Iluka Considers Spinning Off MAC Royalty

30 Octubre 2019 - 3:54PM

Noticias Dow Jones

By David Winning

SYDNEY--Iluka Resources Ltd. (ILU.AU) is revisiting the

possibility of spinning off an iron-ore royalty that has become

more valuable as partner BHP Group Ltd. (BHP.AU) invests more

heavily in Australia's Pilbara region.

Perth-based Iluka said the decision to consider separating the

royalty--known to investors as Mining Area C--followed a

significant increase in the current and future "materiality of

MAC's contribution to Iluka's overall valuation" as BHP progresses

the development of the South Flank iron-ore project in Pilbara.

The review will consider the demerger of MAC, among options that

include possible changes to dividend policies. Capital

requirements, business plans, management structures, and cost and

tax implications will also be examined, Iluka said.

Iluka's royalty, calculated either on each ton of iron ore sold

to customers or produced from the mining area, was secured as part

of the sale of a joint venture interest in the early 1990s.

Iluka is the world's largest producer of zircon, which makes

ceramic products opaque and is used in everything from wash basins

to kitchen tiles. The company is also a major exporter of minerals

such as rutile, used to make pigments in paint.

"Given the substantial scale of the mineral sands business and

the prospective scale of MAC, the time is right to formally review

Iluka's corporate and capital structure with the objective of fully

capitalizing on the respective features of both assets," Chairman

Greg Martin said.

An update on the review's progress is planned alongside Iluka's

annual result in February.

Write to David Winning at david.winning@wsj.com

(END) Dow Jones Newswires

October 30, 2019 17:39 ET (21:39 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

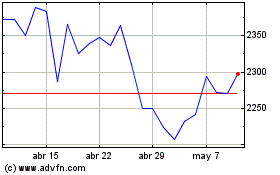

Bhp (LSE:BHP)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

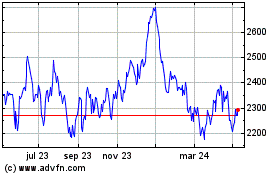

Bhp (LSE:BHP)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024