Rio Tinto Trims 2019 Capex Guidance; Sees Strong Cash Flow

31 Octubre 2019 - 1:25AM

Noticias Dow Jones

By Rhiannon Hoyle

SYDNEY--Rio Tinto PLC (RIO.LN) on Thursday trimmed capital

expenditure guidance for 2019 and said it could record $10 billion

in full-year free cash flow at present commodity prices.

The miner said it expects annual capital expenditure to be $500

million lower than an earlier $5.5-billion forecast, with that sum

deferred into 2020 when it now expects to spend $7 billion.

Rio Tinto said its estimate for free cash flow reflects "the

ongoing cash generation resilience of our world-class assets in a

volatile macro environment."

The miner, which is holding an investor seminar in London on

Thursday, also said its Pilbara iron-ore operations had, at times

operated at a long-targeted 360-million-metric-ton-a-year run rate.

Rio Tinto reiterated 2019 annual shipment guidance of 320-330

million tons and said it expects 2020 shipments up to 5% higher

than its 2019 forecast.

Write to Rhiannon Hoyle at rhiannon.hoyle@wsj.com

(END) Dow Jones Newswires

October 31, 2019 03:10 ET (07:10 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

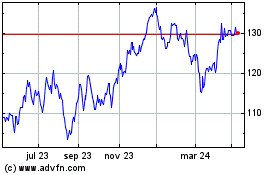

Rio Tinto (ASX:RIO)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

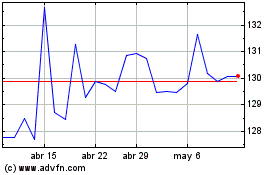

Rio Tinto (ASX:RIO)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024