TIDMWSBN

RNS Number : 9909N

Wishbone Gold PLC

30 September 2019

30 September 2019

Wishbone Gold Plc ("Wishbone Gold" or the "Company")

Wishbone Gold Plc / Index: AIM: WSBN / Sector: Natural Resources

/ NEX: WSBN

Interim results

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulation (EU) No. 596/2014 ("MAR").

Chairman's statement

Wishbone Gold has pleasure in announcing its interim results for

the period ended 30th June 2019. Shareholders are reminded that

these results are unaudited and based on the Company's management

accounts.

The six months ended saw total sales of $6.562m, showing a

substantial increase over the same period last year (2018:

$3.908m). Volumes processed by the Company during this period were

mainly from local trading and from Asia. Gross margins for the

period were 0.48%, showing a slight increase from the last full

year (0.42%). As the Asian percentage of trading has risen over the

last couple of months we have seen margins improve further.

During the period cash increased by $0.012m (period ended 30

June 2018: reduction of $0.20m) and at 30 June 2019 the Company had

net cash of $0.036m (30 June 2018: $0.054m). Net assets at 30 June

2019 were $2.13m (30 June 2018 ($2.88m).

With the marked increase in the gold price we have seen an

increased interest in holding physical gold. There is also

increased activity in cross border trading of physical gold where

we are well positioned in Dubai between Asia and Europe.

The Company is seeking to extricate itself from its Honduras

operations, to focus on the burgeoning growth in trading in the

Middle East. The Australian licences remain in the Company for the

time being and the Board are considering strategies to increase

opportunities here. The Board look forward to updating shareholders

in due course.

We continue our discussions on potential acquisitions and will

announce progress when possible.

Many thanks to all our shareholders for their continuing

support.

S

For further information, please contact:

Wishbone Gold PLC

Richard Poulden, Chairman Tel: +44 207 812 0645

Beaumont Cornish Limited

(Nominated Adviser and NEX Exchange Corporate Adviser)

Roland Cornish/Rosalind Hill Abrahams Tel: +44 20 7628 3396

Turner Pope Investments (TPI) Limited

(Broker)

Zoe Alexander/ Andy Thacker Tel: +44 20 3657 0050

Damson Communications

(Public Relations)

Abigail Stuart-Menteth Tel: +44 20 7812 0645

Wishbone Gold PLC

Consolidated Income Statement

for the period 1 January

2019 to 30 June 2019

Unaudited Unaudited Audited

Six Months Six Months Year Ended

Ended Ended 31 December

30 June 30 June 2018

2019 2018

US$ US$ US$

Sales 6,562,093 3,908,979 10,896,045

Cost of sales (6,530,233) (3,873,223) (10,849,774)

Gross profit 31,860 35,755 46,271

Administration expenses (555,687) (497,834) (1,064,988)

------------- ------------- ----------------

Operating loss (523,827) (462,079) (1,018,717)

Loss on equity sharing agreement - - (797,220)

Impairment of investments - - -

Foreign exchange gains (3,315) (6,746) (10,223)

Finance costs (10,595) (58,603) (64,007)

Loss on ordinary activities

before taxation (537,737) (527,428) (1,890,167)

Tax on loss on ordinary activities - - -

Loss for the financial year (537,737) (527,428) (1,890,167)

------------- ------------- ----------------

Wishbone Gold PLC

Consolidated Statement

of Financial Position

as at 30 June 2019

Unaudited Audited

Unaudited Six Months Year Ended

Six Months Ended 31 December

Ended 30 June 2018

30 June 2019 2018

US$ US$ US$

Current assets

Trade and other receivables 555,936 545,843 583,834

Cash and cash equivalents 36,271 54,102 24,428

Inventory - 27,751 -

Loans 199,864 306,183 199,864

792,071 933,879 808,126

-------------- ------------- -------------

Non-current assets

Property, plant and equipment 193,750 250,024 212,500

Goodwill 748,617 748,625 748,617

Assets 393,874 377,672 371,923

Loans - 572,278 -

1,336,241 1,948,599 1,333,040

-------------- ------------- -------------

Total assets 2,128,312 2,882,478 2,141,166

============== ============= =============

Current liabilities 555,407 1,397,345 863,176

Non-current liabilities - - -

Equity

Share capital 3,791,823 1,730,590 2,872,843

Share premium 7,370,895 7,115,052 7,306,550

Share based payment reserve 64,355 62,908 64,355

Accumulated losses (9,610,478) (7,710,000) (9,072,741)

Foreign exchange reserve (43,690) 286,583 106,983

Total equity and liabilities 2,128,312 2,882,478 2,141,166

============== ============= =============

Wishbone Gold PLC

Consolidated Statement of

Cash Flows

for the period from 1 January

2019 to 30 June 2019

Unaudited Audited

Unaudited Six Months Year Ended

Six Months Ended 31 December

Ended 30 June 2018

30 June 2019 2018

US$ US$ US$

Cash flows from operating

activities

Loss before tax (537,737) (527,428) (1,890,167)

Reconciliation to cash generated

from operations:

Foreign exchange (gain)/loss 3,315 6,745 10,223

Interest expense 10,595 58,603 64,007

Impairment losses - -

Write-off of loan receivable - 107,509

Losss on equity sharing

agreement - 797,220

Depreciation 18,750 - 37,500

Administrative expenses

converted into ordinary

shares - 382,950

Operating cash flow before

changes in working capital (505,077) (462,080) (490,758)

-------------- ------------ -------------

Derease/(increase) in inventory 4 27,755

Decrease/(increase) in receivables 27,898 22,553 (15,437)

Increase/(decrease) in payables (307,769) 178,036 (335,012)

Cash outflow from operations (784,948) (261,487) (813,452)

-------------- ------------ -------------

Cash flows from investing

activities

Increase/(decrease) in fixed

assets 34 -

Net movement in investments - - -

(Increase)/Decrease in Assets (21,951) 9,490 15,239

(Increase)/Decrease in Loans - 27 -

Other investing activities 108,198 (116,744)

Net cash flow from investing

activities (21,951) 117,749 (101,505)

-------------- ------------ -------------

Cash flows from financing

activities

(Decrease)/Increase in loans

payable (10,595) (389,276) (64,007)

Issue of shares for cash 983,325 - 747,289

Interest Paid - - -

Net cash flow from financing

activities 972,730 (389,276) 683,282

-------------- ------------ -------------

Effects of exchange rates

on cash and cash equivalents (153,988) 330,260 (754)

Net increase/(decrease)

in cash 11,843 (202,755) (232,429)

Cash at bank at 1 January 24,428 256,857 256,857

Cash at bank at period end 36,271 54,102 24,428

-------------- ------------ -------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR SEWFFWFUSEDU

(END) Dow Jones Newswires

September 30, 2019 02:00 ET (06:00 GMT)

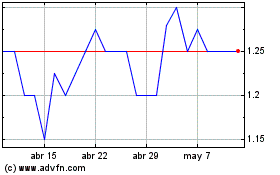

Wishbone Gold (LSE:WSBN)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Wishbone Gold (LSE:WSBN)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024