TIDMBRH

RNS Number : 8088R

Braveheart Investment Group plc

31 October 2019

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulations (EU) No. 596/2014 ("MAR"). With the

publication of this announcement via a Regulatory Information

Service, this inside information is now considered to be in the

public domain.

31 October 2019

Braveheart Investment Group plc

("Braveheart" or the "Company")

Interim Results

Braveheart Investment Group plc (AIM: BRH), the fund management

and strategic investor group, today announces its interim results

for the six months ended 30 September 2019.

Key points:

-- Revenue of GBP250,000 in the six months ended 30 September 2019 (2018: GBP509,000);

-- Loss of GBP122,000 in the six months ended 30 September 2019 (2018: GBP113,000 profit);

-- Loss per share of 0.48p in the six months ended 30 September 2019 (2018: Loss - 0.42p);

-- Dividend of 0.5p per share paid in October 2019; and

-- Completion of acquisition of 100% of Paraytec Limited in October 2019.

For further information:

Braveheart Investment Group plc Tel: 01738 587555

Viv Hallam, Executive Director

Allenby Capital Limited (Nominated Adviser Tel: 020 3328

and Joint Broker) 5656

David Worlidge / Nicholas Chambers

Peterhouse Capital Limited (Joint Broker) Tel: 020 7469

0936

Heena Karani / Lucy Williams

Chief Executive Officer's Statement

We are pleased to report to shareholders the results for the six

months ended 30 September 2019. Progress has continued in all Group

activities and detailed operational summaries follow later in this

report.

Financial Review

Revenue was GBP250,000 in the six months ended 30 September 2019

(2018: GBP509,000). For the first time, the majority of our revenue

is from the operations of our consolidated investments and we

expect that revenues from these consolidated investments will

continue to increase in importance in the future.

We have undertaken an unaudited interim review of the valuations

of the Group's directly held investments and have concluded that,

at this stage, these valuations should remain largely unchanged

from the valuations as at the end of the last financial year, 31

March 2019. Therefore, as at 30 September 2019, the fair value of

the Group's investments was GBP688,000 (30 September 2018:

GBP2,479,000), which comprises the valuations of the historic

investments made by Braveheart up to 2015 (the "Portfolio") of

GBP433,000 (30 September 2018: GBP464,000) and the strategic

investments (the six investments made by Braveheart from 2016, the

"Strategic Investments" including the new investment in Pharm2Farm)

of GBP640,000 (30 September 2018: GBP2,015,000).

Our operating costs for the period under review were GBP372,000

(2018: GBP395,000), a decrease of GBP23,000 on the prior period

despite the costs of the newly consolidated companies, Paraytec and

Kirkstall, being included. It should be noted that there were a few

one-off costs included in last years' accounts, which were the

legal costs of GBP44,000 that related to the share premium

reduction and additional shareholder communication fees relating to

the general meeting for share premium reduction of GBP11,000. The

decrease in cash to GBP1,055,000 reflects the investments made

since the year end and the loss that the group has generated.

We report a loss before tax for the period under review of

GBP122,000 (2018: profit of GBP113,000). This equates to loss per

share of 0.48 pence. We have not made any disposals from the

Portfolio during the period under review and have maintained the

valuations of the Portfolio and the Strategic Investments at the

levels that were reported in our last annual accounts

We believe that our Strategic Investments continue to be the

most likely drivers of growth in shareholder value over the

remainder of the current year and so have concentrated this CEO

Statement on their operations and prospects.

Gyrometric Systems Limited (Braveheart owns 19.95% of the

company)

Gyrometric has developed a patent protected system of hardware

and software to accurately monitor the critical parameters in

rotating shafts.

The Company has well established products for monitoring and

protecting Marine drive shaft couplings for the global coupling

maker Vulkan. In addition, Gyrometric recently announced it has

signed an agreement to install digital monitoring equipment on a

critical drive at Tarmac Limited's ("Tarmac") Tunstead Cement

Plant. The 11kV drive is coupled to the rock crushing mill which

converts limestone from the on-site quarry into powder. Failure of

this primary piece of plant stops the entire process, causing very

expensive down time. Information gathered by Gyrometric, which can

identify problems early enough to plan maintenance and intervene

before major damage is done, is therefore extremely valuable.

Gyrometric will measure digital parameters including dynamic

torque across the coupling, radial displacement of the shaft (and

therefore misalignment), and torsional vibrations of the drive

system. The data will also provide information on the condition of

the gearbox. This initiative by Tarmac is designed to improve the

utilisation of this huge installation of capital equipment.

In a further development, Clarke Energy will co-operate with

Gyrometric to trial digital shaft monitoring in its generating

equipment. Initially the monitoring will employ Gyrometric's unique

digital monitoring of the bearings and shaft alignment in large

generator sets. The objective is to evaluate the potential to

realise value by implementing a predictive maintenance strategy

utilising real time data harvested by the Gyrometric system, rather

than a timed based planned maintenance system.

In both of the above projects, there is potential for

considerable savings in maintenance and down time costs from this

move towards an Internet of Things (IOT) approach. As in

Gyrometric's marine drive monitoring products, the use of rapid

intervention to shut down equipment automatically, when a serious

fault is detected, can protect these high value machines from

catastrophic failures.

Pharm2Farm Limited (Braveheart owns 33.33% of the company)

Following Braveheart's initial investment in Pharm2Farm Limited

("P2F"), our team has been working with the Company to help scale

up manufacturing processes and secure customers.

P2F is currently focused on the commercial hydroponics market,

where Europe currently leads the world with an estimated market

share of over 40% through to 2025. The main reasons for this are;

the year-round demand for fresh produce, the cost and time of

transporting crops and customer desire to reduce environmental

impact. Growing in controlled environments can eliminate pesticides

and optimised plant feeds play a key role in speed to market. The

customer benefits from improved freshness and enhanced nutritional

value.

Hydroponic herb growing in urban areas is attracting a lot of

investment in the UK and worldwide. The successful trial at Griin

Agriculture in Korea, demonstrated a 33% increase in production for

the herb basil by adding P2F's micronutrients to the plant feed.

Further trials will follow in herbs such as parsley, coriander and

dill. The P2F team not only produces the micronutrients needed for

healthy plant growth, but also designs and tests plant feeds for

each stage of life, from germination to maturity and flowering to

fruiting.

The UK government has highlighted the strategic importance of

the food production market and P2F sees a great opportunity for it

to secure grants for technical development and crop trials under

Innovate UK's GBP90m funding programme 'Future Food Production

Systems'.

To support the above markets, P2F recently hired new staff for

both production and sales. In addition, it is seeking to recruit a

sales manager to target the specialist Home & Garden

markets.

Phasefocus Holdings Limited (Braveheart owns 21.20% of the

company)

Phasefocus has developed a series of patented computational

imaging techniques which use a Quantitative Phase Imaging (QPI)

technique called ptychography. This technology is used in many

applications including; live cell imaging, engineering metrology

and electron microscopy.

The Company recently completed the first installation of its new

Livecyte 2 system at Leicester University, UK, where the system is

being used to generate high contrast images of cells, using very

low intensity light (several magnitudes lower than used in

traditional brightfield and fluorescence microscopy). This

significantly reduces phototoxicity and enables long term live cell

imaging - the results are high fidelity images which are artefact

free and robustly quantitative, without the need for cell

labelling. Livecyte systems are being used by researchers at the

cutting edge of cancer and stem cell research, where the ability to

automatically track and characterise thousands of individual cells

in an assay format is a valuable tool.

The Company has over 100 patents and patent applications which

protect its technology. Currently, Phasefocus designs and sells its

own instruments, but is moving to licence its software to global

instrument companies in a wide range of markets. Hitachi High

Technologies has already used the Phasefocus technology to produce

electron microscopes (EMs) with ptychography capability, and

several other leading EM producers are working with the Company to

add this technology to their systems.

In September, Phasefocus held a Livecyte 2 training week at its

offices in Sheffield, which was well attended and included its

distributors from Australia, Canada, Italy, Israel and China. All

were very impressed with the equipment, they already have a strong

pipeline of sales enquiries for this 'big ticket' item to

universities and leading research institutions around the

world.

The Phasefocus technology is also being used regularly to

measure the optical accuracy of contact lenses. Their transparent,

thin, flexible nature make contact lenses very difficult to measure

by conventional methods, but this does not present a problem for

Phasefocus, even in bifocal and trifocal lenses.

Paraytec Limited (Braveheart owned 50.77% of the company on 30

September 2019)

Paraytec develops high performance specialist detectors for the

analytical and life sciences instrumentation market. It continues

to operate profitably and with positive cashflow.

The ongoing GBP1m UKTI grant funded R&D project, where

Paraytec is working to develop a new instrument with Malvern

Instruments, to analyse the quality of protein-based

pharmaceuticals, continues to progress well. It is approaching the

point where the full prototype of the new instrument will be tested

with end users, including; GSK, Medimmune and Fujifilm Diosynth

Biotechnologies.

The pan-European project 'AD Scanner', in the field of

Alzheimer's disease (AD) diagnosis, is progressing well. Paraytec

is working closely with partners: Karolinska Institute, Biomotif,

Amsterdam University and MS Vision, on the integration of

Paraytec's technology into an instrument for the detection and

monitoring of AD from blood samples.

As previously reported, for technical reasons, which are beyond

the licensee or Paraytec's control, sales of licenced instruments

have not progressed as expected. This licence is now winding down,

but termination payments remain due to Paraytec. Future generation

products which are being developed together with this licensee

remain unaffected.

In September 2019, Braveheart made an offer to acquire the

remainder of the share capital of Paraytec not owned by the

Company. Earlier this month, the Company announced that it had

completed the acquisition of 44 per cent. of the share capital of

Paraytec for a total consideration of GBP111,652, which has been

paid for by the issue of 995,186 new ordinary shares in the

Company.

Sentinel Medical Limited (Braveheart owns 38.40% of the

company)

Testing of a prototype instrument to detect bladder cancer from

urine samples is underway, in collaboration with Sheffield

University. A first batch of 'live' samples, provided by bladder

cancer patients undergoing treatment for their condition, has been

received and tested. To date only a small number of samples have

been available, so no conclusions can be drawn at this early

stage.

If the results of these tests are positive, the Company will

launch its plans to develop a point-of-care instrument for the

diagnosis and monitoring of bladder cancer from urine samples.

Kirkstall Limited (Braveheart owns 64.67% of the company)

Kirkstall operates in the market known as 'organ-on-a-chip',

where it has developed Quasi Vivo(TM), a system of chambers for

cell and tissue culture in laboratories.

A new CEO has been appointed and the business relocated to York,

where it now shares resources with Paraytec. Cost saving

opportunities have already been identified and implemented.

Kirkstall has terminated its distributorship agreement with

Lonza and is now selling to its worldwide customer base on a direct

basis. Discussions have been opened with possible new distributors

in Asia.

The EUR4.7m EU grant funded project, CyGenTiG, where Kirkstall

is part of a European consortium to develop new techniques for the

production of engineered tissues by optogenetics, is progressing

well and approaching its first annual review with the funding body.

If this project is successful, it could lead the way to building

replacement human organs, by controlling individual cell growth and

differentiation. Kirkstall's experience will be used in the design,

manufacture and testing of new cell culture chambers, which may

ultimately become a new product range.

Kirkstall saw a healthy increase in demand for its products

following its very successful ACTC conferences, in Cambridge and in

Cardiff this financial year. In particular for its patent protected

product, QV600, which allows researchers to grow cell cultures on a

membrane surface. In the QV600, cells can be nourished by a

continuous perfusion of culture media and simultaneously exposed to

a controlled gaseous environment, which is essential when studying

the growth of certain cells, such as; stomach, lung, skin and

eye.

Plans are underway for the 2020 conference season, which is

expected to include conferences in the USA and Asia.

Outlook

Progress continues across a broad front and we remain optimistic

that this will eventually be reflected in enhanced returns to

shareholders. We will keep shareholders closely informed of

developments, meanwhile.

Trevor E Brown

Chief Executive Officer

Condensed consolidated statement of comprehensive income

for the six months ended 30 September 2019

Six months ended Six months ended

Year ended

30 September 30 September 31 March

2019 2018 2019

(unaudited) (unaudited) (audited)

Note GBP GBP GBP

------------------------------------------------------ ----- ------------------- ------------------- -------------

Revenue 254,067 257,425 181,087

Change in fair value of investments 4 (6,111) 249,544 165,806

Loss on disposal of investment - - (119,220)

Finance revenue 2,102 2,212 3,703

------------------------------------------------------ ----- ------------------- ------------------- -------------

Total income 250,058 509,181 231,376

------------------------------------------------------ ----- ------------------- ------------------- -------------

Employee benefits expense (203,306) (188,506) (308,024)

Impairment of goodwill 16,327 - (1,451,381)

Other operating costs (183,288) (198,627) (378,798)

Finance costs (2,113) (8,067) (3,494)

------------------------------------------------------ ----- ------------------- ------------------- -------------

Total costs (372,380) (395,200) (2,141,697)

------------------------------------------------------ ----- ------------------- ------------------- -------------

(Loss)/ Profit before tax (122,322) 113,981 (1,910,321)

Tax 115 - 7,338

Profit from discontinued operations - - 169,382

(Loss)/ Profit after tax for the period and total

comprehensive income for the period (122,207) 113,981 (1,733,601)

(Loss)/ Profit attributable to:

Equity holders of the parent (130,197) 113,981 (1,711,361)

Non-controlling interest 7,990 - (22,240)

(122,207) 113,981 (1,733,601)

------------------------------------------------------ ----- ------------------- ------------------- -------------

Basic (loss)/earnings per share Pence Pence Pence

* Basic (0.48) 0.42 (6.40)

* Diluted (0.48) 0.42 (6.38)

Condensed consolidated statement of financial position

as at 30 September 2019

30 September 30 September 31 March

2019 2018 2019

(unaudited) (unaudited) (audited)

Note GBP GBP GBP

------------------------------------------------ ----- ---------------------------------- ------------- ----------

ASSETS

Non-current assets

Property, plant and equipment 171 - 495

Intangibles 40,970 - 32,094

Goodwill 3 356,753 380,000 340,426

Investments at fair value through profit or

loss 4 716,147 2,479,959 688,059

Other receivables - 174,939 -

------------------------------------------------ ----- ---------------------------------- ------------- ----------

1,114,041 3,034,898 1,061,074

------------------------------------------------ ----- ---------------------------------- ------------- ----------

Current assets

Inventory 97,748 - 116,293

Trade and other receivables 237,948 130,936 219,045

Assets held for sale - - 124,729

Cash and cash equivalents 1,054,788 1,105,135 1,202,278

------------------------------------------------ ----- ---------------------------------- ------------- ----------

1,390,484 1,236,071 1,662,345

------------------------------------------------ ----- ---------------------------------- ------------- ----------

Total assets 2,504,525 4,270,969 2,723,419

------------------------------------------------ ----- ---------------------------------- ------------- ----------

LIABILITIES

Current liabilities

Trade and other payables (271,058) (141,321) (346,811)

Held for sale liabilities - - (14,729)

Deferred income (74,224) (15,363) (63,624)

(345,282) (156,684) (425,164)

------------------------------------------------ ----- ---------------------------------- ------------- ----------

Non-current liabilities

Borrowings - (16,790) (16,805)

- (16,790) (16,805)

------------------------------------------------ ----- ---------------------------------- ------------- ----------

Total liabilities (345,282) (173,474) (441,969)

------------------------------------------------ ----- ---------------------------------- ------------- ----------

Net assets 2,159,243 4,097,495 2,281,450

------------------------------------------------ ----- ---------------------------------- ------------- ----------

EQUITY

Called up share capital 5 541,650 541,650 541,650

Share premium - 1,567,615 -

Merger reserve - 523,367 -

Retained earnings 1,599,645 1,489,256 1,754,896

------------------------------------------------ ----- ---------------------------------- ------------- ----------

Equity attributable to owners of the parent 2,141,295 4,121,888 2,296,546

Non-controlling interest 17,948 (24,393) (15,096)

------------------------------------------------ ----- ---------------------------------- ------------- ----------

Total equity 2,159,243 4,097,495 2,281,450

------------------------------------------------ ----- ---------------------------------- ------------- ----------

Condensed consolidated statement of cash flows

for the six months ended 30 September 2019

Six months ended

30 September 30 September 31 March

2019 2018 2019

(unaudited) (unaudited) (audited)

GBP GBP GBP

-------------------------------------------------------------------- ------------------- ------------- ------------

Operating activities

(Loss)/ Profit before tax (122,207) 113,981 (1,733,601)

Adjustments to reconcile profit/(loss) before tax to net cash flows

from operating activities

Share-based payments expense - - -

Impairment losses - - -

Increase in the fair value movements of investments 6,111 (249,544) (90,431)

Transfer of accrued dividend/ interest - (10,202) (11,224)

Loss on disposal of equity investments - - 119,220

Taxation (115) - (7,338)

Depreciation 6,711 - 467

Impairment of goodwill (16,327) - 1,451,381

Interest income (2,102) (2,212) (3,703)

Decrease/ (Increase) in inventory 18,545 - (116,293)

Decrease in trade and other receivables 100,825 195,663 266,503

(Decrease)/ Increase in trade and other payables (96,687) (78,522) 189,974

-------------------------------------------------------------------- ------------------- ------------- ------------

Net cash flow (used in)/generated from operating activities (105,246) (30,836) 64,955

-------------------------------------------------------------------- ------------------- ------------- ------------

Investing activities

Proceeds from sale of equity investments - - 154,380

Increase in investments (34,200) - (123,801)

Acquisition of intangibles (15,263) - (32,094)

Acquisition of tangibles - - (962)

Taxation 115 - 7,338

Interest received 2,102 2,212 3,703

-------------------------------------------------------------------- ------------------- ------------- ------------

Net cash flow (used in)/generated from investing activities (47,246) 2,212 8,564

-------------------------------------------------------------------- ------------------- ------------- ------------

Net (decrease)/increase in cash and cash equivalents (152,490) (28,624) 73,519

Cash and cash equivalents at the start of the period 1,207,278 1,133,759 1,133,759

-------------------------------------------------------------------- ------------------- ------------- ------------

Cash and cash equivalents at the end of the period 1,054,788 1,105,135 1,207,278

-------------------------------------------------------------------- ------------------- ------------- ------------

Condensed consolidated statement of changes in equity

for the six months ended 30 September 2019

Attributable to owners of the Parent

-----------------------------------------------------------------

Share Merger Retained Non-controlling

Capital Share Premium Reserve Earnings Total Interest Total Equity

GBP GBP GBP GBP GBP GBP GBP

------------------ --------- -------------- ---------- ------------ ------------ ---------------- -------------

At 1 April 2017

(audited) 541,650 1,567,615 523,367 1,375,275 4,007,907 (24,393) 3,983,514

------------------ --------- -------------- ---------- ------------ ------------ ---------------- -------------

Profit and total

comprehensive

income for the

period - - - 113,981 113,981 - 113,981

At 30 September

2018 (unaudited) 541,650 1,567,615 523,367 1,489,256 4,121,888 (24,393) 4,097,495

------------------ --------- -------------- ---------- ------------ ------------ ---------------- -------------

Transfer of share

premium - (1,567,615) - 1,567,615 - - -

------------------ --------- -------------- ---------- ------------ ------------ ---------------- -------------

Transfer of

merger

reserve - - (523,367) 523,367 - - -

------------------ --------- -------------- ---------- ------------ ------------ ---------------- -------------

Non-controlling

interest on

acquisition - - - - - 31,537 31,537

------------------ --------- -------------- ---------- ------------ ------------ ---------------- -------------

Loss and total

comprehensive

income for the

period - - - (1,825,342) (1,825,342) (22,240) (1,847,582)

------------------ --------- -------------- ---------- ------------ ------------ ---------------- -------------

At 1 April 2019

(audited) 541,650 - - 1,754,896 2,296,546 (15,096) 2,281,450

------------------ --------- -------------- ---------- ------------ ------------ ---------------- -------------

Share-based

payments - - - - - - -

------------------ --------- -------------- ---------- ------------ ------------ ---------------- -------------

Issue of equity

shares - - - - - - -

------------------ --------- -------------- ---------- ------------ ------------ ---------------- -------------

Transfer of

minority

interest - - - (25,054) (25,054) 25,054 -

------------------ --------- -------------- ---------- ------------ ------------ ---------------- -------------

Loss and total

comprehensive

income for the

period - - - (130,197) (130,197) 7,990 (122,207)

At 30 September

2019 (unaudited) 541,650 - - 1,599,645 2,141,295 17,948 2,159,243

------------------ --------- -------------- ---------- ------------ ------------ ---------------- -------------

Notes to the interim financial statements

1 Basis of preparation

The financial information presented in this half-yearly report

constitutes the condensed consolidated financial statements (the

interim financial statements) of Braveheart Investment Group plc

("Braveheart" or "the Company"), a company incorporated in the

United Kingdom and registered in Scotland, and its subsidiaries

(together, "the Group") for the six months ended 30 September 2019.

The interim financial statements have been prepared in accordance

with IAS 34 Interim Financial Reporting and should be read in

conjunction with the Annual Report and Accounts for the year ended

31 March 2019 which have been prepared in accordance with

International Financial Reporting Standards as adopted for use in

the EU. The financial information in this half-yearly report, which

was approved by the Board and authorised for issue on 31 October

2019 is unaudited.

The interim financial statements do not constitute statutory

accounts for the purpose of sections 434 and 435 of the Companies

Act 2006. The comparative financial information presented herein

for the year ended 31 March 2019 has been extracted from the

Group's Annual Report and Accounts for the year ended 31 March 2019

which have been delivered to the Registrar of Companies. The

Group's independent auditor's report on those accounts was

unqualified, did not include references to any matters to which the

auditors drew attention by way of emphasis without qualifying their

report and did not contain a statement under section 498(2) or

498(3) of the Companies Act 2006.

The preparation of the half-yearly report requires management to

make judgements, estimates and assumptions that affect the policies

and the reported amounts of assets and liabilities, income and

expenses. The estimates and associated assumptions are based on

historical experience and other factors that are believed to be

reasonable under the circumstances, the results of which form the

basis of making judgements about carrying values of assets and

liabilities that are not readily apparent from other sources.

Actual results may differ from these estimates. In preparing this

half-yearly report, the significant judgements made by management

in applying the Group's accounting policies and the key sources of

estimation uncertainty were the same as those applied to the

audited consolidated financial statements for the year ended 31

March 2019.

The interim financial statements have been prepared using the

same accounting policies as those applied by the Group in its

audited consolidated financial statements for the year ended 31

March 2019 and which will form the basis of the 2020 Annual Report

and Accounts. The interim financial statements have been prepared

on the same basis as the financial statements for year ended 31

March 2019 which is on the assumption that the Company is a going

concern.

2 (Loss)/Earnings per share

The basic (loss)/earnings per share has been calculated by

dividing the profit for the period attributable to equity holders

of the parent by the weighted average number of ordinary shares in

issue during the period.

The calculation of earnings per share is based on the following

profit and number of shares in issue:

Six months ended Six months ended Year ended

30 Sept 2019 30 Sept 2018 31 Mar 2019

(unaudited) (unaudited) (audited)

GBP GBP GBP

-------------------------------------------------------------- ------------------- ------------------- ------------

(Loss)/ Profit for the period attributable to equity holders

of the parent (122,207) 113,981 (1,733,601)

-------------------------------------------------------------- ------------------- ------------------- ------------

Weighted average number of ordinary shares in issue:

* For basic profit per ordinary share 27,082,565 27,082,565 27,082,565

* Potentially dilutive ordinary shares 75,675 75,675 75,675

-------------------------------------------------------------- ------------------- ------------------- ------------

* For diluted profit per ordinary share 27,158,240 27,158,240 27,158,240

-------------------------------------------------------------- ------------------- ------------------- ------------

Dilutive earnings per share adjusts for share options granted

where the exercise price is less than the average price of the

ordinary shares during the period. At the end of the current period

there were 75,675 potentially dilutive ordinary shares.

3 Goodwill

Paraytec Kirkstall Viking Neon Total

GBP GBP GBP GBP GBP

---------------------------------- --- --------- ---------- --------- -------- --------

At 1 April 2018 (audited) - - - 380,000 380,000

At 30 September 2018 (unaudited) - - - 380,000 380,000

At 31 March 2019 277,883 62,543 - - 340,426

At 30 September 2019 (unaudited) 277,883 78,870 - - 356,753

---------------------------------- -------------- ---------- ----- -------- --------

At the end of the previous year, the Group assessed the

recoverable amount of the above goodwill associated with Neon's

cash-generating unit and determined that goodwill would be moved to

assets held for sale as a result of the company being sold after

the year end.

The income approach was not deemed a reliable method for valuing

the goodwill of Paraytec and Kirkstall. Therefore, the market value

method was used in order to ascertain the value of goodwill at the

period end.

4 Investments at fair value through profit or loss

Level 1 Level 2 Level 3

----------------- --------------- -------------------------------- ------------------------------ ------------

Equity Equity Debt Equity Debt

investments in investments investments in investments investments

quoted in unquoted unquoted in unquoted in unquoted

companies companies companies companies companies Total

GBP GBP GBP GBP GBP GBP

----------------- ---------------- -------------- --------------- -------------- -------------- ------------

At 1 April 2018

(audited) - - - 2,130,558 89,655 2,220,213

Conversion of

loan notes - - - 89,655 (89,655) -

Transfer from

debtors - - - 10,202 - 10,202

Change in Fair

Value - - - 249,544 - 249,544

----------------- ---------------- -------------- --------------- -------------- -------------- ------------

At 30 September

2018

(unaudited) - - - 2,479,959 - 2,479,959

----------------- ---------------- -------------- --------------- -------------- -------------- ------------

Additions at

cost - - - 123,801 - 123,801

Conversion of

loan notes - - - 11,224 (11,224) -

Transfer - - - (1,580,812) 11,224 (1,569,588)

Disposals - - - (273,600) - (273,600)

Change in Fair

Value - - - (72,514) - (72,514)

----------------- ---------------- -------------- --------------- -------------- -------------- ------------

At 1 April 2019

(audited) - - - 688,058 - 688,058

Additions at

cost - - - 34,200 - 34,200

Change in Fair

Value - - - (6,111) - (6,111)

----------------- ---------------- -------------- --------------- -------------- -------------- ------------

At 30 September

2019

(unaudited) - - - 716,147 - 716,147

----------------- ---------------- -------------- --------------- -------------- -------------- ------------

The accounting policies in regards to valuations in these

half-yearly results are the same as those applied by the Group in

its audited consolidated financial statements for the year ended 31

March 2019 and which will form the basis of the 2020 Annual Report

and Accounts. Investments are designated as fair value through

profit or loss and are initially recognised at fair value and any

gains or losses arising from subsequent changes in fair value are

presented in profit or loss in the statement of comprehensive

income in the period in which they arise.

The Group classifies its investments using a fair value

hierarchy. Classification within the hierarchy has been determined

on the basis of the lowest level input that is significant to the

fair value measurement of the relevant investment as follows:

-- Level 1 - valued using quoted prices in active markets for identical assets;

-- Level 2 - valued by reference to valuation techniques using

observable inputs other than quoted prices included within Level 1;

and

-- Level 3 - valued by reference to valuation techniques using

inputs that are not based on observable market data.

The fair values of quoted investments are based on bid prices in

an active market at the reporting date. All unquoted investments

have been classified as Level 3 within the fair value hierarchy,

their respective valuations having been calculated using a number

of valuation techniques and assumptions, notwithstanding that the

basis of the valuation methodology used most commonly by the Group

is 'price of most recent investment'. The use of reasonably

possible alternative assumptions has no material effect on the fair

valuation of the related investments. The impact on the fair value

of investments if the discount rate and provision shift by 1% is

GBP7,160 (2018: GBP24,800).

5 Share capital

30 Sept 30 Sept 31 Mar 2019

2019 2018

(unaudited) (unaudited) (audited)

Authorised GBP GBP GBP

33,645,000 ordinary shares of 2 pence

each

(30 September 2018: 33,645,000,

31 March 2019: 33,645,000) 672,900 672,900 672,900

--------------------------------------- ------------ ------------ ------------

Allotted, called up and fully paid

27,082,565 ordinary shares of 2 pence

each

(30 September 2018: 27,082,565,

31 March 2019: 27,082,565) 541,650 541,650 541,650

--------------------------------------- ------------ ------------ ------------

The Company has one class of ordinary shares. All shares carry

equal voting rights, equal rights to income and distribution of

assets on liquidation or otherwise, and no right to fixed

income.

6 Availability of Interim Results

Shareholder communications

A copy of this report is available on request from the Company's

registered office: 1 George Square, Glasgow, G2 1AL. A copy has

also been posted on the Company's website:

www.braveheartinvestmentgroup.co.uk.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR BGBDGGUXBGCB

(END) Dow Jones Newswires

October 31, 2019 06:55 ET (10:55 GMT)

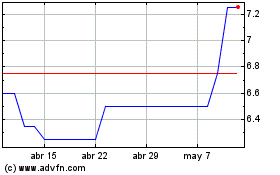

Braveheart Investment (LSE:BRH)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Braveheart Investment (LSE:BRH)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024