TIDMTGP

RNS Number : 3657P

Tekmar Group PLC

10 October 2019

The information communicated within this announcement is deemed

to constitute inside information as stipulated under the Market

Abuse Regulations (EU) No. 596/2014. Upon the publication of this

announcement, this inside information is now considered to be in

the public domain.

10 October 2019

Tekmar Group plc

("Tekmar", the "Group" or the "Company")

Acquisition of Pipeshield International Ltd

("Pipeshield" or the "business")

Tekmar (AIM: TGP), a market-leading technology provider of

subsea protection systems is pleased to announce that it has today

signed a sale and purchase agreement for the acquisition of

Pipeshield (the "Acquisition") for a consideration of GBP6.5

million (the "Consideration") from its founder Steven Howlett (the

"Seller").

Acquisition highlights:

-- Pipeshield is a global market leader in the provision of

patented subsea concrete mattress protection systems;

-- Revenue and profit before tax of GBP6.6m and GBP0.8m respectively

in the year ended 31 December 2018 ("FY18");

-- As at 31 August 2019, Pipeshield had net assets of c.GBP3.1m,

including c.GBP1.1m cash, c.GBP3.0m trade debtors and c.GBP1.3m

trade creditors;

-- Consideration of GBP6.5m, payable in cash and new ordinary

shares in the Company;

-- Founder, Steven Howlett, will remain as Managing Director

of Pipeshield;

-- Increases the Group's cross-selling opportunities; and

-- Opportunity for Tekmar Energy to extend the number of protection

products it offers to existing customers for offshore projects.

The Consideration will be satisfied via GBP3.0m in cash and

GBP0.75m through the issue of 573,833 new ordinary shares in Tekmar

(the "Consideration Shares") to the Seller on completion; plus

deferred cash payments of GBP1.5m on 9 April 2020 and GBP1.25m on 9

October 2020.

This is the Group's third acquisition since its admission to AIM

in June 2018 and continues our strategy to acquire synergistic

offshore energy engineering businesses with a clear focus on subsea

technology and complementary customer bases, which will benefit

from being part of a wider group. Pipeshield broadens our portfolio

of complementary technologies, allowing the seamless supply of

subsea protection products across the lifecycle of a project, and

takes us closer to our vision of being the partner of choice for

the supply and installation support of subsea protection equipment

to global offshore energy markets.

Background on Pipeshield

Pipeshield is a world leading technology provider of subsea

concrete mattresses. These mattresses are used in the protection of

subsea equipment such as pipelines and power cables within all

marine environments, including offshore wind, marine renewables,

oil and gas and marine civil engineering.

Concrete mattresses and associated products are used for the

stabilisation and impact protection of subsea equipment in areas

where they cannot be buried. They are also used to limit the

development of localised scour (seabed erosion) on foundations,

pipelines or in marine ports. The technology is highly

complementary to Tekmar's and has frequently been used in

conjunction on past projects.

The business, which is headquartered in Lowestoft, has

manufacturing operations local to its primary markets, including

Aberdeen, UAE, Saudi Arabia and Singapore. The majority of

Pipeshield's production activity is undertaken at its new leased

facility at Blyth in Northumberland, a major hub for offshore

renewables activity in the UK.

Pipeshield currently employs 25 full time staff, most of whom

are technically focused, plus circa 15 contractors supporting the

manufacturing process at any one time. The business has four

patents, protecting its core technology, and is fully accredited

and independently certified including:

-- Full ISO 14001, 19001 and 18001 for Health, Safety, Quality

and Environmental (HSQE);

-- Dual Queens awards for International Trade and Enterprise

Innovation; and

-- Investor in People Gold standard.

The business has a strong history in the provision of equipment

to the major operators within the marine sector including, most

recently, Technip, Van Oord, DeepOcean, NPCC, Saipem and

Allseas.

Pipeshield provided its patented mattress protection technology

to the first commercial wind farms, including E.on's Scroby Sands

in 2004. Most recently the business was awarded the prestigious

East Anglia scope for Scottish Power's project, which is currently

under construction. Further, Pipeshield has a significant track

record in the oil and gas and marine civil engineering markets, in

which it has most recently supplied multiple contracts in the

Middle East, including a multi-million-pound scope for the Dubai

Marina Masterplan project in the UAE.

Financial Information

As at 31 August 2019, Pipeshield had approximately GBP3.1m in

net assets, including approximately GBP1.1m of cash, GBP3.0m trade

debtors and GBP1.3m trade creditors which will all be acquired by

Tekmar.

Pipeshield recorded revenue of GBP6.6m and profit before tax of

GBP0.8m in FY18 and GBP3.4m and GBP0.1m respectively in FY17.

Tekmar currently expects Pipeshield's results for the year ending

31 December 2019 to be slightly ahead of the prior year. The

majority of revenue in FY19, however, was generated

pre-Acquisition, as performance is heavily H1 weighted in the

business. Consequently, Tekmar does not expect any material uplift

in the Group's full year results in the current financial year to

31 March 2020. IFRS 15 will be applied to Pipeshield post

Acquisition, to align with the Group's existing accounting

policies.

Pipeshield currently has a strong enquiry book which stands at

around GBP45m of live tenders. During FY18, the business achieved a

65% bid to win ratio. A typical split of annual Pipeshield revenue

is 35% marine civil engineering, 35% oil and gas, 30% offshore

wind.

Integration and Synergies

Following the Acquisition, Pipeshield will continue to trade

under its own name from its leased headquarters in Lowestoft and it

will remain a separate legal entity within the Group. The business

will, however, benefit from the Group's shared group services. No

disruption or change for customers or employees is expected.

Pipeshield Board and Management

Steven Howlett will remain as Managing Director of Pipeshield

and has signed a new service agreement, which provides for a

minimum one-year service and contains appropriate restrictive

covenants for a period of six months following termination of

employment. Steven will report to the Board of the Group. All other

management and employees will remain with the business.

The Opportunity

The Board of Tekmar believes that the Acquisition will increase

the Group's cross-selling opportunities. While retaining its own

identity, Pipeshield will be able to draw on other Group businesses

to enhance its customer offering, utilising, for example, Agiletek

and Ryder's analytical skills and Subsea Innovation's mechanical

engineering skills for installation equipment. Pipeshield has the

opportunity to work on the same offshore projects as Tekmar Energy,

allowing Tekmar Energy the opportunity to offer additional

protection products to its existing customers.

Further details of the Acquisition

The Consideration will be satisfied via GBP3.0m in cash and

GBP0.75m through the issue of 573,833 new ordinary shares in Tekmar

(the "Consideration Shares") to the Seller on completion; plus two

deferred cash payments of GBP1.5m on 9 April 2020 and GBP1.25m on 9

October 2020. The consideration is fixed and not subject to any

working capital adjustments.

The Consideration Shares will rank pari passu with existing

ordinary shares and will be subject to a lock-in period of 12

months followed by orderly market provisions for 12 months.

Application will be made for the Consideration Shares to be

admitted to trading on AIM at 8.00 a.m. on or around 15 October

2019.

Following the issue of Consideration Shares, the Company will

have 51,261,685 ordinary shares in issue and the total number of

voting shares in Tekmar will be 51,261,685.

The above figure of 51,261,685 should be used by shareholders as

the denominator for the calculations by which they will determine

if they are required to notify their interest in, or a change to

their interest in the share capital of Tekmar under the Financial

Conduct Authority's Disclosure and Transparency Rules.

In addition, Pipeshield will transfer certain non-core assets to

Mr Howlett pre-completion which will leave an amount owing to

Pipeshield of approximately GBP0.7 million. Under the SPA, on

settlement of this amount then Tekmar will make an additional

deferred settlement of an equivalent amount. Consequently, this

does not affect the cash consideration.

The transferred assets principally consist of Pipeshield's head

office freehold property in Lowestoft, which is being transferred

to Mr Howlet's personal business, Bulldog International Limited, on

a leaseback arrangement to Pipeshield at normal market rates and

terms.

James Ritchie, Chief Executive Officer of Tekmar, said:

"Pipeshield is a perfect fit for Tekmar. Its products are

complementary, allowing us to upsell and expand our offering to

clients, realising our Group vision. The business has many

similarities with Tekmar from both end customers to markets but

also most importantly it fits culturally. The business focuses on

technology, as its key differentiator, and Pipeshield has

outstanding credentials, which demonstrate its commitment to

safety, quality and, above all, its people; these are key values

which we embrace across all Group companies. I am truly excited by

the prospect of adding the Pipeshield offering to Tekmar's

portfolio and I welcome Steve and his team to the family."

Steven Howlett, Founder and Managing Director of Pipeshield,

said:

"Tekmar and Pipeshield have many similarities. We are

industry-leading technology providers within subsea protection and

share a similar history and culture. I am keen to see the business

progress and believe that being part of Tekmar will accelerate the

achievement of our long-held growth aspirations. I want to thank

the Pipeshield team for all its hard work, getting us to this

point, and highlight, to my staff and customers, that this change

in ownership will only increase the opportunities for the business

and our passion for delivering outstanding technical solutions.

Other than that, it's very much business as usual."

For further information contact:

Tekmar Group plc Tel: +44 (0)1325 379

James Ritchie, Chief Executive Officer 520

Sue Hurst, Chief Financial Officer

Grant Thornton UK LLP (Nominated Adviser) Tel: +44 (0)20 7383

Philip Secrett / Samantha Harrison 5100

Berenberg (Broker) Tel: +44 (0)20 3207

Chris Bowman / Ben Wright 7800

Belvedere Communications (Financial PR)

Cat Valentine (cvalentine@belvederepr.com) Tel: +44 (0) 7715

Llew Angus (langus@belvederepr.com) 769 078

Keeley Clarke (kclarke@belvederepr.com) Tel: +44 (0) 7407

023 147

Tel: +44 (0) 7967

816 525

About Tekmar - https://investors.tekmar.co.uk/

Tekmar's vision is to be the partner of choice for the supply

and installation support of subsea protection equipment to the

global offshore energy markets. The Group has five primary

operating companies; these are Tekmar Energy Limited, Subsea

Innovation Limited, AgileTek Engineering Limited, Ryder

Geotechnical Limited and Pipeshield International limited.

Tekmar Energy is a global market leader in protection systems

for subsea cable, umbilical and flexible pipe. Tekmar has been

trusted to protect billions of Euros worth of assets in the

offshore wind, oil and gas, wave, tidal and interconnector markets

since 1985: https://www.tekmar.co.uk/

Subsea Innovation is a global leader in the design, manufacture

and supply of complex engineered equipment and technology used in

the offshore energy market. Its products include large equipment

handling systems which operate on the back of pipelay installation

vessels; emergency pipeline repair clamps (EPRC) which protect

major oil and gas pipelines, and bespoke equipment for use in the

construction of offshore energy projects:

https://www.subsea.co.uk/

AgileTek Engineering is an award-winning subsea engineering

consultancy for offshore energy projects. AgileTek helps its

clients de-risk projects through advanced computer simulation and

analysis. https://agiletek.co.uk/. AgileDat, a division of

AgileTek, provides software development, cloud architecture and

data analytics services. https://agiledat.co.uk/

Ryder Geotechnical provides expert geotechnical design and

consulting services to the offshore wind and subsea oil and gas

sectors. Services include offshore structure foundation design,

geohazard assessment and subsea cable routing and burial

assessment. https://www.rydergeotechnical.com/

Pipeshield is a market leading provider of specialised subsea

protection solutions in the form of concrete mattresses used for

the stabilisation and impact protection of subsea equipment in

areas where they cannot be buried and further to limit the

development of scour (seabed erosion) particularly local to that of

a foundation, pipeline or in marine ports.

http://www.pipeshield.com/.

Tekmar Energy and Tekmar are headquartered in Newton Aycliffe in

the United Kingdom; AgileTek operates from an office in London;

Subsea Innovation has its head office and manufacturing centre in

Darlington, United Kingdom. Ryder operates in Newcastle and within

Agiletek London, Pipeshield's headquarters are in Lowestoft with

manufacturing in Blyth, Northumberland, Tekmar also has

representation in South Korea, USA, China and across the Middle

East.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

ACQEANENEELNFFF

(END) Dow Jones Newswires

October 10, 2019 02:00 ET (06:00 GMT)

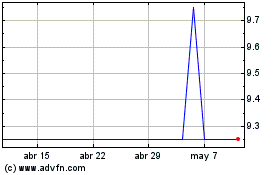

Tekmar (LSE:TGP)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Tekmar (LSE:TGP)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024