TIDMBGLF

RNS Number : 9345Q

Blackstone / GSO Loan Financing Ltd

24 October 2019

THIS ANNOUNCEMENT IS NOT FOR RELEASE, PUBLICATION OR

DISTRIBUTION, DIRECTLY OR INDIRECTLY, IN OR INTO, THE UNITED

STATES, AUSTRALIA, SOUTH AFRICA, CANADA OR JAPAN OR ANY OTHER

JURISDICTION WHERE TO DO SO MIGHT CONSTITUTE A VIOLATION OF THE

RELEVANT LAWS OR REGULATIONS OF SUCH JURISDICTION

This announcement is not an offer to sell, or a solicitation of

an offer to acquire, securities in the United States or in any

other jurisdiction. Neither this announcement nor any part of it

shall form the basis of or be relied on in connection with or act

as an inducement to enter into any contract or commitment

whatsoever.

24 October 2019

Blackstone / GSO Loan Financing Limited

("BGLF" or the "Company")

LEI: 549300NOGRTX0U7CWK43

Conversion of C shares

BGLF, a self-managed Jersey registered alternative investment

fund, announces that as at 1 October 2019, it has reinvested

EUR62.6m into BGCF following the sale of relevant assets acquired

under the C Share rollover process in January 2019, which

represents 85.8% of the value of assets in the C share pool.

Inclusive of cash held within the C share pool, this represents

approximately 87.3% of the C share pool asset value.

Accordingly, the Board of BGLF is pleased to announce that the

Company intends to convert the C Shares into Ordinary Shares (the

"Conversion"). In the absence of unforeseen circumstances, the

Company expects the Calculation Date, being close of business on

the date on which the Conversion Ratio will be calculated, to fall

on 31 October 2019. The calculation of the Conversion Ratio will be

based on the net assets attributable to the Ordinary Shares and C

Shares as at close of business on 31 October 2019, which, along

with the expected timing of six to twelve months, is in accordance

with the Company's prospectus. The Conversion Ratio is expected to

be announced before the end of November 2019.

The Company intends to make a further announcement in due course

setting out the Conversion Ratio applying to the Conversion, the

expected date when such Conversion will occur and the number of new

Ordinary Shares to be issued.

Holders of C Shares, once converted, will not be entitled to

receive the Q3 2019 interim dividend of EUR0.025 cents that was

declared on the Ordinary Shares on 18 October 2019 which will be

payable to Ordinary Shareholders on the register on 1 November 2019

and is due to be paid on 29 November 2019. For the avoidance of

doubt, however, such holders will be entitled to receive the Q3

2019 C Share interim dividend of EUR0.0221 cents that was also

declared on 18 October 2019 to C Shareholders on the register on 1

November 2019. They will also be entitled to receive the quarterly

dividend to be declared in due course on the Ordinary Shares for

the quarter ending 31 December 2019, being the first dividend to be

declared after the Conversion.

Terms used in this announcement shall, unless the context

otherwise requires, bear the meanings given to them in the

prospectus published by the Company on 23 November 2018.

Enquiries:

BNP Paribas Securities Services S.C.A., Jersey Tel: +44 (0)1534

Branch 709181 / +44 (0)1534

(Company Secretary) 813873

IFC 1, The Esplanade, St Helier, Jersey JE1

4BP

Siobhan Lavery / Melissa Le Cheminant

Nplus1 Singer Advisory LLP Tel: +44 (0)20 7496

(Sponsor, Financial Adviser and Broker) 3000

James Maxwell / Ben Farrow

NOTE: PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE

PERFORMANCE RESULTS AND THERE CAN BE NO ASSURANCE THAT BGLF WILL

ACHIEVE COMPARABLE RESULTS.

IMPORTANT INFORMATION

Any reference herein to future returns or distributions is a

target and not a forecast and there can be no guarantee or

assurance that it will be achieved.

This document has been issued by Blackstone / GSO Loan Financing

Limited (the "Company"), and should not be taken as an inducement

to engage in any investment activity and is for the purpose of

providing information about the Company. This document does not

constitute or form part of, and should not be construed as, any

offer for sale or subscription of, or solicitation of any offer to

buy or subscribe for, any share in the Company or securities in any

other entity, in any jurisdiction, including the United States,

Canada, Japan, South Africa nor shall it, or any part of it, or the

fact of its distribution, form the basis of, or be relied on in

connection with, any contract or investment decision whatsoever, in

any jurisdiction.

This document, and the information contained therein, is not for

viewing, release, distribution or publication in or into the United

States, Canada, Japan, South Africa or any other jurisdiction where

applicable laws prohibit its release, distribution or publication,

and will not be made available to any national, resident or citizen

of the United States, Canada, Japan or South Africa. The

distribution of this document in other jurisdictions may be

restricted by law and persons into whose possession this document

comes must inform themselves about, and observe, any such

restrictions. Any failure to comply with the restrictions may

constitute a violation of the federal securities law of the United

States and the laws of other jurisdictions.

The shares issued and to be issued by the Company (the "Shares")

have not been and will not be registered under the US Securities

Act of 1933, as amended (the "Securities Act"), or with any

securities regulatory authority of any state or other jurisdiction

of the United States. The Shares may not be offered, sold, resold,

pledged, delivered, distributed or otherwise transferred, directly

or indirectly, into or within the United States, or to, or for the

account or benefit of, US persons (as defined in Regulation S under

the Securities Act). No public offering of the Shares is being made

in the United States.

The Company has not been and will not be registered under the US

Investment Company Act of 1940, as amended (the "Investment Company

Act") and, as such, holders of the Shares will not be entitled to

the benefits of the Investment Company Act. No offer, sale, resale,

pledge, delivery, distribution or transfer of the Shares may be

made except under circumstances that will not result in the Company

being required to register as an investment company under the

Investment Company Act. Neither the U.S. Securities and Exchange

Commission (the "SEC") nor any state securities commission has

approved or disapproved of the Shares or passed upon or endorsed

the merits of the offering of the Shares or the adequacy or

accuracy of the Prospectus. Any representation to the contrary is a

criminal offence in the United States. In addition, the Shares are

subject to restrictions on transferability and resale in certain

jurisdictions and may not be transferred or resold except as

permitted under applicable securities laws and regulations.

Investors may be required to bear the financial risks of their

investment in the Shares for an indefinite period of time. Any

failure to comply with these restrictions may constitute a

violation of the securities laws of any such jurisdictions.

This document is directed only at: (i) persons having

professional experience in matters relating to investments who fall

within the definition of "investment professionals" in Article

19(5) of the Financial Services and Markets Act 2000 (Financial

Promotion) Order 2005; or (ii) high net worth bodies corporate,

unincorporated associations and partnerships and trustees of high

value trusts as described in Article 49(2) of the Financial

Services and Markets Act 2000 (Financial Promotion) Order 2005 and

persons who receive this document who do not fall within (i) or

(ii) above should not rely on or act upon this document.

No liability whatsoever (whether in negligence or otherwise)

arising directly or indirectly from the use of this document is

accepted and no representation, warranty or undertaking, express or

implied, is or will be made by the Company, or any of their

respective directors, officers, employees, advisers,

representatives or other agents ("Agents") for any information or

any of the opinions contained herein or for any errors, omissions

or misstatements. None of the Agents makes or has been authorised

to make any representation or warranties (express or implied) in

relation to the Company or as to the truth, accuracy or

completeness of this document, or any other written or oral

statement provided. In particular, no representation or warranty is

given as to the achievement or reasonableness of, and no reliance

should be placed on any projections, targets, estimates or

forecasts contained in this document and nothing in this document

is or should be relied on as a promise or representation as to the

future.

Unless otherwise indicated, the information provided herein is

based on matters as they exist as of the date of preparation and

not as of any future date. Recipients of this document are

encouraged to contact the Company's representatives to discuss the

procedures and methodologies used to make the projections and other

information provided herein.

All investments are subject to risk, including the loss of the

principal amount invested. Past performance is no guarantee of

future returns. All investments to be held by the Company involve a

substantial degree of risk, including the risk of total loss. The

value of shares and the income from them is not guaranteed and can

fall as well as rise due to stock market and currency movements.

When you sell your investment you may get back less than you

originally invested. You should always seek expert legal,

financial, tax and other professional advice before making any

investment decision.

Blackstone / GSO Loan Financing Limited is a self-managed Jersey

registered alternative investment fund, and is regulated by the

Jersey Financial Services Commission. The Jersey Financial Services

Commission does not take any responsibility for the financial

soundness of the Company or for the correctness of any statements

made or expressed in this document.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

CONCKNDDOBDDKKB

(END) Dow Jones Newswires

October 24, 2019 02:00 ET (06:00 GMT)

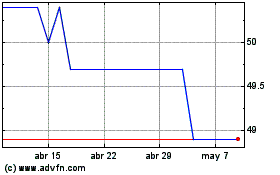

Blackstone Loan Financing (LSE:BGLP)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

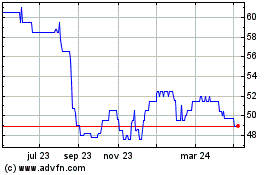

Blackstone Loan Financing (LSE:BGLP)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024