TIDMYCA

RNS Number : 3960R

Yellow Cake PLC

29 October 2019

29 October 2019

Yellow Cake plc ("Yellow Cake" or the "Company")

QUARTERLY OPERATING UPDATE

Yellow Cake, a specialist company operating in the uranium

sector with a view to holding physical uranium for the long term,

is pleased to report its performance for the quarter ended 30

September 2019.

Highlights

-- Estimated net asset value at 30 September 2019 of GBP2.32 per

share ([1]) or US$252.2 million, comprising 9.62 million lbs of

physical uranium (U(3) O(8) ) valued at a spot price of US$25.65/

lb ([2]) and other net assets.

-- Value of U(3) O(8) held by Yellow Cake increased over the

quarter from US$237.5 million ([3]) to US$246.7 million ([4]) .

-- Total U(3) O(8) holdings of 9.62 million lbs acquired at an average cost of US$21.68/ lb.

-- Total increase in value of U(3) O(8) held by Yellow Cake of

18.3% to US$246.7 million ([4]) relative to the aggregate

acquisition cost of US$208.5 million.

-- The Section 232 investigation into uranium imports into the

US concluded during the quarter, with a decision by the US

President not to implement new trade restrictions on imports. As

part of this, a Nuclear Fuels Working Group was established to

review the nuclear fuel supply chain, with their recommendations

expected in mid-November 2019.

-- The Company notes that Yellow Cake shares are currently

trading at a significant discount to net asset value. Should this

significant discount persist, it is the intention of the Yellow

Cake board to consider implementing a share buyback program as a

means of cost effectively acquiring additional exposure to

uranium.

Andre Liebenberg, CEO of Yellow Cake, said:

"Trading activity in the uranium market remains subdued as we

await the findings of the US Nuclear Fuels Working Group. Though

this uncertainty continues to weigh on the uranium price in the

near term, we are positive about the medium and long term outlook

for uranium.

We expect activity to increase in due course as buyers re-enter

the market and we see a return to more normal levels of term

contracting, in particular from US utilities who have been holding

off making purchase decisions. We believe the longer term supply

characteristics of uranium make the commodity a compelling

investment opportunity, further emphasised by the recent decision

by the world's largest producer Kazatomprom to extend production

caps. This will remove nearly 15 million pounds of uranium from the

market in 2021, a material 10% of estimated future global supply.

We remain confident in our strategy and investment proposition.

With our share price trading well below NAV, this presents an

opportunity for us to acquire additional exposure to uranium at a

discount to the spot price, through a share buyback programme. The

Board will consider this if the significant discount persists."

Uranium Market Developments and Outlook

Uranium Market Developments

During the quarter, Kazatomprom announced that its plan to

reduce uranium production by 20% (from previously planned levels)

would be extended through 2021 due to persistent low market prices.

That decision will remove nearly 15 million lbs U(3) O(8) from

anticipated global primary supply in 2021.

On 12 July 2019, following the Section 232 investigation

initiated by the US Department of Commerce (DOC) into uranium, the

President of the United States announced his decision not to impose

new trade restrictions on uranium imports into the country. While

the Secretary of Commerce found that uranium was being imported

into the United States in such quantities as to threaten national

security, the President did not concur with the DOC's finding.

However, the White House agreed that the DOC's report raised

significant concerns regarding the impact of uranium imports on

national security and domestic uranium mining and that a more

comprehensive analysis of national security considerations with

respect to the entire domestic nuclear fuel cycle was therefore

necessary.

In order to evaluate the nuclear fuel cycle, the President

established a Nuclear Fuel Working Group (NFWG) comprised of

thirteen federal government agencies/departments which was to

report back to the White House within 90 days (i.e. on 10 October),

advising of the group's findings and making recommendations to

further enable domestic nuclear fuel production, if required. The

White House granted the NFWG a 30-day extension to mid-November in

order to complete the inter-agency review of the group's

recommendations

Market uncertainties associated with the Section 232

investigation and the subsequent formation of the NFWG contributed

to a significant reduction in spot uranium volumes during the third

quarter when a total of 12.9 million lbs U(3) O(8) were transacted

([5]) compared to 34.9 million lbs U(3) O(8) during the third

quarter of 2018. According to UxC LLC, aggregate spot market

volumes for the nine months to 30 September 2019 approximated 42.5

million lbs U(3) O(8) , a decline of almost 65% compared to the

same period in 2018 ([6]) .

Unlike the third quarter of 2018 when record-setting spot market

volumes led to a price rise from US$22.55/ lb U(3) O(8) to

US$27.35/ lb U(3) O(8) , the comparable three month period in 2019

saw a more modest spot price increase from US$24.70/ lb U(3) O(8)

to US$25.65/ lb U(3) O(8) at the end of September.

During 2018, the United States implemented further economic

sanctions against the Republic of Iran. At that time, sanction

waivers were granted which allowed the continuation of several

nuclear non-proliferation projects within Iran being carried out by

Russian, Chinese and European entities. These waivers must be

renewed on a periodic basis (currently 90-days) with the current

waivers expiring at the end of October. In the event that these

waivers are not renewed, international trade in nuclear fuel could

be significantly impacted, especially the importation of

Russian-sourced nuclear fuel into the United States where nuclear

utilities rely upon Russian-sourced enrichment services for

approximately 20% of reactor requirements. Non-Russian-origin

nuclear fuel components could then be expected to gain additional

value.

On 5 September, the World Nuclear Association released the 2019

edition of the bi-annual market study, "The Nuclear Fuel Report -

Global Scenarios for Demand and Supply Availability 2019-2040."

Significant changes from the previous edition included the three

uranium demand scenarios all showing varying but positive growth

rates through 2040, so-called secondary supplies declining through

the next decade, as well as a clear acknowledgement that the global

uranium market is heading into a period of supply uncertainty where

as yet-to-be identified supply sources ("unspecified") will be

required in order to balance demand and supply.

Several new reactors have entered commercial operation thus far

in 2019. Shin Kori-4 was connected to the South Korean grid in

April with Shin Hanual-1 expected before the end of the year. In

Russia, Novovoronezh II (second unit) entered operation in May. In

April, approval was granted in Egypt to commence construction of

four VVER-1200 reactors at the planned El Dabaa site. Duke Energy

announced that it would be filing for additional 20-year operating

license extensions for its fleet of eleven reactors.

Market Outlook

Submission of the NFWG report findings and recommendations

originally scheduled for 10 October was expected to clarify the US

Administration's policy regarding the domestic nuclear fuel cycle,

thus reducing market uncertainty attributable to that policy review

process. The 30-day extension has delayed that process until

mid-November.

Failure to extend the current waivers of nuclear-related

economic sanctions applied by the US on Iran could lead to

significant market disruption and incrementally higher values for

non-Russian-sourced nuclear fuel components.

There remains a general expectation that market activity will

likely increase as utilities, producers and financial buyers

re-enter the market. Furthermore, term contracting, especially by

US nuclear utilities is expected to increase in order to address

future uncovered uranium requirements.

Net Asset Value

Yellow Cake's estimated net asset value at 30 September 2019 was

GBP2.32 per share ([7]) or US$252.2 million, consisting of

9,616,385 lbs of U(3) O(8) valued at a spot price of US$25.65/ lb

([8]) , a derivative financial liability of US$2.7 million ([9])

and other net assets of US$8.2 million ([10]) .

Based on the spot price of US$24.00/ lb published by UxC LLP,

Yellow Cake's estimated net asset value as at 28 October 2019 was

GBP2.08 per share ([11]) . As at close on 28 October 2019, the

Company's share price was GBP1.90 per share, which represents a 9%

discount to the above estimated net asset value of GBP2.08 per

share.

This announcement contains inside information for the purposes

of Article 7 of Regulation (EU) no 596/2014

ENQUIRIES:

Yellow Cake plc

Andre Liebenberg, CEO Carole Whittall, CFO

Tel: +44 (0) 153 488 5200

Nominated Adviser and Joint Broker: Numis Securities Limited

John Prior Paul Gillam

James Black

Tel: +44 (0) 207 260 1000

Joint Broker: Berenberg

Matthew Armitt Detlir Elezi

Tel: +44 (0) 203 207 7800

Financial Adviser: Bacchus Capital Advisers

Peter Bacchus Richard Allan

Tel: +44 (0) 203 848 1640

Investor Relations: Powerscourt

Peter Ogden

Tel: +44 (0) 779 3 85 8211

ABOUT YELLOW CAKE

Yellow Cake is a London-listed company, headquartered in Jersey,

which offers exposure to the uranium spot price. This is achieved

through its strategy of buying and holding physical triuranium

octoxide ("U(3) O(8) "). It may also seek to add value through the

acquisition of uranium royalties and streams or other uranium

related activities. Yellow Cake seeks to generate returns for

shareholders through the appreciation of the value of its holding

of U(3) O(8) and its other uranium related activities in a rising

uranium price environment. The business is differentiated from its

peers by its lower cost base and ten-year Framework Agreement for

the supply of U(3) O(8) with Kazatomprom, the world's largest

uranium producer. Yellow Cake currently holds 9.62 million lb of

U(3) O(8) , all of which is held in storage in North America.

FORWARD LOOKING STATEMENTS

Certain statements contained herein are forward looking

statements and are based on current expectations, estimates and

projections about the potential returns of the Company and the

industry and markets in which the Company will operate, the

Directors' beliefs and assumptions made by the Directors. Words

such as "expects", "anticipates", "should", "intends", "plans",

"believes", "seeks", "estimates", "projects", "pipeline", "aims",

"may", "targets", "would", "could" and variations of such words and

similar expressions are intended to identify such forward looking

statements and expectations. These statements are not guarantees of

future performance or the ability to identify and consummate

investments and involve certain risks, uncertainties and

assumptions that are difficult to predict, qualify or quantify.

Therefore, actual outcomes and results may differ materially from

what is expressed in such forward looking statements or

expectations. Among the factors that could cause actual results to

differ materially are: uranium price volatility, difficulty in

sourcing opportunities to buy or sell U(3) O(8) , foreign exchange

rates, changes in political and economic conditions, competition

from other energy sources, nuclear accident, loss of key personnel

or termination of the services agreement with 308 Services Limited,

changes in the legal or regulatory environment, insolvency of

counterparties to the Company's material contracts or breach of

such material contracts by such counterparties. These

forward-looking statements speak only as at the date of this

announcement. The Company expressly disclaims any obligation or

undertaking to disseminate any updates or revisions to any forward

looking statements contained herein to reflect any change in the

Company's expectations with regard thereto or any change in events,

conditions or circumstances on which any such statements are based

unless required to do so by applicable law or the AIM Rules.

[1] Net asset value per share on 30 September 2019 is calculated

assuming 88,215,716 ordinary shares in issue, the Bank of England's

daily exchange rate of 1.23200 on 30 September 2019 and the

month-end spot prices published by UxC LLC on 30 September

2019.

[2] Month-end spot price published by UxC LLC on 30 September 2019.

[3] Based on the month end spot price published by UxC LLC on 24 June 2019

[4] Based on the month end spot price published by UxC LLC on 30 September 2019.

[5] Ux Weekly; 30 September 2019; Vol 33, No 39 / Ux Weekly; 2

September 2019; Vol 33, No 35 Ux Weekly; 5 August 2019; Vol 33, No

31.

[6] Ux Weekly; 30 September 2019; Vol 33, No 39.

[7] Net asset value per share is calculated assuming 88,215,716

ordinary shares in issue, the Bank of England's daily exchange rate

of 1.23200 on 30 September 2019 and the month-end spot prices

published by UxC LLC on 30 September 2019.

[8] Based on the month-end spot prices published by UxC LLC on 30 September 2019.

[9] Estimated current value of the Kazatomprom repurchase option

under the framework agreement, which is a potential liability of

US$6.5 mm and may only be exercised if the spot U(3) O(8) price

exceeds US$37.50/ lb for a period of 14 days during the period

between 4 July 2021 and 30 June 2027.

[10] Includes cash and cash equivalents of US$8.8 million.

[11] Net asset value per share is calculated assuming 88,215,716

ordinary shares in issue, a GBP/USD exchange rate of 1.2863 and the

spot price published by UxC LLC on 28 October 2019.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

TSTUWAURKBARUUA

(END) Dow Jones Newswires

October 29, 2019 03:00 ET (07:00 GMT)

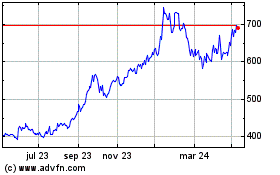

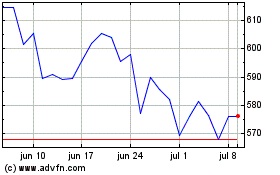

Yellow Cake (LSE:YCA)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Yellow Cake (LSE:YCA)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024