Canadian Dollar Falls As Oil Prices Drop On Inventory Data

03 Octubre 2019 - 4:04AM

RTTF2

The Canadian dollar declined against its major counterparts in

the European session on Thursday on falling oil prices, as bearish

inventory data added to investor worries about slowing fuel

demand.

Crude for November delivery fell $0.16 to $52.48 per barrel.

Data from the Energy Information Administration showed Wednesday

that U.S. oil inventories increased by 3.1 million barrels in the

week ended September 27, nearly twice the expected jump.

The EIA report also said gasoline inventories for the week fell

by about 230,000 barrels, much less than the expected drop.

Meanwhile, distillate stockpiles dropped by about 2.4 million

barrels, nearly 25% more than what was forecast.

Data from payroll processor ADP showed that U.S. private sector

employment rose slightly less than expected in September. Weak data

raised concerns about an economic slowdown, hurting energy

demand.

Official jobs data is due on Friday.

U.S. employment is expected to increase by 140,000 jobs in

September after an increase of 130,000 jobs in August. The

unemployment rate is seen holding at 3.7 percent.

Meanwhile, trade worries persist after the U.S. proposed to

impose tariffs on $7.5 billion of goods from the European Union as

part of a long-running complaint over subsidies given to the

European plane maker Airbus.

The currency has been trading lower against its major

counterparts in the Asian session.

The loonie declined to 80.15 against the yen, its lowest since

September 4. On the downside, 79.00 is possibly seen as the next

support level for the loonie.

The latest survey from Jibun Bank showed that Japan services

sector continued to expand in September, albeit at a slower rate,

with a PMI score of 52.8.

That's down from the 22-month high of 53.3 in August, although

it remains well above the boom-or-bust line of 50 that separates

expansion from contraction.

The loonie slipped to a new 4-week low of 1.3338 versus the

greenback from Wednesday's closing value of 1.3323. If the loonie

slides further, it may find support around the 1.35 level.

The Canadian currency that ended Wednesday's trading at 1.4603

against the euro depreciated to a 10-day low of 1.4620. The

currency may locate support around the 1.48 level.

Final data from IHS Markit showed that the euro area private

sector expanded at the slowest pace in more than six years in

September.

The final composite output index fell to 50.1 in September from

51.9 in August. The reading was below the flash estimate of

50.4.

The loonie fell to a 6-day low of 0.8971 against the aussie,

compared to 0.8936 hit late New York Wednesday. The next possible

support for the loonie lies around the 0.94 level.

Figures from the Australian Bureau of Statistics showed that

Australia's trade surplus decreased in August as exports were down

on weak commodity prices.

Exports decreased by seasonally adjusted 3 percent to A$40.98

billion in August. At the same time, imports dropped slightly to

A$35.05 billion.

Looking ahead, U.S. durable goods orders for August and ISM

non-manufacturing composite index for September are scheduled for

release in the New York session.

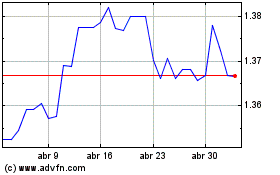

US Dollar vs CAD (FX:USDCAD)

Gráfica de Divisa

De Mar 2024 a Abr 2024

US Dollar vs CAD (FX:USDCAD)

Gráfica de Divisa

De Abr 2023 a Abr 2024