accelerated rate of growth that is anticipated from

this relationship.

Prospects

The breakthrough successes achieved in recent months have been

the culmination of several years of technical and commercial

development activity. Each of the Group's business units are now

closely aligned with global companies that are acknowledged to be

leaders in their respective fields.

There remains much to be done to ensure that we, together with

our commercial partners, are able to fully exploit the

opportunities made possible by our technologies. We are firmly

committed, and well positioned, to provide the resources required

to unlock potential for very exciting future growth.

David M Ford

Chairman

25 September 2019

Strategic Report

Financial Review

Results for the year

Revenues totalled GBP2.23m (2018: GBP2.05m). The pre-tax loss

totalled GBP1.73m (2018: GBP1.91m).

Translogik revenues grew by 11% to GBP2.11m, and SAWSense

generated GBP0.12m of revenues (2018: GBP0.15m). Gross margin

improved to 80.5% (2018: 62.9%) reflecting the continual increase

in the subscription base. The depreciation on capitalised iTrack

kit, included in administrative expenses, increased to GBP0.31m

(2018: GBP0.16m).

Administrative expenses for the year, before depreciation,

amortisation and interest, amounted to GBP2.84m compared with

GBP2.65m in the prior year.

The increase in Translogik revenues reflects the good growth in

new iTrack subscription services following the launch of iTrack II

in September 2016 and despite a 46% reduction in Probe sales during

the period following a record year of sales in 2018.

The Earnings per share (EPS) are set out below (in Pence):

2019 2018

EPS (Loss) (11.11) (19.68)

Taxation

The Company has UK tax losses available to carry forward at 30

June 2019 of approximately GBP21m, subject to HMRC agreement.

Certain elements of development expenditure undertaken by the

Company are eligible for enhanced research and development tax

relief which generally relates to salary costs of technical staff.

The accounting treatment adopted is to recognise the R & D tax

credits on a cash basis due to the uncertain nature of the claim.

During the year the Company received R & D tax credits

totalling GBP283,000 in respect of the two years ended 30 June

2018.

Cash flow and financial position

There was a net cash inflow of GBP1.06m (2018: outflow of

GBP0.93m) during the year, arising from trading and GBP2.34m of net

proceeds arising from the issue of equity share capital during 2019

(2018: GBP0.92m).

Net cash used in operations amounted to GBP0.43m (2018:

GBP1.11m).

At 30 June 2019 the Group had net cash balances of GBP2.65m

(2018: GBP1.59m).

The forward looking cash flow forecasts based on the anticipated

level of activity indicates that the Group should have sufficient

funds available for the short to medium term. The Board note that

part of the effect of increased demand for iTrack services has been

funded by Bridgestone after the year end.

Going Concern

The financial statements have been prepared on the going concern

basis. The Group has made a loss for the year of GBP1.47m (2018:

loss of GBP1.89m). The Group has accumulated losses of GBP3.36m

(2018: GBP1.89m). The balance of cash and cash equivalents at 30

June 2019 is GBP2.65m (2018: GBP1.59m).

The Group's cash used in operations during the year was GBP0.43m

(2018: GBP1.11m).

The Group meets its day to day working capital requirements

through existing cash reserves and does not currently have an

overdraft facility. The directors have prepared cash flow forecasts

for the period to 31 December 2020. These forecasts indicate that

the Group should continue to be able to operate within its current

cash resources for the foreseeable future.

Melvyn Segal

Finance Director

25 September 2019

Consolidated Statement of Comprehensive Income

For the year ended 30 June 2019

Year ended Year ended

30 June 30 June

2019 2018

GBP'000 GBP'000

Continuing

operations

Revenue 2,226 2,050

Cost of sales (435) (761)

---------------------------------------------- ----------------------------------------------

Gross profit 1,791 1,289

Administrative

expenses (3,603) (3,208)

---------------------------------------------- ----------------------------------------------

Operating loss (1,812) (1,919)

Financial income 2 5

Other income 79 -

---------------------------------------------- ----------------------------------------------

Loss before

taxation (1,731) (1,914)

Taxation 266 26

---------------------------------------------- ----------------------------------------------

Loss for the year (1,465) (1,888)

============================================== ==============================================

Basic and fully

diluted loss per

share (pence) (11.11) (19.68)

============================================== ==============================================

Loss for the year (1,465) (1,888)

---------------------------------------------- ----------------------------------------------

Other

comprehensive

income:

Exchange

difference on

translating

foreign

operations 2 -

---------------------------------------------- ----------------------------------------------

Other

comprehensive

income for the

year 2 -

Total

comprehensive

income for the

year

attributable to

the equity

holders of the

parent (1,463) (1,888)

============================================== ==============================================

Consolidated Balance Sheet

at 30 June 2019

at 30 June at 30 June

2019 2019 2018 2018

GBP'000 GBP'000 GBP'000 GBP'000

Non current

assets

Property,

plant and

equipment 529 474

Intangible

assets 946 909

---------------------------------------------- ----------------------------------------------

1,475 1,383

Current

assets

Inventories 566 685

Trade and

other

receivables 789 698

Cash and

cash

equivalents 2,647 1,592

---------------------------------------------- ----------------------------------------------

4,002 2,975

---------------------------------------------- ----------------------------------------------

Total assets 5,477 4,368

Current

liabilities

Trade and

other

payables (604) (316)

Current tax

liabilities (55) (66)

Provisions (70) (100)

---------------------------------------------- ----------------------------------------------

Total

liabilities (729) (482)

---------------------------------------------- ----------------------------------------------

Net assets 4,748 3,876

============================================== ==============================================

Equity

Issued share

capital 5,451 5,025

Share

premium 2,591 682

Translation

reserve 23 21

Share based

payments 41 41

Accumulated

loss (3,358) (1,893)

---------------------------------------------- ----------------------------------------------

4,748 3,876

============================================== ==============================================

Consolidated Statement of Changes in Equity

For the year ended 30 June 2019

Group Share Share Translation reserve Share based payments Cumulative Total

capital premium losses equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at 1

July 2017 4,766 22 21 - (5) 4,804

Comprehensive

income for the

year:

Loss for the

year - - - - (1,888) (1,888)

Total

comprehensive

income for the

year - - - - (1,888) (1,888)

Share based

payments - - - 41 - 41

Shares issued

and share

premium 259 660 - - - 919

------------------------------------------ ---------------------------------------------- ---------------------------------------------- ---------------------------------------------- ---------------------------------------------- ----------------------------------------------

Balance at 30

June 2018 5,025 682 21 41 (1,893) 3,876

------------------------------------------ ---------------------------------------------- ---------------------------------------------- ---------------------------------------------- ---------------------------------------------- ----------------------------------------------

Comprehensive

income for the

year:

Loss for the

year - - - - (1,465) (1,465)

Other

comprehensive

income for the

year:

Currency

movement on

subsidiary

reserves - - 2 - - 2

Total

comprehensive

income for the

year - - 2 - (1,465) (1,463)

Shares issued

and share

premium 426 1,909 - - 2,335

------------------------------------------ ---------------------------------------------- ---------------------------------------------- ---------------------------------------------- ---------------------------------------------- ----------------------------------------------

Balance at 30

June 2019 5,451 2,591 23 41 (3,358) 4,748

========================================= ============================================== ============================================== ============================================== ============================================== ==============================================

Consolidated Cash Flow Statement

For the year ended 30 June 2019

Group

Year ended Year ended

30 June 30 June

2019 2018

GBP'000 GBP'000

Loss from operations (1,465) (1,888)

Adjustments for:

Taxation (266) -

Financial income (2) (5)

Depreciation 369 227

Amortisation of

intangible assets 396 332

Share based payments - 41

---------------------------------------------- ----------------------------------------------

Operating cash flows

before movements

in working capital (968) (1,293)

Increase in

receivables (91) (203)

Decrease/(increase) in

payables 247 (169)

Decrease in

inventories 119 300

Decrease in trade

lease receivables - 266

---------------------------------------------- ----------------------------------------------

Cash (used)/generated

in operations (693) (1,099)

Taxation

(paid)/recovered 266 (7)

---------------------------------------------- ----------------------------------------------

Net cash used in

operations (427) (1,106)

---------------------------------------------- ----------------------------------------------

Investing activities

Interest received 2 5

Acquisitions of

property, plant and

equipment (424) (443)

Acquisitions of

intangible assets (433) (303)

---------------------------------------------- ----------------------------------------------

Net cash used in

investing activities (855) (741)

---------------------------------------------- ----------------------------------------------

Financing activities

Proceeds from issue of

equity share capital 2,335 919

---------------------------------------------- ----------------------------------------------

Net cash from

financing activities 2,335 919

---------------------------------------------- ----------------------------------------------

Net decrease in cash

and cash equivalents 1,053 (928)

Unrealised Currency

translation gain 2 -

Cash and equivalents

at the beginning

of year 1,592 2,520

---------------------------------------------- ----------------------------------------------

Cash and equivalents

at the end of year 2,647 1,592

============================================== ==============================================

NOTES RELATING TO THE GROUP FINANCIAL STATEMENTS

BASIS OF PREPARATION

The group financial statements have been prepared and approved

by the Directors in accordance with the International Financial

Reporting Standards (IFRS) as adopted by the EU and with those

parts of the Companies Act 2006 applicable to companies reporting

under adopted IFRS.

IFRS and IFRIC are issued by the International Accounting

Standards Board (the IASB) and must be adopted into European Union

law, referred to as endorsement, before they become mandatory under

the IAS Regulation.

1 SEGMENT INFORMATION

The Group has two reportable segments being the unique trading

divisions, SAWSense and Translogik, which make use of technology

developed by the Group to measure and record temperature, pressure

and torque.

The business revenues include royalties, engineering support and

sale of product in relation to this technology.

Information regarding the Group's segments is included in the

primary statements and notes to the financial statements. Revenue

and EBITDA are the Group's key focus and in turn is the main

performance measure adopted by management.

The tables below sets out the Group's revenue split and

operating segments.

Revenue

Year ended Year ended

30 June 2019 30 June 2018

GBP'000 GBP'000

North America 743 322

Chile 670 660

Australia 398 400

UK & Europe 192 362

Japan 31 160

Rest of the World 192 146

---------------------------------------------- ----------------------------------------------

2,226 2,050

============================================= =============================================

Translogik SAWSense Admin Total

GBP'000 GBP'000 GBP'000 GBP'000

Year ended 30

June 2019

Sales 2,106 120 - 2,226

===================== ===================== ===================== ====================

Gross profit 1,678 113 - 1,791

Other Income - 79 - 79

Overheads (1,227) (472) (1,902) (3,601)

----------------------------- ------------------------------ ------------------------------ -----------------------------

Profit/(loss)

before

taxation 451 (280) (1,902) (1,731)

Taxation 108 158 266

------------------------------- ------------------------------- ------------------------------- -------------------------------

Profit/(loss)

for the year 559 (122) (1,902) (1,465)

====================== ====================== ====================== ======================

Translogik SAWSense Admin Total

GBP'000 GBP'000 GBP'000 GBP'000

Year ended 30

June 2018

Sales 1,903 147 - 2,050

===================== ===================== ===================== ====================

Gross profit 1,173 116 - 1,289

Overheads (978) (482) (1,743) (3,203)

----------------------------- ------------------------------ ------------------------------ -----------------------------

Profit/(loss)

before

taxation 195 (366) (1,743) (1,914)

Taxation 26 - - 26

------------------------------- ------------------------------- ------------------------------- -------------------------------

Profit/(loss)

for the year 221 (366) (1,743) (1,888)

====================== ====================== ====================== ======================

During the year ended 30 June 2019 there were 3 (year ended 30

June 2018: 3) customers whose turnover accounted for more than 10%

of the Group's total revenue as follows:

Year ended 30 June 2019 Revenue Percentage

GBP'000 of total

Customer A 466 21%

Customer B 429 19%

Customer C 397 18%

Year ended 30 June 2018 Revenue Percentage

GBP'000 of total

Customer A 400 20%

Customer B 365 18%

Customer C 262 13%

2 FINANCIAL INCOME AND EXPENSE

Recognised in profit or loss

Year ended Year ended

30 June 30 June

2019 2018

GBP'000 GBP'000

Finance income 2 5

Total finance income 2 5

========== ==========

3 TAXATION

Recognised in the statement of comprehensive income

Year ended Year ended

30 June 30 June

2019 2018

GBP'000 GBP'000

Current tax expense

Current year - -

Adjustment for

previous year (266) (26)

---------------------------------------------- ----------------------------------------------

Tax credit in

statement of

comprehensive income (266) (26)

============================================= =============================================

Reconciliation of effective tax rate

Year ended Year ended

30 June 30 June

2019 2018

GBP'000 GBP'000

Loss before tax (1,731) (1,914)

============================================= =============================================

Tax calculated at

the average

standard UK

corporation tax

rate of 19.00%

(2018: 19.00%) (329) (364)

Expenses not

deductible for tax

purposes 12 3

Additional

deduction for R&D

expenditure (120) -

Current year losses

for which no

deferred

tax asset was

recognised 391 357

Adjustment to

deferred tax

average rate

of 19% 46 -

Adjustment for

overseas profits - 4

Prior year

adjustment (266) (26)

---------------------------------------------- ----------------------------------------------

Total tax

(credit)/charge (266) (26)

============================================= =============================================

A deferred tax

asset has not been

recognised

in respect of the

following item:

Tax Losses 3,760 3,345

============================================= =============================================

The applicable UK corporation tax rate is 19% throughout the

reporting period.

The Group has tax losses, subject to agreement by HM Revenue and

Customs, in the sum of GBP20.7m (2018: GBP19.7m), which are

available for offset against future profits of the same trade.

There is no expiry date for tax losses. An appropriate asset will

be recognised when the Group can demonstrate a reasonable

expectation of sufficient taxable profits to utilise the temporary

differences.

The rate of Corporation Tax will reduce to 17% with effect from

1 April 2020.

The effective tax rate used to calculate the current tax for the

period ended 30 June 2019 was 19.00% (2018: 19.00%).

4 EARNINGS PER SHARE

Basic loss per share is calculated by dividing the loss after

taxation of GBP1.47m (2018: loss of GBP1.89m) by the weighted

average number of ordinary shares in issue during the year of

13,184,581 (2018: 9,595,825). Unexercised options over the ordinary

shares are not included in the calculation of diluted loss per

share as they are anti-dilutive.

Year ended Year ended

30 June 30 June

2019 2018

Number Number

Weighted average

number of shares -

basic 13,184,581 9,595,825

Share option

adjustment - -

---------------------------------------------- ----------------------------------------------

Weighted average

number of shares -

diluted 13,184,581 9,595,825

============================================= =============================================

Basic and fully diluted loss per share (continued)

Year ended Year ended

30 June 30 June

2019 2018

GBP'000 GBP'000

Loss from

operations (1,465) (1,888)

---------------------------------------------- ----------------------------------------------

Basic

(loss)/earnings

per share (11.11) (19.68)

============================================= =============================================

Earnings

attributable to

shareholders

Basic

(loss)/earnings

per share (11.11) (19.68)

============================================= =============================================

There are 665,000 share options at 30 June 2019 (2018: 665,000)

that are not included within diluted earnings per share because

they are anti-dilutive.

5 CASH AND CASH EQUIVALENTS

Group

30 June 2019 30 June 2018

GBP000 GBP000

Cash and cash equivalents per balance

sheet 2,647 1,592

Cash and cash equivalents per cash

flow

statements 2,647 1,592

------------ ------------

6 STATUTORY ACCOUNTS

The Financial information set out in this preliminary

announcement does not constitute the Company's Consolidated

Financial Statements for the financial years ended 30 June 2019 or

30 June 2018 but are derived from those Financial Statements.

Statutory Financial Statements for 2018 have been delivered to the

Registrar of Companies and those for 2019 will be delivered

following the Company's AGM. The auditors Grant Thornton UK LLP

have reported on those financial statements. Their reports were

unqualified, did not draw attention to any matters by way of

emphasis without qualifying their report and did not contain

statements under Section 498(2) or (3) of the Companies Act 2006 in

respect of the Financial Statements for 2019 or 2018.

The Statutory accounts are available on the Company's website

and will be posted to shareholders who have requested a copy and

thereafter by request to the Company's registered office.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

FR SEUFMIFUSEIU

(END) Dow Jones Newswires

September 26, 2019 02:01 ET (06:01 GMT)

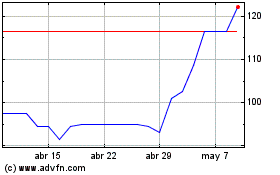

Transense Technologies (LSE:TRT)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Transense Technologies (LSE:TRT)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024