New Zealand Dollar Falls As NZ Jobless Rate Rises

05 Noviembre 2019 - 9:00PM

RTTF2

The New Zealand dollar declined against its major counterparts

in the pre-European session on Wednesday, after a data showed that

the nation's jobless rose in the third quarter.

Data from Statistics New Zealand showed that the unemployment

rate came in at a seasonally adjusted 4.2 percent in the third

quarter.

That exceeded expectations for 4.1 percent and was up from the

11-year low mark of 3.9 percent in the three months prior.

On a yearly basis, employment was up 0.9 percent - in line with

expectations following the 1.7 percent jump in the previous three

months.

Asian shares are trading mixed as investors awaited concrete

details from the Sino-U.S. trade negotiations.

As the two sides try to hammer out details of the "phase one"

trade deal, Beijing wants Washington to make a solid commitment

towards removing tariffs.

The kiwi declined to a 1-week low of 0.6361 against the

greenback and a 5-day low of 69.28 against the yen, from its early

highs of 0.6384 and 69.69, respectively. If the kiwi falls further,

0.62 and 67.5 are likely seen as its next support levels against

the greenback and the yen.

Reversing from its early highs of 1.7342 against the euro and

1.0800 against the aussie, the kiwi dropped to a 6-day low of

1.7413 and a 1-1/2-month low of 1.0828, respectively. The next

possible support for the kiwi is seen around 1.78 against the euro

and 1.10 against the aussie.

Looking ahead, PMIs from major European economies and Eurozone

retail sales for September are scheduled for release in the

European session.

At 10:00 am ET, Canada Ivey PMI for October will be

released.

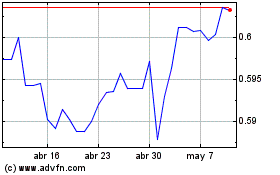

NZD vs US Dollar (FX:NZDUSD)

Gráfica de Divisa

De Mar 2024 a Abr 2024

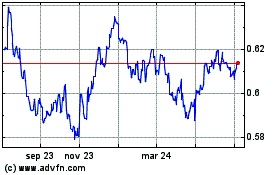

NZD vs US Dollar (FX:NZDUSD)

Gráfica de Divisa

De Abr 2023 a Abr 2024