BP Chief Dudley to Step Down Having Steered Oil Giant Through Gulf Disaster -- 2nd Update

04 Octubre 2019 - 5:39AM

Noticias Dow Jones

By Adria Calatayud

BP PLC Chief Executive Bob Dudley will retire next year, after

nearly a decade steering the energy giant through the aftermath of

the Deepwater Horizon crisis.

Mr. Dudley will step down in February and be succeeded by

Bernard Looney, the chief executive of BP's upstream operations.

Mr. Looney will take over the CEO role and join the BP board on

Feb. 5, the company said Friday.

BP appointed Mr. Dudley as CEO about six months after the 2010

Deepwater Horizon disaster, which killed 11 people in the U.S.'s

largest oil spill. The American-born leader replaced Tony Hayward,

who had received criticism for what some observers saw as

insensitivity toward the oil-spill crisis. Mr. Hayward said he

wanted his life back in the midst of the ordeal.

Before Mr. Dudley took over, some feared BP could be destined

for bankruptcy. The company's value declined by more than half in

the months following the accident. The spill resulted in a $20

billion settlement with the U.S. government, which requires the

company to make payments through to 2032.

Mr. Dudley's time as BP's chief was marked by crises that forced

the company to adapt and evolve. He took the reins as CEO from Mr.

Hayward taking responsibility for the Gulf of Mexico oil-spill

containment and cleanup operation. A few years later, he navigated

the company through a collapse in oil prices, which forced the

entire industry to cut costs and adjust to a world of cheaper

crude.

Through the combined efforts of Mr. Dudley and Mr. Looney, BP is

able to maintain profitability during times of lower oil prices.

The company's cash breakeven -- the oil price needed to make a

profit after dividends and capital expenditure -- is around $50 a

barrel of oil, below the industry's $55-$60 a barrel level,

according to JPMorgan.

"During his tenure he has led the recovery from the Deepwater

Horizon accident, rebuilt BP as a stronger, safer company and

helped it re-earn its position as one of the leaders of the energy

sector," said BP Chairman Helge Lund.

Under Mr. Dudley the company embarked on a massive divestment

plan and is on track to have sold $75 billion of assets by 2020.

The company has returned to making acquisitions, most recently

buying BHP Billiton Ltd.'s onshore U.S. oil and gas assets for

nearly $11 billion.

Mr. Dudley also oversaw BP's focus on low-carbon energy in

recent years.

Before becoming chief executive, Mr. Dudley ran BP's joint

venture with a group of Russian billionaires, TNK-BP. He will

formally step down as CEO in February and retire in March.

His replacement, Mr. Looney, joined BP in 1991 as a drilling

engineer and was appointed head of upstream in 2016. Mr. Looney has

run BP's upstream business since April 2016 and has been a member

of the group's executive management team since 2010, the company

said.

Mr. Looney pushed for modernization in BP's upstream business,

which handles oil and gas discovery and extraction operations, said

Barclays PLC analyst Lydia Rainforth in a note to investors. His

focus on innovation could help BP in its efforts to be seen as a

cleaner, lower carbon company, she said.

"Given the drive for digital solutions and the work on reducing

carbon emissions, it is likely that the appointment of Mr. Looney

as CEO may accelerate the journey that BP is on regarding the

energy transition," Ms. Rainforth added.

(END) Dow Jones Newswires

October 04, 2019 06:24 ET (10:24 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

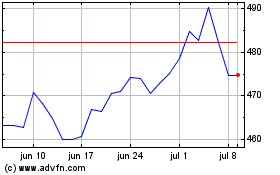

Bp (LSE:BP.)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Bp (LSE:BP.)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024