EUROPE MARKETS: European Stocks Edge Back From 2019 Highs

22 Octubre 2019 - 4:30AM

Noticias Dow Jones

By Steve Goldstein, MarketWatch

European stocks weakened on Tuesday, as a generally solid set of

corporate earnings from companies including Swiss bank UBS and

aerospace group Saab wasn't enough for traders to bid stocks to a

new high.

After closing Monday at the highest level since May 22, 2018,

the Stoxx Europe 600 weakened 0.31% to 392.98.

The index isn't far from its record high of 414.06.

"With risks related to the trade war fading away, investors have

switched their focus back to data and especially to corporate

earnings which will provide them with more clues on how companies

have dealt with the negative impacts of the U.S.-China trade

disputes in the third quarter. The current earning season shows

good results so far, which indicates there may be enough space for

an extended rally on stocks before Christmas if the current risk-on

trading stance continues," said Pierre Veyret, a technical analyst

at ActivTrades.

The German DAX declined 0.02% to 12745.39, the French CAC 40

weakened 0.56% to 5616.94 and the U.K. FTSE 100 declined 0.06% to

7159.32.

U.S. stock futures were lower after a 57-point gain on Monday

for the Dow Jones Industrial .

With little on the economics front in Europe, corporate news was

the main driver of action.

UBS (UBS) rose 1.2% as the Swiss bank reported a stronger than

forecast third-quarter profit, helped by its wealth and asset

management arms.

Reckitt Benckiser (RB.LN) shares fell 4.4% as the consumer

products giant cut its sales outlook for the year, citing a weak

performance in its health division, which was hurt by light

restocking of cold and flu products, as well as weakness for its

Durex condom unit and Dettol anti-bacteria product unit.

Novartis (NOVN.EB) (NOVN.EB) shares slipped 0.9%, after a nearly

14% gain this year. The Swiss drugmaker reported

stronger-than-expected sales and operating profit in the third

quarter, and increased its guidance for the year.

Aerospace group Saab (SAAB-B.SK) jumped 5.3% after the company

reported stronger earnings and sales than forecast.

Just Eat (JE.LN) jumped 23.9% to 730 pence after technology

investor Prosus (PRX.AE) launched a rival 710 pence a share bid for

the U.K. delivery service. Takeaway.com (TKWY.AE) , the rival Just

Eat suitor, rose 4.7%.

Delivery Hero shares (DHER.FF) rose 4.9%.

(END) Dow Jones Newswires

October 22, 2019 05:15 ET (09:15 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

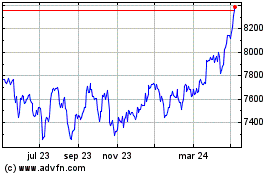

FTSE 100

Gráfica de índice

De Mar 2024 a Abr 2024

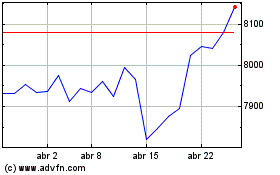

FTSE 100

Gráfica de índice

De Abr 2023 a Abr 2024