TIDMFCH

RNS Number : 4276Q

Funding Circle Holdings PLC

21 October 2019

21 October 2019

Funding Circle Holdings plc

Q3 2019 Update

Full-year guidance unchanged

Funding Circle Holdings plc ("Funding Circle"), the leading

small and medium enterprise ("SME") loans platform in the UK, US,

Germany and the Netherlands, today announces updates to its

statistics pages for the three months ending 30 September 2019 (the

"Quarter").

The data by country included in this announcement is also

available on the Company's website at

corporate.fundingcircle.com/investors/loan-performance-statistics.

Operational overview

-- Loans under management GBP3.7 billion, up 31% compared to Q3

2018. Year to date total originations of GBP1.8 billion vs GBP1.6

billion compared to the same period last year, up 9%.

-- Projected annualised returns for 2019 continue to show an improvement over recent years.

-- In July in the UK, Funding Circle completed a GBP232 million

asset-backed securitisation transaction adding 9 new institutional

investors onto the platform in the UK.

-- In August in the US, Funding Circle closed a $198 million

securitisation, its first asset-backed securitisation of US small

business loans, adding 18 new institutional investors onto the

platform in the US.

FY 2019 Outlook

-- Guidance for 2019 is unchanged; performance on track to meet market expectations.

Samir Desai CBE, CEO and co-founder, said:

"In the third quarter, loans under management reached GBP3.7

billion and projected returns for 2019 continued to show an

improvement over recent years. In what remains an uncertain

economic environment we continue to manage the business prudently,

which we are confident is the right course of action for the

long-term growth and development of our business."

Group performance

2019 YTD 2018 YTD % Q3 2019 Q3 2018 %

Loans under management GBPm 3,675 2,809 31% N/A N/A N/A

------ --------- --------- ---- -------- -------- -------

Originations GBPm 1,753 1,608 9% 561 565 (0.5%)

------ --------- --------- ---- -------- -------- -------

Reporting timetable

-- The next reporting date for loan performance statistics

(gross yield, projected annualised return and projected bad debt)

will be January 2020.

-- Full Year results will be released in March 2020.

Our statistics

Loans under management (million)

2012 2013 2014 2015 2016 2017 2018 2019

YTD

Group

(GBP) 52 145 366 860 1,362 2,107 3,148 3,675

----- ----- ----- ----- ------ ------ ------ ------

UK (GBP) 52 144 332 653 1,027 1,584 2,208 2,513

----- ----- ----- ----- ------ ------ ------ ------

US ($) N/A 54 261 354 577 939 1,110

------------ ----- ----- ------ ------ ------ ------

DE (EUR) N/A 27 30 65 131 170

------------------- ----- ------ ------ ------ ------

NL (EUR) N/A 16 40 95 124

-------------------------- ------ ------ ------ ------

Originations (million)

2012 2013 2014 2015 2016 2017 2018 2019

YTD

Group

(GBP) 49 130 311 721 1,065 1,738 2,292 1,753

----- ----- ----- ----- ------ ------ ------ ------

UK (GBP) 49 129 279 531 823 1,264 1,531 1,172

----- ----- ----- ----- ------ ------ ------ ------

US ($) N/A 334 281 514 792 575

------------ ------------ ------ ------ ------ ------

DE (EUR) N/A 33 19 55 105 84

------------ ------------ ------ ------ ------ ------

NL (EUR) N/A 21 34 81 64

------------------- ------------- ------ ------ ------

Gross Yield

2012 2013 2014 2015 2016 2017 2018 2019

YTD

UK 9.2% 8.4% 9.9% 9.5% 9.5% 9.5% 9.7% 9.9%

----- ----- ----- ----- ------ ------ ------ ------

US N/A 14.5% 13.2% 12.3% 12.8% 12.9%

------------ ------------ ------ ------ ------ ------

DE N/A 6.7% 9.5% 9.5% 10.2% 10.6%

------------ ------------ ------ ------ ------ ------

NL N/A 8.6% 10.7% 11.6% 11.0%

------------------- ------------- ------ ------ ------

Projected annualised return range (after fees and bad

debt)(1)

2012 2013 2014 2015 2016 2017 2018 2019

YTD

UK 7.1-7.2% 6.0-6.2% 7.2-7.4% 6.5-6.8% 5.0-5.5% 4.0-4.6% 4.2-5.2% 5.0-7.0%

--------- --------- --------- --------- --------- --------- --------- ---------

US N/A 2.6-2.8% 4.1-4.9% 5.3-6.2% 5.0-6.3% 5.7-7.8%

-------------------- -------------------- --------- --------- --------- ---------

DE N/A 0.1-1.0% 2.3-4.1% 5.0-6.9% 5.0-7.0% 5.0-7.0%

-------------------- -------------------- --------- --------- --------- ---------

NL N/A 3.7-4.5% 5.6-7.6% 6.0-8.0% 6.0-8.0%

------------------------------- -------------------- --------- --------- ---------

Projected bad debt rate range(2)

2012 2013 2014 2015 2016 2017 2018 2019

YTD

UK 1.3-1.3% 1.5-1.6% 1.7-1.9% 2.0-2.2% 3.1-3.6% 4.0-4.6% 3.6-4.6% 2.1-4.0%

--------- --------- --------- --------- --------- --------- --------- ---------

US N/A 10.7-10.9% 7.5-8.3% 5.5-6.4% 6.1-7.3% 4.8-6.8%

-------------------- -------------------- --------- --------- --------- ---------

DE N/A 4.7-5.6% 4.5-6.2% 1.8-3.6% 2.4-4.3% 2.8-4.7%

-------------------- -------------------- --------- --------- --------- ---------

NL N/A 3.2-4.0% 2.4-4.3% 2.9-4.8% 2.3-4.2%

------------------------------- -------------------- --------- --------- ---------

S

Media Enquiries:

Funding Circle

David de Koning - Director of Investor Relations and

Communications (0203 927 3893)

Headland Consultancy

Mike Smith / Stephen Malthouse (020 3805 4822)

About Funding Circle:

Funding Circle (LSE: FCH) is a global SME loans platform,

connecting SMEs who want to borrow with investors who want to lend

in the UK, US, Germany and the Netherlands. Since launching in

2010, investors across Funding Circle's geographies - including

retail investors, banks, asset management companies, insurance

companies, government-backed entities and funds - have lent more

than GBP8 billion to 77,000 businesses globally.

Forward looking statements and other important information

This document contains forward looking statements, which are

statements that are not historical facts and that reflect Funding

Circle's beliefs and expectations with respect to future events and

financial and operational performance. These forward looking

statements involve known and unknown risks, uncertainties,

assumptions, estimates and other factors, which may be beyond the

control of Funding Circle and which may cause actual results or

performance to differ materially from those expressed or implied

from such forward-looking statements. Nothing contained within this

document is or should be relied upon as a warranty, promise or

representation, express or implied, as to the future performance of

Funding Circle or its business. Any historical information

contained in this statistical information is not indicative of

future performance.

The information contained in this document is provided as of the

dates shown. Nothing in this document should be construed as legal,

tax, investment, financial, or accounting advice, or solicitation

for or an offer to invest in Funding Circle.

Definitions and notes to the editor:

1. The projected annual return shows how loans are estimated to

perform. Loans are shown by the year they were taken out, and are

after fees and bad debt. Returns equal gross yield minus net losses

minus servicing fee and is estimated, using an internally managed

model, by cohort of origination incorporating actual returns

received for each cohort and adding future expected returns which

are determined using the same aforementioned model. Net yield is

compounded to recognise re-investment. These expectations may be

revised, for example if macroeconomic conditions change, and the

projected return, projected gross yield and the projected bad debt

rate may be adjusted to reflect this.

2. The projected bad debt rate shows the projected annualised

percentage of loans, by loan amount, that will not be repaid. Loans

are shown by the year they were taken out and include recoveries.

It can take up to five years for loans to be fully repaid, so the

projected return, projected gross yield and projected bad debt rate

take into account how each year of loans are performing and how

Funding Circle expects them to perform in future. These

expectations may be revised, for example if macroeconomic

conditions change, and the projected return, projected gross yield

and the projected bad debt rate may be adjusted to reflect

this.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

TSTMPBJTMBBBBTL

(END) Dow Jones Newswires

October 21, 2019 02:00 ET (06:00 GMT)

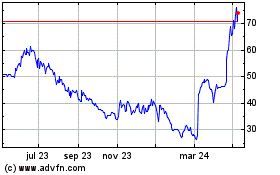

Funding Circle (LSE:FCH)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

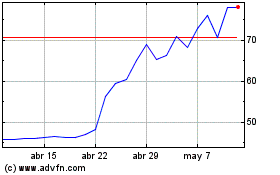

Funding Circle (LSE:FCH)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024