Finra Fines BNP Parbas $15 Million Over Money-Laundering Controls

24 Octubre 2019 - 12:30PM

Noticias Dow Jones

By Patrick Thomas

The Financial Industry Regulatory Authority said Thursday it

fined BNP Paribas SA $15 million for failing to develop an

anti-money-laundering program that could detect suspicious penny

stock and wire transfer activity.

The fine relates to activity from BNP Paribas Securities Corp.

and BNP Paribas Prime Brokerage Inc.

Finra said that between February 2013 and March 2017, BNP lacked

a written anti-money-laundering program that could reasonably be

expected to detect questionable activity in its penny stock deposit

and resale and wire transfers.

The self-regulatory organization claims BNP's

anti-money-laundering oversight was understaffed and until 2016, it

didn't include any surveillance that could target suspicious

penny-stock activity.

Finra says that for a two-year period, BNP processed more than

70,000 wire transfers with a value of $233 billion, but only had

one investigator to review alerts. Finra says BNP didn't fully

revise its program until March 2017, despite identifying many of

the alleged problems with its program in 2014.

A BNP representative declined to comment.

BNP didn't admit or deny the charges as part of its settlement

but consented to the entry of FINRA's findings.

Write to Patrick Thomas at Patrick.Thomas@wsj.com

(END) Dow Jones Newswires

October 24, 2019 13:15 ET (17:15 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

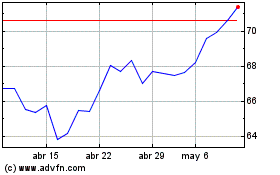

BNP Paribas (EU:BNP)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

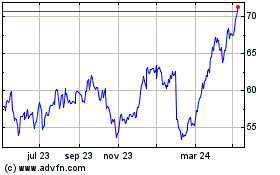

BNP Paribas (EU:BNP)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024