Craigslist and eBay are among the most profitable venues for

swindlers, study finds

By Yuka Hayashi

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (September 30, 2019).

WASHINGTON -- The online ads that you willingly click on are

more likely to make you a scam victim than the robocalls flooding

your phone with urgent messages.

A new study of consumer behavior toward fraudulent schemes found

that scammers are far more likely to succeed in engaging and

stealing money from potential targets by using websites and social

media than through the phone calls and emails they have long

used.

That tendency has made online marketplaces like Craigslist and

eBay among the most lucrative venues for scammers to hunt for

targets, along with social-media platforms, the study found. Such

scammers often run official-looking websites with fake consumer

reviews, and try to lure targets with items including used cars,

vacation rentals and tickets to popular concerts and sporting

events.

The study, conducted jointly by the consumer-education arms of

Better Business Bureau and the Financial Industry Regulatory

Authority along with the Stanford Center on Longevity, was based on

interviews of 1,408 consumers in 2018 who filed a fraud tip or

report to the BBB between 2015 and 2018.

On social media, 91% of the respondents said they initially

failed to recognize fraudulent advertisements as scams and

proceeded to engage, and 53% eventually lost money. On websites,

81% of respondents engaged and 50% lost money.

Those represent far higher success rates for scammers than they

experience through phone calls and voicemail, where only 39% of

respondents engaged and 11% lost money. Some 42% of scam emails

drew engagement and 13% led to monetary losses. The median losses

among those who participated in the study were around $600.

The findings surprised the study's authors. "It could be that

our defense may be down or lowered when we are on a site that we

choose to visit," said Gary Mottola, research director for Finra

Investor Education Foundation. "It is easier to identify fraudulent

activity when it comes through active channels like phone calls

where we expect it to come through."

The study found people most easily fall victim to what the BBB

categorizes as "online purchase" scams, which involve purchases and

sales on direct seller-to-buyer sites like Craigslist and eBay.

Scammers may pretend to purchase an item and then send the seller a

bogus check and ask for a refund of the "accidental" overpayment.

In other cases, the scammer, when posing as a seller, will simply

never deliver the goods, or send fake or inferior items.

Nearly half, or 47%, of the people who reported encountering

online purchase scams lost money, compared with other prevalent

types of schemes like "tech support" scams, where 32% reported

losing money, and sweepstakes/lottery scams, where 15% became

victims.

Lisa Bryant considers herself a well-educated consumer who does

her homework before making purchases. When the 49-year-old program

manager for an aerospace company spotted a Tahoe deck boat that she

and her husband had been looking for on Craigslist last month, she

carefully studied the website of a consignment warehouse that was

handling the transaction and claimed to be located not far from her

home in Tacoma, Wash.

"It's a great website. It's very sophisticated, " she said. "It

makes it look like they have been in business forever. It had

references. It had reviews and listed all the locations."

That, she said, made her ignore some warning signs, including a

wire transfer that initially failed to go through and the lack of

listing on Yelp.

Soon after Ms. Bryant sent an agreed-upon purchase amount of

$16,400 to the seller's bank account, she said, the company went

silent. The boat was never delivered, she said, and the seller's

website is now defunct. She said she asked her bank to reverse the

payment but hasn't heard back.

Other victims who alerted BBB in recent months include a

California consumer who reported losing $300 on concert tickets

offered on Craigslist. A Maryland victim reported having lost $203

for DJ equipment he agreed to buy on Craigslist and paid for via

PayPal. These reports weren't verified by BBB.

Representatives for Craigslist couldn't be reached for comment.

An eBay spokesman said the company's technology, combined with its

partnerships with rights owners, law enforcement and government

officials, "ensure a safe shopping experience" for its

customers.

The new study comes as scammers appear to be expanding their

activities, helped in part by social media and online transactions.

Consumers filed 372,000 fraud complaints to the Federal Trade

Commission reporting a total loss of $1.5 billion in 2018, with the

number of complaints up 34% from 2017, according to tallies by the

report's authors.

Characteristics often found among scam victims included feelings

of loneliness and being isolated from others, the study found.

People from lower-income households, defined as those earning

$50,000 or below annually, also engaged and lost money at

significantly higher rates than others.

The respondents to the study -- among the over 90,000 consumers

who submitted scam reports to BBB -- included both victims and

those who escaped the harm of scam attempts. Of all those who

participated in the survey, reporting scams from any of the sources

studied, 47% said they didn't engage with the scammers. Among the

others, 30% engaged but weren't victimized while 23% engaged and

lost money.

The study's findings underscored the effectiveness of

intervention by companies or agencies involved in transactions,

such as bank tellers and employees of wire-transfer services, the

authors said. Among the respondents who engaged with scammers, 20%

reported that such organizations intervened or tried to intervene

to stop the scams and successfully prevented monetary losses in

more than half of those cases.

Banks and investment firms have in recent years been stepping up

efforts to train employees to detect unusual transaction activities

to help reduce financial exploitation targeting seniors.

Write to Yuka Hayashi at yuka.hayashi@wsj.com

(END) Dow Jones Newswires

September 30, 2019 02:47 ET (06:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

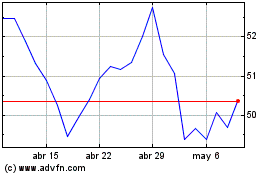

eBay (NASDAQ:EBAY)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

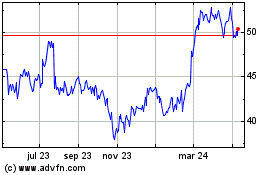

eBay (NASDAQ:EBAY)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024