TIDMBLU

RNS Number : 7010P

Blue Star Capital plc

14 October 2019

THIS ANNOUNCEMENT AND THE INFORMATION IN IT, IS RESTRICTED, AND

IS NOT FOR PUBLICATION, RELEASE OR DISTRIBUTION, DIRECTLY OR

INDIRECTLY, IN WHOLE OR IN PART, IN OR INTO THE UNITED STATES,

CANADA, AUSTRALIA, JAPAN OR THE REPUBLIC OF SOUTH AFRICA OR ANY

OTHER JURISDICTION IN WHICH SUCH PUBLICATION OR DISTRIBUTION WOULD

BE UNLAWFUL. THIS ANNOUNCEMENT HAS BEEN ISSUED BY AND IS THE SOLE

RESPONSIBILITY OF THE COMPANY.

THIS ANNOUNCEMENT IS FOR INFORMATION PURPOSES ONLY AND IS NOT AN

OFFER FOR SALE OR SUBSCRIPTION IN ANY JURISDICTION IN WHICH SUCH

OFFER, SOLICITATION OR SALE WOULD BE UNLAWFUL UNDER THE SECURITIES

LAWS OF ANY SUCH JURISDICTION.

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION.

14 October 2019

Blue Star Capital plc

("Blue Star" or the "Company")

Placing and Investments in Esports Opportunities

Blue Star Capital plc (AIM: BLU), the investing company with a

focus on technology and its applications within media and gaming,

is pleased to announce that it has conditionally placed (the

"Placing") 900,000,000 new ordinary shares of 0.1p each in the

Company ("Ordinary Shares") (the "Placing Shares") at a placing

price of 0.1p per Placing Share (the "Placing Price) to raise in

aggregate GBP900,000. The net proceeds of the Placing will be

invested in certain esports opportunities described below.

The Placing, which has been carried out by Smaller Company

Capital Limited, the Company's broker, on behalf of the Company

comprises two elements:

1 a firm Placing of 450,000,000 Placing Shares (the "First

Placing") at the Placing Price to raise in aggregate GBP450,000

conditional only upon the completion of the first part of the

Investment Agreement (detailed below) and the admission to trading

of those Placing Shares on AIM (the "First Admission"); and

2 a conditional Placing of 450,000,000 Placing Shares (the

"Second Placing") at the Placing Price to raise in aggregate

GBP450,000 conditional on: (i) the First Placing having completed;

(ii) resolutions (the "Resolutions") having been passed at a

general meeting of the Company (the "General Meeting") granting the

directors of the Company authority to issue and allot the relevant

Placing Shares and certain warrants to subscribe for Ordinary

Shares (as outlined below); (iii) the completion of the second part

of the Investment Agreement (detailed below); and (iv) the

admission to trading of those Placing Shares on AIM ("Second

Admission").

The Company has entered into an investment agreement (the

"Investment Agreement") under the terms of which it will make

investments of approximately GBP150,000 each in six esport

companies. The first part of the Investment Agreement (which will

complete upon First Admission) relates to an investment of

approximately GBP450,000 in three esport companies. The second part

of the Investment Agreement (which will complete upon Second

Admission) relates to an investment of approximately GBP450,000 in

three further esport companies.

It is anticipated that First Admission will occur on or around

18 October 2019 and that application will be made for Second

Admission shortly after the General Meeting. The Placing Shares

will rank pari passu in all respects with the existing Ordinary

Shares in issue including the right to receive all dividends and

other distributions declared, made or paid after their date of

issue.

A circular, containing a notice of the General Meeting at which

the Resolutions will be proposed, will be posted to Shareholders in

the Company in due course.

Tony Fabrizi, Chief Executive Officer, has invested GBP20,000 as

part of the First Placing. Following his investment, Tony Fabrizi's

holding in the Company will comprise 62,000,000 ordinary shares,

representing 2.3 per cent. of Blue Star's enlarged share capital.

Derek Lew, who the Company is proposing to appoint as Chairman,

subject to normal regulatory due diligence, has invested GBP100,000

in the First Placing. Further details on Mr Lew are set out

below.

Background to the Transactions and use of proceeds

The Company believes that a significant opportunity exists

within esports which, according to estimates by games and esports

analytics provider Newzoo, may see total global esports market

revenue increase to US$1.1 billion for 2019. The largest component

of this estimate relates to sponsorship, media rights and

advertising and the Company will take advantage of this growth

opportunity by investing in franchises and infrastructure

investments targeting different regions globally.

An opportunity has been presented by Jonathan Bixby (through his

company Toro Consulting Ltd, the "Introducer"), who founded and

listed Argo Blockchain plc by way of a Standard Listing on the

London Stock Exchange's main market on 3 August 2018, to invest in

six esports businesses which are being developed. These investment

opportunities are in line with the Company's investing strategy of

investing in gaming. Esports encompasses competitive, organised

gaming and has seen a significant growth in recent years in terms

of the number of events, the number of competitors and audience

viewing and, importantly, revenues generated through activities

including ticket sales, merchandising, media rights and

partnerships.

It is the intention of each of the companies in which Blue Star

will invest to create or acquire a competitive esports franchise to

generate revenue from tournament winnings, digital marketing

opportunities, sponsorship, membership, merchandise and promotional

tours and events. Each of the companies is targeting a different

region globally for financing and team building but all will

attempt to become global brands. Blue Star is investing at an early

stage in each of these companies and as part of its investment Blue

Star has secured the right to invest in future rounds of each

company to allow it to maintain its position, if it so chooses.

Further details of the companies in which Blue Star will invest

are as follows:

Company Investment Jurisdiction

The Lords Esports GBP150,000 representing 11.1 UK

plc per cent. of the issued share

capital of The Lords Esports

plc

Googly Esports plc GBP150,000 representing 11.1 India and

per cent. of the issued share UK

capital of the Googly Esports

plc

The Dibs Esports $185,000 (USD) by way of a convertible USA

Corp loan note which Blue Star may

convert into equity securities

in accordance with the terms

of the loan note and which,

on conversion, will represent

approximately 13.7 per cent.

of the issued share capital

of The Dibs Esports Corp

Dynasty Esports $255,000 (SGD) to be invested, Singapore

PTE Ltd conditional upon completion

of the Conditional Subscription,

which will represent 13.7 per

cent. the issued share capital

of Dynasty Esports PTE Ltd

The Cubs Esports $250,000 (AUS) to be invested, Australia

PTY Ltd conditional upon completion

of the Conditional Subscription,

which will represent 13.3 per

cent. of the issued share capital

of The Cubs Esports PTY Ltd

The Drops Esports $250,000 (CAD) to be invested, Canada

Inc conditional upon completion

of the Conditional Subscription,

which will represent 13.3 per

cent. the issued share capital

off The Drops Esports Inc

Update on Blue Star

The Company's main investment is SatoshiPay, where it currently

owns 27.9 per cent. of the issued share capital. Based on

SatoshiPay's most recent fund raise in March 2019, Blue Star's

investment is valued at approximately GBP4.6million.

SatoshiPay has spent much of 2019 refining its product offering

and developing a number of technical features of its business, most

notable the Solar wallet, international VAT compliance tools for

its publishers and a login-based cross-device wallet backup.

In addition to its offering for the publishing industry,

SatoshiPay is broadening its reach into other verticals and intends

to expand its services within the cross-border B2B payments

vertical which is currently estimated to be a GBP160bn market.

Although in its infancy, SatoshiPay is already engaged in a number

of customer conversations and while this sector remains highly

competitive the opportunity to exploit SatoshiPay's existing

technology appears to be strong. SatoshiPay will continue to

develop its publishing vertical as it has a number of key

relationships within this sector and anticipates announcing

transactions later this year.

In addition to its investment in SatoshiPay, Blue Star has a 1

per cent. shareholding in Sthaler, a biometric payments business.

Sthaler has recently announced a major initiative in Manchester and

is continuing to attract interest both commercially and from

investors. The Company's board remains confident in Sthaler's long

term potential.

Finally, the Company's investment in Disruptive Tech Limited has

continued to disappoint and it seems likely that the position will

be further written down with the publication of the Company's

accounts.

Grant of Warrants

In consideration of the Introducer introducing the investments

to the Company and to provide the Company with potential future

funding and in respect of incentivisation of directors, the Company

has agreed to grant warrants to subscribe for Ordinary Shares

("Warrants") to the Introducer and to Tony Fabrizi, Chief Executive

Officer and Derek Lew.

On completion of the First Placing, the Company will grant,

(subject, in the case of Derek Lew, to him being appointed as a

Director) Warrants as follows:

Exercise Name Warrants Term from date of grant

price

Toro Consulting

0.1p Ltd 220,000,000 6 months

Tony Fabrizi 25,000,000 12 months

Derek Lew 55,000,000 12 months

------------

300,000,000

The Company will (subject, in the case of Derek Lew, to him

being appointed as a Director and the passing of the resolutions

granting the directors of the Company authority to allot shares)

grant further Warrants as follows:

Exercise Name Warrants Term from date of grant

price

Toro Consulting

0.175p Ltd 220,000,000 12 months

Tony Fabrizi 25,000,000 18 months

Derek Lew 45,000,000 18 months

------------

290,000,000

Toro Consulting

0.25p Ltd 180,000,000 18 months

Tony Fabrizi 15,000,000 24 months

Derek Lew 30,000,000 24 months

------------

225,000,000

Proposed Appointment

The Company is proposing to appoint Derek Lew to the Company as

Chairman of the Board. The appointment will be subject to normal

regulatory due diligence and a further announcement will be made at

the time of the appointment.

Derek Lew has advised, started and invested in technology

companies for over 20 years. An active member of the technology

community in Vancouver, he is President & CEO of venture

capital fund manager GrowthWorks Capital Ltd. Derek is a Partner

with Initio Group, a Vancouver, BC-based early-stage angel

investment firm. Derek started his technology career as a lawyer,

advising both technology companies and investors in all areas,

including life sciences, ITC and e-commerce.

As Past-Chair of Innovate BC (formerly the British Columbia

Innovation Council), the Crown Agency of the Province of British

Columbia mandated to accelerate technology commercialization, Derek

supports entrepreneurs and technology start-ups.

Derek holds a Bachelor of Arts from the University of British

Columbia and a Bachelor of Laws from the University of Alberta.

Related Party Transaction

The grant of warrants to Tony Fabrizi, Chief Executive Officer,

and to Derek Lew, upon his appointment as a director, and Tony

Fabrizi's participation in the First Placing are deemed to be a

related party transactions for the purposes of Rule 13 of the AIM

Rules for Companies (the "AIM Rules"). The Directors, with the

exception of Tony Fabrizi, consider, having consulted with the

Company's nominated adviser, Cairn Financial Advisers LLP, that the

terms of the transactions are fair and reasonable insofar as the

Company's shareholders are concerned.

Total Voting Rights

Following the issue of the Placing Shares pursuant to the First

Placing, the Company will have 2,692,582,852 Ordinary Shares issue.

There are no Ordinary Shares held in treasury. The figure of

2,692,582,852 may be used by the Company's shareholders as the

denominator for the calculations by which they will determine if

they are required to notify their interest in, or a change to their

interest in, the Company under the Financial Conduct Authority's

Disclosure Guidance and Transparency Rules.

Tony Fabrizi, Chief Executive Officer, said, "We have been

watching the development of the esports sector of gaming closely

and the rate of growth in popularity and, importantly, associated

revenue being generated presents a significant investment

opportunity. We are investing at an early stage and not restricting

our focus to a particular region or jurisdiction as we consider

this to be the best opportunity to capture value for all

shareholders."

This announcement contains inside information for the purposes

of Article 7 of EU Regulation 596/2014.

Blue Star Capital plc +44 (0) 777 178 2434

Tony Fabrizi

Cairn Financial Advisers

LLP +44 (0) 20 7213 0880

(Nominated Adviser)

Jo Turner / Liam Murray

Smaller Company Capital

Limited +44 (0) 203 651 2911

(Broker)

Rupert Williams/Jeremy Woodgate

IMPORTANT NOTICE

The information contained in this announcement is for

information purposes only and does not purport to be full or

complete. No reliance may be placed for any purpose on the

information contained in this announcement or its accuracy,

fairness or completeness.

This announcement does not constitute an offer to sell, or the

solicitation of an offer to acquire or subscribe for, Placing

Shares in any jurisdiction. The offer and sale of Placing Shares

has not been and will not be registered under the applicable

securities laws of Canada, Australia, Japan, New Zealand or the

Republic of South Africa. Subject to certain exemptions, the

Placing Shares may not be offered to or sold within Canada,

Australia, Japan, New Zealand or the Republic of South Africa or to

any national, resident or citizen of Canada, Australia, Japan, New

Zealand or the Republic of South Africa.

The Placing Shares have not been, and will not be, registered

under the Securities Act, or the securities laws of any other

jurisdiction of the United States. The Placing Shares may not be

offered or sold, directly or indirectly, in or into the United

States (except pursuant to an exemption from, or a transaction not

subject to, the registration requirements of the Securities Act).

No public offering of the Placing Shares is being made in the

United States. The Placing Shares are being offered and sold only

outside the United States in "offshore transactions" within the

meaning of, and in reliance on, Regulation S under the Securities

Act.

The distribution of this announcement outside the UK may be

restricted by law. No action has been taken by the Company, Cairn

or SCC that would permit (i) a public offer of Placing Shares in

any jurisdiction or (ii) possession of this announcement in any

jurisdiction outside the UK, where action for that purpose is

required. Persons outside the UK who come into possession of this

announcement should inform themselves about the distribution of

this announcement in their particular jurisdiction. Failure to

comply with those restrictions may constitute a violation of the

securities laws of such jurisdiction.

This announcement is directed only at persons who are: (a) if in

a member state of the European Economic Area ("EEA"), persons who

are qualified investors, being persons falling within the meaning

of article 2(e) of the Prospectus Regulation ("Qualified

Investors"), or (b) if in the United Kingdom, Qualified Investors

who (i) have professional experience in matters relating to

investments falling within article 19(5) of the Financial Services

and Markets Act 2000 (Financial Promotion) Order 2005 (the

"Order"); or (ii) fall within article 49(2)(a) to (d) (high net

worth companies, unincorporated associations, etc.) of the Order;

or (c) are persons to whom they may otherwise be lawfully

communicated (all such persons together being referred to as

"Relevant Persons").

This announcement must not be acted on or relied on by persons

who are not Relevant Persons. Persons distributing this

announcement must satisfy themselves that it is lawful to do so.

Any investment or investment activity to which this announcement

relates is available only to Relevant Persons and will be engaged

in only with Relevant Persons. This announcement does not itself

constitute an offer for sale or subscription of any securities in

the Company.

Cairn Financial Advisers LLP ("Cairn") is acting as nominated

adviser to the Company for the purposes of the AIM Rules. Cairn is

not acting for, and will not be responsible to, any person other

than the Company for providing the protections afforded to its

customers or for advising any other person on the contents of this

announcement or on any transaction or arrangement referred to in

this announcement. Cairn's responsibilities as the Company's

nominated adviser under the AIM Rules are owed solely to the London

Stock Exchange and are not owed to the Company, any Director or to

any other person. No representation or warranty, express or

implied, is made by Cairn as to, and no liability is accepted by

Cairn in respect of, any of the contents of this announcement

Smaller Company Capital Limited ("SCC") is authorised and

regulated in the UK by the FCA and is acting as broker to the

Company in connection with the Placing. SCC is not acting for, and

will not be responsible to, any person other than the Company for

providing the protections afforded to its customers or for advising

any other person on the contents of this announcement or on any

transaction or arrangement referred to in this announcement. No

representation or warranty, express or implied, is made by SCC as

to, and no liability is accepted by SCC in respect of, any of the

contents of this announcement.

This announcement contains (or may contain) certain

forward-looking statements with respect to certain of the Company's

plans and its current goals and expectations relating to its future

financial condition and performance and which involve a number of

risks and uncertainties. The Company cautions readers that no

forward-looking statement is a guarantee of future performance and

that actual results could differ materially from those contained in

the forward-looking statements. These forward-looking statements

can be identified by the fact that they do not relate only to

historical or current facts. Forward-looking statements sometimes

use words such as "aim", "anticipate", "target", "expect",

"estimate", "intend", "plan", "goal", "believe", "predict" or other

words of similar meaning. Examples of forward-looking statements

include, amongst others, statements regarding or which make

assumptions in respect of the planned use of the proceeds of the

Placing, the Company's liquidity position, the future performance

of the Company, plans and objectives for future operations and any

other statements that are not historical fact. By their nature,

forward-looking statements involve risk and uncertainty because

they relate to future events and circumstances, including, but not

limited to, economic and business conditions, the effects of

continued volatility in credit markets, market-related risks such

as changes in interest rates and foreign exchanges rates, the

policies and actions of governmental and regulatory authorities,

changes in legislation, the further development of standards and

interpretations under IFRS applicable to past, current and future

periods, the outcome of pending and future litigation or regulatory

investigations, the success of future acquisitions and other

strategic transactions and the impact of competition. A number of

these factors are beyond the Company's control. As a result, the

Company's actual future results may differ materially from the

plans, goals, and expectations set forth in the Company's

forward-looking statements. Any forward-looking statements made in

this announcement by or on behalf of the Company speak only as of

the date they are made. These forward looking statements reflect

the Company's judgement at the date of this announcement and are

not intended to give any assurance as to future results. Except as

required by the FCA, the London Stock Exchange, the AIM Rules or

applicable law, the Company expressly disclaims any obligation or

undertaking to release publicly any updates or revisions to any

forward-looking statements contained in this announcement to

reflect any changes in the Company's expectations with regard

thereto or any changes in events, conditions or circumstances on

which any such statement is based.

Notification of a Transaction pursuant to Article 19(1) of Regulation

(EU) No. 596/2014

1 Details of the person discharging managerial responsibilities/person

closely associated

------ ------------------------------------------------------------------------------------

a. Name Anthony Fabrizi

------------------------------------------

2 Reason for notification

---------------------------------------- ------------------------------------------

a. Position/Status Chief Executive Officer

---------------------------------------- ------------------------------------------

b. Initial notification/ Initial

Amendment

---------------------------------------- ------------------------------------------

3 Details of the issuer, emission allowance market participant,

auction platform, auctioneer or auction monitor

------------------------------------------------------------------------------------

a. Name Blue Star Capital plc

----------------------------------------

b. LEI 213800Y6XGR31P2LKT12

---------------------------------------- ------------------------------------------

4 Details of the transaction(s): section to be repeated for

(i) each type of instrument; (ii) each type of transaction;

(iii) each date; and (iv) each place where transactions have

been conducted

------ ------------------------------------------------------------------------------------

a. Description of Ordinary Shares

the financial

instrument, type GB00B02SSZ25

of instrument

Identification

Code

---------------------------------------- ------------------------------------------

b. Nature of the Placing

transaction

---------------------------------------- ------------------------------------------

c. Price(s) and volume(s) Price(s) Volume(s)

---------------------------------------- ------------------

0.1p 20,000,000

------------------ -----------------

d. Aggregated information

- Aggregated Volume n/a

- Price

---------------------------------------- ------------------------------------------

e. Date of the transaction 11 October 2019

---------------------------------------- ------------------------------------------

f. Place of the transaction UK

---------------------------------------- ------------------------------------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

MSCKXLFFKBFXFBZ

(END) Dow Jones Newswires

October 14, 2019 02:00 ET (06:00 GMT)

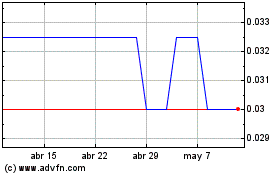

Blue Star Capital (LSE:BLU)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Blue Star Capital (LSE:BLU)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024