Dollar Rebounds After U.S. Jobs Data

04 Octubre 2019 - 5:05AM

RTTF2

The U.S. dollar rebounded from its recent lows against its most

major counterparts in the European session on Friday, after the

release of mixed jobs data that showed the economy created fewer

jobs than expected in September, but the jobless rate dropped.

Data from the Labor Department showed that U.S. employment

increased less than expected in the month of September.

The report said non-farm payroll employment rose by 136,000 jobs

in September compared to economist estimates for an increase of

about 145,000 jobs.

Meanwhile, the increases in employment in July and August were

upwardly revised to 166,000 jobs and 168,000 jobs, respectively,

reflecting the addition of 45,000 more jobs than previously

reported.

The Labor Department also said the unemployment rate fell to 3.5

percent in September from 3.7 percent in August. Economists had

expected to unemployment rate to remain unchanged.

Data from the Commerce Department showed that the U.S. trade

deficit widened more than anticipated in August.

The report said the trade deficit widened to $54.9 billion in

August from $54.0 billion in July. Economists had expected the

trade deficit to widen to $54.5 billion.

Recent data on manufacturing and services came in well below

expectations, fueling concerns over a significant slowdown in

economy.

Market participants widely expect the Federal Reserve to cut

interest rates at its upcoming meeting on October 30.

The currency dropped against its major rivals in the previous

session, excepting the franc.

The greenback recovered to 1.0957 against the euro, from a low

of 1.0997 hit at 8:30 am ET. The greenback is seen finding

resistance around the 1.06 level.

Survey data from IHS Markit showed that Germany's construction

sector expanded modestly in September, led by a growth in housing

activity that offset slower declines in commercial and civil

engineering.

The construction purchasing managers' index, or PMI, rose to

50.1 in September from August's 62-month low of 46.3. Any reading

above 50 indicates expansion in the sector.

Reversing from a low of 1.2357 touched at 10:15 pm ET, the

greenback appreciated to 1.2279 against the pound. The next

possible resistance for the greenback is seen around the 1.21

level.

The greenback reached as high as 107.13 against the yen,

following a decline to 106.56 at 8:30 am ET. Next immediate

resistance for the greenback is seen around the 109.00 level.

Following a 9-day decline to 0.6337 against the kiwi at 8:30 am

ET, the greenback bounced off to 0.6307 immediately. Should the

greenback rises further, it may find resistance around the 0.61

level.

In contrast, the greenback fell to a 2-day low of 0.9925 against

the franc, compared to 0.9987 hit late New York Thursday. On the

downside, 0.97 is possibly seen as the next support level for the

greenback.

The greenback declined to a 2-day low of 1.3297 against the

loonie from Thursday's closing value of 1.3334. The currency is

likely to locate support around the 1.30 level.

Though the greenback recovered from data-led decline against the

aussie, it was short-lived. The greenback was trading at 0.6762

versus the aussie, near a 3-day low of 0.6766 hit at 8:30 am ET.

The currency may locate support around the 0.71 mark, if it weakens

further.

Data from the Australian Bureau of Statistics showed that

Australia's retail sales increased in August.

Retail sales advanced 0.4 percent on month, following a flat

growth a month ago. This was the fastest growth in four months.

However, the pace of growth was slightly slower than the expected

0.5 percent.

Looking ahead, Canada Ivey PMI for September will be released

shortly.

Fed Chairman Jerome Powell will deliver a speech in Washington

at 2:00 pm ET.

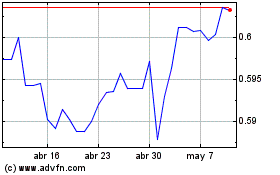

NZD vs US Dollar (FX:NZDUSD)

Gráfica de Divisa

De Mar 2024 a Abr 2024

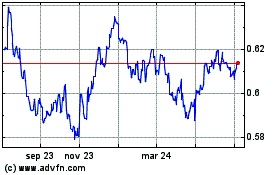

NZD vs US Dollar (FX:NZDUSD)

Gráfica de Divisa

De Abr 2023 a Abr 2024