TIDMTHR

RNS Number : 7554R

Thor Mining PLC

31 October 2019

31 October 2019

THOR MINING PLC

("THOR" OR THE "COMPANY")

QUARTERLY REPORT JULY TO SEPTEMBER 2019

Highlights Outlook for December Quarter

2019

------------------------------------------------------------------- --------------------------------------------------------------

TUNGSTEN & MULTI COMMODITIES

Molyhil, NT Australia

* Marketing activities to lock in project finance and * Complete 2(nd) phase drilling at Bonya, and prepare

off-take agreements for both tungsten and molybdenum initial tungsten resource estimate

concentrates.

* Continued discussions with potential Molyhil project

* Significant upgrade Molyhil Mineral Resource financiers and off-take partners.

Estimate.

* Tungsten price has strengthened by more than 25%

* Drilling commences at Bonya. since early September.

Pilot Mountain, Nevada USA

* Commenced discussions with various US investors aimed * Continuing discussions with US investors to secure

at securing specific investment to progress this project investment.

project.

* Metallurgical process optimisation work.

COPPER

Kapunda, SA Australia

* Regulatory approval work for field pump testing at * Field pump testing at Kapunda.

Kapunda.

Moonta, SA Australia

* Mineral Resource Estimate (MRE) on three of the * Follow-up analysis to include additional drill-hole

Moonta copper deposits for 114,000 tonnes copper data in mineral resource estimate.

metal.

GOLD & OTHER COMMODITIES

* Negotiations with traditional owner groups to secure * Secure grant of additional tenements

grant of other tenements.

* Initial ground reconnaissance survey over Pilbara

* Preliminary field activity preparation tenements.

CORPORATE & FINANCE

During the quarter, the board of the Company was strengthened

with the appointment of Mr Mark Potter.

Subsequent to the end of the quarter, the Company advised of a

two stage placing of capital, to raise, before expenses,

UKGBP510,000 (approximately A$955,000).

Commenting, Mr Mick Billing, Executive Chairman of Thor Mining,

said:

"Despite challenging market conditions, particularly for

tungsten, we remain confident in the quality of the Molyhil

project, and continue to focus on adding to its value through

resource upgrades and exploration drilling at Bonya. We look

forward to the initial resource estimates at Bonya which we expect

late in the current quarter. We believe this will significantly

improve the production profile and economics of the Molyhil

project, and also increase the overall attractiveness of the

project to strategic investors and offtake partners. Discussions

with these parties continue."

"In addition, we are pleased to have recently commenced

discussions with a number of US investors for investment in the

Pilot Mountain project."

"Our ISR copper investments continue to show great promise and

have now advanced to initial drill and pump flow test program stage

which is expected to commence shortly."

"The directors and management have also initiated a program of

cutting non-essential project and corporate expenditure in order to

conserve cash resources whilst discussions with strategic and

financial investors for Molyhil and Pilot Mountain continue."

TUNGSTEN PROJECTS

Tungsten and Molybdenum Price Trends

Tungsten prices continued a downward slide until early

September, then improved rapidly, recovering some of the ground

lost in previous months. The price recovery is largely attributed

to the acquisition of the FANYA warehouse stocks in China, removing

much of the potential market overhang.

At the date of this report, the price of tungsten, per mtu of

APT (Ammonium Para Tungstate) was US$227.50/mtu, while the

molybdenum price sits at US$10.00/lb.

Industry discussion continues to forecast tight supply

conditions for tungsten concentrates and downstream products, with

dominant supplier, China, enforcing improved environmental

standards, and restricting the issue of new mine production

licences . This implies a recovery in tungsten pricing in the near

term. In addition, industry expectations are that molybdenum will

be subject to supply constraints for several years.

MOLYHIL TUNGSTEN PROJECT - NT (100% Thor)

During the quarter, Thor continued discussions with various

potential partners who have expressed interest, in either off-take,

joint venture or debt finance arrangements. It is hoped that, on

the back of improved tungsten prices, and successful drilling

outcomes at the nearby Bonya deposits, a favourable arrangement can

be finalised in the near term.

Adjacent to Molyhil, the Bonya tenements, in which Thor holds a

40% interest, host outcropping tungsten deposits, a copper resource

and a vanadium deposit.

Subsequent to the end of the quarter, a reverse circulation (RC)

drilling program of approximately 2,000 metres commenced at Bonya

with the objective of generating sufficient assay information for a

mineral resource estimate on two of the known tungsten

deposits.

A full background on the project is available on the Thor Mining

website www.thormining.com/projects.

During the quarter also, the Company reported assays results

from the second of two large diameter diamond drill holes at

Molyhil, which were conducted to obtain sufficient material to

produce additional scheelite and molybdenum concentrates for

potential customers. Best assay results from the second of these

holes was 5 metres(m) @ 1.74% WO (tungsten trioxide), including 2m

@ 0.81% Mo (molybdenum) from 78m and 7m @ 1.58%WO(3) from 88m

including 4m @ 0.44%Mo from 88m.

Subsequent to the end of the quarter, the Company reported an

updated Mineral resource estimate for the Molyhil deposit

comprising Indicated and Inferred Mineral Resources of 4.7 million

tonnes at 0.28% WO (Tungsten trioxide), 0.14% Mo (Molybdenum),

0.05% Cu (Copper), and 18.0% Fe (Iron) above a cut-off grade of

0.12% WO(3) equivalent.

The revised resource estimate increases contained WO by 1.5% ,

and contained Mo by 9.3% compared with the previous estimate, and

includes copper, which had not previously been reported since

2006.

An update to the Open Cut Ore Reserve, and the Definitive

feasibility Study (DFS) has not been commissioned at this stage,

however the directors may elect to revisit these in the event that

mineral resource estimates for the nearby Bonya deposits, if and

when produced, suggest potential for a material upgrade.

Table A: Molyhil Summary JORC (2012) Mineral Resource Estimate -

Reported 10 October, 2019

Classification '000 WO(3) Mo Cu Fe

Tonnes

--------

Grade Tonnes Grade Tonnes Grade Tonnes Grade

% % % %

---------------- -------- ----- ------ ----- ------- ----- ------ ------

Indicated 3,780 0.29 11,000 0.14 5,400 0.05 1,800 18.7

Inferred 930 0.25 2,300 0.15 1,400 0.04 300 15.2

-------- ----- ------ ----- ------- ----- ------ ------

Total 4,710 0.28 13,300 0.14 6,800 0.05 2,200 18.0

-------- ----- ------ ----- ------- ----- ------ ------

Notes:

-- Thor Mining PLC holds 100% equity interest in this

project.

-- The Mineral Resource is reported at 0.12% WO(3) equivalent

cut-off and above 200mRL only on a dry, in-situ basis

-- The Company is not aware of any information or data which

would materially affect the Mineral Resource, and all assumptions

and key technical parameters relevant to the previous estimate

remain unchanged.

Details of the resource announcement may be accessed via the

following link:

https://www.asx.com.au/asxpdf/20191011/pdf/449d2szw7y7hzy.pdf

Bonya (Tungsten, Copper, Vanadium) (40% Thor)

During the June quarter an initial 2,184m reverse circulation

(RC) drilling program, funded by Thor (40%) and Arafura Resources

(60%) was conducted, producing encouraging tungsten and copper

assays from the White Violet and Sarmakand deposits.

Results from this program have been released and can be accessed

via the following links:

https://www.asx.com.au/asxpdf/20190624/pdf/44622kz8fk6rr8.pdf

https://www.asx.com.au/asxpdf/20190628/pdf/4466ghkhyhpznt.pdf

Subsequent to the end of the quarter, a follow up RC drilling

program of approximately 2,000 metres commenced, targeting an

estimation of Mineral Resources for the White Violet and Samarkand

deposits. The program is being funded by the JV participants in

proportion to their respective equity.

Vanadium

During the quarter, Thor and Arafura Resources, released details

of a study outlining the potential of the Jervois Vanadium Project,

along with a proposed development plan. The study details can be

accessed via the following link:

https://www.asx.com.au/asxpdf/20190703/pdf/446bv386tvk7fh.pdf

PILOT MOUNTAIN TUNGSTEN PROJECT - NEVADA USA (100% Thor)

Thor's Pilot Mountain Project, acquired in 2014, is located

approximately 200 kilometres south of the city of Reno and 20

kilometres east of the town of Mina, located on US Highway 95.

The Pilot Mountain Project is comprised of four tungsten

deposits: Desert Scheelite, Gunmetal, Garnet and Good Hope. All of

these deposits are in close proximity (three kilometres) to each

other and have been subjected to small-scale mining activities at

various times during the 20th century.

A full background on the project is available on the Thor Mining

website www.thormining.com/projects.

The directors believe Pilot Mountain's resource is substantial

on a global scale, and has potential for significant growth, in

particular from the discovery in the August 2017 drilling program

of an additional parallel zone of scheelite mineralisation at the

Desert Scheelite deposit (Figure 6.).

The directors believe that the Desert Scheelite resource, which

outcrops at surface at the western end for more than 400 metres,

has potential to develop into a long term open pit mining operation

which, when supplemented by higher grade mineralisation from the

other deposits at Pilot Mountain, has the potential for a longer

term profitable operation.

This significant tungsten resource is strategically located in

the USA and tungsten has been confirmed by the US Department of the

Interior as a critical mineral in 2018.

Locked cycle testwork on material from the Desert Scheelite

deposit, was completed during the June quarter, resulting in

production of a high grade scheelite concentrate grading 68% WO

with recovery of 73.6%. Further work is in progress aimed at

improving this recovery.

Environmental study parameters are being established with

relevant agencies, and Infrastructure studies have also

commenced.

The metallurgical testwork on material from the Desert Scheelite

deposit announced during the June quarter also identified the

previously unexpected presence of gold in the sample. Subsequent

check assays for gold have, to date, not conclusively confirmed

economic gold mineralisation, and hence the Company requested,

despatch of some of this material from the laboratory in China, to

be re-assayed in an Australian laboratory facility.

Subsequent to the end of the quarter, two directors attended a

mining investment event in New York USA, partly aimed at inviting

investment interest in the Pilot Mountain project. A number of

contacts have been made & follow up discussions with several

are in progress.

KAPUNDA and MOONTA COPPER PROJECTS - SA

Thor holds a 25% equity interest in private Australian company,

EnviroCopper Limited ("ECL"), along with rights to acquire a

further 5% interest via investment of an additional A$0.4million.

In turn ECL has entered into an agreement to earn, in two stages,

up to 75% of the rights over metals which may be recovered via

in-situ recovery ("ISR") contained in the Kapunda deposit from

Australian listed company, Terramin Australia Limited (ASX: "TZN"),

and rights to 75% of Moonta copper project comprising the northern

portion of exploration licence EL5984 held by Andromeda Metals

Limited (ASX:ADN).

Information about EnviroCopper Limited and its projects can be

found on the EnviroCopper website:

https://www.envirocopper.com.au/

Kapunda

During 2018, the Australian Government Ministry for Science,

Jobs and Innovation announced an offer to ECR for research funding

of A$2,851,303, over a 30 month period, for the Kapunda In-Situ

Copper and Gold Recovery Trial.

During the June quarter the Company advised of successful gold

recovery from Kapunda core, in addition to copper recovery, using a

CSIRO developed thiosulphate product, instead of, the more normal,

cyanide.

Field pump tests of the flow of fluids through the deposit for

successful ISR activities have recently been approved by the South

Australian authorities, and this drilling program, and pumping

testwork, is expected to commence during November 2019.

Other near-term activities at Kapunda include continued

community liaison in respect of project activities, testwork on

historical drill core to determine the optimum extraction agent

(lixiviant) most suited to the Kapunda deposit and establishing

appropriate parameters for future field trials.

Moonta

During the quarter the Company advised that Enviro Copper

Limited, on behalf of Environmental Metals Recovery, had completed

a Mineral Resource Estimate (MRE) on several of the deposits at

Moonta, based on substantial historical drilling. The results of

this study was an Inferred Resource estimate of 66.1 million tonnes

(MT) grading 0.17% copper (Cu), containing 114,000 tonnes of

contained copper, at a cutoff grade of 0.05%Cu.

The full details of the resource announcement may be accessed

via the following link:

https://www.asx.com.au/asxpdf/20190815/pdf/447hw9dbbkg94b.pdf

GOLD PROJECTS

SPRING HILL GOLD PROJECT - NT (ROYALTY ENTITLEMENT)

In February 2017 Thor completed the A$3.5 million sale of its

Spring Hill Gold project(1). The sale transaction carries an

ongoing residual royalty of:

-- A$6 per ounce of gold produced from the Spring Hill tenements

where the gold produced is sold for up to A$1,500 per ounce;

and

-- A$14 per ounce of gold produced from the Spring Hill

tenements where the gold produced is sold for amounts over A$1,500

per ounce.

(1)Refer AIM announcement of 26 February 2016 and ASX

announcement of 29 February 2016

No royalties were received during the quarter, however the

owners of the Spring Hill project have advised that they are

progressing mine permitting, and also that the treatment plant for

toll processing the ore has been refurbished. They are hopeful of

commencement of operations in the near term.

OTHER PROJECTS

During the March quarter the Company advised of an agreement to

acquire two private Australian companies (Hamersley Metals Pty Ltd,

and Pilbara Gold Pty Ltd) with licences and applications in areas

prospective for gold and uranium in Western Australia and the

Northern Territory.

Subsequent to the end of the quarter, a field reconnaissance

program incorporating soil and stream sediment sampling commenced.

Details of the program, along with analysis and results will be

published shortly.

INVESTMENTS

Thor holds an investment in Hawkstone Mining Limited, an ASX

listed company (ASX: HWK) with a 100% Interest in a Lithium project

in Arizona, USA.

During the quarter Hawkstone, announced an Indicated and

Inferred Mineral Resource Estimate of 32.5 Million Tonnes grading

1,850 parts per million (ppm) Li, or 320,800 tonnes Lithium

Carbonate Equivalent, reported above an 800ppm Li cut-off.

Subsequent to the end of the quarter Hawkstone announced the

issue of additional vendor shares which results in the issue to

Thor of additional equity in Hawkstone, with Thor now holding

15,234,375 ordinary shares in Hawkstone representing approximately

1.87% of the issued capital of Hawkstone.

At the time of writing Hawkstone shares were trading @

A$0.012/share

Information about Hawkstone and its Big Sandy project can be

found at Hawkstone's website, http://hawkstonemining.com.au/.

CORPORATE AND FINANCE

During the quarter, the board of Thor was strengthened with the

appointment of Mr Mark Potter. Mr Potter is also a director of

Metal Tiger PLC, the Company's largest shareholder. We welcome the

contribution of Mark to the team.

Subsequent to the end of the quarter, the Company advised of a

two stage placing of capital to raise, before expenses,

UKGBP510,000 (approximately A$955,000). The first tranche of the

placing is the issue of 113,333,333 ordinary shares in the company,

with the second tranche issuing, conditional on shareholder

approval at the forthcoming Annual General meeting of shareholders,

a further 141,666,667 ordinary shares.

Competent Person's Report

The information in this report that relates to exploration

results, and exploration targets, is based on information compiled

by Richard Bradey, who is a Member of The Australasian Institute of

Mining and Metallurgy. Mr Bradey is an employee of Thor Mining PLC.

He has sufficient experience which is relevant to the style of

mineralisation and type of deposit under consideration and to the

activity which he is undertaking to qualify as a Competent Person

as defined in the 2012 Edition of the 'Australasian Code for

Reporting of Exploration Results, Mineral Resources and Ore

Reserves'. Richard Bradey consents to the inclusion in the report

of the matters based on his information in the form and context in

which it appears.

Enquiries:

Mick Billing +61 (8) 7324 1935 Thor Mining PLC Executive Chairman

Ray Ridge +61 (8) 7324 1935 Thor Mining PLC CFO/Company Secretary

Colin Aaronson/ +44 (0) 207 383 Grant Thornton UK Nominated Adviser

Richard Tonthat/ 5100 LLP

Ben Roberts

Nick Emerson +44 (0) 1483 413 SI Capital Ltd Joint Broker

Claire Louise 500 Hybridan LLP Joint Broker

Noyce / +44 (0) 203 764

John Beresford-Peirse 2341

Updates on the Company's activities are regularly posted on

Thor's website www.thormining.com, which includes a facility to

register to receive these updates by email, and on the Company's

twitter page @ThorMining.

About Thor Mining PLC

Thor Mining PLC (AIM, ASX: THR) is a resources company quoted on

the AIM Market of the London Stock Exchange and on ASX in

Australia.

Thor holds 100% of the advanced Molyhil tungsten project in the

Northern Territory of Australia, for which an updated feasibility

study in August 2018(1) suggested attractive returns.

Adjacent Molyhil, at Bonya, Thor holds a 40% interest in

deposits of tungsten, copper, and vanadium, including an Inferred

resource for the Bonya copper deposit(2).

Thor also holds 100% of the Pilot Mountain tungsten project in

Nevada USA which has a JORC 2012 Indicated and Inferred Resources

Estimate(3) on 2 of the 4 known deposits. The US Department of the

Interior has confirmed that tungsten, the primary resource mineral

at Pilot Mountain, has been included in the final list of Critical

Minerals 2018.

Thor is also acquiring up to a 60% interest Australian copper

development company Environmental Copper Recovery SA Pty Ltd, which

in turn holds rights to earn up to a 75% interest in the mineral

rights and claims over the resource on the portion of the historic

Kapunda copper mine in South Australia recoverable by way of in

situ recovery.

Thor has an interest in Hawkstone Mining Limited, an Australian

ASX listed company with a 100% Interest in a Lithium project in

Arizona, USA.

Finally, Thor also holds a production royalty entitlement from

the Spring Hill Gold project of:

-- A$6 per ounce of gold produced from the Spring Hill tenements

where the gold produced is sold for up to A$1,500 per ounce;

and

-- A$14 per ounce of gold produced from the Spring Hill

tenements where the gold produced is sold for amounts over A$1,500

per ounce.

Notes

(1) Refer ASX and AIM announcement of 23 August 2018

(2) Refer ASX and AIM announcement of 26 November 2018

(3) Refer AIM announcement of 13 December 2018 and ASX

announcement of 14 December 2018

Refer AIM announcement of 10 February 2016 and ASX announcement

of 12 February 2018

Refer AIM announcement of 26 February 2016 and ASX announcement

of 29 February 2016

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

DRLZFLBXKBFZFBE

(END) Dow Jones Newswires

October 31, 2019 03:00 ET (07:00 GMT)

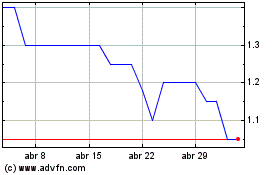

Thor Energy (LSE:THR)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Thor Energy (LSE:THR)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024