TIDMURU

RNS Number : 2114O

URU Metals Limited

30 September 2019

URU Metals Limited

("URU Metals" or "the Company")

Final Results

URU Metals is pleased to announce its final results for the year

ended 31 March 2019. The full Report & Accounts are available

on the Company's website and are expected to be posted to

shareholders today.

Chairman's Statement

For the Year Ended 31 March 2019

I am pleased to present to our shareholders and stakeholders the

consolidated financial statements of the Group for the year ended

31 March 2019.

Excellent progress has been made at our flagship Zebediela

Project, and the technical team are confident in their ability to

prove up the strike length of the recently discovered Ni-Cu-PGE

mineralisation at Zebediela, and develop the project into a world

class Ni-PGE project.

The past financial year has been a fruitful year for URU, with

achievements in fulfilling investment strategies. We are now well

positioned to take advantage of potential positive movements in the

nickel market.

To view the Full Report & Accounts with the illustrative

figures and tables please use the following

link:http://www.rns-pdf.londonstockexchange.com/rns/2114O_1-2019-9-30.pdf

Jay Vieira

Non-executive Chairman

Chief Executive Officer's Report

For the Year Ended 31 March 2019

Below are the major events in the year ended 31 March 2019 and

major events after the reporting period.

Zebediela Nickel Project

Major advances have been made in the past twelve months in the

understanding of the geology of the Zebediela Project in a regional

context. The Zebediela Project is located on the Northern Limb of

the Bushveld Complex, one of the most exciting and profitable

nickel, copper and platinum group elements, (Ni-Cu-PGE) mining and

exploration areas globally. The project shares similar geology to

Anglo American Platinum's Mogalakwena Mine, the world's best PGE

mine, as well as the adjacent Ivanhoe Mines' Platreef Project,

where shaft sinking on two shafts is progressing to a depth of in

excess of 980m.

A thorough review of all data was undertaken, which included the

relogging of core from historical drillholes on the Zebediela

Project, plus the interrogation of historical reports from the area

around the Zebediela Project. This has led the technical team to

conclude that there is potentially 5 km of strike length of

Platreef related Ni-Cu-PGE mineralisation, hidden beneath a veneer

of cover rocks on the project location. The Platreef is the same

horizon that both Anglo American Platinum and Ivanhoe Mines exploit

and are aiming to exploit at their respective mines.

A comparison of the grades and basket prices of recent drilling

by URU with that of Anglo Platinum and Ivanplats, as well as that

of the operational Nkomati Nickel Mine, also located in South

Africa on the Bushveld Complex, indicates that the target Ni-Cu-PGE

is of a higher Nickel grade than that being mined at both

Mogalakwena and Nkomati mines, and, although it is lower than

Ivanplat's Platreef Project grade, it is near surface as opposed to

being in excess of 800 m deep at the Platreef Project.

The figure below shows the location of known drillholes that

intersect Platreef (Critical Zone rocks), and from this image, it

becomes clear that the potential exists for Platreef material to be

found to the west of the historically mapped outcrop of the

Platreef, shown by the red dashed line in the image below.

When these drill results listed in the table above are taken

into a regional context, it is evident that the potential for over

5 km of strike length of Platreef on the Zebediela Project exists,

at grades with a superior basket price to that being mined at

Mogalakwena mine, as well as Nkomati Nickel mine.

The geophysical surveys conducted in 2018 assisted with detailed

mapping of the geology of the area, and the target horizon, in

close proximity to the shale - hornfels contact of the Transvaal

Supergroup metasediments, has been identified.

The Department of Mineral Resources (now the Department of

Minerals and Energy) (DMRE) in December 2018 issued the renewal for

Prospecting Right LP148PR over Uitloop 3 KS, which forms the core

license of the Zebediela Project. An application in terms of

Section 102 of the Mineral and Petroleum Resources Development Act

of 2002 (the MPRDA) has been made to append licenses LP1074PR and

LP1787 to LP148PR.

An application to the DMRE for a mining right over the Zebediela

Project was made and accepted in August 2019. The mining right

application will secure the tenure of the project for 30 years once

it is granted. The basis of the Mine Works Program which

accompanies the application was made on the existing NI43-101

compliant resource, which contains an Indicated Resource of 485.4

million tonnes at 0.245% Ni and an Inferred Resource of 1,115.1

million tonnes at 0.248% Ni. The Company, however, has the right to

amend the Mine Works Program via Section 102 of the MPRDA, to

incorporate a mine plan to exploit any Ni-Cu-PGE resource that may

be defined by further planned exploration drilling.

As part of the Mining Right application process, the Company has

submitted an application for Environmental Authorisation for the

Zebediela Project and commenced with environmental impact

assessment studies and a public consultation process.

Based on recent discoveries in other geological terrains that

host similar ultramafic rocks to those found on the Zebediela

Project, the potential exists for the area to host massive

sulphides nickel deposits.

The high nickel and palladium to platinum ratio in the Platreef

mineralisation, found at shallow depths, coupled with the increase

in nickel and palladium prices over the past 12 months, make the

Zebediela Project an exciting Ni-PGE targets. The close proximity

to existing road, rail, power and mining infrastructure bode well

for the potential to develop the project into a world-class

Ni-Cu-PGE mine and URU remains committed to the responsible

development of the project.

Burgersfort Nickel Project

After a decision was taken to focus on the Zebediela Nickel

Project, the Company wrote down its 50% interest in the Burgersfort

nickel assets in South Africa.

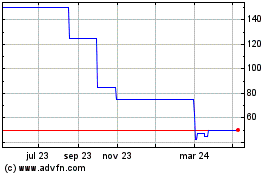

Investment in Management Resource Solutions PLC (MRS)

On 1 March 2017 The Company acquired 7,550,000 shares of

Management Resource Solutions Plc ("MRS") from Scopn Pty Ltd.

("Scopn") at a price of GBP0.05 per share. As consideration the

Company issued to Scopn 25,166,666 new shares of the Company (each

at an implied price of GBP0.045). On 10 April 2017 the Company

subscribed for an additional 10,000,000 shares of MRS at a price of

GBP0.05 per share for total cash consideration of GBP500,000

bringing the Company's aggregate interest in MRS to 17,550,000

shares (representing 9.59% of its current issued share capital).

The Group believes operational efficiencies can be realised to

restore MRS' profitability and the potential exists for significant

revenue growth as a result of re-opening and/or expanding of mining

operations in New South Wales, coupled with the continual demand

for New South Wales coal from the Chinese, South Korean and

Japanese markets. The Board believes the investment in MRS provides

the Group with a liquid investment with potential near-term

upside.

On 5 May 2017, trading in MRS shares resumed on the AIM market

of the London Stock Exchange. The closing middle market share price

was GBP0.075 per MRS share on 27 September 2018 representing an

overall value of $1,726,780 based on 17,550,000 shares held.

On 19 September 2019, MRS announced that two of its main

subsidiaries in Australia, Bachmann Plant Hire Pty Ltd ("BPH") and

MRS Subzero Pty Ltd (trading as MRS Services Group, "MRSSG"), were

put in voluntary administration. This announcement resulted in the

suspension of the trading of MRS shares. Accordingly, the Group

impaired the investment in MRS during the year ended 31 March 2019.

Subsequently MRS announced that it's working on a finance solution

to restart the trading of its shares.

Strategy for 2019/2020

Zebediela Nickel project

Based on the improved understanding of the geology of the

Zebediela Project, the company will continue to focus its efforts

on understanding and defining the Platreef Ni-Cu-PGE

mineralisation, and apply modern sound geological principles to

developing an exploration strategy to explore for massive sulphide

nickel associated with the ultramafic rocks found on the project

area.

The Group remains committed to its strategy of acquiring mineral

assets, through:-

-- direct investments in companies with prospects with medium to

long term production potential;

-- partnership with other industry participants to develop

projects with production forecast in the near to medium term;

and

-- Investment of 100% equity in earlier stage projects with the

potential to develop world class sized mineral resources that could

be brought to market over the long term.

The Group would not rule out investing in longer term, 100%

equity projects, or in other prospective junior companies should

the right opportunity arise. However, this would be dependent on

investor appetite at the time.

The Nickel Market

Nickel is used in numerous products including, industrial,

consumer, military, transport/aerospace, marine, and stainless

steel. 78% of the world's nickel is consumed by the stainless steel

industry. Growing quite rapidly is the use of nickel in electric

vehicle batteries, although at this stage it only accounts for

about 3% of the nickel demand. With the growth in electric vehicles

expected to continue, the demand for nickel will increase too. At

this stage the main demand for nickel is still from the

stainless-steel industry to meet specific industry requirements for

heat resistance and corrosion. Nickel-containing materials are also

needed to modernize infrastructure, for industry and to meet the

material aspirations of their populations.

Overall positive trend - At the end of 2018, the average nickel

price was approximately $10,791.00 per metric ton, with the highest

nickel price recorded in 2018 at approximately $15635.00 per metric

ton. The nickel price has increased by $ 7,347.50 per metric ton or

69.29 % since the beginning of 2019, with the nickel price

currently at $ 17,952.00 per metric ton. The Group believe the

nickel price has been lifted by sustained demand growth and

decreasing supply.

Outlook - The Group has a positive outlook on the nickel market.

The nickel price reached a maximum value of $18,153.00 per metric

ton on 12 September 2019 in the World Bank Commodity Markets

Outlook Report published in April 2018, forecast was that nickel

would reach $18,000 a metric ton by 2030.

Your Management believes that our current projects have the

potential to deliver shareholder value and look forward to updating

shareholders on the development of its Nickel projects in South

Africa.

John Zorbas

Chief Executive Officer

30 September 2019

Consolidated Statement of Comprehensive Income

For the Year Ended 31 March 2019

----------------------------------------------

2019 2018

$'000 $'000

-------------------------------------------------------------------- ------ --------

Administrative expenses (737) (862)

Exceptional items (note 18) (1,554) -

--------------------------------------------------------------------- ------ --------

Operating loss (2,291) (862)

Net loss for the year (2,291) (862)

--------------------------------------------------------------------- ------ --------

Other comprehensive income

Items that will be reclassified subsequently to income

Unrealised loss on financial assets at fair value through OCI (876) (334)

Effect of translation of foreign operations (350) 159

--------------------------------------------------------------------- ------ --------

Other comprehensive loss for the year (1,226) (175)

--------------------------------------------------------------------- ------ --------

Total comprehensive loss for the year (3,517) (1,037)

--------------------------------------------------------------------- ------ --------

Basic and diluted net loss per share (USD dollars) (note 8) (2.94) (1.10)

--------------------------------------------------------------------- ------ --------

The loss per share calculation relates to both continuing and

total operations.

The accompanying notes to the consolidated financial statements

are an integral part of these statements.

Consolidated Statement of Financial Position

As at 31 March 2019

--------------------------------------------

As at As at

31 March 31 March

2019 2018

$'000 $'000

----------------------------------------------------- -------- --------

ASSETS

Non-current assets

Property, plant and equipment (note 10) 43 85

Intangible assets (note 11) 2,471 3,243

Long-term prepaid assets (note 9) 41 41

------------------------------------------------------ -------- --------

Total non-current assets 2,555 3,369

Current assets

Financial asset at fair value through OCI (note 12) - 1,676

Trade and other receivables (note 13) 64 67

Cash and cash equivalents 475 1,317

------------------------------------------------------ -------- --------

Total current assets 539 3,060

------------------------------------------------------ -------- --------

Total assets 3,094 6,429

------------------------------------------------------ -------- --------

EQUITY AND LIABILITIES

Equity

Share capital (note 14) 7,806 7,806

Share premium (note 14) 46,938 46,938

Other reserves 1,030 1,380

Accumulated deficit (53,839) (50,672)

------------------------------------------------------ -------- --------

Total equity 1,935 5,452

------------------------------------------------------ -------- --------

Current liabilities

Trade and other payables (note 16) 1,159 977

------------------------------------------------------ -------- --------

Total liabilities 1,159 977

------------------------------------------------------ -------- --------

Total equity and liabilities 3,094 6,429

------------------------------------------------------ -------- --------

The accompanying notes to the consolidated financial statements

are an integral part of these statements.

Consolidated Statement of Cash Flows

For the Year Ended 31 March 2019

------------------------------------

2019 2018

$'000 $'000

----------------------------------------------------------- ------ --------

Cash flows from operating activities

Net loss for the year (2,291) (862)

Adjustments for:

Share-based payments - 203

Depreciation 40 33

Impairment of intangible asset 868 (145)

Impairment of financial assets at fair value through OCI 686 -

Unrealised foreign exchange gain 114 -

Changes in non-cash working capital items:

Decrease/(increase) in receivables 33 (37)

Increase in trade and other payables 182 300

------------------------------------------------------------ ------ --------

Net cash used in operating activities (398) (508)

------------------------------------------------------------ ------ --------

Investing activities

Purchase of financial assets at fair value through OCI - (650)

Purchase of intangible assets (401) (406)

------------------------------------------------------------ ------ --------

Net cash used in investing activities (401) (1,056)

------------------------------------------------------------ ------ --------

Financing activities

Net proceeds from exercise of share options - 203

------------------------------------------------------------ ------ --------

Net cash generated by financing activities - 203

------------------------------------------------------------ ------ --------

Loss on exchange rate changes on cash and cash equivalents (43) -

------------------------------------------------------------ ------ --------

Net decrease in cash and cash equivalents (842) (1 ,361)

Cash and cash equivalents, beginning of year 1,317 2,678

------------------------------------------------------------ ------ --------

Cash and cash equivalents, end of year 475 1,317

------------------------------------------------------------ ------ --------

The accompanying notes to the consolidated financial statements

are an integral part of these statements.

Consolidated Statement of Changes in Shareholders' Equity

For the Year Ended 31 March 2019

---------------------------------------------------------

Equity attributable to shareholders

Share Foreign

Option Currency

Shares and

Share Share to be Warrants Translation Accumulated

Capital Premium Issued Reserve Reserve Deficit Total

$'000 $'000 $'000 $'000 $'000 $'000 $'000

----------------- ------- ------- ------ -------- ----------- ----------- ------

At 31 March 2017 7,726 46,723 - 2,307 (1,123) (49,476) 6,157

Share-based

compensation - - - 129 - - 129

Shares issued

upon exercise

of stock options 80 123 - - - - 203

Reclassification

of fair value

of stock options

exercised - 92 - (92) - - -

Net loss and

comprehensive

loss for the year - - - - 159 (1,196) (1,037)

------------------ ------- ------- ------ -------- ----------- ----------- ------

At 31 March 2018 7,806 46,938 - 2,344 (964) (50,672) 5,452

------------------ ------- ------- ------ -------- ----------- ----------- ------

Net loss and

comprehensive

loss for the year - - - - (350) (3,167) (3,517)

------------------ ------- ------- ------ -------- ----------- ----------- ------

At 31 March 2019 7,806 46,938 - 2,344 (1,314) (53,839) 1,935

------------------ ------- ------- ------ -------- ----------- ----------- ------

The accompanying notes to the consolidated financial statements

are an integral part of these statements.

Notes to Consolidated Financial Statements

For the Year Ended 31 March 2019

------------------------------------------

1. General information

URU Metals Limited (the "Company"), formerly known as Niger

Uranium Limited, and before that, as UraMin Niger Limited, was

incorporated in the British Virgin Islands ("BVI") on 21 May 2007.

The Company's shares were admitted to trading on AIM, a market

operated by the London Stock Exchange on 12 September 2007. The

address of the Company's registered office is Intertrust, P.O. Box

92, Road Town, Tortola, British Virgin Islands, and its principal

office is Suite 401, 4 King Street West, Toronto, Ontario, Canada,

M5H 1A1.

On 21 November, 2018, the Company resolved to re--organise the

Company's share capital by combining all of the Existing Ordinary

Shares on the basis of one new ordinary share of no par value ('New

Ordinary Share') for every 1,000 Existing Ordinary Shares, such

shares having the same rights and being subject to the same

restrictions as the Existing Ordinary Shares as set out in the

Articles of the Company ('Consolidation'). All references to common

shares, stock options and warrants have been fully retrospectively

restated to reflect the Consolidation.

The consolidated financial statements of the Group for the year

ended 31 March 2019 comprise the Company and its subsidiaries.

2. Nature of operations

During the year ended 31 March 2019, the Group's principal

business activities were the exploration and development of mineral

properties in South Africa.

The business of mining and exploring for minerals involves a

high degree of risk and there can be no assurance that planned

exploration and development programs will result in profitable

mining operations. The Group has not yet established whether its

mineral properties contain reserves that are economically

recoverable. Changes in future conditions could require material

write-downs of the carrying values of mineral properties.

The Group is in the exploration stage and is subject to the

risks and challenges similar to other companies in a comparable

stage of development. These risks include, but are not limited

to:

-- Dependence on key individuals;

-- receipt and maintenance of all required exploration permits and property titles;

-- successful development; and

-- as noted above, the ability to secure adequate financing to meet the minimum capital required

to successfully develop the Group's projects and continue as a going concern.

3. Basis of preparation

The annual consolidated financial statements of the Group have

been prepared in accordance with International Financial Reporting

Standards ("IFRS") and International Financial Reporting

Interpretations Committee ("IFRIC") interpretations. The Group has

consistently applied the accounting policies detailed below

throughout all periods presented.

The consolidated financial statements have been prepared on a

historical cost basis convention, as modified by the revaluation of

financial assets at fair value through other comprehensive

income.

Items included in the consolidated financial statements for each

entity in the Group are measured using the currency that best

reflects the economic substance of the underlying events and

circumstances relevant to that entity (the "functional currency").

Similarly, the Group reports its results in a specified currency

(the "presentation currency"). The functional currencies of the

Company and its subsidiaries (with their abbreviation defined in

note 4) are set out in the table below:

URU Metals Limited ("URU") CAD

Niger Uranium Societe Anonyme ("NUSA") CFA

8373825 Canada Inc. ("Nueltin") CAD

Svenska Skifferoljeaktiebolaget ("SSOAB") SEK

Southern Africa Nickel Ltd. ("SAN Ltd") USD

Umnex Minerals Limpopo Pty ("UML") USD

Lesogo Platinum Uitloop Pty ("LPU") USD

All of the Company's subsidiaries were dormant in the year.

The Group's consolidated financial statements are presented in

US Dollars, rounded to the nearest thousand.

In accordance with IAS 21, Effects of Changes in Foreign

Exchange Rates ("IAS 21"), Group entities and operations whose

functional currencies differ from the presentation currency are

translated into US dollars.

-- Monetary assets and liabilities are translated at the closing rate as at the date of the statement

of financial position;

-- Income and expenses are translated at the average rate of exchange for the reporting period;

-- Equity balances are initially translated at closing exchange rates and subsequent balances

are translated at historical rates; and

-- Translation gains and losses are recognised in consolidated other comprehensive income and

are reported as such in accumulated other comprehensive income.

4. Summary of significant accounting policies

The accounting policies set out below have been applied

consistently to all periods presented in these consolidated

financial statements.

(a) Going concern

These consolidated financial statements have been prepared based

on accounting principles applicable to a going concern, which

assume that the Group will continue in operation for the

foreseeable future and will be able to realise its assets and

discharge its liabilities in the normal course of business. As at

31 March 2019 the Group had net current liabilities of $620,000

(2018:$2,083,000 net current assets) and had not yet achieved

profitable operation and expects to incur further losses in the

development of business. The Group will therefore need further

financing to operate over the next 12 months.

Management acknowledges that uncertainty remains over the

ability of the Group to meet its funding requirements but believes

that financing will be available and continues to explore debt and

equity financing options that would provide the Group with

sufficient cash to continue with its exploration activities. In

assessing whether the going concern assumption is appropriate,

management takes into account all available information about the

future, which is at least, but is not limited to, twelve months

from the end of the reporting period. These circumstances indicate

the existence of material uncertainties that may cast significant

doubt as to the Group's ability to continue as a going concern.

There is, however, no assurance that the sources of funding

described above will be available to the Group, or that they will

be available on terms and a timely basis that are acceptable to the

Group. Accordingly, these consolidated financial statements do not

reflect the adjustments to the carrying values of assets and

liabilities, the reported expenses and the statement of financial

position classifications used that would be necessary should the

Group be unable to continue as a going concern. These adjustments

could be material.

As part of their going concern review, the Directors have

followed the guidelines published by the Financial Reporting

Council entitled "Guidance on the Going Concern Basis of Accounting

and Reporting on Solvency and Liquidity Risk" issued in April

2016.

The Directors have prepared detailed financial forecasts and

cashflows for the twelve months from the date of signing these

financial statements. In developing these forecasts, the Directors

have made assumptions based upon their view of current and future

economic conditions over the forecast period.

(b) Basis of consolidation

Subsidiaries

Subsidiaries are all entities that are controlled by the Group.

The definition of control involves three elements; power over the

investee, exposure or rights to variable returns and the ability to

use power over the investee to affect the amount of the investors'

returns. Subsidiaries are fully consolidated from the date on which

control is transferred to the Group. They are deconsolidated from

the date that control ceases.

Any contingent consideration to be transferred by the Group is

recognised at fair value at the acquisition date. Subsequent

changes to the fair value of the contingent consideration that is

deemed to be an asset or liability is recognised in accordance with

IAS 39 either in profit or loss or other comprehensive loss.

Contingent consideration that is classified as equity is not

re-measured, and its subsequent settlement is accounted for within

equity.

Associates

Associates are entities over which the Group exercises

significant influence but does not exercise control. Investments in

associates are accounted for using the equity method of accounting

and are initially recognised at cost, which includes goodwill

identified on acquisition, net of any accumulated impairment loss.

The Group's share of its associate's profits or losses after

acquisition of its interest is recognised in profit or loss and

cumulative post-acquisition movements are adjusted against the

carrying amount of the investment. Where the Group's share of

losses of an associate equals or exceeds the carrying amount of the

investment, the Group only recognises further losses where it has

incurred obligations or made payments on behalf of the

associate.

Financial asset at fair value through other comprehensive

income

Financial assets consist of equity investments in other

companies or limited partnerships where the Group does not exercise

either control or significant influence.

Financial assets are shown at fair value at each reporting date

with changes in fair value being shown in Other Comprehensive

Income, or at cost less any necessary provision for impairment

where a reliable estimate of fair value is not able to be

determined.

Joint arrangements, joint operations and joint ventures

A joint arrangement is a contractual arrangement in which two or

more parties have joint control. Joint control only exists when

decisions require unanimous consent of the parties sharing that

control. A joint arrangement is either a joint operation, where the

parties have rights to the assets and obligations of the operation

and thus recognise its share of the assets, liabilities, and

operations, or a joint venture, where the parties have rights to

the net assets or the obligation, and thus recognise their interest

as an investment using the equity method.

Transactions eliminated on consolidation

Intra-group balances and transactions and any unrealised income

and expenses arising from intra-group transactions, are eliminated

in preparing the consolidated financial statements.

(c) Foreign currency transactions

i) Foreign currency transactions

Transactions in foreign currencies are translated to the respective functional currencies

of Group entities at exchange rates at the dates of the transactions. Foreign exchange gains

and losses resulting from the settlement of such transactions and from the translation of

monetary assets and liabilities denominated in foreign currencies are recognised in profit

or loss.

Monetary assets and liabilities denominated in foreign currencies at the reporting date are

retranslated to the functional currency at the exchange rate at that date. Non-monetary assets

and liabilities denominated in foreign currencies that are measured at fair value are retranslated

to the functional currency at the exchange rate at the date that the fair value was determined.

Foreign currency differences arising on retranslation are recognised in consolidated statement

of other comprehensive income.

ii) Foreign operations

The assets and liabilities of operations, including goodwill and fair value adjustments arising

on acquisition, are translated to the Group presentation currency (where different) at exchange

rates at the reporting date. The income and expenses of foreign operations are translated

to the Group presentation currency at average exchange rates, unless this average is not a

reasonable approximation of the cumulative effect of the rates prevailing on the transaction

dates, in which case income and expenses are translated at the rate on the dates of the transactions.

Equity balances are translated to presentation currency at historical exchange rates.

Foreign currency differences are recognised directly in other comprehensive income and such

differences have been recognised in the foreign currency translation reserve (FCTR). When

a foreign operation is disposed of, in part or in full, the relevant amount in the FCTR is

transferred to profit or loss.

Foreign exchange gains and losses arising from a monetary item receivable from or payable

to a foreign operation, the settlement of which is neither planned nor likely in the foreseeable

future, are considered to form part of a net investment in a foreign operation and are recognised

directly in other comprehensive income in the FCTR.

(d) Property, plant and equipment

Items of property, plant and equipment are measured at

historical cost less accumulated depreciation and accumulated

impairment losses. The cost of property, plant and equipment was

determined by reference to the cost at the date of acquisition.

Historical cost includes expenditure that is directly

attributable to the acquisition of the asset. The cost of replacing

part of an item of plant and equipment is recognised in the

carrying amount of the item if it is probable that the future

economic benefits embodied within the part will flow to the Group

and its cost can be measured reliably. The carrying amount of the

replaced part is derecognised. The costs of the day-to-day

servicing of plant and equipment are recognised in profit or loss

as incurred.

Gains and losses on disposal of an item of plant and equipment are determined by comparing

the proceeds from disposal with the carrying amount of plant and equipment, and are recognised

net within the statement of comprehensive income.

Depreciation is calculated over the depreciable amount, which is the cost of the asset, less

its residual value. If the useful lives and depreciation methods are the same for significant

parts of assets, these are not depreciated on a component basis. Depreciation methods, useful

lives and residual values are reviewed at each reporting date and adjusted if appropriate.

Depreciation is recognised in profit or loss on a straight-line basis over the estimated useful

lives of each part of an item of plant and equipment as follows:Field equipment 3 years

(e) Exploration costs and intangible assets

Exploration and evaluation costs are capitalised on a project-by-project basis, pending determination

of the technical feasibility and the commercial viability of the project. In accordance with

IFRS 6, 'Exploration for and Evaluation of Mineral Resources', the Group allocates costs incurred

to cash generating units (CGUs), which are projects, or groups of projects, which share a

consistent profile and proximity. Exploration costs are presented in intangible assets in

the Statement of Financial Position.

Capitalised costs include costs directly related to the

exploration and evaluation activities in the CGU.

General and administrative costs are allocated to the

exploration property to the extent that the costs are directly

related to activities in the relevant areas of interest. Costs

incurred before the legal rights are obtained to explore an area

and costs relating to a relinquished or abandoned licence are

recognised in profit or loss.

Exploration and evaluation assets shall be assessed for

impairment at each reporting period in accordance with IFRS 6, and

any impairment loss is recognised in profit or loss.

Once technical feasibility and commercial viability have been

established, exploration assets attributable to those projects are

tested for impairment and reclassified from exploration properties

to development properties.

Mineral property acquisition costs, and exploration and

development expenditures incurred subsequent to the determination

of the feasibility of mining operations and approval of development

by the Group, are capitalised until the property to which they

relate is placed into production, sold, allowed to lapse or

abandoned.

(f) Cash and cash equivalents

Cash and cash equivalents comprise cash in hand, deposits held

at call with banks and other short-term highly liquid investments

with original maturities of three months or less from inception

which are readily convertible to a known amount of cash and are

subject to an insignificant risk of changes in value.

(g) Financial instruments

A financial instrument is any contract that gives rise to a

financial asset of one entity and a financial liability or equity

instrument of another entity.

(i) Financial assets and financial liabilities

Financial assets and financial liabilities are classified into

one of three categories as summarised in the table below:

Derivative Initial Subsequent to initial URU's assets

Category status measurement recognition, held at: in the

category

Amortised cost Non--derivative Fair value Amortised cost using

Trade and other receivables

The effective interest

method

Amortised cost Non--derivative Fair value Same as above Cash and cash

equivalents

Other financial liabilities Non--derivative Fair value Same as

above Trade and other payables

Fair value through profit

Other financial liabilities Non--derivative Fair value and loss Contingent consideration

Fair value through other

comprehensive income Non--derivative Fair value Fair value

through profit Marketable securities

and loss

The classification is determined at initial recognition and

depends on the nature and the purpose of the financial asset.

Financial assets are recognised when the Group becomes a party to

the contractual provisions of the instrument.

Fianncial assets at amortised cost

A financial asset shall be classified as amortised cost if both

of the following conditions are met: (a) the financial asset is

held within a business model whose objective is to hold financial

assets in order to collect contractual cash flows and (b) the

contractual terms of the financial asset give rise on specified

dates to cash cash flows that are solely payments of principal and

interest on the principal amount outstanding.

Other financial liabilities

The Group initially recognises financial liabilities on the

trade date at which the Group becomes a party to the contractual

provisions of the instrument.

Financial liabilities are recognised initially at fair value

plus any directly attributable transaction costs.

Financial assets at fair value

Fair value determination

Fair value is the price that would be received to sell an asset

or paid to transfer a liability in an orderly transaction between

market participants at the measurement date. The fair value

hierarchy establishes three levels to classify the inputs to

valuation techniques used to measure fair value. Level 1 inputs are

quoted prices (unadjusted) in active markets for identical assets

or liabilities. Level 2 inputs are quoted prices in markets that

are not active, quoted prices for similar assets or liabilities in

active markets, inputs other than quoted prices that are observable

for the asset or liability, or inputs that are derived principally

from or corroborated by observable market data or other means.

Level 3 inputs are unobservable (supported by little or no market

activity). The fair value hierarchy gives the highest priority to

Level 1 inputs and the lowest priority to Level 3 inputs. The

Company has no financial instruments carried at fair value as at 31

March 2019 other than the investment in Management Resource

Solutions Plc (MRS) which is a Level 2 financial asset at fair

value.

Financial assets at fair value through profit or loss are

financial assets held for trading. A financial asset is classified

in this category if acquired principally for the purpose of selling

in the short term, or if it is a derivative financial instrument.

Assets in this category are classified as current assets if

expected to be settled within 12 months, otherwise, they are

classified as non--current. Securities in privately held companies

are initially recorded at cost, being the fair value at the time of

acquisition. At the end of each financial reporting period, the

Company's management estimates the fair value of investments based

on the criteria below and reflects such valuation in the

consolidated financial statements. These are included in Level 1 as

disclosed in note 6.

A financial asset shall be measured at fair value through other

comprehensive income if both of the following conditions are met:

(a) the financial asset is held within a business model whose

objective is achieved by both collecting contractual cash flows and

selling financial assets and (b) the contractual terms of the

financial asset give rise on specified dates to cash flows that are

solely payments of principal and interest on the principal amount

outstanding.

Changes in fair values of financial assets through other

comprehensive income are presented as fair value gain or loss on

investment in the consolidated statement of comprehensive income,

and within operating activities in the statement of cash flows.

(ii) Derecognition of financial assets and financial

liabilities

A financial asset is derecognised when the contractual right to

the asset's cash flows expire or if the Group transfers the

financial asset and substantially all risks and rewards of

ownership to another entity. Any interest in transferred financial

assets that is created or retained by the Group is recognised as a

separate asset or liability.

The Group derecognises a financial liability when its

contractual obligations are discharged or cancelled or expire.

(iii) Offset

Financial assets and financial liabilities are offset and the

net amount presented in the statement of financial position only

when the Group has a legal right to offset the amounts and intends

either to settle on a net basis or to realise the asset and settle

the liability simultaneously.

(h) Impairment of assets

(i) Financial assets

Financial assets are assessed for indicators of impairment at

each reporting period end. Financial assets are impaired when there

is objective evidence that the estimated future cash flows of the

financial assets have been affected by one or more events that

occurred after the initial recognition of the financial asset.

An impairment loss in respect of a financial asset measured at

amortised cost is calculated as the difference between its carrying

amount and the present value of the estimated future cash flows

discounted at the assets original effective interest rate. Losses

are recognised in profit or loss and reflected in an allowance

account against receivables. Interest on the impaired asset

continues to be recognised. When an event occurring after the

impairment was recognised causes the amount of impairments loss to

decrease, the decrease in impairment loss is reversed through

profit or loss.

(ii) Non-financial assets

The carrying amounts of the Group's non-financial assets are

reviewed at each reporting date to determine whether there is any

indication of impairment. If any such indication exists, then the

asset's recoverable amount is estimated.

The recoverable amount of an asset or cash-generating unit is

the greater of its value in use and its fair value less cost of

disposal. In assessing value in use, the estimated future cash

flows are discounted to their present value using a pre-tax

discount rate that reflects current market assessments of the time

value of money and the risks specific to the asset. For the purpose

of impairment testing, assets are grouped together into the

smallest group of assets that generates cash inflows from

continuing use that are largely independent of the cash inflows of

other assets or groups of assets. Fair value less cost of disposal

is determined as the amount that would be obtained from the

disposal of the assets in an arm's length transaction between

knowledgeable and willing parties.

An impairment loss is recognised if the carrying amount of an

asset or its CGU exceeds its estimated recoverable amount.

Impairment losses are recognised in profit or loss.

Impairment losses recognised in prior periods are assessed at

each reporting date for any indications that the loss has decreased

or no longer exists. An impairment loss is reversed only to the

extent that the asset's carrying amount does not exceed the

carrying amount that would have been determined, net of

depreciation or amortisation, if no impairment loss had been

recognised.

(i) Income tax

Income tax expense comprises current and deferred tax. Income

tax expense is recognised in profit or loss except to the extent

that it relates to items recognised directly in equity or other

comprehensive income.

Current tax is the expected tax payable on the taxable income

for the year, using tax rates enacted or substantively enacted at

the reporting date, and any adjustment to tax payable in respect of

previous years.

Deferred tax is recognised in respect of temporary differences

between the carrying amounts of assets and liabilities for

financial reporting purposes and the amounts used for taxation

purposes. Deferred tax is not recognised for the following

temporary differences: the initial recognition of assets or

liabilities in a transaction that is not a business combination and

that affects neither accounting nor taxable profit or loss, and

differences relating to investments in subsidiaries to the extent

that it is probable that they will not reverse in the foreseeable

future. In addition, deferred tax is not recognised for taxable

temporary differences arising on the initial recognition of

goodwill. Deferred tax is measured at the tax rates that are

expected to be applied to temporary differences when they reverse,

based on the laws that have been enacted or substantively enacted

by the reporting date. Deferred tax assets and liabilities are

offset if there is a legally enforceable right to offset current

tax liabilities and assets, and they relate to income taxes levied

by the same tax authority on the same taxable entity, or on

different tax entities, but they intend to settle current tax

liabilities and assets on a net basis or their tax assets and

liabilities will be realised simultaneously.

A deferred tax asset is recognised to the extent that it is

probable that future taxable profits will be available against

which the associated unused tax losses and deductible temporary

differences can be utilised. Deferred tax assets are reduced to the

extent that it is no longer probable that the related tax benefit

will be realised.

(j) Loss per share

The Group presents basic and diluted loss per share ("EPS") data

for its ordinary shares. Basic EPS is calculated by dividing the

profit or loss attributable to ordinary shareholders of the Group

by the weighted average number of ordinary shares in issue during

the period. Diluted earnings or loss per share is similar to basic

earnings or loss per share, except that the denominator is adjusted

to include the dilutive potential ordinary shares that would have

been outstanding assuming that options and warrants with an average

market price for the year greater than their exercise price are

exercised and the proceeds used to repurchase ordinary shares.

(k) Segmental reporting

An operating segment is a component of the Group that engages in

business activities from which it may earn revenues and incur

expenses, including revenues and expenses that relate to

transactions with any of the Group's other components. All

operating segments' operating results are reviewed regularly by the

Group's chief operating decision maker, the CEO, to make decisions

about resources to be allocated to the segment and assess its

performance, and for which discrete financial information is

available.

(l) Employee benefits

Pension obligations and other post-employment benefits

The Group does not offer any pension and/or post-employment

benefits to employees.

Short-term employee benefits

Short-term employee benefits obligations are measured on an

undiscounted basis and are expensed as the related service is

provided. A liability is recognised for the amount expected to be

paid under short-term cash bonuses if the Group has a present legal

or constructive obligation to pay this amount as a result of past

service provided by the employee, and the obligation can be

estimated reliably.

Share-based compensation

The Group operates an equity-settled, share-based compensation

plan, The Niger Uranium Limited Share Option Plan 2008. The grant

date fair value of the employee services received in exchange for

the grant of the options is recognised as an expense with a

corresponding increase in equity, over the period that the

employees become unconditionally entitled to the awards. The total

amount to be expensed over the vesting period is determined by

reference to the fair value of the options granted, excluding the

impact of any non-market vesting conditions. Non-market vesting

conditions, such as forfeiture rates, are included in assumptions

about the number of options that are expected to vest. At each

reporting date, the entity revises its estimates of the number of

options that are expected to vest. It recognises the impact of the

revision of original estimates, if any, in profit or loss, with a

corresponding adjustment to equity.

(m) New accounting standards and interpretations

During the year ended 31 March 2019 the Group adopted the

following IFRS standards:

IFRS 2 - Share--based Payment ("IFRS 2")

IFRS 2 was amended by the IASB in June 2016 to clarify the

accounting for cash--settled share--based payment transactions that

include a performance condition, the classification of share--based

payment transactions with net settlement features and the

accounting for modifications of share--based payment transactions

from cash--settled to equity--settled. On 1 April, 2018, the Group

adopted this amendment and has determined that the adoption of this

new amendment does not have a significant impact on its

consolidated financial statements.

IFRS 15 -- Revenue From Contracts With Customers ("IFRS 15")

IFRS 15 replaces IAS 18 -- Revenue, IAS 11 -- Construction

contracts, and some revenue--related interpretations. The standard

contains a single model that applies to contracts with customers

and two approaches to recognising revenue: at a point in time or

over time. The model features a contract--based five--step analysis

of transactions to determine whether, how much and when revenue is

recognised. New estimates and judgmental thresholds have been

introduced, which may affect the amount and/or timing of revenue

recognised. On 1 April 2018, the Company adopted IFRS 15 and has

determined that the adoption of this new standard does not have a

significant impact on its consolidated financial statements.

IFRS 9 Financial Instruments ("IFRS 9")

On 24 July 2014 the IASB issued the completed IFRS 9, Financial

Instruments, (IFRS 9) effective on 1 January 2018 with early

adoption permitted.

IFRS 9 includes finalised guidance on the classification and

measurement of financial assets. Under IFRS 9, financial assets are

classified and measured either at amortised cost, fair value

through other comprehensive income ("FVOCI") or fair value through

profit or loss ("FVTPL") based on the business model in which they

are held and the characteristics of their contractual cash flows.

IFRS 9 largely retains the existing requirements in IAS 39

Financial Instruments: recognition and measurement, for the

classification and measurement of financial liabilities.

The Group adopted IFRS 9 in its consolidated financial

statements on 1 April 2018. Due to the nature of its financial

instruments, the adoption of IFRS 9 had no impact on the opening

accumulated deficit balance on 1 April 2018. The impact on the

classification and measurement of its financial instruments is set

out below.

All financial assets not classified at amortised cost or FVOCI

are measured at FVTPL. On initial recognition, the Company can

irrevocably designate a financial asset at FVTPL if doing so

eliminates or significantly reduces an accounting mismatch.

A financial asset is measured at amortised cost if it meets both

of the following conditions and is not designated at FVTPL:

It is held within a business model whose objective is to hold

the financial asset to collect the contractual cash flows

associated with the financial asset instead of selling the

financial asset for a profit or loss; Its contractual terms give

rise to cash flows that are solely payments of principal and

interest.

All financial instruments are initially recognised at fair value

on the consolidated statement of financial position. Subsequent

measurement of financial instruments is based on their

classification. Financial assets and liabilities classified at

FVTPL are measured at fair value with changes in those fair values

recognised in the consolidated statement of loss and comprehensive

loss for the year. Financial assets classified at amortised cost

and financial liabilities are measured at amortised cost using the

effective interest method.

The following table summarises the classification and

measurement changes under IFRS 9 for each financial instrument:

Classification IAS 39 IFRS 9

Cash and cash equivalents Loans and receivables (amortised

cost)

Amortised cost

Trade and other receivables Loans and receivables (amortised

cost)

Amortised cost

Marketable securities Available for sale FVOCI

Accounts payable and accrued liabilities Other financial

liabilities (amortised cost)

Amortised cost

IFRS 9 Financial Instruments ("IFRS 9") (continued)

(i) The Company made an irrevocable election upon adoption of

IFRS 9 to classify the marketable securities at FVOCI, with all

subsequent changes in fair value being recognised in other

comprehensive income. FVOCI is a new measurement category with

which the cumulative changes in fair value will remain in OCI and

is not reclassified to profit or loss upon disposal of the

investment.

The original carrying value of the Company's financial

instruments under IAS 39 has not changed under IFRS 9.

The following IFRS and IFRIC Interpretations have been issued

but have not been applied by the Group in preparing these financial

statements as they are not as yet effective and in some cases had

not yet been adopted by the European Union.

The Group intends to adopt these Standards and Interpretations

when they become effective, rather than adopt them early.

-- IFRS 16, 'Leases"

-- IFRS 10 and IAS 28 (amendments), 'Sale or Contribution of

Assets between an Investor and its Associate or Joint Venture'

-- Amendments to IFRS 2, 'Classification and Measurement of

Share--based Payment Transactions'

-- Amendments to IAS 7, 'Disclosure Initiative'

-- Amendments to IAS 12, 'Recognition of Deferred Tax Assets for Unrealised Losses'

The directors do not expect that the adoption of the Standards

listed above will have a material impact on the Group in future

periods.

IFRS 16 is a significant change to lessee accounting and all

leases will require balance sheet recognition of a liability and a

right--of--use asset except short term leases and leases of low

value assets. The effect on the Group cannot be accurately

quantified at this stage but is expected to be immaterial on the

Group is currently not a party to any material operating leases as

lessee or lessor.

A number of IFRS and IFRIC interpretations are also currently in

issue which are not relevant for the Group's activities and which

have not therefore been adopted in preparing these consolidated

financial statements.

5. Critical Accounting Estimates and Judgements

The preparation of the consolidated financial statements in

conformity with IFRSs requires the use of certain critical

accounting estimates. It also requires management to exercise its

judgement and make estimates and assumptions that affect the

application of the Group's accounting policies and the reported

amounts of assets, liabilities, income and expenses.

Estimates and underlying assumptions are reviewed on an ongoing

basis. Revisions to accounting estimates are recognised in the

period in which the estimates are revised and in any future periods

affected. The Group makes estimations and assumptions concerning

the future. The resulting accounting estimates may not equal the

related actual results.

The estimates, assumptions and judgements which have a

significant risk of causing material adjustment to the carrying

amount of assets and liabilities are:

Determination of the Functional Currency

The Group comprises several entities in three different

countries; Canada, South Africa and Sweden. The statutory financial

statements of each entity, where required, are prepared using the

functional currency of the country where it is registered to do

business except where management have chosen a more appropriate

currency as the functional currency. On preparation of the

consolidated financial statements management chooses an appropriate

exchange rate to translate each of the functional currencies to the

presentational currency. The consolidated financial statements are

presented in USD. These judgements may change if future events

dictate that a more appropriate presentational currency should be

adopted.

Impairment of exploration and evaluation expenditure (intangible

assets)

At 31 March 2019 the carrying value of intangible assets of the

Group were $2,471,000 (2018: $3,243,000). The Group capitalises

expenditure relating to exploration and evaluation where it is

considered likely to be recoverable or where the activities have

not yet reached a stage that permits a reasonable assessment of the

existence of reserves. The directors have carried out an assessment

of the carrying value of exploration and evaluation expenditure and

any required impairment in accordance with the accounting policy in

note 4.

Assessment of significant influence

The Group holds 7.85% of the issued share capital of Management

Resource Solutions Plc ('MRS') which is below the 20% assumed

threshold for significant influence. However as J. Zorbas was

appointed as the Non-executive Chairman of MRS on 10 April 2017

management have reviewed the criteria detailed in IAS 28

'Investments in Associates' of potential indication of the

existence of significant influence. Management judgement is

therefore required to assess whether significant influence is

exercised over MRS in the year and have concluded that the Group

did not exercise significant influence over MRS in the year. J.

Zorbas resigned as Non-executive Chairman of MRS on 30 August

2019.

Valuation of financial assets at fair value through other

comprehensive income

The Group has adopted a policy of the revaluation of financial

assets through other comprehensive income. Management therefore

need to determine fair value and thus need to exercise judgement in

their assessment of the fair value hierarchy.

In respect of the carrying value of the shares held in MRS

management have assessed the current suspension of the company's

shares on AIM, due to two of its principal subsidiaries being

placed into administration, and the likelihood that the refinancing

will be completed and that the company's shares will be re admitted

to trading on AIM.

Share based payments

The Company has issued share options to Directors and advisors.

The Black Scholes model is used to calculate the appropriate charge

for these options. The use of this model to calculate a charge

involves a number of estimates and judgements to establish the

appropriate inputs to be entered into the model, including areas

such as the use of appropriate interest and dividend rates,

exercise restrictions and behavioural considerations. A significant

element of judgement is therefore involved in the calculation of

the charge.

Calculation and recognition of contingent consideration

The Group is exposed to potential contingent consideration from

previous acquisitions as detailed in note 11. Management exercises

judgement in assessing whether the contingent consideration should

be recognised in the consolidated financial statements.

6. Financial risk management

The Group's Board of Directors monitors and manages the

financial risks relating to the operations of the Group. These

include credit risk, liquidity risk and market risk which includes

foreign currency and interest rate risks.

Credit risk

Credit risk is the risk of loss associated with a counterparty's

inability to fulfill its payment obligations. The Group's credit

risk is primarily attributable to the Group's cash and cash

equivalents and trade and other receivables. The Group has no

allowance for impairment that might represent an estimate of

incurred losses on other receivables. The Group has cash and cash

equivalents of $475,000 (31 March 2018 -- $1,317,000), which

represent the maximum credit exposure on these assets. As at 31

March 2019, the majority of the cash and cash equivalents were held

with a major Canadian chartered bank from which management believes

the risk of loss to be minimal.

Liquidity risk

Liquidity risk is the risk that the Group will encounter

difficulty in meeting the obligations associated with its financial

liabilities that are settled by delivering cash or another

financial asset. The Group's approach to managing liquidity is to

ensure, as far as possible, that it will always have sufficient

liquidity to meet its liabilities when due, under both normal and

stressed conditions, without incurring unacceptable losses or

risking damage to the Group's reputation.

Typically the Group tries to ensure that it has sufficient cash

on demand to meet expected operational expenses for a period of

twelve months, including the servicing of financial obligations;

this excludes the potential impact of extreme circumstances that

cannot reasonably be predicted. Management monitors the rolling

forecasts of the Group's liquidity reserve on the basis of expected

cash flows.

The following are the contractual maturities of financial

liabilities:

6 months

Carrying Contractual 6 months to 5

amount cash flows or less years

$'000 $'000 $'000 $'000

------------------------- -------- ----------- -------- --------

31 March 2018

Trade and other payables 1,159 1,159 1,159 -

-------------------------- -------- ----------- -------- --------

31 March 2018

Trade and other payables 977 977 977 -

-------------------------- -------- ----------- -------- --------

Market risk

Market risk is the risk that changes in market prices, such as

foreign exchange rates, interest rates and equity prices will

affect the Group's loss or the value of its holdings of financial

instruments. The objective of market risk management is to manage

and control market risk exposures within acceptable parameters,

while optimising the return.

Foreign currency rate risk

The Group, operating internationally, is exposed to currency

risk on purchases that are denominated in a currency other than the

functional currency of the Group's entities, primarily Pound

Sterling ("GBP"), the Canadian Dollar ("CAD"), the South African

Rand ("ZAR"), Swedish Krona ("SEK") and the US Dollar ("USD").

The Group does not hedge its exposure to currency risk.

In respect of other monetary assets and liabilities denominated

in foreign currencies, the Group's policy is to ensure that its net

exposure is kept to an acceptable level by buying or selling

foreign currencies at spot rates when necessary to address short

term imbalances.

The Group's exposure to foreign currency risk, based on notional

amounts, was as follows:

USD GBP SEK CAD Total

$'000 $'000 $'000 $'000 $'000

---------------------------- ----- ----- ----- ----- ------

31 March 2019

Cash and cash equivalents - 466 - 9 475

Trade and other receivables - - - 64 64

Trade and other payables - (201) (53) (905) (1,159)

----------------------------- ----- ----- ----- ----- ------

31 March 2018

Cash and cash equivalents - 1,294 - 23 1,317

Trade and other receivables - - - 67 67

Trade and other payables - (217) (58) (702) (977)

----------------------------- ----- ----- ----- ----- ------

Interest rate risk

The financial assets and liabilities of the Group are subject to

interest rate risk, based on changes in the prevailing interest

rate. The Group does not enter into interest rate swap or

derivative contracts. The primary goal of the Group's investment

strategy is to make timely investments in listed or unlisted mining

and mineral development properties to optimise shareholder value.

Where appropriate, the Group will act as an active investor and

will strive to advance corporate actions that deliver value adding

outcomes. The Group will undertake joint ventures with companies

that have the potential to realise value through mineral project

development, and invest substantially in those joint ventures to

advance asset development over the near term.

Market risks

Sensitivity analysis

A 10% strengthening of the USD against the following currencies

at the year end would have increased/(decreased) equity and profit

or loss by the amounts shown below. This was determined by

recalculating the USD balances held using a 10% greater exchange

rate to the USD. This analysis assumes that all other variables, in

particular interest rates, remain constant.

31 March 2019 31 March 2018

Equity Profit or loss Equity Profit or loss

$'000 $'000 $'000 $'000

---- ------ -------------- ------ ------------------------

GBP - (27) - (108)

CAD - 83 - 61

SEK - 6 - 6

----- ------ -------------- ------ ------------------------

7. Capital risk management

The Group includes its share capital, share premium, reserves

and accumulated deficit as capital. The Group's objective is to

maintain a flexible capital structure which optimises the costs of

capital at an acceptable risk. In light of economic changes and

with the risk characteristics of the underlying assets, the Group

manages the capital structure and makes adjustments to it. As the

Group has no cash flow from operations and in order to maintain or

adjust the capital structure, the Group may issue new shares, issue

debt and/or find a strategic partner. The Group is not subject to

externally imposed capital requirements.

The Group prepares annual expenditure budgets to facilitate the

management of its capital requirements and updates them as

necessary depending on various factors such as capital deployment

and general industry conditions. During the year ended 31 March

2019 there were no changes in the Group's approach to capital

management.

8. Earnings per Share

The calculation of basic and diluted earnings per share is based

on the result attributable to shareholders divided by the weighted

average number of ordinary shares in issue in the year.

Basic earnings per share amounts are calculated by dividing net

loss for the year attributable to ordinary equity holders of the

parent by the weighted average number of ordinary shares

outstanding during the year.

The Company has potentially issuable shares which relate to

share options issued to directors and third parties. In the years

ended 31 March 2019 and 31 March 2018 none of the options had a

dilutive effect on the loss in the two years.

As at As at

31 March 31 March

2019 2018

$'000 $'000

-------------------------------------------------------------------------------- -------- --------

Loss used in calculating basic and diluted earnings per share ($) (2,291) (862)

Number of shares

Weighted average number of shares for the purpose of basic earnings per share 779,944 779,944

--------------------------------------------------------------------------------- -------- --------

Weighted average number of shares for the purpose of diluted earnings per share 779,944 779,944

Basic loss per share (US dollars) (2.94) (1.10)

Diluted loss per share (US dollars) (2.94) (1.10)

--------------------------------------------------------------------------------- -------- --------

9. Long-term prepaid assets

31 March 31 March

2019 2018

$'000 $'000

------------------------- -------- --------

Long-term prepaid assets 41 41

-------------------------- -------- --------

On determination that an impairment charge was required for the

Group's SSOAB Licences project, the Group identified a long-term

prepaid asset for future drilling costs that may be applied to

projects undertaken in other locations. Accordingly, the long-term

prepaid asset was transferred out of intangible assets.

10. Property, plant and equipment

Field

equipment

COST $'000

--------------------------- ---------

At 31 March 2017 119

Impact of foreign exchange 2

---------------------------- ---------

At 31 March 2018 121

Impact of foreign exchange (3)

---------------------------- ---------

At 31 March 2019 118

---------------------------- ---------

Field

equipment

ACCUMULATED DEPRECIATON $'000

--------------------------- --------------

At 31 March 2017 3

Depreciation for the year 33

---------------------------- --------------

At 31 March 2018 36

Depreciation for the year 40

Impact of foreign exchange (1)

---------------------------- --------------

At 31 March 2019 75

---------------------------- --------------

Field

equipment

CARRYING VALUE $'000

----------------- ---------

At 31 March 2018 85

At 31 March 2019 43

------------------ ---------

11. Intangible assets

Exploration costs

------------------ -----

COST $'000

------------------ -----

At 31 March 2017 4,557

Additions 406

Foreign exchange 98

------------------- -----

At 31 March 2018 5,061

Additions 401

Foreign exchange (369)

------------------- -----

At 31 March 2019 5,093

------------------- -----

ACCUMULATED AMORTISATION AND IMPAIRMENT $'000

---------------------------------------- -----

At 31 March 2017 1,761

Foreign exchange 57

----------------------------------------- -----

At 31 March 2018 1,818

Impairment (note 18) 868

Foreign exchange (64)

----------------------------------------- -----

At 31 March 2019 2,622

----------------------------------------- -----

CARRYING VALUE $'000

----------------- -----

At 31 March 2018 3,243

At 31 March 2019 2,471

------------------ -----

The Group has operated three distinct projects, SSOAB Licences,

Nueltin Licence and the South African Projects as detailed

below:

The exploration costs, amortisation and impairment detailed in

the above table are in respect of the Group's South African

Projects only. The Group's exploration costs in respect of its

SSOAB Licences project of $1,145,000 were fully impaired at 31

March 2016 and the exploration costs in respect of its Nueltin

Licence project of $153,000 were fully impaired at 31 March 2015.

The Burgersfort South African project has been fully impaired in

these consolidated financial statements. At 31 March 2019 the

carrying value is solely in relation to the Zebediela Nickel

Project described below.

SSOAB Licences

SSOAB (as defined in note 3) had 100% ownership of several

exploration licences near the town of Örebro, Sweden. The Swedish

licences are considered to be a single project, and thus to be one

CGU. During the year ended 31 March 2016, due to the continued

decline of the prices of oil and uranium, the Group decided not to

pursue the development of SSOAB properties and therefore determined

that the recoverable amount of the intangible assets under the

SSOAB properties was estimated to be $nil. The Group fully impaired

the intangible assets in the consolidated statement of financial

position for the year ended 31 March 2016. The foreign currency

reserve of SSOAB was reclassified from equity to the consolidated

statement of comprehensive income in the year ended 31 March

2017.

Nueltin Licence

Nueltin (as defined in note 3) was party to an option agreement

with Cameco Corporation ("Cameco"), the holder of a licence located

in the Nunavut Territory of Canada. Under the agreement, Nueltin

could earn 51% interest in the project from Cameco in return for

exclusively funding CDN$2.5 million in exploration expenditure by

31 December 2016. The Cameco project was considered to be one CGU.

The Group fully impaired the intangible assets in the consolidated

statement of financial position in the year ended 31 March 2015 as

the Group had no plans to pursue the project in Nunavut Territory

and thus let the option expire.

South African Projects

In November 2013, the Group acquired (i) a 100% interest in

Southern Africa Nickel Limited ("SAN Ltd.") which had been the

Group's joint venture partner since 2010 on the Zebediela Nickel

Project and (ii) a 50% interest in the Burgersfort Project. SAN Ltd

in turn had a 74% interest in a joint operation (the "SAN-Umnex

Joint Venture"). The remaining 26% was held by Umnex Mineral

Holdings Pty ("UMH"), which had title to the Zebediela licences

through its subsidiary, UML. With the Group's acquisition of SAN

Ltd., the SAN-URU joint venture was dissolved and San Ltd. obtained

ownership of the JV's 50% interest in the Burgersfort Project with

BSC Resources as the other party to the agreement. On 10 April

2014, SAN Ltd. and UMH agreed that SAN Ltd. would purchase 100% of

Umnex Minerals Limpopo Pty ("UML") from UMH for consideration of

33,194,181 new Group shares and 8,000,000 bonus shares issued to

directors and officers for their services in the acquisition of

UML.

The Burgersfort Project extends over two adjacent prospecting

rights in Burgersfort North and Burgersfort South. The Group has no

plans to pursue the project and as announced on 31 May 2019 has

fully impaired the intangible assets related to Burgersfort Project

in the amount of $868,000 in the consolidated statement of

financial position as at 31 March 2019.

The Zebediela Nickel Project extends over three separate

adjacent prospecting rights in the Limpopo Province of South

Africa. All three rights are now held by Lesogo Platinum Uitloop

Pty ("LPU"), which in turn is 100% owned by UML.

All three rights are currently compliant with minimum

expenditure obligations, annual report submissions, annual

prospecting fees, and submitted prospecting work programs.

Under the terms of the acquisition agreement, UMH is permitted

to return the shares and take back the licences should the

Group:

-- fail to maintain adequate cash funds to meet its general and project expenditure obligations,

or