TIDMPIP

This announcement contains inside information as stipulated under the Market

Abuse Regulations (EU) no. 596/2014 ("MAR").

23 October 2019

PipeHawk plc

("PipeHawk" or the "Company")

Final results for the year ended 30 June 2019

Chairman's Statement

I can report that turnover for the year ended 30 June 2019 was GBP6.7 million

(2018: GBP4.8 million), an increase of 39.6%. The Group made an operating profit

in the year of GBP57,000 (2018: GBP408,000 loss) and a profit before taxation for

the year of GBP12,000 (2018: GBP502,000 loss) and a profit after taxation of GBP

312,000 (2018: GBP151,000 loss). The earnings per share for the year was 0.91p

(2018: loss per share 0.45p).

The second half of the year benefitted from a pre-tax profit of GBP129,000 as a

one-off item in relation to the reduction of the amount of debt due to the

vendors of Thomson Engineering Design.

The politicians faffing around with Brexit has undeniably had an effect on this

year's results and to some extent continues to do so. However, UK business has

generally had to move on, and delayed orders have eventually been placed such

that we have had a very reasonable second half of the year. The unaudited

results for the second six months of the year saw turnover of GBP3.8 million, a

pre-tax profit of GBP176,000 and a post-tax profit of GBP300,000.

QM Systems

QM Systems has made great progress this year and I am pleased to report an

increase in sales achieved to approximately GBP4.5 million with a profit before

tax and management charges of approximately GBP330,000, despite incurring

significant recruitment fees as we increased our engineering resource pool. It

is worth noting that during the second half of the financial year, QM Systems

generated an unaudited revenue of approximately GBP2.6 million with a profit of

approximately GBP229,000 indicating that the business is now running at a

significantly higher revenue rate and profit margin. The increase in both

turnover and profit during the second six months is a direct result of

recruitment, throughout the 2018 calendar year, of engineering resource to our

mechanical/software and manufacturing teams. Our overhead remained largely

unaffected when compared to the previous year demonstrating that the business

had been well prepared for the anticipated growth. In addition, closer project

management on each job has seen a marked improvement in profit margin retention

across all projects compared to previous years.

Order intake for the period has been excellent with orders received of GBP5.6

million during the 2018/19 FY. We have carried over approximately GBP2.6 million

of orders into our current financial year and the first three and a half months

to date have seen a further order intake of GBP2.7 million. Quotation activity

remains buoyant and we are expecting a number of further orders to land

throughout the current financial year. It is encouraging to see that our new

order intake is spread widely across current and new clients alike

demonstrating that QM Systems maintains excellent client retention as well as

attracting new clients, largely through reputation and word of mouth.

We have seen a real mix of orders awarded, with orders ranging in size from

approximately GBP50,000 to well over GBP2 million. Orders have been awarded across

a wide range of industrial sectors including Marine, Automotive, Retail, Rail,

Petrochemical, Aerospace, Building Services and Food and Beverage. This

demonstrates that QM Systems continues to actively expand its client base

across multiple industries; continuing to build a robust and stable business

model.

We have seen a number of service contracts established within 2018 and 2019 and

we have now established a structured service division within QM Systems that we

will continue to grow to create a continuous business stream. We have also

seen, as expected, an increase in sales of the Test Interface System for one of

our key clients in the Petrochemical industry. Our high end robotic vision

system developed with a key partner within the aerospace industry has been

completed and installed at our first client's facility, and is gaining a

significant level of interest within the wider aerospace industry. We fully

expect that this product will be sold into a number of locations globally over

the next few years.

Progress on two of our larger projects with Penso and Cox Powertrain has been

excellent with both projects currently undergoing commissioning and

installation. Both projects are due for completion within the first half of

this current financial year.

It is most reassuring to see that in the face of the material uncertainty that

surrounds the current progress with Brexit, QM Systems has both returned to

a good level of profitability and laid the foundations for ongoing future

success.

Thomson Engineering Design ("TED")

PipeHawk acquired TED in November 2017 and, following a slow start to the 2018/

19 FY, the increase in TED's quotation activity has translated into orders

placed resulting in a strong final six months of the period. Revenue realised

for the year was GBP681,000, however GBP457,000 of this revenue was realised during

the final six months of the financial year. TED contributed a post-tax profit

to the Group of GBP4,000.

Order intake for the UK market has been mixed and slower than expected, in part

due to the delayed release of Network Rail funding for larger infrastructure

projects. Sales growth has been predominantly achieved through the expansion of

international markets where distributors for France and the Asia Pacific

Territories have been established. TED has also commenced trading within the

Canadian Market.

Both quotations and order intake since the year end have been buoyant. In

particular quotation activity has been very strong internationally and

particularly outside of Europe, with a number of significant orders

anticipated. Quotation activity has continued within Europe, however, given the

material uncertainty that exists around Brexit, many clients are outwardly

unwilling to commit orders until Brexit has been delivered and trading terms

are clear.

The Group has supported TED with investment in new and innovative products.

During the year TED completed the release of its brand new E-Clipper and

Threader dragger products, together with a light weight version of its 7

Sleeper Spreader. TED has achieved sales for all of these products with new and

existing clients, with the E-Clipper and 7 Sleeper Spreader products seeing

particularly strong interest. TED has also sold a number of the Mast

Manipulator products both within the UK and abroad.

TED, with the support of the Group, is continuing to invest in the next range

of innovative products which will further support the success already achieved

with the existing products mentioned above.

The team at TED has worked hard to re-open doors with previous clients. This

has resulted in success with four previous clients who had not worked with TED

for some time. It seems the rail infrastructure industry is beginning to

acknowledge TED's capability in providing cost effective ergonomic solutions to

all manners of handling requirements. In particular, feedback following

delivery of orders has been very positive indeed with a number of clients

wishing to explore the other products or services that TED has to offer.

During the year the Company agreed a reduction of the amount of debt due to the

vendors of TED to GBP71,000. The Company acquired TED with a debt due to vendors

of TED amounting to GBP200,000, and so this reduction has added GBP129,000 to the

Company's consolidated profits for the year ended 30 June 2019.

Technology Division

New unit sales for 2018/19 financial year have remained broadly static in

comparison to the previous year in terms of quantum. However, the markets in

which those sales have been achieved has changed markedly, with Middle East &

Asia now overtaking Europe for the first time, indicating the switch of focus

away from EU countries is beginning to bear fruit.

Over the same time, the UK market has seen an increase in sales of upgrades,

accessories and servicing, as customers working predominantly in the utilities

sector continue to invest in existing equipment rather than renewals or fleet

growth. To capitalise on this trend, marketing efforts have lately shifted away

from attendance at large "whole market" shows and events to smaller venues,

offering greater focus on face-to-face meetings. R&D resources have also been

committed to find new ways to extend servicing and maintenance regimes beyond

home markets.

Over the same period our R&D efforts have also resulted in a number of

improvements to hardware design which have delivered a measurable reduction in

unit costs. Going forward, the cost reductions are expected to continue, as

more of those improvements work through to production.

As access to EU based grant funding begins to close with the approach to

Brexit, new opportunities are being sought for funding of next generation

systems. A number of bespoke development avenues available through industry

consortia are also being pursued.

Adien

Adien's results were somewhat disappointing after a positive start to the year,

undoubtedly affected by the failure to resolve Brexit one way or the other,

which resulted in work scheduled for May and June 2019 being delayed until

after the year end. Nevertheless, the strategy of consolidation and improvement

has continued and Adien has recently secured a number of sole supplier

frameworks for five years plus, principally in the power and defence sectors;

these are expected to provide a steady income stream for the next 3 to 5 year

period.

In addition, Adien is in the early stages of trialling a new service which will

continue to build on the concept of providing a "one stop shop" to our key

clients.

The levels of business activity since June 2019 have risen considerably despite

the political issues that remain ongoing.

Financial position

The Group continues to be in a net liability position and is still reliant on

my continuing financial support.

My letter of support dated 24 October 2018 was renewed on 7 October 2019 for a

further year. Loans, other than those covered by the CULS agreement, are

unsecured and accrue interest at an annual rate of Bank of England base rate

plus 2.15%.

The CULS agreement for GBP1 million, provided by myself, was renewed last year

and extended on identical terms, such that the CULS are now repayable on 13

August 2022.

In addition to the loans I have provided to the Company in previous years, I

have deferred a certain proportion of fees and the interest due until the

Company is in a suitably strong position to make the full payments.

Historically, my fees and interest payable have been deferred. During the year

under review, this amounted to GBP216,000. At 30 June 2019, these deferred fees

and interest amounted to approximately GBP1.6 million in total, all of which have

been recognised as a liability in the Company's accounts.

Strategy & Outlook

The PipeHawk group remains committed to creating sustainable earnings-based

growth and focusing on the expansion of its business with forward-looking

products and services. One small such acquisition has been made since the year

end in Wessex Precision Instruments Ltd, where I expect with synergies and cost

savings an early return to its profitability. PipeHawk acts responsibly towards

its shareholders, business partners, employees, society and the environment in

each of its business areas.

PipeHawk is committed to technologies and products that unite the goals of

customer value and sustainable development. All divisions of the Group are

currently performing well and I remain optimistic in my outlook for the Group.

Gordon Watt

Chairman

22 October 2019

Enquiries:

PipeHawk Plc Tel. No. 01252 338 959

Gordon Watt (Chairman)

Allenby Capital (Nomad and Broker) Tel. No. 020 3328 5656

David Worlidge/Asha Chotai

Notes to Editors

For further information on the Company and its subsidiaries, please visit:

www.pipehawk.com

Consolidated Statement of Comprehensive Income

For the year ended 30 June 2019

Note 30 June 2019 30 June 2018

GBP'000 GBP'000

Revenue 2 6,680 4,789

Staff costs 5 (3,265) (2,703)

Operating costs (3,358) (2,494)

Operating profit/(loss) 4 (408)

57

Sale of shares in joint venture - 142

Profit/(loss) before interest and taxation 57 (266)

Finance costs 3 (45) (236)

Profit/(loss) before taxation 12 (502)

Taxation 7 300 351

Profit/(loss) for the year attributable to 312 (151)

equity holders of the parent

Other comprehensive income - -

Total comprehensive profit/(loss) for the 312 (151)

year attributable to equity holders of the

parent

Profit/(loss) per share (pence) - basic 8 0.91 (0.45)

Profit/(loss) per share (pence) - diluted 8 0.72 (0.45)

The notes below form an integral part of these financial statements.

Consolidated Statement of Financial Position

at 30 June 2019

30 June 2019 30 June 2018

Note

Assets GBP'000 GBP'000

Non-current assets

Property, plant and equipment 9 525 481

Goodwill 10 1,190 1,190

1,715 1,671

Current assets

Inventories 11 134 178

Current tax assets 315 372

Trade and other receivables 12 1,592 1,175

Cash and cash equivalents 774 19

2,815 1,744

Total assets 4,530 3,415

Equity and liabilities

Equity

Share capital 17 344 340

Share premium 5,205 5,191

Retained earnings (8,896) (9,208)

(3,347) (3,677)

Non-current liabilities

Borrowings 13 2,661 2,966

Trade and other payables 14 3 8

2,664 2,974

Current liabilities

Trade and other payables 14 3,270 1,972

Borrowings 15 1,943 2,146

5,213 4,118

Total equity and liabilities 4,530 3,415

The notes below form an integral part of these financial statements.

Consolidated Statement of Cash Flow

For the year ended 30 June 2019

Note 30 June 2019 30 June 2018

GBP'000 GBP'000

Cash flows from operating activities

Loss from operations 57 (408)

Adjustments for:

Depreciation 90 106

Profit on disposal of fixed asset (13) -

134 (302)

Decrease in inventories 44 10

(Increase) in receivables (417) (196)

Increase in liabilities

1,570 143

Cash used in operations 1,331 (345)

Interest paid (147) (87)

Corporation tax received

358 232

Net cash generated from/(used in)

operating activities 1,542 (200)

Cash flows from investing activities

17 197

Proceeds from sale of joint venture

Acquisition of subsidiary net of - 11

cash acquired

Purchase of plant and equipment (75) (17)

Proceeds from disposal of fixed 16 -

assets

Net cash (used in)/generated from (42) 191

investing activities

Cash flows from financing activities

Proceeds from borrowings - -

Repayment of loan (676) (10)

Repayment of finance leases (69) (34)

Net cash used in financing (745) (44)

activities

Net increase/(decrease) in cash and 755 (53)

cash equivalents

Cash and cash equivalents at 19 72

beginning of year

Cash and cash equivalents at end of

year 774 19

The notes below form an integral part of these financial statements.

Statement of Changes in Equity

For the year ended 30 June 2019

Consolidated Share Share Retained Total

capital premium earnings

account

GBP'000 GBP'000 GBP'000 GBP'000

As at 1 July 2017 330 5,151 (9,057) (3,576)

Loss for the year - - (151) (151)

Other comprehensive

income - - - -

Total comprehensive - - (151) (151)

income

Issue of shares 10 40 - 50

As at 30 June 2018 340 5,191 (9,208) (3,677)

Profit for the year - - 312 312

Other comprehensive

income - - - -

Total comprehensive - - 312 312

income

Issue of shares 4 14 - 18

As at 30 June 2019 344 5,205 (8,896) (3,347)

The share premium account reserve arises on the issuing of shares. Where

shares are issued at a value that exceeds their nominal value, a sum equal to

the difference between the issue value and the nominal value is transferred to

the share premium account reserve.

The notes below form an integral part of these financial statements.

1. Summary of Significant Accounting Policies

General information

PipeHawk plc (the Company) is a limited company incorporated in the United

Kingdom under the Companies Act 2006. The addresses of its registered office

and principal place of business are disclosed in the company information on

page 3. The principal activities of the Company and its subsidiaries (the

Group) are described on page 8.

The financial statements are presented in pounds sterling, the functional

currency of all companies in the Group. In accordance with section 408 of the

Companies Act 2006 a separate statement of comprehensive income for the parent

Company has not been presented. For the year to 30 June 2019 the Company

recorded a net profit after taxation of GBP81,000 (2018: loss GBP126,000).

Basis of preparation

The financial information set out in this announcement does not constitute the

company's statutory accounts for the years ended 30 June 2019 or 2018. The

financial information for the year ended 30 June 2018 is derived from the

statutory accounts for that year, which were prepared under IFRSs, and which

have been delivered to the Registrar of Companies. The financial information

for the year ended 30 June 2019 is derived from the audited statutory accounts

for the year ended 30 June 2019 on which the auditors have given an unqualified

report, that did not contain a statement under section 498(2) or 498(3) of the

Companies Act 2006.

The financial statements have been prepared in accordance with international

financial reporting standards as adopted by the EU and under the historical

cost convention. The principal accounting policies are set out below.

The Group has adopted IFRS 9 Financial Instruments and IFRS 15 Revenue from

Contracts with Customers from 1 July 2018. As detailed in the accounting

policies below the Directors have assessed that the adoption of these standards

has no material impact on transition.

A number of new standards and amendments to standards and interpretations have

been issued but are not yet effective and in some cases have not yet been

adopted by the EU.

The directors are in the process of considering the potential changes that may

occur to the financial statements under IFRS 16 "Leases". This is expected to

apply to periods commencing on or after 1 January 2019 and therefore will

impact the Group for the first time in the financial statements for the year

ended 30 June 2020. Under the new standard the substantial majority of the

Groups operating lease commitments would be bought onto the balance sheet and

depreciated separately. There will be no impact on cashflows although the

presentation of the cash flow statement will change significantly. As set out

in note 20 the future aggregate minimum lease payments of the Groups operating

leases were GBP189,000 at 30 June 2019 on an undiscounted basis.

Basis of preparation - Going concern

The directors have reviewed the Parent Company and Group's funding requirements

for the next twelve months which show positive anticipated cash flow

generation, prior to any repayment of loans advanced by the Executive Chairman.

The directors have furthermore obtained a renewed pledge from GG Watt to

provide ongoing financial support for a period of at least twelve months from

the approval date of the Group and Parent Company statement of financial

positions. The directors therefore have a reasonable expectation that the

entity has adequate resources to continue in its operational exercises for the

foreseeable future. It is on this basis that the directors consider it

appropriate to adopt the going concern basis of preparation within these

financial statements. However a material uncertainty exists regarding the

ability of the Group and Parent Company to remain a going concern without the

continuing financial support of the Executive Chairman.

Basis of consolidation

The consolidated financial statements incorporate the financial statements of

the Company and entities controlled by the Company (its subsidiaries). Control

is achieved where the Company has the power to govern the financial and

operating policies of an entity so as to obtain benefits from its activities.

The results of subsidiaries acquired or disposed of during the year are

included in the consolidated statement of comprehensive income from the

effective date of acquisition or up to the effective date of disposal, as

appropriate. Where necessary, adjustments are made to the financial statements

of subsidiaries to bring their accounting policies into line with those used by

other members of the Group. All intra-group transactions, balances, income and

expenses are eliminated in full on consolidation.

Business combinations

Acquisitions of subsidiaries and businesses are accounted for using the

acquisition method. The cost of the business combination is measured as the

aggregate of the fair values (at the date of exchange) of assets given,

liabilities incurred or assumed, and equity instruments issued by the Group in

exchange for control of the acquiree. The acquiree's identifiable assets,

liabilities and contingent liabilities that meet the conditions for recognition

under IFRS 3 Business Combinations (revised) are recognised at their fair

values at the acquisition date, except for non-current assets (or disposal

groups) that are classified as held for sale in accordance with IFRS 5

Non-current Assets Held for Sale and Discontinued Operations, which are

recognised and measured at fair value less costs to sell.

Goodwill arising on acquisition is recognised as an asset and initially

measured at cost, being the excess of the cost of the business combination over

the Group's interest in the net fair value of the identifiable assets,

liabilities and contingent liabilities recognised.

Goodwill

Goodwill arising on the acquisition of a subsidiary or a jointly controlled

entity represents the excess of the cost of acquisition over the Group's

interest in the net fair value of the identifiable assets, liabilities and

contingent liabilities of the subsidiary or jointly controlled entity

recognised at the date of acquisition. Goodwill is initially recognised as an

asset at cost and is subsequently measured at cost less any accumulated

impairment losses.

For the purpose of impairment testing, goodwill is allocated to each of the

Group's cash-generating units expected to benefit from the synergies of the

combination. Cash-generating units to which goodwill has been allocated are

tested for impairment annually, or more frequently when there is an indication

that the unit may be impaired. If the recoverable amount of the cash-generating

unit is less than the carrying amount of the unit, the impairment loss is

allocated first to reduce the carrying amount of any goodwill allocated to the

unit and then to the other assets of the unit pro-rata on the basis of the

carrying amount of each asset in the unit. An impairment loss recognised for

goodwill is not reversed in a subsequent period.

On disposal of a subsidiary or a jointly controlled entity, the attributable

amount of goodwill is included in the determination of the profit or loss on

disposal.

Investments in joint ventures

A joint venture is a contractual arrangement whereby the Group and other

parties undertake an economic activity that is subject to joint control that is

when the strategic financial and operating policy decisions relating to the

activities of the joint venture require the unanimous consent of the parties

sharing control.

The results and assets and liabilities of joint venture are incorporated in

these financial statements using the equity method of accounting, except when

the investment is classified as held for sale, in which case it is accounted

for in accordance with IFRS 5 Non-current Assets Held for Sale and Discontinued

Operations. Under the equity method, investments in joint ventures are carried

in the consolidated statement of financial position at cost as adjusted for

post-acquisition changes in the Group's share of the net assets of the joint

venture, less any impairment in the value of individual investments. Losses of

a joint venture in excess of the Group's interest in that joint venture (which

includes any long-term interests that, in substance, form part of the Group's

net investment in the joint venture) are recognised only to the extent that the

Group has incurred legal or constructive obligations or made payments on behalf

of the joint venture.

Any excess of the cost of acquisition over the Group's share of the net fair

value of the identifiable assets, liabilities and contingent liabilities of the

joint venture recognised at the date of acquisition is recognised as goodwill.

The goodwill is included within the carrying amount of the investment and is

assessed for impairment as part of that investment. Any excess of the Group's

share of the net fair value of the identifiable assets, liabilities and

contingent liabilities over the cost of acquisition, after reassessment, is

recognised immediately in profit or loss.

Where a Group entity transacts with a joint venture of the Group, profits and

losses are eliminated to the extent of the Group's interest in the relevant

joint venture.

The investment in joint venture is held at cost in the parent entity financial

statements

Revenue recognition

For the year ended 30 June 2019 the Group used the five-step model as

prescribed under IFRS 15 on the Group's revenue transactions. This included the

identification of the contract, identification of the performance obligations

under the same, determination of the transaction price, allocation of the

transaction price to performance obligations and recognition of revenue.

The point of recognition arises when the Group satisfies a performance

obligation by transferring control of a promised good or service to the

customer, which could occur over time or at a point in time.

Sale of goods

Revenue generated from the sale of goods is recognised on delivery of the good

to the customer on this basis revenue is recognised at a point in time. There

is no change to the accounting policy resulting from the adoption of IFRS 15.

Sale of services

In relation to the design and manufacture of complete software and hardware

test solutions and the provision of specialist surveying, revenue is recognised

through a review of the man-hours completed on the project at the year-end

compared to the total man-hours required to complete the projects. Provision is

made for all foreseeable losses if a contract is assessed as unprofitable.

Management do not consider the impact of IFRS 15 to have a material impact on

the financial statements because contracts with customers have one performance

obligation, the delivery of the system solution or mapping drawings and the

Group has a right to payment for performance completed to date.

Revenue represents the amount of consideration to which the Group expects to be

entitled in exchange for transferring promised goods or services to a customer,

excluding amounts collected on behalf of third parties.

Revenue from goods and services provided to customers not invoiced as at the

reporting date is recognised as a contract asset and disclosed as accrued

income within trade and other receivables.

Although payment terms vary from contract to contract invoices are in general

raised in advance of services performed. Where billing has exceeded the revenue

recognised in a period a contract liability is recognised and this is disclosed

as payments received on account in trade and other payables.

Property, plant and equipment

Property, plant and equipment are stated at cost less accumulated depreciation

and accumulated impairment losses. Depreciation is charged so as to write off

the cost of assets over their estimated useful lives, using the straight-line

method. The estimated useful lives, residual values and depreciation method are

reviewed at each year end, with the effect of any changes in estimate accounted

for on a prospective basis. Assets held under finance leases are depreciated

over their expected useful lives on the same basis as owned assets or, where

shorter, the term of the relevant lease. Gains and losses on disposals are

determined by comparing the proceeds with the carrying amount and are

recognised within the Statement of Comprehensive Income.

The principal annual rates used to depreciate property, plant and equipment

are:

Equipment, fixtures and fittings 25%

Motor vehicles 25%

Inventories and work in progress

Inventories are stated at the lower of cost and net realisable value. Costs,

including an appropriate portion of fixed and variable overhead expenses, are

assigned to inventories by the method most appropriate to the particular class

of inventory, with the majority being valued on a first-in-first-out basis. Net

realisable value represents the estimated selling price for inventories less

all estimated costs of completion and costs necessary to make the sale.

Work in progress is valued at cost, which includes expenses incurred on behalf

of clients and an appropriate proportion of directly attributable costs on

incomplete assignments. Provision is made for irrecoverable costs where

appropriate.

Financial assets

IFRS 9 supersedes IAS 39 Financial Instruments: Recognition and Measurement

with new requirements for the classification and measurement of financial

assets and liabilities, impairment of financial assets and hedge accounting.

IFRS 9 introduces a new forward-looking impairment model based on expected

credit losses to replace the incurred loss model in IAS 39. This determines the

recognition of impairment provisions as well as interest revenue.

The Group adopted IFRS 9 from 1 July 2018 with retrospective effect in

accordance with the transitional provisions.

The Group's principal financial assets are cash and cash equivalents and

receivables.

The Group has assessed the impact of IFRS 9 on the impairment of its financial

assets and has concluded that the change in the impairment is immaterial.

While cash and cash equivalents are also subject to the impairment requirements

of IFRS 9, the identified impairment loss was immaterial.

The Group's financial assets consist of cash and cash equivalents and trade and

other receivables. The Group's accounting policy for each category of financial

asset is as follows:

Financial assets held at amortised cost

Trade receivables and other receivables are classified as financial assets held

at amortised cost. They are initially recognised at fair value plus transaction

costs that are directly attributable to their acquisition or issue and are

subsequently carried at amortised cost using the effective interest rate

method, less provision for impairment.

Impairment provisions are recognised when there is objective evidence (such as

significant financial difficulties on the part of the counterparty or default

or significant delay in payment) that the Group will be unable to collect all

of the amounts due under the terms receivable, the amount of such a provision

being the difference between the net carrying amount and the present value of

the future expected cash flows associated with the impaired receivable. For

receivables, which are reported net, such provisions are recorded in a separate

allowance account with the loss being recognised within administrative expenses

in the statement of comprehensive income. On confirmation that the receivable

will not be collectable, the gross carrying value of the asset is written off

against the associated provision.

The Group's financial assets held at amortised cost comprise other receivables

and cash and cash equivalents in the statement of financial position.

Derecognition of financial assets

The Group derecognises a financial asset only when the contractual rights to

the cash flows from the asset expire; or it transfers the financial asset and

substantially all the risks and rewards of ownership of the asset to another

entity.

Equity instruments

An equity instrument is any contract that evidences a residual interest in the

assets of an entity after deducting all of its liabilities. Equity instruments

issued by the Group are recorded at the proceeds received, net of direct issue

costs.

Financial liabilities

Financial liabilities, including borrowings, are initially measured at fair

value, net of transaction costs. Financial liabilities are subsequently

measured at amortised cost using the effective interest method, with interest

expense recognised on an effective yield basis.

The effective interest method is a method of calculating the amortised cost of

a financial liability and of allocating interest expense over the relevant

period. The effective interest rate is the rate that exactly discounts

estimated future cash payments through the expected life of the financial

liability, or, where appropriate, a shorter period.

Derecognition of financial liabilities

The Group derecognises financial liabilities when, and only when, the Group's

obligations are discharged, cancelled or they expire.

Finance leases

Assets held under finance leases are initially recognised as assets of the

Group at their fair value at the inception of the lease or, if lower, at the

present value of the minimum lease payments. The corresponding liability to the

lessor is included in the statement of financial position as a finance lease

obligation.

Lease payments are apportioned between finance charges and reduction of the

lease obligation so as to achieve a constant rate of interest on the remaining

balance of the liability. Finance charges are charged directly to profit or

loss. Contingent rentals are recognised as expenses in the periods in which

they are incurred.

Operating leases

Operating lease payments are recognised as an expense on a straight-line basis

over the lease term, except where another systematic basis is more

representative of the time pattern in which economic benefits from the leased

asset are consumed. Contingent rentals arising under operating leases are

recognised as an expense in the period in which they are incurred.

In the event that lease incentives are received to enter into operating leases,

the aggregate benefit of incentives is recognised as a reduction of rental

expense on a straight-line basis, except where another systematic basis is more

representative of the time pattern in which economic benefits from the leased

asset are consumed.

Pension scheme contributions

Pension contributions are charged to the statement of comprehensive income in

the period in which they fall due. All pension costs are in relation to

defined contribution schemes.

Share based payments

Equity-settled share-based payments to employees and others providing similar

services are measured at the fair value of the equity instruments at the grant

date. Details regarding the determination of the fair value of equity-settled

share-based transactions are set out in note 20.

The fair value determined at the grant date of the equity-settled share-based

payments is expensed on a straight-line basis over the vesting period, based on

the Group's estimate of equity instruments that will eventually vest. At each

statement of financial position date, the Group revises its estimate of the

number of equity instruments expected to vest. The impact of the revision of

the original estimates, if any, is recognised in profit or loss over the

remaining vesting period, with a corresponding adjustment to reserves.

Foreign currencies

Monetary assets and liabilities denominated in foreign currencies are

translated into sterling at the rates of exchange ruling at 30 June.

Transactions in foreign currencies are recorded at the rates ruling at the date

of the transactions.

Taxation

Income tax expense represents the sum of the tax currently payable and deferred

tax.

Current tax

The tax currently payable is based on taxable profit for the year. Taxable

profit differs from profit as reported in the consolidated statement of

comprehensive income because it excludes items of income or expense that are

taxable or deductible in other years and it further excludes items that are

never taxable or deductible. The Group's liability for current tax is

calculated using tax rates that have been enacted or substantively enacted by

the year end date.

Deferred tax

Deferred tax is recognised on differences between the carrying amounts of

assets and liabilities in the financial statements and the corresponding tax

bases used in the computation of taxable profit, and is accounted for using the

statement of financial position liability method. Deferred tax liabilities are

generally recognised for all taxable temporary differences, and deferred tax

assets are generally recognised for all deductible temporary differences to the

extent that it is probable that taxable profits will be available against which

those deductible temporary differences can be utilised. Such assets and

liabilities are not recognised if the temporary difference arises from goodwill

or from the initial recognition (other than in a business combination) of other

assets and liabilities in a transaction that affects neither the taxable profit

nor the accounting profit.

Deferred tax liabilities are recognised for taxable temporary differences

associated with investments in subsidiaries and associates, and interests in

joint ventures, except where the Group is able to control the reversal of the

temporary difference and it is probable that the temporary difference will not

reverse in the foreseeable future. Deferred tax assets arising from deductible

temporary differences associated with such investments and interests are only

recognised to the extent that it is probable that there will be sufficient

taxable profits against which to utilise the benefits of the temporary

differences and they are expected to reverse in the foreseeable future.

The carrying amount of deferred tax assets is reviewed at each statement of

financial position date and reduced to the extent that it is no longer probable

that sufficient taxable profits will be available to allow all or part of the

asset to be recovered. Deferred tax assets and liabilities are measured at the

tax rates that are expected to apply in the year in which the liability is

settled or the asset realised, based on tax rates (and tax laws) that have been

enacted or substantively enacted by the year end date. The measurement of

deferred tax liabilities and assets reflects the tax consequences that would

follow from the manner in which the Group expects, at the reporting date, to

recover or settle the carrying amount of its assets and liabilities.

Deferred tax assets and liabilities are offset when there is a legally

enforceable right to set off current tax assets against current tax liabilities

and when they relate to income taxes levied by the same taxation authority and

the Group intends to settle its current tax assets and liabilities on a net

basis.

Current and deferred tax for the year

Current and deferred tax are recognised as an expense or income in the

statement of comprehensive income, except when they relate to items credited or

debited directly to equity, in which case the tax is also recognised directly

in equity.

Impairment of property, plant and equipment

At each year end date, the Group reviews the carrying amounts of its property,

plant and equipment to determine whether there is any indication that those

assets have suffered an impairment loss. If any such indication exists, the

recoverable amount of the asset is estimated in order to determine the extent

of the impairment loss (if any). Where it is not possible to estimate the

recoverable amount of an individual asset, the Group estimates the recoverable

amount of the cash-generating unit to which the asset belongs. Where a

reasonable and consistent basis of allocation can be identified, corporate

assets are also allocated to individual cash-generating units, or otherwise

they are allocated to the smallest group of cash-generating units for which a

reasonable and consistent allocation basis can be identified.

Recoverable amount is the higher of fair value less costs to sell and value in

use. In assessing value in use, the estimated future cash flows are discounted

to their present value using a pre-tax discount rate that reflects current

market assessments of the time value of money and the risks specific to the

asset for which the estimates of future cash flows have not been adjusted.

If the recoverable amount of an asset (or cash-generating unit) is estimated to

be less than its carrying amount, the carrying amount of the asset (or

cash-generating unit) is reduced to its recoverable amount. An impairment loss

is recognised immediately in profit or loss.

Where an impairment loss subsequently reverses, the carrying amount of the

asset (or cash-generating unit) is increased to the revised estimate of its

recoverable amount, but so that the increased carrying amount does not exceed

the carrying amount that would have been determined had no impairment loss been

recognised for the asset (or cash-generating unit) in prior years. A reversal

of an impairment loss is recognised immediately in the statement of

comprehensive income.

Research and development

The Group undertakes research and development to expand its activity in

technology and innovation to develop new products that will begin directly

generating revenue in the future. Expenditure on research is expensed as

incurred, development expenditure is capitalise only if the criteria for

capitalisation are recognised in IAS 38. The Company claims tax credits on its

research and development activity and recognises the income in current tax.

Critical judgements in applying accounting policies and key sources of

estimation uncertainty

The following are the critical judgements and key sources of estimation

uncertainty that the directors have made in the process of applying the

entity's accounting policies and that have the most significant effect on the

amounts recognised in these financial statements.

Impairment of goodwill

Determining whether goodwill is impaired requires an estimation of the value in

use of the cash-generating units to which goodwill has been allocated. A

similar exercise is performed in respect of investment and long term loans in

subsidiary.

The value in use calculation requires the directors to estimate the future cash

flows expected to arise from the cash-generating unit and a suitable discount

rate in order to calculate present value, see note 10 for further details.

The carrying amount of goodwill at the year-end date was GBP1,190,000 (2018: GBP

1,190,000). The investment in subsidiaries at the year-end was GBP1,197,000

(2018: GBP1,197,000).

The methodology adopted in assessing impairment of Goodwill is set out in note

10 as is sensitivity analysis applied in relation to the outcomes of the

assessment.

Impairment investment in subsidiaries and inter-company receivables

As set out in note 12, an impairment assessment of the carrying value of

investments in subsidiaries and inter-company receivables is in line with the

methodologies adopted in the assessment of impairment of goodwill.

2. Segmental analysis

2019 2018

GBP'000 GBP'000

Turnover by geographical market

United Kingdom 6,509 4,787

Europe 29 -

Other 142 2

6,680 4,789

The Group operates out of one geographical location being the UK. Accordingly

the primary segmental disclosure is based on activity. Per IFRS 8 operating

segments are based on internal reports about components of the Group, which are

regularly reviewed and used by Chief Operating Decision Maker ("CODM") for

strategic decision making and resource allocation, in order to allocate

resources to the segment and to assess its performance. The Group's reportable

operating segments are as follows:

· Adien - Utility detection and mapping services - Sale of services

· Technology Division - Development, assembly and sale of GPR equipment -

Sale of goods

· QM Systems - Test system solutions - Sale of services

· TED - Rail trackside solutions (included in the test system solutions

segment) - Sale of services

The CODM monitors the operating results of each segment for the purpose of

performance assessments and making decisions on resource allocation.

Performance is based on revenue generations and profit before tax, which the

CODM believes are the most relevant in evaluating the results relative to other

entities in the industry.

In utility detection and mapping services one customer accounted for 20% of

revenue in 2019 and 5% in 2018. In development, assembly and sale of GPR

equipment one customer accounted for 39% of revenue in 2019 and two customers

for 54% in 2018. In automation and test system solutions one customer

accounted for 35% of revenue and 16% in 2018.

Information regarding each of the operations of each reportable segments is

included below, all non-current assets owned by the Group are held in the UK.

Utility Development, Automation and Total

detection assembly and test system

and mapping sale of GPR solutions

services equipment

GBP'000 GBP'000 GBP'000 GBP'000

Year ended 30 June 2019

Total segmental revenue

1,314 192 5,174 6,680

Operating profit (47) 34 70 57

Finance costs (10) (1) (34) (45)

Profit /(loss) before (57) 33 36 12

taxation

Segment assets 529 1,322 2,679 4,530

Segment liabilities 481 4,239 3,157 7,877

Non-current asset 75 - 62 137

additions

Depreciation and 55 - 35 90

amortisation

Utility Development, Automation and Total

detection assembly and test system

and mapping sale of GPR solutions

services equipment

GBP'000 GBP'000 GBP'000 GBP'000

Year ended 30 June 2018

Total segmental revenue

1,534 173 3,082 4,789

Operating profit 52 (102) (358) (408)

Finance costs (28) (149) (59) (236)

Profit / loss before 24 (109) (417) (502)

taxation

Segment assets 596 1,375 1,444 3,415

Segment liabilities 615 4,308 2,169 7,092

Non-current asset 91 - 457 548

additions

Depreciation and 63 - 43 106

amortisation

3. Finance costs

2019 2018

GBP'000 GBP'000

Interest receivable and other income (155) -

Interest payable 200 236

45 236

Interest receivable and other income

comprises of:

Loan adjustment (see below) 129 -

Other income 26 -

155 -

Interest payable comprises interest on:

Finance leases 14 8

Directors' loans 147 138

Other 39 90

200 236

Loan adjustment

The vendors of Thomson Engineering Limited agreed to amend the terms of the

acquisition and the liability owed to them was reduced from GBP200,000 to GBP

71,000, resulting in an adjustment of GBP129,000.

4. Operating profit for the year

This is arrived at after charging for the Group:

2019 2018

GBP'000 GBP'000

Research and development costs not capitalised 1,774 1,049

Depreciation of wholly owned property, plant 27 51

and equipment

Depreciation of property, plant and equipment 62 55

held under finance leases

Auditor's remuneration

- Fees payable to the Company's auditor for 43 28

the audit of the Group's financial statements

- Fees payable to the Company's auditor and

its subsidiaries for the provision of tax 7 4

services

Operating lease rentals:

- other including land and buildings 100 118

The Company audit fee is GBP9,000 (2018: GBP8,500).

5. Staff costs

2019 2018

No. No.

Average monthly number of employees, including directors:

Production and research 71 64

Selling and research 10 11

Administration 6 6

87 81

2019 2018

GBP'000 GBP'000

Staff costs, including directors:

Wages and salaries 2,928 2,408

Social security costs 284 253

Other pension costs 53 42

3,265 2,703

6. Directors' Remuneration

Salary Benefits 2019 2018

and fees in kind Total Total

GBP'000 GBP'000 GBP'000 GBP'000

G G Watt 71 - 71 71

S P Padmanathan 25 - 25 25

R MacDonnell 4 - 4 2

Aggregate emoluments 100 - 100 98

Directors' pensions 2019 2018

No. No.

The number of directors who are accruing retirement

benefits under:

- defined contributions policies

- -

The directors represent key management personnel.

Directors' share options

No. of options

Granted Date from

At start during At end of Exercise which

of year year year price exercisable

R MacDonnell 500,000 - 500,000 3.0p 6-Mar-15

S P 200,000 - 200,000 3.9p 15-Nov-19

Padmanathan

The Company's share price at 30 June 2019 was 4.25p. The high and low during

the period under review were 6.20p and 3.52p respectively.

In addition to the above, in consideration of loans made to the Company, G G

Watt has warrants over 3,703,703 ordinary shares at an exercise price of 13.5p

and a further 6,000,000 ordinary shares at an exercise price of 3.0p.

7. Taxation

2019 2018

GBP'000 GBP'000

United Kingdom Corporation Tax

Current taxation (306) (329)

Adjustments in respect of prior years

6 (22)

(300) (351)

Deferred taxation

- -

Tax on profits/loss (300) (351)

Current tax reconciliation 2019 2018

GBP'000 GBP'000

Taxable profit/(loss) for the year

12 (502)

Theoretical tax at UK corporation tax 2 (95)

rate 19% (2018: 19%)

Effects of:

- R&D tax credit adjustments (333) (186)

- Income not taxable (3) (27)

- other expenditure that is not tax 6 8

deductible

- adjustments in respect of prior 4 (22)

years

- short term timing differences

24 (29)

Total income tax credit

(300) (351)

The Group has tax losses amounting to approximately GBP2,650,000 (2018: GBP

2,460,000), available for carry forward to set off against future trading

profits. No deferred tax assets have been recognised in these financial

statements due to the uncertainty regarding future taxable profits.

Potential deferred tax assets not recognised are approximately GBP450,000 (2018:

GBP418,000)

8. (Loss)/profit per share

Basic (pence per share) 2019 - 0.91 profit per share; 2018 - 0.45 loss per

share

This has been calculated on a profit of GBP312,000 (2018: loss of GBP151,000) and

the number of shares used was 34,126,707 (2018: 33,543,803) being the weighted

average number of shares in issue during the year.

Diluted (pence per share) 2019 - 0.72 profit per share; 2018 - 0.45 loss per

share

In the prior year the potential ordinary shares included in the weighted

average number of shares are anti-dilutive and therefore diluted earnings per

share is equal to basic earnings per share. The current year calculation used

earnings of GBP392,000 being the profit for the year, plus the interest paid on

the convertible loan note (net of 20% tax) of GBP80,000 and the number of shares

used was 54,657,116 being the weighted average number of shares outstanding

during the year of 34,126,707 adjusted for shares deemed to be issued for no

consideration relating to options and warrants of 530,409 and the impact of the

convertible instrument of 20,000,000.

1. Property, plant and equipment

Freehold Equipment, Leasehold Motor

fixtures improvements vehicles Total

and

fittings

GBP000 GBP'000 GBP'000 GBP'000 GBP'000

Cost

At 1 July 2018 265 1,680 223 291 2,459

Additions - 137 - - 137

Disposals - (42) - - (42)

At 30 June 2019

265 1,775 223 291 2,554

Depreciation

At 1 July 2018 13 1,463 223 279 1,978

Charged in year 3 78 - 9 90

Disposals - (39) - - (39)

At 30 June 2019

16 1,502 223 288 2,029

Net book value

At 30 June 2019 249 273 - 3 525

At 30 June 2018

252 217 - 12 481

The net book value of the property, plant and equipment includes GBP199,268

(2018: GBP195,322) in respect of assets held under finance lease agreements.

These assets have been offered as security in respect of these finance lease

agreements. Depreciation charged in the period on those assets amounted to GBP

61,791 (2018: GBP55,183).

10. Goodwill

Goodwill Total

GBP'000 GBP'000

Cost:

At 1 July 2018 and 30 June 2019

1,250 1,250

Impairment

At 1 July 2018 and 30 June 2019

60 60

Net book value

At 30 June 2019 1,190 1,190

At 30 June 2018 1,190 1,190

The goodwill carried in the statement of financial position of GBP1,190,000 arose

on the acquisition of Adien Limited in 2002 (GBP212,000) and the acquisition of

QM Systems Limited in 2006 (GBP849,000), and the acquisition of TED in 2017 (GBP

129,000).

Adien Limited represents the segment utility detection and mapping services and

QM Systems Limited represents the segment test system solutions.

QM Systems Limited is involved in projects surrounding:

· The creation of innovative automated assembly systems for the

manufacturing, food and pharmaceutical sectors.

· The provision of inspection systems for the automotive, aerospace rail

and pharmaceutical sectors.

· Automated test systems.

The Group tests goodwill annually for impairment or more frequently if there

are indicators that it might be impaired.

The recoverable amounts are determined from value in use calculations which use

cash flow projections based on financial budgets approved by the directors

covering a five year period. The key assumptions are those regarding the

discount rates, growth rates and expected changes to sales and direct costs

during the period. Management estimates discount rates using pre-tax rates that

reflect current market assessments of the time value of money and the risks

specific to the business. This has been estimated at 10% per annum reflecting

the prevailing pre-tax cost of capital in the Company. The growth rates are

based on forecasts and historic margins achieved in both Adien Limited, QM

Systems Limited and TED. For Adien these have been assessed as 8% growth for

revenue in years 1 and 5% for years 2 and 3 and 2.5% thereafter and 2.5% for

overhead growth. For QM Systems these have been assessed as 34% growth for

revenue in year 1 and 10 % in year 2 and 3 and 5% for years 3 to 5 and 5% for

overhead growth. For TED these have been assessed as 20% growth for revenue in

year 1 and 10 % in year 2 and 3 and 5% for years 3 to 5 and 2.5% for overhead

growth. No terminal growth rate was applied. The reason for the significant

Year 1 revenue growth in QM and TED is an expectation based on current trading

and the pipeline.

The directors believe that any reasonable possible change in the key

assumptions on which the recoverable amount is based would not cause the

carrying amount of goodwill attributed to Adien Limited, QM Systems Limited and

TED to exceed the recoverable amount except as disclosed below:

If the Adien starting revenue growth was reduced to FY 2019 levels and

inflationary growth rates applied to revenue and costs then goodwill would be

impaired by GBP130,000. The directors have regard to the sales pipeline and are

satisfied that the forecast revenues and growth rates used can be achieved.

11. Inventories

2019 2018

GBP'000 GBP'000

Raw materials 71 87

Finished goods

63 91

134 178

The replacement cost of the above inventories would not be significantly

different from the values stated.

The cost of inventories recognised as an expense during the year amounted to GBP

2,241,000 (2018: GBP1,157,000). For the Parent Company this was GBP35,000 (2018: GBP

37,000).

12. Trade and other receivables

2019 2018

GBP'000 GBP'000

Current

Trade receivables 1,038 720

Prepayments and accrued 554 455

income

1,592 1,175

13. Non-current liabilities: borrowings

2019 2018

GBP'000 GBP'000

Borrowings (note 15) 2,661 2,966

14. Trade and other payables

2019 2018

Current GBP'000 GBP'000

Bank overdraft - 13

Trade payables 1,071 743

Other taxation and social 272 329

security

Payments received on account 1,431 437

Accruals and other creditors 496 450

3,270 1,972

2019 2018

Non-current GBP'000 GBP'000

Trade payables - -

Other creditors 3 8

3 8

The performance obligations of the IFRS 15 contract liabilities (payments

received on account) are expected to be met within the next financial year.

15. Borrowing analysis

2019 2018

GBP'000 GBP'000

Due within one year

Bank and other loans 146 426

Directors' loan 1,714 1,658

Obligations under finance lease

agreements 83 62

1,943 2,146

Due after more than one year

Obligations under finance lease 89 118

agreements

Bank and other loans 139 311

Directors' loan

2,433 2,537

2,661 2,966

Repayable

Due within 1 year 1,943 2,146

Over 1 year but less than 2 years 2,472 2,774

Over 2 years but less than 5 years

189 192

4,604 5,112

Directors' loan

Included with Directors' loans and borrowings due within one year are accrued

fees and interest owing to GG Watt of GBP1,601,000 (2018: GBP1,658,000). The

accrued fees and interest is repayable on demand and no interest accrues on the

balance.

The director's loan due in more than one year is a loan of GBP2,433,000 from G G

Watt. Directors' loans attract interest at 2.15% over Bank of England base

rate. During the year to 30 June 2018 GBP100,000 (2018: GBPnil) was repaid. The

Company has the right to defer repayment for a period of 366 days.

On 13 August 2010 the Company issued GBP1 million of Convertible Unsecured Loan

Stock ("CULS") to G G Watt, the Chairman of the Company. The CULS were issued

to replace loans made by G G Watt to the Company amounting to GBP1 million and

has been recognised in non-current liabilities of GBP2,433,000.

Pursuant to amendments made on 13 November 2014 and 9 November 2018, the

principal terms of the CULS are as follows:

- The CULS may be converted at the option of Gordon Watt at a price

of 5p per share at any time prior to 13 August 2022;

- Interest is payable at a rate of 10 per cent per annum on the

principal amount outstanding until converted, prepaid or repaid, calculated and

compounded on each anniversary of the issue of the CULS. On conversion of any

CULS, any unpaid interest shall be paid within 20 days of such conversion;

- The CULS are repayable, together with accrued interest on 13 August

2022 ("the Repayment Date").

No equity element of the convertible loan stock was recognised on issue of the

instrument as it was not considered to be material.

Finance leases

Finance lease agreements with Close Motor Finance are at a rate of 4.5% and

5.19% over base rate. The future minimum lease payments under finance lease

agreements at the year end date was GBP133,822 (2018: GBP116,844) and GBP38,102

(2018: GBP62,167). The difference between the minimum lease payments and the

present value is wholly attributable to future finance charges.

Bank and other loans

A working capital loan balance of GBP227,000 was given by Mirrasand Partnership

from a trust settled by Mr G Watt. The loan attracts interest at 10% per annum.

The loan was repaid on 25 April 2019.

Included in bank and other loans is an invoice discounting facility of GBP127,000

(2018 GBP133,000).

Included in bank and other loans is a secured mortgage of GBP157,850 which

incurred an interest of 4.42% until March 2019 followed by a rate of 2.44% over

base rate for 10 years, and an interest rate of 2.64% over base rate until

March 2029. The mortgage is secured over the freehold property.

2019

Brought Cash Non-cash: Non-cash: Carried

forward flows New leases Accrued fees forward

/interest

Director loan 4,195 (207) - 159 4,147

Finance leases 180 (69) 62 (1) 172

Other 737 (469) - 17 285

Loans and 5,112 (745) 62 175 4,604

borrowings

2018

Brought Cash Cash: Cash: Non-cash: Carried

forward flows advance Discounting Accrued forward

facility* costs

Director 4,083 (10) - - 122 4,195

loan

Finance

leases 64 (34) 76 74 - 180

Other

306 - 408 - 23 737

Loans and

borrowings 4,453 (44) 484 74 145 5,112

*Included in working capital adjustments in cashflow statement

16. Financial Instruments and derivatives

The Group uses financial instruments, which comprise cash and various items,

such as trade receivables and trade payables that arise from its operations.

The main purpose of these financial instruments is to finance the Group's

operations.

The main risks arising from the Group's financial instruments are credit risk,

liquidity risk and interest rate risk. A number of procedures are in place to

enable these risks to be controlled. For liquidity risk these include profit/

cash forecasts by business segment, quarterly management accounts and

comparison against forecast. The board reviews and agrees policies for

managing this risk on a regular basis.

Credit risk

The credit risk exposure is the carrying amount of the financial assets as

shown in note 12 (with the exception of prepayments which are not financial

assets) and the exposure to the cash balances. Of the amounts owed to the

Group at 30 June 2019, the top 3 customers comprised 56.78% (2018: 19.38%) of

total trade receivables.

The Group has adopted a policy of only dealing with creditworthy counterparties

and the Group uses its own trading records to rate its major customers, also

the Group invoices in advance where possible. The Group's exposure and the

credit ratings of its counterparties are continuously monitored and the

aggregate value of transactions concluded is spread amongst approved

counterparties. Having regard to the credit worthiness of the Groups

significant customers the directors believe that the Group does not have any

significant credit risk exposure to any single counterparty.

An analysis of trade and other receivables:

2019 Neither

Carrying impaired

amount nor past Past due but not impaired

due

61-90 days 91-120 days More than

121 days

Trade and

other 1,038 919 46 13 60

receivables

2018 Neither

Carrying impaired

amount nor past Past due but not impaired

due

61-90 days 91-120 days More than

121 days

Trade and

other 720 532 102 12 74

receivables

Interest rate risk

As disclosed in note 15 the Group is exposed to changes in interest rates on

its borrowings with a variable element of interest. If interest rates were to

increase by one percentage point the interest charge would be GBP28,000 higher.

An equivalent decrease would be incurred if interest rates were reduced by one

percentage point.

The Group has adopted a policy of only dealing with creditworthy counterparties

and the Group uses its own trading records to rate its major customers, also

the Group invoices in advance where possible. The Group's exposure and the

credit ratings of its counterparties are continuously monitored and the

aggregate value of transactions concluded is spread amongst approved

counterparties. Having regard to the credit worthiness of the Groups

significant customers the directors believe that the Group does not have any

significant credit risk exposure to any single counterparty.

The Group allows an average receivables payment period of 60 days after invoice

date. It is the Group's policy to assess receivables for recoverability on an

individual basis and to make provision where it is considered necessary. No

debtors' balances have been renegotiated during the year or in the prior year.

As at 30 June 2019, trade receivables of GBPnil (2018: GBPnil) were impaired and

provided for.

Liquidity risk

As stated in note 1 the Executive Chairman, G G Watt, has pledged to provide

ongoing financial support for a period of at least twelve months from the

approval date of the Group statement of financial position. It is on this basis

that the directors consider that neither the Group nor the Company is exposed

to a significant liquidity risk. Notes 14 and 15 disclose the maturity of

financial liabilities.

Contractual maturity analysis for financial liabilities, (see note 15 for

maturity analysis of borrowings):

2019 Due or due Due between Due between Due between Total

in less 1-3 months 3 months-1 1-5 years

than 1 year

month

Trade and

other 1,567 - - 3 1,570

payables

2018 Due or due Due between Due between 3 Due Total

in less 1-3 months months-1 year between

than 1 1-5 years

month

Trade and

other 1,206 - - 8 1,214

payables

Financial liabilities of the Company are all due within less than one month

with the exception of the intercompany balances that are due between 1 and 5

years.

Interest rate risk

The Group finances its operations through a mixture of shareholders' funds and

borrowings. The Group borrows exclusively in Sterling and principally at fixed

and floating rates of interest and are disclosed at note 16.

Fair value of financial instruments

Loans and receivables are measured at amortised cost. Financial liabilities

are measured at amortised cost using the effective interest method. The

directors consider that the fair value of financial instruments are not

materially different to their carrying values.

Capital risk management

The Group's objectives when managing capital are to safeguard the Group's

ability to continue as a going concern in order to be able to move to a

position of providing returns for shareholders and benefits for other

stakeholders and to maintain an optimal capital structure to reduce the cost of

capital.

The Group manages trade debtors, trade creditors and borrowings and cash as

capital. The entity is meeting its objective for managing capital through

continued support from GG Watt as described per Note 1.

17. Share capital

2019 2019 2018 2018

No GBP'000 No GBP'000

Authorised

Ordinary shares of 1p 40,000,000 400 40,000,000 400

each

Allotted and fully

paid

Brought forward 34,020,515 340 33,020,515 330

Issued during the 340,000 4 1,000,000 10

year

Carried forward

34,360,515 344 34,020,515 340

Fully paid ordinary shares carry one vote per share and carry a right to

dividends.

During the year the Company issued 340,000 ordinary 1p shares for 5p per share

as part of the consideration for the vendor loan adjustment regarding the

acquisition of Thomson Engineering Design Limited.

11,403,703 (2018:11,403,703) share options were outstanding at the year end,

comprising the 1m employee options and the 10,403,703 share options and

warrants held by directors disclosed below. No options or warrants were

exercised.

Share based payments have been included in the financial statements where they

are material. No share based payment expense has been recognised.

No deferred tax asset has been recognised in relation to share options due to

the uncertainty of future available profits.

The director and employee share options were issued as part of the Group's

strategy on key employee remuneration, they lapse if the employee ceases to be

an employee of the Group during the vesting period.

Employee options

Date Options Exercisable Number of Shares Exercise Price

Between March 2015 and March 2022 500,000 3.75p

Between July 2016 and July 2023 100.000 3.00p

Between November 2019 and 400,000 3.875p

November 2026

Directors' share options

No. of options

Granted Date from

At start during At end of Exercise which

of year year year price exercisable

R MacDonnell 500,000 - 500,000 3.0p 6-Mar-15

S P 200,000 - 200,000 3.9p 15-Nov-19

Padmanathan

The Company's share price at 30 June 2019 was 4.25. The high and low during the

period under review were 6.20p and 3.52p respectively.

In addition to the above, in consideration of loans made to the Company, G G

Watt has warrants over 3,703,703 ordinary shares at an exercise price of 13.5p

and a further 6,000,000 ordinary shares at an exercise price of 3.0p, the

warrants expired on 12 December 2018.

The weighted average contractual life of options and warrants outstanding at

the year-end is 3.89 years (2018: 1.2 years).

18. Financial commitments

2019 2018

GBP'000 GBP'000

Capital commitments

Capital expenditure commitments

contracted for, but

not provided in the financial - -

statements were as follows:

Operating lease commitments

The future aggregate minimum

lease payments under

non-cancellable operating leases

are as follows:

2019 2018 2019 2018

Land and Building Motor Vehicles

* Within one year 37 35 16 16

* One to five years 140 - 19 -

* Over five years 12 - - -

189 35 35 16

19. Related party transactions

Directors' loan disclosures are given in note 15. The interest payable to

directors in respect of their loans during the year was:

G G Watt - GBP146,993

The directors are considered the key management personnel of the Company.

Remuneration to directors is disclosed in note 6.

As at 30 June 2019, there was an amount of GBPnil (2018: GBP3,444) due from Online

Engineering Limited, a company that G G Watt is also a Director.

Included within the amounts due from and to Group undertakings were the

following balances:

2019 2018

GBP GBP

Balance due from:

Adien Limited - -

QM Systems Limited - 459,375

Thomson Engineering Design Limited 322,603 73,643

Balance due to:

Adien Limited 106,858 32,141

QM Systems Limited 1,125,390 1,405,866

These intergroup balances vary through the flow of working capital requirements

throughout the Group as opposed to intergroup trading.

There is no ultimate controlling party of PipeHawk plc.

20. Subsequent events

On 16 October 2019 the Group announced that it had acquired the entire issued

share capital of Wessex Precision Instruments Limited ("Wessex") for a

consideration of GBP1 (the "Acquisition"). Wessex produces and sells a range of

equipment for testing the slip resistance characteristics of aggregates used in

public areas, including in supermarkets and around swimming pools. The Board

believes that the Wessex business presents a number of synergistic cost saving

opportunities for the Company and will complement the Company's subsidiary QM

Systems and its existing portfolio of test and measurement equipment.

In the year ended 31 March 2019, Wessex recorded unaudited revenues of

approximately GBP340,000 and an unaudited loss after tax of approximately GBP

61,000. As at 31 March 2019, Wessex had net liabilities of approximately GBP

52,000.

The Company is evaluating the fair value of the assets acquired and liabilities

assumed and any necessary pro forma financial information.

21. Copies of Report and Accounts

Copies of the Report and Accounts will be posted to shareholders later today

and will be shortly be available from the Company's registered office, Manor

Park Industrial Estate, Wyndham Street, Aldershot, Hampshire GU12 4NZ and from

the Company's website www.pipehawk.com.

22. Notice of Annual General Meeting

The annual general meeting of PipeHawk plc will be held at the offices of

Allenby Capital Limited, 5 St Helen's Place, London, EC3A 6AB at 10:00 a.m. on

Thursday 12 December 2019.

END

(END) Dow Jones Newswires

October 23, 2019 02:00 ET (06:00 GMT)

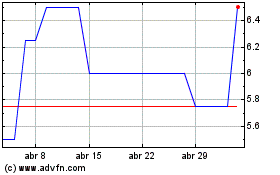

Pipehawk (LSE:PIP)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Pipehawk (LSE:PIP)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024